By David Llewellyn-Smith, founding publisher and former editor-in-chief of The Diplomat magazine, now the Asia Pacific’s leading geo-politics website. Originally posted at MacroBusiness

One the markets that has been least easy to predict this year has been US bonds. The long term US bond bears, that are often monetarists at heart and believe QE will bring inflation, have been queuing up to short. Likewise, post-Keynesian’s have pointed at Japan and laughed about secular deleveraging and widow-maker trades.

The fact is, the bears have been wrong all year, and even with recent inflationary rumblings are still wrong. That has not stopped BofAML issuing a new warning today:

Jobs uncertainty

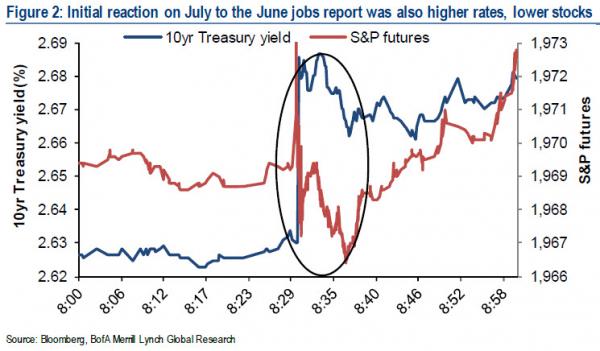

Today’s market reaction to Fed chair Janet Yellen’s Humphrey Hawkins testimony – which was initially perceived as hawkish – provided another highlight of just how nervous investors have become about the risk of tighter monetary policy, post the very strong June payrolls report. Thus, as 10-year interest rates rose 4bps during the first hour after the release of the testimony, stocks declined about 0.4% (Figure 1).

Clearly weighing on stocks was also commentary in the Fed’s Monetary Policy Report that certain sectors – specifically smaller social media and biotech companies – appear richly valued in the market. However, these sectors account for a very small share of the market and the Fed argued that the general stock market is not trading far from historical norms. Today’s initial market reaction mirrored almost exactly the initial reaction on July 3rd to the June jobs report itself, as in the first seven minutes or so 10-year Treasury yields rose 5bps while stocks declined roughly 0.3% (Figure 2).

We argued that the current pace of jobs creation mirrors what forced the Fed’s hand in the 1994 rate hiking cycle, which led to lower stocks and wider credit spreads. This is not to suggest that we are forecasting a repeat of 1994 – only that we, as statisticians, have insufficient information yet to reject decisively that this is 994. Hence the initial reaction today when – after strong readings on Empire Manufacturing and Retail Sales –chair Yellen sounded more upbeat in her assessment of the economy and repeated that “If the labor market continues to improve more quickly than anticipated by the Committee, resulting in faster convergence toward our dual objectives, then increases in the federal funds rate target likely would occur sooner and be more rapid than currently envisioned”. Again, this scenario may not actually play out – but clearly the likelihood of such development increases with good economic data.

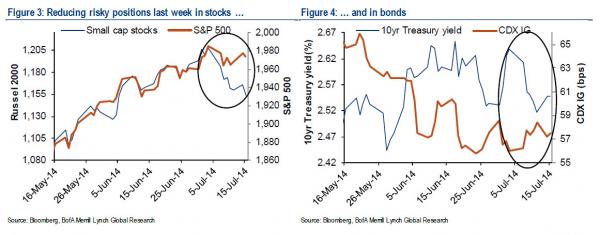

Again, we think this means that hedges should be set and long positions in risky assets reduced. We also think that this most likely explains the weak markets during the early part of last week, in a vacuum of little economic data, following the strong jobs report issued just before the Independence Day holiday weekend (Good news, flight to quality). For example declining stocks led by higher beta small caps, and widening credit spreads (Figure 3). With rallying Treasuries this indeed suggests rational risk reduction in reaction to the jobs report (Figure 4).

Apart from buying vol in credit we think that a particularly attractive hedge against interest rate risk in credit right now is the 10s/30s spread curve flattener.

Fair enough. But I’m not holding my breath. The Fed does not look in a hurry to me with Janet Yellen rightly pointing to a lot of shadow slack in the US labour market. Mid next year still looks like the timing for a hike.

