At one level, it’s vastly amusing to watch Big Pharma, through its powerful lobbying group PhRMA, complaining that its ox is being gored by insurers through how they’ve designed Obamacare plans. On another, though, the analysis prepared for PhRMA confirms what this site has long argued, that the Obamacare plans represent a deliberate effort to extract more rents from the public at large on behalf of the medical-industrial complex.

For those who remember the backstory, the Affordable Care Act was intended to enrich both insurers and drug manufacturers, by providing new requirements and subsides so that a whole new group of previously uninsured would have medical coverage. Both players also got some protection of their margins, the insurers through profit “limits” that allow them to pay even less out of premium dollars to health care than they do now, the drugmakers through a ban on drug reimportation. As a result, Health insurer and pharmaceutical company stocks rose when the ACA was passed.

But the drug companies apparently woke up only now to the fact that the insurers were in a position to, and would, game the design of Obamacare plans to their benefit and to the disadvantage of the pharmaceutical industry. The critical element is that health insurers are increasingly forward integrating into providing medical care via having their own networks of HMOs.

Let’s focus initially on the pained recognition by the drug companies that the insurers are managing to cut a much bigger piece of the Obamacare cake for themselves.

PhRMA commissioned a study from Milliman, Inc. on Obamacare plans. Now on the one hand, one should look at any research paid for by a industry association with a good deal of skepticism. However, since the drug industry was expected to be one of the big winners out of Obamacare, if they are now complaining, in effect, that they aren’t getting what they expected, there’s good reason to think they’ve been out-maneuvered by the insurers.

The press release and study try to present the problem as one of the poor public being shafted. While that no doubt is true, it’s not hard to see what the real agenda here is.

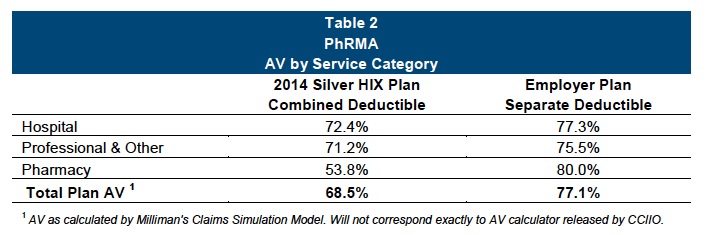

The study focused on Silver plans, since that is what the overwhelming majority (62%) of Obamacare enrollees selected. It notes that those plans still fall short of private insurer plans. The actuarial value of the typical employer-provided plan is 77%, versus 68.5% for an unsubsidized Obamacare plan (that also raises the specter that the insurers are cheating, since the actuarial value of Obamacare Silver plans is supposed to be 70%).

The issue is that the benefits are skewed to skim on drug benefits relative to other medical services. 46% of the Silver plans have a combined deductible, which means that patients must satisfy the deductible before they get reimbursed for drug coverage. By contrast, in employer provided plans, 89% do not have a deductible for medications. they are covered from the first dollar. From the report:

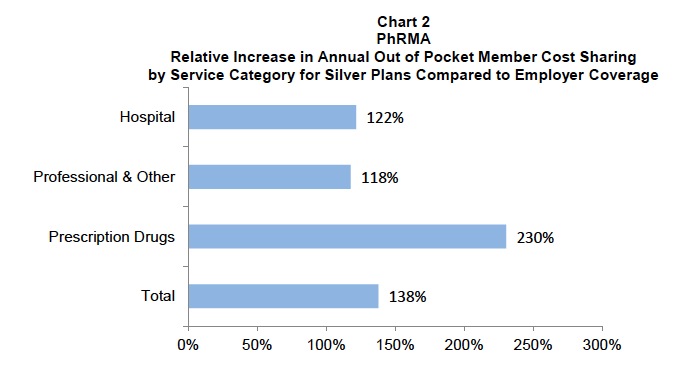

And they show how much of a difference this makes in how much extra patients pay for these Obamacare plans versus typical employer-provided plans:

Now what one can actually conclude from this is certain Obamacare policyholders lose out in a big way on drug coverage relative to the baseline of what employers decided to negotiate for the bosses and employees. The reality, which the PhRMA doc tries to obscure, is that the clear loser is the drug companies themselves.

Now of course, you might say that this outcome reflects consumer choice. But I’d hazard in most cases not. From what I can tell, many people who were selecting Obamacare plans were overwhelmed by complexity, and tried to simplify the choice by focusing on the variables that they deemed to be most important. Getting a plan that gave them access to doctors and hospitals they cared about, as well as overall deductible levels versus premium levels, appeared to dominate over other elements of the plans.

Now one might ask why the insurers decided to skew so many of their plan offerings this way. Perhaps it did not occur to you that they have their tentacles much more directly in the provision of primary and hospital care? In other words, we have a Godzilla versus Mothra battle under way here, and it looks like Godzilla (the insurers) are winning. Big Pharma apparently didn’t understand the degree to which insurers could use policy design to direct more of the Obamacare looting to their own pockets.

This trend of insurers getting more and more into the health care business itself has been under way for some time. For instance, from a 2011 article in Becker’s Hospital Review:

Two related but distinct trends are emerging, and quietly: insurers buying physician groups and insurers buying hospitals. The first development has been subtle. Four of the five largest health insurers have increased physician holdings in the past year, according to a Kaiser Health News report. Recently, UnitedHealth Group has been buying medical groups and launching physician management companies. The same report said the strategy has stirred little controversy largely because few people know about it. One physician group mentioned in the report learned of United’s new strategy only when it received a phone call from company with an offer.

So far, UnitedHealth is the payor with the largest revenue to buy physicians, but it is not the first. CIGNA Medical Group launched its CareToday clinics in 2006, providing “an alternative to traditional [physicians’] offices” in Arizona. Last December, Louisville-based Humana purchased Concentra, an urgent-care system based in Addison, Texas. In early June, Indianapolis-based WellPoint acquired CareMore Health Group, a health plan operator based in Cerritos, Calif., that owns 26 clinics.

