There’s a very special annual conference in Florida (WSJ paywall):

MIAMI BEACH, Fla. — Surveying the crowd at an annual conference he runs here, journalist David Marchant delivered some chilling news: A few days earlier, a speaker from a previous year’s conference had been shot in the head in the Bahamas in apparent relation to a business dispute.

Mr. Marchant runs one of the country’s more unusual annual trade gatherings. The OffshoreAlert Conference since 2002 has brought together a diverse collection of the hunters and the hunted: tax avoiders, convicted fraudsters, and their advisers — as well as the regulators and law-enforcement officials who try to catch them. This week, they sat side by side on conference panels, and sipped cocktails a few yards from the beach outside the swank Eden Roc hotel.

“It’s like that famous bar in ‘Star Wars,’ where they all come together — the good guys, the bad guys, the seriously guilty — and they all exchange information on neutral territory,” said Jack Blum, a Washington attorney and prominent expert on tax havens and money laundering, who has spoken at several of the conventions.

Lest you should think that is a wee bit too cosy to be altogether attractive,

Since 1997, Mr. Marchant has published a one-man newsletter, “OffshoreAlert,” exposing tax frauds, Ponzi schemes, money laundering and the latest developments in locales like Bermuda, Bahamas and the Cayman Islands. The publication’s slogan: “The pen is mightier than the fraud.” The newsletter now has roughly 4,000 people who pay for subscriptions or access to his Web site.

At least 11 people have been charged with crimes based on scams he has exposed, and at least five have gone to prison. He has been sued for libel seven times. He has received multiple death threats.

Organizing a gathering that permits offshore tax havens the opportunity to promote themselves might seem peculiar for a journalist dedicated to exposing offshore abuses. But Mr. Marchant says he wants to create a forum where everyone can have their say. “I think that’s where the credibility comes from,” he says, adding that there is a big difference “between something being illegal and something being immoral or unethical.”

Blogging How to Identify Red Flags in Investment Schemes, Marchant expounds a brutally concise Theory of Ponzis:

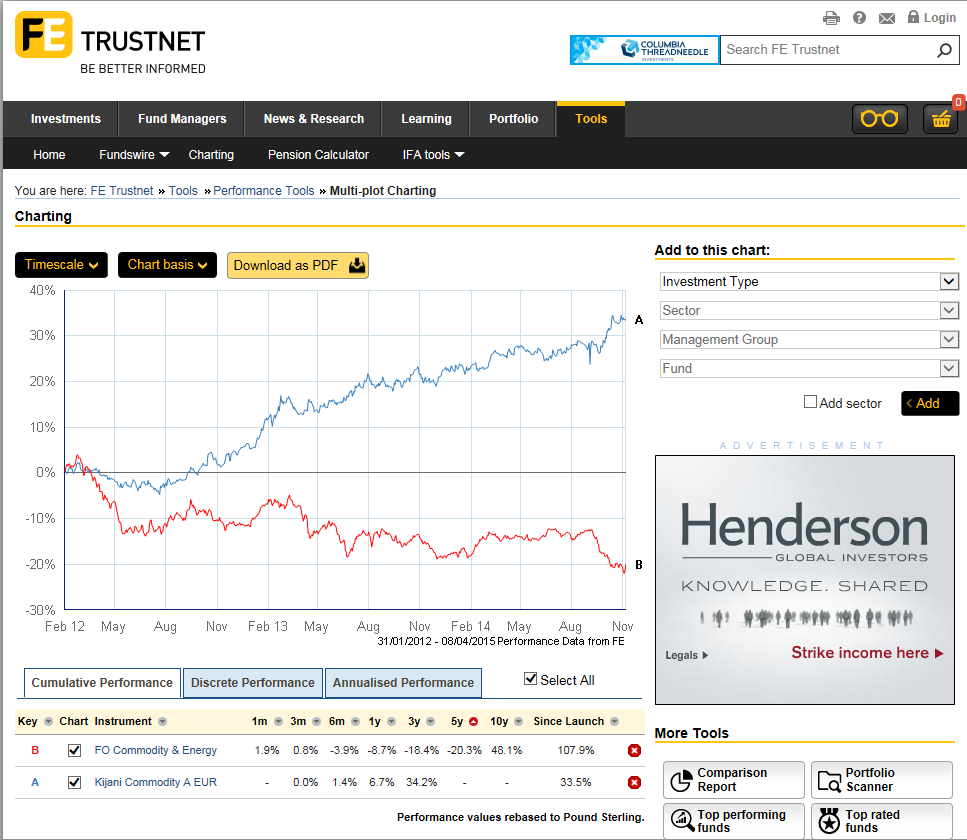

As an investigative reporter, the easiest financial crime for me to detect is a Ponzi scheme. Any investment scheme with a performance chart that is essentially a diagonal line trending upwards with little or no meaningful variation over many months is a Ponzi scheme and, as such, doomed to failure.

