Jamie Dimon likes to write grandiose letters to shareholders. Unfortunately, the financial media sees fit to treat them seriously. And his minders manage to save him from himself. Right after the crisis, Dimon’s annual missive contained an section praising the heroics of his staff, comparing them at length to the soldiers at Iowa Jima. Dimon was persuaded to get rid of that bit only because his outside PR firm threatened to quit.

This year’s letter, as recapped by the Financial Times, is every bit as exaggerated, although less obviously so to the outsider. The theme this year is why too big to fail banks like his need to be left alone by meanie regulators and rabid politicians.

Customers allegedly need one-stop investment banking and commercial banking services. Here is Dimon’s claim:

Mr Dimon set out the benefits of structures spanning corporate and investment banking, arguing that they allow big banks such as JPMorgan to perform “mission-critical services . . . that regional and community banks simply cannot do”.

Since when? Commercial banking services (commercial loans and revolving credit, cash management, foreign exchange) are sold to treasurers and assistant treasurers of banks. Investment banking services (public bond and stock offerings, mergers) are sold to chief financial officers and CEOs. Both commercial and investment banks deal in derivatives (plain vanilla ones like swaps to supposedly lower funding costs, more complex ones for tax and accounting gaming). And as we’ve argued, the more complex ones are negative value added from a societal perspective, so any arguments that rely on the importance of complex products that integrate derivatives with more traditional products should be taken with a fistful of salt.

Moreover, most large and large-ish commercial corporations like to play horses for courses in their selection of financial firms. They don’t like to rely on one major firm, and if they are multinationals, they want to hire a local bank in countries that are important to them because the local bank will have better local intel than a foreign bank. Even if the big foreign bank gets a few stars from the domestic market, people in that country know their long-term career prospects and job security are higher at a local player.

Lots of finance is good for America. Dimon again:

The US financial services industry does not conform to simple narratives. It is a complex ecosystem that depends on diverse business models coexisting because there is no other way to effectively serve America’s vast array of customers and clients.

False again. Numerous studies have found that larger financial sectors are negatively correlated with growth rates. The sort of “complex ecosystems” for finance that Dimon touts as a virtue is virtuous only as far as the people in his industry are concerned. One of the most devastating findings came in a recent IMF paper. From a 2015 post:

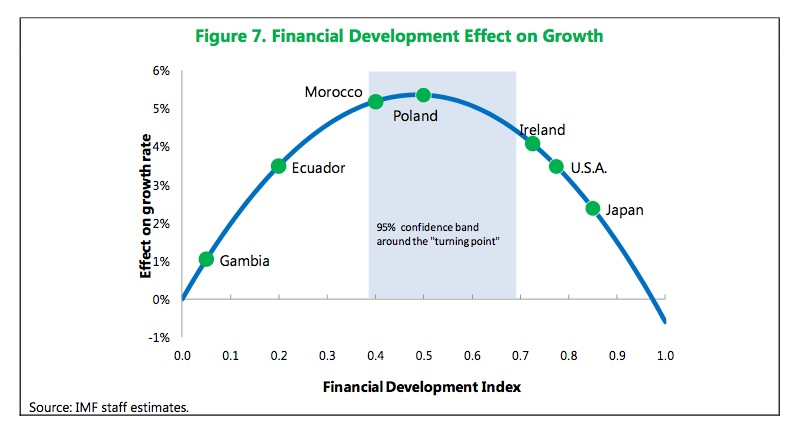

But the recent IMF paper, Rethinking Financial Deepening: Stability and Growth in Emerging Markets, is particularly deadly. Even though it focused on the impact of financial development on growth in emerging markets, its authors clearly viewed the findings as germane to advanced economies. Their conclusion was that the growth benefits of financial deepening were positive only up to a certain point, and after that point, increased depth became a drag. But what is most surprising about the IMF paper is that the growth benefit of more complex and extensive banking systems topped out at a comparatively low level of size and sophistication. We’ve embedded the paper at the end of this post and strongly urge you to read it in full.

