By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

The oil industry is dead-serious when it talks about slashing operating costs and capital expenditures. It has to. Preserving cash is suddenly a priority, after years when money was growing on trees.

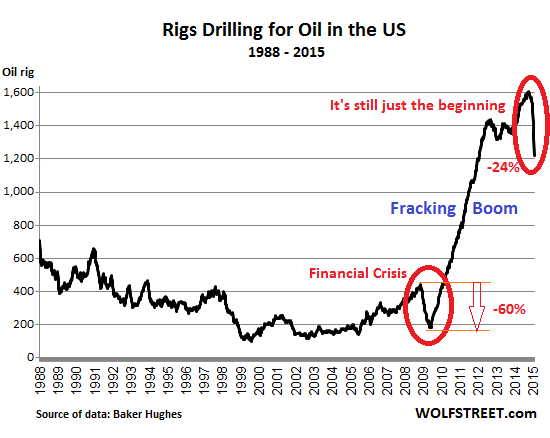

In the US, the cost cutting has reached frenetic levels. One place where it shows up on a weekly basis is the number of rigs actively drilling for oil. And that rig count dropped by 94 to 1,223 in the latest week, as Baker Hughes reported today. A phenomenal plunge, by far the worst ever. In January, the rig count crashed by 276, the most ever for a calendar month. That’s 18.4%! the rig count is now down 386 from its peak on October 10, by nearly a quarter!

And yet, it’s still just the beginning. The chart shows the breathless fracking-for-oil boom that started after the financial crisis. Not included are the rigs drilling for natural gas. That fracking boom had started years earlier and ended in a glut and total price destruction that continues to this day (chart). Note the two-month cliff-dive, the worst ever. During the financial crisis, the oil rig count fell 60% from peak to trough. If this oil bust plays out the same way, the rig count would drop to 642! The bloodletting in the industry would be enormous.

When the rig count was released today, West Texas Intermediate spiked nearly 9% to $48.32 a barrel, fired up by a big bout of short-covering. It now trades for $47.74, up 7.2% for the day. And yet, it’s still below $50!

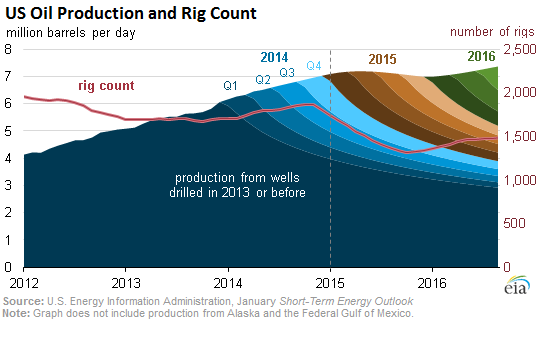

But the cutbacks in investments and drilling activities have not yet had any impact on actual production. That is a function of existing wells. New wells are constantly being completed, and their production adds to existing production. So what really needs to happen for the oil bust to end is a decline in production – because demand isn’t picking up the slack. But that just isn’t happening, not yet.

Production continues to rise, internationally and in the US. Oil company by oil company, they’re all projecting further increases in production. They’re cutting drilling activities, they’re laying off people, they’re closing facilities, but they’re pumping as much oil as they can to salvage what’s left of their fizzling cash flow.

The US Energy Information Agency projects production from US wells (except from Alaska and the Federal Gulf of Mexico) to continue rising into 2015 with a tiny bit of tapering toward the end of the year. In this chart, which the EIA released on January 26, the maroon line represents the total rig count for oil and gas (rather than just for oil,as above). The colored areas (dark blue to green) represent production from new wells each quarter. Their drooping lines are a reflection of the steep decline rates inherent in fracked wells. In other words: new wells have to be drilled constantly just to keep production flat. If the rig count drops by enough, there won’t be enough new wells to make up for dwindling production from legacy wells. That’s when production will begin to taper off.

