Yves here. On the one hand, I’m a bit reluctant to link to a site that says it is part of the “liberty network.” On the other hand, libertarians and progressives teamed up successfully on Audit the Fed. Plus there are a few readers who describe themselves as libertarians, but when you press them to explain their views, they often differ from libertarian orthodoxy. So I am suspending my usual reservations on this issue, since this post has some merit, and we’ll see how this writer, who looks to be new to blogging, evolves.

Nevertheless, there are a couple of points to keep in mind. Being the reserve currency issuer is not the boon the author presents it to be. The issuer inevitably winds up being a net importer to keep currency in circulation abroad. Being a net importer means you are using your demand to employ people overseas. Other countries seek strongly to be a net exporter because they recognize that providing an adequate level of employment is key to social stability.

The burdens that go with being the reserve currency issues is a big reason why China is unlikely to be willing or able to step into that role any time soon. The government, more so than in other countries, depends on preserving employment and wage growth as key to its legitimacy. Running the needed trade deficits that go with being a reserve currency issuer is anathema to that prime directive.

By Séamusín Reilly. Originally published at Convergent Interests

On December 16th, 2015, Federal Reserve Officials announced that after 6 years of 0% interest, they would finally raise the Federal Fund Rate. The move was seen by many as an attempt to provide markets with a boost of confidence. Although markets initially sold off on the news, they have in fact rebounded back to normal levels. Still, the question of whether or not the US economy is strong enough to maintain levels of growth has yet to be answered. Washington’s privileged position as issuer of the global reserve currency has allowed for an unprecedented monetary expansion with relatively low impact on global financial markets. Instead of consuming its own inflation, it exports it to producing economies who seem happy enough to send their hard-earned wealth to US consumers for what many people consider mere pieces of paper. The result of a repeat US economic engine stall, yet another round of monetary injection, doesn’t seem likely to draw the ire of the international order that subsidizes US consumption. Any criticism of Fed monetary policy or speculation concerning its implications would be met with the usual bromides about how the dollar is still strongest among weak rival currencies.

The Dollar’s much coveted and seemingly unshakable position as global reserve currency has caused many to speculate on the true nature of its relationship to US foreign policy and global international affairs. Washington’s ability to run massive deficits in the face of minimal international pressure compel many to believe that the US is somehow holding the world hostage. Lending credibility to this view, US military interventionism in Iraq and Libya, as well as an aggressive posture towards Iran, all happened to coincide with the governments of those countries adopting anti-dollar policies. Ever a popular villain in conspiracy mythology, the Fed is said to be a front operating at the behest of an international cabal of bankers hell-bent on controlling the world through a one world currency. In this scenario, the US government is painted as simply the enforcement arm of its puppet masters on Wall St.

Just What Is A Petrodollar?

This shortsighted view of international politics comes equipped with some anecdotal evidence. On August 15th, 1971, then President Nixon closed the gold window. This move was precipitated by a negative balance of payments from twin deficits resulting in diminishing Fed specie holdings compared to a 3 fold increase of foreign exchange reserves in foreign vaults accumulated during the Bretton-Woods era. In an attempt to prop up the Dollar, Nixon entered into a series of arrangements with top oil producing nations to limit their sales to dollar transactions. The most egregious misconception about these agreements is that somehow the dollar became a sort of commodity currency, but with the adoption of global fiat, the US had no reason to protect the dollar’s value. It did, however, have an immense need to finance ever growing deficits.

With the adoption of dollar denominated sales, oil producing countries had surplus dollars that they used to invest in banks which in turn lent the petrodollars to the US to finance its budget deficits. This is the scheme, and it doesn’t get any more dramatic than that. The goal was never meant to create dollar demand by backing it with oil, but simply to ensure there was adequate demand for US debt by flooding Iranian and Saudi treasuries with so many dollars that they couldn’t be used in any other way. Leaders of the West realized that the economic system established by Bretton-Woods was no longer sustainable without close coordination by central banks. In 1975, the G7 forum, which was largely designed to organize Western efforts after the 1973 oil crisis, began using the forum to coordinate fiscal and monetary policy protecting the Bretton-Woods institutions that had become so valuable to western economic dominance.

