Yves here. This is an important piece, and I hope you circulate it widely. It explains in a clear, accessible way why lowering interest rates does more to goose asset prices and fuel levered speculation than stimulate real economy investment.

By Cameron Murray, a professional economist with a background in property development, environmental economics research and economic regulation. Originally published at Fresh Economic Thinking

The mysterious real interest rate – the one typically denoted as r in economic theory – does not have a real life counterpart. This is a problem for economic theory. And it is a major problem for policy makers relying on monetary policy to boost economic activity.

While we think of the nominal interest rate minus inflation as getting close to the theoretical concept of real interest rates, changing this value in practice through central bank operations does not actually change the real return on capital and stimulate investment through that channel.

Why?

Because the price of capital is determined by the interest rate! We have known this for a long time. Joan Robinson wrote about the circularity of reasoning when we measure the quantity of capital by its price. She was ignored. As I expect to be.

For those who want to understand a little deeper, the here are some more details. First we take the standard economic view. In this view there is a thing called capital, K, that has a fixed cost (because it is a machine or building etc.), and each unit of K has an income earning potential, net of depreciation, each period, which I call I. To buy each K people borrow money at the rate r, meaning that as long as the ratio I/K > r it is profitable to invest in more capital, K.

So if my business can generate $100,000 in extra profit each from an extra machine, the business might see the value in spending $1,000,000 on that machine if they can borrow to pay for it at a 9% interest rate (costing $90,000 per year in interest), rather than an 11% interest rate (an annual interest cost of $110,000).

However here’s the circularity problem. The gains from a lower cost of new investment are made whether the investment is undertaken or not because they become capitalised in the value of the business immediately. That is because the value of the option to expand is always captured in the market value of the assets of the business.

What is this option I speak of? Where did it come from all of a sudden?

The way I snuck this in to my definition of capital is part of the fundamental problem that permeates all the economic debates about capital. One group talks about capital as machines – independent robots, vehicles, machines and tools, who get to keep the returns from their existence. Yes, my bulldozer gets income from its efforts in this view, not the owner of the bulldozer. Because once you have an ownership structure overlaid, you have a system of property rights which contain real options for investment, and they have a value.

Think about land. Land is often referred to as capital, but it is nothing but piece of paper offering a particular set of rights to a three dimensional chunk of the universe. The land is an ownership right, not a physical object. See my mud map of economic concepts to help see what I mean here.

Once we have shifted to a view of capital of a system of property rights, some of which have physical machines attached to them – like a building attached to land rights, or a truck attached to various rights held by a trucking company – we can begin to see the circularity problem more clearly.

We now have a world were investors maximise the return on their property rights, not one where machines decide how to maximise the return on themselves.

This means that anyone making a decision to invest in new machines must take into account the current value of their property rights as part of the cost of capital. Because the full opportunity cost of the investment in machine is the next best alternative, which is to sell the property rights at market values. In the diagram below I try to capture the idea that all physical capital – buildings, machines and so forth – are attached to property rights, and that only if we look at the value of the whole can we get the true cost of new capital investment from the perspective of owners of property rights.

Let’s now see the effect of decreasing interest rates in a world of property rights, and where the value of these rights is part of the cost of capital. We will take the simplest case of a piece of vacant land, where the full value of the property right is from the option to build on that land to earn a future income. Here only the building is part of physical capital in standard economic theory.

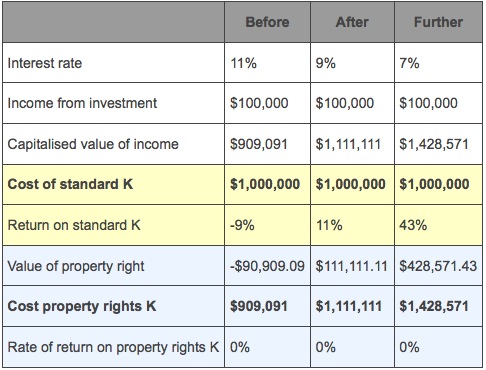

We will then see what effect a reduction in interest rates has on the cost of “property plus capital”, and therefore the incentive to invest for owners of property rights. The table below summarises.

Let me walk you through this. The interest rate is the real interest rate. Take it as the nominal interest rate in a zero inflation environment for simplicity. The income from investment is the annual income after the building is built. The value of that income is capitalised at the new interest rate to show the static value. Then we see that when the interest rate is reduced, the $1mill building gets a positive rate of return, and hence the change to the interest rate will provide the incentive to invest.

As a side note, the alternative way to see this is to simply assume that the cost of the building is borrowed at the interest rate, as I did earlier when discussing the standard view. In this case the cost of capital is $110,000 per year before the interest rate fall, and $90,000 per year after the interest rate drop, shifting the investment from an unviable to viable way earn the $100,000 per year.

But, if we consider the value of the property right as well, we have a different picture. Here, the value of the property right is the residual after taking the investment return (capitalised value of income) and subtracting the physical investment cost (cost of investment). Before with interest rates of 9% the value is negative, and there is clearly no return on capital. But even after the interest rate is dropped to 9%, the return on the combined “property plus capital” is zero, because the cost of capital now includes the opportunity cost of selling the property right.

Even if we decrease interest rates further, say to 7%, the rate of return on “property plus capital” is still zero, as I show in the last column. Owners of property rights simply gain at the expense of those in society who do not own substantial property rights and will be future buyers of those rights.