The level of returns do not meaningfully fluctuate because they are not related to profits or losses from any underlying business activity, as is the case with legitimate enterprises, but are paid from new money coming into the scheme. When the level of new investments inevitably drops below the amount needed to meet redemptions, operating costs, and pay-outs to insiders, it collapses.

When conducting due diligence, it doesn’t matter who is behind such a scheme. The names and professional backgrounds of management and directors are irrelevant and it is of no consequence if they don’t show up in your KYC database(s). A diagonal line equals fraud, end of story.

Courtesy of Trustnet, here’s a performance graph that has apparently caught Marchant’s eye:

Trustnet identifies the fund management group behind Kijani, Belvedere Management Ltd, and two more of its funds, Exigo, and The Apollo.

At first blush, neither raises any big red flags under Marchant’s Theory of Ponzis. If Exigo’s an Absolute Return fund, as implied by the benchmark assigned by Trustnet, it’s a pretty unimpressive performer. Meanwhile The Apollo handily underperforms Trustnet’s Mixed Asset benchmark. On a quick look, and ignoring the Marchant Theory of Ponzis for a moment, we have one stellar commodities fund and two ho-hum probably-lowish-risk mixed funds whose underlying investments aren’t published at Trustnet.

Nevertheless, Marchant thinks there’s a whole lot more to Belvedere than that. In a paywalled piece entitled “EXPOSED: Belvedere Management’s massive criminal enterprise” he comes out all guns blazing:

Offshore fund group Belvedere Management, which claims to have $16 billion of assets under administration, management and advisory, appears to be one of the biggest criminal financial enterprises in history, headed by David Cosgrove, Cobus Kellermann and Kenneth Maillard, OffshoreAlert can reveal.

Well, that’ll make a few waves. There’s more, in bullet points:

- $130 million Cayman Ponzi scheme under Brighton SPC umbrella fund

- City of London police investigating £100 m-plus Ponzi scheme by ‘CWM’

- Both schemes part of rampant fraud by Belvedere Management Group

- Group headed by David Cosgrove, Cobus Kellermann and Kenneth Maillard

- Belvedere operates in many countries, particularly Mauritius, Guernsey, Cayman & South Africa

Dealing with the second bullet point first: we know a bit about CWM already. CWM’s FX trading business was the subject of a recent post at NC. CWM FX is currently in a kind of holding pattern after a London police raid and 13 arrests.

There’s more CWM: they have hooked up their brand with an FCA-registered Manchester-based financial services outfit, Cottons Financial Planning Group Limited. I doubt if that arrangement will continue for very long if the police raid on CWM FX ends in charges. For the moment, though, CWM and Cottons are jointly pushing what appear to be 20 ultra-niche offshore funds (“CWM Albania Fund”, anybody?) via the web site www.cwmfunds.com, from which we discover that Brighton SPC has a tie-up with CWM, as well as with Marchant’s “Cayman Ponzi”:

Brighton SPC (the “Fund”) is an exempted segregated portfolio company incorporated on the 15th May 2014 under Cayman Islands law with registration number OS-288064, with its registered office situated at Suite # 4-210, Governors Square, 23 Lime Tree Bay Avenue, Grand Cayman, KY1-1209, Cayman Islands.

An SPC is a collective investment vehicle designed to segregate the assets and liabilities of different classes of shares from each other. The segregated pieces are sometimes called “cells”. This type of structure is meant to prevent certain kinds of unpleasantness in bankruptcy. Generically, Lehman and MF Global clients will have more than an inkling of the sort of mess that can arise. I have no idea whether SPCs actually function as advertised or not.

Meanwhile Kjjani Commodity Fund, of the strikingly performant Trustnet price graph, is of course the “Cayman Ponzi”, and they’re rather hacked off with Marchant’s coverage:

On March [17] the solo publisher, David Marchant, posted an online article that included indirect comments about the Kijani fund questioning how it could so successfully deliver consistent absolute returns.

