This is a welcome bit of good news. Countries are finally standing up for the rule of law over rule by multinational corporation.

The most troubling feature of the stalled but far from trade deals, the TransPacific Partnership and the Transatlantic Trade and Investment Partnership, is that they would increase the power of investor panels to overrule national laws. Here are some overview sections on these tribunals from a November post that contains a good deal more information:

Let’s give more detail on how heinous this deal and its ugly sister, the Transatlantic Trade and Investment Partnership, aka the Trans Atlantic Free Trade Agreement, are. They would extend the authority of secret arbitration panels to hear cases against governments and issue awards. Mind you, the premise of these panels is that some of the signatory nations have banana republic legal systems that might authorize the expropriation of assets, like factories, so foreign investors need recourse to safe venues to obtain compensation. This is a ludicrous proposition to most of the signatories, not only to signatories of the Atlantic agreement (all advanced economies with mature legal systems) as well as potential signatories like Singapore, Japan, Canada, and Australia (and while America’s judicial system leaves a lot to be desired, it can hardly be accused of being unfriendly to commercial interests)….

Now consider what this means. These companies are not suing for actual expenses or loss of assets; they are suing for loss of potential future profits. They are basically acting as if their profit in a particular market was guaranteed absent government action. And no one else enjoys these rights. Consider highly paid workers in nuclear plants. Will they get payments commensurate with the premium they’ve lost over the balance of their working lives from the phaseout of nuclear power? Will cigarette vendors in Australia get compensated for the decline in their sales? Commerce involves risk, which means exposure to loss, yet foreign investors want, and seem able to get, “heads I win, tails you lose” deals via these trade agreements.

And this system is deeply corrupt:

