By Arthur Berman, a petroleum geologist with 36 years of oil and gas industry experience. He is an expert on U.S. shale plays and is currently consulting for several E&P companies and capital groups in the energy sector. Berman is an associate editor of the American Association of Petroleum Geologists Bulletin, and was a managing editor and frequent contributor to theoildrum.com. He is a Director of the Association for the Study of Peak Oil, and has served on the boards of directors of The Houston Geological Society and The Society of Independent Professional Earth Scientists. Originally published at OilPrice

Saudi Arabia is not trying to crush U.S. shale plays. Its oil-price war is with the investment banks and the stupid money they directed to fund the plays. It is also with the zero-interest rate economic conditions that made this possible.

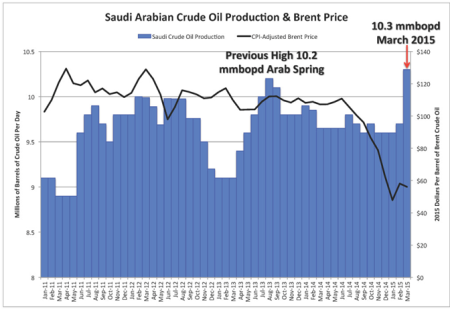

Saudi Arabia intends to keep oil prices low for as long as possible. Its oil production increased to 10.3 million barrels per day in March 2015. That is 700,000 barrels per day more than in December 2014 and the highest level since the Joint Organizations Data Initiative began compiling production data in 2002 (Figure 1 below). And Saudi Arabia’s rig count has never been higher.

Figure 1. Saudi Arabian crude oil production and Brent crude oil price in 2015 U.S. dollars. Source: U.S. Bureau of Labor Statistics, EIA and Labyrinth Consulting Services, Inc.

Figure 1. Saudi Arabian crude oil production and Brent crude oil price in 2015 U.S. dollars. Source: U.S. Bureau of Labor Statistics, EIA and Labyrinth Consulting Services, Inc.

Market share is an important part of the motive but Saudi Minister of Petroleum and Mineral Resources Ali al-Naimi recently emphasized that “The challenge is to restore the supply-demand balance and reach price stability.” Saudi Arabia’s need for market share and long-term demand is best met with a growing global economy and lower oil prices.

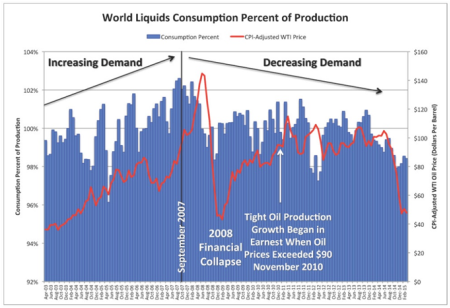

That means ending the over-production from tight oil and other expensive plays (oil sands and ultra-deep water) and reviving global demand by keeping oil prices low for some extended period of time. Demand has been weak since the run-up in debt and oil prices that culminated in the Financial Collapse of 2008 (Figure 2 below).

Figure 2. World liquids demand (consumption) as a percent of supply (production) and WTI crude oil price adjusted using the consumer price index (CPI) to real February 2015 U.S. dollars, 2003-2015. Source: EIA, U.S. Bureau of Labor Statistics, and Labyrinth Consulting Services, Inc.

(click to enlarge image)

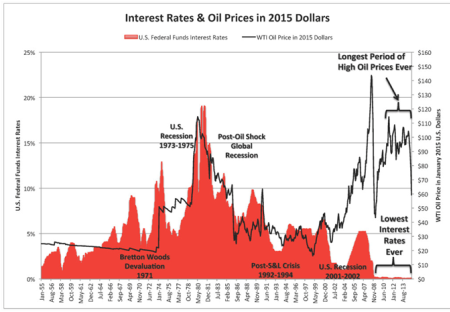

Since 2008, the U.S. Federal Reserve Board and the central banks of other countries have further increased debt, devalued their currencies and kept interest rates at the lowest sustained levels ever (Figure 3 below). These measures have not resulted in economic recovery and have helped produce the highest sustained oil prices in history. They also led to investments that are not particularly productive but promise higher yields that can be found otherwise in a zero-interest rate world.

