Yves here. Mind you, the rating agencies are far from the only neoliberal enforcers as far as emerging economies are concerned. But it is nevertheless instructive to compare an official rationale with data.

By Felipe Rezende, of the Department of Economics of Hobart and William Smith Colleges. Originally published at New Economic Perspectives

So S&P has downgraded Brazil’s rating on long-term foreign currency debt to junk and lowered its long-term local currency sovereign credit rating to ‘BBB-‘ from ‘BBB+’.

First, what are sovereign debt ratings? Standard & Poor’s sovereign rating is defined as follows:

A current opinion of the creditworthiness of a sovereign government, where creditworthiness encompasses likelihood of default and credit stability (and in some cases recovery).

So that ratings are related to “a sovereign’s ability and willingness to service financial obligations to nonofficial (commercial) creditors.”

What does this tell us? To begin with, credit rating agencies have repeatedly been wrong. The same agencies that rated Enron investment grade just weeks before it went bust, the same people that assigned triple A rating to toxic subprime mortgage-backed securities are now downgrading Brazil sovereign debt. As the FCIC report pointed out “The three credit rating agencies were key enablers of the financial meltdown. The mortgage-related securities at the heart of the crisis could not have been marketed and sold without their seal of approval.” (FCIC 2011)

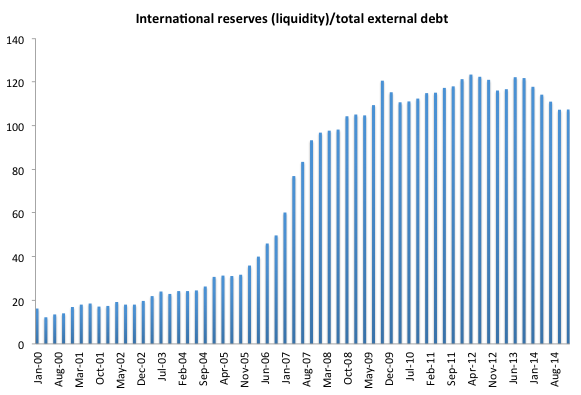

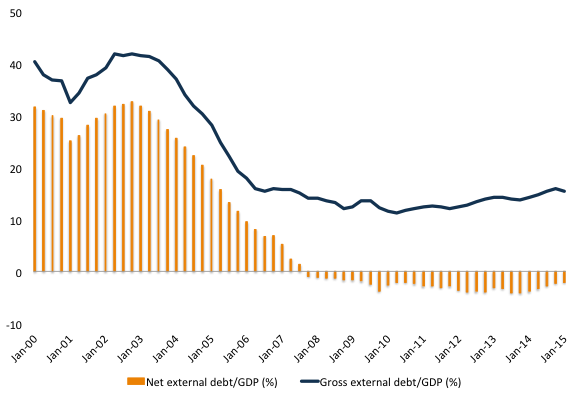

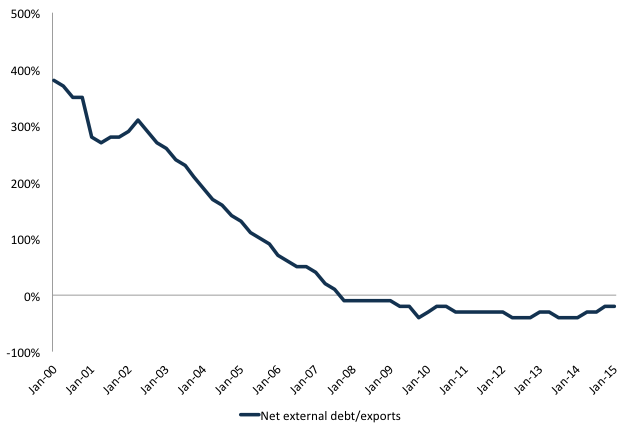

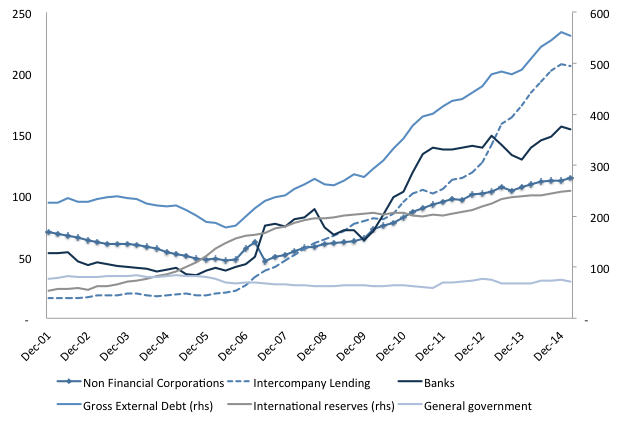

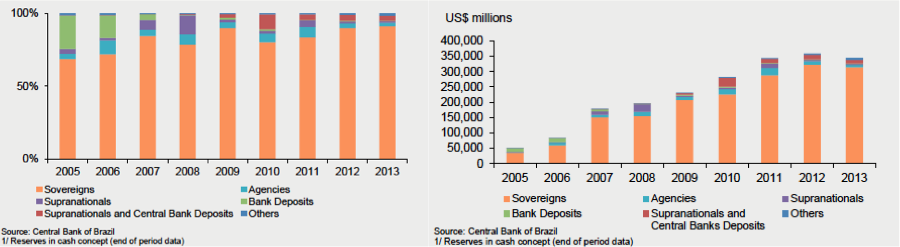

After all, should you take the credit rating agencies seriously? The answer is no. Brazil is a net external creditor, that is, though the federal government has debt denominated in foreign currency, it holds more foreign currency assets (figure 1) than it owes in foreign currency debt (figure 2). Brazil’s public sector can pay all of its long-term financial obligations denominated in foreign currency. Moreover, Brazil’s federal government can never become insolvent on obligations denominated on its own currency (note that since 1999 Brazil maintains a floating exchange rate regime, which increases domestic policy space).

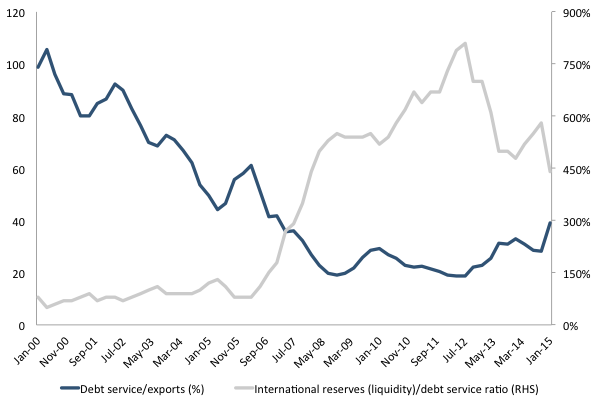

A closer look at indicators of external vulnerability (figure 3 and 4) show that there is no solvency risk associated with Brazil’s external public debt. As of March 2015, Brazil foreign currency-denominated government debt amounts to US$ 72 billion and Brazil’s international reserves position (US$ 363 billion), which are sufficient to pay its short- and long-term obligations denominated in foreign currency.

Figure 3. Debt service to exports and international reserves to debt service ratio. Source BCB

