By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Testosterone Pit.

“Homes in more than 1,000 cities and towns nationwide either already are, or soon will be, more expensive than ever,” Zillow reported gleefully the other day. “National home values have climbed year-over-year for 21 consecutive months, a steady march upward….”

Glorious recovery. Our phenomenal housing bubble that, when it blew up spectacularly, helped topple our financial system, threw the economy into the Great Recession, caused millions of jobs to evaporate, and made people swear up and down: never-ever again another housing bubble.

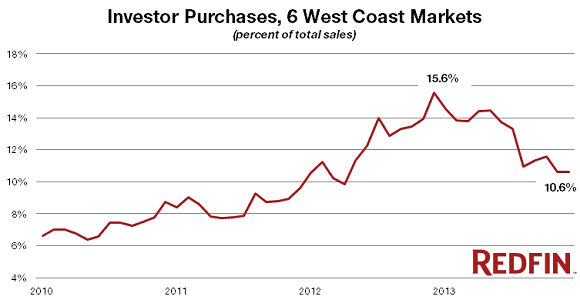

Steps in the Fed, and trillions of dollars get printed and handed to Wall Street, and assets prices become airborne, and Wall Street jumps into the housing market and buys up hundreds of thousands of vacant single-family homes, drives up prices, and armed with free money, shoves aside first-time buyers and others who would actually live in these homes, and turned them instead into rental units. Now in over 1,000 cities, prices are, or soon will be, as high as they were at the peak of the last housing bubble.

The difference? Last time, all that craziness was called a “housing bubble” with hindsight. This time, it’s called a “housing recovery.”

The result of this, as Zillow called it, “remarkable milestone”: real buyers who intend to live in these homes are falling by the wayside. Every week for months, mortgages to purchase homes have been between 10% and 15% below the same week in the prior year. In the latest week, they dropped 21%, the worst week I remember seeing. The number of refis has plunged even more, but that only ate into bank income statements and caused thousands of people to get laid off. Purchase mortgages, when they drop, decimate home sales.

Real Americans, rather than Wall Street, have been priced out of the housing market. Inflation has eaten into their wages. Many people can only find part-time work. Mortgage interest has risen from ridiculously low to just historically low [ Hot Air Hisses Out Of Housing Bubble 2.0: Even Two Middle-Class Incomes Aren’t Enough Anymore To Buy A Median Home].

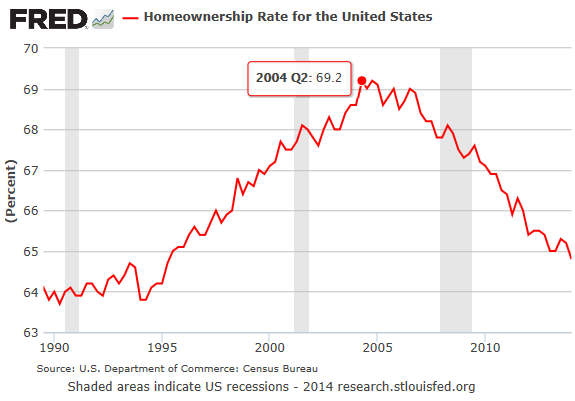

So the rate of homeownership in the first quarter, after ticking up last year and triggering bouts of false hope, fell to 64.8%. The lowest level since 1995! It had peaked in Q2 2004 at 69.2%, a sign that even as the prior housing bubble was gaining steam, regular folks were already priced out of the market. This ugly trajectory is the face of the “housing recovery” sans Wall Street:

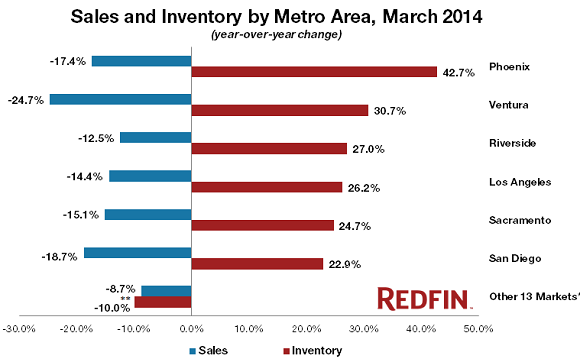

And now history has become a Fed-induced rerun. It started in six until recently white-hot housing markets in Arizona and California – Phoenix, Ventura, Riverside, L.A., Sacramento, and San Diego – where home prices have skyrocketed to the point where few people can afford them. Electronic real-estate broker Redfin, which covers 19 metro areas around the country, explained the impact of “the double whammy” – rising prices and mortgage rates – this way:

Someone who purchased a $350,000 home in Riverside in March 2013 with a 20 percent down payment and a 30-year fixed rate of 3.4% would have a monthly mortgage payment of $1,241. But with prices up 19.6%, the same home would now cost $418,600. At the current mortgage rate of 4.33%, the monthly mortgage payment on that home is now $1,663, a 34% jump from a year ago.

