By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Testosterone Pit.

The US economy, and by extension the world economy, is desperately waiting for the spring escape velocity to finally kick in. This American phenomenon has been forecast to occur for six years in a row now, with the prior five forecasts having turned out to be just a mix of political wishful thinking and unfettered Wall Street hype, followed by a shrug and an “ah shucks, maybe next year.”

So while we were still waiting for the escape velocity, world trade, one of the major indicators of what’s going on in the globalized economy, has descended into a very unpropitious slump.

World trade volume dropped 0.5% in March from February, after it had already dropped 0.7% in February, the CPB Netherlands Bureau for Economic Policy Analysis, a division of the Ministry of Economic Affairs, just reported in its March world trade report. For the first quarter, volume was down 0.8%, after a 1.5% increase in the fourth quarter.

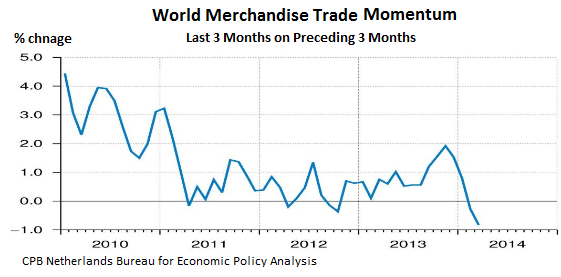

To eliminate the inherent volatility of these kinds of monthly numbers, the CPB offers what it calls trade “momentum” data – which it defines as “the change in the three months average up to the report month relative to the average of the preceding three months.” It eliminates some of the monthly up-and-down noise.

That trade momentum measure slumped 0.8% in March, after having edged down 0.3% in February. This is what it looks like, going back to 2010. Note the steep dive since late last year that entered negative territory in February:

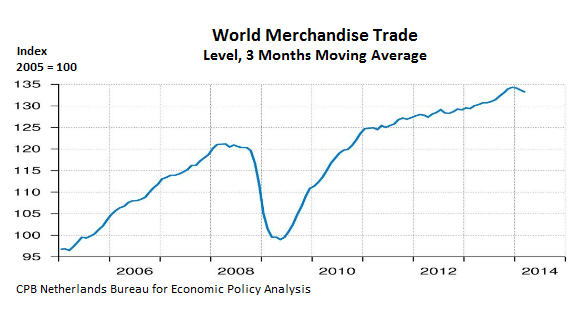

The CPB’s Trade Index looks at it from a slightly different perspective. The chart below shows the steady rise of world trade volume from 2005 up to the global financial crisis, when things came to an abrupt halt and momentum went over the cliff, then the rapid recovery, and since late last year, the slump.

But it’s even worse. While shrinking import volumes were concentrated in the emerging markets, there was “a remarkable increase” in imports by Japan. And there was a reason, a very temporary one.

Japanese households and businesses have been front-loading major expenditures, including building materials, machinery, cars, jewels, electronics, etc. in anticipation of the consumption-tax hike that took effect on April 1. The tax is very broad based, and by front-loading durable-goods purchases, buyers were able to save 3% (a tax free gain!) in a country where 10-year government bonds have been yielding below 1% for years. Front-loading was one heck of a deal. Everyone did it. And imports soared [here is my chart of Japan’s increasingly out-of-whack trade deficit from 2011 through Q1 2014].

That temporary jump in imports by the third-largest economy in the world papered over some of the trade weaknesses elsewhere. Without that buying binge in Japan, trade momentum in the first quarter would have been even worse.

That’s the good news.

“On the export side the picture was more negative,” the CPB report points out. Exports volume fell across the board in advanced economies, but particularly in Japan and the Euro area, though it recovered in Central and Eastern Europe. And in the emerging economies, exports fell for the fourth month in a row. The elephant in that room was China.

Momentum declined in both, advanced and emerging economies. In the US, where the by now infamously illusory escape velocity is once again just about to occur, “import and export momentum remained negative.”

I’m wondering how much world trade volume is tied to energy costs for the actual transportation. Previously, most of what I have read ascribed a big chunk of this to labour costs and regulatory hurdles; the neo-liberal Daily Double. If world energy prices are about to spike, this would indeed be a Triple Witching Hour.

Meanwhile, curiously, the Baltic Dry Index is below 1000. Hmmm…

Have fun on page 13, a taste – “Oceangoing shipping is also the least regulated freight mode, at least for air pollution. These issues are discussed in more detail in the following sections”

http://www.oecd.org/greengrowth/greening-transport/41380820.pdf

skippy… Ummm something about all the energy refinement – processing being moved off shore on platforms or superships. Have a nice day…..

skippy;

Thanks for that link. A good read, especially the part about the correlation between “fast shipping” and pollution levels. (Who could have guessed that almost half of right whale deaths were related to large vessels going faster?)

The money quote came near the end where the piece says that, roughly, the modern fixation on speedy delivery directly ties into increased pollution. Talk about short termism and perverse incentives!

John Michael Greer has suggested on the Archdruid Report that a return to sailing vessels for trans-oceanic transport may well be in our future. If we were smart, we’d start doing it right now. Maybe there’s a business venture in there for somebody. Green shipping on a five-mast vessel–takes longer, but saves whales and the atmosphere.

If I had the money, a fleet of aluminum hulled square rigged sailing vessels augmented with solar panels might not be a bad investment right about now.

Cousteaus’ bunch had, or maybe still have, a wind powered ‘savonius rotor’ type sail propeller system.

I want to know what those folks in global power positions who believe that every crisis should be taken advantage of are working on as priorities?

Does eleven dimensional chess include blowing up the world as an optional outcome? We may wish we could all go so quickly.

Instead we will get some weird alignment of countries supporting the US trying to out compete the rest of the world for increasingly scarce resources as both sides ignore the screams of science about the potential implications of societal trends.

I am beginning to warm to the nuclear option somewhat these days. If we are all going to die and go through a lot of suffering anyway, why not make it quick instead of drawn out like we seem to be excelling at now? Humanity was an interesting experiment but it died of hubris. Lets get it over and let the Cosmos begin healing.

“Humanity was an interesting experiment but it died of hubris. Lets get it over and let the Cosmos begin healing.”

Sorry but you got it wrong. Rationally Nature has always been constructed on a tug-of-war between Individualism and Mutualism and mutually-assured nuclear self-destruction has helped remove some of the imbalance if not all. In consequence we are now starting to work albeit too slowly on mutually-assured eco-system self-destruction.

M.A.S.S. Sounds real ‘Best and Brightest’ to me. I think the fate of the Mekong Delta, after all that Agent Orange, is the prototype of our brave new world ecology.

Al Gore is looking for volunteers to help the Cosmos heal.

And with one click of his mouse he was Scott-Free!

If, in fact, global trade has decline even less than a percentage point then it is a pretty important event since the world-system depends on trade to prosper in the current definition of the term. For me, this is not a bad thing since anything that undermines this system will motivate people to find alternatives and we are, fortunately in a good position, in terms of technology and basic knowledge, to implement a world of alternatives.