“There is definitely a national landgrab over primary care physicians,” says Ted Schwab, partner at the Health and Life Sciences practice of Oliver Wyman, an international management consulting firm. This creates a clash between the insurance industry and hospital industry as both fight to control primary care, the epicenter of care management. “We work with insurance companies all over the country, and every single one of them is discussing this in their board rooms. Some are very aggressive, some have decided not to do it,” says Mr. Schwab.

The model poses a natural threat to providers, particularly hospitals. OptumHealth, UnitedHealth’s subsidiary, has said its physician networks serve all players in a health system, including rival health plans with policyholders who use the same physicians. Still, the CMO of a physician group in Nevada declined UnitedHealth’s offer, saying it would compete directly with the group’s business model, according the same Kaiser Health News report. Primary care physicians are already in high-demand, and by acquiring them in certain markets, insurers could potentially wrest control of entire health systems by influencing referrals — whether that is an explicit intention or not.

A proposed deal in Pittsburgh has proven insurers can take their acquisitions one step further and buy entire hospital systems. While the concept may be making headlines, the unorthodox model is leaving many players in the healthcare industry with cold feet.

Now even though insurer acquisition of hospitals has gone in fits and starts, insurance company employees have been making their plans clear. In fact, they don’t necessarily need to own hospitals directly to dictate their economics, so they may decide to leave them as stand-alone entities. From a post at Whole Health Chicago (emphasis original):

The speaker at these evenings is always a physician employed by the insurance company. His/her title is medical director (I begin to think there must be dozens and dozens on their payroll) and he always begins by reassuring the audience that he was in clinical practice himself so he understands something of what physicians–especially primary care physicians–are facing. I view this physician more as a “Judas steer,” the animal that leads an innocent but doomed herd of cattle through the slaughterhouse corridors to the killing floor.

• The health industry hopes that individual medical practices and small medical groups will ultimately disappear from the landscape by being financially absorbed into larger groups owned by hospital systems. It’s more economically sound for the insurance industry to deal with several large medical players than thousands of mom-and-pop operations. A health care consultant specializing in these mergers and acquisitions told me her firm was unbelievably busy, that small practices were being vacuumed up all over the country. In this construct, doctors who’ve owned their practices for decades sell to a mega-group and become employees…The ultimate decision-makers in these vast systems are called health care executives. They’re usually non-MD MBAs, and we doctors refer to them as “suits.” Unless you cross them the wrong way (in which case reading up on witness protection techniques might be a good idea), health care executives are quite pleasant and very well dressed. Little wonder. They take home enormous salaries and stock option bonuses.

• The name of the game now becomes low-cost standardization of medical care.

• You might be saying “Isn’t this just like that HMO I was in once, but with bigger operators? When I was in an HMO, all I heard my doctor say was ‘sorry, you can’t have that.’” Yes, Virginia, this is just like an HMO, but with one major difference. If you hated your HMO, you could opt out and spend more money for good old-fashioned fee-for-service PPO (preferred provider organization) coverage. These were doctors who agreed to accept the insurer’s fee rate, but still had the freedom to order tests and drugs they chose themselves and weren’t penalized for doing what they thought best for you. The only problem? This PPO opt-out is headed for extinction.

• Let me close with a best-as-I-recall quote from an insurance company medical director. “We can no longer afford to pay for health care under the PPO model. Our plan is to phase out all fee-for-service care during the next few years. We’ll pay you doctors a finite amount of money to take care of a defined population. We tell doctors, ‘Don’t spend much money and you can keep the difference. Period. Don’t follow guidelines, and you’ll be leaving behind some serious money on the table and we’ll just take it back.’”

So in the end, all but the wealthiest patients, who will be able to pay for doctors who opt out of the insurance paradigm completely, will see a degradation of health care at insurers’ hands. We only get a big of incidental comic relief in seeing the Big Pharma players getting a bit of the short end of the stick too.

I don’t doubt that any of this is true, but there’s one thing I’m having trouble understanding. This vertical integration seems like exactly the model of Kaiser Permanente, and everyone I know who’s a member thinks it’s the best thing ever. So what’s the difference?

First, you have not experienced the non-Kaiser versions. I’m with Cigna, and have a very rare and precious indemnity plan (meaning I am not limited to a network). But when I go to a Cigna doctor, the nonsense I have to deal with is astonishing. And this is in the Communist state of New York, where I have the right of external appeal (as in I can go to the state insurance board).

Second, I have it from someone with good contacts at Kaiser that they are having trouble adapting to the new cost pressures (this was before the ACA, they’ve been experimenting with their business model but have not succeeded in fixing their margin issues) and expect like all the good regionals to be swallowed up by the behemoths, the Wellpoints and the HCAs.

Looks like I picked the wrong week to stop smoking/shooting up heroin.

Starting a private psychiatric practice in the Twin Cities (Banger: Nordic America, not Carrboro/Chapel Hill), and leaving a largely public service agency similar to most of my work over the past 20 years. Some of the ACA-inspired “Integration of Care” within the enlarging organizations is actually useful. I participate in a project that has clearly improved diabetes and depression treatment for some of the most complex = expensive patients. Yet much of care only needs to be integrated because it has been widgetized under the same economic pressures. And we do not really get paid for the consultation that truly improves the care –

– which is part of why the local behemoth, HealthPartners, funds much of the research, because no one gets paid under the current (or future?) rules. HealthPartners owns the patients; they will get paid now for the hospital trip, but in future years hope to get paid for just the insurance, and hold the hospitalization. This forward thinking was not possible in the fragmented health insurance market of years past; only Medicare would see the real cost savings and improvement in outcomes. In some ways these nice Minnesotans really are progressive.