And even a year ago, a family with two median incomes had to stretch to buy that house. Now, in these six markets, sales are plunging and inventories of houses for sale are soaring. A deadly mix.

In Phoenix, inventories were up 42.7% in March from prior year, but sales were down 17.4%. So sellers slashed prices to get rid of these homes. In Phoenix, the hardest hit of the bunch, 45% of the sellers cut their prices. That’s how it starts. Haven’t we been there before? For instance, at the beginning of the prior housing-bubble implosion? This is what that debacle looks like:

It didn’t look quite this terrible in 11 of other markets that Redfin tracks: Austin, Baltimore, Boston, Chicago, Long Island, Philadelphia, Portland, San Francisco, San Jose, Seattle, and Washington, D.C. (due to “data anomalies,” Denver and Las Vegas were not included). Sales were still down, but so were inventories. When the last housing bubble imploded, it didn’t happen all at once across the country. In some cities, home prices peaked in early 2006; in San Francisco, they peaked in November 2007.

And what happened to the Wall Street investors who whipped the market into frenzy by deploying the Fed’s free money? Soaring prices are “eroding investor profit potential,” Redfin points out, and many have pulled back. As of year-end 2013, the percentage of investor purchases in these six markets dropped to 10.6% from 15.6% a year earlier. And since then, they’ve dropped even more. Easy come, easy go.

“Housing affordability is really taking a bite out of the market,” is how the chief economist for the California Association of Realtors explained the March home sales fiasco. “We haven’t seen this issue since 2007.” And so, the benchmarks established during the terrible implosion of the prior housing bubble are suddenly reappearing. Read…. Housing Bubble 2.0 Veers Elegantly Toward Housing Bust 2.0

Gut reaction – Oh crap. Here it comes. I thought the dam would hold at least until the fall.

1st Qtr. Growth GDP – .25 of 1% but the CPI change cut from 1.6% to 1.3% – so the “potential” manipulation of the CPI created positive # rather than negative.

many other metrics look strange as well

I’m hoping it will not.

I sold my house in December. Closed in January.

Renting a small apartment for now.

Thinking that rates are going to stay low or maybe even go lower as mortgage apps keep dropping. Also thinking that builders are going to start to get desperate and the cost of building material drop as we get closer to fall and sales stay anemic. I also expect that people looking to sell land are going to get impatient as builders buy less and less of it.

SO…going to wait until September or October and do a construction loan for a log cabin style home with geothermal heating/cooling, my own well and solar. Going to get as far away from dependency on utilities as I can. Going for a garden, greenhouse and keeping pigs, chickens and a couple of steer too.

Don’t go the “log cabin” route. Surf to “Land2Plan.com ” and look at the EC

O-Home (Energy Conservation Optimized). Look under “Web Publications” and download the PDF file.

You may want to hold off on taking out money to construct a home. These 3D printed homes coming out soon promise to be cheap, high-quality, and quickly constructed (less than a day), all through automation:

“Khoshnevis estimated that Contour Crafting will save the construction 20 percent to 25 percent in financing and 25 percent to 30 percent in materials. The biggest savings would come in labor, where Contour Crafting would save 45 percent to 55 percent by using 3D printers instead of humans. There would also be fewer CO2 emissions and less energy used.”

http://www.ibtimes.com/3d-printers-build-entire-houses-contour-craftings-aims-print-2500-square-foot-homes-20-hours-video

And if that still sounds excessively expensive, there is a Chinese company manufacturing homes with a similar technique for less than 5k dollars each. Although they don’t really look all that great:

http://www.treehugger.com/green-architecture/3d-printed-houses-built-shanghai-fiber-reinforced-cement.html

But hell, I’ve always wanted to live in a tiny unadorned concrete box anyway (preferably with a hot tub–and underground. I kind of have a fetish about living in a cave) so for me personally this is exactly what I was looking for!

Test

“So the rate of homeownership in the first quarter….”

Why do Experts keep using the term Homeownership for a home that is mortgaged? Homedebtorship is the correct term. Even then, once a mortgage is paid off, a home still has liabilities, mainly property taxes and maintenance.

