By Robert Waldmann. Originally published at Angry Bear

Via Steve Benen and Greg Sargent.

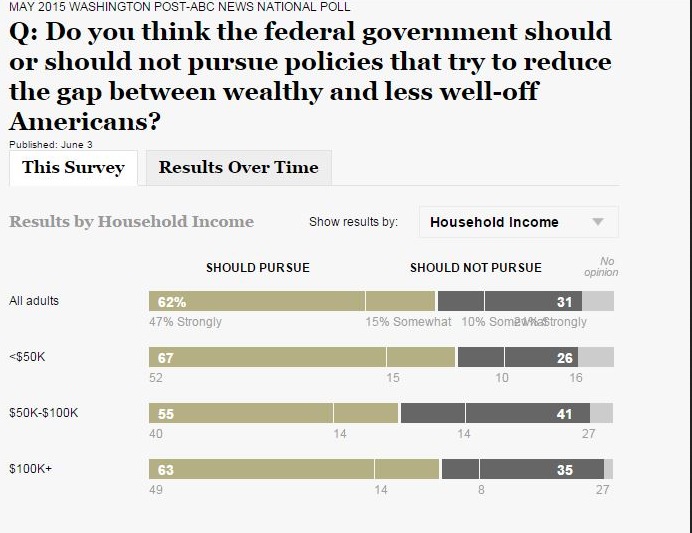

The Washington Post/ABC News pollsters asked “Do you think the federal government should or should not pursue policies that try to reduce the gap between wealthy and less well-off Americans?”. 62% of respondents answered yes. This should be very unsurprising as it is roughly the same as the fraction who have been telling Gallup that high income people pay less than their fair of taxes for two decades now. It is also similar to the number who support higher taxes on high incomes to pay for the ACA and (in another poll) to prevent exaustion of the social security trust fund.

I have been, partly ironically, referring to this solid majority opinion as “class war” but Benen mentioned something which tends to unermine the class war interpretation/joke

What’s more, support for action in this area is quite broad. A majority of Americans regardless of race, for example, support actions to reduce the wealth gap. A majority of Americans regardless of age agree. Indeed, across the board – gender, level of education, household income, geographic region – there’s a broad consensus that this is an issue worthy of national action.

Wait a majority in the highest income sub group (income over $ 100 thousand a year) answered yes ? That sure doesn’t sound like class war does it ?

In fact, 63% of those respondents answered yes which is actually a tiny insignificant 1% higher than the overall fraction 62%.

Now I think the class war hypothesis can be saved if the vast majority of even the highest income subset don’t consider themselves “wealthy”. I sure wouldn’t consider a family of 5 with income of $101,000 and a mortgage wealthy (even though they are by world standards and very wealthy by the standards of almost all of human history). The class interest based struggle could be between the bottom 99% and the top 1% who are too few to show up noticeably in polls.

update: the vast majority of households with income over $ 100K are not in the top 1%. In fact almost 22% of US households had income over $ 100K back in 2012. What I meant to type is that the results of the poll can be reconciled with the idea that we are all selfish if the vast majority of houeholds with income over 100K don’t think they are “wealthy” but rather think the wealthy are the top 1%. To get in the top 1% a family needed $388,905 already in 2011. The idea I was trying to present is that someone struggling along with $ 120k might want to take from the wealth with $ 400k per year. I’d rather think that people who consider themselves wealthy are willing to share their wealth with the rest of the US (provided other wealthy people do too).

end update

Still the result is nice and potentially very useful to Democratic candidates who can argue that they are not advocating class warfare but proposing that we deal with a national problem as a majority of Americans regardless of their income think we should.

The strategy has the additional advantage that Republican candidates and operatives will have trouble resisting the argument that the poll is meaningless because many people with income over $ 100K* are absurdly poor takers and not like the job creators at all. Some will not hide the fact that families with income of $110,000 per year are much too poor to be in the class whose interests they serve.

this is one of those things which is always presented in binary format, ie: 0) tax the rich or 1) cut services to the poor.

this ignores corporate tax levels falling to zero (and below!). there was a time when corporations ponied up roughly 1/3 of u.s. tax revenue.

Report Calls Out 15 Fortune 500 Companies for Paying No Taxes

Oh, but it’s all nice and legal, right? If it’s legal, don’t we just have to go on blindly accepting it, since, well, you know, it’s LEGAL. The lawmakers have performed their function, integrated all the information and balanced all the competing interests, and made it so its all nice and proper and legal. And who are we to do anything other than wait our turn to, you know, vote for different lawmakers and chief executives who will weigh the needs and interests of the ordinary people a teensy smidge more heavily in writing out the words of statutes and regulations and policies and guidance documents that establish, with liberty and justice for all, what’s legal? Because after all, all we ordinary people have to protect us in our persons, papers and property is the power, sweep and majesty of the law, and the regulators and police and courts that ensure that the fair and just law is faithfully and impartially executed, and is no respecter of persons.

That is how it works, right? And if we don’t like it, we can always go to Russia, or Cuba. I hear there are great new opportunities for profit in Cuba…

The math you’re describing happens to have a straightforward policy explanation. We have introduced progressive income taxation and payroll taxes (Social Security/Medicare) on individuals. So the total pie of federal tax collections is much bigger.

We can argue whether these things are good or not, but the way percentages work, by definition corporate income would fall a lot in percentage terms. Excise taxes have actually fallen by a bigger percentage than corporate taxes.

I very much agree we should eliminate all the tax loopholes – both the ones used by corporate persons and the ones used by natural persons. But I have no problem with the bulk of federal (and local, for that matter) tax collections coming from individuals. At a theoretical level, I think it’s actually easier to design a simple and progressive tax system around individuals than corporations.

And in practice, the corporate public policy issues are often about things that aren’t really tax related. The issue of media concentration, for example, is a much bigger social problem than CBS not paying enough in taxes.

Just re-reading this, but hey, why not a progressive tax on corporations? Dividends not included, of course. I mean, it’s genius. And understandable. OMG, I see a Tshirt… a mug! a banner! a bumper-sticker! (exercise left to the student… Nedd? — not that you’re a student!!)