With the adoption of dollar denominated sales, oil producing countries had surplus dollars that they used to invest in banks which in turn lent the petrodollars to the US to finance its budget deficits. This is the scheme, and it doesn’t get any more dramatic than that. The goal was never meant to create dollar demand by backing it with oil, but simply to ensure there was adequate demand for US debt by flooding Iranian and Saudi treasuries with so many dollars that they couldn’t be used in any other way. Leaders of the West realized that the economic system established by Bretton-Woods was no longer sustainable without close coordination by central banks. In 1975, the G7 forum, which was largely designed to organize Western efforts after the 1973 oil crisis, began using the forum to coordinate fiscal and monetary policy protecting the Bretton-Woods institutions that had become so valuable to western economic dominance.

Due largely to competing economic interests by the countries represented, their ability to stem an economic unraveling was initially ineffective. By 1978, US inflation had risen to 9% while inflation in the rest of the world slowed dramatically by comparison. Both the Carter administration and the Fed did everything in their power to control dollar devaluation, but it was clear by this time that without the assistance from foreign governments the dollar would not be able to survive. By fall of that year, assistance manifested itself in the form of Carter’s Dollar Defense Package (Page 101). Governments of Germany, Japan, and Switzerland assisted in the monetary intervention. IMF special drawing rights were reintroduced after an eight year hiatus and swap lines were created to bolster the US position.

Reagan’s Strong Dollar and the End of Petrodollar Importance

Over the course of the next six years the dollar experienced a meteoric rise in value. While it’s hard to fully attribute the causes of dollar appreciation in the early 80’s to any one particular factor, a convergence of fiscal and monetary policy decisions by the Reagan administration and Western leaders played a key role. A sharp rise in dollar interest rates, along with deregulation of financial markets and tightening fiscal policy abroad, gave the dollar the necessary juice to fuel its ascent. Efforts by Western financial officials were so successful that the dollar even became too strong. By late 1984 the dollar was considered to be highly overvalued and blame for budget and trade deficits were laid at its feet. The global reserve currency began a slight descent in the beginning of 1985, but there was little effect on US trade deficits which were still having a severe impact on US manufacturing. In the later part of the year, western financial heads met once again to closely coordinate their efforts to bring about an orderly depreciation and ease US political pressure.

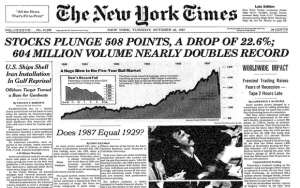

Despite the best efforts of the world’s central banks, monetary intervention failed to shore up the US trade deficit and preceded a dramatic distortion in the structure of the global economy, culminating in the stock market crash of October 19th, 1987. As wealth evaporated around the world, all eyes turned towards the newly appointed Fed Chairman Alan Greenspan, who was all too eager to affirm the “readiness to serve as a source of liquidity to support the economic and financial system.” Notwithstanding his domestic interventions, it wasn’t until the G7 issued a combined statement in December of that year assuring that international policy intentions would indeed be synchronized, that markets began to stabilize. By 1988, instability in foreign exchange markets was dissipating. The crisis was essentially worked through. The result was the inception of a new, highly organized global financial system built around the almighty dollar, ensuring its hegemony. The financial power block known simply as The West had reached its maturity. From this point on, US debt would be subsidized by coordinated actions from the worlds central banks, rendering the petrodollar irrelevant.

Despite the best efforts of the world’s central banks, monetary intervention failed to shore up the US trade deficit and preceded a dramatic distortion in the structure of the global economy, culminating in the stock market crash of October 19th, 1987. As wealth evaporated around the world, all eyes turned towards the newly appointed Fed Chairman Alan Greenspan, who was all too eager to affirm the “readiness to serve as a source of liquidity to support the economic and financial system.” Notwithstanding his domestic interventions, it wasn’t until the G7 issued a combined statement in December of that year assuring that international policy intentions would indeed be synchronized, that markets began to stabilize. By 1988, instability in foreign exchange markets was dissipating. The crisis was essentially worked through. The result was the inception of a new, highly organized global financial system built around the almighty dollar, ensuring its hegemony. The financial power block known simply as The West had reached its maturity. From this point on, US debt would be subsidized by coordinated actions from the worlds central banks, rendering the petrodollar irrelevant.