The contribution of the IMF paper is that the authors developed a new index to do a comprehensive job of capturing financial activity. Previous work had tended to look either at the size and sophistication of financial institutions, or the depth and complexity of financial markets. The new index incorporates both aspects of financial activity, as well as incorporating access. The writers concede that their measure is still imperfect, but is an improvement over other approaches. They also stress that they are well aware of the issue of establishing that the relationship between the size and complexity of the financial sector is causal, and not a mere correlation…

This is the money chart:

The authors have a more sophisticated and nuanced assessment than “Having a financial sector that is more developed than Poland’s is a bad idea.” From the paper:

There is no one particular point of “too much finance” that holds for all countries at all times. The shape and the location of the bell may differ across countries depending on country characteristics including income levels, institutions, and regulatory and supervisory quality. In other words, a country to the right of the average “too much finance” range may still be at its optimum if it has above average quality of regulations and supervision; conversely, a country to the left of the range with weak institutions may have reached its maximum already.

This implies that countries like the US, UK, and Japan before its crisis, went pedal to the metal in the wrong direction by deregulating institutions and markets at the same time. That policy shift, in combination with overt and covert subsidies, fostered explosive growth in products and trading volumes, particularly is the least regulated sectors.

The Chinese are coming! You cannot make this up:

I do not want any American to look back in 20 years and try to figure out how and why America’s banks lost the leadership position in financial services. If not us, it will be someone else and likely a Chinese bank.

It used to be that people like Dimon would brandish the threat of European universal banks as ready to invade the US we didn’t support our home grown institutions. Having advised more than a few foreign banks operating here, their US operations were virtually without exception sub-scale and with accordingly lower profits than similar-in-balance-sheet sized US institutions. But Europe and European banks are such obvious basket cases that even normally very provincial Beltway denizens have heard about their distress, so Dimon can’t use them to scaremonger any more. So Dimon plays the Yellow Peril card instead.

Why is this nonsense? First, it took world-class commercial banks like the then Citibank and JP Morgan well over 15 years of hard slogging to establish a serious beachhead in the investment banking game. The biggest obstacle was cultural incompatibility. Commercial banking has staff with very narrow responsibilities, with highly routinized, repetitive tasks, lots of controls, and hierarchical structures with top managers having thousands of people under their supervision. Historically, investments banks had very flat hierarchies, and were extremely freewheeling, but could do so because the top managers (who were partners) supervised small units, of business in which they were deeply expert and actively involved, and ween’t even managers in the banking sense. They weren’t administrators (save at the very top of the firms) but were running their own books of business.

The Japanese, which actually at least had very large commercial banks in the 1980s that had established operations in major economies around the world, were only able to follow the Japanese footprint and for the most part either participated in low-end commodity businesses where the size of their balance sheets and low return requirements were a plus, and also did get business with Western firms that had or were seeking to establish operations in Japan. The Chinese are decades behind in the internationalization of their banks where the Japanese were as of the mid 1980s. And do you think the Chinese would fare any better than the Japanese in hiring and retaining top Western “talent” long enough to get skill transfer?

And that’s before you get to the reserve currency issue. The US banks have a huge natural advantage with the dollar as the reserve currency, and that is not going away any time soon. As much as China hungers for the status that goes with that, it does not want the attendant costs of running ongoing current account deficits, which is tantamount to exporting jobs. That’s anathema given how important high employment levels and wage growth are to political legitimacy in China.

The Fed is mean and wrong too. This is precious:

Mr Dimon took special aim at the US Federal Reserve’s stress test, the Comprehensive Capital Analysis and Review , which has become the regulator’s primary tool for keeping the banks in check.

Mr Dimon noted that last year’s test, the fourth of a now-annual series, was “extremely severe” on credit risk, imagining losses for JPMorgan well in excess of anything seen during the global financial crisis of 2008-09, and on a par with the Great Depression of the 1930s.

As unlikely as the Fed’s Armageddon scenarios may be, Mr Dimon noted that JPMorgan, alone, has enough resources to absorb the entirety of the losses assumed by CCAR.

Dimon is still apparently peeved that the Fed put limits on JP Morgan dividends and share buybacks in 2015, deeming the bank to need to strengthen its capital levels.