Can’t the Experts even get their terminology correct? It really demonstrates how financial propaganda has won the day for the 1%.

You can have pets. There is at least one true selling point.

Well, the word mortgage is derived from “death pledge.” So there ya go.

The problem … then and now … is economic value.

Liquidity induced asset inflation does NOT create economic value.

As a tiny investor … I’ve not bought a house since August of last year. I don’t flip, I buy for income.

Too bad “they” wasted all that pain by providing liquidity and not enforcing insolvency on the banksters

The inability to learn from past mistakes is the very definition of stupidity. The repetition of damaging acts to the majority for the unfair benefit of a minority is corruption. The Fed is thus either stupid or corrupt, and that’s not meant to be and exclusive choice.

The Fed and all levels of government are corrupt–those in positions of power are usually in denial though–you see this a lot in the USA. Some people are pious Christians who quote scripture on FB and praise their wives and then screw every woman that comes their way (not their wives don’t like it)–I’m thinking of someone I know–this person is not stupid or “bad.” The same is true of public officials–in order to avoid cognitive dissonance they live in a world of self-delusion–scary huh?

Under great stress, the human animal thinks in metaphors. “If we can keep the ship afloat, we can get back on course” or “back on track” or “back to shore.” First and foremost, those in charge wanted the institutions they held near and dear (the FIRE sector, which American elites hitched their wagon to after Breton Woods fell apart) to survive. All else was of secondary concern. So I’d chalk the policies that are blowing this new bubble up to panic, tunnel vision, and mendacity rather than stupidity. For elites, this last crisis all worked out fine, and they are sure it will work out fine again if anything goes wrong (and their instinctive believe is as long as they are in charge, nothing can really go wrong).

This isn’t stupidity, except on a societal level I suppose. This is “dance while the music is playing”.

Hubris 2.0

Too much emphasis on resell housing market rather then new home construction which has had a bigger impact on the overall economy plus how many people want to live in these hot arid locations in poorly constructed houses other then flippers. Housing is expensive in large metro area’s with higher value jobs available and a lack of new multi family housing except in crime ridden locations. The housing market has not recovered in the sense that we do not see large numbers of new housing tracts being built far or near major metro job markets that has always been a large source of housing for 1st time buyers.

But the point wasn’t to get construction moving (that would have created jobs, which would have created wage growth, can’t have that) the point was to a) bail out mortgage bond holders b) allow some of the trapped homedebtors to escape via resell. Now, a lot more of the overpriced turkeys will be sitting on investors books instead of on joe and jane sixpack.

It was just a shell game to shift the liability.

The existing single family housing market is not a measure of middle income loss since the last bubble or that rising prices is a sign that a new bubble has formed its a bit more complicated. Existing family housing has traditionally been a move-up purchase as 1st time buyers had purchased new single family,condo, townhouse and had taken there money from the sale of there 1st time purchase and used it towards the downpayment on a existing single family house. Tax laws have promoted the use of RE equity to be used less on move up down payments and needed repairs creating the impression that modern day families do not have the economic base as earlier generations but its a bit misleading since many families in the past would never have been able to move up into the single family housing market without the profit from there prior sale. Another issue is that the current value of many single family homes in metro areas still do not approach there replacement costs and many others are in poor conditions as they have not had necessary maintenance due to there age or poor construction putting new buyers in a difficult position as they lack the cash necessary to make the repairs.

I am a Broker Associate in Western Sonoma County. There are quite a few different markets in the County and while we did not have the big players here we did have quite a few speculators who bought foreclosures and planned too sell them after 2 years or so when the capital gains hit was smaller. That activity was concentrated in the more urban parts of the County and prices there seem to be stabilizing. I work primarily in the west part of the County, country properties. And in the last few weeks I have seen an increase in over asking offers, multiple offers and all cash offers. This is for good quality homes in the $600K-$1MM range on half an acre to a few acres. Two recent closes for properties in the $600K-$700K range were for substantially more than was expected by the listing agents. The demand for properties like this does not just come from locals, a lot of it comes from outside the area, particularly SF and San Jose but also from foreign buyers.

Didn’t someone once say “history repeats itself – first as tragedy, second as farce”?

But is it a housing bust with a lot less capacity for damaging the rest of economic activity? Flipping houses uses some resources, but nothing like building nearly unsellable subdivisions and condo towers. If the investments made involved more cash and less debt, the losses are still real, but more in the category of “too bad” than “something needs to be done”.

lol; you said “middle class” and “20% down payment” in the same sentence.