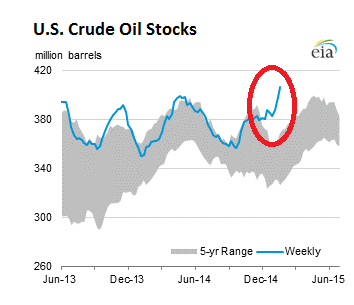

Meanwhile, rising production in the US, combined with slack demand growth, is ballooning crude oil inventories. In the latest reporting week, these inventories (excluding the Strategic Petroleum Reserve) rose by another 8.9 million barrels to 406.7 million barrels, the highest level for this time of year in “at least the last 80 years,” the EIA reported. These inventory levels (blue line) are on a terrific upward trajectory that defies the 5-year range and seasonal fluctuations:

Every rally in oil over the last six months has gotten hammered down brutally. Eventually, the oil glut will end. Everyone knows this. But we haven’t seen demand pick up or production decline to make a dent in the glut. And the wave of defaults and bankruptcies that needs to happen to shake out over-indebted, less efficient players has only just started. So it appears that folks who are trying to catch this falling knife may get some of their fingers sliced off.

But time and money are running out for junk-rated energy companies. Read… Debt and Fracking at Low Oil & Gas Prices: Wave of Defaults, “Outright Liquidations” Next

Buy’em when there’s blood in the streets

If that blood is from fingers getting cut off, so be it

Trying to time the bottom by “waiting for a sign” is just as stupid…so start adding some oil, right here, right now

If it get’s cheaper, add some more

Can’t tell if it was sarcasm but remember buying when there is blood on the streets implies you aren’t bleeding to death. The Capitalists who did (and continue to do) that are often the ones who caused the bloodshed in the first place, and their mountains of Capital provides them the luxury of attaining assets in a crisis. People with the means, say Charles Koch, will be the ones buying up these underwater fracking claims for pennies on the dollar then tossing them back out to contractors and developers at a handsome premium once oil goes up again, which it will.

Be careful that you aren’t reaching into the maw of a shredding machine, or you will likely lose your fingers as well.

It looks like in a year or so we’ll have oceans of oil just laying around in storage tanks not doing much and few to no (American) organizations left to produce oil. Then a year after that?

Anyway there is something interesting going on here relating to monetary theories here. How do monetary theories account for corruption and the political failure that led our society to being mortally dependent on a non-renewal and swiftly dwindling resource? From all appearances any alternative energy scheme cooked up by the political hacks and funded by elaborate monetary theories these days would merely result in the funneling yet more scarce resources of a society into brain-dead projects like highways for soon to be obsolete personal passenger vehicles and into the pockets of the oligarchs and political apparatchiks. Which would exacerbate our current predicament rather than ameliorate it.

The free market just doesn’t do long-term planning or externalities, period. Monetary theories don’t have a jot to do with it.

“Free market is short term, planning”. So what have we gotten from the tax payer supported, high end vo-techs?

I have observed from a distance, I had no opportunity, later no desire, to attend these vocational training institutes. That as the number of MBAs keeps rising, the economy is subject to more frequent and extreme oscillations.

Corollary to number of lawyers vs their wealth in society, or the number of elective and un-necessary surgergical procedures corollates to the number of surgeons and specialized medical facilities.

Not quite accurate – the current structure of Wall Street doesn’t reward or value long-term planning. It’s all about gambling on ultra-short term changes: a form of roulette in which the players are funded by the spectators, keep a large chunk of the winnings, and suffer none of the losses. Change that reality, and the markets will again reward long-term planning.

Market externalities must be addressed through a government, of some cartel with government-like enforcement powers. (The tragedy of the commons scenario.) However, market imperfections are a different issue from long-term planning.

Government is a cartel with government-like enforcement powers. A government that has no respect for its chartering document and consequently lacks moral legitimacy is nothing more than the best-armed and best-organized racket on the block. I’m often confused when I see various groups such as gun-control nuts and religious zealots and monetary theory ideologues advocating ceding additional powers for government. It’s like giving a criminal who already has the run of your house the key to your safe as well.

Define market

Any social space where anything or things are buyed and selled for “money” or “moneytised credit”, however denominated.

Here’s my initial discussion: https://www.emptywheel.net/2015/01/30/what-is-the-definition-of-a-market/

The comments are also interesting.

Not true. There are all kinds of market theories to explain these things. Just none that survives scrutiny.

“How do monetary theories account for corruption and the political failure that led our society to being mortally dependent on a non-renewal and swiftly dwindling resource? ”

They don’t, which is one reason why they are useless. However, the rest of your comment is more interesting. The “free market” system in the US has started to deliver the same sorts of useless and obviously corrupt “investments” that were once associated with failing communist systems.