Yeah, it does sound intuitive. I’d say any taxation anywhere would be better than how things currently work.

Personally, I think there are a few logistical complications where if we’re simply dreaming up an ideal scenario, it’s more effective having the bulk of the taxation on the individual. There is also a philosophical point that the act of saying corporations need to pay their fair share implies they are social actors in and of themselves rather than merely a vessel for individual people to take collective action.

1) corporate taxes add a layer of complexity simply because we tax net income (profit = revenue – expenses) rather than gross income (just revenue).

2) the issue with corporate malfeasance is more about power than size, and so a progressive tax would be a poor metric to address that (as opposed to direct regulation like minimum wages and anti-competitive behavior)

3) U.S. corporate rates are actually high relative to the rest of the world – what we do is then add all kinds of one-off loopholes reducing the effective rate. Figuring out the income of natural US persons is a little easier than of legal ones.

4) Inequality is an issue at the level where control is exerted, and that is at the individual level. Corporations don’t make decisions – individual managers and directors do. Significantly higher taxes, if anything, would incentivize management teams to pay themselves even more – the higher the marginal tax rate, the less costly an expense becomes.

5) the nonprofit exemptions are out of control. Significantly increasing corporate tax collections I think would result in more activity being pushed into untaxed outlets. (Of course there’s a radical solution here, too: eliminate not for profit incorporation…)

6) progressive corporate rates in particular become a trickier area since a corporation is just a legal idea, not a specific biological entity in the physical world. Rich people could lower their taxes by owning more smaller companies while effectively operating them as fewer bigger companies. The same professional class runs all the major institutions in our society. The cross-board and cross-management overlap is pretty interesting if you’re into corporate governance.

So let’s throw out the current corporate tax schedule which is glutted with loopholes (for big business but not small and medium business who produce most of the jobs), and replace with a pristine code and lower corp taxes.

Can I say I think the gov’t should not pursue policies that increase the gap between the wealthy and less wealthy? Smarter people can please explain why it’s not wealthy/less wealthy vs well off/ less well off, arbitrary, open for interpretation, que npr with the baby talk explanation… how bout “the wealthy tended their garden and cared for their companions while the less well off stared at their bloomberg screen threatening to rip eveyone’s face off?.

more to the point, can more taxes really pay for things? (mmt) is our problem tax collections? or distribution? an f-35 for instance, as spending, or gas tax as collections…

hmmmm. I don’t know. I do know that the Bush/Obama tax cuts for the top income group blew a hole in the US budget that Obama and the GOP now use as an excuse to push austerity and attack Social Security. Deficit hysteria. So taxes pay for things, or at least the politicians say they do. Instead of waiting for the pols to adopt a new theory about taxes, accept their current theory of taxes. Insist they raise back up the taxes on the group that has received such handsome govt tax cut largess at the expense of everyone else for the past 10 years. It was only supposed to be a temporary tax cut anyway, just long enough to spend down the surplus. (remember when we had one?) Then it was supposed to sunset.

Oh yes, I remember that now (so many years, think of all that could have been done, not least being increasing Social Security cap, or axing that carried interest thing for vultures…) Thanks flora, it seems that would have been an actual case of reducing income inequality.None of our overlords, or not enough of them, felt that was necessary at the time. I would say hike over 250k,get rid of ss income cap, and figure out some way to tax the mitt romneys, schwartzman, langone et. al. It would be interesting to see what response the over 400k crowd has to the question posed, I can see a lot of 100k people thinking they’re going to raise their bosses taxes, i think even the 200k crowd fancies they are not the rich, even though it would take me 10-15 years to make that much. I’m severely disappointed, but trying to engage constructively…

Which is Example A as to why the GOP is one of the most economically ignorant, physic-envy group of loons in modern US history. They can’t distinguish economic cannibalism from actual innovation.

They’re extractors, not creators.

Just to drive home the point, some wealthy people are behind the move for a $15/hr minimum wage. Because they realize that they need customers with money to spend.

Too much wealth concentration shifts economic activity to unproductive behaviors, like stock buyback so. Some smart rich people actually understand this dynamic, but those smart rich people appear to give the GOP a wide berth.

In general, no smart, sane person goes anywhere near the Republican Party any more. It’s become the Party of Stupid. I think when Charlie Crist left, that was the last one.

There are still some smart but mildly crazy people in the Republican Party who can be helpful on individual issues (Justin Amash, for example). But even they are few and far between.

“I don’t know. I do know that the Bush/Obama tax cuts for the top income group blew a hole in the US budget that Obama and the GOP now use as an excuse to push austerity and attack Social Security.”

The Reagan tax cuts did the same thing. Reagan, Bush II, Obama, three times is enemy action.

“hmmmm. I don’t know. I do know that the Bush/Obama tax cuts for the top income group blew a hole in the US budget that Obama and the GOP now use as an excuse to push austerity and attack Social Security. “

This is a VERY common misconception. The Bush cuts were implemented in May 2003. From that point on, in spite of a massive amount of spending on two wars and funding a massive new agency (Homeland Security), the deficit steadily fell. Then the housing bubble broke, and that ultimately “blew a hole” in the US budget. Don’t fall into the trap of repeating stupid things from stupid web sites.

TARP enacted in 2008 cost approx $431 billion. The Bush tax cuts for the wealthy were set to expire in 2010. Obama and the Congress extended those tax cuts at a cost to the treasury of $858 billion. In 2011 Obama and the Congress decried budget deficits and used that as an excuse to attack Social Security and reduce federal unemployment benefits. In 2012 there was another extension of the Bush tax cuts.

Tarp? You are confirming my previous post. It was the housing collapse which brought about the so-called Great Recession and the subsequent deficits. Did Obama extend the tax cuts? Yes….it would be a HUGE mistake to have taxes increased in the middle of an economic downturn. By the same token, as mentioned in my previous post, the Bush cuts resulted an a profound influx of revenue into the federal treasury. On the other hand, tax increases often result in less revenue coming in as they take money away from consumers and the risk takers.

