Yves here. Steve Horn of DeSmogBlog has done important original reporting and uncovered what could be impermissible dealings between North Dakota officials and David Petraeus, in his role as emissary for one of private equity’s best-known players, KKR. Readers may recall that KKR is already mired in controversy over allegations that it shortchanged limited partners in its funds in its dealing with its captive consulting firm, KKR Capstone.

Horn focuses on the ethics issues, which are troubling in and of themselves. But as worrisome is what KKR is attempting to pull off. KKR has particular expertise in being early to find and dazzling large and not terribly sophisticated investors. KKR was the first to target public pension funds, and succeeded in wooing Oregon and Washington’s state funds in the early 1980s. Admittedly, then private equity funds really were earning outsized returns, and the two Western states, seen as more innovative than their peers, also helped KKR woo other public pension funds.

But private pension funds are subject to a raft of regulation, the most important being ERISA. Public pension funds generally comply with those rules even though they are not obligated to do so.

By contrast, the pot of money apparently being targeted is North Dakota’s oil and gas legacy fund, which may grow to be as large as $5 billion by 2017. It is almost certain that this fund is subject to much less in the way of gatekeeping than public pension funds are. That would make it even easier for private equity funds, which have been showing mediocre performance since the crisis, to get their feeders into a new money source that hasn’t gotten the memo that savvy, longstanding private equity players like Harvard and CalPERS are getting cold feet about the strategy. Horn’s article mentions that the legacy fund’s advisory board recommended a 50% allocation to private equity fund managers.* If that is the case, that an insanely high allocation that no reputable finance professional would consider.

If you are in North Dakota, I would strongly encourage you to call or write you state legislators, the state attorney general, and the state treasurer, and demand an investigation both of the dealings with KKR and ask whether the oil and gas legacy fund’s advisory board is considering investing in private equity or other risky, high-fee alternative investments, and if so, why that isn’t being disclosed in a clear, straightforward manner.

By Steve Horn, a freelance investigative journalist and past reporter and researcher at the Center for Media and Democracy Originally published at DeSmogBlog

DeSmogBlog has obtained emails via North Dakota’s Open Records Statute revealing facts that could be interpreted as indicating that North Dakota Treasurer Kelly Schmidt broke State Investment Board ethics laws.

The potential legal breach occurred during a late-April fracking field trip made to the state by former CIA Director Gen. David Petraeus.

In a radio interview responding to DeSmogBlog’s original investigation about the trip, Schmidt said rolling out the red carpet for Petraeus — who now works at Manhattan-based private equity giant Kohlberg Kravis Roberts (KKR), which holds over $1 billion in oil and gas industry assets and calls itself a “mini oil and gas company“ — was “not unusual.”

KKR initially told DeSmogBlog it followed all state and federal laws during the Petraeus visit.

But new emails obtained by DeSmogBlog from both the North Dakota State Investment Board and the Office of the North Dakota State Treasurer call that and much more into question.

Rewinding back to where it all began, for the final stops of the two-day Petraeus visit to North Dakota, he and his KKR colleagues Ari Barkan and Vance Serchuk met with representatives from the North State Investment Board and the North Dakota Department of Land Trusts.

Banal convenings at face-value, what preceded and followed the meetings tells a bigger story: first a crucial plane flight and then a follow-up invitation to come to New York City to talk business.

Looked at on the whole, the plane flight and what came after it raises fundamental legal and ethical questions about the burgeoning — and much-touted in some circles — North Dakota oil and gas Legacy Fund.

Fly Like an Eagle

On day one of the Petraeus visit, Schmidt flew on a private plane chartered by KKR from the Bakken Shale oil fracking fields in Watford, North Dakota out to Bismarck, North Dakota.

In introducing Petraeus in Bismarck for a speaking engagement with the North Dakota National Guard, Schmidt thanked the troops for fighting in oil wars, as seen in a video obtained by DeSmogBlog from a Freedom of Information Act request. It was skewered in a recent episode of comedian Lee Camp‘s show, “Redacted Tonight.”