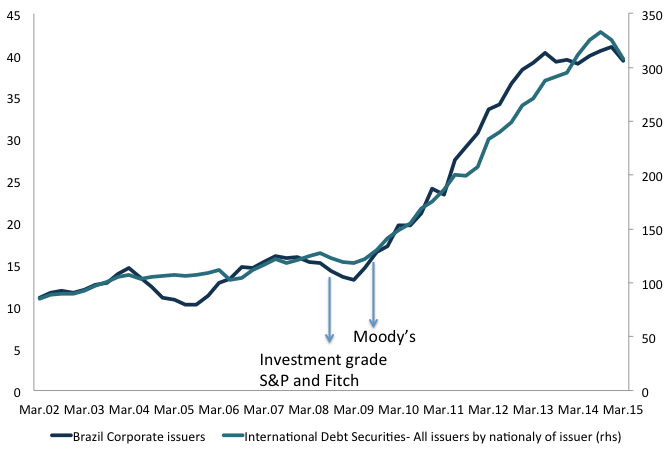

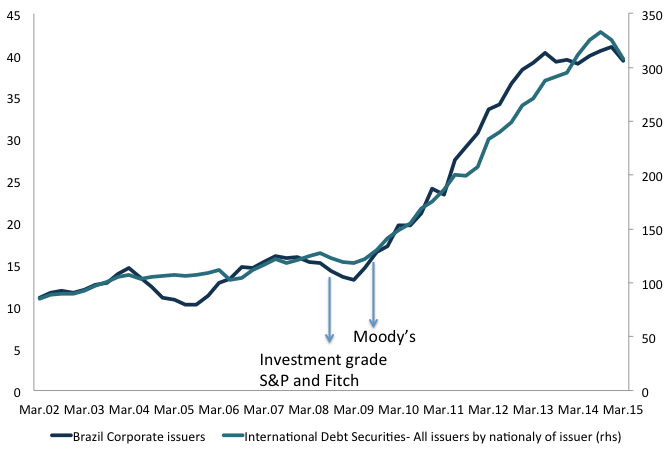

Following Brazil’s upgrade to investment grade status by Standard & Poor’s and Fitch in 2008, low interest rates in global financial centers since the aftermath of the 2007-2008 global financial crisis have pulled Brazilian non financial companies to tap international markets (figure 5 and 6). During this period, Brazilian corporate issuers have sharply increased their external borrowing through foreign subsidiaries (see for instance Bastos et al. 2015; Avdjiev et al., 2014), in which investment-grade corporate bonds witnessed strong issuance. Moreover, low or negative bond risk premium in advanced economies have pushed investors’ demand for higher-yielding assets (Shin 2013; Turner 2014).

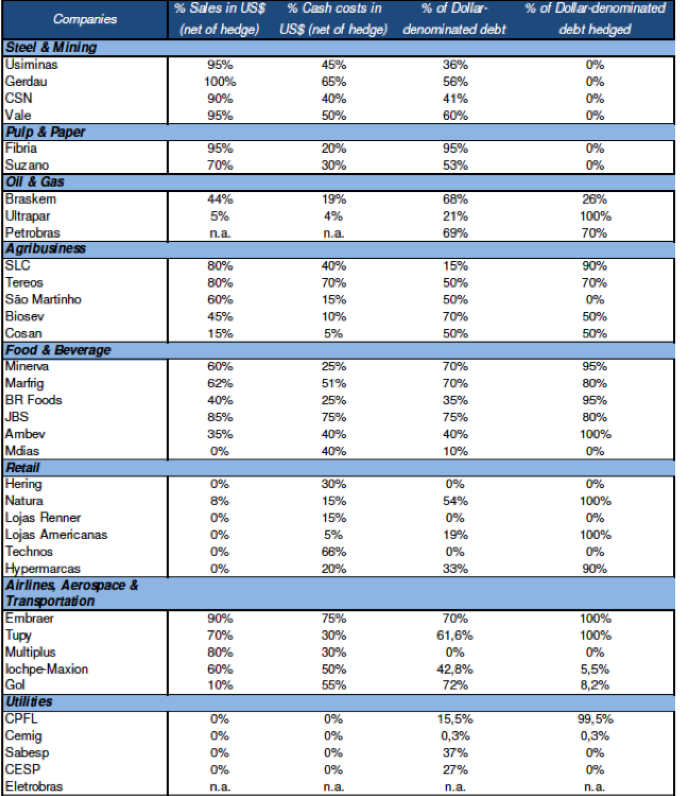

Brazil’s corporate sector has experienced since 2007 a sharp increase in foreign-currency debt. That is, Brazilian corporate issuers of U.S. dollar denominated debt are subject to foreign exchange risk, deterioration in international funding conditions such as rising interest rates in advanced economies, a reversal of investor’s risk appetite for emerging market debt, which can cause refinancing problems as international borrowing costs rise and global liquidity dries up. So, with the increase in external issuance foreign currency bonds by corporates and banks there has been an increase in foreign currency exposures risks, in particular for unhedged foreign currency debt (table 1). However, these risks can be managed effectively. The adoption of a floating exchange rate regime in 1999 eliminated the problems Brazil used to have when it adopted a fixed exchange rate regime. It has become a net external creditor and it has improved external debt ratios, and thus eliminated an historical source of external financial fragility. Moreover, the Brazilian Central Bank (BCB) is ready to implement programs that will use its US$363 billion of foreign reserves to smooth exchange rate volatility and support foreign currency liquidity.

Here is what the government should do: it should use its foreign currency reserves, which are mainly invested in liquid sovereign bonds (figure 7), to pay all of its foreign debts. Brazil will still hold a significant amount of reserves (US$ 295 billion) and without sovereign debt obligations in foreign currency the ratings are irrelevant.

S&P also downgraded Brazil’s long-term local currency sovereign credit rating to ‘BBB-‘ from ‘BBB+’ and the outlook is negative. So what did they announce about it?

“We believe Brazil’s credit profile has weakened further since July 28, when we revised the outlook on Brazil to negative. At that time, we signaled increased execution risks to the corrective policy changes already underway, mainly stemming from fluid political dynamics in Congress associated with spillover effects from investigations of corruption at state-owned energy company Petrobras. We now perceive less conviction within the president’s cabinet on fiscal policy.