Dollar Dominance

The impact of Nixon’s petrodollar agreements on US foreign policy have been largely overblown and remain a distraction from the true nature of US imperialism. Dollar hegemony remains at the forefront of US international policy, but it isn’t through specific instances of US military action that this policy is manifested. Instead, it is the entrenchment of the global financial system in the developed world and the vested interest that Western leaders have in the status quo that keeps the system afloat. The US empire is one of Multi-National corporations and International Trade Deals. For these reasons, European central banks and foreign governments act in their best interest when they collude with the Federal Reserve to lend much needed support to the US dollar. This collusion, not the much misunderstood petrodollar, is dollar hegemony fully manifested, and remains a key aspect of western dominance of the global financial system to this very day.

Shortly after Washington began following through with a yearlong promise to reign in its latest quantitative easing program in December 2013, Belgian treasury holdings skyrocketed by 141 Billion dollars over the course of the next four months, giving the dollar the support it needed to wean itself off of the monetary injection. It is likely that the ECB was the covert buyer of these treasuries, using a Belgium based clearing house called Euroclear as a front. This quid pro quo is business as usual for Western central banks. In 2011, when the Greek sovereign debt crisis first made its way into the news, it was reported that the US central bank was engaging in its own covert bond buying program. In April of 2015, as a first quarter contraction in the US hinted at a possible recession, the ECB began a round of quantitative easing for themselves, once again shielding the rickety financial system from experiencing the type of turbulence that might knock the whole thing off its hinges. This type of coordinated behavior by western central banks has been routine throughout the modern era. The interconnectedness of the global financial system demands as much. Central banks all over the world; all using each other’s foreign reserves to back their own monetary expansion. The need for ever more financial support perpetuates itself.

It is not dollar hegemony that rules the world, but the global financial system which gives the dollar its place of privilege. Instead of sovereign states, these member nations of the G-7 are no more than special interest lobbies jockeying for use of the United States and NATO military machines. Not to suggest that they don’t exert a sizable amount of influence over US foreign policy, as demonstrated by the intervention in Mali, Libya, and Syria. The “West” often acts in concert and for shared economic goals. The clearest recent example of this is the deteriorating relationship between Russia and the West. During the winter of 2013, Ukrainian president Yanukovych backed out of a 15 billion dollar deal with the IMF in favor of a similar deal offered by Russia. Within a few months the US brazenly backed a coup to see his pro-Russian government overthrown. US deputy secretary Victoria Nuland handpicked former head of the National Bank of Ukraine Arseniy Yatsenyuk to assume the role as Prime Minister. A month later the IMF readied an 18 Billion dollar bailout package which the new Ukrainian government promptly agreed to. Russia responded by seizing the former Russian territory of Crimea which was met with harsh criticism and sanctions by Europe and the States. Although the policy was meant to be seen as a response to Russian aggression in Eastern Europe, the ironic truth was that the entire policy began an organized attack on the Russian economy by the west.

Facing pressure from Brussels, by the middle of 2014 the Bulgarian government halted construction on a Russian pipeline meant to bring billions of dollars in natural gas into Europe. When Russia responded by negotiating construction of the pipeline through Turkey, and then through the Balkans, US taxpayer-funded NGOs began fomenting what looked be another color revolution, this time in Macedonia. The citizenry responded en masse.

Over 100,000 anti-coup Macedonians took to the streets on May 18th, demonstrating their support for their current government. The Macedonian coup may have been defeated, but the event highlights the strategic partnership between the US and EU in shaping geopolitics of the region.

Still, the ability of the United States to influence global politics has declined dramatically over the years.

Until recently, the US intelligence and military machine could reliably persuade any foreign government of any policy seen to be in the interest of the US and its allies, but cracks in the foundation began to show during the Arab Spring, where US puppet states in the Middle East were pressured into reform by their civilian populations. The US backed opposition to the Syrian regime has had minimal successes, and the puppet government of Yemen has been ousted by a marginalized militia who has since maintained control of the capital city.