“David and I have been out in the western portion of North Dakota where we have shared with him the challenges we’ve been facing to help make our nation and our world an energy independent country so that you and your fellow officers and enlisted folks never have to go over there again in order to fight for the oil we all need,” said Schmidt.

KKR — as we discovered in an earlier Open Records Statute request — required Schmidt to get legal clearance to fly on the private plane. Schmidt got the clearance within a couple of hours from Assistant Attorney General Janilyn Murtha.

Murtha gave Schmidt the legal clearance because — although Schmidt sits on the Board of the State Investment Board by legal mandate — “KKR does not have any current or pending business relationship with the [State Investment Board],” Murtha wrote.

Therefore, Murtha continued, “the conflict of interest provisions of the aforementioned code of conduct and associated fiduciary responsibilities are not implicated by the benefit described herein.”

Most important is what Murtha wrote next.

“If in the future the [State Investment Board] considers entering into a business relationship with KKR, and Treasurer Schmidt is then an acting board member, she may bring the prior contact with KKR to the attention of both the board and legal counsel and determine at that time if a conflict exists.”

New emails obtained by DeSmogBlog demonstrate Schmidt knew KKR had an April 30 breakfast with the State Investment Board to talk business. In fact, the new emails reveal Schmidt helped set the meeting up.

Further, other emails show Murtha forwarded the legal clearance she wrote for Schmidt off to David Hunter and Darren Schulz, Chief Investment Officer (CIO) and Deputy CIO for the State Investment Board, respectively.

In other words, all parties involved were “in the know.”

The new documents also portray that, in the trip’s aftermath, KKR and the State Investment Board have kept in touch and scheduled a mid-July meeting to discuss ”entering into a business relationship” with one another.

New York, New York

A few days after the April 30 breakfast meeting held between the KKR team and both Hunter and Schulz, Hunter sent a thank you email to KKR‘s Ari Barkan. Barkan serves as Director for KKR‘s Client and Partner Group.

“I just wanted to drop you a note to let you know I truly enjoyed our meeting last week and found our conversation with David, Vance, Darren and yourself to be truly compelling,” Hunter wrote to Barkan. “As your schedule permits over the next few weeks, let’s attempt to set up a meeting in New York during the first two weeks of July or August.”

After kicking back-and-forth a few emails, Barkan told Hunter a mid-July business meeting date would work best for a meeting at KKR‘s New York City office.

“Please also keep in mind that, at the moment, I am envisioning two separate topics of discussions – one connected to private markets and one to credit – so really we are talking about 1.5 hours for each one,” Barkan wrote in an email.

Emails show Hunter invited Schmidt to the mid-July gathering, though she had to decline the invitation due to other commitments.

Breaking the Law?

So, did Schmidt engage in breaking the law?

“Conflicts of interest and the appearance of impropriety shall be avoided by SIB members,” reads the North Dakota State Investment Board Governance Manual.

“Board members must refrain from financial and business dealings that tend to reflect adversely on their duties. If a conflict of interest unavoidably arises, the board member shall immediately disclose the conflict to the SIB.”

The Governance Manual also says members of the State Investment Board should not act as middlemen — or “agents,” using the Manual’s legal fine print — for transactions between the Board and entities such as KKR.

Emails show Schmidt apparently played that role. She declined comment for this article.

Another “[c]onflicts of interest to be avoided,” says the Manual, is “participation in any transaction involving for which (sic) the board member has acquire (sic) information unavailable to the general public, through participation on the board.”

So it comes down to a question of whether flying on a privately chartered plane with unique access to KKR — an opportunity “unavailable to the general public” — fits that bill.

It appears that at the very least, Schmidt came close to breaking the law.

But the conflict of interests review is done by the Executive Director of the State Investment Board — in this case, David Hunter, who also serves as CIO — on an annual basis, according to the Governance Manual.

