By Yanis Varoufakis, professor of economics at the University of Athens. Cross posted from his blog

On 30th October, in its Report to Congress on Economic and Exchange Rate Policies, the US Treasury took a swipe at Germany, accusing it of exporting economic depression to the rest of Eurozone and, indeed, to the global economy. The German Finance Ministry responded the next day with a statement that: “There are no imbalances in Germany that need correction. On the contrary, the innovative German economy contributes significantly to global growth through exports and the import of components for finished products.” There are few occasions in any argument where one side is completely right and the other comprehensively wrong. This is one of them!

The US Treasury is spot on and the German response, unwittingly, confirms this. In this post I summarise the analytical foundation (as I see it) of the US Treasury position; a position that, incidentally, this blog has been putting forward (and analysing) for years. In brief, I shall be showing that to succeed, the current German policies must destroy whatever balance is left in the global economy. And given that, ultimately, it cannot succeed, it is bound to wreck further Europe’s Periphery and to deliver an unwanted deflationary shock to the global economy.

The Argument’s Gist

Before the Euro Crisis, Germany and the rest of the surplus Eurozone countries had a large Current Account surplus both toward the rest of the Eurozone and towards the rest of the world. A large portion of the surplus countries’ profits (due to these net exports) were rushing back to the Eurozone Periphery thus fuelling consumer booms and real estate bubbles. During that period, savings (S) exceeded investment (I) in the surplus countries while the opposite held true in the Periphery (since capital was flowing freely to the Periphery in the form of ‘investments’ that helped aggregate investment there dwarfed local savings).

Following the Euro Crisis, and the collapse of the Periphery’s aggregate demand (as a result of both the sudden reversal of the capital flows and the austerity measures taken), investment in the Periphery collapsed (sometimes to negative levels). Thus, suddenly, the Periphery mimicked the surplus countries in that savings exceeded investment there too (S>I). At the same time, imports into the Periphery subsided (courtesy of the sharp recession) and so the Periphery’s Current Account deficit narrowed (e.g. Greece) or was even transformed into a surplus (e.g. Spain).

Enter the Germany-driven Eurozone-wide policy of balancing budgets across the Eurozone. Here is why this policy turns the Eurozone into an exporter of recession to the rest of the world (as the US Treasury has claimed):

- While savings exceed investment (S>I) both in the surplus and in the deficit countries, in Europe’s Core as well as in its Periphery, and

- While low aggregate demand in the Periphery tends to eliminate Current Account deficits by the sheer power of collapsing imports (due to the Periphery’s recession)

the attempt to balance budgets can only bear fruit if the Eurozone as a whole manages to reach a Current Account surplus of between 8% and 10%. In other words, the Germany-inspired policy that is being pursued currently in Europe, as a means to fight the Crisis, is uniquely consistent with an attempt (perhaps an unconscious one) to turn the Eurozone into a mercantilist fiend; into a net exporter that would make China look like an exemplary global citizen.

Now, of course, the Germany-inspired policies are bound to fail. For it is clear that, as the Eurozone’s Current Account surplus is pushing beyond 1.5% and rising (as per the German plan) the euro will appreciate much more, destroying Germany’s best laid plans for turning the Eurozone into a Greater Germany while, at the same time, crushing what is left of the Periphery’s social economies.

Nevertheless, before they are abandoned, these policies are perfectly capable of doing a great deal of damage. Both to Europe and to the world. While the United States has, indeed, a great deal to answer for regarding its own contribution to global economic woes, on this matter the US Treasury is entirely correct: Germany is turning the Eurozone into a net exporter of deflation, recession and global instability.

The Analysis Behind the Last Statement (wonkish – for a full academic article on this matter click here )

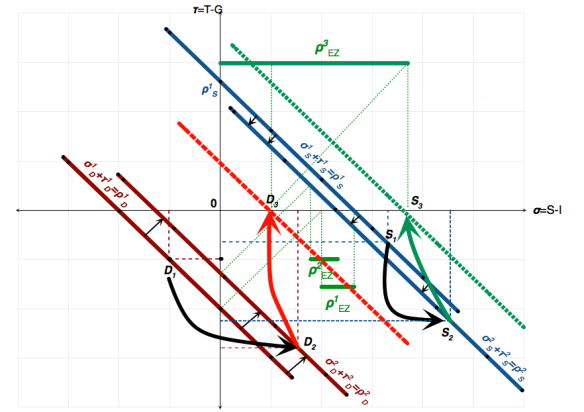

The diagram below offers a snapshot of the relative macroeconomic position of the Eurozone’s deficit and surplus member-states in relation to their budget, current account and net investment positions.

