China’s great success as a significantly controlled economy is foundering for similar reasons to that of the last great Asian success story, Japan, which also had a model of central guidance and in many ways, even less economic integration that China has shown in recent years (Japan’s domestic market was famously impenetrable to foreigners even after the West demanded the dismantling of import barriers; Japanese consumers simply did not want and 30 years later are still suspicious of foreign goods).

Japan had financial liberalization forced on it by the US in the 1980s, which wanted the world made safe for America’s investment banks. Japanese banking was deregulated rapidly, and Japanese banks, lacking the skill to manage complex new risks, blew themselves up in remarkably short order (admittedly aided and abetted by the Bank of Japan, which though that stoking asset appreciation would create a wealth effect that would increase domestic consumption).

The Chinese variant of this story is that China’s evolution from an economy with restrictions on capital flows and a controlled currency to one that is more open is deemed to be both internationally and in China a sign that China is “maturing”. But we’ve been skeptical of the conventional wisdom that leaving economies open to the free movement of capital is all that it is cracked up to be. This view was confirmed by an important 2011 paper, Global imbalances and the financial crisis: Link or no link?, by Claudio Borio and Piti Disyatat of the Bank of International Settlements, which ascertained that America’s capital flows were a stunning 61 times greater than trade flows, and argued that a major driver of the crisis was excessive financial elasticity. Similarly, in their study of 800 years of financial crises, Carmen Reinhart and Kenneth Rogoff found that higher levels of international capital flows were strongly correlated with more frequent and severe financial crises.

For instance, consider an article today from the Roubini Global Economic Monitor, which takes a conventional view of China’s actions. Notice how the loosening of government control over financial markets is seen as “reform” and China is depicted as having to navigate a tricky path between continuing with assumed to be salutary reforms and managing growth, which until recently, was applauded internationally as a great Chinese success and has been key to the legitimacy of the current regime:

Market-Oriented Reforms Versus Stability Concerns

Chinese authorities continue to struggle to find a balance between growth and reforms and to communicate these policy positions, something we highlighted as a risk in our IMF Trip Report. The latest evidence shows that policy makers have restarted reforms, particularly in the financial sector, and allowed some stabilization policies to expire, which added to pressure on local markets. We believe policy makers remain focused on supporting growth while making reforms on the margin, which will perpetuate financial volatility. Two key reforms have added to this volatility:

• The PBoC liberalized the FX reference rates in August, disclosed the weight of the currency basket that the Bank claims to target in December and reduced FX intervention. These are positive moves, but the lack of clarity on the rules through which they are implemented has created uncertainty and allowed market actors to consider CNY a one-way bet.

• Stock-market measures have exacerbated concerns. The State Council approved a stock-market circuit-breaker system in December and put it into effect in January in a bid to dampen market volatility (clearly this move has not had the desired effect). Other support mechanisms were set to lapse, putting pressure on large actors to sell. Meanwhile, the National People’s Congress on December 27 authorized the government to implement IPO registration reforms, which will take effect in March, increasing the supply of shares.

These moves support the reforms laid out in the Fifth Plenum of the 18th Communist Party Central Committee, reinforced by China’s desire to promote the international use of RMB (including in the IMF’s Special Drawing Rights basket). In addition, top leaders have consolidated their political power and are in a good position to withstand anti-reform pressure from recalcitrant interest groups

Yves here. Keep in mind that I am not saying that China’s old economic model was sustainable. We’ve pointed out repeatedly that no large economy has made the transition from being export led to being consumption led without experiencing a major crisis.

But what is striking is the degree to which China appears to be in denial that it can’t have more open financial markets and maintain the same degree of control over the economy that it once enjoyed. And it isn’t that it’s objectives have tensions between them. They are contradictory. And the lack of understanding of the position it is in has the potential to lead to more self-inflicted damage than if it had a better grip on the internal inconsistency of its aims.

Ambrose Evans-Pritchard of the Telegraph has a new article that is the best one-stop shopping on the state of play in China that I’ve seen in the last few days. One of its most important observations is a throwaway in the middle of the piece:

George Magnus, from UBS, said Beijing is trying to reconcile impossible objectives. “They don’t want any tightening. They are trying to keep interbank rates as low as possible,” he said.

In economic parlance, it is the Impossible Trinity. No country can have an open capital account, a managed exchange rate and sovereign monetary policy. One must give.

So what are the things that China is trying to achieve that can’t work out?