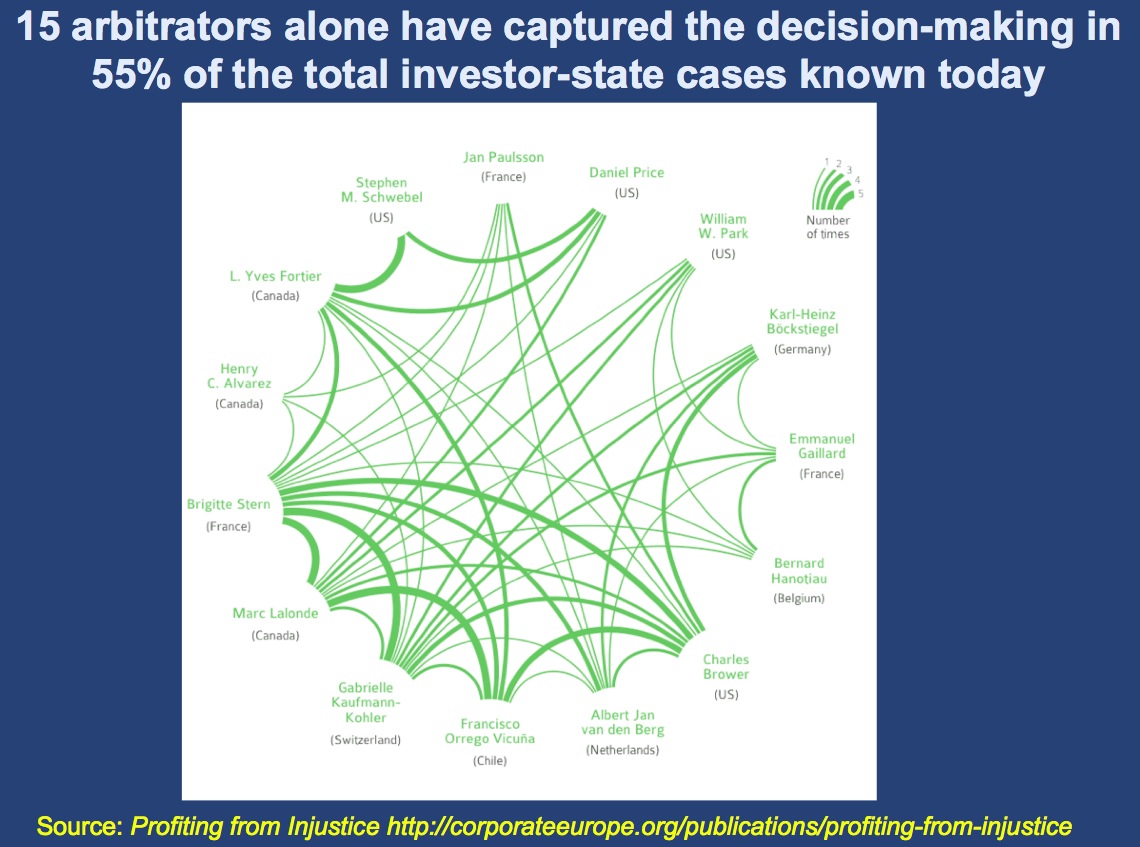

And it’s even worse than you imagine once you understand how these panels work. Recall how Public Citizen mentioned the role of the panelists who go between working for the companies and serving on the panels? A small and tight-knit group has disproportionate influence (click to enlarge):

Consider the implications of the fact that the 15, and the larger community of panel “regulars,” work both sides of the street. They draw cases that go before the trade panel, as well as hear them. Thus it’s in their interest to issue aggressive rulings in order to facilitate more cases being filed.

The Wikileaks release of two highly contested chapters of the TransPacific Partnership appears to have solidified opposition to its worst provisions, the investor panels. And in an very encouraging development, Germany also wants these panels removed from the deals.

And this rebellion looks to be turning into a rout. Martin Khor tells us not only are countries opposed to these provisions in new trade agreements, but they are unwinding them in existing deals.

By Martin Khor, Executive Director of the South Centre, Geneva. Cross posted from Triple Crisis

The tide is turning against investment treaties that allow foreign investors to take up cases against host governments and claim compensation of up to billions of dollars.

Indonesia has given notice it will terminate its bilateral investment treaty (BIT) with the Netherlands, according to a statement issued by the Dutch embassy in Jakarta last week.

“The Indonesian Government has also mentioned it intends to terminate all of its 67 bilateral investment treaties,” according to the statement.

It has not been confirmed by Indonesia. But if this is correct, Indonesia joins South Africa, which last year announced it is ending all its BITS.

Several other countries are also reviewing their investment treaties.

This is prompted by increasing numbers of cases being brought against governments by foreign companies who claim that changes in government policies or contracts affect their future profits.

Many countries have been asked to pay large compensations to companies under the treaties.

The biggest claim was against Ecuador, which has to compensate an American oil company US$2.3bil (RM7.6bil) for cancelling a contract.

The system empowering investors to sue governments in an international tribunal, thus bypassing national laws and courts, is a subject of controversy in Malaysia because it is part of the Trans-Pacific Partnership Agreement (TPPA) which the country is negotiating with 11 other countries.

The investor-state dispute settlement (ISDS) system is contained in free trade agreements (especially those involving the United States) and also in BITS which countries sign among themselves to protect foreign investors’ rights.

When these treaties containing ISDS were signed, many countries did not know they were opening themselves to legal cases that foreign investors can take up under loosely worded provisions that allow them to win cases where they claim they have not been treated fairly or that their expected revenues have been expropriated.

Indonesia and South Africa are among many countries that faced such cases.

The Indonesian government has been taken to the International Centre for Settlement of Investment Disputes (ICSID) tribunal based in Washington by a British company, Churchill Mining, which claimed the government violated the United Kingdom-Indonesia BIT when its contract with a local government in East Kalimantan was cancelled.

Reports indicate the company is claiming compensation of US$1bil to US$2bil (RM3.3bil to RM6.6bil) in losses.

This and other cases taken against Indonesia prompted the government to review whether it should retain its many BITS.

South Africa had also been sued by a British mining company which claimed losses after the government introduced policies to boost the economic capacity of the blacks to redress apartheid policies.

India is also reviewing its BITS, after many companies filed cases after the Supreme Court cancelled their 2G mobile communications licences in the wake of a high-profile corruption scandal linked to the granting of the licences.

But it is not only developing countries that are getting disillusioned by the ISDS. Europe is getting cold feet over the investor-state dispute mechanism in the Trans-Atlantic trade agreement (TTIP) it is negotiating with the United States, similar to the mechanism in the TPPA.

Two weeks ago, Germany told the European Commission that the TTIP must not have the investor-state dispute mechanism.