- σi = Si-Ii denotes savings in excess of investment for country i

- τi = Ti-Gi is the govenrment i’s budget surplus, and

- ρi = Xi-Mi is the difference between export income and income spent on imports, while subscripts D and S refer to the deficit and the surplus Eurozone member-states respectively, the downward slopping lines depict the loci that deficit and surplus countries are constrained on by the standad identities of national income categories.[i]

Before the Euro Crisis the Eurozone deficit and surplus countries where at points like D1 and S1: The deficit countries occupied a point on their ρD contraint which reflected a current account deficit (ρ1D<0), a budget deficit (τ1i <0) and investment exceeding savings, as a result of the capital inflows from the Eurozone’s core (as well as from the City and Wall Street). In contrast, the surplus member-states where finding themselves in the adjacent quadrant since, by definition, their current account was in surplus (ρ1S>0). So:

Before 2008/10, the Eurozone as a whole experienced a small but discernible trade surplus with the rest of the world ρ1EZ (=ρ1D+ρ1S>0).

After the Euro Crisis the Eurozone deficit and surplus countries were violently shifted from positions D1 and S1 (respectively) to positions D2 and S2 – see the black arrows. The deficit countries saw a collapse of investment which pushed them into the same quadrant as the surplus countries, with their trade deficit shrinking fast as imports collapsed. The result of this shift was that:

After 2010, the Eurozone increased its trade surplus with the rest of the world from ρ1EZ (=ρ1D+ρ1S>0) to ρ2EZ (=ρ2D+ρ2S>0)

Germany’s current plan for the Eurozone is to balance budgets everywhere – especially in the ‘profligate’ Periphery. But this translates into a ‘push’ along the red arrow for the Periphery and the green arrow for countries like Germany, The Netherlands and Austria. Notice that, to be possible, such a ‘push’ demands that:

After 2013, the Eurozone becomes a mercantilist fiend – that its trade surplus with the rest of the world expands to a gigantic ρ3EZ (=ρ3D+ρ3S>0).

And this is the analytical underpinning of the US Treasury’s (correct) point: To succeed, the current German policies must destroy whatever balance is left in the global economy. And given that, ultimately, it cannot succeed, it will wreck Europe’s Periphery and deliver a deflationary shock to the global economy.

[i] From the standard identities Y=C+I+G+X-M (where Y=gross domestic product, or GDP, C=consumption, I=investment, G=government expenditure, X=export-generated income, and M=income spent on imported goods and services) and Y=C+S+T (where S=domestic savings and T=taxes), it turns out that S+T=I+G+X-M or (S-I)+(T-G)=(S-I).

I don’t believe this analysis is accurate. What if the Eurozone countries as a group invest their surplus around the world? What if that investment cultivates sustainable, productive enterprises that promoted social stability in other nations leading to better economic prospects and real wealth creation, then there would be a balance.

All those lines and arrows and algebra don’t really say anything. All it says is there was malinvestment of intra-European surpluses. If there hadn’t been malinvestment, the lines and arrows would point in different directions.

So what makes something malinvestment versus sustainable productive investment? Very hard to say when it is occurring, using math. Using common sense and anthropomorphic projection in n-dimensional gnostic matrix space it’s not so hard. But it’s not something that shows up on a Cartesian coordinate system until it’s over — and then it’s too late.

Forgetting math and using gros bon sens, production of goods such as food and necessities of life, should be more spread out geographically.

Using math, everything should probably be made in 1 single area to maximize efficiencies. Until we get 1 company per sector on a global basis, we still have a lot of fat to cut. LOL!

Should have written mathiness and not math… because that is what the business elite is using.

generalization in the abstract, Moneta. Who are the “we”, and what specifically “FAT” do you endorse cutting? U.S. pensions? Social Security? Medicare?

I am being sarcastic. As in… we the people of the world… in the name of “efficiencies” and “economies of scale”, the optimizers’ job will not be done until there is 1 huge company.