Given Schmidt acted as facilitator for the original meeting between KKR and the State Investment Board — which is now sending Hunter (and Deputy CIO Darren Schulz) to New York City for a meeting to talk business — it appears unlikely legal action of any sort will ensue.

“The Democrats have for several sessions pushed for an ethics commission to cover questionable activities of elected and appointed officials including legislators,” North Dakota Sen. Carolyn Nelson (D) told DeSmogBlog. “We have not prevailed, but that doesn’t mean that we won’t continue to try.”

KKR to Tap Oil Legacy Fund?

Among the biggest pots of money the North Dakota State Investment Board oversees and invests is the oil and gas Legacy Fund, created through a state constitutional amendment, which citizens voted for in 2010.

“Thirty percent of total revenue derived from taxes on oil and gas production or extraction must be transferred by the state treasurer to a special fund in the state treasury known as the legacy fund,” reads the amendment.

The North Dakota Petroleum Council — a state-level offshoot of the American Petroleum Institute — was the top campaign contributor in the effort to convince citizens to vote for the constitutional amendment creating the Fund.

Some believe that pot of cash will be worth over $5 billion by 2017, ushering in potential for corruption and siphoning off of wealth earned from oil and gas extraction to out-of-state firms like KKR.

“[T]he creation of a $5 billion fund opens new opportunities for out of state lobbying and influence,” wrote Glen Bruhschwein, a North Dakota attorney who maintains the website NDLegacyFund.com.

“North Dakota needs to be alert and wary as the scent of money wafts across the border. The primary targets of influence peddling will be the legislature, the State Investment Board (SIB) and a Legacy Fund Advisory Board.”

Moving in the direction Bruhschwein forewarned against, at a November 2013 meeting the Fund’s Advisory Board voted to take up the investment recommendations outlined in an April 2013 report.

Among the recommendations: give 50-percent of revenue generated to either U.S.-based or internationally-based equity firms — such as KKR — for capital investments.

