By Arthur Berman, a petroleum geologist with 36 years of oil and gas industry experience. He is an expert on U.S. shale plays and is currently consulting for several E&P companies and capital groups in the energy sector. Berman is an associate editor of the American Association of Petroleum Geologists Bulletin, and was a managing editor and frequent contributor to theoildrum.com. He is a Director of the Association for the Study of Peak Oil, and has served on the boards of directors of The Houston Geological Society and The Society of Independent Professional Earth Scientists. Originally published at OilPrice

Exporting crude oil and natural gas from the United States is among the dumbest energy ideas of all time.

Exporting gas is dumb.

Exporting oil is dumber.

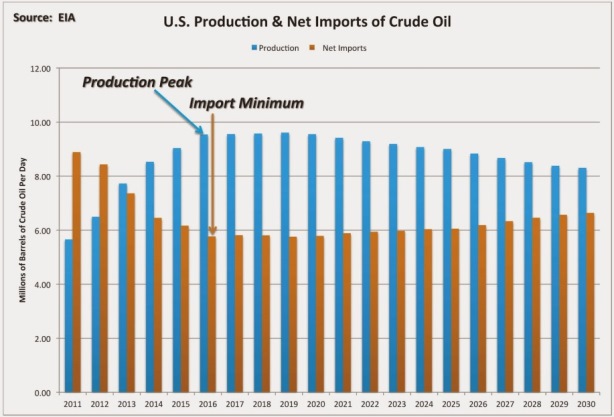

The U.S. imports almost half of the crude oil that we use. We import 7.5 million barrels per day. The chart below shows the EIA prediction that production will slowly fall and imports will rise (AEO 2014) after 2016.

This means that the U.S. will never be self-sufficient in oil. Not even close.

What about the tight oil that is produced from shale? That’s included in the chart and is the whole reason that U.S. production has been growing. But there’s not enough of it to keep production growing for long.

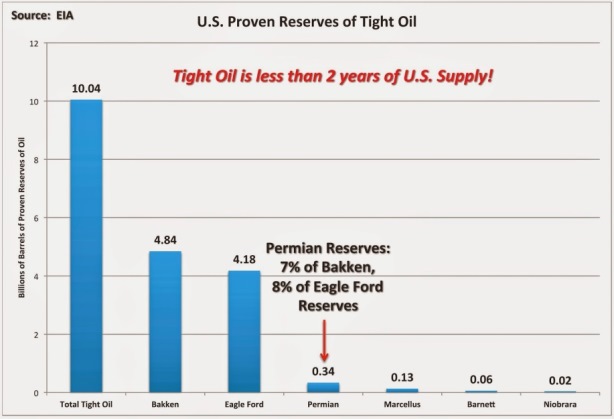

Here is a chart showing the proven tight oil reserves just published last month by the EIA.

Total tight oil reserves are 10 billion barrels (including condensate). The U.S. consumes about 5.5 billion barrels per year, so that’s less than 2 years of supply. Almost all of it is from two plays–the Bakken and Eagle Ford shales. We hear a lot of hype from companies and analysts about the Permian basin but its reserves are only 7% of the Bakken and 8% of the Eagle Ford.

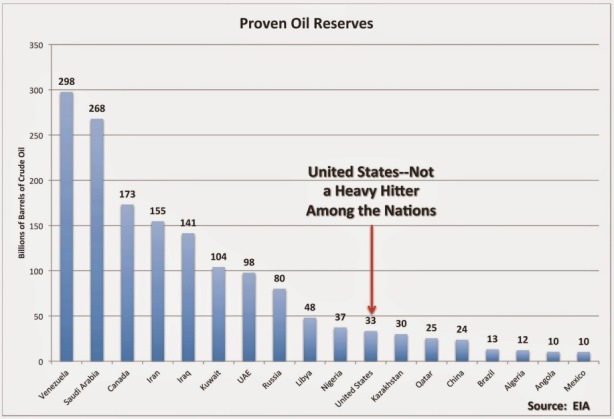

Tight oil comprises about one-third of total U.S. crude oil and condensate reserves. The U.S. is only the 11th largest holder of crude oil reserves (33.4 billion barrels) in the world with only 19% of Canada’s reserves and 12% of Saudi Arabia’s reserves.

In other words, the U.S. is a fairly minor player among the family of major oil-producing nations. For all the fanfare about the U.S. surpassing Saudi Arabia in production of crude oil, we are not even players in reserves. What that means is that we may temporarily pass Saudi Arabia in production because it chooses to restrict full capacity, and U.S. production will fade decades before Saudi Arabia’s production begins to decline.