Figure 3. U.S. Federal Funds rates and WTI oil prices in January 2015 U.S. dollars. Source: U.S. Bureau of Labor Statistics, EIA and Labyrinth Consulting Services, Inc.

(Click image to enlarge)

The quest for yield led investment banks to direct capital to U.S. E&P companies to fund tight oil plays. Capital flowed in unprecedented volumes with no performance expectation other than payment of the coupon attached to that investment.

This is stupid money. These capital providers are indifferent to the fundamentals of the companies they invest in or in the profitability of the plays. All that matters is yield.

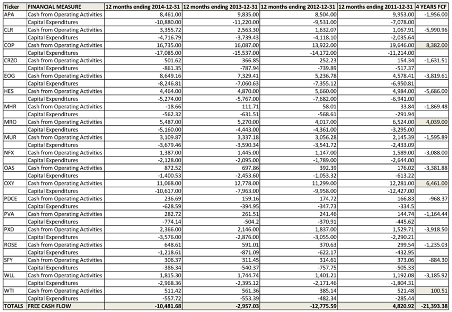

The financial performance of most companies involved in tight oil plays has been characterized by chronic negative cash flow and ever-increasing debt. The following table summarizes year-end 2014 financial data for representative tight oil-weighted E&P companies.

![]()

Table 1. Summary of 2014-year end financial data for tight oil-weighted U.S. E&P companies. Money values in millions of U.S. dollars. FCF=free cash flow (cash from operations plus capital expenditures); CF=cash flow; CE=capital expenditures. Source: Google Finance and Labyrinth Consulting Services, Inc.

Some rationalize the negative free cash flow as an expansion of capital base that will result in future profits. The following table shows that over the past 4 years, tight oil negative cash flow increased and has reached a cumulative of more than -$21 billion for the representative companies. Almost half of that negative cash flow took place in 2014.

Table 2. Summary table of cash from operations and capital expenditures for tight oil-weighted U.S. E&P companies. Values in millions of U.S. dollars. Source: Google Finance and Labyrinth Consulting Services, Inc.

(Click image to enlarge)

How long do the losses continue before the cheerleaders of shale plays admit that the enterprise is not profitable? Only the more diversified integrated companies like ConocoPhillips, Marathon, and OXY show meaningful long-term positive cash flow. If companies could not show positive cash flow at $95 per barrel, what price is necessary and what will that do to the world economy?

Some of my readers dispute the poor economics of these plays based on incorrect notions of break-even profitability–some believe that tight oil plays are profitable at $35 per barrel oil prices (see comments from my last post).

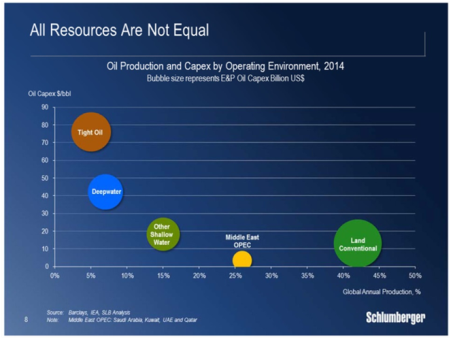

Following are two slides taken from Schlumberger CEO Paal Kibsgaard’s recent presentation at the Scotia Howard Weil 2015 Energy Conference held in New Orleans. These slides present a well-informed and objective view of how tight oil plays compare to other plays.

In my Figure 4, Mr. Kibsgaard shows that the average break-even price for tight oil plays is about $75 per barrel. By comparison, Middle East OPEC break-even prices are less than $10 per barrel. Other conventional oil plays break even at less than $20 per barrel.

Figure 4. Slide from Schlumberger CEO Paal Kibsgaard’s presentation at the Scotia Howard Weil 2015 Energy Conference.