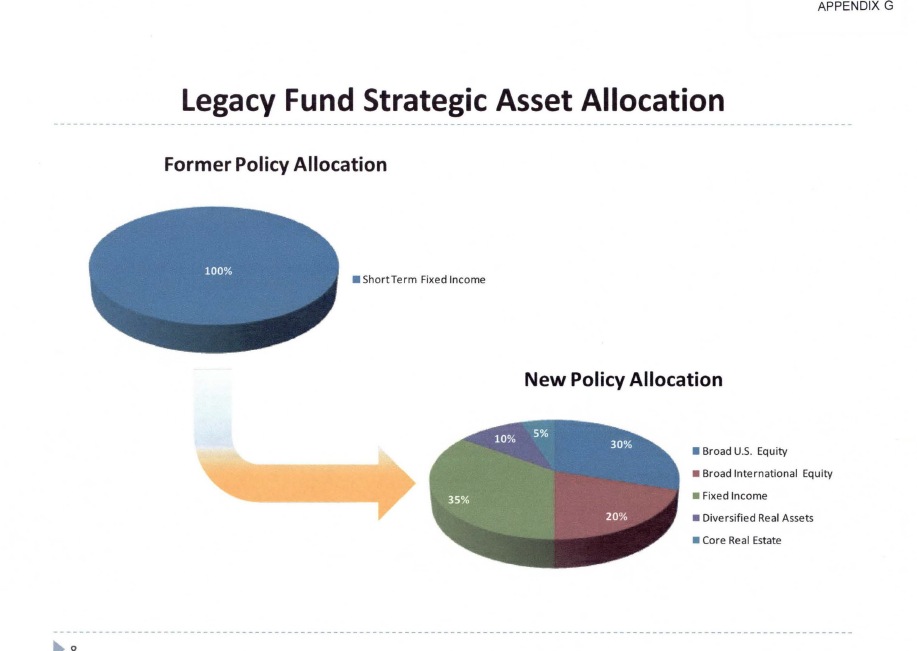

Image Credit: North Dakota Legacy and Budget Stabilization Fund

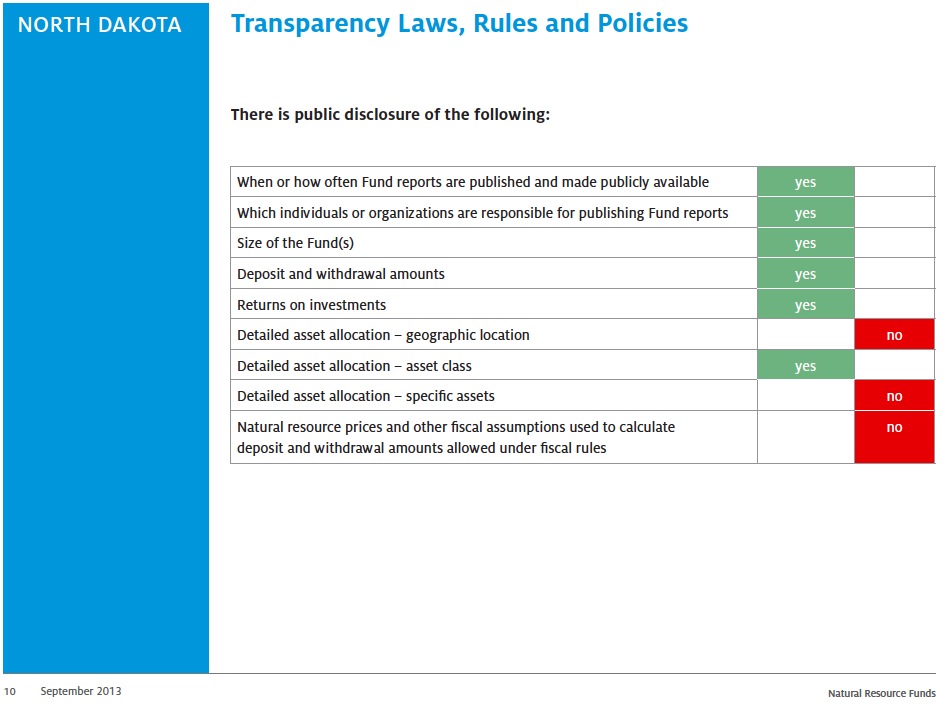

One of the critiques Revenue Watch Institute (now called the Natural Resource Governance Institute) raised for the Fund in its September 2013 analysis of it, which meets 13 of its 16 best practices for sovereign wealth funds, is lack of transparency with regards to the assets it invests in.

Similarly, an August 2013 Bismarck Tribune article noted, “What North Dakota’s Legacy Fund will be used for hasn’t been decided upon yet.”

David Hunter, CIO of the North Dakota State Investment Board, denied comment when asked if discussing investments related to the Legacy Fund will be on the agenda for his looming July meeting with KKR in New York City. He also denied comment when asked if it presents a legal conflict of interests, since Schmidt previously flew on a KKR-chartered plane.

Image Credit: Natural Resource Governance Institute

A KKR spokeswoman also denied comment when asked these same questions by DeSmogBlog.

But a May 2013 article appearing in Foundation & Endowment Money Management reported the Fund has plans to tap into private equity funds at some point soon down the road.

“Hedge funds and private equity will not be in the initial mix, but [State Investment Board Deputy CIO] Schulz envisions an inclusion down the road, especially as the state is slated to start dipping into the endowment fund in 2017,” explained the story.

California Redux?

Yves Smith (a pen name for prominent investor Susan Webber), managing editor of the website NakedCapitalism.com, told DeSmogBlog she sees the situation in North Dakota as a parallel in some ways to what unfolded a few years ago with the California Public Employees’ Retirement System (CalPERS).

“Flying on a fund manager’s private jet (and staying gratis in his hotel in New York) was considered a sufficient ethics breach so as to lead to what was almost certainly the forced resignation of CalPERS’ senior investment officer, Leon Shahinian, who was in charge of private equity,” she said.