They will try to convince us, and probably rationalize to themselves, that robots will do all the work while humans can relax.

My comment was meant to show how absurd our economic system is!

“What if the Eurozone countries as a group invest their surplus around the world?”

That would still require either a private or public sector deficit in the rest-of-world current account deficit countries.

It’s just for illustration and very appropriate.

tau = – sigma + ro

or y = m x + n where m= -1, i.e. negative slope at 45 degrees, and n is the value of y when x is zero.

Merkel, who was a physicist, can not invoke her lack of economics understanding, when pressed on the subject with such clear and basic facts! Even our European leaders with basic high school education could easily understand Germany’s intentions from that graph. Or is their salary depending on just that?

Let’s see. Germany makes things and sells them to countries that borrow money to buy them. In the periphery they blow asset bubbles on more borrowed money. The bubbles collapse. And the villain is: GERMANY.

Yes, it all makes perfect sense. Instead of selling the stuff to the periphery Germany should have given it away. Bad, bad Germans. Still screwing everything up.

No wonder people don’t understand economics. It’s so counterintuitive.

s spade,

If one country runs a current account surplus, some other country has to run a current account deficit, which means that either their private or public sector (or both) has to be in deficit, i.e. they have to go into debt. It’s logically impossible for all countries to have current account surpluses at the same time.

By running current account surpluses against other eurozone countries, Germany was requiring those countries to run current account deficits – i.e. it was requiring them to become increasingly indebted, so that Germany could accumulate a surplus. Germany’s policy of continually accumulating a surplus at the expense of their fellow eurozone countries made a crisis inevitable, given the fixed-exchange rate nature of the currency union and the lack of a unified fiscal policy across the eurozone.

And no, Germany didn’t have to give their current account surplus away, they just had to stop trying to accumulate surpluses at the expense of other eurozone countries.

Countries don’t run surpluses or deficits. These things happen. If a country doesn’t export to cover imports it has to borrow. Putting the onus on exporters is ridiculous. Surely, the periphery countries could have exported something: olives, wine, tomatoes, cheese, etc. They could have boosted tourism. That was how the Eurozone was supposed to function. It didn’t. Instead, politicians in the periphery borrowed, banks in the periphery borrowed and blew asset bubbles. Bubbles create crashes. It’s simple, really.

“Countries don’t run surpluses or deficits.”

Yes they do.

“These things happen.”

Know-nothing.

“Putting the onus on exporters is ridiculous.”

No it’s not, especially in a single currency system like the eurozone. Constantly trying to accumulate a surplus, i.e. hoarding and not spending, at the expense of other eurozone countries is a simple “beggar thy neighbour” approach which is doomed to end in tears.

“Surely, the periphery countries could have exported something”

But current account surplus countries like Germany don’t want to spend (on consumption or investment), they want to hoard. They think that having a surplus is a Good Thing, whilst having a deficit is a Bad Thing. They don’t seem to understand that they can ONLY have a surplus because someone else has a deficit.

So..you’re saying if someone in Greece buys a BMW, it creates a binding agreement on someone Germany to eat 2 tons of olives?

No wonder the Eurozone is so screwed up.

No I’m not saying that. What a dumb comment.

Just tell your Bankers to Drive (Korean) Chevies, Renaults,

or Fiats.

Tell the masses to buy made in Greece T-shirs and Boxer shorts, (if they can find them),

Ask the Periphery to increase output and reduce wage cost per

unit to match or beat the Germans.

Be Patriotic, buy your own products!!!

PROBLEM SOLVED

?PAINLESSLY?

If you are driving an Escalade and admiring its made in USA quality, as you are caressing the wood trim, it was made in Honduras, by a German Company with German machines and dies.

Someone needs to get a grip, and stop blaming others

for their weakness.

Wow, you really don’t get it. You really need to get that your statement is so remarkably uninformed that it is tantamount to putting your foot in your mouth and chewing.

If you run persistent trade surpluses, you finance your trade partners. Period. That’s how it works.

Germany saying it wants to run surpluses and not lend to periphery countries in like a fat person saying they want to be thin but they don’t want to change their diet, eat less, or exercise. And you’re surprised the rest of the world is unsympathetic?

