Naked Capitalism readers have frequently called for the Post Office to offer basic banking services, as post offices long have in many countries, notably Japan. That idea has gotten an important official endorsement in the form of a detailed, extensively researched concept paper prepared by the Postal Service’s Inspector General. I’ve embedded it and strongly urge you to read and circulate it.

One of the stunning parts in reading the document is to see how wildly successful this program could be, precisely because traditional banks are withdrawing from many of the neighborhoods in which moderate and lower-income people live, and non-banks offer targeted, richly priced services, too often designed to take advantage of desperation or simple lack of alternatives. Even though most of us are aware of this general picture, the USPS IG, dimensions the scale of this problem and the costs to the affected households

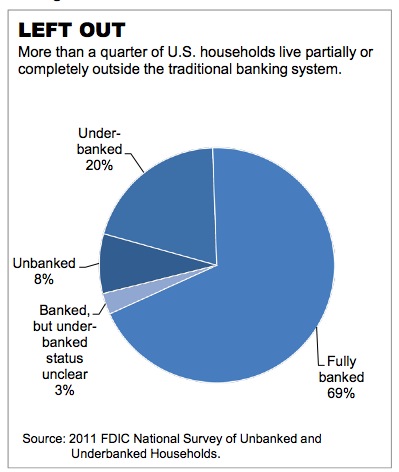

There are 34 million un and underbanked American households, which translates into 28% of the population. And consider what this second-class status translated into in fees and other charges:

There are 34 million un and underbanked American households, which translates into 28% of the population. And consider what this second-class status translated into in fees and other charges:

The average underserved household has an annual income of about $25,500 and spends about $2,412 of that just on alternative financial services fees and interest. That amounts to 9.5 percent of their income. To put that into perspective, that is about the same portion of income that the average American household spends on food in one year.5 In 2012 alone, the underserved paid some $89 billion in fees and interest.

And this level of charges plays directly into financial distress:

For the most vulnerable Americans — including many of the underserved — the difference between making it and not is a small amount of money. Among the 1.1 million people who filed for personal bankruptcy in 2012, their median average income of $2,743 a month was just $26 less than their median average monthly expenses. Put another way, these people were just $26 a month away from making ends meet.

Despite the enormous amount of taxpayer and stealth public support (the taxes on savers known as ZIRP and QE), banks continue to reduce service levels to the broad public, closing 2300 branches in 2012 alone. 93% of the cuts since 2008 have, not surprisingly, taken place in lower-income neighborhoods.

The Postal Service’s existing branch network and its presence in payment services (it currently offers domestic and international postal money orders and prepaid debit cards via American Express) and positive customer perceptions (it is widely seen as highly trustworthy) makes it easy to expand its financial service offerings. In some ways, this move would represent the Postal Service returning to its roots, since the Postal Savings System provided savings accounts from 1911 to 1967, and at its peak served over 4 million customers. And even though banks are certain to squawk, the fact that they’ve abandoned many communities and districts strengthens the Postal Service’s case for filling the gap:

Remember that in some rural communities, where the USPS has been closing branches due to cost pressures, the demise of the local post office is the death knell for the town. The addition of financial services would not simply help keep a critical service going by providing the additional revenues to keep these branches open; the addition of banking services would be a real boon to these struggling small towns.

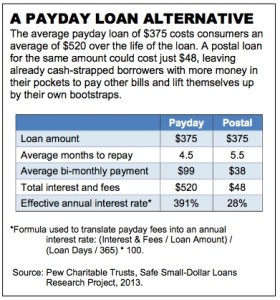

The document outlines product opportunities for the Postal Service. The low-hanging fruit is expanded payment services, via a Postal Services reloadable prepaid card, which could be FDIC insured through partnership with a bank, and check cashing. But the more interesting and socially valuable opportunities like in helping citizens save more, say via an interest-bearing savings feature on the prepaid cards, and undercutting payday lenders. It says quite a lot about how rapacious this market is when a product with an effective interest rate of 28% is a screaming bargain:

Postal Loans would be available to people who have their paychecks directly loaded onto their Postal Service prepaid card (this also could be for government payments, such as Social Security or disability benefits) and have received at least two straight payments. For those whose employers do not offer electronic transfer, they could be eligible for a loan if they load at least two consecutive paychecks onto a Postal Service prepaid card.