Let’s put all of this together.

• The U.S. will never be oil self-sufficient and will never import less than about 6 million barrels of oil per day.

• U.S. total production will peak in a few years and imports will increase.

• The U.S. is a relatively minor reserve holder in the world.

How does this picture fit with calls for the U.S. to become an exporter of oil? Very badly. For tight oil producers to become the swing producers of the world? Give me a break.

Perhaps we should send congressional proponents of oil export like Joe Barton (R-TX), Ted Cruz (R-TX) and Lisa Murkowski (R-AK) to “The Shark Tank” TV show to try to sell their great idea to the investors and judges.

I’m out.

“• The U.S. will never be oil self-sufficient and will never import less than about 6 million barrels of oil per day.”

I’m not, ordinarily, a gambling man. I’ll make an exception here and go all in betting that the US will definitely import less than about 6 million barrels of oil per day, when it is also self-sufficient, in that its oil production meets demand, and all three values are zero.

The big unknown here is just how efficient automobiles can become, and living space energy efficiency.

The West has been tied to the reciprocating internal combustion engine for over a century now. In automobiles, that has been tied to a mechanical torque distribution system, the drivetrain. There are other systems, proven out in theory and some demonstration models. Change the drivetrain out for an electric all wheel drive system, like used on the moon rovers over 45 years ago now, and you get large reductions in weight and friction loss. Will it cost more to produce? Yes, until economies of scale begin to function. Agatha Christie was quoted as saying that she was most amazed at how she ended up owning her own car, and couldn’t have ever imagined that servants would be so difficult to afford. Different times have different outlooks. When Christie was growing up, only wealthy people could afford motor cars because, I’m going out on a limb here, economies of scale hadn’t affected automobile production yet. Servants, they were everywhere. Now the servants are mainly mechanical, and cars are all over the place.

Info on the Lunar Electric Rover:

http://nssdc.gsfc.nasa.gov/planetary/lunar/apollo_lrv.html

Very interesting. This makes the Obama fracking frenzy even more myopic and greed-addled. Nothing but more riches for Big Oil. Perhaps we should think about keeping shale gas in the ground and in reserve just in case … you know … we might actually need it down the road. Isn’t that what “energy security” really means?

Heh heh. Rational thinking again. Try that on a pol. Guaranteed eye glaze.

Mr. Wonderful: What is your cost of production?

Joe Ted and Lisa: $100 per barrel

Mr Wonderful: What does a barrel sell for?

Joe Ted and Lisa: right now just over $40 per barrel.

Mr Wonderful: ooooohhhhh, that sucks. You are nothing but a bowl of puss to me. I’m out.

Kevin, what are you doing here?

I’m no expert, but from what I understand the desire to export crude is because there is a surplus of certain types of it. Obviously we are still a net importer, that goes without saying. Refineries in this country are tooled to process certain grades, and beyond that the rest of the oil is trapped absent the ability to export. The trapped oil fetches a major discount to the world prices. I’m a little disappointed that a geologist doesn’t acknowledge that basic point.

There is also the detail of unrefined vs refined products.

Refiners produce a range of products depending on their objective. More specifically a refinery cannot just produce gasoline or diesel fuel to satisfy a local market demand. (as well, as I think is pointed out above, refineries arr typically organized to process crude in a certain range of specification).

For a simplistic example on the subject of import/export/domestic use of refined products, If maximizing profit indicates maximizing, say, gasoline, the refinery will still inevitably produce some percentage of heavier fractions, like diesel and bunker fuel. If there is no local market for those also-ran fractions, or the price is subpar, they are exported to where demand exists. The same on the flipside, if a refinery someplace else maximizes diesel production and the gasoline fraction also-ran products are more valuable in another market, they will be exported.

At the highest level, Lee Raymond had it correct, attempting to use petroleum as a political policy weapon is ignorant. Once crude is out of the ground it a global commodity and it really doesn’t matter where it came from, what does matter is the delivered price. The notion of “energy independence” is an illusion. Using domestic crude that costs 100 beans is economically innumerate objective if one can purchase equivalent oil for 50 beans. The analogy that considers the global oil market as a big bathub with many different size spigots running into it is an apt one. Once it’s in the market, it doesn’t really matter where it came from because it it can be economically produced it is an inevitability that it will be.