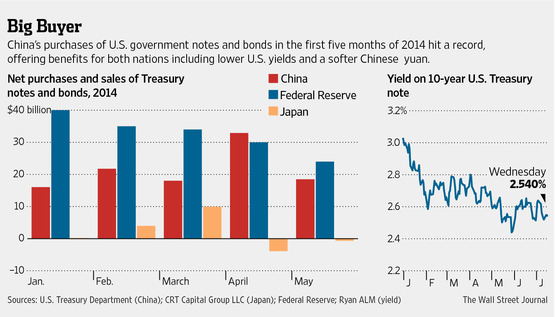

In the mean time, one major support for the bond bulls has emerged in China. Last night the US released its CIC data and it showed China is very active in the US market again. From the WSJ:

The Chinese government has increased its buying of U.S. Treasurys this year at the fastest pace since records began more than three decades ago, data released Wednesday show. The purchases help explain Treasurys’ unexpectedly strong rally this year. The yield on the 10-year U.S. Treasury note has fallen to 2.54%, from 3% at the end of 2013. Yields fall as prices rise.

The world’s most-populous nation boosted its official holdings of Treasury debt maturing in more than a year by $107.21 billion in the first five months of 2014, according to the U.S. government data. The buying has been fueled by China’s efforts to lift its export-driven economy by weakening its currency, the yuan, against the dollar, market analysts said, a strategy that encompasses hefty purchases of U.S. assets.

China officially holds roughly $1.27 trillion of U.S. debt, about 10.6% of the $12 trillion U.S. Treasury market.

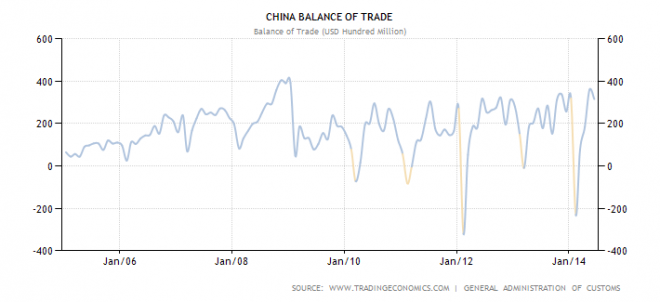

Hmm, well, it’s a lot of support but the explanation is wrong. The Chinese trade surplus is not the result of any new vigorous mercantilist push. The PBOC only began deflating the yuan a few months ago and that was more about controlling the hot money flowing into credit than it was trade. The rising Chinese trade surplus has resulted from the Chinese rebalancing. Imports haven’t grown in two years:

But exports have:

And it was rapidly rising imports in raw materials that helped correct the surplus until 2012. But since then, the slowdown in building and corresponding falls in commodity prices has the surplus rising again:

This is important because it’s probably going to keep going for a few years yet. Eventually you can rightly expect rebalancing to drive a shrinking trade surplus as the rising real exchange rate and unleashed consumer suck in goods from all over. But before that happens commodity prices are going to fall further and China is going to have plenty of dough to recycle into US bond markets.

They might send it elsewhere but, then again, they’ve tried that and now they’re back. When the money mounts up there really is no other market big enough to accommodate the Chinese surplus.

The US bond bears could be disappointed for quite a while yet.

Won’t stop the usual suspects from crying about military and oil and dollar hegemony all coming to an end yesterday!!!!!!!!!!!!!!!

Even though said commenters have been wrong a hundred times already in the past four years.

Four years is nothing. They’ve been wrong about Japan for twenty.

In Jan. 2014, what would cause Chinese exports to cut in half, and their balance of trade to shrink 150%? Those deltas seem to be unbelievably large and sudden, as was the rebound.

A drop in X-Mas paraphernalia and lawn decorations in February?

http://youtu.be/yRN7oN4XGKU

I guess everybody saw the news that astronomers now think there’s 100 million earth like planets in the galaxy. That’s shocking news for the observant mind. So what are all you guys gonna do now — all you guys who somehow know everything about anything that happens politically and militarily on earth and write your opinions down and post them as commetns in the PG? And all you women who write down your hormonal emotings about every foul deed done anywhere on earth to animal or man and post those as comments? What if you had to keep track of 100 million planets where all sorts of sh**T was flying every day in every direction? And all you bloggers who have expert opinions on every thing that happens politically, economically or meteorologically? What are you gonna do now, now that you have to keep track of 100 million planets if you really want to be informed and lead the pack? I know what I’d do — Youtube! But you’ll probably just try harder, and sleep less. :)

I hope they are not more advanced than us…. or they’ll soon be taking over our planet because they destroyed theirs.

