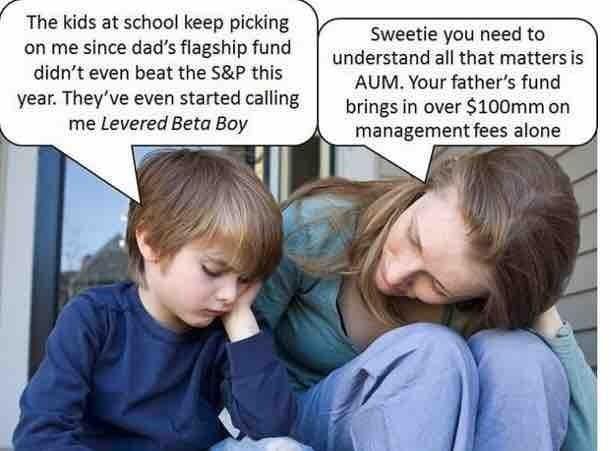

This is both a private equity joke and a test to see if you’ve become buzzword compatible enough to get it. If you do, you go the the head of the class. If not, please ask for an explanation in comments and the investment-industry-savvy members of the commentariat are sure to pipe up to help.

And don’t feel bad if you have been reading our private equity posts faithfully but find this a bit beyond you. One of the pet tricks of financiers is to use specialized terminology for concepts that are for the most part not all that hard to understand.

“Levered beta boy”. LOL!

We all know PE firms and hedgies ALL generate alpha, ALL the time.

Wall St. is Lake Wobegone.

negative alpha is an alpha too, do not be cruel to negative alpha please..

It’s not the performance, baby. It’s all about the rent I can charge!

These two people look too ‘normal’ for the task. The background also is too prosaic. Wooden clapboard walls when it should be polished marble!

And, “all that matters is AUM.” Oh my, when I got the double pun… Substitute ‘Om” for AUM, and there you have it, the Religious nature of Finance.

That’s a $10 million house in Fairfield County, CT, where old money still likes the traditional New England look.

Maintenance-intensive clapboard involves the same anachronistic mindset as a gravel drive: one hires retinues of workers to manually scrape and refinish it, under one’s exacting supervision.

Polished marble is for fireplaces.

Oh my. That really does prove the real estate aphorism; “Location, location, location.”

We’ve seen houses probably similar to your cited domicile, here in the American Deep South for under 100 grand. Yes to the labour intensive nature of the wooden siding; I’ve done that myself. Polished marble is good for bathroom floors too.

Provincetown, MA.

That’s “Sweetie has two mommies” territory. Wouldn’t work for that pic!

But it is a beautiful place, that’s for sure.

…returns are incidental to commissions …pickpockets on steroids…reminds me of this:

https://www.youtube.com/watch?v=gAq3jjc-Wv4

Eh? a mere $100mm in rent, er, fees? No wonder Beta Boy has the Blues! Needs moar green!

Entertaining and informative !

Only way to improve is to have a mock convo between June Cleaver & the beaver ( or Andy and Barney…)

This one applies to ALL fund managers, not just private equity.

Performance doesn’t matter, just pile up the assets with heavy doses of marketing and rake in fees off of that large pool!

Of course, Vanguard, the only non-profit in the asset management game, has the cure for all the fee-gouging….

http://www.marketwatch.com/story/the-vanguard-effect-on-fund-feeds-in-one-handy-table-2015-11-13

AUM, Sweetie, leveraging beta is paying for your private school tuition and the chauffeured Bentley. Johnny’s Dad was leveraging alpha and just got a margin call from Lloyd Jr.’s Daddy.

sounds to me like Johnny’s dad is a financial Master Beta . . . or maybe a Beta Master.

The wife doesn’t seem to mind. bowhahahahahahahah. There’s always the tennis instructor to fill in the gaps, no pun intended. bowhahahahahah

Coulda just been a lucky jerkoff. Only Mom’s hairdresser knows fer sure.

The graphic applies to hedge fund managers, not private equity managers. Hedge funds mark their portfolios to market, and that’s why the other kids know how this kid’s dad is doing. Nobody knows how the private equity funds are doing or what the actual returns are — there’s no comparing of deal IRR’s and the S&P500…

That’s incorrect.

1. PE is regularly benchmarked against the S&P 500.

2. PE is regularly referred to as levered beta. Hedge funds are criticized as only providing synthetic or alternative beta.

3. This cartoon was sent by someone in PE and is making the rounds.

Do you regularly make stuff up?

Responses:

1. PE should be benchmarked against a stock index, or better yet against a levered style index. However, one can’t really do that with annual returns because the valuations reported by the PE funds are garbage. Read this paper http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2720479 and see how the monthly return betas of PE investments are biased to zero (to zero, not towards zero!) by the hold-to-maturity accounting.