Except that they spawned United HC, headquartered in MN and tax domiciled in, I think, the Bahamas for tax reasons. Another aspect of widgetization is that the “mid-level providers” come in various flavors and largely learn on the job, so their relative ignorance spawns more “consumer” protection rules from the Dept of Human Services and State legislature. Advanced Practice Nurses are quite capable and not as de-humanized as most early career doctors, but our best academic programs are woefully remiss in educating them for real-world practice. So a new requirement will be to get a doctorate to practice at the same level as they currently practice, in the future with a little more tangentially relevant education. Credentials, credentials everywhere: CPN, PA APRN MA CMA now DNP, and yet more nice bureaucrats to promulgate patient protection guidelines based on the latest 1994 research.

I can’t stand to spend much more time in this system. I was a beta-tester for a very good EMR in 1998. Now I use a taxpayer subsidized piece of crap. Once I am free, starting in August, I will accept insurance for a while, but plan to drop out in a couple years. Rather than go concierge – yuck – will have a sliding scale. This seems the more ethical route, versus continued compromise within our fascist system. And get more active with Physicians for National Health Plan. I’ll have some alternative practices that will not get reimbursed anyway – better than the fake-evidence-supported-best-practices – but for the standard fare, I expect enough people will figure out that they’d never meet the ever-higher deductibles anyway, so I’ll do OK until somebody complains that the Tomkins Affect Psychology, or 5-HTP or Kundalini Yoga did not cure his OCD. Then I’ll share a jail cell with the kid from Michigan who caught a sinful fish (NPR this AM) and failed to pay off the courts (just figured out why all the spawning in this note, Holy Sigmund Freud!).

It’s clear to me that under the US’s “for profit” model we will continue to fall farther and farther behind the rest of the developed nation in healthcare access and quality. Barring a shift to real single payer we will clearly never get to a place where quality healthcare which stands up to the standards of the rest of the developed world, can become the norm. Things will get worse and worse.

Since you mentioned Kaiser, let me mention a website “KaisernospacePapers dotcom” which compiles links to the websites of former Kaiser patients and their families. However, problems are occurring everywhere and that may be intentional as it allows the “legal standard of care” to be pushed lower and lower relative to treatment norms in the better systems in the developed world. We are really very far behind the better systems with no light at the end of the tunnel coming from the ACA madness.

Rapid erosion of quality due to the adoption of a “capitation” / “pay for non-service” model, is becoming the norm under managed care in the USA.

We desperately need single payer, which would dramatically lower costs by numerous mechanisms. However, the health insurance industry, the drug industry and the US government have been working very very hard to, in a covert aggressive manner, ban the things which would be necessary to bring about single payer and its savings. For example, free trade agreements now mandate the one way incremental privatization of almost all public services in nations signatory to the WTO’s services agreement (GATS) and bar the creation of any new “nonconforming” public services, which they frame as monopolies and as a theft of healthcare markets from their rightful owners, the corporations. Of course they are also trying to use FTAs and their investor-state entitlements which are already in force (GATS, etc. – – to give corporations in those nations irreversible entitlements to markets by setting up pretextural situations… (see http://www.kmov.com/news/investigates/News-4-investigates-Workers-paid-taxpayer-dollars-to-do-nothing-259002161.html – also here) which the thus demonstrably irresponsible USG may well soon try to leverage in the worst possible manner to say public healthcare is already out of the question, due to corporate entitlements already existing.

They also are attempting to use the multilateral free trade agreements to bar all of the price saving strategies that countries with pre-existing public healthcare systems (which were grandfathered in) are using to reduce the cost of pharmaceuticals for their people.

Almost nobody in the media [picked up how the so called “doc fix” eliminated the cap on deductibles in the ACA plans sold to employers](http://www.cjr.org/the_second_opinion/the_ap_downplays_its_own_obamacare_scoop.php). This is going to mean that patients/payers are going to be paying the full prices fro drugs until they meet their OOP max for the year which in most cases will be around $12,600 plus the plan premiums. So, a poor family with a member who has to take an expensive medication is going to run into this very large cost monthly which will likely kick them off the plan long before they reach the OOP max and star seeing money from the insurer. What’s the point, a lot of people are going to say, better to just pay cash.

They are talking people’s futures.

The correct term for this is “zero actuarial value”. While these plans TECHNICALLY aren’t this, for many low income families, they EFFECTIVELY are. I haven’t done the detail math, but I believe we’ll come to see a new “donut hole” developing; one consisting of people who are above the Medicaid cut-off, but who do not have enough money to bridge the extreme deductibles to get to when their O-Care plans actually begin to pay for real.

BTW, zero actuarial values plans USED to be illegal in most states whose insurance commissioners took their jobs seriously. Thanks to the Republican is the White House, it now looks like they will become national policy for the working poor.

What people may not know is Big Pharma quit innovating a long time ago. They were content to sit on their patent laurels for years. But time has run out. Block buster patents have run their course and now they see competition. Enter Free Trade Agreements. TTIP and TPP could be the ticket back to prosperity. Tucked in these agreements are extending patents further. These free loading companies know how to

pick themselves up by their bootstraps.It is not surprising they were asleep at the switch when ACA came around. Big Pharma pays consultants tens of millions of dollars a year to keep up with tax and government regs. It sounds like the consultants were sleeping as well. You lose some and you win some.

Riverdaughter used to work in Big Pharma before they fired like 10,000 scientists and blew town.

Re AVs: The ACA requires a 70% AV for Silver plans, but only a 60% AV for bronze plans. My intuition is that nearly all ACA customers have purchased one of these two levels. So if 62% have a silver plan and, say, 35% have a bronze plan, then a overall AVA of ~68% sounds reasonable (if not at all just, or right, or anything like that).

The most macabre part of this post, for me, is the incentivizing of docs to ration care in order to bump-up their own salaries. Not that fee-for-service aligns incentives all that well, mind you, but fee-for-withholding-service seems to be even more perverse.