Did you read the one about the periodic table? It is changing. Elementally.

http://www.youtube.com/watch?v=UCmUhYSr-e4

Did you mean to send us off to Otis? Thanks. It’s my favorite all-time song.

Regret the diversion from a substantively important topic, Susan. Couldn’t resist Craazy’s invite… The China meme is also largely a diversion IMO. China’s relative importance as a purchaser of U.S. Treasury bonds has been significantly less than that of the Fed under QE, and I believe China’s holdings only comprises about one third of the roughly 30% of total U.S. Treasury debt held by Foreign and International investors, including those in the Cayman Islands and other “safe havens”. Then there is the intragovernmental component of the public debt, which is roughly equivalent to the total amount held by foreign and international investors.

… “Lions and Tigers and Bears, Oh My!!”

http://www.youtube.com/watch?v=buqtdpuZxvk

‘One [of] the markets that has been least easy to predict this year has been US bonds. The long term US bond bears, that are often monetarists at heart and believe QE will bring inflation, have been queuing up to short.’

Prediction is a mug’s game. One can, however, respond to what’s happening concurrently in the market.

Moreover, the economics of shorting bonds don’t work over periods of more than a few days. Since the short seller has to pay coupon interest to the party who lent the bonds, the sold-short bonds must decline in price by at least double the interest paid to even equal the return of holding them long. Tough odds, except for insiders.

One rough compass for navigating bonds is the yield curve. When it starts to rise, yields on longer-term bonds are likely to rise as well. But thanks to ZIRP, the yield curve is flat on the floor. It suggests that for now, one can hold longer maturities without unreasonable risk.

Given enough time, the Fedsters may find another excuse to stay easy — any stupid thing will do. So the much-dreaded ‘normalization’ may never happen at all. Central planning ain’t normal to start with.

I think one must ask oneself what happens if:

-rates go negative

-rates stay flat

-rates increase

If any one of these scenarios happens over the next 5 years, a large number of our social institutions will fail without government bailouts.

The first one is pensions. Anyone of these scenarios has the potential to wreak havoc. So to say it’s a mug’s game is a red herring. It’s true that it is impossible to know what the black swan will be, but we have enough data to know one is coming.

So if one is focusing on maximizing their portfolio based on short-term data, chances are one is missing the big picture, which is restructuring one’s life to make it shock absorbent.

I am in my mid-40s and I am not sure that focusing on my investment portfolio is the best use of my time. In my mind, it’s fighting a losing battle against an older generation, currently in power, that is just eyeing it.

I’m with you on the coming pension crisis. But that’s baked in the cake in any interest rate scenario, since the returns aren’t there to meet promised benefits.

Unlike stocks, which usually undergo bull markets of three years or more (this one’s in its sixth year), bonds don’t trend very well. They go up for a new months, down for a few months, with sharp and unpredictable reversals.

As a rough guide, the yield curve works because its numerator (a short-maturity yield such as T-bills) is not random. Short rates are controlled by the central planners, and exhibit enduring up and downtrends. This highly unnatural phenomenon can be exploited, specifically by holding short maturities when they decide to tighten. But that time is not yet.

Maybe next year, or the year after that, Lord willing and the crick don’t rise …

Ahem – any of those scenarios are already occurring. Short-term rates (FED FUNDS, short-maturity libor) have been at historical lows since late 2008 – early 2009.

You (and me) want rates to stay generally flattish to slightly increasing. Rates moving lower just means more damage in the labor markets.

The FED balance sheet, as currently constructed, was not exactly built to sustain possible fall out from higher interest rates (and by higher, I mean the UST 10 year going north of 4.00%). Those fixed rate MBS have a nasty convexity feature at higher interest rates.

Personally, I don’t care about the rates because all 3 scenarios lead to a shock which will make a good chunk of the population roar. The shock will just hit different areas first.

‘Those fixed rate MBS have a nasty convexity feature at higher interest rates.’

That’s probably what Bernanke piously tells his clients these days. He warned the FOMC punters … but they just wouldn’t listen!