This matter of income inequality is a red herring designed to hide the fact that the American ruling class is taking over the world. Through privileged distribution of fiat money real material possessions are acquired. The ruling class, and it is ruling because it rules, is used to command. That is what ruling is. It is extraordinarily difficult for a ruler to yield power, on the contrary, every spontaneous natural movement is seen as a threat to the possibility of ruling. The opposite of ruling is to obey and simply Americans are not used to obey.

Proof of this position is the veto at the UN and the veto at IMF, the stipulation that the Head of NATO will always be an American and there must be some other situations that I know not of.

The discussion about inequality of income is very easy to carry on. It is quantitative. But acquiring power is qualitative. It consists fundamentally in assuring that my power will be transmitted to my heirs that my seed will continue commanding. Great universities prepare the heirs of the ruling class for the task of commanding and that task requires subjects. So the empire expands.

They’re actually not taking over the world; they’re “taking it over” in the same way that Charles VI was taking over the world when he was Holy Roman Emperor, King of Spain, etc. — it was illusory. Same way the later Roman emperors had authority which was merely titular, while real power had passed to other local officials.

Part of it is, frankly, that the great universities are apparently not training the scions of the ruling class in the basic principles of enlightened self-interest… so the scions are really screwing it up, Russia-before-the-revolution-style.

Any discussion of taxes is absurd while the feds aren’t required to balance their books. Cost controls don’t exist at the federal level for that very reason.

Wealth inequality is a symptom of a system run amuck, but penalizing a group isn’t the answer, it’s distribution that is the key, as someone mentioned, not re-distribution.

Besides, the poll is wrong and Buffet/Gates are lying, not that it matters.

Yah, let’s not talk about redistribution of the gains in productivity and of course more important, of title to all the land, housing, factories and resources. Because redistribution means that my little personal success as a minor player in the Great Taking might be in jeopardy of redistribution, particularly as the Rulers will happily push me under the bus wheels and dust off their hands with a self I congratulatory smirk at a job well done, a bullet ducked, and go back to watching their “wealth” just grow and grow and grow, all by itself… Too bad those stupid, weak people lost their wealth and got so deep into debt… GOD gave me my money, with a little help from the financial industry and government…

The talk only seems to include those most evident until one realizes that many more taxes exist in the form of regressive taxation….sales tax, fee for banking services, tolls, gas taxes (please fill in more hidden taxes). As I see it, taxes are a brake..to tax someone is to put a burden upon him. All taxes are passed onto the end user as all production of goods take into account the tax burden which is built into pricing. Since all taxes are in effect, paid by citizens, it follows in my mind that they should be used for what the majority of those citizens whish….the public good, the commons, infrustructure…those things that lower the cost of living and doing work… ensure prosperity.

Two types of business exist; extractive rent seeking (high frequency trading for example) and productive (widget building or wealth creating). We should be taxing the cap out of extractive enterprise and putting that unit into productive use.

Right, people making 100k are “affluent Americans”. More dishonest polling used to manufacture “opinions”.

The staple of the Left. We have already been through this, as any reader here over 60 would know, and this has been a disaster. This is just another case of taxes for thee but nit for me.

Get it straight: you do not deserve other people’s property because you do not make the money you would like to make. It is theft and narcissism, and does little else but bankroll corrupt politicians and their equally corupt clients and attendant Nomenklatura, and degrade society and harm our civilization.

You want to live like aristos without earning it,

If you are in California or New York City, yes, $100K does not go far. But if you are in the heartlands or the South, or a retiree or have no kids, that’s a very comfortable income. And more important, tax data says it is upper income and hence by objective standard is affluent.

If you don’t like the tax regime in the US and you think you are so talented, emigrate. You’ll quickly find that virtually all of the places that have US-level living standards would tax you even more.

Though, I’d have to figure most of the people earning that live in California or New York or at least another major metropolitan area where it’s your lowest level (immediate) white collar management salary. Because that’s where salaries are actually that high for some. On the one hand it’s not that much, 100k won’t put you in the homeowner class in California (which we’re constantly told is the middle class lifestyle). If you have to ask who the tax breaks for mortgage interest are for, well let’s just say you ain’t got the doh ray me. But willingness to pay targeted taxes for education and so on makes sense (yes these are sometimes on income tax not just property tax).

I take your point, but in at least some of those places (in Europe, for example) you might be taxed more, but stuff you would have to pay for here ( out of pocket health care, college, etc…) would cost a lot less. I’ve lived in Sweden, for example, and as taxed as people are there, they live pretty well.

Oh, agree, but he is complaining about taxes, and that sort typically hates guvmint.

I live in a high tax state and I get a lot for what I pay in taxes.

‘… you do not deserve other people’s property because you do not make the money you would like to make’

F*ckin’ A … glad somebody set out the basic principle. It used to be called the politics of envy.

Imagine a small town with one wealthy family … say, Bentonville, Arkansas. The citizens vote to tax all incomes over $100,000 and redistribute the loot to themselves. You’d think the rule of law would preclude such naked predation. But the 16th amendment destroyed such protections.

Mostly big cities have income taxes. But now there’s no constitutional bar against smaller towns simply plundering the better off. No different than an armed posse just going to their house and demanding, ‘hand it over, bitchez.’ But with the proper paperwork, it’s ‘all legal.’

And what’s it used for? To feed the global dominance of the U.S. military, which sucks the life out of the economy with its value subtraction economic model. Without the evil of the permanent withholding tax (implemented in 1943 by none other than the progressives’ bête noire, Milton Friedman), the vast national security state that destroys both liberty and prosperity would not have happened.

Don’t feed the Beast!

‘Cept for the last 40 years, the “conservative” Rs have been implementing “Starve the Beast”, but first assert “Defense Cuts Are Off the Table”. Then the rest of Congress has been mostly going along with the plan.

Time for a change in the implantation of the slogan, I would think. Besides. you can’t starve the beast anyway – it’s racked up about $16T in non-SS treasury bonds. And unlike some people here, I happen to think the people/entities holding them do expect to be paid back in reasonably sound dollars.

“‘Cept for the last 40 years, the “conservative” Rs have been implementing “Starve the Beast”, but first assert “Defense Cuts Are Off the Table”.”