Brigitte Zypries, a junior economy minister, told the German parliament that Berlin was determined to exclude arbitration rights from the Transatlantic Trade and Investment Partnership (TTIP) deal, according to the Financial Times.

“From the perspective of the [German] federal government, US investors in the European Union have sufficient legal protection in the national courts,” she said.

The French trade minister had earlier voiced opposition to ISDS, while a report commissioned by the UK government also pointed out problems with the mechanism.

The European disillusionment has two causes.

ISDS cases are also affecting the countries. Germany has been taken to ICSID by a Swedish company Vattenfall which claimed it suffered over a billion euros in losses resulting from the government’s decision to phase out nuclear power after the Fukushima disaster.

And the European public is getting upset over the investment system. Two European organisations last year published a report showing how the international investment arbitration system is monopolised by a few big law firms, how the tribunals are riddled with conflicts of interest and the arbitrary nature of tribunal decisions.

That report caused shock waves not only in the civil society but also among European policy makers.

In January, the European Commission suspended negotiations with the United States on the ISDS provisions in the TTIP, and announced it would hold 90 days of consultations with the public over the issue.

In Australia, the previous government decided it would not have an ISDS clause in its future FTAs and BITS, following a case taken against it by Philip Morris International which claimed loss of profits because of laws requiring only plain packaging on cigarette boxes.

In Malaysia, the ISDS is one of the major controversial issues relating to the TPPA. Many business, professional and public-interest groups want the government to exclude the ISDS as a “red line” in the TPPA negotiations.

Prime Minister Datuk Seri Najib Tun Razak had also mentioned investment policy and ISDS as one of the issues (the others being government procurement and state-owned enterprises) in the TTPA that may impinge on national sovereignty, when he was at the Asia-Pacific Economic Cooperation Summit and TPPA Summit in Indonesia last year.

So far, the United States has stuck to its position that ISDS has to be part of the TPPA and TTIP. However, if the emerging European opposition affects the TTIP negotiations, it could affect the TPPA as this would strengthen the position of those opposed to ISDS.

Meanwhile, we can also expect more countries to review their BITS. Developing countries seeking to end their bilateral agreements with European countries can point to the fact that more and more European countries are themselves having second thoughts about the ISDS.

Originally published in The Star (Malaysia).

I am a SME manufacturer in Europe and can add ISDS would have its merits. There is so much red tape in importing items to Europe I can understand why many European countries are inclined to take ISDS taken off the table. By design, Europe has many behind the border barriers that drive up the cost of doing business. Red tape has done an excellent job in protecting local industries to the detriment of importers. In most cases the barriers are so huge it makes it pointless to bring items to market here as a SME.

Because trade negotiations are large multinational centric, we SMEs get left out. Therefore barriers that affect us get left out of trade agreements. This is where the ISDS would be an excellent tool to level the playing field.

I think the ISDS could be a useful tool. Entrenched local interest would be on notice for imposing onerous red tape.

Don’t export to those countries then. Companies, even small engineering ones, are pitched to be the nimblest, most brilliantly adaptive social organisations on the face of the planet. Either adapt and take risk or don’t.

Your company interest is not necessarily the interest of the people of a state you wish to sell into. At least not at the price of permitting you to threaten their tax dollars because the state doesn’t continually molly coddle you with a safe, “fair” environment. No one owes you a living. Or stability. Individuals were shawn of that 35 years ago in order to give companies greater flexibility (such was their fabulous adaptability). Their flexibilty (ie the privileges granted them by the state over resources, people and money) strait jacketed and impoverished the collective rights of people to the security of a job, a commons and a mixed economy that mitigated paying out for every little bloody thing as if we were bionically attached to a meter..

You want fairness, but what would you be prepared to provide for that privilege? To stay in a country and pay fair wages in the face of declining profits? I don’t think. Where’s the quid pro quo? The collateral evidence of the last 2 generations is conclusive. These deals are one sided. Companies demand fairness from a state, but have trivial obligations within the state borders. And threat is their greatest weapon.

I see nothing but pain for the people of countries which buckle to the demand that society build itself around the interest of corporate (or mid-sized engineering company) stability and profits. Businesses can show their adaptability and roll with the punches – or just stay home.