Brazil’s 2016 budget proposal tabled on Aug. 31 incorporated yet another revision to the government’s fiscal targets in a short period of time. The proposed budget is based on a primary deficit of 0.3% of GDP, rather than the previously revised 0.7% of GDP surplus target that was announced in July. This change reflects internal disagreement about the composition and magnitude of measures needed to redress the slippage in public finances.

Without an unexpected overperformance, the proposed fiscal target in the budget would yield three consecutive years of primary (non-interest) fiscal deficits and a continual rise of net general government debt. While the Ministry of Finance is working on putting forward various measures to regain the 0.7% of GDP initial surplus target, they will need to be negotiated piecemeal with Congress. More importantly, the series of events leading to the budget proposal suggests to us diminished cohesion within President Rousseff’s cabinet and contributes to our assessment of a weaker credit profile.” S&P 2015

Really? S&P is complaining about lack of budget cuts? That is, is it complaining that the Rousseff’s administration is reluctant to implement “reforms” that will slash the social safety net? Is it trying to influence the political process behind budget outcomes in a society that operates with a democratic political system?

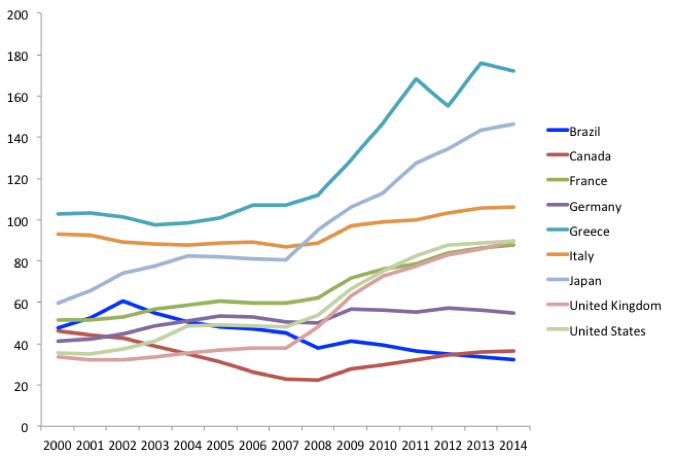

Brazil is a sovereign government with a sovereign currency. Note that Brazil’s net general government debt is close to historical lows (figure 7). So, should Brazil be downgraded to junk? Are there solvency risks associated with local currency debt? The answer is no. Unfortunately, analysts, mainstream economists, and market pundits fail to distinguish between a currency issuer (e.g. Brazil) and a currency user (e.g. Greece). Brazil is a sovereign government that issues its own currency (Real). It is the monopoly issuer of a nonconvertible floating exchange rate currency so solvency it is not an issue. There is no solvency risk in obligations denominated in the domestic currency. It spends by crediting bank accounts with the central bank and collects taxes by debiting bank accounts with the Brazilian central bank (BCB). The Treasury account with the BCB is an accounting record of credits and debits to the Treasury (Rezende 2009). Permeated by the false idea that Brazil faces a fiscal crisis, it was also caught up in the austerity fever, which contributed to its worst economic downturn in 25 years. Moreover, as I have argued elsewhere, because Brazil has an external sector deficit equal to 4.34% of GDP as of July 2015, then government sector has to run a deficit greater than the current account deficit to allow the nongovernment sector to accumulate net financial assets. An attempt to run fiscal austerity in this scenario brings about further declines in income and employment, which can result in a Minsky-Fisher type debt-deflation process.

We also need to look at the macro provision of liquidity and incomes. Private financial liabilities (IOUs) denominated in the state unit of account represent short positions, that is, forward commitments to deliver currency. Ultimately, only the government (the treasury and central bank) is a net supplier of currency. To convert private financial liabilities (IOUs) into the government’s currency, ultimately requires the existence of government deficits and central bank lending facilities.

However, as long as policymakers believe that the federal government faces a budget constraint due to the inappropriate application of the household budget constraint to a sovereign government, there will be resistance to adopt an alternative policy. For instance, the Brazilian Treasury secretary and market analysts have expressed their concerns about the domestic public debt. The government is being pressured by markets to run targeted primary surpluses to convince lenders of the ability to meet the debt service (note that this policy has similarities with the structural adjustment polices implemented in Latin America, which also caused crisis).