Military spending has been trending down for years. In 1960 defense amounted to 35% of the total budget. In 2010 it was 19.5%. The 2014 figures are not available, but you can be sure that it is even lower.

A bit out of touch, aren’t we, Jim? All I see is increase in hidden taxation on the poor by municipalities (think various fines), what with tax revenues being diverted to subsidies for big business. Chicago’s TIF program is prime example. Public services are being converted into yet another rent extraction tool for private profit. Public property is being privatized for a fraction of its true value. So shout it out Jim: “…you do not deserve other people’s property because you do not make the money you would like to make”.

Speaking of OPM and predation .. how did the Rebirth of Englewood Community Development Corp and the Bobby L. Rush Center for Community Technology work out in Englewood?

LOL, was that funded with tax dollars??? No, it was funded largely by SBC (which we now know as AT&T), with a few other corporations donating money. But why would these corporations throw money at Bobby Rush, my supremely corrupt congresscritter? Because he sits on the House Energy and Conmmerce Committee, that’s why. Legalized American bribery in return for legislative favors at its best. So what was your point, that corporations and politicians mutually coexist in a state of corruption? I think we all knew that already, Opti.

Actually something shy of $200K in straight up tax dollars were kicked in for a vapor building.

But all of it is taxation on the community, including the SBC donation, assuming SBC does not have a printing press, its pretty clear where those funds come from.

And so who perpetuates the corruption? Ultimately it is people, the people of Englewood in this case, voting against their own interests. Why is Bobby Rush re-elected?

Who had even a vague interest in the community to follow the money and the execution of yet another program?

Why oh why is Bobby Rush :

Rush Keynote Speaker at Georgetown Black Law Student Association Graduation Ceremony

http://rush.house.gov/

The solution is not necessarily more taxes.

So it appears that the taxpayer money went to documented expenses. Look, corruption is deplorable but $32K vs $1 million speaks volumes about how valuable Rush was to SBC.

Hope you enjoyed blaming the victims. I would understand it if you just dropped in from Mars and had no idea how American elections work. But you didn’t, so you dress your desire not to pay taxes as principled opposition to corruption. Sorry but what works on Yahoo won’t fly so easily here. I’m disappointed you would even try

Ah it was only $32K of tax monies in this instance, that’s ok then. Yes documented expenses, indeed.

Hope you enjoyed blaming the victims.

Old saw that doesn’t scale down. I can agree w/ the concept of not “blaming the victim” at higher levels of abstraction, like a POTUS election, or even a gubernatorial election, where the candidate choices (possibilities) are a distinction with no difference, but at the community level representation level I call BS.

Bobby Rush has been elected, what 11 times!?! And these are pluralities of typically in the mid to high 80%s. I presume he had no primary opposition? So yeah , here is a case where I unequivocally blame the voter and the community.

No SBC did not give Bobby Rush $1MM, they donated it to a bonefide community development corp. The fact of the matter as I see it is no one apparently had interest in seeing the project through.

…so you dress your desire not to pay taxes as principled opposition to corruption.

Save your sanctimony, you have absolutely no idea what I pay in taxes or what deductions I could take that I forgo. Frankly I really have no issue with paying taxes, it’s not something I wring my hands about, but I do take issue with the unrepresentative way much of these monies are squandered. Do I feeI I pay my fair share now ? Absolutely

It is very illustrative also that you had nothing to say about Chicago’s TIFs,

There are many things that I dont bother saying. So if you’re interested, here is the short form : I think TIF funding in bad policy, period. How it has been used in Chicago has been proven to be counterproductive historically as much of it was allocated to areas that were growing in value anyway. Consequently it has been a diversion of potential tax revenue.

So , in summary:

,TIF funding : Bad,

Bobby Rush: Bad,

chronically re-electing Bobby Rush: Bad.

0 community stewardship of monies donated for community development: Bad,

Heroic amounts of tax money squandered at City, State and Federal Levels: Bad

My, both guns blazing over one of the smaller crooks you will find amongst the congresscritters, and then over a corporate bribe. So how do you expect me to address it? Forget primaries, I don’t remember the last time Bobby had a challenger in the general elections. And this being Chicago, again, you know damn well that the voters have little to no say in the elections. It’s fine and well to heap it upon a crook, but frankly you are riding a hobby horse and thinking that you are riding Bucephalus when you start heaping it on the “community level”. Did you ever even set foot in Englewood other than driving by on the Ryan? I rather doubt it.

PS No doubt Romney feels he’s paid his fair share of taxes also, so let’s leave feelings out of it…

both guns blazing/ hardly.. I just thought it would be interesting to see if you’d predictably trot out the “blame the victim” mantra to justify a slug like B Rush being elected 11 times with impunity w/ typically ++80% majorities! And no I don’t buy into the “it’s Chicago you know how it is” deflection BS either. And the same goes for JJackson Jr., he has virtually identical pluralities for 10 elections.

Did you ever even set foot in Englewood other than driving by on the Ryan? I rather doubt it.

I’m sure not in over 30 years at least? I have no reason to. Is there some venue or highlight I’ve been missing?

You seem to posture as if there is some noblesse oblige virtue to being a resident or spending time in Engelwood. What’s the point? I take no issue with your choosing to live there, bottom line you’re doing what you feel is in your interest–which you should do.

As far as taxes go..Do you pay enough taxes OIF?.. I presume not, so why aren’t you coughing up more, you know the City and States could ALWAYS use more revenue. Isn’t it time give back?? Even skipping the supplementary monetary contributions you should be good for, you apparently received an excellent education in the City, presumably far better than most residents of Engelwood. Are you making any effort to educate local residents? Perhaps to think critically about their congressional representation? If not, then save the sanctimony.

“Predictably trot out the blame the victim mantra”? That’s the predictable horsesh!t of the sanctimonious white suburbanite who can judge what’s going on Englewood without having been there. ‘Cause you are so perceptive, no doubt. Me, I live just about next door in Hyde Park, and pass through Englewood often, and talk with people from there who work in my neighborhood. I don’t presume to know enough to pass judgement on who they vote for. Obviously you have no such misgivings, despite not knowing the first thing about the reality on the ground. What’s more, you fail to get worked up about the myriad other sh!theads whose districts you’ve no doubt visited, and whose whiter, wealthier, more educated constituencies keep reelecting them year after year. I certainly didn’t detect any such blaming in the aftermath of the mayoral elections, when white people on the North Side made sure to get Rahm reelected even though he is utterly failing most of them as well. Funny how that works in Optiworld.