As we reminded readers yesterday, economists Victor Shih has warned in 2011 that capital flight by China’s emerging wealthy could precipitate a financial crisis. China’s liberalizing capital mobility has helped that happen.

As Evans-Pritchard explains, China muffed the handling of how it shifted from a dollar-based currency peg to a trade-weighted one in December, spooking domestic investors. China went through an estimated $140 billion in foreign exchange reserves trying to defend the currency. That’s more than double what it has ever spent in a month.

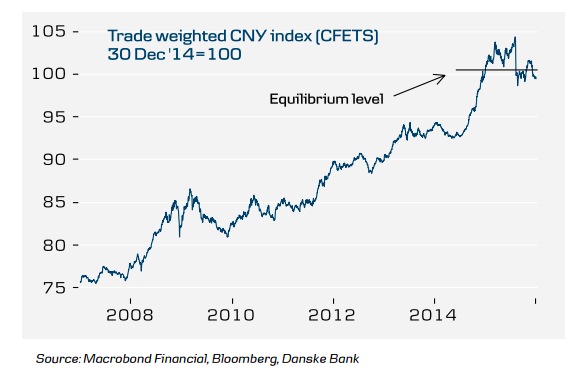

Stop here. Many assumed then and still that China really wants a cheaper currency, and the effort to support it was all optics. But there are reasons to question the assumption. While one generally has to take what central banks say with a fistful of salt, the PBoC has a point when it stresses that China is running a trade surplus of close to $600 billion a year and doesn’t need a cheaper currency. And there is a big reason for China not to want the renminbi to fall all that much. Many domestic companies borrowed in dollars to take advantage of the much lower interest rates. If the Chinese currency falls too quickly, the economy would be hit by a wave of bankruptcies, more than offsetting any trade gains. Economonitor, like Evans-Pritchard, sees the Chinese government as genuine in saying they don’t want a weaker currency right now. Economonitor suggests if anything they might like some volatility to punish speculators who are betting on further declines. The renminbi was allowed to soften in 2015, since it had risen due to its tie to the greenback against other currencies, as this chart from the Telegraph shows:

Here is where we get to China’s bind. China is less able to fight the currency impact of capital flight than one might think. Even though China has $3.3 trillion of foreign exchange reserves, the IMF deems $2.6 trillion to be the prudent minimum given that China also has dollar liabilities of $1.2 trillion (notice the cost of seeking international stature? China is now hostage to foreign benchmarking). But this is the bigger, more fundamental contradiction:

The central bank still has the clout for a shock-and-awe blitz to defend the yuan, but this entails serious costs. Reserve depletion causes monetary tightening, compounding the economic downturn. It is the exact opposite of the boom years when China accumulated reserves, causing the economy to overheat.

It can, in theory, offset this by cutting the reserve requirement ratio for banks (RRR) all the way down from 18pc to 5pc, where it was during the banking crisis in 1998. This would inject $3 trillion of stimulus. Yet to do this would weaken the currency, accelerate the exodus of capital, and trap China in a vicious circle…

In trade terms, China does not need to devalue, and it would not help much. The trade share of GDP has fallen to 41pc from 65pc a decade ago as the country moves up the economic ladder. Yet it needs internal stimulus to keep a hard-landing at bay, and that cannot easily be achieved if credit policy is kept tight in order to defend the exchange rate. Beijing will have to choose.

And as the piece concludes, contrary to the assumption of some commentators, China is using yet more debt to stimulate the economy:

Jonathan Anderson, from Emerging Advisors Group in Shanghai, said the latest burst of stimulus – led by an 18pc rise in credit – is clear evidence that Beijing is unwilling to take its medicine and deflate the country’s $27 trillion loan bubble. “The debt ratio is rocketing upwards. China is still adding new leverage at a massive, frenetic pace,” he said.

“The authorities have clearly shown that they have no intention of addressing leverage problems. Our new base case is that the Chinese government will simply let the debt party go on until it eventually collapses under its own weight,” he said. `

As Bette Davis said, “Fasten your seat belts. It’s going to be a bumpy night.”

Update 6:55 AM: Just as this post was scheduled to launch, I saw the new lead story at the Financial Times, China steps up capital controls to stem outflows. The officialdom has recognized that, at least for the nonce, that more liberal capital movement and being able to control its foreign exchange rates and monetary policy don’t mix. The move to impose capital restrictions also confirms the point of view that China is not keen to have its currency depreciate. Letting domestic investors move their money overseas would continue to put downward pressure on the remnimbi and give China cover if that was what the government wanted to happen.