People could borrow up to 50 percent of their gross paycheck. For a person who earns $18,000 per year and gets paid twice a month, that is $375. Every borrower could be required to pay a minimum of 5 percent of their gross pay from each paycheck until the loan is paid off. In this scenario, that would be $38 from each paycheck.47 The Postal Service would automatically withhold loan payments from borrowers’ paychecks before putting the difference on their Postal Card. If the Postal Service charged a $25 upfront loan fee and a 25 percent interest rate, the borrower would pay off the loan in 5 1⁄2 months, paying a total of $48 in interest and fees across the life of the loan.

And as Dave Dayen points out at The New Republic, the Postal Service has the authority to launch these products now:

The Postal Accountability and Enhancement Act (PAEA) of 2006 put restrictions on offering new “non-postal” services. However, the report points out, “given that the Postal Service is already providing money orders and other types of non-bank financial services, it could explore options within its existing authority.”

This transforms postal banking from a nice idea that works in other countries but would never get through Congress to something the USPS could test right away. While the Inspector General does not represent the final legal word on the subject, precedent would be on the side of the Postal Service if it wanted to construe the PAEA this way. The 1984 Supreme Court ruling in Chevron v. NRDC generated what is known as the “Chevron deference,” which gives fairly generous latitude to federal agencies in interpreting statutes. Congress could always act at the behest of payday lenders and other operators to ban the USPS from specifically offering financial services, but then gridlock would work in the Postal Service’s favor, foiling Congress’ effort to stop postal banking.

I’m not as confident that the incumbents won’t be able to throw sand in the gears via a court challenge. While there’s good reason to think they might not ultimately prevail, mere delay would stymie the Postal Service at a time when it is in keen need of more revenues. That means branch closures would continue apace, reducing somewhat its effectiveness as a competitor.

The flip side is that this idea has such obvious popular appeal that raising awareness of this option and cultivating public support would increase the PR cost of trying to stymie this idea in courts. Imagine Elizabeth Warren and Sherrod Brown grilling big bank execs on their profit margins on these products and how much they earn by gouging low and moderate income Americans, particularly after having gotten all sorts of support from the long-suffering public during and after the crisis.

So please talk up this proposal up with friends and colleagues. The more support we can garner for providing good, fairly priced products to the many customers banks have chosen to neglect or abuse, the better.

I commented recently that being poor is very expensive. Hasn’t gotten any less so since. Only one woman, also poor, responded and I wonder if we two are the only poor who regularly read here.

Dear CB;

It depends on what you or I consider as being “poor.”

I work at a Boxxstore and make about 30 grand, including “benefits.” My wife gets about 3 grand Social Security. Say, 32.5 K. We’re lucky, we own our home outright. Lots of our acquaintances owe various sums and are terrified. So, leaving out abject poverty, which is cruel in and of itself, a flow chart of income and expenditures would be the way to go.

It is sort of liberating to discover how much of what “Modern Life” considers indispensable one can do without. Cable TV? What a waste of time! Big shiny car? Who are you impressing anyway? Giant McMansion? Both of the above! The list is well nigh endless.

The real poverty, I’ll aver, is spiritual. By bringing the subject up in the first place you and the lady you mentioned have demonstrated riches that can not be alienated from you.

PS, I remember “shining” rabbits for the pot back when I would be laid off between plumbing jobs. Plus the monthly “excess” food give aways, and paper Food Stamps, and odd jobs that barely earned enough to pay gas money and a days groceries, and afternoons spent trying to work my way through the “Federalist Papers” and the “Anti Federalist Papers.”

A lot of the time, one can be poor and not know it. Todays Glamour Media are all about making sure no one understands reality. As the Jefferson Airplane say in “White Rabbit,” “Feed Your Head!”

Being poor IS expensive because one cannot access economies of scale as the non-poor do such as buying quality things that last instead of making do (for the moment only) with inferior goods.