Good one!

“(due to “data anomalies,” Denver and Las Vegas were not included).”

Snort. Everything about Las Vegas is anomalous.

Someday that giant mistake of a city will disappear into the desert, and the world will be better for it.

(Source: I used to live there.)

We just bought a place in San Diego. Not as an investment, just as our first home. Our dilemma was that we wanted an extra room for our growing family. I would have preferred to rent, but rental prices are crazy at the moment. Every year the rents have increased. And the problem is that there is such a demand for rentals that the price increases every year. Our last rental, a 2 bed 1 bath place in not great condition at $1800/month, had 18 people contact the landlord in one hour of posting to craigslist. He was kicking himself for not asking for more.

To get a bigger place we were left with the choice of renting a 3 bed 2 bath for $2400/month or buying for about $500,000. As a comparison, in 2006 the rent for a 3 bed 2 bath was about $1700, while they were selling for well over $500,000. Even with the recent rise in mortgage rates the financial calculation was pretty easy to make. According to the government inflation has been stable, but no one told the landlords. As the man said: The rent is just too damn high.

It is easy for people to say “prices are too high now” but what do I do? Pay ridiculous rent, or enslave myself to a mortgage? Middle class professionals like myself are in a awkward position. There is no easy choice.

Reaping & Sowing

So, as you can see, if you look at the data, the legacy 1% cannot exist without the top tier of the middle class – doctors, lawyers, school administrators, automators, etc, which is all make-work, artificial control of breeding patterns, but it can exist without the rest of the middle class. You make the rough adjustment of system gravity to the extent you feed them. All the Fed can do is print money, and all government can do is control wages, for the purpose. That’s it. Some people’s money is worth more than others.

Very few individuals exist purely in one middle class event horizon, but they will defend their event horizon against all outsiders and they do compete within the horizon, for the spoils of corruption and economic war, in demographic booms and busts fed by ignorance. If you are unique and productive, you can enter and exit at will, but inside the horizon you must appear to accept its assumptions or you will get smashed. To the extent you travel through the horizons, economic mobility is adjusted.

If you adopt habits which both appear to be productive within the empire and relative to nature, you need only invest 10% of your time to employ its gravity, but what we are really talking about is the propulsion drive required for space travel. Seek and you shall find. The trick to finding the needle in the haystack is to be the needle.

The empire is not growing market share in a collapsing economy by accident. You are successful to the extent others choose you to be. Take care of your seed and don’t plant it in crappy soil. Appreciate what you have been given and you will be given more.

The majority will wait while others take the risk and do the work, adopting whatever priest offers the religion to justify stealing it, which works in your favor, if you move forward. Don’t expect labor to concern itself with the losers, or winners, of empire stupidity. It’s about the DNA; intelligence is a perception and knowledge is a derivative.

“be the needle…” Another brilliant gem to be added to my kevinearick archive. Keep ’em coming, amigo!

-from a long-time lurker and HUGE fan of this site and commentariat.

” It’s about the DNA;”

Can’t sign-off on that one.

well, there are few things that are lost in the discussion.

The US has become the go to place for the global monied class to have as a backstop against their local economy.

compared to the rest of the worlds financial centers, NYC, SF, LA and DC look dirt cheap.

thus there are at least 10 million family units globally over the next ten years which will move to what they might consider a thriving urbane community in the US as the equivalent of a safe full of gold tucked away in a bank vault in switzerland.

To the rest of the world, the US govt debt is conservative, and even switzerland is at massive risk as almost all its bank deposits are flight money and not internally driven.

When you look at the purported deposits verses actual GDP in France, Germany and England, there is a massive disconnection between the Bank Sizes and the actual local economy.

That means that people will have to move to more affordable locations. Its a fact of life and has always been so in the US. People moved from New York City in the 70’s due to crime and the cheaper homes in New Jersey. Those who were too afraid or too broke to move all look like financial geniuses today…but many (not most) who stayed did so out of need, not desire. Should they be stripped of the bonanza just because they got lucky…?

You can still buy a 3br 2bth home 15 minutes from the beach here on the west coast of Florida in the tampa bay area for less than 100k all day long, in safe locations with good schools. We just have the worlds worst real estate agents down here who don’t know how to market.

Its not a bubble, its called better heeled competition, or as was described in that nice gary cooper movie….the modern day globalony heelots….

Hadn’t seen it quite that way before – US policy, by design or improbable levels of incompetence, creates conditions of virtually constant global instability that shakes the trees for all those golden apples.