Good replies, on both comments. If a higher rate concerns you (over the longer run) then generate a time value of money for your personal rate of return. Use the current “risk free” UST 10yr yield (Friday’s open might be interesting, possibly) for the first run of numbers.

Then generate a 2nd calculation using a 10, 15 or 20 year trend of the UST 10yr yield. Today’s lower rate (artificially low, real, whatever) doesn’t really serve yours, mine or anyone’s purpose for retirement planning on a 20-30 year horizon.

This is a fun debate at the office, actually. A healthy level for prime rates is not 3.25%, but more like 6.0% or above. FED / FOMC wanted real rates at their lows to generate asset inflation, to reflate the housing stock (residential and commercial). Looks like asset inflation is just what they’re getting (and credit, and junk bonds, and levered loans, and cr*p IPO stocks). Who knew ?

China biggest export to the U.S. is deflation. Bond buying and below cost exporting by China and the stripping of the America’s high-cost/high paying manufacturing sector all up to deflation for years to come. They buy our bonds and dump their finished goods suppressing price pressure. All this recent M&A activity is a reminder of all the redundancy in the supply chain of the world’s economy. Hugh layoffs will result and any future demand will be met with lower cost automation. Overcapacity is the result of over investment, much of it driven by low cost money.

The incessant and very weird chant to raise interest rates today is not related to actual inflation, but instead is wedded to some strange assbackwards belief that higher rates will restore pricing power by reducing overcapacity that eventually will result in inflation down the road. This is how distorted things have become.

It’s so No Exit.

I don’t think post-Keynesians are worried about bond vigilantes or china. They realize that the fed sets these rates.

This interest rate is just risk free money for those who own the Treasuries. The real stability for pension funds etc will come if the fed and congress can shift money away from the fire sector. Money is just a tool best used to put idle labor and resources into socially productive activity.

“It’s hard to make predictions. Especially about the future.”

How does China come up with all that money when their production is crashing and their shadow banking trusts are defaulting and etc? Does China still buy up all those German bonds? And more complex is the new banking system being set up by the BRICS. Shouldn’t China be investing in their membership countries? If this is only a currency war between the US and China, it actually serves the New Normal here to keep the economy cool. What happens to China’s investment in treasuries when we can’t afford to import? How low can they go?

China gets dollars by selling us things and euros by selling to the EU. So what’s happening there doesn’t affect their capacity to buy our securities as long as we keep spending on Chinese goods.

Raising Rates

Jesus didn’t produce fish and bread out of thin air. When the crowd assembled, there were plenty of critters with food. In fact, there were critters with hoards of food, but they were afraid to share for fear of being trampled to death by those from whom they had systematically stolen it, not unlike the problemsolution you always see before you.

There is no lack of resources, dammed by lack of faith, and never has been. Prices keep going up and demand keeps falling, accelerating the collapse of money with lost purchasing power, leaving the hoarders hoarding debt, and dead real estate inventory, desperately seeking a new energy source. Chimerica keeps printing and buying dead real estate globally, because the critters have no idea what to next, for fear that their own mobs will trample them.

When Jesus said I am the way, he was talking about the example of redistribution, by taking individual responsibility to discount agency. Israel and Palestine bombing each other to maintain the petrodollar status quo is certainly not the way, but, like most everyone else, the critters are locked into MAD, to preserve the façade of artificial scarcity, the past, derivative perceptions of stupidity, willful ignorance.

The wizard cannot raise interest rates without accelerating collapse, until the majority accepts the stupidity of its fear, but the critters would not have joined peer pressure groups in the clock if they were capable of facing their fear, surrounding themselves with cheap crap, as a poor replacement for love, instead. Physical war, bombing impoverished children, is misdirection, until it isn’t and things get out of hand.

You can go anywhere in the world, walk into a city or corporation, and see the same problem, automatons locked into the psychology of fear, joining peer pressure groups pretending not to fear, in a positive feedback loop, creating artificial scarcity, marching step by expedient step, down the Nazi path of subsidized obsolescence.

You have five teams, a supervisor, a manager, a secretary, and a bank, issuing debt. The supervisor systematically cross-pollinates the process with ideas from each team. A proprietary programmer systematically replaces them all with a machine, the bank calls in the debt, confiscating all employee assets pledged against the debt, the machine is shipped abroad, and product is shipped back, all depending upon a global demographic ponzi to maintain the velocity of money – brilliant, absolutely brilliant.