The special report that revealed Shahinian flew on a private jet paid for by private equity firm Apollo Global Management offered a simple suggestion in the recommendations section: no pay-for-play.

“Gifts, meals and travel of this kind may create potential fitness issues and conflicts of interest, or at least the appearance of them, and suggest that decisions could be made for reasons other than the merits of a particular investment,” stated the report.

“No gift, meal or trip is worth compromising the integrity of the CalPERS investment process, or creating an appearance that it has been compromised.”

Smith also pointed to a study saying it is almost without a doubt that Schmidt flying on a KKR-chartered plane was meant to — and likely will — curry favor from the State Investment Board for future deals, including those to be discussed at the July meeting in New York.

“Social psychologist Robert Cialdini, in his widely acclaimed book ‘Influence: The Psychology of Persuasion,’ stated that research has found that gifts as minor as a can of soda will render a prospect more receptive to a sales pitch. People like to think that they can get red carpet treatment from vendors and not be influenced, but they are kidding themselves.”

____

*Note that the allocation table in the post does not show a recommendation to hand over 50% to private equity funds, but instead looks like an allocation between real estate and investments in liquid securities. Since Horn got additional information via FOIA, he might have gotten that tidbit from other sources.

We give too much deference to military brass. That needs to change. There are just too many careerists in the military waiting out their time, quietly siding with industry before they hang up the uniform. As soon as they don their civies, they’ve struck gold. Those firms they quietly coddled over the years now provide them oversized contracts and benefits. When the Iraq war was in full motion flag officers knew there was no strategy and they knew there was no way of winning. But did anyone resign in protest since large sums of treasure and blood would be wasted? No. It’s all about self preservation. Nothing else matters, including subordinate soldiers. Flag officers, such as Betraus, understood the ticket to get rich was all about war making so they saw no conflict.

Include military officers as big time enablers of the 1%.

The revolving door from the pentagon to Lockheed and others is a real problem.

The less talked about problem is with our officers being mediocrities. Real leaders are punished and mediocre careerists climb the ranks. Which means that when asked to fight a real war with consequences, our military is lead by Ray Odiernos and Tommy Frankses. Hardheaded idiots who don’t ask questions and don’t think for themselves.

The saying I learned from this site is, “the fish rots from the head” and it’s certainly true about our military.

As a veteran and former Army officer, I concur that most officers are enablers of the 1%. But not all.

There are actual leaders among the sycophants, but they generally don’t get very far before being “encouraged” to leave, based on my experience and observation. Some free thinkers manage to become generals or sergeants-major, or at least did during my time in the US Army, but these people were definitely a minority.

KKR has particular expertise in being early to find and dazzling large and not terribly sophisticated investors.

KKR deserves every penny of what they can steal. How else are they going to put fuel into their yachts?

Hmm. And we wonder why the US Army keeps losing wars. Corrupt leadership will do that.

One of the ways for the average citizen to take back some control from the 1% is to have state funds invested by state employees in businesses where they can exercise voting rights to temper the bad policies of the corporations. This certainly isn’t going to happen if states invest their funds with predatory hedge funds.

Pension funds have fiduciary responsibilities to their beneficiaries, so there must be limits to what that fiduciary can do to further social policies that do not benefit the people who are supposed to benefit from the pension fund.

A mini-sovereign wealth fund such as North Dakota’s may have more freedom to do good for all the citizens of North Dakota than a pension fund may have. Making direct monetary returns from the investment is not the only consideration. Bettering the state infrastructure, endowing education for the children, investing in employment situations for adults, and many other things may also be a benefit that is worth investing in.

http://insurancenewsnet.com/oarticle/2014/06/12/north-dakotas-economic-growth-outpaces-all-other-states-for-fourth-consecutive–a-517003.html

Hhhmmm…and not a mention in all of this of the Bank of North Dakota, the only “public bank” in the US of A.

But I’m sure… naw… ethics violations could never taint the BND….could they?