China is ratcheting up ad hoc capital controls to stem accelerating capital outflows, with banks restricting dollar purchases amid fierce demand from households and companies.

The foreign exchange regulator has provided verbal guidance to banks in Shenzhen instructing them to limit dollar buying by individual and corporate clients, according to a person with knowledge of the situation.

The official Shanghai Securities News cited client managers at banks in Shenzhen including Industrial and Commercial Bank of China and Bank of China as saying that demand for US and Hong Kong dollars had increased sharply since the start of the year. Chinese residents are permitted to buy up to $50,000 annually, with the quota resetting at the beginning of the calendar year. “They’re focused on Shenzhen and Shanghai because that’s where demand has really spiked,” said the person…

The latest tightening comes after the central bank temporarily suspended some foreign banks in China, including Standard Chartered, Deutsche Bank and Singapore’s DBS, from conducting certain foreign exchange transactions designed to arbitrage the gap between the onshore and offshore renminbi exchange rates. All three banks declined to comment.

Chinese importers and exporters have long been sensitive to shifting exchange rate expectations, calibrating their foreign currency management accordingly. What is new, traders and bankers say, is the increased demand from households…

Online foreign exchange settlement at multiple banks have suffered temporary outages or slow response times as demand from retail customers overwhelms their capacity, Shanghai Securities News reported.

At a mid-sized bank in Shanghai, customers are restricted to buying $5,000 in foreign exchange per day unless they make an appointment in advance and $10,000 per day if they do, with no more than three appointments allowed per week, the paper reported.

China has this balancing act, which is really a product of their own unique economic model. China’s economy essentially rests on 3 stools: one is the old Communist, command-style economy which is still roughly half of China’s GDP. This is comprised largely of the old “white elephants”, the State Owned Enterprises. 2. Is the Japanese/Korean model, whereby the state directs investment into particular areas and does this through the aegis of private enterprises. It’s the old Japanese “MITI” model, where the state essentially targets priority sectors (such as clean tech – solar power) and uses the state’s investment to drive down relentlessly the input costs and make the resulting product cheaper and cheaper as it is sold on to the global export markets. They did this in solar so successfully and it’s one of the reasons why solar costs have gone down so much. Essentially, here the state acts as “loss leader” as it tries to develop national champions. 3. is the “wild west capitalism”, which has been manifested in things like property speculation, “wealth management products”, the shadow banking system, etc.

China is trying to curb the excesses of the latter, but if it attacks this too aggressively, it risks setting in motion a huge debt deflation dynamic. This is especially dangerous, given that capital expenditure is about 45% of GDP (a huge historic number, although it was as high as 55% a few years ago – by way of comparison, during Japan’s bubble years, capex as a percentage of GDP got as high as 24%, and that was considered historically unprecedented. The US capex as a percentage of GDP is around 15-17%). So when the debt deflation moves into action, China mobilises its SOEs to do “something” no matter how economically unproductive, in order to arrest an incipient debt deflation. And I think they are doing this again and that’s also the reason why they are allowing the Yuan to decline somewhat (they did the same thing between 1992-94 and wiped out Southeast Asia in the process).

And because China still has large foreign exchange reserves, and comparatively small foreign debt, they can do this for a while longer. So I think China will continue to export deflation to the rest of the world, but the rest of the world is more vulnerable than China in many respects. China might end up being the “last man standing”

Good stuff, Mr. Auerback,

My question, is in regards to your below remark, which I agree is probably more or less accurate.

“And I think they are doing this again and that’s also the reason why they are allowing the Yuan to decline somewhat (they did the same thing between 1992-94 and wiped out Southeast Asia in the process). ”

So, which ‘dominoes’ are likely to get impacted the most by this policy? Will SE Asia get hit again? They won’t be vulnerable as they were in 1997-8 as they don’t have fixed exchange rates with large CA deficits. How do you think this plays out downstream? In other words, who suffers and how much from China’s domestically minded policy?

quick question: if China is mobilizing its SOEs isn’t that analogous to the US deciding to stimulate the US economy with a jobs program – money spent directly into the economy? And foreign exchange variations mean little because if you produce what the rest of the world actually needs, they will come.

The worry is that their SOE’s are like our military-industrial complex corporations.

And perhaps they will come when you produce for the world, but those in tainted foodstuff production will suffer.

Good comment.

I read the article, read your comment, and the following comments, in an attempt to understand what it was that was Unique about the Chinese model. I am obviously not understanding this. I am looking at this from an on-the-balance view of both the US and China’s economies, and given the part our government plays in protecting and subsidizing our economy it sort of becomes a wash (once again, in my view).