Dimon conveniently omits that the reason he and his peers didn’t suffer a Great Depression level wipeout was that central banks and national treasuries rose into the rescue. And spare me the “fortress balance sheet” myth. JP Morgan was about a $2 trillion bank attached to a $75 trillion derivatives clearing operation. Morgan Stanley and Goldman would have failed were it not for the AIG money laundering operation and other emergency measures. If Morgan Stanley and Goldman had failed, JP Morgan was next in line.

And he completely sidesteps the real issue. The cost of the last crisis was so great that there isn’t any justification for allowing banks to operate as private entities. The cost periodic crises impose on society at large are so great that the banks can’t begin to pay for the costs. Andrew Haldane of the Bank of England did the quick and dirty math in 2010:

….these losses are multiples of the static costs, lying anywhere between one and five times annual GDP. Put in money terms, that is an output loss equivalent to between $60 trillion and $200 trillion for the world economy and between £1.8 trillion and £7.4 trillion for the UK. As Nobel-prize winning physicist Richard Feynman observed, to call these numbers “astronomical” would be to do astronomy a disservice: there are only hundreds of billions of stars in the galaxy. “Economical” might be a better description.

It is clear that banks would not have deep enough pockets to foot this bill. Assuming that a crisis occurs every 20 years, the systemic levy needed to recoup these crisis costs would be in excess of $1.5 trillion per year. The total market capitalisation of the largest global banks is currently only around $1.2 trillion. Fully internalising the output costs of financial crises would risk putting banks on the same trajectory as the dinosaurs, with the levy playing the role of the meteorite.

Yves here. So a banking industry that creates global crises is negative value added from a societal standpoint. It is purely extractive. Even though we have described its activities as looting (as in paying themselves so much that they bankrupt the business), the wider consequences are vastly worse than in textbook looting.

At the time, critics contended that his output loss estimate of one times global GDP was unreasonably high. It now looks about right. And Haldane pointed out in the same paper that the classic economic analysis of whether to tax an activity that imposed costs on bystanders (called externalities) or prohibit the activity entirely depended on the level of private gain versus public cost. Where the public costs clearly outweigh the private gain, as Haldane’s calculation clearly demonstrates, prohibition is the right answer. Thus putting banks out of the too big to fail business is a completely orthodox remedy, despite the continuing protests of executives like Dimon and economists willing to fall in with the banking party line.

Do read the comments on this Financial Times article. It’s gratifying to see that even people in the banking industry aren’t buying what Dimon is selling.

_____

* As I have stressed elsewhere, these bankers are not “talented” in the way their PR would like you to believe. But they do have very specialized skills which you cannot acquire outside the major capital markets firms.

O hown I wish ‘Slimin were lecturing us from jail, a la Madoffs occasional missive. It really is too much to bear that Obama’s “favorite banker” does anything other than apologize from some shackles in Attica or SingSing, while some huge guy fondles those famous silver locks as a prelude to some serious bondage and penetration fun. Of course, at the very least, this despicable creature should be shunned

I have to reply only to the text, “penetration fun”. There is no place that I know of where “rape” of another human being is considered “fun” to that individual. No matter the crime, to advocate such an act is ignorant and foolish in the extreme. I point this out on any site, as boorish thinking. We must rise above the colloquialisms of group think.

Ok. I was being sarcastic. When you”ve gone thru what I went thru with Chase – forecllosing on a paid up commercial loan on a historical bldg I spent 5 years of my life restoring, and WaMu loan Chase got for free, and even while it had a receiver in place let the building rot so bad I was called into criminal court because my name was on title, tho I had no control of the building — then you will understand I was not kidding or joking about Jamie getting Shawshanked. I had hoped Jamie would die a painful death from throat cancer, or even learn humility and humanity from that experience, but sadly he emerged out the other side an even more arrogant version of himself.

So yes, resentment sometimes keeps me alive, sometimes just waiting as other wags have noted here for Jamie’s head to tumble in basket sans body.

So, to be clear, and this makes me a bad person, so be it. I meant what I said, as horrible as that makes me sound. When it some to Slimin’, it is NEVER a laughing matter. He is a stinking human shaped bag of fecal pus. He did things – such as to me – and to his his shareholders and those widows and orphans who held WaMu stock a lot of money that was rightfully theirs.