We need single-payer, and a national program to churn out more primary care docs. Euthanize the rentiers!

No, please read the paper. They calculated the AV specifically for Silver plans. And you can see that even in the header of the table included in this post, that this is “Silver HIX” meaning “Silver Health Care Exchange” plans. The text of the paper similarly states that the AV for unsubsidized Silver plans is 68.5%, not the mandated 70%.

No mention of Medicare – the holdout and beacon for another way to organize payments and more flexible medical practices in the US. A future Obama (perhaps Hilary) will likely push for a Medicare voucher system.

That insurance companies and providers–drug and device manufacturers, docs, hospitals and clinics–should be on the same side of this issue never made much sense.

At its most basic, here’s how the system works. Insurance companies touch ALL “healthcare” dollars first. Including those taxpayer dollars which subsidize Obamacare plans. They keep what they want, and dole out the rest to “providers.” Drug companies etc. can only make what the insurance companies will give them. Period. By supporting ACA, all providers, pretty stupidly as it turns out, agreed to let the insurance companies control their profits. They were bound to get squeezed.

It’s not unlike Walmart stupidly supporting cutting food stamps or not raising the minimum wage. Do they REALLY not know where the money spent in their stores comes from?

When you think about it, the drug companies should have supported single payer–what I like to think of as the military-industrial complex model. The government is the only customer. Market directly to the people, bribe the money whores in congress and cut out the insurance company middle man.

NOW there’s more money to go around. A lot more, judging from how things go in military-industrial world. It’s pretty much UNLIMITED. And no middle man to siphon off potential profits.

By allying themselves with insurance companies, they have, stupidly again, put their profits center stage. And, consciously or not, subjected themselves to a “budget.” People pay insurance premiums every month. Every time the premiums go up, insurers blame the cost of “care”–DRUGS and other “services” in other words–and demand that those costs be brought down. “Reimportation” anyone?

Under these circumstances, the idea that phrma will ever sell enough “million dollar drugs” to make them profitable is pure pie in the sky. Who do they think they are anyway, boondoggle jet plane contractors? By submitting to a system controlled by profit-crazy insurance companies, the cost of which is in every citizen’s face every month, they’ve cut their own profit-crazy throats.

And it couldn’t have happened to a nicer bunch.

They were not in direct competition. It was like sports teams raising the prices for the Yankees/Sox/Cubs coming to town. Deep down, they want to be the new Yankees (Ex. Miami Heat/the Pats/Seahawks). Gaddafi’s vaunted off shore fortune is a good analogy. It turned out to be a fund of multiple currencies the government used to buy items on the market Libya doesn’t make. They doled it out to hotels, bribes, malls, and soccer arenas in an orgy, and now they are fighting because of choices made based on bad projections and unbridled greed. Groups worked together to grab it, but they killed an arbiter who skimmed but not as much as everyone else.

The patient could still be bled, and MBAs barely understand how their business works. Why would they grasp a complex system? As far as lobbying Congress without the middlemen of insurers, no one wants that because if Congress has to set the price Congress can be held accountable which means less profit. With the insurers and state commissioners, Congress can shirk accountability. Here in Virginia, we have a law called Dylan’s law which is a civil rights holdover. It’s meant to prevent localities from passing racist laws, but it also requires most localities in Virginia to get permission from the legislature to do anything. The local governments and state legislators love this because they can blame the other for problems. If it’s no one’s responsibility, no one can be held accountable.

Thank you for relating your OPINION on how the payments system works. Indeed, these are populist myths about how the payments system works that have grown up over the years. Insurance companies are the monsters ruining everything. Doctors and hospitals are victims, just like you and I. Black and white. Life is so simple.

It’s pretty obvious however that you have NO actual experience with the system, and no real knowledge of it, because you simply have no idea what you are talking about. Insurance companies are mostly passive agents who collect a standard percentage simply because of where they have managed to position themselves. To the extent that they set prices, they LOWER the prices the providers have set for themselves. They are restricted by the federal government as to the percentage of profit they can take (see, Medical Expense Ratio). And there is no grand collusion between medical providers and insurance companies. (That they don’t air their dirty laundry does not mean they don’t have any.) In fact, both sides know that there are only so many dollars going around, and that the side that fights the hardest for each penny is the side that will get that penny.

And that’s just to start with what you got wrong.

I know that navigating the placement of comments on this site can be tricky sometimes, but, you see, the way your comment is placed, it looks like you are responding to MY comment. Which, after reading YOUR comment, cannot possibly be the case.

After your reference to insurance companies as “mostly passive agents who collect a standard percentage simply because of where they have managed to position themselves” I can’t be sure you are even on the right page. The comments generally refer to the posted article which you will find at the top of the page under the title. Not much suggesting “passivity” in that post.

As for any “restrictions” ” by the federal government as to the percentage of profit they can take (see, Medical Expense Ratio)” I’d just say, “Thanks. A little comedy is always a welcome respite from the monotony of depressing news.”

To your point, an excellent post by Nomi Prins pointed out as soon as the ACA was passed how insurers started shifting items that were clearly overhead to medical costs to allow for even more looting.

A mistake the drug companies made was to not write something in the ACA law for themselves. Instead, Billy Tauzin and PhRMA contented themselves with a flashy smile and photo op with Obama after an unwritten handshake agreement to cut pharma costs by $80B over a number of years. Billy was proud that he could make this BS, unenforceable agreement. Now, he’s gone and PhRMA is in a tizzy that their share of the pie is getting swallowed by someone else. What was good in 2009 isn’t so good in 2014. Oh well, Billy says, let’s go play some golf.

They did prevent drug re-importation though, they got that.

>NOW there’s more money to go around.