(Click image to enlarge)

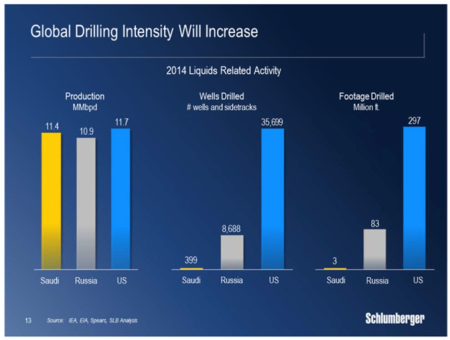

In my Figure 5, Mr. Kibsgaard shows Schlumberger’s assessment of drilling intensity or efficiency. For nearly equal oil-production volumes of about 11 million barrels per day, U.S. oil producers drilled more than 35,000 wells and 297 million feet of hole compared to 399 wells and 3 million feet of hole for Saudi Arabia.

Figure 5. Slide from Schlumberger CEO Paal Kibsgaard’s presentation at the Scotia Howard Weil 2015 Energy Conference.

U.S. companies drilled almost 100 times more wells to reach the same daily production as Saudi Aramco. Strident claims of increased efficiency by tight oil producers sound absurd in this context.

Prolonged low oil prices will prove that tight oil plays need at least $75 per barrel to break even. When oil prices recover to that level, only the best parts of the tight oil core areas will be competitive in the global market. As production declines from expensive tight oil, oil sand and ultra-deep-water plays, inexpensive Saudi oil will gain market share.

Saudi Arabia is not trying to crush tight oil plays, just the stupid money that funded the over-production of tight oil. Too much supply combined with weak demand created the present oil-price collapse. Saudi Arabia hopes to prolong low prices to benefit their long-term needs for market share and higher demand.

So their business model is pumping money down till the Earth grows sick and vomits oil? Looks, interestingly, as almost the opposite of “helicopter money” ;)

There is a geopolitical/sectarian aspect to their move as well which normally supersedes every other motive in that region imo.

If certain parties are correct and we can expect the global economy to become more and more dysfunctional and, after the next inevitable crash, capital to dry up permanently (or only be created in the form of worthless paper that people don’t want to use) this is starting to look like what they called in nuclear strategy a “use it or lose it” scenario. If your enemy has a serious counterforce capability and you know that that is his targeting strategy, if he’s going to launch then you have to or else your missiles will be knocked out in their silos and there goes your credible threat of mutually assured destruction (the obvious problem of nuclear winter induced by such a strike never having fully penetrated the nuclear strategists’ heads).

It would appear that when it comes to oil and natural gas, the theory today is use it or lose it. If the capital markets and complex infrastructures and long supply chains that make this all possible are doomed, that makes some sense. It certainly indicates that at least some of the players think so. The other possibility is they know from computer models we are not privy to that the manifestations of climate change are about to get a whole lot worse and before the PTB are forced to leave that oil in the ground they are going to use as much of it as they can. Either way, things are really screwy and critical information we need to know is being withheld from us. I’m preparing for the worst.

tight oil plays need at least $75 per barrel to break even

It seems that the profit-maximizing move would be to drop the price to a point that makes it uneconomical to invest in “tight oil plays” and threaten to drop it further if investment continued.

The Saudi’s may want to stop “tight oil” but they may also be furthering other objectives also.

=

=

=

H O P

The author said Western economic policies “helped produce the highest sustained oil prices in history.”

Actually, oil prices are set by the Sauds. The price is whatever the Sauds want it to be.

I tend to believe that the price war is targeted at Iran and Russia. American and Canadian producers are collateral damage.

Perhaps. One thought is the Saudis own Versailles. Even now, the Obama administration is running head long into assisting active genocide despite his swing to legacy shopping. The Saudis fear both the U.S. moving towards any alternatives or consumption reduction which reduces Saudi power in Versailles. If there is an uprising in Saudi Arabia itself, the Saudis won’t find a safe haven here. Too many people think Saudi Arabia should have been the target of the 9/11 wrath. The Saudis need the power and influence to stifle a rebellion.