That was a rhetorical question. It’s annoying to me that people believe that merely putting the right monetary theory into practice will somehow cause our society to function better/fairer. We do not have a monetary problem. We have a political problem We also have the related problem that our civilization is exhibiting all the classic signs of a civilization that’s about to fall apart. There is no monetary theory that’s willing to encompass that fact, and therefore there is no monetary model that’s worth a damn outside of a narrow subset of extremely abnormal circumstances that we find ourselves in today. The conditions that give rise to our current economic system are fragile and temporary; monetary theorists assume them to be permanent laws of nature.

At least if you put MMT in place, you have a monetary theory that says, “That isn’t a monetary issue, it’s a political issue.”

It’s a great time to build up the Strategic Reserve. Has anybody mentioned that yet?

Currently it’s 95% full (691 million barrels out of 727 million barrel capacity).

http://www.spr.doe.gov/dir/dir.html

Time to increase the capacity. Or, purchase oil for future delivery from an oil company that has it in their reservoir.

Indeed. There may be opportunities here. Upon first blush, it may appear nonsensical to pump oil out of the ground in one place and then to dump it into the ground somewhere else. Why not just buy the oil already stored in ‘reserves’? But, upon reflection, one realizes that there exists a ‘lack of aggregate demand’. Thus, the government could step in to supplement this demand. Clearly, due to the sharp drop in oil prices and the idling of rigs, there is an output gap and a low risk of inflation. And, upon even further reflection, a further benefit is espied. The jobs so preserved and created would fit neatly into a ‘jobs guarantee’ program. Moreover, if the economy unexpectedly does not recover as much as forecast by economists, the process could easily be reversed. The oil can now be pumped from the Strategic Reserve and dumped back into the fracking sites. This might be a boon, as extra jobs may be so guaranteed due to the unfamiliarity of the process, at least initially. In addition, if the economic recovery is lackluster, little oil will get burned, and will be available for ‘repositioning’ when redoubling stimulating fiscal efforts. What’s not to like… ?

Although it is garnering the lion’s share of the media’s attention, it is important to note that Oil is not the only troubled sector at this time. Similar pressures are being experienced across basic materials and related sectors that include shipping.

For example here is a money quote from an article about problems in the shipping industry in Bloomberg yesterday:

“The flood of ships on the market at the minute” is causing the decline, Max Benenson, a London-based analyst at Arrow Shipbroking, said by phone. “Post-crash, with a lot of help from private equity and support from the funds, a lot was purchased, a lot was commissioned.”

See: http://www.bloomberg.com/news/articles/2015-01-29/shipping-gauge-falls-to-28-year-low-as-china-demand-growth-slows

Put your bets on battery and PV technology. It is the only way out of the hole. We just don’t know it yet.

Well . . . bulk storage of hydrogen gas right where vast PV projects can make vast amounts of electricity might also be worth betting on. A huge solar installation on the Libyan coast, say . . . could send a third of its daylight hours electricity to Europe and use the other two thirds to electrolize seawater and pressure-store the hydrogen.

Then at night that same facility could re-burn the hydrogen to produce and ship as much electricity through the night-time hours as what it shipped from direct sunlight-conversion during the day light hours.

Those are all amazing ideas! If we can get all the technologies and infrastructures together (since we don’t have them all yet–especially the technology part) and start implementing them twenty years ago, we might just have enough time to mitigate the imminent and horrific downward spiral of industrial civilization. Of course if we can’t get all that stuff rolling in twenty years ago, we’re in for a world of deprivation and pain.

The fossil fuel economy is about to go up in vapor. And without a large-scale operating fossil fuel economy, most solar electricity is a pipe dream. Pinning our hopes on that stuff now is a dead end, and not something adults should be doing. Bummer news, but Santa Claus isn’t real and technological progress isn’t going to save us from having to readjust our expectations and living standards.

The author talks about the “cliff” without also discussing the steep climb. It would be one thing if the sudden drop in rigs, heading toward 600 in operation, followed 30 years of seeing 1000 or more rigs running. But that’s not the case. If oil production does fall to 600 rigs, that will still be higher than the 30 year average of about 500. What has happened is that a very big bubble, one that inflated from 400 rigs to 1200 in a short 4 years, is deflating. Bubbles swell, and they burst. That should be the headline. Nothing historic, unless history only goes back 4 years.

Of course the rallies are being hammered down. There is no QE to keep the price up, and the Saudis will keep pumping to keep the prepay machine cranking.

I love the 4th paragraph where the author does math. And treats it like it’s amazing. Must be in management!