Single payer systems do tend to buy for *their* people, more modern drugs with fewer side effects *for less money*

The large variations in price between different countries expose the fact that the cost of the drugs is arbitrarily picked by the company based on what they think the market (and the political conditions) will bear.

We have a mixed world of non-profit/well run public systems/poorer public systems (most started in the 20th century) and other, mostly “developing markets” with large gaps between rich and poor – the for profit countries where the price is “whatever the market will bear” – however in most of them the prices are still far lower than here- then there is the US, with by far the highest prices in the world and the most inefficient system, being the bastion of the for profit model. I have read a number of times that the US has lower drug and healthcare utilization than most other developed countries.

Recently Ive read elsewhere that its more of a mixed situation. I suspect that the first impression was probably righter though. A lot of Americans now can’t afford to take the drugs which are supposed to be managing their health conditions. More and more of us can’t afford to go to the doctor as more and more costs are shifted to families.

Do people in the US really get less healthcare, take fewer, older drugs, and often can’t afford to buy drugs which doctors prescribe for them? I think that is where we are headed because the system just has boxed itself in where its basically on an ideological mission to dump the side of government that attempts to take responsibility for and solve problems, because that role for the government is needed more and more as we get better at using “labor saving” technology to limit the need for workers.

It often seems to me that the US healthcare industries see themselves as ideologically against public healthcare and public services globally, framing them in the free trade agreements as undesirable monopolies. Single payer’s cost controlling effectiveness is anathema to them. Just like the “domino theory” of the past, they see public healthcare as being too attractive and too sustainable.

…..

>By allying themselves with insurance companies, they have, stupidly again, put their profits center stage.

Huh? That’s definitely not the US you are talking about, right?

The fact is, the US media more than they would in any other country, let them get away with murder and don’t call them on anything related to the impact of their policies.

>And, consciously or not, subjected themselves to a “budget.”

Superficially, but if you look at US trade policy, we are doing our best to get them the highest prices they possibly can, with the blowback being that the US government cannot then try to limit prices here because that would hurt the free trade argument that price controls in any form are wrong, because they crimp profits and eliminate the incentive to create.

Everything I have read says that the price of even the most mundane brand name drugs has doubled or even quadrupled in the US in the last few years.

Even if they sell much less in the US, where incomes are already falling fast, its worth it to avoid price controls to them even if they someday get flack for it (but for that to happen, the media would have to tell people it was happening which they clearly wont do)

So the free trade is the only future argument gets to be made around the world, **because getting the highest possible prices now while the developing world still has money**, is so important to their strategy..

The developing world’s middle classes are growing very rapidly and that’s where the growth is now.

>People pay insurance premiums every month.

Actually under the ACA, for most people the premiums are arguably almost insignificant. Compare the premium for many families (just a few hundred dollars) to the total cost that family will be paying if it has a sick member (many times that) and you can see that the ACA plans are structured so differently than insurance plans are that they are a completely different animal. Insurance isn’t really the right word. Maybe “Buying club”? “No discount buying club”? I don’t know.

Even with the full premiums plus OOP octs being paid every year I think the most a family could end up paying might be $20-25 a year even now. I think that is probably still a LOT less than even the most mediocre outside-of-ACA nongroup plan costs even now with the ACA having reduced the costs for nongroup ACA plans measurably. (I think a lot of that subsidy money will end up being channeled to lower the premiums of the wealthy, because the poor will rapidly be in debt and many will then be completely unable to use their new “insurance”)

>Every time the premiums go up, insurers blame the cost of “care”–DRUGS and other “services” in other words–and demand that those costs be brought down.

Its like that old story about the guy who was “teaching” his horse to live on no food. Ever hear it?

>“Reimportation” anyone?

I am almost certain that the Obama administration is aggressively blocking drugs that people attempt to buy overseas because that was his deal with PhRMA, remember? How would companies buy and sell the rights to American products if those rights were meaningless because people could buy drugs overseas for less? They have to do that. Its just like the policy that makes it so people can only sign up at a certain time of the year for health insurance. The system has to be very strict, otherwise people would find ways to avoid it.

>Under these circumstances, the idea that phrma will ever sell enough “million dollar drugs” to make them profitable is pure pie in the sky.

They don’t have to sell as many of them, figure they sell one thousand people that drug every month, or year, that’s a billion dollars. As long as the benefit is clear, those who have the money will pay and those who dont will have to do without.

>By submitting to a system controlled by profit-crazy insurance companies, the cost of which is in every citizen’s face every month, they’ve cut their own profit-crazy throats.

Drug companies have friends in Washington- and have for quite a while. But, like the for-profit prison industry, their clout with the politicos grows as more and more other industries shut down. The drug industry, hospital and insurance industries are among the few bright spots on a largely dismal economic picture.

Drug lobbyists, having the ear of their donees, are arguing that patents should last forever, making low cost generic drugs a thing of the past.

My friend’s Obamacare story:

“He [her husband] just got back from California and the diagnosis. He’ll be on a chemo pill for the rest of his life. The pills are like $300 each and he has to take every day. That’s like $10k a month (Costco discount $9700). Of course, our Obamacare deductible is $6300 (who ever in their right mind thought that was an affordable deducible number is delusional – especially for seniors in between social security and Medicare coverage years!). Now, we are going through all the red tape just to get the medication certified by HMSA before they will allow it to be covered. The doctor is checking with Squibb to see if there is a month free and programs for seniors before Medicare kicks in. What a frickin’ racket.”

Yeah, Obamacare’s really going to help all Americans. ???

Obamacare helps all Americans;

Obamacare did not help your friend;

Therefore, by definition, your friend is not an American.

QED

Makes perfect sense to me [/snark]

Something called the “deductible cap” in employer plans was repealed in April. The change may not kick in right away. There has been almost no coverage about it.