When you discount money, with intelligent discretion, an eye on the future, you are effectively raising rates. It doesn’t matter what the Fed or Congress do. Any and all governments are the gravitron. The transportation bill, driving energy exploitation, only cobbles together consensus for ten months. If you follow the morons, you are going to find yourself in a war, every time, all the time.

You are the economy. The Fed can only follow your lead, and pretend to lead itself, which is to your advantage, unless you want to spend all your time playing stupid, in a civil contract, keeping the enemy close, which is really just a mirror of yourself, debt inflating assets, on debt as income, in accounting misdirection.

Without your guidance, raising children to be productive, in a home built for the purpose, the circuit can only swing in a pendulum, until it stops, at which point the planet replaces the species. Whether you like it or not, you have always been in the same boat with everyone else.

Jesus simply saw the system for what it is, gravity. And you are no less a child of God than Jesus. Every government has a mythology justifying its stupidity. Why do you suppose Russia accepted the petrodollar? Have you looked at the prices in global cities relative to population and tourism?

The Vatican collected debt to hide sin, in a positive feedback loop, just like the rest of them. Jerusalem is a city, just like the rest of them. Sweden is a nation, just like the rest of them. And you have better things to do than enter a coliseum built on sand, to join a crowd, and bet on Rapture, self-fulfilling prophesies issued by false prophets hiding behind a teleprompter, built for the purpose.

Don’t cede your responsibility and expect anything other than hollow promises on the way back to the past, the DNA churn pool, as a result. Who occupies legacy, as the scapegoat, is an irrelevant trade-off, in a clock going nowhere, faster and faster. Whether Trump controls debt or debt controls Trump is a mater of perspective. Careful what you wish for.

When you cede your responsibility as a parent, you see empire, jurisprudence over the mythology of false motion, civil marriage. The Court cannot take your children, because they are not your children to begin with. Prepare them, the best you can accordingly, building the bridge on faith, experience looking where others do not.

The trick to parenting is to take your children to the beach, let them wear themselves out, give them a bath and put them to bed, not wake up late, give them sugar, set them in front of a TV and race off to a make-work job. The economy is built by those intelligent enough to employ the stupidity of gravity.

I have been to a lot of places and worked with a lot of people, and have yet to see money fulfill anyone. Money is just a transmission mechanism in a clock, on one side of a fulcrum, populated by ignorance and fear, a meaningless convention beyond itself, which is why enough is never enough, for the theorists.

If you are not happy with the world around you, change your focus, by building a better one, and you will see labor, well beyond the empire’s grasp.

Until someone can convincingly demonstrate why the US rates won’t follow Japan’s history, then I will expect rates to continue to decline 7 years and out. That down-trend in the 10Y from 1981 is still intact, even with the taper tantrum of last year. Hoisington predicts the 30Y will eventually settle in at 1.7-2.5% reflecting the declining growth in the economy.

As for the short end, the Fed may well try a “normalization”, but I suspect the havoc will cause them to reverse course quickly. There may be no exit possible.

No real reason why we should pay interest on securities or sell long-term anyway. We could chuck the whole thing and issue national certificates of deposit for pension funds and household saving.

You still have to pay interest to people, Ben, to get them to actually defer consumption.

As Lee Adler discussed today, the U.S. labor market appears to be tightening:

http://wallstreetexaminer.com/2014/07/initial-claims-below-record-lows-of-housing-bubble-show-economic-distortion-overheating/

… Oh, what to do?… What to do?

My own opinion is that the Fed’s network will push up Oil prices, just as they did in July 2008, while continuing to suppress interest rates, probably through their repo facility and other mechanisms.

In fact, we saw prices jump in the price of Oil this week as West Texas Intermediate Crude futures prices were supported at $99 bbl, then pushed up to $103.78 to close out the week — a 4.8 percent jump in two days.

I believe this policy approach meets multiple objectives in the Fed’s eyes in that it would slow wage growth and demand which might lead to inflationary pressures (the Fed disregards food and oil prices in its core inflation measure) while supporting key constituencies (Big Oil and Big Finance) and deflecting blame elsewhere, preferably internationally.

Just a thought, and I could be wrong. But isn’t it fun trying to figure out their hand signals?