The most recent defection by western puppet states from the international order has been Turkey. While presumably disenchanted by US inability to secure a Middle Eastern oil pipeline from Qatar through Syria, the NATO member instead began to cozy up to Russia, who has doubled down on its resistance to Western pressure. Russian-Turkish relations have since deteriorated due to competing interests in Syria, but this turn hasn’t necessarily pressured Turkey back into its traditional role as Western puppet.

Instead, it has been reported that Turkey is exercising an independent foreign policy aimed at achieving its own geopolitical goals. Not surprisingly, Western media outlets have begun reporting that it may be time for the current regime to go. This turn is more substantial than it first appears. Turkey, a NATO ally and loyal Western ally is not a typical run of the mill western supported fascist dictatorship. The fact that after 50 years of US subservience the nation has begun to shake of the chains of Western control, demonstrates deeper cracks in the foundation of Western dominance.

Further east, former G-8 member Russia’s reluctance to concede Ukraine and its pipeline in the face of Western sanctions has been particularly burdensome to Western officials. Instead of compelling Russia to accept Western terms, Western policies have caused the Kremlin to warm relations with China, whom the Russian people see with increasing favor, and with whom Russian President Putin has recently entered into a security partnership, alongside Pakistan and India. Additionally, the opening of the BRICS New Development Bank is seen by many as a potential rival to the Bretton-Woods institutions and a threat to dollar hegemony. Russian Foreign Minister Sergei Lavrov says the multilateral organization “illustrates a new polycentric system of international relations”. This challenger to the financial status quo is very clearly meant to strip the West of global financial and political dominance.

While BRICS nations make up 40% of the world’s population, the G7 still controls over 40% of the global economy. It isn’t probable that this new polycentric political arena will have a tremendous impact on the position of the dollar in the immediate future. With 30% of the total US foreign treasury holdings being used as reserves for their own unsound monetary systems, it is unlikely that the BRICS are interested in seeing a dramatic shift in the dollar’s value. More importantly, multinational corporations capitalized in dollar denominated assets exercise a tremendous amount of political power, even in those countries furthest removed from the tip of the modern uni-polar world. There is no doubt, however, that the intention of this new power block is to liberate itself from dollar supremacy.

Thanks for the article Yves, interesting read. As to your opening observation that “reserve currency status” brings with it a burden is so true. It makes one wonder why any country would want the hegemonic “privilege”. Maybe its just tied to the delusions of “empire”. There is nothing new under the sun.

Seems logical that the world may gravitate back around to using gold as the “reserve-currency/asset” of choice again. Gold doesn’t care about employment, social stability, religion or politics, it just remains the same, its nobodies debtor, or conqueror. Every country could devalue local currency against it and it wouldn’t notice, start a trade war or a hot war either.

Will history rhyme again?

I’m intrigued by that assertion, especially if this comes from a more libertarian perspective and an author who actually mentions NATO. Of course corporate welfare in various forms is a key part of what is happening, but the core issue is a literal military empire, not some vague commercial facsimile of one. One of the most successful Big Lies in our domestic political discourse is to blame convenient corporate villains instead of the public officials who are responsible for decision-making and implementation.

This isn’t the 1980s anymore. The global financial system (post Bretton Woods) collapsed somewhere there in the 1990s. Today, things are held together by direct imperial threats, not corporate board rooms.

The direct imperial threats include economic warfare, as displayed by the IMF and ECB.

As demonstrated in Greece, Ukraine, and before Greece Ireland.

Wash – You are sorely confused. The fact that “the public officials” you speak of are actually being pressed to wear corporate emblems on their suits sized to reflect the level of financial support given should be all that needs to be understood to refute your assertions.

Also that quote you put up is all you & Yves need know about why being an importer rather than focusing on exports is the name of the game.

That’s actually what my pseudonym refers to – the need to cleanse our leadership class of those corporate emblems. [It also contains a playful, not so hidden message for our freakout-friends on the conspiratorial right. It’s like the FedEx logo, once you see it, you won’t unsee it. Plus I like to eat.]