It’s also possible AP “made a mistake” covering it. ~~(censored)~~

Also. I shouldn’t write when I am sleepy. In my other post I meant a family might have to pay $20-25k a year. of course. Not $20-25

However, each calendar year, once they reach the OOP max, which is I think $12,500 cost on the drugs and visit copays the additional copays will stop and they will just have to pay the premium, which is what Obama’s “average family” (a family without any sick members) would pay.

When you say “he will be on a chemo pill” could you be more specific? The only situation I (not a doctor!) can think of where a person would need to take chemotherapy-like drugs for the rest of their life is a transplant scenario (to suppress the immune system) and it doesn’t sound like your friend got a transplant (I’m not sure if they give transplants to people with low-grade insurance, also. I’ve heard they don’t.)

Anyway, I’m not a doctor, but your use of phrases just didn’t seem to be clicking.

OTOH, I have heard zillions of stories along the lines of people in UK getting treated for conditions, people in the US with the identical conditions being told by their insurance that its not covered, and not being able to afford to pay for multi-thousand dollar a month drugs (drugs are also much more expensive here) out of pocket and going without treatments. Some people die because they get such a run around they just die before it gets resolved. That’s one area where UK and their NHS is way ahead of the USA. And the USA keeps getting worse and worse.

Nice timing on this post, as yet another corrupt biz-gov money grab is revealed:

The Obama administration has quietly adjusted key provisions of its signature healthcare law to potentially make billions of additional taxpayer dollars available to the insurance industry if companies providing coverage through the Affordable Care Act lose money. The move was buried in hundreds of pages of new regulations issued late last week.

The Temporary Risk Corridors Program … was supposed to pay for itself. But insurance industry officials have grown increasingly anxious about the new system’s adequacy.

[The new regulations] allow the administration to tap funds appropriated for other health programs to supplement payments to insurers, according to administration and industry officials.

http://www.latimes.com/nation/la-na-insurance-bailout-20140521-story.html#page=1

————

Great: yet another example of Obama just making up the rules as he goes along, with no Congressional authorization. Calling this ‘Third World’ would be an insult to developing nations. Yes, we have no bananas.

welfare for insurance co’s CEOs while the nation continues to suffer under the weight of this bloated and inefficient monstrosity of a health care system

oops that was a reply to Jim’s comment above

Yves–

First, healthcare.gov makes it very, very easy to see which plans have a separate deductible for pharma. Since sightly over 50% of Silver plans (the best plans for most people if you looko at premiums and out-of-pocket costs) have no separate deductible for Pharma consumers can easily find a plan that will not involve higher out of pocket costs.

Secondly, some people who never or very rarely take medications may get a better deal

(in terms of premiums and co-pays for services) by picking a plan with a separate Pharma

deductible.

If Phama is complaining, so be it. No one promised them a Sweetheart deal– though Billy

T. thought they did. (My theory is that Rham had his fingers crossed behind his back)

As for Obama, he has made it clear that letting Medicare negotiate for discounts from drug

manufacturers is still on the table. I’m pretty sure this will happen before he leaves office–or at least he will try his best.. Everyone (even Wall Street analysts) realize that drug makers have been too greedy–particularly when it comes to cancer drugs. And as folks on Wall

Street know “Pigs get fed. Hogs get slaughtered.” Pharma has been a hog.

As far as I know Kaiser P . is doing very well. Group Health Cooperative in Seattle is another “integrated plan” that is doing extremely well. They’ve been using “shared decision-making”

to improve quality while also reducing costs. (When patients know facts about risks they tend to be less enthusiastic about surgery than surgeons are.

Cigna isn’t a non-profit, so I don’t think of it as an integrated system that is in any way

comparable to KP and GHC. Research published by Consumer Reports (using NCQA data)

showed that closed networks offer higher quality care and better patient satisfaction–in part because there is better co-ordination and co-operation among providers, and in part because at KP and GHC docs are looking over each other’s shoulders. No solo

practitioners doing their own thing (the way they have always done it.) Everyone is expected to practice evidence-based medicine.

In NYC, I’ve always been in a closed network, and happy with it.

BTW, you mention that in NYS you have a right to appeal. Under the ACA you now have a right to a very speedy appeal at two levels (both the insurer and an outside board) in

every state.

Finally, comparisons to employer-sponsored plans are somewhat misleading since the average

large company employer sponsored plan is significantly more expensive than a Silver plan.

(To compare prices, you need to add what the employer pays toward the premium to what the employee pays.)

One of the goals of the PPACA is to make insurance affordable, and in the Exchanges, a

combination the fact that all insurers must cover the same essential benefits means that they must compete on price. This has brought prices down. (I recently bought an excellent Exchange plan that costs me about $100 less a month than the very good COBRA plan I had from my former employer. And it gives me a 0 deductible with very low co-pays. All of the doctors I was using are in the plan. And NYC is one of the most expensive markets in

the country (our doctors and hospitals way over-charge, simply because they can. Manhattanites actually brag about how expensive their doctors are. Here, physicians are a status symbol, like cars.

What you refer to as “low-cost standardization of medicine”: I would call “evidence-based

medicine.” Those wealthy patients who opt out of closed networks will not only pay more, they will be over-treated, and in many cases be injured or killed by that overtreatment.

What they do not understand is that the opposite of “overtreatment” is not “undertreatment”–it is “appropriate treatment.” More care is not better care. More expensive care is not

better care. Insurers who actually care about their patients are non-profit HMOs like

Kaiser, Group Health Cooperative, etc.

“they must compete on price” assuming that you’re not a state with a monopoly, and that the insurance companies act in good faith, etc. It’s true that there are some people who are helped by ObamaCare. What’s unconscionable is that the degree of access to help that people are given varies randomly by age, jurisdiction (whether state or even county), employment status and whether they can invest enough time “shopping” for the best plan.

As I indicated above, I have reports from insiders that indicate that Kaiser will not be independent three years from now. It’s currently unprofitable despite several years of trying to remedy that. All the regionals are going to be road kill and absorbed by the national players.