Why wouldn’t Saudi royals and princelings be welcomed here? As long as they brought their money with them?

A question… What linkage if any is there between shale / tight oil and natural gas price / supply? For cost (of adding new generation capacity if not fuel), versatility and environmental reasons our local utility is switching from coal to natural gas electricity generation. Since it operates under what amounts to a cost-plus business model, isn’t this asking for trouble if there is a very tight coupling between drilling for tight oil and shale gas if the end of “stupid money” is on the horizon?

It depends on how long the price of gas stays low – which is likely to be a decade or more as many shale gas wells will remain in production for years if not decades. Also, changing to nat. gas decreases carbon production, which is good for everyone. Its probably a smart move.

Except that if you factor in the inevitable Methane (CH4) leakage, you’re behind the 8 ball since Methane – whilst short lived, is 100x more potent a greenhouse gas than Co2.

Additionally, when the methane finally does break down in the atmosphere, it produces water and carbon dioxide. So even after the methane’s gone, there’s still a greenhouse gas byproduct of the methane in the air.

Is shale gas like shale oil with the most production coming within the first few years? With shale oil isn’t the production decline much steeper than conventional oil? The point is that if this is the case the price of shale gas is not likely to stay low. I’ve read that even at current prices PV is cheaper than gas and wind is MUCH cheaper. So it looks to me like it is a smart move only for utilities desiring to keep their costs up so they can get that state guaranteed cost-plus revenue stream.

I’m a believer in global warming (if you burn 600 million years of accumulated ‘ancient sunlight’ in a couple of hundred, it seems eminently reasonable to expect problems). But when even money (when you can’t get it for free) says to make the switch, it would appear greed and short-term thinking are driving the train.

Yes, the investment banks have been stupid when chasing yield. (Aside: I wonder if the Saudi royals are savvy enough to park most of their wealth in institutions that do not fund tight oil plays). But I argue that major U.S. oil companies have been even stupider. During those heady $100 bbl days, the majors enriched their execs and shareholders by buying back scads of their stock. Hence, this highly profitable industry has little accumulated wealth and limited ability to withstand price shocks. What should be happening now, and likely is to a small degree, is large oil companies gobbling up small ones and doing so with accumulated wealth, not debt. Eventually the price of oil will rise and the U.S. will have a huge inventory of rusting oil rigs. Brilliant.

This sounds like the Saudis have declared war on our finance industry. Because finance threatens the stability of demand. If prices get too high, making tight oil profitable, then demand goes down and the Saudis begin to lose. So naturally they dropped their price. Poor banksters. But then… the cost of production for tight oil drops considerably when they can buy the energy they need to drill at 30$bll. So how does it balance out? Then too the dollar is the strongest currency so the petrodollar can make lotsa money selling on to the EU etc. I doubt seriously that the Saudis want to undermine petrodollars. Not sure how that whole thing works. I agree that alternative energy is happening faster than we realize and the Saudis are getting all they can in the next 10 years. But the stupid money is so stupid it’s a little hard to believe.

The shape-shifting Berman:

Here’s Berman earlier in the year saying that Saudi policy is “all about the money”: “The current situation with oil price is really very simple. Demand is down because of a high price for too long. Supply is up because of U.S. shale oil and the return of Libya’s production. Decreased demand and increased supply equals low price.

As far as Saudi Arabia and its motives, that is very simple also. The Saudis are good at money and arithmetic. Faced with the painful choice of losing money maintaining current production at $60/barrel or taking 2 million barrels per day off the market and losing much more money—it’s an easy choice: take the path that is less painful. If there are secondary reasons like hurting U.S. tight oil producers or hurting Iran and Russia, that’s great, but it’s really just about the money.”

http://www.nakedcapitalism.com/2015/01/real-cause-low-oil-prices-interview-arthur-berman.html

Berman says the idea that the policy was implemented to hurt Russia is “secondary” at best.