Multiply my experience by millions. A friend of mine got foreclosed on by Chase, and my bud almost committed suicide.

Remember, no matter how vicious I am being viz Jamie, I”m holding back. No apology here.

I’m with you down2long – there are times when wishing for barbarian acts are appropriate. Dimon belongs with the slime that are the Khazarian mafia. I have little doubt that their time is nearly up on this good Earth.

Maybe the best way to solve your problem is to insure the little guy and let the banks do as they may. When they fail, problem solved.

Of course Dimon, who made $27 million last year, doesn’t want his gravy train to end. He’s able to skim such vast sums because he controls the institution of imperial money.

The only solution for greedy sociopaths like this is punitive taxation. Or being separated from his head. What a truly repulsive character.

I actually dream of the day we see Slimin’s head bouncing down into a basket.

Thought that many times myself.

with the phrase…I’m richer than you’… emblazoned on the side…..

– the systemic levy needed to recoup these crisis costs would be in excess of $1.5 trillion per year. The total market capitalisation of the largest global banks is currently only around $1.2 trillion.

Is this statement true or false? “Permit me to issue and control the money of a nation, and I care not who makes its laws!” The attribution is false but the content is true.

Trying to figure out where the self-serving silliness comes from, going to the zeitgeist stew of wikipi: “Chicago macroeconomic theory rejected Keynesianism in favor of monetarism until the mid-1970s, when it turned to new classical macroeconomics heavily based on the concept of rational expectations.” Click a link to monetarism, “objectives of monetary policy are best met by targeting the growth rate of the money supply rather than by engaging in discretionary monetary policy.” (Eye-popping sidelink to chart of money supply.) MIT school: all faculty and alumni. We don’t need no stinkin’ theory, we are the gears in the machine and the hand on the lever! Discretionary monetary policy means being in the position to exercise discretion over who gets the money. Put your alumni at the top of central banks around the world, control who gets rich and who don’t

Which looks like a self-sucking ice cream cone until you tie in U.S. military doctrine of ‘full spectrum dominance’ which was better spelled out by the Chinese in ‘Unrestricted Warfare’ (1999). Michael Hudson has been explicit about ‘economic warfare’ but the phrase goes back to at least 1913 (according to ngrams).

Which, returning to the Haldane quote, forces the question: warfare against whom? Which is why I, as a defensible position, claim that 2008 meets the definition of a coup. Haldane’s numbers define the logistics.

A wonderful question from Howard S. Becker: “Are things better or worse around here than they used to be?” Another quote, more to the notion of theory and practice that I started with: “reverse the explanatory sequence and see the differences as the result of the definitions the people in a network of group relations made” which pretty much defines politics and economics at this point, with a few notable exceptions.

Here’s a Hudson post from half-a-decade (almost) ago:

http://www.counterpunch.org/2012/12/31/the-financial-war-against-the-economy-at-large/

Huh. A note for commentariat, the “Name” section allows you to change your name (accidentally) without chucking for having the same address.

Ah, well, anonymity is a figment in the eyes of the allmighty, I suppose.

I knew it was time to completely quit glancing at CNN when I saw a commercial they had featuring Jamie Dimon in various flattering (I guess) poses—-looking studiously at something, walking briskly with an authoritative sense of purpose, etc. I mean that’s ALL this commercial was—about 30 seconds of Jamie Dimon. Sad.

This kind of article is timed to help Hill in the NY primary. A lot of people who live in NY think what’s good for Wall Street is good for them, probably. They don’t want all the brokers to pack up and move to Shanghai.

… or to “Iowa Jima.” :-)

Michael Hudson is a god that walks the planet.

The problem/solution is geriatric teenagers running a global extortion racket. International trade can only be next positive if each culture can sustain oscillation on its own and trade surplus, instead of trading depravity. What we have is artificial borders with cultures trying to strangle each other, both externally and internally, the masters angle drilling into the slaves territory and selling the slaves their own energy. When in Rome.

In America, you can’t walk out your door without stepping in someone else’s trap, and now we are building infrastructure so you can’t move in your own home without stepping into a trap. We had an agreement that kids were to be left to be, and now we can’t wait for them to get out of the womb before we start putting extortion gates in their path. Even empires have death and birth.