The analogy IMO applies to other less politically red meat commodities. Does it make sense to have a domestic political objective to produce Copper or Corn that cost 100 beans if you can purchase it delivered for 50 beans? Maybe not so much.

Well, wasn’t that Adam Smith’s idea about free trade?

Doesnt he work for Valero?

I wonder if Oil companies could sue the states for losses due to US restrictions on export if the TPP and its evil siblings were signed? Could they argue artificially high prices such as, Well, we wanted to sell it all before the price dropped so we insist the price is at 110 a barrel and we believe that at those prices we could have extracted 10 times the estimated reserves, so there! Pay up citizens!

Only foreign investors can sue for what amounts to the loss of profits they said they were going to make. But that would include players like BP and Royal Dutch Shell.

Only foreign investors- Right and thanks for the clarification. (Things fall out of my head so often now-a-days it almost makes real noise). It’s still absolutely mind boggling and I imagine BP is licking it’s chops to make back some of the money it spent on the Gulf oil spill..

When I finished my comment above, I suddenly realized, hey wait, they actually could do something like this…

Google “Lone Pine Resources lawsuit”. The target is Canada and NAFTA is the justification, but otherwise the scenario is exactly as you described.

The foreign restriction applies, but Lone Pine claimed that they qualified as a foreign company because they are incorporated in Delaware.

“Exporting crude oil and natural gas from the United States is among the dumbest energy ideas of all time.”

Not for the energy companies. Lifting the export bans would allow the energy commodities to seek the highest prices realized across the globe. Exports would then allow prices to rise in the U.S. And the suggestion that the U.S. is awash in oil and gas allows the uninformed to connect in their minds that lifting the export bans would be fine, as there is “plenty” of energy to go around.

And there is also that pesky link between lifting the export ban and the U.S. government’s involvement in Ukraine:

https://thesmallr.wordpress.com/2014/05/27/rosy-predictions-of-declining-natural-gas-prices-ignores-the-long-term/

Is the price drop even about exports? Or are falling prices really a threat to electric cars, solar power, and the envrionmental movement as a whole? Saudi Arabia is not really threatened by the U.S. exporting oil. They are threatened by us cutting our use of it generally.

C, the break even price for solar was fifty dollars, below that price solar did not compete some years ago.

There is another potentially interesting twist to this. Electric utilities in the US are converting to gas powered generators, partly for environmental (GHG) reasons but I suspect mostly because natural gas fired generators are both less expensive and more versatile. So what happens to electricity rates when the gas bubble pops? (For that matter, what happens to electricity supply?)

It seems pretty clear to me that the US, with its vast suburbias and wide open spaces should be going all-out for electrifying its transportation system and renewables – and maybe even keeping some coal in place until it gets there.

This is good, no? Canada has become a one party tar state where environmental activism is illegal. The country as a whole doesn’t even benefit, the money all goes to a few oligarchs, the same is true for North Sea oil in the UK.

We get rentier capitalism already, no need to make it worse.

US Tight oil production estimates by EIA are themselves are quite rosy, as explained by this peak properity podcast

http://www.peakprosperity.com/podcast/89793/shocking-data-proving-shale-oil-massively-over-hyped

Yes, that’s a separate issue that we’ve posted on, that the estimates of the production over time from what we laypeople refer to as fracking look to be exaggerated in a big way. More recent estimates based on more granular geological work by both the University at Texas and the Post Carbon Institute come up with much lower figures.

See these posts for examples:

http://www.nakedcapitalism.com/2014/12/new-study-says-us-fracking-boom-will-fall-quickly-after-2020.html

http://www.nakedcapitalism.com/2014/10/drilling-deeper-new-report-casts-doubt-fracking-production-numbers.html

Thaaaaaank you… !

I vote this post in for “Best Three First Sentences Opening” of the year Naked Capitalism award.

I’m aware the year has just started…but let’s get real here for a second; we all know the odds of besting this contender are pretty darn slim.

Yves …start working on a trophy and ceremony award …!

(…and more of him please)

this post sounds very reasonable and well-informed, but leaves out one very important fact:

We won’t make money if we sell it to ourselves but we will if we export it! Would you pay yourself for something you sell yourself? Hello?

Those republicans probably get this. That’s why they want to export it., Also, if we buy other countries’r oil and they buy ours — we both make money! Neither of us would make any money f we tried to sell it to ourselves. You gotta think outside the box!