Even more encouraging, the Post Office is demonstrating a survival instinct.

But do you think the Too Big To Fails will allow the post office to cut into their profits?

the beauty of it is that since they make no profits of these people right now anyways (well, not directly, they do service the paydayloan companies… ), they may well ignore it. Of course, should a sufficient part of their retail customers start to migrate, they will scream..

They won’t ignore it. At the first sign of movement toward implementation, as Lambert suggests is feasible under existing law, the TBTF banking poobahs will have their Congress pass legislation that rescinds that authority. It will be perceived as the camel’s nose under the tent of too big of a threat.

We used to have a Post Office Bank in Britain. The last Labour government seems to have rearranged things so that Bank of Ireland runs things now. Good choice, eh?

I think the operative distinction is “for whom?”

Yves, here’s the problem I am having with traditional banks. They are quick to hand out credit cards. But if u ask them for a loan to consolidate your balances, they say no way, they ask for all kinds of collateral, they ask for cosigners, and even tho they impose an interest rate, the rate is somehow not comparable to either the card rate or standard loan rates.

I mentioned this idea to Sen. Bernie Sanders who is working to keep the post office together.

He thought is was a good idea and said he would look into it. I’m thinking he kept his word.

Banks squawk? The banks best keep quiet since the monetary sovereign is the ONLY proper provider of a risk-free storage and transaction service for its fiat – which point should be made over and over again till people get it and demand that government deposit insurance be abolished.

The banks live in a glass house but few comprehend that.

Looking at the Federal Reserve, it obvious the most qualified people to start and run a banking operation are government workers.

Risk-free transactions with and storage of fiat are easy and the Postal Savings Service should do nothing else. No lending and no paying of interest.

Well, I thought that Post Office workers theoretically work for us, the Public. Bank workers don’t even pretend to any more.

Well looking at JP Morgan, it’s obvious the private sector are just the people to run a bank.

I’m sure there’s some official name for this fallacy, but I’ll just call it the broad-brush fallacy:

That Fed directors have engaged in crappy policy doesn’t prove that every employee and every agency will be as incompetent as the Fed directors. Just like the fact that Jaime Dimon is a criminal doesn’t prove that all bankers are criminals.

Look up the Bank of North Dakota and their record over the last 100+ years of existence and then tell me how public employees are unfit to run a bank.

Government workers have to pass tests to qualify for jobs. Private sector is lowest wage worker. Are you afraid that you might have competent services from the government, or do you work for a private sector financial institution that has paid fines for money laundering for drug, arms, and human traffickers?

I get mail 6 days a week no matter the weather. I quit Key bank because they were clip artists with a system for manipulating my accounts so as to simply take my money. Fuck the private sector, they are organized crime.

Well. Of course the problem with all this is exactly the entity which would be expected to perform “Postal Banking” — the United States Post Office.

I understand that it’s de rigueur for liberals to support the Post Office, but many times I really wonder how many of them/you actually go into a Post Office branch and actually *use* the Post Office on an on-going basis.

Case in point: I live in a small ZIP code — maybe 10K residents — that’s on an island so there’s no practical alternative (driving quickly to a larger branch closer to a bigger city) to my lovely local Post Office.

Yesterday was typical. Of the three windows, one was open. A line of eight people (when I got in line) snaked out into the lobby. There were quickly three more people behind me. After five minutes a second (but not the third) window opens. Every single customer had some sort of special case situation that took minutes individually. It took me over ten minutes just to get to the counter. Even my extremely simple transaction — first class mailing a parcel that was going to this same ZIP code — took minutes because I had to be asked a long list of apparently-mandatory questions (Do you want insurance? Do you want tracking? Is there anything hazardous, flammable or what-ever-the-hell — which I now have to certify by clicking “Yes” on the terminal that I will swipe my debit card on when we get through all the bullshit boiler plate and just do what I’m asking)…

And now we’re going to let these clowns do retail banking at exactly the same counter with one window open and a line streaming out the door?

Oh, lovely.

ATMs and transactions over the Internet should eliminate almost all need to visit a Post Office.