In his latest article, Berman changes his tune and says there is a conspiracy, but it’s not directed at the Russians but at the “investment bankers”. Here’s the quote : “Saudi Arabia is not trying to crush U.S. shale plays. Its oil-price war is with the investment banks and the stupid money they directed to fund the plays.”

The question is, which Berman do we believe?

Good question, I don’t believe any Bermanista Manifestos. As a big oil geologist, he has been socialized for over 3 decades to see the world though an oil drilling rig, not a geopolitical analyst. Not only have you pointed out varying notions on the why of Saudi oil price policy produced by Mr. Berman, but even his most obvious criticism of tight oil, that these wells produce for about 2 years and then production falls off a cliff, leaving years of financing in place and not enough product to sell to service the debt, shows that Saudis don’t have to manipulate price one way or the other. The Saudis certainly do not need to crater the price by maintaining productions levels to insure falling demand will produce falling prices. If tight oil is only producing decent levels for about 2 years and then are played out, why would the Saudis hurt themselves financially by not protecting price? It is commonly agreed they are protecting market share, but not from a self liquidating industry of tight oil. The on rush of shifting away from oil to natural gas but even more importantly, to wind, solar, thermal, hydro and even nuclear power, is the problem the Saudis are trying to address. The future does not belong to oil. The question is, how much time is left for oil and how much can be sold in that time.

———————————————————————————————–

From the mouth of the Saudi oil minister, Ali al-Naimi, “Demand will peak way ahead of supply,” he told reporters in Qatar three years ago. If growth in oil consumption flattens out too soon, the transition could be wrenching for Saudi Arabia, which gets almost half its gross domestic product from oil exports.

Last week, in a speech in Riyadh, Naimi said Saudi Arabia would stand “firmly and resolutely” with others who oppose any attempt to marginalize oil consumption. “There are those who are trying to reach international agreements to limit the use of fossil fuel, and that will damage the interests of oil producers in the long-term,” he said.

U.S. State Department cables released by WikiLeaks show that the Saudis’ interest in prolonging the world’s dependence on oil dates back at least a decade. In conversations with colleagues and U.S. diplomats, Naimi responded to the American fixation on “security of supply” with the Saudi need for “security of demand,” according to a 2006 embassy dispatch. “Saudi officials are very concerned that a climate change treaty would significantly reduce their income,” James Smith, the U.S. ambassador to Riyadh, wrote in a 2010 memo to U.S. Energy Secretary Steven Chu. “Effectively, peak oil arguments have been replaced by peak demand.”

http://www.bloomberg.com/news/articles/2015-04-12/saudi-arabia-s-plan-to-extend-the-age-of-oil

———————————————————————————————————–

Peak demand, not peak oil is the Saudi problem and low prices force commitments to invest in autos that once purchased new, will be held for at least 19 years. Slowing down EV, electric vehicles is the goal. And the future does not even lie with the US auto market, but rather India and China growing consumer demand. Brazil produces a fuel industry that runs autos on 100% alcohol. Spain, despite their economic woes, will come out of their depression with a national electric high speed rail system, instead of an American style Interstate Highway System with gas guzzlers. Other nations as well are diving in head first into solar and wind electricity production because the internalization of energy production will support the economic growth of any nation that invests in not exporting hard currency to OPEC in exchange for gas or crude oil.

China’s leader is in Pakistan to announce $45Bil USD investments on infrastructure to expand the Silk Road from Western China to Pakistan with an emphasis on coal, nuclear and solar energy production. Oil is strikingly absent from the bi-lateral agreement. See BBC link for China/Pakistan announcement. There is a lot more to this than what is just being noticed by the Western media. The Chinese leader was escorted into Pakistan by 8 Pakistani military jets. It is a huge coup for Chinese soft power.

http://www.bbc.com/news/world-asia-32377088

For geo-political and climate treaty pressures to abandon fossil fuels, including oil, Saudi Arabia needs to prolong the oil demand by hook or by crook. If it hurts some friends or enemies, so be it, as long as they can sell oil to world for a little bit longer, because that is all they have to sell anyone at all.