In many jurisdictions the comments made would have been considered libellous but Marchant works in Miami where it is extremely difficult to obtain an injunction to prevent publication of inaccurate and damaging articles because the right to freedom of speech is so rigorously upheld.

On March [18] two directors of the Brighton SPC Board resigned and the decision was taken to voluntarily suspend the fund for a short period while new directors were appointed and steps taken to address any concerns flagged up by the allegations, which are being strongly contested.

That all looks like straight shooting, as far as it goes, which is, admittedly, not very far. However, this next bit of Kijani’s release does gloss over some public records available at Kijani’s previous domicile:

On the back of good performance and growing AUM, a programme of structural changes had already been taking place to help underpin the fund’s growing reputation. This programme included the recent switch of domicile to the Cayman Islands (which is on the OECD white list of jurisdictions that have implemented internationally agreed tax standards and is regarded by EU regulators as AIFMD compliant).

One could certainly argue the toss about the reasons for the domicile switch, from Mauritius. Back in October 2014, the Mauritius Financial Services Commission issued warnings against two other Belvedere funds, Four Elements PCC and Lancelot Global PCC, and followed that up by closing them both down a couple of weeks ago and suspending the licence of RDL Management Limited, another Belvedere company. Call me a cynic if you will, but irrespective of any “programme of structural changes”, I think that Mauritius FSC investigation just might have something to do with Belvedere-originated Kijani’s broadly contemporaneous decision that the Caymans are a nicer place to hang out than Mauritius.

The next bit of the Kijani announcement might have some spin too:

One of the first formal decisions of the new Board has been to remove from the SPC all cells that are unseeded and unconnected to the Kijani suite of funds. This is a sign of Kijani’s maturity and scale and will eliminate the possibility of collateral harm that might be caused in the event of unconnected cells experiencing reputational damage in the future.

The Brighton SPC will be renamed the Kijani SPC to reflect the move.

Well, removing the unconnected Brighton SPC cells and renaming the SPC might be a sign of maturity and scale, I suppose. But the change does invite the question, why totally unconnected investments were ever in the same SPC in the first place. Chucking all the investments into one big heap like that doesn’t seem particularly tidy, even if it’s technically irrelevant to the intended bankruptcy protections.

But there’s a less flattering explanation for the sudden concern that unconnected Brighton SPC cells might inflict collateral reputational damage on Kijani. It might be a sign that Kijani are well aware that the other Brighton SPC cells are connected to CWM, and that CWM was raided by London fraud police two weeks before the Kijani announcement.

In short, if you trusted Kijani before that announcement, you might actually trust them a little less afterwards. More disclosure, more candour, would have helped.

Because of the Belvedere link, the Marchant article, and news from the Mauritius Financial Services Commission on the 18th March, in Communique on Lancelot Global PCC, the Four Elements PCC and Belvedere Management Limited, Kijani have another reputation problem:

The Financial Services Commission, Mauritius (the ‘FSC Mauritius’) refers to the Press Article entitled “EXPOSED: Belvedere Management’s massive criminal enterprise” dated 17 March 2015, which was published by “Offshore Alert”.

The FSC Mauritius wishes to apprise the members of the public/investors that Lancelot Global PCC and The Four Elements PCC (the ‘Companies’) are under the administration of Belvedere Management Limited. The Companies are already subject to enforcement actions by the FSC Mauritius. The FSC Mauritius gave directions and prohibited the Companies from accepting new business/investor. You may refer to the two Public Notices with regards to Lancelot Global PCC and Four Elements PCC respectively issued by the FSC Mauritius on 20 October 2014.

In accordance with its functions to protect consumers of financial services, an inspection was conducted in 2015 and the FSC Mauritius shall issue a Notice in due course to keep members of the public/investors informed.

The public/investors may contact the FSC Mauritius for any clarification regarding the above entities.

Looking a little further afield in the Belvedere fund universe, we find some other nuggets.

First, Belvedere runs some onshore funds in South Africa, but a presumably rather sweaty independent audit, initiated very soon after Marchant’s article came out, says they’re fine.

Second, Belvedere man Cobus Kellerman had some wonderful investment timing when his Ankh Analytic sold out its indirect holdings in Basileus Capital on the very day its principal, Julian Williams, was shot and killed by his former business partner Hermann Pretorius, who then shot himself. Pretorius’ RVAF Trust then turned out to be a Ponzi. Basileus Capital got into difficulties too:

The empire of slain businessman Julian Williams appears poised for collapse, following the announcement that his Basileus Capital group has initiated “business rescue proceedings”.