What it appears to be is an effort to force China to liquidate a portion of their creditor status.

You know wrapping TBTF derivatives’ exposure in an FDIC gaurantee to sidestep margins calls and credit downgrade doesn’t necessarily pass the Free Market smell test.

Of course there are the agri-subsidies, and defense appropriations, and other assorted nonsense that, if not implmented, would have rendered the US a considerably lesser economic power.

Perhaps only someone well down in the 99% could make this assumption, but many of us could not imagine shipping our money and ourselves overseas. As much as America pisses me off on a regular basis, and disgusts me from time to time, it is my country and I’ll be damned if I’ll let Jeb, Donald, and Hilary chase me out. So perhaps what is so startling is the number of rich Chinese who are ready, willing and up until recently able to move their money (and tentatively themselves) out of China. I think most Westerners see China as an ancient, self-involved and self-contained world unto itself. We forget about the huge number of Chinese merchants who over the centuries got up and left for Vietnam, Indonesia, Thailand, Malaya, and later the United States. Outsiders like myself imagine the cultural and emotional ties that the Chinese feel for China are a mirror image of those we feel for our own countries. Perhaps this is one of the false notions that have surprised both us and the CCP.

How are you going to ship USD out of the USD currency zone? The only way to do that is through cash (which supply is controlled by the government, so no way trillions of USD would be “flying” everywhere), good luck with billions or trillions of USD moving away elsewhere in the planet. Is the same for any other currency zone.

Capital “flight” is a bogeyman created to scare politicians and their voters, except for the EMU which isobviously an exception (different nation states, w/o a common Treasury and fiscal authority, with a common currency, where there is freedom to move financial capital between the states, this is pretty much an unique arrangement in the world right now).

Biz interest would love a world wide EMU, but that’s not the point we are at, hence any allegation to capital flights should be carefully examined (how large is the debt of that country in other currency-zone denominated currency, how large are the forex reserves, how far do you believe the other parties are going to go to provide liquidity, is important to remain that allowing capital “flight” as an huge REAL political and social cost (ie. labour market, export biz interests, etc.) something you will often see happily being ignored by media and analysts.

Is not as linear as they make it appear, nothing usually is.

Your observation reinforces what some of us here on the (American) Gulf Coast learned after Katrina; it’s not race, it’s class that matters. The new ‘Jet Set’ owes allegiance to money alone, not King (Emperor) nor Country, nor Land of our Fathers’ Pride. For now, the ‘Neo Best and Brightest’ have some control over the fates of nations. You of all people should appreciate that if the wealthy classes don’t read and learn from History, they soon will become History.

If you are wanted in Russia, but have a lot of money, you can go to London.

If you are wanted in China, and have a lot of money, you can go to Australia or come here.

If you are wanted here, they will get you anywhere in the world…eventually.

You don’t have to be chased out. You will be kept here.

This is a giant generalization based strictly on anecdotal impressions. I’ve traveled a reasonable amount, and almost everywhere I’ve gone, I’ve seen both Chinese and Indian merchants in a huge range of countries. Said merchants have often been in that particular country for several generations.

What made the Chinese and Indians leave their native lands? I assume it’s similar impetuses/causes that led many people from a huge range of nations to migrate (whether legally or not) to the USA.

Nowadays, many of my friends kids from the USA are leaving here to work overseas in a variety of countries. Some will stay and some will return.

People go, if they can, where opportunities are.

1% USA “citizens,” otoh, hold no allegiance to this once great nation, at least not anymore (if they ever did). Their sole allegiance is to themselves and their money, which they can shift at will around the globe. The 1% from China are not much different from the 1% from anywhere else.

Money cannot fly outside of their currency zones, is not like in the EU where Greek euros can be ‘converted’ immediately to German euros. The ‘renmibi’ currency zone is (mostly) mainland China, there is no where capital can “flight”.

Now excessive depreciation can be a problem ofc, but in a world awash of deflation where commodities are becoming worthless, and China is anyway the one with the biggest commodity reserves in the world, this is not a problem. The only way currency can “flight” is by selling, and for any transaction there needs to be a counterpart, so is not like there is infinite liquidity and market-making regarding currency exchanges, something that anyway most states including USA won’t allow to go to severe extremes and it destroys their own labour market which is bad for political stability.

Because in the end is not about the finances, but about the politics, the biggest mistake in the ongoing situation that the western media and analysts are making is to believe that the capacity to endure pain and social risk for Chinese authorities are higher than those of the western parties.