Anyway, the point here is an operational one about the system. The very fact that politicians have to be bought demonstrates that power in our system resides primarily in the formal government. Transnational corporations are not independent actors carrying out a metaphorical empire; they depend upon the actual projection of force by the nation-state. So we can quibble about how exactly decisions get made and whether Bush and Obama and Pelosi and Ryan and Cheney and Biden and countless other politicians are anti-Christs, naive puppets, hostages, mercenaries, or something else. But whatever exactly motivates those people, it is the actual USFG deploying military forces around the globe that matters. If transnational corporations themselves were the empire, they wouldn’t need the USFG.

P.S., sorry, meant to include an explicit statement on why I would argue this distinction is important. If I am right in understanding the problem that the government itself calls the shots, then our organizational task is to figure out how to put a group of leaders in place who are beholden to the ideology of the public good rather than the pathologies of corruption and authoritarianism. It’s a management issue; with different leaders, the apparatus of the state could be directed in different directions.

However, if corporations don’t merely run the place, but are the place, if we have moved from nation-states to corporate states, then a much more fundamental revolution is in order. That is a different problem to understand and calls for a different kind of organizational response. For example, it means that most of our detailed discussion about finance and monetary policy and environmental policy and so forth is irrelevant (or actually a counterproductive waste of time and energy) because all those ideas ultimately depend upon the premise that a government management structure exists with which to implement specific policy proposals.

Which is a more wordy way of addressing the basic question of ‘do elections matter?’ I accept the possibility that they do not, but once we go down that path, we embrace a moral obligation to overthrow the whole legal system and replace it with a system where elections do matter (or alternately, a system of political economy superior to elections). That’s what makes me an optimist; I think our system is not that far gone. I think that’s why there is so much energy pumped into making corporations appear all powerful and explaining away every wart of the Democrats: because the elites/oligarchs/whatever are not firmly in control.

Quite the contrary, they are in a fragile and precarious strategic position which an actual opposition political party could expose and defeat.

Washunate:

People like Janine Wedel have argued that our political system has largely evolved beyond the older, more narrow definitions of corruption in which envelopes are passed under the table to a situation of what she calls structural corruption where power is centered around the ability of key individuals to play multiple roles in a multiplicity of informal networks of influence–that are largely unaccountable–to any traditional representative democratic institutions like Congress (for example, think someone like Rubin or Summers, in economic policy formulation.

People like Michael J Glennon have argued, in addition, that the primary cause of continuity in American security policy is the existence of a network of national security officials who are essentially self-governing with virtually no accountability, transparency or checks and balances of any kind.

Our political system may be further gone than you think–which may also mean dramatically different strategies need to be devised–rather than banking on the outmoded assumption that we can steer our own government in a new direction simply by electing new officials.

Finance and national security are two of the areas where national governments, not transnational corporations, are most clearly in charge. I’m very open to the possibility that choices in these realms were forced upon political leaders. For example, maybe Obama was told his children would be kidnapped and tortured if he didn’t go along. That would certainly focus the mind of most fathers.

But that requires some kind of evidence or it’s just more excuses for why Democrats don’t actually act with the public good in mind. The simpler explanation is that our political leaders hire people like Rubin, Summers, Greenspan, Bernanke, Yellen, etc. because they will implement their desired economic policies.

Or to say it differently, it’s not me you need to convince that things are much worse. It’s much of the academic left/intelligentsia that has spent the past decade justifying every betrayal of the Democratic Party and/or proposing lofty new program ideas that require good management in place to implememt them.

“National governments are in charge of finance”. Really? You mean the “national government” that issues the USD? (Not). Or the one that distributes it broadly, evenly, and fairly for the society to use? (Not). Maybe you mean the national government that passes finance laws written by banks without even reading them? Or the national government that holds banks to a standard of justice and enforcement for all of their criminal activites?

Syllogism? What came first the chicken or the egg?

Where to begin – one could suggest the author read Chapter 1 of Wray’s MMT and rewrite considering sector balances and fiat currencies, and present the different line of argument which would arise.

I´m surprised the author is not elaborating more about the financial system. I.e how US investments abroad have resulted in a continuous negative NIIP(Net international Investment Position) since 1986(Plaza Accord 1985) and a negative current account deficit since 1977.