Business rescue is an alternative to liquidation provided for under the updated Companies Act.

Also at risk are investors in the JSE-listed BK One, a capital-raising vehicle for Basileus.

…

There is a trail of related party transactions, comprising intercompany investments, loans and write-offs, which raise questions about how much of the cash Basileus was able to raise from investors actually made its way into the project “pipeline” of which it boasted.

Belvedere crops up in the BK One story again, benefitting handsomely from a relatively terrible BK One deal for shares in Avalloy:

The February report discloses that R52-million was used to buy shares in Avalloy from SA Superalloys and from a mysterious Mauritian investment fund called Four Elements. A further R11.6-million was spent in taking over a loan to Avalloy that Four Elements had extended. Part of the loan had been converted into shareholding, meaning BK One had bought an effective 10.5% shareholding in Avalloy at a cost of R65-million. In contrast, the Industrial Development Corporation got its 10% in effect for free – a bonus for providing a R35-million loan.

Even more curious is that an associate of Four Elements was the major subscriber to shares in BK One, accounting for nearly half of the R200-million raised. The second-biggest shareholder in BK One, with 17%, is another Mauritian entity, Two Seasons, which shares the same management team as Four Elements: Ken Maillard and David Cosgrove of Belvedere Management, Mauritius. A message left on Belvedere’s automated answering service went unanswered.

Third, Belvedere funds made (purportedly modest) investments in the very dreadful Harlequin Property scheme, famous in the UK, a resort development company that sucked up £400Mn of investor funds and ran out of cash with hardly any of the promised development complete.

Fourth, David Cosgrove of Belvedere has some previous form:

The now exposed Belvedere Ponzi kingpin David Cosgrove is no stranger to the South African financial authorities. Just over a decade back, he single handedly collapsed JSE-listed financial services company mCubed after the Reserve Bank and SARS discovered he was helping clients to illegally ship money offshore.

Described by those who know him as a high-pressure salesman who considers laws and regulations the same way SA taxi drivers view traffic lights, Cosgrove used the institutional offshore allowance as a vehicle to prey on rich South Africans nervous about the country’s future.

When the scheme was discovered, the authorities levelled a R140m fine on mCubed, which in effect killed the business, a piece of which was later picked up by the equally corrupted Fidentia. As a result, Cosgrove is about as popular at the Financial Services Board and in SA financial circles generally, as Netanyahu would be at an ISIS gathering.

Now there’s a comparison to jib at.

Fifth, there’s another player in the mix, De Vere Group, a renowned high pressure distributor of financial products. They have a beef with Belvedere and they’ve been giving Marchant a helping hand:

One of the world’s largest independent financial advisory organizations today revealed it helped a U.S. based investigative financial news service expose what could be one of the world’s biggest-ever frauds in order to protect investors and try to recover assets.

deVere Group confirmed it provided evidence of wrongdoing to Miami-based OffshoreAlert, run and managed by investigative journalist David Marchant, to highlight the alleged shady dealings of Mauritius-based Belvedere Management Group.

…

“We suspect that this case could turn out to be one of the largest financial scams in history and we will do whatever is necessary to recover value lost by investors worldwide.”

Here’s their beef:

The deVere spokesperson explains the reason for the organization’s interest: “Like many other international brokerages, several years ago deVere was approached by the fund manager of a Belvedere-administered fund to invest in the Strategic Growth Fund.

“At the time, Strategic Growth Fund (SGF) was described as ‘best of breed’. It was outperforming the market in the early years at the time of any client introductions and all due diligence was carried out by deVere, other brokerages and life companies.

“However, from 2011, the Strategic Growth Fund considerably underperformed and clients were advised to withdraw. In early 2013, the deVere CEO issued a memo to all his managers advising them to ask clients to withdraw from the Strategic Growth Fund. A few days later the fund administrator suspended the fund due to, it can be reasonably assumed, the many withdrawals from deVere clients.

“Some of this fund has since been released and some of our clients, fortunately, withdrew before the fund was frozen.

“We are hopeful that the reported police investigation will result in assets being recovered for the benefit of investors.

So what have we got, when we put it all together? Well, either workaday fund management has got a whole lot more exciting than I remember it being, or there is rather a lot of smoke here.