Venezuela has the largest amount of proven oil reserves; even more than Saudia Arabia!!

No wonder there have been so many attempts to get rid of Chavez and Maduro.

LOL at the use of proven reserves to justify an debate about production. After 36 years, Mr. Berman should know better.

Is all this chatter about oil enough to make the wind blow?

The US Does Not Have Oil Reserves to Meet Annual Consumption For Beyond 10 Years.

http://www.eia.gov/tools/faqs/faq.cfm?id=33&t=6

The following from the above link.

“Only a relatively small amount of crude oil is directly consumed in the United States. Nearly all crude oil is refined into petroleum products such as gasoline, diesel fuel, heating oil, and jet fuel, which are then consumed. Liquids produced from natural gas processing are also consumed as petroleum products. Renewable biofuels, such as ethanol and biodiesel, can be used as a substitute for or an additive to refined petroleum products. EIA includes volumes of biofuels in data on total petroleum consumption.

In 2013, the United States consumed a total of 6.89 billion barrels of petroleum products, an average of 18.89 million barrels per day.1 This total includes about 0.32 billion barrels of biofuels. ”

————————————————————————————————————————————————–

Assuming 7bil/yr consumption, our 33bil/bbl reserves will last 4.77yrs. The biofuels included, only extends minimally the overall crude consumption. A different energy not from crude would have to replace it, for example, in auto fuel, to extend our national reserves for industrial purposes. As we write, the number of purely electric vehicles, EV, on the road in the USA right now is growing at a rapid rate. With each passing year, the sales of EV and Hybrids will reduce demand for crude and its distilled fuel, gasoline. This may extend minimally the burn rate of crude oil by reducing the annual consumption. But ultimately, we will have to import more and more oil in about 20 or so years to the point that imports are the overwhelming oil consumption is base upon imports. What is more disturbing is that while crude oil is banned, refined gasoline is not and is regularly sold. Our crude imports are currently that much greater due to the export of refined gasoline. See huge spike in refined crude exports on link below.

http://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=PET&s=MGFEXUS1&f=M

So oil independence is, as Mr. Berman points out, a physical impossibility. We just don’t have that much oil,even with deus ex machine of new technologies, new discoveries etc. The conjuncture of hard to reach and expensive to extract oil and gas with EV and industrial solar power installations means that the slow but steady electric energy model will displace the burning of fossil fuels. The EIA cautions against the simplistic dividing of proven reserves by annual consumption to arrive at the point in time when we run out of oil due to unknown technologies yet to be and unknown reserves to be discovered. Of course, the same deus ex machine of solar energy and electric vehicles is not granted the same rosy future of scientific breakthroughs and commercialized technologies. The difference between 1974 and today is that today, there are 286,000 EV on the road mostly sold in the last 2 years, plus 5,000,000 hybrids, mostly Prius from the last 15 years. Oil independence will not come from oil drilling, but from the slow but sure displacement of fossil fuels by electricity as the energy model for a technological economy.

The other difference today is the already operating industrial capacity solar energy power plants that operate when the sun is up or the stars are out. Intermittent is an engineering term, not the curse of the mummy.

http://www.nrel.gov/learning/re_csp.html

The 2nd concentrated solar power plant is being ramped up for feeding the power grid, ensuring the baseload of electricity 24/7. You can see one of many operational CSP plants in video below.

http://thekidshouldseethis.com/post/29627361853

Here’s the skinny to what’s going on:

– The law against exporting oil is outdated and antiquated. It should have been abolished with price control legislation in the 1970’s.

– WTI is a superior quality oil to Brent, and yet is sold at a discount to Brent.

– US refineries are mostly set up to run heavier oil and are not willing to pay high prices for the high quality WTI oil that is over supplied as a result of this export law that forces US companies to sell only to the US. It would be very expensive and time consuming for US refineries to change their plants to accommodate better quality oil.

– The refineries that are best suited to run WTI are outside the US and hence US producers are not allowed to sell to them as a result of this export restriction law.

– The differential between WTI and Brent will likely disappear if this law is finally eliminated. This result would give the producers better revenue for their production, increase the efficiency at the refineries that would get the US oil, and insure that this WTI is not sub-optimally processed by domestic refineries.

– Recently, some producers have been allowed to sell condensate outside the US, but the US ban on exports is still in place. There are no restrictions on the sale of refined products (like gasoline) to other countries. Why treat oil differently? Should we have restrictions on exporting olives just because we import more than we export?