And I have lived in Manhattan for over 30 years and many of my friends are high-earning professionals. I have never once heard anyone brag about how much their doctor cost.

Maggie,

>*”If Phama is complaining, so be it. No one promised them a Sweetheart deal– though Billy

T. thought they did. (My theory is that Rham had his fingers crossed behind his back)”*

Actually, did you know that the numerous drug savings strategies which were allegedly taken off the table” by the “deal” between Obama and Tauzin, were in fact, already off the table, due to US-promoted trade agreements?

So, isn’t it kind of *”strange”* that (just elected) Obama would “take them off the table” AGAIN! And make such a BIG STINK about making a “deal” to do it, huh?

I wish i shared your enthusiasm. It would be great if you could explain what the cost implications of the Trans Pacific Partnership are for drug prices, like the discounts you mentioned being negotiated for Medicare. But of course, you can’t, nobody can, because the terms of the TPP – like other trade agreements, are secret.

However, in back rooms, its clear that the US keeps pushing for (but largely behind closed doors) is bans in free trade agreements on government entities “negotiating for discounts”. **Where and how could the US allow its own government to negotiate for discounts when that seems to be represented now as such an evil thing?**

>*”some people who never or very rarely take medications may get a better deal

(in terms of premiums and co-pays for services) by picking a plan with a separate Pharma

deductible.”*

I can see why Obama would want to **minimize the number of people paying very high prices, after all, he’s a politician, and people only get one vote**.

But is it wise, to try to hide the faults in a system which is unsustainable, **by shifting them to the sickest people?**

>*”another “integrated plan” that is doing extremely well. They’ve been using “shared decision-making”* Is that a re-wording of “capitation” or a new scary euphemism? here’s one I recently heard for the first time thats good “fee for non-service”

>*”to improve quality while also reducing costs. (When patients know facts about risks they tend to be less enthusiastic about surgery than surgeons are.”*

Well, *there* was a good point made the other day about how doctors are often very enthusiastic about procedures which patients often were dramatically worstened by, But I suppose times are hard for everybody and whether its doctors or insurers or drug companies they are all fighting for a share of that health care dollar, especially as the rest of the economy gets smaller, more and more businesses start depending on people getting sick, more.

It is actually starting from MEDPAC, CMS, Medicare/Medicaid and Congress. Government incentives are changing so to shift medical reimbursements from expensive hospital care to primary care in the community. There is merit in the strategy as research literature shows population health is positively associated with primary care (not specialist care or acute care hospitals). Moreover, just a few days ago, bloggers on this website described some very grim hospital experiences of their loved ones. (My heartfelt condolences to you all for what you have been through.) Some of these type experiences have been picked up in Medicare data and provoked MEDPAC recommendations and I hope we can accomplish them (enact them as laws). Cognizant of these trends, hospitals and insurers want to own a piece of primary care. They’re not particularly committed to providing primary care; they’re first off committed to retaining the government tit they’re so used to sucking. But what are we to do? We use carrots and sticks to move the big ugly creature closer to goal.

ACA is not the shake-up. ACA is one product of the root shake-up happening. It is really coming from Medicare and Congress. There will be many more shakeouts to come. The rats will run from one side of the ship to another until it all shakes down.

If you live in a big city you may not realize just how poor the distribution of doctors and primary care providers are across the nation. Things have got to change. We are track for a national crisis otherwise.

The drug companies might be last in the rifle scope, but their turn will come one day.

I wouldn’t shed too many tears for big Pharma. Two of the more common meds I Rx for patients, one costs $120. and the other $165., are available in Canada [same exact name brand drug] for $20. and $30.

It’s a disgrace what these corporations are doing to the American public.

I’m not shedding a tear. I think it’s sort of comical that they though they were going to get their share at the feeding trough but are being outmaneuvered by the insurers.

Probably the Market Solution to that is for big pharma to buy into the insurers, or become insurers themselves. If the big profits are being made at the margins, only greater fools will get left working in the core.

Several years ago now, I was appointed to my first nurse manager job overseeing an invasive cardiology suite. Among other things, pacemakers were inserted there. In the world of pacemakers, there are multiple models to choose from depending on the patient’s clinical and lifestyle requirements. To keep it simple, lets call the most technically sophisticated pacemaker model (with intrinsic heart rate control, etc.) the Lamborghini model. The least technically sophisticated model which, does basics – the Chevy. As you can imagine, the cost differences btw the two were astronomical.

The cardiologist and the vendor were great buds, they seemed to take a good number of trips to Aspen for conferences and such. The vendor dude helped the Cardiologist during procedures by providing the devices, pacers wires and such via the trunk of his car. I thought it was nice because I didn’t have to manage this expensive inventory – the device dude was ALWAYS available to bring his “bag” to the lab when we had procedures scheduled.

Before long, I noticed a curious pattern. Time and time again, the Lamborghini models were being inserted regardless of the patient’s clinical necessity. Nursing home patients, bed ridden patients, it didn’t matter, everyone received the most sophisticated device that money could buy; it was costing the hospital a fortune.

I was concerned. So being a young, principled nurse manager, I took my concerns to hospital leadership. Pretty soon after, I was without a job.

Moral of the story: the post ACA pity party for hospitals and physicians is terribly naive. As the saying goes – you’ve made your bed, now lie in it.

Update: Medtronic will pay U.S. $9.9 million to settle kickback allegations. http://www.startribune.com/business/260978651.html.

My question: will the cardiologists involved in this disgrace be taken to task by the alternative press?

Yves ~

From the PhRMA press release:

“Silver exchange [individual market] plans … are often not comparable to typical plans sponsored by employers …”

They never have been. Individual market plans have always lagged far behind group plans as to what they will cover, and how much they will pay for it. Is PhRMA is trying to say this is something new to ObamaCare, when it has actually been standard industry practice for many decades?