Nevertheless, there is, some stubborn folk still contend, relatively little fire so far, in the context of an $18Bn offshore fund management and insurance group that invests in just about anything, globally. Half close your eyes, and there is just a clean set of SA collective funds, an inflexible and impressionable regulator in Mauritius, a loudmouth in Miami, a sprinkling of infelicitous investments that others, untainted, also fell for, one unusual price graph, 13 fraud arrests in London, and a murder-suicide preceded by some rum-looking dealings in an insolvent fund and in a Ponzi. Oh and a fund that investors can’t get their money out of, a year after it froze withdrawals.

OK, OK, it did get a little harder to keep the eyes half-closed, there. But some folk can do it. There will be two readings of this incomplete fact set, for a little while longer. It’s either Marchant as fearless publisher of the truth, exposing a monster scam; in his own words:

DeVere isn’t the story here. Belvedere Management Group is the story and that is controlled by David Cosgrove and Cobus Kellermann. Kenneth Maillard’s role seems to be primarily to provide false Net Asset Values to investors and there are many others. The scope of this fraud is breathtaking. It’s astonishing. There’s probably never been a fraud like this in the history of finance, just in terms of the complexity, the number of investors, the number of jurisdictions involved, and the number of shell companies involved. It is truly staggering.

…or it’s Marchant as hallucinating catspaw for de Vere, a fund distributor with a grudge, wrecking the reputation of an admittedly buccaneering but basically honest fund manager. For what it’s worth, I figure Marchant would have to have be evil, insane, or both to sell himself like that, at a level of legal and reputational risk that would annihilate any conceivable payoff. If Marchant’s evil or insane, then connoisseurs, at his annual conferences, haven’t noticed yet. And clearly, de Vere is not his only source; far from it.

On the other hand, he’s clearly making an extraordinary claim, so let’s have some extraordinary evidence. One must look out for more lurid Belvedere stories from Marchant, which he promises to deliver over the next few months. It’s almost enough to tempt me into coughing up the $60/month subscription to Offshore Alert. There ought to be further official enquiries too, in the Caymans or in Mauritius. It’s time to get the popcorn.

This meeting was at the Eden Roc eh? Par for the course. It should have been held at the Sherry Frontenac. More of a Ricks’ Place feel. (Look quick! There’s Peter Lorrie, contemplating a crime!)

All I can say, my head buzzing, is, truth is indeed stranger than fiction.

I couldn’t find the popcorn, so I loaded up on some cheap, can’t miss, ground nut futures in anticipation of the next thrilling installment!

The majority of the water used by agriculture is used by animal agriculture. The production of milk, eggs and dairy is nutritionally wholly unnecessary. All for the production of superfluous protein, which nobody except those who are starving lack. Meanwhile, sources of plant protein require much less water, and can be produced pretty much everywhere people live. So why do we all keep talking about ‘agriculture’ as this undifferentiated necessity (well, so long as we aren’t talking almonds)?

Ugh, wrong topic, sorry Richard. That’s what I get for visiting no on my phone.

Thanks for this fascinating article. Particularly appreciated Marchant’s description of how to recognize a Ponzi scheme:

… “Blogging How to Identify Red Flags in Investment Schemes, Marchant expounds a brutally concise Theory of Ponzis:

As an investigative reporter, the easiest financial crime for me to detect is a Ponzi scheme. Any investment scheme with a performance chart that is essentially a diagonal line trending upwards with little or no meaningful variation over many months is a Ponzi scheme and, as such, doomed to failure.

The level of returns do not meaningfully fluctuate because they are not related to profits or losses from any underlying business activity, as is the case with legitimate enterprises, but are paid from new money coming into the scheme. When the level of new investments inevitably drops below the amount needed to meet redemptions, operating costs, and pay-outs to insiders, it collapses.

When conducting due diligence, it doesn’t matter who is behind such a scheme. The names and professional backgrounds of management and directors are irrelevant and it is of no consequence if they don’t show up in your KYC database(s). A diagonal line equals fraud, end of story.”

Heh, wonder if Marchant has looked at a performance chart of the S&P500 stock index since November 21, 2011, lately?

. . . performance chart of the S&P500 stock index . . .

My thoughts exactly.

Who is the patsy now?

Ha! Nice analogy, and not such a stretch when one considers how much the public market’s Reason of Being has changed in the last 35 years. My question then is who would theoretically be running this scheme? Who’s the sucker?