Glad you didn’t take the comment personally.

I didn’t take it personally, so that’s your projection.

I’m simply gobsmacked that someone would display such ignorance and then persist in it (per your exchange with PJames above). The argument you are making isn’t some sort of minority view in a contested debate. It’s simply and utterly incorrect and if you could be bothered to do some research, you’d find that out.

What you are doing is just like insisting the world is flat and acting as if continuing to say “the world is flat” makes it true.

OK, let’s connect the dots. Germany desperately needed to increase sales of German products to stave off the looming economic crisis created by reunification. Solution: Create the Eurozone, where exports are no longer exports, then use your domestic banks and their capital surpluses to fuel a spending spree (If you think the periphery banks were providing the cash, you haven’t been paying attention.). Then Germany ramped up the ex-DDR industries using the periphery bubbles it was blowing. Voila, they’ve kicked the can down the road and possibly shifted the mess entirely to other countries.

As long as we have global central banks syncing up monetary policy globally, and global governments syncing up fiscal policy globally, resulting in pro-cyclical monetary and fiscal policy being in synch globally, which dwarf the natural business cycle in any particular region, which results in global boom and bust – worsened by a financial sector gone wild – it will just never seem like things are working correctly.

Makes me wonder why we all aren’t craazy.

where the heck did Phil Pilkington run off to? He should come here and explain this stuff and bring Andrew Dittmer with him. Mr. Dittmer was the best thing that happened to the Peanut Gallery since I don’t know when. If you couldn’t understand something before he explained it, you might just be confused. But if you couldn’t understand it after he explained it, you had to admit to yourself that you’re a moron. I guess he has better things to do than explain things that seem complicated but really are simple, to all of us. he probably thinks we should be able to figure it out by ourselves already. He has a PhD in Math from Harvard so I can understand how he might have better things to do. But still, it was a loss.

Just yesterday I saw a video on the internet about a woman who turned $100,000 into $41 million by trading options. It looked easy, quite frankly, with just a little luck and a calculator. Why sweat the day job? It’s already time to get rich quick.

I’m sure Phil has been busy working on something really big and mind boggling. Like how transformer coupling is the link between sunspots and the bizness cycle, and how some obscure guy Keynes knew recommended counter cyclical fiscal policy to offset this phenom. Only thing I’m not sure about there is how we do it after constant pro-cyclical fiscal policy, largely produced by the Bush Tax cuts for the rich.

Having some problem remembering Dittmar. Wasn’t he the dude that was really good at making Libertarians and Bankers sound silly, especially if they were one and the same?

Making $14 million sounds good. Does that come with any sort of guarantee? I ask because I convinced myself that after the last two market crashes, I shouldn’t do anything risky if I wished to stay retired. (and I really, really, do)

Only the first $7 million is gauranteed. After that, it gets risky.

I think it has to to with writing calls and puts and collecting premiums until you get rich.

It’s like taking money from the Germans to build an airport 50 miles from anywhere and 100 miles from the nearest city, and a train track 100 miles from the airport to the city. It might be a good idea. It probably is, since a city will form itself around the airport and everybody will get rich building houses and then fly from the airport to Moscow and New York and back, in business class.

If it doesn’t work, well, let’s not worry about that while the money’s rolling. Pessimists don’t get rich quick. Have you noticed that? I’m starting the option strategy on Monday since waiting around for GLD to skyrocket isn’t working and I don’t want to have to “get competitive” and actually do something people are willing to pay me for. That sounds awful.

“competitiveness” is a bit of a red herring. The real problem is countries that just want to hoard and not spend.

$7 million risk free still sounds pretty decent. Let me know on Tuesday how it worked out, and then maybe I’ll give it a try. Or better yet maybe do a main post, ’cause a lot of folks would want to see how that’s done.

GLD kinda scares me because all the gold is supposed to be in a JPM vault. I mean, c’mon.

In the mean time I’m staying long dollars, but I do have a reason. I figure that since the Greek government can’t borrow Euros from German banks anymore to buy German stuff and scatter it around Greece for the Greek peoples to use, the Greek people will just say faaack…we’re gonna stimulate the economy ourselves and borrow Euros from a French bank and buy BMWs. Or Krups appliances if they can’t get a big loan.