Don’t export! We don’t care. Honestly, if you need this type of hammer, it’s not worth it to us. You’re meant to be risk-takers, not social burdens.

What? You missed the big picture.

No, sir, I’m afraid that you are missing the “big picture”.

When you wish to export your goods to a locality are you about enriching that locale or about enriching your pocketbook? We all know it is the latter. The “red tape” is often there to protect the environment, the jobs and wages, and even the consumers themselves. Corporations that do not provide those jobs or have to deal with the consequences of their policies on the communities they wish to operate in should be the last group whose opinion and self perceived rights are considered – if at all. Your profits are not their concern.

Barring local government corruption, which our Chamber of Congress Supreme Court proves is everywhere, the appropriate response to this is always – “Either meet the standards of the community OR go trade elsewhere.” ALWAYS.

“Entrenched local interest would be on notice for imposing onerous red tape.”

What a delightfully Orwellian way to describe the attempt by supra-national corporations to abolish democratically accountable law-making.

It is not supra-national corps…. read my piece. It is SMEs.

Sounds like a “starving artists” argument to me…

What’s that I hear? Could it be.. is it a nanoscale violin?

yes, such as minimum wage laws (well, hardly in all countries), environmental protection legislation, corporate tax levels that are a smidgen higher than that in the average banana republic, a requirement to offer at least 2y warranty on most electronic goods, etc. The horror!

It has also done an “excellent” job in somewhat decreasing the rate at which jobs are outsourced or lost, thus keeping local demand for goods — influenced as it is by the availability of local jobs — higher than it otherwise would have been. In addition — considering we’re talking in bland generalities anyway, I feel free to propagandize in the same way you do — we are probably buying slightly fewer goods that are designed to fail 1 month after the warranty period expires, with slightly fewer toxic substances in them than comparable goods from certain other nations tend to contain.

Furthermore, let’s not forget that one of the main reasons why your SME is interested in buying goods from abroad is precisely because they are manufactured in countries where workers have fewer rights, where environmental protection is “not a priority”, etc. Why on earth do you turn a blind eye to that? I know, it’s the “capitalist way”. But is that an excuse?

In sum, let’s try to cherry pick a tad less, and let’s try to see that the harms caused by accepting the creation of these undemocratically-accountable, ideologically controlled courts that can upend procedurally “democratic” decisions at will outweigh the few positives that by and large only exist because people are more easily abused in countries that we trade with because of that reason.

You obviously have not had the fun and experience of importing goods…. into Europe! Please go get some experience before authoring such…. crap…. and then get back to me.

Do you think that you ability to import should prevail over any country’s national law?

There are a couple levels at least to addressing John. On one hand, a lot of import regulations are just bureaucratic quicksand, but the point his critics are making is that there are many strands of red tape that derive from legitimate legislative attempts to protect citizens from one hazard or another. Like GMO food, for example. The Jeffersonian ideal is that public of the EU or Mexico or whatever ought to be allowed to determine what’s safe or not. Not a panel of “experts” who probably also serve on the boards of big multinationals or who are ideologically committed to Ayn Rand style feudalistic capitalism.

I’m curious about your apparent difficulties sourcing locally. Would you care to share a specific example of something you needed to import for your business that red tape prevented you from importing? I’ll assume that you are engaged in a positive business in an ethical manner or you probably wouldn’t be engaging here. Are there other possible solutions to your problems that wouldn’t involve giving more power to corporations?

I do not follow your logic. How can a tribunal such as the ISDR (Investor State Dispute Resolution) help you?

Your complaint, that importing goods into Europe is a bureaucratic headache, is not something that can be used in an ISDR process against your own government.

Have you considered trying to be more “competitive”? Or is that just “crap” force-fed to workers?

In case YOU missed it, here’s the “big picture” from 1994 from someone with possibly more experience than yourself.

http://www.youtube.com/watch?v=4PQrz8F0dBI&list=PLD255EEFDD0D9F07E

And if your still interested ( starting at 1:48:10), which might explain the hostility of the interview.

http://www.c-span.org/video/?c3988561/goldsmith

I fail to see how my having experience with importing goods into Europe is relevant at all. In any case, your response is rather lacking in substance.. Either explain why you think my response irrelevant (considering your emotional and hostile response, I doubt it is), or explain what I am missing.*

* I have no doubt that there are aspects to the importing process that are inefficient and un-useful, but I sincerely doubt that you will be able to sue your own government via ISDR panels to address that. As such, you are either hoping to remove useful barriers — in which case I refer you to my previous reply — or you will be suing to make the importing process more efficient, which seems to me rather unlikely to be fixable via ISDR “law”suits.