The dollar is also a widely used carry-trade currency. Asia i.e today have the biggest short position i dollars ever, 6 trilion usd. Dollar strength is a pretty safe bet.

You are right. I didn’t bring it up specifically. It was meant to be implied, but wasn’t clear enough. I also believe based on the z1 we are close to 12 trillion in dollar denominated assets abroad. That is an important pointy to stress as well.

Unfortunately after 2000 words people lose interest and I was already at 2500. Thanks for reading. It is really is an honor.

Thank you Séamusin. I agree it is difficult to decide how to limit an essay published on web-sites.

Another important factor making Washington power stay strong is how they use the World Bank and IMF. Concerning your comments on Ukraine it is interesting to know that IMF recently and suddenly changed the rules on how they engaged in the Ukraine-bailout. Normally(always) IMF demands that state/national debt must be repaid when granting a loan(with austarity). In the ukrainian case the loan was given without paying the russian debt. And noone is talking about this. A silent press.

In the intro: Being a net exporter means you are using your demand to employ people overseas..

Did you meant to say, “Being a net importer…”?

Agreed

Thanks, I noticed that as well.

And while we’re at it; HAD you meant to say, or did you MEAN to say, or was it your INTENTION to say.

Now it’s other’s turn to correct my post.

Ha, Ha, good catch!

others’ turn? ;-)

Unless you entice, seduce, leave no other option for the workers but to borrow, at ever lower rates, thank God.

Then, you can export jobs overseas.

Wait, that’s how we have managed so far…that, and renting out rooms/beds/bathrooms in your apartment.

And renting out cars… let’s don’t forget cars… though the people reduced to living in their cars can’t probably pay cell connect bills and keep the interior clean enough to attract the snotty Yuppies and others so many of whom use Uber to suit their pleasures on the way (they hope) to personally being Uber Alles their very own special selves…

the short sightedness of US elites, acting without concern for the eventual nationalization of all the production centers they’ve stripped and relocated overseas, is also a big factor in why we have the deficits.. mercantilism works.

You really thiink the dominance of the “neoliberal” structure is so brittle that whatever remains of sovereign entities whose residents and citizens used to identify as nations will or would ever have the cojones to nationalize all those production centers? What possible effing gain from doing that, except in the rare case of a “populist demagogue” who might raise up the necessary popular momentum to overcome all the tank traps and auto-firing cannon both literal and financial that are aimed at all the paths by which such wishfulness might dare to approach?

Mossadegh found out how things work, and Allende, and any number of other what might one call them, Solons or “statesmen” or forgive me for even using the word that has been so sullied, “patriots.” So many ways a human can be killed, or can be non-personed…

Altho the author calls the petrodollar and subsequent international maneuverings straightforward banking by the western block, I have the feeling that this “simple” system has become so uncontrollable that the West is panicked to keep it running. We haven’t cut ties with Russia, but we have ordered them to create another system with China et.al. which does not skim our profits. Sort of like we created a western economy based on western finance and they can create their own. And if non-western countries like Russia and China, the BRICS, try to free-ride on western banking systems, making their own profits from our hard work, it will screw everything up for good. I don’t understand how something so politically complex can be considered ordinary banking – it is complex because it is so difficult to keep going. It is fragile. So when Russia tried to use the system and claimed to be a “partner” and etc. it was just impossible. I wish someone would analyze how the western banking system has run amok in all its “simplicity” so that regardless of its simple financial premise – it’s really a can of worms and was all based on excessive growth, etc.

huh… you meant “excessive greed,” didn’t you?

“By 1978, US inflation had risen to 9% while inflation in the rest of the world slowed dramatically by comparison. Both the Carter administration and the Fed did everything in their power to control dollar devaluation, but it was clear by this time that without the assistance from foreign governments the dollar would not be able to survive.” … “Over the course of the next six years the dollar experienced a meteoric rise in value.”

Maybe not central to the main argument but I found this claim (in bold) implausible.

Not a bad post…

At the rate events are developing, I just don’t see how the U.S. can continue to exist, in its’ current state, for too much longer……..too many threads being pulled from the fabric of cohesiveness!