That should confuse everyone so much the Euro will take a dive and my dollars will be looking great! They’ll be saying “Is Greece Spain?” and all kinds of weird shit. haha.

So just to carry Prof. V’s explanation of the trading cycle, like a diagram of the energy cycle where everything that goes around comes around, I get stuck and can’t get past NAFTA, TAFTA and the TPP. Why, if trade is to be balanced between imports and exports, or recycled surplusses, is it even important at all in this new technological world? Every country can simply be self sufficient. All trade does anymore is benefit big monopolists who write secret trade agreements. If we lived in a fantasy world of naive capitalism, some grassroots capitalism which no longer exists if it ever existed, then a trade cycle might seem like a good thing. But we don’t. I don’t think a balance of exports and imports solves anything.

Here’s my takeaway: what’s Germany gonna do if and when people stop buying cars?

ah, capital, can only replicate, its own process…which is why the Fed is clueless as to why it cannot hold labor steady with international free trade, and inflate domestic RE with artificial prohibition, without building a bomb, currency deflation.

The problem with all monetary theories is assuming that government, or its assumed capital boss, has any clue where to put the money…

Labor and capital is a trade-off, that the Fed assumes are independent, for the sake of building the bubble, hoping to get out before the middle class explodes.

The top-down union model does not, nor has it ever, worked.

“the attempt to balance budgets can only bear fruit if the Eurozone as a whole manages to reach a Current Account surplus of between 8% and 10%”

Why do they need to reach a current account surplus? Couldn’t they just have a balanced current account (X = M)?

The higher the current account surplus, the more a government can reduce spending in the quest for balanced budgets. Germany, for example, would be reducing domestic demand with spending cuts on the one hand and making up for it by importing foreign demand with surplus exports.

And yes, if you think this sounds stupid you’re right.

Agreed. However there is this common misconception that such stupidity is ‘virtuous’. Some commentors here seem to share that completely erroneous idea.

“the attempt to balance budgets can only bear fruit if the Eurozone as a whole manages to reach a Current Account surplus of between 8% and 10%”

Why do they need to reach a current account surplus? Couldn’t they just have a balanced current account (X=M), so that saving then equals investment (S=I), instead of saving exceeding investment (S>I)?

“the attempt to balance budgets can only bear fruit if the Eurozone as a whole manages to reach a Current Account surplus of between 8% and 10%”

Why do they necessarily need to reach a current account surplus? Couldn’t they potentially have a balanced current account (X=M) along with a balanced government budget (G=T), so that saving then equals investment (S=I), instead of saving exceeding investment (S>I)?

I love the analysis. I believe the last term in your footnote should be (X-M) rather than (S-I.

Prof. Varoufakis slickly avoids two important arguments.

1. It was understood that nations who entered the Eurozone would care for a balanced budget, That was a promise given, and Germany simply refers to the promise.

2. Would the “periphery” really be better off if Germany left the Eurozone? Then they shall say so and we Germans will be happy to leave it.

Germany has exceeded the deficit limits on numerous occasions. So apparently, promises only run one way.

I think Germany leaving the eurozone is fine. Countries should go back to their national currencies. A country like Greece could simply set any euro denominated debt on a one drachma to one euro basis and then use its restored sovereign money creation powers to pay its debts to Germany off in drachmas. Naturally, since you want Germany out of the eurozone, you could have no problem with such a deal.

The budget balance is, unfortunately, not under the control of governments. The private sector is in the driver’s seat and can derail any fiscal policy if it so chooses

Unfortunately, Varoufakis unnecessarily messes up his correct conclusions by using a hard to understand technical explanation in order to illustrate it.

He should have used instead the excellent, rigorous, crystal clear “Krugman cross” model (http://krugman.blogs.nytimes.com/2009/07/15/deficits-saved-the-world/?_r=0) later extended to the foreign sector by the likes of Parenteau (http://neweconomicperspectives.org/2009/07/employing-krugmans-cross-farewell-mr.html) and Scott Fullwiler (http://neweconomicperspectives.org/2009/07/sector-financial-balances-model-of-aggregate-demand.html).

Speaking in plain English, GDP accounting tells us that, necessarily,

The public deficit of a country equals the sum of its private sector surplus and its foreign account deficit.