Except for loans, one might ask? That’s easy; a Postal Savings Service should make no loans nor pay interest nor charge for services up to normal household limits on account size and number of transactions.

ATMs suck for deposits.

Good point. I’ve yet to trust an ATM when it comes to deposits. So hire more Post Office workers and whatever else it takes since a risk-free storage and transaction service for its fiat is an essential function of the monetary sovereign ITSELF.

Boy, ain’t that the truth. Tried making two deposits when my bank went to “no envelope/we scan the check” method of ATM deposits. Both the checks I submitted for deposit were rejected. Went to the local branch where the teller explained that the reason one check was rejected was that the signature of the person who wrote the check included a lower case “p” and that the tail of the “p” over-wrote one of the imprinted routing numbers on the check.

The teller could give me no reason why the other check was rejected. And who was that check from, you ask? None other than the United States Treasury. It was my income tax refund check.

Ever since, all deposits done in person with a teller.

Actually not if you have the newer ATMs. I never used the old envelope ones, never trusted them. But now, you pull up the account where you want the deposit to go, insert the check face up (they show you how to orient it). The machine tells you what it thinks the amount of the check is (on my 3 tries so far with handwritten checks it got it right every time). You confirm and it gives you a receipt. You can even ask for a little scanned image of the check you deposited on the receipt, and I get that every time.

We must use the same bank…….. or both bought the same implementation product. I have all the records of the transactions emailed back to me.

I figure that way there is a permanent record if needed, on a server in Utah (well technically, it only has capacity for 5 years, but the problem will be resolved before 5 years has passed.) Need a copy of an endorsed check the bank can’t find? Just file a FOIA! No need to bother with boxes of receipts anymore, allow the NSA to be your own personal recordkeeper.)

I love ATM deposit and banking in general! My only beef is that you can only get $20 bills.

Yeah, ATMs are fantastic. I’ve been using them for years for all my deposits.

At least you can afford the present postal system. Imagine how badly you’d get buggered by a private, extremely for profit mail “franchisee!”

There was a reason Ben Franklin started the Postal Service. The free exchange of ideas.

As an added bonus, imagine how well the U.S. Postal Service would run if it were not saddled with that unique full vesting of its’ retirement fund mandate. No other entity that I know of has as onerous a burden as that.

Full vesting of pensions? It goes well beyond that. Currently the USPS is being required to pre-pay the projected retirement benefits not just for workers who haven’t yet been hired, but for those who are not yet BORN. (Funding retirement benefits 75 years out for people who will hit full retirement at 65.)

You’re right: we need to beef-up Post Office staffing levels considerably, as well as build out the infrastructure to accommodate the extra traffic teller windows will generate. Good point.

The post office works damn well. It is seriously understaffed, unfortunately, due to deliberate funding raids from Congress (there have been articles about this). That slows things down.

It isn’t any faster at the criminal megabanks, which are understaffed for their own profiteering reasons. It isn’t any faster at UPS generally either.

“first class mailing a parcel that was going to this same ZIP code”

You went to the post office for that? Do you go there to pick up mail, too? Don’t they have a drop box that you can drop your parcel in? Surely they do. You are aware of usps, right? All you need is a scale – wrap it, address it, weigh it, slap some postage stamps or print out your paid online postage on it and put it on the porch for the letter carrier or drop it in the box.

First world problems.

Are you telling me you’ve never had to wait in a long line at an understaffed private business? I’ve had the exact kind of experience you describe AT A BANK more often than I care to recall. Does that prove that nothing should be done by the private sector?

I’d also add that it’s likely that your local Post Office is understaffed because of the way Congress has hamstrung the Postal Service. They have to cut costs somehow to meet those absurd requirements for pre-paying retirement benefits.

Post-office banking is extremely popular in India, has been for over 60 years and is used extensively by lower income people (and part of the middle class as well). In fact India Post is efficient and has excellent operations in rural and remote areas. For example, one of the most popular services is the money order, where the postman actually hands cash to the recipient on delivery, no fuss no muss. India Post is one of the few institutions that are liked by the public (if you ignore the usual grumbling that one sees in queues). Most importantly, the regional postmasters-general tend to be very smart people and are both responsive and quick to change. (Many years ago I knew one of them, he was smart as a whip and popular too.)