As far as taxes go, I would say that I pay more than my fair share in local, state taxes, and federal taxes. Why? Because my property taxes get diverted to help the Pritzkers open a Hyatt and to subsidize Whole Foods to open a store, all in fairly wealthy Hyde Park. I am subsidizing billionaires and corporations. I pay the same regressive flat tax to the state that Bruce Rauner does. Again, I am subsidizing millionaires. And I pay higher effective federal tax rate than the Mittster and General Electric. Again, I am subsidizing billionaires and global corporations. So yes, I pay more than my fair share compared to these a$$holes.

And yes, I received excellent private school education from the same school that counts John Paul Stevens and Michael Hudson as alumni. Yet I am more than happy to pay my property taxes to fund the public schools, except that a big chunk gets diverted to the pritzkers and to connected charter school operators. I am, as are many Hyde Parkers, quite involved in these local and national issues. Guess what: it’s hard for whites to win the trust of black people given their experiences. It’s even harder when a bunch of corrupt corporate entities give money to a bunch of corrupt black politicians and a corrupt black reverends to buy them off. Its not that many black people don’t know what’s going on, they do. But they also see the white power structure continue to systematically discriminate them, segregate them, and kill them. So why in the world would you think that they will trust the whites to suddenly treat them fairly? I know I wouldn’t.

So save YOUR sanctimony because you don’t know the first thing about the people and their neighborhoods. Direct it at the white neighborhoods that keep electing the same corrupt politicians, ’cause honestly, your fixation on one black a$$hole and his black constituents is stinking up the joint to high heaven.

I don’t presume to know enough to pass judgment on who they vote for.

Well, ok then, does that sentiment scale up to larger demographics/ elections as well?, Say POTUS?

What’s more, you fail to get worked up

Nor do I get worked up about BRush, I merely asked how the Rebirth of Englewood Community Development Corp and the Bobby L. Rush Center for Community Technology worked out?. The distinction I can make about BRush vs many other corrupt congressional reps is that he does little or nothing for the constituency that continues to reelect him. To be clear, it’s not something I’ll get worked up about, that’s who his constituency wants, it’s fine by me I guess, I don’t have a dog in that fight but I’ll point out the obvious.

What’s more, you fail to get worked up about the myriad other sh!theads whose districts…

Again, not something I influence nor get worked up about..

Rahm? No credible opposition as I pointed out originally. What do you want me to do, stamp my feet about the unfairness of it all? I’m guessing it was more than “White Liberals” that voted for him , no? You seriously think Chewy would have been any better? The runoff was an expression of dissatisfaction, RE was baked in because no one else (electable) ran against him, and that can was pretty well kicked down the road here on NC.

As far as taxes go, I would say that I pay more than my fair share in local, state taxes, and federal taxes. Why?

AHHHH! Mr. Pot, I would like to introduce you to Mr. Kettle! On this we agree, although the Pritzkers are not my bone of contention relative to how I feel my taxes are most significantly misappropriated.

Again with the BS rationalizations. “No one electable” ran against Rahm, says you. No one, electable or not, ran against Rush, period. What do you want the residents of Englewood to do in such scenario where The Machine has well assured that its guy is going to win come what may??? Then, you talk about the mayoral runoff being an expression of dissatisfaction and ask if Garcia would have been any better. Who the fack knows, what really comes through is your double standard: that white liberuls are dissatisfied with Rahm but vote for him over the brown guy anyway. Yet blacks in Englewood are complicit in Rush’s corruption for doing the same thing as white liberuls, even though they don’t even have an alternative on the ballot?! WTF?! No, no white suburban sanctimony there, no sir…

Yet blacks in Englewood are complicit in Rush’s corruption

The Machine has well assured that its guy is going to win come what may???

That’s your projection.. I said they apparently choose to vote against their own interest. There is no “Chicago Machine” representative in the voting booth. Do you think an exit poll would deviate from the election result in Englewood? I don’t, and I think that is the simplest explanation why he runs essentially unopposed (other than the occasional R and 3rdparty candidate).

your double standard: that white liberuls are dissatisfied with Rahm but vote for him over the brown guy anyway.

As far as Rahm and the “white liberals”, you might not like it of course, but aren’t they voting in their interest? BTW, was it only “white liberals” that voted for RE?? In your opinion, is it all reducible to voting by color in Chicago? The fact that Garcia is Hispanic is why he lost, is the right?

There is no Machine representatives when white districts vote for their Machine aldercreature and congresscritter either. Yet they are somehow not voting against their interests but blacks are. I’m sure that makes perfect sense in Optiland.

Wait, I though you said they were dissatisfied?! So which are they, dissatisfied or voting in their best interests? Make up your mind already.And yes, blacks voted for Rahm too. For the same reason they voted for Rush. Joravski covered it in some depth in the Reader over the years. Yet, the ward voting shows a lot heavier concentration in Rahmm voters in white wards than Garcia or Rahm voters in black wards. So the whites voted in a block and the blacks did not. So yes, it was reducible to race, that’s for damn sure. So, is Optiland gonna call out the whites or what?

Wait, I though you said they were dissatisfied?! So which are they, dissatisfied or voting in their best interests?

tedious exchange.. you have a notional conflict w/someone voting in ones perceived interest while not being entirely satisfied, I don’t. That hoe most elections go down except for true believers.

ward voting shows a lot heavier concentration in(of) Rahmm voters in white wards than Garcia or Rahm voters in black wards

ok, so what?

I am subsidizing billionaires and… So yes, I pay more than my fair share compared to these a$$holes.

Well ok then, and so am I, but I should pay more and you shouldn’t? Was that your point or what am I missing?