Since the eurozone countries want to achieve a balanced budget while also maintaining a private sector surplus, it follows that this will be possible if – and only if – they manage to attain a very high current account balance.

But once and if they achieve massive current account surpluses (which will contribute to destabilize the world economy) the euro will tend to appreciate and this appreciation will rapidly annul said surpluses.

It follows that the Eurozone “austerian” economic strategy is wrong and the U.S. criticism is right.

What is really a pity – perhaps a tragedy – is that the euro periphery countries have not immediately jumped to use this well founded American criticism as a weapon to resist the austerity that core europe has been imposing on them.

“But once and if they achieve massive current account surpluses (which will contribute to destabilize the world economy) the euro will tend to appreciate and this appreciation will rapidly annul said surpluses.”

Unless the ECB behaves like other mercantilist central banks and tries to hold the exchange rate down. Like the Chinese or Japanese central banks, for example.

Pre GFC OCED data showed that when you look at the trade balance of the Eurozone as a whole vs the ROW, it was mainly German exports TO THE ROW that offset most of the rest of the Eurozone’s imports FROM THE ROW. I think there were a couple other countries that had small surpluses or where at least neutral with the rest of the world. IIRC they were France and the Netherlands.

That would mean a sideways, or stable, euro measured against some absolute pure, un-manipulated currency.

But this data doesn’t support the “Germany is messing everything up” narrative, so never mind.

craazyboy,

pre-GFC, Germany’s current account surplus against other eurozone countries was a problem for those countries, given the single currency, single monetary policy, and the lack of a unified fiscal policy across the eurozone. Now the policy is to try and achieve a large current account surplus for the eurozone as a whole, which means that other countries in the ROW will have to run current account deficits for that to be possible.

Yes, that is the problem now. Just wait till we hear what Japan’s, China’s and even the USofA’s solution to their respective problems are. The same. (not to mention Brazil, India, etc…)

you can’t all run current account surpluses at the same time. Germany seems to think that everyone can and should. They seem to think it is immoral for countries to run deficits, despite the fact that those deficits are what make other countries’ surpluses possible. They pat themselves on the back for their large surpluses, and criticise countries that run deficits. Their position is completely illogical.

No you can’t, and I doubt Germany thinks everyone should, but China, Japan, the US and others do think they should be the lucky one, because it’s the only way economics lets them get out of the mess they’re in.

The other dumb thing our treasury said a few years back was to chide Germany for inadequate consumption. Population about 90 million? They are going to be the demand sink for Asia, Japan, US, and Europe?

Or maybe Greece will do it – Just don’t let them buy anything from Germany?

of course a major difference between countries like Greece and the US is that Greece doesn’t create the money it uses to buy imports, whereas the US does. In the case of the US you could say mercantilist countries like Germany and China are actually in a losing position. They give the US goods they work hard to produce, and the US gives them pieces of paper called dollars. Under a fixed exchange rate system or single currency system like the eurozone, mercantilism is genuinely a “beggar thy neighbour” policy, and the Germans deserve to be criticised for pursuing such a “beggar thy neighbour” policy against their fellow eurozone countries. It is a truly moronic approach for them to take. However when dealing with countries that issue their own currencies on a floating exchange rate, the shoe could be on the other foot.

In the special case of the US, Chinese mercantilism took a chunk of our economy due to low labor cost/yen pegged low. We can compete with Germany and even Japan nowadays. In fact, both even put some auto plants in the US.

As far as “beggar thy neighbor”, I don’t know for sure, but I don’t think there is much direct industry competition between Greece and Germany. The only trade would be of the mutually beneficial type – things the other country doesn’t have. (except that part about Greece buying military stuff to be a stronger member of NATO, but politics…)

Then of course most multi-national banks were involved in bond issues and loans – but were completely unfettered by lack of a local central bank that normally would have to facilitate currency exchange and could run out of popular ones due to trade deficits. So no brakes.

So if you have a large current account deficit and large fiscal deficits, it simply means someone borrowed and spent too much, and if part of that was going towards internal investment, they didn’t get a return on investment. And if the government is doing it, the way they get return on investment is thru taxation. Then with the Euro they don’t have the devaluation option – which is over rated anyway because certain countries that over use the de-val option find out they aren’t allowed to borrow or pay bills in their own currency anyway.