Brazil’s current crisis is not due to a government debt crisis, though the conventional wisdom believes that Brazil’s sovereign debt is “unsustainable”. The attempt to run primary surpluses is driven by the belief that you need to stabilize the government debt to GDP ratio and convince lenders of the ability to meet the debt service (does that sound familiar?). Again, as expected, fiscal austerity failed in Brazil as well.

The conventional wisdom misses the important point that Brazil cannot be forced by markets to default on its domestic debt. It has attained monetary sovereignty, that is, it issues its own currency and it has adopted since 1999 a floating exchange rate regime. From this perspective, there is no need for a risk premium. Unfortunately, the federal government has announced a series of cuts in key areas including infrastructure, education, health, and important social programs when it should expand its investments in logistics, energy, innovation and so on.

It will be necessary the adoption of an alternative policy to not only deal with the impacts of a dollar shortage but also to support domestic activity through a targeted government expenditure policy.

It should also provide tax cuts to households and firms. Finally, it should adopt an employment guarantee program to everyone willing and able to work at the announced money wage. Regrettably, these policies are not on the government agenda.

Yves / Susan / Felipe Rezende:

The current shutdown of the Brazilian economy has nothing to do with neoliberal enforcement, S&P downgrades, or fiscal austerity suffocation.

Brazil has closed for business due to exhaustion of a growth model based on consumption. Duly bubbled up by easy credit availability, irresponsably stimulated by the ruling government, with political and electoral motivations.

The consumption bubble inflated by easy and irresponsible credit has burst. Bang, boom, bust, gone. As simple as that.

What is left behind this monumental blunder is a horrible mess. The cleanup will take a long time.

But the cleanup has no date to start yet, damage evaluation is still in the works.

Stay tuned, but stay seated.

Can’t claim any expertise in Brazilian politics but Roussef seems like a ditherer. Are there any Corbyn-like figures waiting in the wings?

Can’t credit agencies that issue ideologically motivated and provably wrong decrees like this be subject to some kind of legal action? These are the same private agencies that downgraded US debt a couple years ago in a blatant attempt to influence the debate in Congress about the federal budget.

Maybe if there could be some liability imposed for being incorrect, but that is the antithesis of failing upward

IIRC, it has something to do with “first amendment legalese” with the keyword being “opinion”.

https://www.youtube.com/watch?v=zIGThxn_eGk

In 2011 the DoJ started investigating Standard and Poor’s for improperly rating dozens of mortgage securities prior to the 2008 debacle.

In 2013 the DoJ sued Standard and Poor’s, charging civil fraud for fraudulent rating of mortgage bonds.

Standard and Poor’s (S&P) defense of it’s ratings practices was that it was merely issuing an opinion protected by ‘freedom of speech’, not issuing carefully researched fact-based objective analysis.

I believe S&P was fined and continue on in business.

One interesting bit: In late 2013 political fights threatened to, once again, shut down the U.S. govt. Some U.S. credit rating agencies threatened to downgrade U.S. govt debt if that happened. Everybody and their dog laughed at the credit rating agencies who acted as if we still took them seriously.

‘Here is what the government should do: it should use its foreign currency reserves, which are mainly invested in liquid sovereign bonds (figure 7), to pay all of its foreign debts.’

A couple of years ago, foreign currency assets were 43% of the balance sheet of Banco Central do Brasil:

https://www.bcb.gov.br/ingles/inffina/Financial%20Statements%20042013.pdf

Selling $72 billion of those assets to retire debt would be a large QT (Quantitative Tightening) operation. As S&P would say (and I echo them), “Go ahead. Make my day.”

Not even mentioned in this article is Brazil’s inflation rate, which has accelerated to 9.5% even in the face of a global deflationary shock. Brazil has a long and sordid history of hyperinflation. For it to be flirting with double-digit inflation again, when every competently-managed economy on the planet has no inflation at all, shows just how out of control it is.

The timing of S&P’s downgrade also shouldn’t be overlooked.

Pressure on the government is mounting from all angles. Many believe Roussef’s presidency won’t survive in 2015. Brazil’s revolution is a right-wing revolution. The ‘middle classes’ in the major cities and south-east in general are fed up with their loss of privileges and coming out of the closet now (In the past they were slightly embarrassed about poverty in the north-east and inequality). Political parties, as always opportunistic, are now aligned in their opposition to the government, smelling blood, and the workers party (PT) is completely isolated.

For over a decade the PT was able to slowly introduce social programs and bring out swaths of people out of poverty. High commodity prices with China being a keen buyer certainly helped the economy a lot. This is over now and Brazil’s economy has taken a hit.