“With the adoption of dollar denominated sales, oil producing countries had surplus dollars that they used to invest in banks which in turn lent the petrodollars to the US to finance its budget deficits. ”

They don´t invest in banks, necessarily. Dollar-income stays as reserves held by their national banks. All dollar-reserves are held at The New York Federal Bank as liabilities to other centralbanks. There is no difference between China and oil-exporters when it comes to dollar-recycling. Dollar-reserves are normally invested in US Treasuries, aka currency with interest.

Yes, USA today have to run twin deficits in the long run to maintein world growth and confidence in the dollar as the world reserv currency. It´s called Triffins dilemma.

The dollar could eventually lose it´s confidince due to debt and deflation.

“Over the course of the next six years the dollar experienced a meteoric rise in value. While it’s hard to fully attribute the causes of dollar appreciation in the early 80’s to any one particular factor,…”

Volcker raising the fed funds rate to 23% 1981……not a particular factor?

” Being a net exporter means you are using your demand to employ people overseas. ”

Was that supposed to be “net IMPORTER”? I don’t generally fuss about typos, but that one’s confusing.

Shoot, yes. Aiee. Will fix.

Apologies for a stupid question – how do Treasuries tie in?

On the puzzling increase in UST settlement fails

http://ftalphaville.ft.com/2016/01/04/2149052/on-the-puzzling-increase-in-ust-settlement-fails/

Bill Mitchell gets at some of this in a 2009 blog

Treasuries

“”I also note that the issuance of Treasury bonds acts like corporate welfare for the purchasers who typically are financial institutions and foreign governments. Why should they enjoy a risk-free government annuity? There is nothing to be gained from that. The futures traders use the government bond as a pricing vehicle (as the risk-free asset).

But why couldn’t they develop a private benchmarking asset to fulfill the same function but which wouldn’t carry the public transfer of funds connotation? The answer is that they clearly could and their continual claims that the government has to issue debt to maintain financial stability in futures markets etc are just special pleading and are spurious.””

—–

Treasuries currently act as a foundation for various markets. But if they continue to support the ‘cotton candy’ as Satyajit Das describes it of various financial products they may lose their validity to currencies based more on the real economy.

In his book ‘Extreme Money: Masters of the Universe and the Cult of Risk’ (2011) Satyajit Das talks about the ‘Liquidity Factory’.

On an inverse pyramid at the bottom little pinnacle are the central banks, 2%, then there are bank loans, 19%, then securitized debt, 38% and then derivatives 41%.

———-

These Treasuries seem to be playing a game of musical chairs and don’t seem capable of supporting all the cotton candy.

Time to go back to FED´s original purpose? Elastic money through private bonds. Not UST.

No, I don’t think the Fed needs to work with bonds to fund the Treasury.

The Fed also needs to do real regulation. Banks that have access to its funds should make loans based on good due diligence.

UST’s are like super cash. When you have a few billion $ that you want to/have to keep very liquid.

The fails are probably occurring because no one want to hold (incur rate risk) the actual T.

I haven’t been able to follow izzy in a while, but she’s done very good stuff on this in the past. I believe what she, or “the market”, is saying is that a lot of “people” who were selling UST futures didn’t own the T’s and therefore couldn’t deliver them.

“prices will go down, we’ll be fine” Naked short, in some sense.

As global corps have hollowed out the US production base, with the help of “trade” agreements, being a net importer has been more a requirement than a burden. When the first objections were raised to the $ as reserve currency the 1960’s, the US was not only fighting the Vietnam War partially on credit [its foreign exchange cost], but our firms were investing in Europe by the same means. Then the $’s status as a reserve currency was clearly a benefit, not at all a burden. Our trade deficit with China has been far larger than any liquidity requirement, suggesting $ overvaluation, at least in this case.