In order to understand what is going on in the oil market you have to look through the right lens.

In my analysis – which I developed here at Naked Capitalism about three years ago – the oil market has been subject to a ‘macro’ market manipulation by the US on a cosmic scale.

The rationale for this manipulated bubble (as when the oil price quadrupled from $3/bbl to $12/bbl in 1973 and was maintained at US insistence at the higher level) is that at the engineered higher prices it was possible for the US to fund development of higher cost oil (in 1973/4 this was Alaska, North Sea & US Gulf oil) which had the effect of freeing the US from reliance on Saudi oil and thereby enhancing US energy security.

The beauty of this strategy is that the US fund energy security and OPEC gets the blame. Genius.

In my view, the new US status as high cost swing oil producer represents IMHO the most significant oil market development in the last 50 years, in the way it frees them from the Saudis, and permits Big Oil to pursue – this time, the non-violent way – the last remaining global low cost reserves in Iran & Iraq.

So to contradict Arthur Berman because I make different assumptions, I think that the Saudis are not in control of the market as they pretend, but have been controlled by a greater market strategy of which they have probably only dimly been aware.

When QE ended late last year, the oil price fell – as I forecast three years ago it would when QE ended (albeit I misjudged when that would be!) – to $45/55 bbl by January 2015. Its current rebound since then has nothing whatever to do with physical supply, and, in my analysis everything to do with financial demand by Saudi Arabia using $20bn of their reserves.

Why so silent about natural gas? Why just the focus on oil?

PA annual natural gas production

WV annual natural gas production

I don’t think any of the major players have a clue as to what they are doing, nor why they are doing it.

The oil market has always been driven by emotion, not logic. And as a result, we are where we are.

To take down the banksters, one would have to take down the politics that supports them: the central banks and the bought politicians. I doubt even the Saudis can do that…not for lack of trying!

I still think the Saudis’ main purpose is power-political, and that they are coordinating strategy with their US and Western allies. The Saudis are currently engaged in two proxy wars against Iran and Russia (Syria, Yemen). The USA/EU are engaged in a proxy war in Ukraine.

US tight oil producers are collateral damage, but the US gov & central bank will protect the investors. US capital that finances tight oil will get bailed out. It’s not like it actually costs the US authorities very much to do that sort of thing, and they have already demonstrated that they can expand their money supply without serious consequences to their own power.

On the other hand heavy damage will be suffered by high-cost oil exporters who don’t control the world’s most powerful central banks (Hi there, Canada!). Stephen Harper is possibly the world’s most useful idiot. Indeed, Canada’s last remaining natural competitive advantage seems to lie in the production of newer and more useful idiots.

Geopolitically, this Saudi/US cheap oil strategy might drive a nice wedge between China and Russia, retarding the possibility of closer cooperation of the latter two countries.

Meanwhile, major oil consumers get a real economic stimulus which is more effective than monetary stimulus. Maybe subsidizing really inefficient oil production was a way for ZIRPQE to finally find some way into the real economy. Stimulus via malvestment–the usual. Mother Nature and the Future get the negative externalities–the usual. Artificially cheapened fuel means incentive to invest in future overconsumption–the usual.

The Saudis, of course, while leading the play, are also being as tools. The Western countries will use the Saudis as the bad guy in proxy wars in the ME. But since the Saudis are deeply unpopular among the citizenry in the Wester world, it will be the easiest thing in the world, once the Iranians and Russians have been forced to submit, to pull the rug out from under the Saudi dynasty and ravage that country. Western publics will cheer the bombing that happens then. Afterwards, so much good stuff to turn over to the carpetbagger capitalists, and with a semi-slave labour force already in situ! And to think that the Western leaders can pose as liberators and re-educators of any women who survive there! All those dumb Western secular liberals will have to lick it up and say how much they love the Empire.