2. PE may be regularly (and appropriately) called levered beta, but that term is by far more often used when talking about hedge funds. This is because the reporting makes the levered beta nature of many hedge funds obvious, whereas the levered beta nature of PE funds is opaque due to reporting deficiencies.

3. The fact that the cartoon was sent to you by someone working in PE means that that person has a phone or a computer, but it does not mean that the cartoon is about PE. It also doesn’t mean that the image originated from a PE shop.

In fact, there are many hints in the cartoon that make it rather obvious (to me) that it’s about hedge funds and not about PE. For example, the structure of PE funds is such that there is a sequence of funds and no one flagship fund. In contrast, hedge-funds and asset managers running hedge-fund like structures frequently have what is commonly referred to as their “flagship fund”. There are no meaningful annual return reporting by PE funds and the meaningless annual returns are not discussed in press, whereas annual hedge fund returns are meaningful and they are frequently written up in the press.

No, I don’t regularly make stuff up. I know what I am talking/writing about, and that’s not overconfidence.

I see a textbook case of the Dunning Kruger syndrome has decided to grace our site with his presence. Let me repeat myself: you continue to prove you don’t know much about PE, and know less about alts generally than you think. You’d be a lot better informed if you bothered reading our extensive posts on this industry.

1. Academic studies almost without exception compare PE against either the S&P 500 or a smaller cap index. Pension fund consultants benchmark PE against the S&P 500 or a custom equity index, which is usually a smaller cap index or mix of indices. They do NOT use levered indexes. What they do instead is add a risk premium, almost always 300 basis points but 450 in the case of Yale, which invests mainly in VC. I’ve criticized the use of the 300 bps standard as imprecise and sloppy and have argued for other methods.

Oh, and I’m quite familiar with the paper you linked to. I wrote about it shortly after it was published. And you misrepresent its findings: it does not “benchmark” PE; it says PE can be replicated with a levered stock strategy, with much higher reported vol and higher net returns by eliminating PE fees and costs.

And if you knew PE, you’d know returns are reported on a quarterly, not monthly basis. Had you read the paper carefully, you would also have seen indications of that in its description of PE data sources. You clearly come from the hedge fund world and projected its monthly reporting on to PE.

2. If you knew as much as you pretend to know about hedge funds, you’d know it was much more widely referred to as “alternative beta” or “synthetic beta” since one of the hedge funds industry’s claims is (supposed) low correlation with stocks, while private equity is acknowledged to correlate strong with stocks, and the more honest investors in it cop to that. Moreover, hedge funds on average are levered less than PE is (there have been various papers debunking the idea that the average hedge fund is heavily dependent on gearing, although some strategies are obviously very highly levered). For industry incumbents, who seek to control the use of nomenclature so as to reinforce their sales patter, referring to hedge funds as “levered beta,” thus saying it was highly correlated with stocks, would contradict one of their most prized marketing points.

3. Funds like Blackstone VI ARE referred to as “flagship funds”. See this from an industry newsletter, for instance:

4. I never suggested the cartoon came from a PE shop, so you engage in dishonest argumentation too (you appear to need to acquaint yourself with the term “straw mannnig”). It was sent by an financial services industry expert who has researched and published extensively on the PE, and is more capable than you are of discerning what it refers to than you are.

In other words, your protests to the contrary, your remarks prove do have an appetite for making stuff up. Glad you can get away with that at your day job. It does not go over well here.

I’m so glad we get along :-D

I know that was a little rough, but for someone new to the site to come in and play one-upsmanship on a humorous post, and then double down, is not on here. I welcome informed disagreement, but I do not welcome people who start off by picking fights out of a need to be the smartest guy in the room when they aren’t. This is not a chat board and I don’t need people who suck up my time. I probably should have simply deleted his comment but he asked to be taught a lesson.

Love the cartoon! It is equally applicable to hedge funds as it is to PE or am I missing something.

And your smackdown was equally entertaining! made my day!

Yves,

I could do without Craazyboy and his comment about a lucky jerk-off, or whatever. Why don’t you come down on him? I will not waste adjectives on describing why it disturbs me to find a comment like that on this site. In a way it disturbs me more than intellectual arrogance. .

I understand the concept of limited partners buying a PE or hedge fund bill of goods.

Actually inventing investing terminology like this escapes me.

OK. I’ll ask. What the heck is levered beta and AUM?

got it. levered beta and AUM=Assets Under Management.

`Honey, maybe you won’t be able to get into Harvard like the mean kids, but you’re a better person than they are because you’ll be able to put your name on a new wing at the B-school.’