Now read closer. How is PhRMA claiming this discriminatory pricing occurs? By the use of high deductibles. In other words, they are factoring in to their average prices drugs that are not even eligible for payment!!! Yet lots of things end up as not eligible because of high deductible plans. Drugs are hardly being singled out, as this press release would like to have you believe. So what we have here is PhRMA hinting at special treatment for drugs over other medical expenses; an exemption (perhaps) from the effects of high deductibles.

Yet high deductible plans have been the direction of the individual market for years, well before ObamaCare. Increasingly, they are coming in to the group market also, and are THE key component of ObamaCare’s plans for containing the cost of health insurance plans. [Not the cost of health care. Just the price of health insurance.] If PhRMA were to get their way on this here, the increased costs would go directly onto the price of the more modestly-priced silver plans, and they would effectively cease to exist.

What we are looking at here then is not the insurers involved in some nefarious plot to gouge a bigger slice of the pie away from the drug industry, but rather the insurers trying trying to enforce a cap on the price of silver plans. We are looking at the insurers attempting to control costs, and the drug industry complaining when that cost control effort touches them.

NOTE #1: I don’t want anyone to think I endorse high deductible plans as a way to control costs. They are probably the worst thing to happen to health insurance in our lifetimes. Yet, as long as Congress has no spine for taking on the absurd inflation in medical prices (3-4% over baseline inflation almost every year of the last four decades], insurers are stuck with the task, and we end up with extreme ideas like preventing access to already purchased coverage via absurdly high deductibles.

NOTE #2: As for insurance companies buying into HMOs, suggesting (by proximity, at least) this is in any way related to the drug coverage issue above is a long stretch. ALSO, please read Ezekiel Emanuel’s new book (or his New Republic article, “Insurance Companies as We Know Them Are About to Die And here’s what’s going to replace them”, (

http://www.newrepublic.com/article/116752/ezekiel-emanuel-book-excerpt-end-health-insurance-companies ). Clearly, Emanuel (certainly an insider) is convinced that the exact opposite is happening; that medical corporations will end up taking over the insurance functions. The more likely truth is that both sides have reached the limits of their expansions, and that with Wall Street’s “expand or die” principle operating, both are trying to cannibalize the other’s operations. This would be disastrous for the healthcare consumer, as it would place the cost control function under the same umbrella as the price setting function, and as bad as healthcare inflation has been, it would get much worse.

NOTE #3: (1)A close friend is an officer for a large hospital company, responsible for a portion of the payments function. It was she who first told me about hospitals (including hers) buying up private practices. According to her, this was happening in a big way, and was common practice among major hospital corporation. She never mentioned insurers were doing this also. (2) I’ve had several discussion on this with my oncology nurse, who has related to me a number of sad tales of doctors selling their practices, and getting fired from them shortly afterwards. (Apparently their skills are not wanted; only their customers.) In talking about these, she has always said the practices are being sold to hospitals, not to insurers. — While these anecdotes certainly do not mean insurers aren’t doing this, it does suggest that insiders see hospitals as the major drivers of this; not insurers. It seems to me more likely that hospitals do not want this to become common knowledge among the general public, and there would be good reason for them to not want this. As it stands, the private practice designation is a sort of brand name that consumers trust, and that means the designation is worth money. Were consumers to learn that they couldn’t trust that what appear to be a private practices may not be such at all, the private practice designation would become largely worthless, and the hospitals’ investments in them wasted.

As someone who works in this field and spends all day studying the benefit design of every single one of these exchange plans, I can say that the portrayal here is actually quite accurate.

One shortcoming of the Milliman study is that they did not look at state-based marketplaces (only state ‘partnership’ states, of which I believe there are 7), so this excludes something like 35% of the states. However, looking at the full 50 states + DC doesn’t differ appreciably in its ultimate conclusions and trends. They didn’t investigate Bronze, Gold, and Platinum, but I can tell you that the dire conclusion is the same–sucks to be a patient in one of these plans if you’re taking a pricey medication. If you have a disease that requires a ‘specialty’ medication, good luck finding the money to pay for it if you’re in most Bronze plans. You’ll face an average medical + pharmacy deductible north of $5k, and then will probably have to pay nearly 35% coinsurance for your drug thereafter. Many MS drugs cost upwards of $5k/month, so you do the math. Not good.

Some in pharma are just starting to understand how bad access is for their drugs. A well-known MS therapy that enjoys relatively good access in the commercial book of business is (quite shockingly) not covered by most of the exchange plans on the market. That means the insurer won’t even pay a dime for it, and the patient pays 100% of the cost.

The deductible issue is a whole other debacle; it is in fact NOT consistently transparent as to whether patients face a combined medical and pharmacy deductible vs. just a pharmacy deductible, and whether one or neither of those deductibles must be paid before your copay or coinsurance kicks in. We had to call up the insurers one by one and talk to multiple representatives to get a straight answer, and let me tell you, the plans are all different–*even* from the same insurer and the same metal level.

Re: Accountable Care Organizations and insurers buying up large physician group practices and hospitals…Yves hit the nail on the head that this is devolution of the market into HMOs. From talking with many leaders in the ACO movement, I think they sincerely believe that better integration of care will benefit the patients (and it will), but that said, I believe the incentives this model creates will eventually turn nefarious.

One interesting tidbit re: how broad the *physician* networks are within the exchanges–access to primary care and specialist physicians is exactly the same across all metal levels (Bronze through Platinum) that a given insurer offered. This is not the notion floating out there; many people think if you pay ‘more’ for an expensive plan you’ll be able to see the doctors you want. Not true. In an unexpected twist, some HMO plans actually had broader physician networks than PPOs (offered by different insurers). Still trying to dig deeper to find out why.

Happy to talk more about the details behind this in a non-public format.