Europe is near close to collapse, a new huge credit event, and a slowing China will destroy whatever little growth is left in the eurozone (so is similar to a credit event in this regard) will trigger political chaos in the continent (which is almost there). USA ‘recovery’ could be stop on it’s track by a too strong dollar, a credit event is going to bring down the ‘Unicorn valuations’ complex, the real estate bubbles developed in certain parts of the country, and the fracking-oil complex is already in crisis mode and blowing up.

This is a game of who is the last standing man, and the ability of the Chinese government to repress its own population overtly, while diminished due to growth of middle class, still is there, as it’s the social control over their own population, at least compared to the West, other Asian countries, or the chaos that is the Middle East.

The weakest link right now are Europe and the MENA, China could possibly force other currency regions to do the readjustment for them, before they have to do much.

*that the western media and analysts are making is to believe that the capacity to endure pain and social risk for Chinese authorities are higher than those of the western parties.

actually the other way around sorry: to believe that the capacity to endure pain and social risk for Western authorities are higher than those of the Chinese.

Money Fries. China has had the largest gold imports too. To “liberalize” financial markets, one thing they needed to do was loosen some of the previous capital controls, enabling Yuan/FX conversions. Then the entire exporter class takes payment in foreign currency, so it seems pretty easy for them to just not convert it to Yuan domestically, if they use a foreign bank. And Chinese real estate investors buying around the world have been in the news for years. The sellers aren’t taking Yuan, so there’s plenty of evidence China does leak.

Agree with CB that capital has been exiting China at the high end since the Bubble peaked a couple years ago – and that Chinese own significant chunks of the prime real estate in every major ‘Western’ city. Perhaps the question is “Who is in a position to game the rules, and get away with it?”

As an American international competitor with Japan in the 70’s and 80’s I got my hat handed to me by them from all the fraud they concocted in their own system that then spread to our system. It’s not possible to give unlimited funds to export oriented companies at phony low interest rates to export products that have artificially low export pricing so they can pay artificially low import duties around the globe. Lying, cheating and stealing, it’s what those with unlimited assets do.

I can imagine that this is what has occurred with the “China Miracle”.

I think we can look forward to China being a new Japanasium of hurt for a long time.

What is unaccountable to me is the fact that the USA developed internally first and became a net exporter of manufactured goods only after 1898. Yet everyone wants to jump on this bizarre export oriented growth bandwagon. The only nation that really led its developments via exports and got away with it for long was Britain, and they did it because 1) they were first and therefore had the largest niche to grow into, and 2) they could ride both manufactures and then capital goods as the other nations started to industrialize and needed to glom unto British machines and technology. The largest lace factory in the US (and for a time in the world) was in Scranton, Pennsylvania. There was a youtube video that showed scavengers rummaging through the place around 2000. The huge machines that produced the lace products had large plates on them: they had been manufactured in Birmingham, England in 1893! So as late as that date the USA was still importing big capital goods from the UK (the design of America’s first two battleships were also imported from the UK at that very time).

However, Britain was a one-off, an historical anomaly. You don’t copy an anomaly in the hope that you might be able to catch lighting in a bottle. You do what America, Germany, and France did. Why countries would buy the ideological claptrap of export-oriented industrial development is beyond me.

I think you should add “3) colonialism” to your “they did it because” list. British trade was supported by gun-boat diplomacy – the opium wars being some of the most egregious. Balzac’s quote “Behind every great fortune lies a great crime” also applies to countries.

Yes, India, in particular was a big, captive source of demand. I feel like I saw a book come out recently talking about that subject. Brits actively worked hard to stop nascent industrialization in India, seizing machines and banning exports of finished products. Pushed the country hard into exporting only primary commodities.

China’s model isn’t Britain; it’s Japan and the little dragons (Taiwan, Korea, Hong Kong and Singapore), three of which are Chinese cultures that were poor fifty years ago, but are developed economies today.

JP Morgan’s Guide to the Markets (slide 44) shows exports as a percentage of GDP:

Looking at Germany — a rich, export-oriented economy — China probably doesn’t regard an export-oriented model as so bizarre.

Your point is well taken that there might be a better way to prosperity, particularly given the planet’s shifting demographics. But no one is quite sure what it is. So China sticks to Mao’s maxim to cross the river, one stepping stone at a time.

All four – Taiwan, Singapore, Korea, Hong Kong – are Confucian, and Chinese culturally, to various degrees.

You man your place in the hierarchy. Defend it.