It’s even harder when a bunch of corrupt corporate entities give money to a bunch of corrupt black politicians and a corrupt black reverends to buy them off. Its not that many black people don’t know what’s going on, they do

Actually , in this case SBC (is it corrupt?) gave funds to Englewood Community Development Corp not to Rush. What happened was my original question.

It’s even harder when a bunch of corrupt corporate entities give money to a bunch of corrupt black politicians and a corrupt black reverends to buy them off. Its not that many black people don’t know what’s going on, they do.

And that’s the explanation why a Rush is perpetually voted in with ~85% plurality? not much of an explanation. Ultimately it’s a curiosity to me, you think I’m “worked up” about it. I’m not, I just think it’s unfortunate.

No, no white suburban sanctimony there, no sir…

LOL! White suburban sanctimony indeed!.. you’re a victim of you own preconceptions. Yes, back in the day my neighbor McKinley Morganfield (Muddy Waters) and I would get together in the evenings and could practice my sanctimony on him. LOL.. your too much sometimes OIF

Opti,

The issue seems to boil down to what Foucault bangs on about, which means in places like Chicago the voting process is completely broken e.g. a sociopolitical environment which precludes any meaningful alternatives.

The neoliberal blocks of wealth and advantage have all the bases covered from birth, education, social networks, perception management, grooming, et al.

Skippy…. it like asking POW prisoners about taking control of their own lives, especially after a few generations.

PS It is very illustrative also that you had nothing to say about Chicago’s TIFs, which are naked giveaways to connected rich people and have nothing to do with their stated objective of financing redevelopment of poor neighborhoods. Unless of course you can provide clear evidence that the Loop, River North, or Hyde Park are economically distressed hoods. Good luck with that. Yes, Rush is corrupt. Yes, he wasted $32K of taxpayer dough on this particular boondoggle. Drop in the bucket compared to the billions of taxpayer dollars wasted on giveaways to the rich. That’s not argument against taxation, it’s an argument that the rich have bought all levels of government.

If you were trying to sink your own argument, you couldn’t have made a better choice than referencing the Walton empire. Whatever legitimate gains Sam made have been more than balanced out by the ill-gotten gains of his heirs and their running of the empire trampling everyone in their path to amass more and more &&& regardless of the consequences.

Talk about an argument for an estate tax, for no other reason than to limit the amount of damage that spoiled children can do to a society when they come of age.

I can never tell if you’re joking

It does make it fun. Basically Jim is advocating aristocracy in that particular scenario.

Wearing his Ron Paul button although he is right about the military.

Imagine a small town with one wealthy family … say, Bentonville, Arkansas.

And what’s it used for? To feed the global dominance of the U.S. military, which sucks the life out of the economy with its value subtraction economic model.

Me neither, Pepsi. The global dominance of the US military is what enabled the wealthy family from Bentonville to generate the vast bulk of it’s wealth, through Chinese slavery. You would think they could at least pay for some of it.

Please identify the US retailers who also generate their wealth through Chinese slavery. If you are typing on an Apple computer you can throw them in.

I’m hardly one to criticize someone for hyperbole but really. Walmart was around long before China was our dominant trade partner. Their business history is a lot more complicated than that.

Squeezing suppliers past the point where demand gets stifled has always been part of the plan. Good shrewd shopkeeping tactics. But they’re operating on a macro scale now, with the same old micro minds.

Please identify the US retailers who also generate their wealth through Chinese slavery

Can you think of any retailer that doesn’t generate their “wealth” through Chinese slavery? That’s what big retail is these days. Made in China, or Asia somewhere.

Walmart was around long before China was our dominant trade partner.

Walmart in particular, was the driving retail force behind the rapid pace of exploitation of Chinese slave labor. Companies located here, were encouraged to shift production to China, or else no sale.

Their business history is a lot more complicated than that.

I’ll say! That’s how they got to be so powerful so that they could push manufacturers around to the other side of the globe.

With the US Navy there to protect them.

You have all the talking points down pat. Care to provide any links to back them up? In particular:

was the driving retail force behind the rapid pace of exploitation of Chinese slave labor.

Seems to me I’ve read that Wall street was the driving force urging companies–including Walmart– to outsource and thereby boost their bottom line. Not to mention economics professors and “comparative advantage.”

And one reason I bring up Apple is because it is the interesting case where the slaveys get paid about the same (and of course they do get paid) to make one of the highest markup mass market products being sold. If it were only about The High Cost of Low Price (a documentary about Walmart) then why isn’t Apple showing their patriotism by bringing production back home? Perhaps it isn’t just about price or just about Walmart.

As you say, try buying a manufactured product these days that isn’t from China. Walmart is the symptom, not the disease.

http://www.credittoday.net/public/Brief_History_of_Outsourcing.cfm If one can believe the “history,” oursourcing and offshoring are Good Things. Depending where one is in the supply chain.There are a whole lot more sources, opinions and viewpoints on the “trend,” of course.

Apple’s suppliers are so skewed towards Asia and China, it is an absurdity. Between 80 to 90%. It’s about the money. Patriotism is a moral value.

The rub is, it would be expensive and messy to wrench that production away from Asia, almost an impossibility now, impossible tomorrow.

The Walton family fortune is approaching a tenth of a trillion dollars. First mover advantage gets you that.

The finance pirates were there loading the guns and running the helm on their dreadnought, grant you that.

The global dominance of the US military

huh? wtf are you smoking. China is the biggest place in the world that I can think of that the US military is pretty much irrelevant, other than apparently setting a bad example how to squander resources.

. Follow the money pal. The US-China relationship is all about a mutually intertwined financial sector deathgrip, not the military.

Yes, making $100K a year is affluent. You are roughly speaking in the top quintile of American households.

Due to being a nice round number and roughly at that 80% inflection point, it is a rather useful marker if one is grouping households into a few broad categories.

Agreed. The majority of the income of the top 20% of households is other people’s property. This of course is more concentrated the more you go up (10%, 5%, 1% .01%, etc.)

Extreme wage inequality is driven by public policy, not natural economic law.

What’s in a word? They’re just convenient conventions that like the loose change on my counter are just a medium of exchange. So why get get exercised about one little word that is used so frequently with little or no conscious thought?