You are 100% correct re ISDR rules, they are available only to foreign investors.

“In Australia, the previous government decided it would not have an ISDS clause in its future FTAs and BITS…”

The new Abbott Govt. has been making positive noises about the TPP, but I don’t know whether they have yet considered the ISDS aspect. Right-wing Govts. in Australia have a dreadful record of kowtowing to the US, however.

We have a really good process in UK law called judicial review. Or it would be if ordinary people could afford it. I would expect similar problems in ISDS. I’d love to believe we can resist these corporate trade agreements, but we are grouping round getting the NHS excluded in the UK. We think the deals are done deals except where we can rally round something as treasured as the NHS. The people doing the deals are lawyers. You can hardly see them doing anything to prevent a new gold seam for lawyers.

In the discussion about the TTP and TTIP the Eli Lilly suit against Canada is receiving little attention. Last summer LIlly indicated it was suing Canada through the NAFTA mechanism for $500M over a patent issue with Lilly alleging Canadian courts were overly aggressive in ending two LIlly patents. In this case the foreign corporation vs. nation state issue is more visible, however when the issue is foreign corporation vs. state or local government it is clear how the scales don’t balance.

I’ve covered it at least twice in earlier posts, but due to space limits, I don’t go through the partial list of OMG investor cases (some of the really awful ones are in Latin and Central America, but the advanced economy ones are generally more germane for Americans). That for calling attention to this case.

Sounds like our corporate overlords don’t know the right way to boil a frog…

If they just lay low until all the pending trade deals are passed, then slowly increase the outrageousness of their claims, we the sheeple will happily give up our money to guarantee the profits of foreign firms, all while believing it’s in the name of creating jobs.

It sounds like the corporate-types jumped the gun this time. But in 5 years, when most of the current heads of state / legislators are replaced, they’ll try again, and probably succeed since we frogs will probably be used to a much higher water temperature by then anyways…

I don’t think so. The corporate criminals have passed the Corruption Collapse Threshold — the point at which the corruption is severe enough to prevent the functioning of basic societal functions. People won’t tolerate that, and neither will politicians who represent even a fraction of the people.

It remains to be seen how the corporate CEOs pushing this bullcrap will be taken down, but they will be taken down.

on a lighter note, I have heard that checking your bits every once in a while is good.

Here’s the U.S. trying to cut red tape in India that might jimmy up John’s juices: U.S. Tries To Stop India’s Solar Policy While

FakingPushing Fight Against Climate Change (ha,ha,ha,ha,hahahaha – U.S. has such a sense of humor!)http://www.huffingtonpost.com/2014/03/28/india-us-solar-wto_n_5031345.html

Color me cynical, but it occurs to me that our best shot at stopping these deals lies in the growing recognition, among the corrupt political classes, that these agreements could mean the closing of several lucrative revolving doors now open to them. Why bother buying off politicians, bureaucrats, and police if it’s only necessary to keep a small secret tribunal of corporate lawyers happy?

Great point. I suspect politicians are so utterly corrupt that they would be only too happy to be the last ones out the door. They think of the current payoff, what they can get in the right here and now. The last thing they worry about is what the next batch of crooked politicians will do if the well dries up as long as me myself and moi même are well taken care of.

That’s just sad when grifters don’t even try to keep the scam going for their clueless, cocaine-sniffing sons and daughters!! Maybe soon we’ll see a return of cashing in ill-gotten gains for junior titles of nobility– like so many British robber barons did in the 19th century. They knew the easy money was gone, so they tried to help their young’uns marry into the aristocracy. Paul Ryan, Bart.?!?!

Your colour me cynical point is spot on Uly. The politicians might just realise they are giving up their own skim. Or they might re-jig the system so they can make more by having the power to appoint to the new legal bureaucracy.