Helpful opinion, thanks

Glad the article mentions George Magnus. There are a hundred economists having opinions about China who base themselves on the western mindset and assume everyone else is the same.

Magnus has been out there for donkey’s years and knows the relevant criteria. I listen to him.

I would look at it as the outcome of pax-Americana global corporatism – huge multinationals and networks of multinationals have created global supply/production/transport/trade chains with the power to create ‘natural’ exporters or importers and forge destinies to fit – and woe to the country that doesn’t pursue its comparative advantage with maximum possible return by exhausting its resources, its environment or its People’s sanity. China I think gambled Chinese sovereignty for access to what it believed was the core array of Western expertise. Initially, it seemed a reasonable course if pursued with great care – but they made the truly enormous error of losing perspective with success, which translated into pouring a generation’s worth of effort into building a truly giant, brand-new country on a mass urbanization model that had already revealed its fatal future weaknesses. They’ve also made themselves the Number 1 ‘threat’ to the US just by virtue of existing, ‘threat’ defined as per official US policy, and very clearly one important reason for the rapidly accelerating capital outflows leading up to the PBOC move. I’d also wonder aloud how much US and other foreign capital inflows/departure has played a part in this process going back to how wildly out of control the Chinese stock market bubble became so quickly.

China should’ve gone for capital controls long ago. It should also ditch the ‘liberalization’ of markets entirely and concentrate on its Asian/African/European opportunities rather than waste precious resources attempting, like Japan, to play a better game than the US only to see its future toileted when the US simply broke the rules.

“We” did slowly learn from the Jap Miracle, Korean Miracle and Asian Tiger Miracle. “Our” multinationals needed to become multinational importers before Chinese companies could develop into global marketeers.

Problem solved, for some.

One unknown quantity is the amount of “dark money” the Chinese public has stashed under mattresses and whatnot. If it is greater than American public debt risk exposure, they might still have the upper hand.

In any case, if their “failed” economy is still forecasting 5-7% growth projections, that will still more than many others can boast!!

Thanks again for articles and insights. Still watching this situation as it develops. NC, of course, is the best at getting towards what’s really happening. And how it might shake out, and what the impacts might be.

Re: … “Many domestic companies in China borrowed in US dollars to take advantage of the much lower interest rates. If the Chinese currency falls too quickly, the economy would be hit by a wave of bankruptcies…”

As I understand this, a significant part of what we are seeing is the unwinding of currency carry trades which Chinese borrowers undertook expecting continuation of the US dollar currency peg. They borrowed dollars at relatively low interest rates, putting the loan proceeds into speculations in yuan assets and commodities that they speculated would provide them gains above the interest on the debt.

Instead of gains, however, yuan assets and commodity prices have fallen, and the related asset liquidations and sales of yuan by borrowers to buy the dollars necessary to meet their debt payments appears to be a major factor driving down the prices of Chinese stocks. Those stocks are in turn collateral for other loans. Hence, the Chinese government imposed stock market circuit breakers in an effort to put a floor under stock prices (which have now been lifted).

Defense of the yuan in an effort to protect their borrowers from default due to foreign exchange differences is causing the PBoC to sell their foreign exchange reserves, a portion of which are invested in US Treasury bonds.

https://twitter.com/SoberLook/status/685338355521970176

I am likely missing some aspects of this, but it doesn’t seem to me that this will end well.

Good piece and comments, thoughI think taking pot shots at the Chinese ‘policy errors’ coming from AP and others is a bit rich given the unvarnished version of what goes on in the City, BoE, Wall Street, the Fed et al, the new Gang That Couldn’t Shoot Straight – just like the old Gang! – that has so thoroughly muffed it by knowingly enabling, again, the absolute worst of the ‘cowboys’ engaged in the mega-looting of nations – and hollowing out major US corporations – via debt traps and more explicit disaster capitalism as it’s played out globally – recall all that talk about shale oil, big Agra ideas, etc in the Ukraine? Could Iraq have been attacked and destroyed if it hadn’t possessed massive oil resources?

Anyway, having gotten themselves into such a serious mess, I think China had no choice but to hit the brakes in an effort to regain control and slow things down. They ought to, for their own good, lower their growth targets substantially and shoot for being more or less ‘static’ within the next decade, unless there is a decisive technological development that gets us completely off the fossil fuel cycle, averting not just Climate Change dangers, but the all of the toxic implications of all the products and processes.

China’s future will be decided over the next several years – and I think they will choose a smaller , longer-lived China capable of holding itself together while the US and West ride off into madness.