“I don’t think there is much direct industry competition between Greece and Germany”

It doesn’t matter if there is or not. Germany’s compulsive hoarding constantly sucks demand out of the eurozone economy. I suppose macroeconomic issues like this escape your attention as you apparently consider economics to be some sort of simpleton morality play.

‘Devaluation’ refers to an official reduction of a currency’s value within a fixed exchange rate regime, not to a floating exchange rate system. Perhaps you should study some more.

European austerity and American surplus recycling are both wrong. They are both based on mercantilism capitalism. The EZ is just more conservative. And the US thinks trickle down is better than no money circulation at all. If surplus recycling is the money cycle there can be no wealth accumulation, theoretically. If austerity is the money cycle it crashes at intervals sufficient to insure there is also no wealth accumulation. Except under both policies monopolists will make lavish gains of no use to either social system. Capitalism is absurd probably because it is nothing more than mercantilism. Capitalism can’t solve its own problems with balanced trade. It’s just too crooked.

Great post… More on this issue at another post today.

http://angrybearblog.com/2013/11/a-study-in-the-dynamics-of-international-flows-4.html

The other post is my view of the comparative advantage in terms of labor share that China and Germany have. Those two countries are spreading low labor share rates. It is a contagion.

Something needs to be done about this…

Edward,

Krugman is referring to US private saving, not ‘national saving’, which includes ‘government saving’ (government budget surplus).

US private saving is currently in excess of US private investment, due to the large government budget deficit and the shrinking current account deficit.

See this graph, which shows gross private saving (GPSAVE) and gross private domestic investment (GPDI) for the US:

http://research.stlouisfed.org/fredgraph.png?g=nXF

so, economics is not economics, it’s war?

which is first, dust bowl or war?

“Things have changed in Germany since Chancellor Angela Merkel’s government launched its energy transition policy in June 2011, prompted by the Fukushima nuclear power plant catastrophe in Japan. The decision to hastily shut down all German nuclear power plants by 2022 has shifted the political fronts. Old coalitions have been shattered and replaced by new ones.

Indeed, this is not just about cleared forests. Grasslands and fields are being transformed into oceans of energy-producing CORN that stretch beyond the horizon. Farmers are using digestate, a by-product of biogas production, to fertilize their fields as soon as they thaw from the winter. And entire tracts of land are being put to industrial use — converted into enormous solar power plants, wind farms or highways of power lines, which will soon stretch from northern to southern Germany.”

Thanks for the excellent macro analysis.

FWIW, just a nit with footnote [i]:

The derivation of the sectoral financial balances accounting identity should be:

S+T=I+G+X-M or (S – I) + (T – G) = (X – M).

Some thoughts:

1. Is more consumption in Germany the answer? Do not high quality products, infrastructure, and governance reduce the need for high levels of consumption? Is mild deflation not inherent to the sensible implementation of technological advances?

2. Is not a current account deficit as deplorable as a current account surplus? Can not the imbalance be fixed by having deficit countries improve the quality of their exports instead? Why does the treasury not advocate this latter option, iow, why does the treasury not support higher standards?

As the answer to 2 above may be clear, it seems we are left with:

3. Trade among entities that are not peers is not possible. Furthermore, as trade amongst strict peers will get out of balance as soon as one peer gains a relative advantage, the latter is not possible either.

Which leaves one conclusion:

4. The only sustainable form of trade is barter. No deficit, no surplus, no debt. Despite all the ‘debunking’ of barter, and the bleating about debt, the core economic exchange is ultimately still goods for goods…

All this current account surplus / deficit talk is just nonsense words. It should be boiled down to the fact that Germany produces products that people in other countries want to have. Unfortunately for the other countries, they don’t produce much that Germans want to have. If this trade system was reduced to a barter system, then the other counties would not be getting many products from Germany. But because they are not using barter, but instead using a fiat currency with near unlimited ability to borrow, these countries are putting themselves into debt-slavery so they can get the german products. So if the countries want to reverse the situation, they have to make products that germans want. Sounds simple, but it is not since this requires massive educational, cultural, and civil changes to these countries. In the long run those changes are exactly what these countries need. I am in Italy and it is basicially a third world country with first world prices. It needs to be ruled be germans, and hopefully that is the outcome of this eurozone crisis.