The kids aren’t buying the it was good enough for us so it’s good enough for you bullsh anymore so the geriatrics are selling sunk costs to each other to bid up the price with no fools to unload the stupidity, and the hippies printing money are dumber than the CBs. The sum of the parts cannot be less than the total, without triggering degeneration.

The old timers now running the show do nothing but gossip and drive around making sure nothing changes. It’s disgusting, and who they vote for is irrelevant.

How’s that?

Oh really? Well, I think Jaimie Dimon needs to leave the USA alone. Likely the rest of the USA agrees. Also, its clear the guy is a mental case just from reading his crap.

Jamie Dimon must cease and desist from using intellectual phrases he obviously does not know the meaning.

“The US financial services industry does not conform to simple narratives. It is a complex ecosystem that depends on diverse business models coexisting because there is no other way to effectively serve America’s vast array of customers and clients.”

NO, finance is not a complex ecosystem, it is not an ecosystem at all. This is a goddamn lie. When Joseph Wharton ponied up a small fortune to found the The Wharton School of Finance and Economy, he did not try to find Darwin to come in to do research and lecture. They established the first study in America of business on a national basis using the social sciences, not biology. The misappropriation from the natural sciences is another attempt at misdirection away from the social fiction of our economic arrangements.

There are no iron laws to be derived from physics, no naturally occurring economic circumstances, as right as rain in the rain forest, with its truly complex ecosystem. No, Mr Dimon, misrepresents the business he has chosen, banking, and makes it into something it is not, in order to give it the standing of the earth itself, in orbit, obeying the gravity of the solar system with the sun at its center and on its surface, the land and the seas teaming with flora, fauna and all manner of creatures, living together in the complex web of life that the biological sciences are beginning to plumb the depths of.

Banking, however, is money grubbing and a counting of the money grubbing, accounting, which is all banking has become. Today, little more than a set of software programs bought from 3rd party developers to track and transfer money from here to there and keep the accounts in order. Complex ecosystem? The only complex system is the systemic fraud and lies from the human beings who pretend they are a part of the civilization that provides them the shield from the complex ecosystem of nature that would drown them in powerful floods from monsoons, hurricanes and tsunamis or the droughts that would kill crops or other plagues, pestilence and wars that would also kill them off. Mr Dimon may think he lives in a financial jungle, but he really lives in a stately mansion when not perched high upon his steel and glass aerie of the commanding heights of capitalism.

Maybe he thinks of himself as “Chauncey Gardiner”?

A spectre is haunting Europe, where lumbering TBTF dinosaurs still roam the earth. Two examples will suffice.

Deutsche Bank (DB) ten-year stock chart:

Santander (SAN) ten-year stock chart:

Both of these national champion European banks are trading at prices BELOW their March 2009 crisis lows, and at distressed dividend yields of 5.4%.

By contrast, their U.S. TBTF counterpart JPMorgan has more than tripled from its March 2009 crisis low, with a 3.0% dividend yield.

TBTF, comrades: Too Big To Fix.

Note the slippery slope DB slide begins under the tenure of Herr Josef Ackermann, who continues to roam the earth despite coming within a hair’s breadth of some serious time on multiple occasions.

The only consolation as “ackermannes” has become German slang for “bankster.”

I’m all for leaving them alone. Most of their business would shrivel up almost immediately if the government stopped supporting the big financial institutions.

I’d like to see a debate between Haldane and Dimon – diapers optional… and no holds barred.

Why bother? Dimon knows he won. He knows he runs the show. Short of doing what Occupy Wall Street tried to foment (dragging bankers from their glass towers and lynching them), there is nothing to do but smile and send Dimon his ever-growing cut of wealth.

Or we could stop voting for anyone and everyone who ever held public office (i.e. impose our own term limits and turf them ALL out). We could demand independent, intensive investigations into the banks, the Pentagon, the DHS, Congress, and the White House.

Nah. Let’s just keep giving Dimon money.

Jamie (whakinda PU$$Y name, izat?) can $pare the DIMON$ !