Take “earn,” as used so frequently. Blithely states that our rulers “earn” their incomes and wealth and power. In my value system, I and other nurses and road crews and retail slaves and welders and auto mechanics and burger flippers and baristas “earn” the money we get paid. In that older, less “sophisticated,” understanding of the word.

Do the Koch’s or the Walton brats or Carly Fiorina or Dimon or the Clintonopoly “earn” those unimaginably huge incomes and enormous, generationally regenerating piles of wealth, all that territory and assets and stuff that the deck they’ve stacked just keeps creating for and crediting to them? I “earn,” by being still able to do something with my labor that is “valued” by people that control wealth or at least are able to be debited to pay my $16 an hour. The Rulers don’t “earn,” as I would use and conventionally understand the word. They “take,” they “inherit,” they “foreclose,” they “grab,” they “transfer,” they “leverage,” they “flat out steal,” they “redistribute upward,” and so forth.

But every repetition of the Narrative usage of “earned” cements the manufactured consent more firmly around our feet.

It’s a lost cause, likely, to cavil at little stuff like this. But this long-game perversion and co-optation of the language is the ‘sauce Bernays’ in which we ordinary “earners” cook our own goose.

I’ve been pointing this out repeatedly. Dividends, capital gains, etc. are even explicitly described as “unearned income” in the tax code.

Yet propaganda writers in the newspapers talk about “high earnings” when referring to people profiting from capital gains — which is simply literally wrong.

I have low earnings, and I do pretty well for myself investing in the stock market. I would never be so arrogant as to call those profits “earnings”.

Who are these wealthy you speak of? By all means bleed the forbes 400 of their ill gotten boodle, but keep your government hands off my piddling 6 figure income.

“Who are these wealthy…?”

I’ve always liked David Cay Johnson’s expanation.

“ The average increase in real income reported by the bottom 90 percent of earners in 2011, compared with 1966, if measured at one inch, would extend almost five miles for the top 1 percent of the top 1 percent.

….

“Those at the top are pulling away from everyone else not because of hard work, but the shift of income from labor to capital and changes in federal income, gift, and estate tax rules. ”

http://www.taxanalysts.com/www/features.nsf/Articles/C52956572546624F85257B1D004DE3FC

So, on a bar graph the the 1-90% income earners increase in wealth from 1966 to 2011 would be 1 inch high. While the increase for the top .001% earners would be 5 miles high. Basically, drop a one inch golf ball where you stand, then drive five miles away and chalk a line. That’s the graph. And its due to tax favoritism.

or, if you prefer a vertical instead of horizontal bar graph, you could drop a golf ball a sea level in India and then another one at the top of Mt. Everest.

That I think is a very important mindset to understand.

It’s true the most extreme concentration of wealth and power is at the very top (and all but a few neoliberals, MMTers, and conservative anti-taxers want to tax the living daylights out of ’em). We essentially all agree on that front. Yet it doesn’t happen.

What is the mechanism for keeping that system going? The concentration of wealth and power at every rung of the ladder below them. Most of the day to day oppression and injustice in our society is carried out by the people making six and seven figure salaries, not nine and ten figure ones.

That’s the cognitive dissonance, the soft corruption of careerism: to decry the super rich while simultaneously believing one’s own outsized privileges to be acceptable precisely because they’re not as bad as the super rich.

You want government hands off your piddling income? Public policy is what allows you to make so much in the first place, from IP law to banking bailouts to media consolidation to industrial agriculture to the police state to massive direction of spending in medicine, defense, education, and so forth. Median household income in the US is far less than six figures. And your comment makes it sound like that is just your income, not your total household income, that is a piddling six figures.

Many Americans who say they support higher income tax rates on people of their income level will, if those rates are implemented, take aggressive and legal steps to minimize their exposure and, if possible, avoid exposure altogether.

They are already presumably doing what they can under the tax code, so I don’t find this argument persuasive.

I am in a high tax state and am content to live here because I get value for my taxes.

I fail to see how it would be any different from how it is now. Nearly everyone who has a somewhat higher income is going to seek ways to minimize their taxes. I do, but I still pay what I consider to be my fair share. Unlike some I know, I don’t believe it’s “unfair” or whatever that I am in a higher tax bracket. I recognize the many benefits I enjoy from good use of my taxes. I don’t get it when citizens seem to believe that it’s amazingly unfair to pay to a higher tax rate when they earn more.

Appears to me that there’s a disconnect between what we enjoy here in the USA – fading, failing and crumbling as it is – and having to contribute to ensure that we still have some relatively decent roads, highways, bridges, water systems, public schools, fire depts., etc.

That’s one of the practical reasons that a simpler tax code would be so effective. Every tax deduction on the books is regressive. Removing the loopholes removes the ability to avoid the taxation.

Well, they support higher tax rates for _other_ people of their income level.

I doubt seriously whether the treasury would turn down any extra contributions, should they be so inclined.

People who are making over $100k or even over $400k may have money, but not much power. The taxes to be raised by the government, monetary theory aside, is clearly as political a move as any sort of financial techique. The point of the raising of taxes in order to support social programs that redistribute wealth to those at the bottom 1/5 of income also serves as a safety valve against the kind of social problems and even social change that could fundamentally restructure the social order in opposition to the real financial and political interests of the top 1/5 in income of the population. Giving out higher wages and benefits helps the employed, but not the unemployed or the impoverished and too busy single parents raising young kids or taking care of elderly. To keep the surplus labor population from busying themselves with the day to day task of survival via criminal activity from drug dealing to purse snatching, the state has always acted as a redistribution mechanism of the surplus wealth that is produced by society as a whole, even though the elite few benefit materially in greater proportion to their actual numbers in any given society.