My hands are increasingly arthritic, so will not give this the long response it warrants. So in short, I’m afraid I have to say I categorically reject the notion the US dollar as world reserve currency has not been central to US Empire Inc., and in fact is a major source of both historical, enormous global fractures between haves and have nots (read Global Rift from back in the early ’80’s) and between the US vs all competitors, allies included (Japan, Europe, Germany, Canada, anyone) since the post-WWII establishment of a US-centred global financial system – and in the form of Fed policy is a major factor in the genesis of the current global geo-political/geo-financial crisis. It has paid for itself so many times over as an instrument of power and source of wealth the notion that it hasn’t and doesn’t requires making the same sort of mistake economists as a profession made with respect to entirely misunderstanding finance and financial markets – and still do, what with the US now sitting on a global infinite leverage pile in its own currency, also the global currency, premised on fantasy levels of future production that is simply not going to happen. It was assumed for two decades that the phenomenon of ’emerging markets’ would continue unabated pulling in all of Asia and Africa even as China et al forged ahead at Warp 8. The extent of the total financial miscalculation in terms of ‘no next China’ as much as ‘a much slower growing China’ is the exceedingly grim ‘who gets to eat this?’ question facing all of us – a prospect so unpalatable the world is on the brink of war.

While I’m sure it’s true neither China nor anyone else either desires or could provide a global substitute on its own, I submit as well every crushed national effort to steer a course independent of US financial institutions lending US dollars (and various ‘sort of’ dollars, eg, Eurodollars), dollars everyone must hold and spend on all those things globally priced in dollars (including interest rates) – oil of course being the obvious strategic WMD of dollar power.

If the US actually considered it a ‘burden’ it would’ve relieved itself of it long ago by introducing a truly neutral basket or some other alternative. Just as the UN could’ve been the ‘global policeman’ but for tragic refusal of the US to part with its nuclear monopoly, constructing a global currency and financial system was and is eminently doable. Meanwhile, in most everywhere outside the US, huge dollar-denominated debts are going bad and headed for worse while domestic purchasing power across most of the globe for the vast array of dollar-denominated goods and services produced all over the globe flags, sputters, fails.

Time to accept that ‘growth’ cannot and will not play even the same pale role re ‘raising all boats’ enough to head off severe social consequences even within the US and set our minds to creating an economy capable of delivering individual and social well-being.

I certainly didn’t mean to imply that the US doesn’t receive a tremendous amount of benefit from the dollar being the global deserve currency. Especially militarily, as a significant portion of the federal budget get pumped directly into the military machine.

I was only suggesting that dollar dominance is not so fragile that the US needs to protect it militarily, and that any moves militarily are just the USG abusing its power, not guarding it.

You are right to say that any nation that doesn’t get in line ends up getting clobbered, first financially and eventually militarily. These countries don’t represent a threat.

“Why the IMF Meetings Failed And the Coming Capital Controls”, Michael Hudson

In this “new form of warfare”, possessing reserve currency creation privileges (or being good friends with the bankers and politicians of a country that does) is equivalent to access to ‘financial weapons of mass destruction’. American politicians have long understood this fact. See Nomi Prins’ “All the Presidents’ Bankers”.

They may not know exactly why but Sen. Durbin’s 2009 observation that Banks “Frankly Own The Place” is an indication that the junior ranks of this country’s (s)elected officials are, at least within the country’s borders, dimly aware of the power bestowed by credit creation privileges on the banks and their 0.01% clients for whom they create most of it these days.

The definitive legislator in this matter is Mother Nature:

Stephen Nowicki, “Biology: The Science of Life, Part 1”, The Teaching Company Limited Partnership, 2004, p. 12.

Whether or not this competition remains relatively peaceful or ends in nuclear conflagration, now very much depends on ending the reign of the “junk economics” that mistakes debt (money) creation for wealth.

Here is Hudson’s easy-to-consume 90 second audio that explains the mechanism with remarkable clarity and simplicity:

http://www.informationclearinghouse.info/article43827.htm

But wait! It gets even better! By guaranteeing the debt of foreign governments – either officially or through financial engineering by the likes of Goldman Sachs – are US banks and its governments not also allowing the 0.01% in vassal states to substitute sovereign debt of the country in question for the taxation which would otherwise ‘reduce their score’ in the game; kind of like what’s been happening in the US only on (perhaps?) a more modest scale?

The existing corrupt system is unsustainable because infinite growth is not possible on a finite planet. The elites are fighting with full force any resistance to their regime in order to grab all they can before it collapses, and they know full well that it will. The 2008 financial crash was just a little flare-up in comparison to the conflagration that is coming, which will be exacerbated by devastation from abrupt climate change.