Corruption has been the catalyst for the soft coup currently unfolding, but corruption has always been around and the opposition is probably even worse in this respect. It’s not the real reason for people wanting change. The people from the state of São Paulo, where most of the opposition comes from, have on many occasions elected right-wing governors and mayors known beforehand to be very corrupt. As for the justification, a popular saying here goes as follows: “rouba mais faz” (steals but works).

It’s rather a combination of fear of losing privileges, racism and anything that may resemble Venezuela. Many people here believe that there’s some socialist or communist ‘agenda’ (just like many people in the US believe Obama is a socialist with a hidden agenda). During recent massive demonstrations against the government, people with banners demanding military intervention (a sad return to the 70/80’s, presumably) were peacefully walking hand in hand with people from all walks of life. Another thing that could be observed is that the anger is 95% white middle-class. The hatred is real and can be felt everywhere. I never saw this coming. Heck, it’s been so much better since PT came to power in 2003 compared to previous governments.

Mainstream media has been very successful in driving the people’s negative perception and creating the fear and proper conditions for this coup. Roussef’s popularity is probably at the lowest point of any president in the history of Brazil as a democratic country, so the fertile ground is created. The only thing that’s missing is a legal case against Roussef in order to start impeachment proceedings, but they’ll invent something to bypass the democratic process. They are not prepared to wait until the next election.

I see the S&P downgrade as and intentional part of creating this fertile ground. I don’t think these rating agencies work in isolation.

As for the question if there’s a Corbyn-like figure waiting in the wings? Of course there are, but they can mainly be found in the PSOL party, which is tiny. In any case, it’s irrelevant right now. The pressure is coming from the other side and it will take a miracle to defend the little bit of progress that has been achieved over the last decade, or so.

Seen any sign of NED there?

DeHaan, you sound like you don’t have a clue what life is like in the large cities for the so-called middle class in Brazil. Husband and wife both work and have to find a way to get kids to daycare or have someone come in and stay with them. They live in tiny apartments. They spend hours and hours in traffic or horrible public transportation. They work all the time and come home late exhausted. What privileges do you think they are losing?

If they wouldn’t have taken it upon themselves to compete with and lord it over the working class, I’d have some sympathy for them and their precious pwofessional bourgeois lifestyles. As it is, let their employers work them 23-hour days until they drop out of society.

Tenney, I’m a member of the São Paulo so-called middle class.

The critique on Roussef’s government in the article is that it isn’t left-wing ENOUGH. If it were, it might have deeper public support.

Agreed. And mistakenly Felipe also puts that the government should have a guaranteed emplyoment program. Don’t forget that Brazil already have more than enough of bad social programs like Bolsa-familia, bolsa-preso, bolsa-droga, bolsa-travesti, etc. so much that people who benefit from those don’t wanna work at all, why would any one elect to participate in a guaranteed working program. Just to make a point I’m not agreeing with S&P by no means and for sure there’s a political agenda in their timing, although it can be justified for political instability and economic outlook.

Fernando, no, these social programs have actually been very successful, widely acclaimed as such, and relatively cheap to bring many families out of poverty. It’s that old and tired argument that people enjoying even minimum social benefits just to survive don’t want to work at all. In fact, they’ve been so successful, especially in the traditionally poor north-east, that it became a real challenge to the opposition and hence the traditional media outlets (globo, estadão, etc.) started undermining these programs in people’s perception of them as vote-buying assistentialism and therefore government abuse and mismanagement of resources, a view widely held in São Paulo, but nothing is further from the truth.

Of course, the definition of “successful” is always contingent. People talk about unsuccessful social programs but there is very little focus on crony capitalism or military spending or the like.

How about offering the jobs and *see*? Tough to work if there aren’t any.

All very well in theory and I would be the first to support a move to the left. There’s so much to be done here. I agree that the PT government party has marginalized its traditional grass root support on the left and left itself vulnerable. But the public ‘mood’ and political reality is not at all conducive towards a move to the left. It is scrambling to defend against the reactionary forces on the right. The chance was there during the Lula administration, with massive popular support, but currently the government is an emperor without cloths and facing a hostile senate and congress. PT is in no position to make a radical move to the left. Tanks would be rolling in the streets soon. Not kidding.

Even if Brazil paid its foreign debt in full, financial interests might have another bomb to throw. How much domestically denominated debt was issued through Wall Street and is subject to the jurisdiction of SDNY and the 2nd Circuit? How much of that debt has trigger clauses that include such events as, oh say, rating downgrades? Brazil is going to end up in the same fight as Argentina.