The leisured wealthy may get most of the goods with the least work on their part, but in this day and age do not have the capacity or in many cases the stomach for running a brutal police state. Lots of police and prisons cost lots of money. That includes lots of pensions and health benefits. Imprisoning vast amounts of unemployed African-American men, by the million, is a costly as providing them with project tenement slums and food stamps and cash payments. And when they come out, light drug possession crimes transform statute criminals into fully recruited gang members. There is a growing unwillingness to lock people up,because it costs too much. So marijuana is becoming legalized and decriminalized across the nation, bit by bit, state by state, city by city. The death penalty is also falling by the wayside as much as from the fortune in legal costs to the state defending for decades the court decision to execute as from moral or ethical or constitutional grounds. Soon enough, only murderers, rapists, armed robbers and violent offenders will be jailed, because we can’t live with those sociopaths. Drug offenders will not be the police departments problem, but rather the public health department.

If you are watching TV and seeing a city like Baltimore burning, people in Ferguson MO protesting and some rioting. If you see coast to coast marching in the streets by African Americans protesting Treyvon Martin and continuing over a year latter as the BLACK LIVES MATTER movement, again, all across the nation. If you see teachers striking in city after city, $15/hr wage demonstrations at your Mickey D and Walmart, you know that society, across the board, has serious problems that need to be faced by a change in government policy toward the economic rewards distributed to make billionaires out of thin air during IPOs and foreclosures on homes for the crime of unemployment and no paycheck.

Wildfires spread during droughts, taking out any homes in the way. And social rebellion in the streets can spread during a drought of paychecks when desperate people don’t care anymore, because no one cares about them. Taxes are the price we pay for Civilization. If you want to decentralize into warrior bands and clans and shut down the government start building city walls with moats and be prepared to pull up the drawbridge at a moments notice. If that is the direction you would rather take with gated communities. Or, you can just pay your taxes and we can all live like civilized human beings. Civilization, it’s been a good idea for thousands of years, don’t break what works.

Soon enough, only murderers, rapists, armed robbers and violent offenders will be jailed

and political prisoners (whistleblowers)

https://www.wsws.org/en/articles/2011/01/whee-j06.html

They usually don’t make it to trial to be jailed.

I think Yves was making an interesting point the other day about how public attitudes toward the wealthy can influence policy. Since I’m a movie guy I’ll point out that rich people were routinely ridiculed in the American movies of the 1930s. There was farce such as A Night at the Opera but also social dramas like those of Frank Capra where heavies (literally) such as Edward Arnold would ooze villainy. A consistent theme was making fun of the rich and the celebration of the common man. Doubtless this was just giving the less affluent audiences of the time what they wanted–it was “box office”–but the mass media also must have played a role in the highly progressive tax regime and useful financial regulations that emerged.

Cut to now when some of the viewers of Oliver Stone’s Wall Street saw it less as a cautionary tale and more as a cool get rich model (I believe Stone himself said this). Michael Douglas’ villain–the source of “greed is good”–was of course a PE man. And while Jon Stewart loves to make fun of Donald Trump you won’t hear him making fun of rich people in general. He is one. His brother works for the NY stock exchange.

Change the culture, change the world. The public is ready but will the media help? It’s time to start laughing at the rich.

according to mmt, which i discovered through this site… higher taxes alone are not a good idea…

unless govt spending goes up more than the tax increase, private saving will go down…

am i wrong?

As I recall — we had a more progressive tax system, not so very long ago. “We” opted to gain the benefits of trickle down economics, which “we” have. I didn’t enjoy any trickle down benefits. Did anyone else notice any trickles? The “experiment” worse than failed — why such agonies to return to the old progressive tax system which worked fairly well for a very long time? Why not augment that system to fill new found holes. Returning to a more progressive tax system is neither revolutionary nor reactionary. The impact on the wealthier among us would be to decrease the growing gaps between wealthy and poor and realign their interests together with ours toward the common good. Tax corporations and make them pay fair taxes — why not? Let them leave if they want to — just let them also leave our markets.

Are higher taxes necessary to counter austerity? MMT says no — but larger tax kitties make it that much harder to argue austerity baloney. Do higher tax rates on the wealthy shift income to the poor through welfare payments? If they do, it will take a very long time at current rates of welfare payment to shift much income anywhere. I enjoy productive work. If others do not, I cannot begrudge them a living income, even an income that allows for certain pleasures and enjoyments in life — be they so simple as a six-pack on the weekend. We are a wealthy country. This is a wealthy world.

Do higher tax rates on the wealthy stifle their job creative engines? What creative engines — job creative or otherwise? The real entrepreneurs I’ve known and talked with did what they did out of love. The money was an enticement, but their commitment to their enterprise was not about money. The CEO’s stealing money from the corporations they are supposed to husband are not entrepreneurs by any measure. If higher taxes stifles their greed … that is a good thing.

Aside from efforts to repair the gross inequity in the distribution of wealth, taxes must be raised to very high levels on the very wealthy to strip away the power their wealth has accrued. We cannot have a democracy where the few control such obscene wealth and buy such obscene powers as they have.

im all for it, but if we do it, the govt also has to spend… im just saying lets not JUST tax the rich, create a budget surplus, then have private saving go down…

BECAUSE…

TPTB will spin it as “we tried taxing the rich it didnt work” or something…

im very cynical about these things…

The rich paid less when tax rates were more progressive in the ’50 and ’60s. They all bought into real estate tax shelters which dramatically reduced their income taxes. The result was that the US now has twenty times the per capita retail space that France has. It was a colossal misuse of resources, and that is why there is little traction, even among Democrats, for higher taxes now.

Frankly, even most of the top 1% supports taxing the rich more; they don’t poll ’em very often, but it shows up quite clearly when they are interviewed. Heck, Warren Buffet said so.

The top 1% would like these taxes used to make their own lives easier, of course. House the homeless and get them out of the sight of the 1%. Build nice train services for them to ride on, and nice airports for them to fly first class out of, and other such infrastructure things.

The problem is that there is are a few small, very powerful cliques which want to dismantle our democracy entirely. These include the Dominionists (who want a religious theocracy), the Koch Brothers (who want a form of totalitarian fascism), and so on. Obviously *they* want lower taxes because they’re trying to destroy the US government completely, so that they can take power.

The poll is pretty useless since there is hardly anyone, rich or poor, who wouldn’t want to see the gap narrowed. But the difference would be how to implement those policies. Keep in mind that the dream of America has always been to make the poor man rich, NOT make the rich man poor.