Unfortunately, Republicans in Congress (or should I say their masters) would never allow the USPS to go into banking

Please re-read the post. USPS already has the authority to do so. So it would be a matter of the Republicans stopping them. As long as Obama doesn’t mess things up so badly as to lose a Democratic majority in the Senate, the Republicans can’t block this. A court challenge to tie up the Postal Service seems like the more effective course of obstruction.

I apologize for not reading through the entire post before commenting. But I doubt the banksters would have much difficulty getting enough Democrats to side with the Republicans to keep the USPS off their turf.

It doesn’t have the authority, as the post office conceded back in 2008.

I’m glad to see this proposal from the USPS. These services are all small scale (small amount of money per transaction) and are continuously becoming more expensive at the big banks. So there is a niche and a need. Wells Fargo is going big time into mortgages, hiring every originator they can find and training them to broker their products through WF to private equity investors; JPM doesn’t want anything to do with small time banking; BAML isn’t saying what it wants to become which prolly means it doesn’t know; Citi is Saudi; GS was always a big trust company; regional banks just wanna be big banks and invest foolishly, etc. Plus Obama just announced last nite that he was asking Treasury to design a new retirement investment instrument called MyRA – so we can invest directly in guaranteed treasuries (no doubt because they will be in negative interest for decades to come, but whatever; it’s better than losing all your money). The USPS Bank would be well positioned to handle MyRAs as well as SS payments.

No risk means you should not receive any real interest or do you want to be a thief in direct proportion to the amount you “invest”? Indeed, you should receive negative real interest to cover storage costs plus maybe a hoarding penalty besides.

People, let’s please eliminate welfare in proportion to one’s wealth and replace it with welfare according to one’s need. Too much to ask?

Yves, very interesting, thanks for highlighting this. One of my longer term interests has been seeing if there’s some way of developing a local bank model that is funded by local capital for local use. The obvious conceptual response to TBTF is for us to loan currency directly to each other as our personal savings and spending needs change over time. Unfortunately, the transaction costs involved in doing so, particularly underwriting and collections, dwarf the value of the lending.

The reason bank branches are closing is that they are expensive to run, from the HVAC to the health insurance. The USPS is caught up in the same operational squeeze, so I’m not sure how combining the two (unprofitable mail and unprofitable finance) changes the economics?

Addressing making the Post Office an independent business, addressing underbanked communities, and addressing the unbanked are three separate issues; there’s no magic profit fountain in garnishing the wages of people making $18,000 a year.

The monetary sovereign has an inherent DUTY to provide a risk-free storage and transaction service for its fiat whether that service is profitable or not. But also abolish government deposit insurance and large account holders like the banks can be charged enough to pay for the little guy too.

Yeah, one of the simplest ways of making postal banking profitable is to eliminate the FDIC :)

But then, that’s targeting the fully banked, not the underbanked, and at any rate, that’s talking about solutions above the pay grade of the USPS. Which is the fundamental conundrum of the Post Office. It’s trapped in this purgatory of not being funded as a true public service, yet not being allowed to act like a true profit-constrained independent business, either. I mean, even attempts to sell post office real estate are mired in the kinds of petty cronyism destroying our institutions.

Personally, I don’t subscribe to the duty view on public banking. I don’t have a problem with only 70% of the population being fully banked. Rather, what I have a problem with is extreme inequality which pushes both fully banked and underbanked alike into paycheck by paycheck living. The notion that selling prepaid Visa cards and small cash loans and generally pushing the ‘cashless economy’ changes anything meaningful is pretty funny. To me, underbanking isn’t a cause of social problems; it is an effect.

Very good point about the need to confront the real problem – paycheck to paycheck living…there are more of those people and their situations more dire.

TBTF is NOT too big to shrink to insignificance. How? Ban further credit creation, at least temporarily, and meter out new fiat equally to the population till all deposits are 100% backed by reserves less borrowed reserves. Then give everyone some time to move their deposits to a new Postal Savings Service and then cancel government deposit insurance and abolish the Fed. Then allow the banks to leverage as much as they dare with only the banks themselves and their now entirely voluntary depositors and other creditors bearing all risk and uncertainty.

Or not. Justice is coming with or without Progressives and if I can’t change your minds I’ll at least remove the excuses of ignorance or TINA, so help me God.

Hopefully the republics will not be permitted to bankrupt and privatize the post office by forcing them to fully fund the pensions of all their employees for decades into the future, something they demand of no other private corp. This would destroy any opportunity for the post office to serve the public banking needs of the working classes as they have so successfully in the past.

Great idea. However, considering the efforts Republicans have put into sabotaging the USPS’s ability to provide the services it already provides, I’d say the chances of the Post Office being allowed to offer new services in potential competition with some of those politicians best clients are approximately zero.

When it comes to fiat, the monetary sovereign ITSELF (eg. Postal Savings Service) is the ONLY proper provider of a risk-free transaction and storage service for it. The bankers have conned us into providing them with government deposit insurance and their own pet fiat creator, the Central Bank, so it’s not a Postal Savings Service that is the usurper but the government-backed banking cartel.

Ellen Brown’s Public Banking Institute has been working with the USPS on this. At the Public Banking Conference last June in San Rafael, there was a very interesting presentation on the publicly owned art (murals, frescoes, statuary) in the publicly owned post offices that are being closed and sold off. This is happening a lot in California, as one example, where old post offices often sit on prime land that private developers are salivating over. Here is the video: http://www.youtube.com/watch?v=FCz8yhRbDDY

BTW, guess who has the contract to sell the old publicly owned post offices, some of which are architectural gems in their own right? Senator Diane Feinstein’s husband has that contract. Nice, huh?

The United States had a postal banking system from 1911 to 1967.

http://en.wikipedia.org/wiki/United_States_Postal_Savings_System

Anyone who’s read Mario Puzo’s “The Fortunate Pilgrim” will remember that his family rode out the worst of the Great Depression reasonably well because they banked with the Postal Savings system.

If the Post Office does it, will FedEx or UPS want a piece of the action as well?

“Have your deposit ready because our driver can’t stay longer than 5 seconds for the pickup.”

Am I the only one who gets mad about FedEx “SmartPost” and and UPS “Mail Innovations” and DHL “Global Mail” deliveries? They start out in the private carrier system, travel to some hub where it is then trucked off to the regional postal hub, to be delivered the rest of the way. Packages from Texas, my prescriptions, took 3 days with USPS. Now it’s 8 days with DHL global mail. Two days from NJ for UPS is now 6 days with SmartPost. They also claim to offer tracking which may not materialize on the private segments of the journey, showing up as not in the system, until it enters the USPS system.

I have no idea what the terms of the contracts are between the private carriers and USPS. But the rates must save the sellers money or they would go back to using US mail alone. And now the private carrier is getting a significant cut of this same reduced rate. US Mail has taken on the most expensive portion of transporting the goods, the latter and most remote legs of the journey. I don’t understand how USPS isn’t losing their pants on these contracts. They get less money. We get service that hasn’t been so slow since using air transport to move mail long distances became standard, instead of an upgrade available at a higher cost. The former regular snail mail has become the upgraded version.

RE: Postal bank.

The New Republic article says “Maybe it’s time for President Obama to step in…”

Good Effing Luck! Barry will never, ever, do what Massa does not want!

If this program is, indeed, wildly successful, will USPS no longer need to deliver tons of heavily subsidized unwanted junk mail merely to survive? If not, USPS is an excellent candidate for privatizing. As in Deutsche Post. While preservation of high-maintenance historic buildings offers recognizable cultural value, preservation of high-maintenance historic organizations does not.

I am wondering how international payment systems work. Say, US imports goods from China and pays for them with USD. What happens if Bank of China intervenes? What happens if it does not? Can you help me go through this transaction through use of balance sheets of economic agents?(Importer, Exporter, Chinese bank, US bank, FED, Bank of China) What happens to bank reserves in US? Thank you?