Under this view the investment effect of lower interest rates disappears. The reason being that the capital of economic theory, and hence the real interest rate of economic theory, cannot be detached form the reality of a system of property ownership rights.

I’m not the only one to say this either. Once you are in a world of property rights and real options, the key determinant of investment is not the real interest rate of standard theory. Here’s Raj Chetty showing that increasing interest rates from low levels can bring forward investment – the exact opposite of the standard view. In a world of property rights an real options, the key factor is not what to invest, but when to invest in order to maximise the rate of growth in the value of your property rights. Hence there is a huge role for speculation on the price of property rights, and a clear logic behind following the herd during asset cycles. Under these conditions it is also the case the reducing interest rates reduces the cost of delaying investment, and may in fact slow rates of investment and economic activity!

Let me summarise. First, standard theory has machines earning incomes and ignores the system of property rights it attempts to model. Second, once you incorporate a system of property rights these right have values, and the value of these rights must be added to the cost of machines to calculate the economic (opportunity cost) of capital. Third, once you have done this, changing the nominal interest rate (or even nominal rate minus inflation) changes no investment incentives, as all property rights holders immediate gain the value, which becomes a cost of investment. Finally, other factors that effect the cost of delaying investment by owners of property rights probably have a larger effect on investment, and in fact decreasing interest rates decreases the cost of delaying investment.

This is not to say that there may be some effect of monetary policy through other channels, such as decreasing interest costs of borrowers, allowing them to increase spending. But if this is the dominant effect, without an investment incentive, than loose monetary policy may primarily inflate asset prices, and not economic activity. This prediction gels with the reality of the past decade.

If I understand this correctly, and maybe I don’t, this is something that is theoretically true – because in theory everyone has perfect information and markets exist that let people act, but is actually true in few circumstances. I can see it most clearly in large firms that own the right to extract a commodity?

As interest rates fall, all of a sudden there is a surge in the demand for copper. A copper mining company could buy more equipment to extract copper and sell it to increase profits. Or they could do nothing and see share value increase due to the value of the underlying asset in their business (the copper). The value of the shares increase either way. The CEO makes his bonus either way?

As the owner of a small business this won’t work as nobody is going to buy my business, or even part of my business right now. And I need the increase in cash flow (profits) now not at some theoretical time in the future in which events and technology may have changed things that made that potential investment worthless.

Yes. Financialization is the lubricant that makes it possible to think of everything as an asset that could immediately be liquidated at near full value, including hypothetical growth options. When everything is fully financialized and real world frictions are removed, it will always make more sense to buy and sell the assets and their affiliated options that to actually invest and improve anything.

This is one of the most straightforward ways to visualize how increased financialization can harm the economy. Although simply calling bankers parasites is arguably even more straightforward.

– The value of that income is capitalised at the new interest rate to show the static value.

Unsophisticated question here: what is the delta-t? Is it the full time to pay off the loan at the particular interest rate using all the Income?

The author’s view also squares with the enormous corporate stock buybacks funded with debt that has replaced shareholder’s equity on the balance sheets of so many large corporations. I was told in casual conversation by an employee at one large corporation that the ROI hurdle for new investment in productive capital assets at the company where he works is now 25%. (Not to dwell on motivations, but it is also noteworthy that corporations’ stock buybacks at high prices serve to maximize the value of insiders’ stock options and executive bonuses.)

I expect bankruptcies, attendant “restructuring”, and an eventual realignment of debt servicing capacities of many large corporations to accompany higher interest rates. Just one of the many maladjustments that stem from the Fed’s QE-ZIRP policies in the wake of the 2008 financial collapse. But it has been a terrific party for the 1 Percent.

How does it square?

Doesn’t the evidence show that stock buybacks are pretty much hit or miss in regard to raising stock price? Of course you are still left with the bill if debt was used to do it. Is that what ties in?

Seems to me that as a CEO you have choices. Among those choices are whether to use the proceeds of debt borrowed by your company to invest in productive capital assets and business expansion, or to use the cash you borrow within the constraint of your company’s finite debt servicing capacity from existing cash flows to repurchase your company’s stock; thereby increasing your company’s debt, diminishing your company’s equity capital, reducing the number of shares outstanding, increasing this year’s Earnings per Share (and thereby triggering executive bonuses), but reducing your company’s capacity to borrow more debt in the future due to your decision not to undertake investment in productive assets that would increase your corporation’s longer term cash flows and debt servicing capacity?

As the CEO you set the ROI hurdle for the first choice at 26% (3-year required payback) because (you argue) the cost of capital includes the opportunity cost of alternatively selling the property right; i.e., shares of the company.

That’s what tied it in for me. Hope this clarified my earlier comment, Bill.

Share buybacks serve to increase a corporation’s earnings per share in the near term, and that can in turn provide a short-term boost to a company’s stock price. However, the longer term costs of these massive share buyback decisions are arguably now beginning to be reflected in declining cumulative GAAP earnings of the corporations that make up the S&P500 stock index; i.e., they have not used cash proceeds from the increased debt to invest in productive capital assets, R&D, etc. that serve to increase their long-term cash flows and have thereby both constrained the company’s capacity to borrow in the future due to alternatively using the funds to repurchase shares, and have concurrently impaired the value of the property right; i.e., the value of the company.

Yes, I agree this is very important work. It deals with a basic structural problem with our economy which is too much private ownership of capital.

Privatization is one of the pillars of neoliberalism and is getting worse as we see many formerly public utilities such as electricity and water being privatized.

Money is a public resource created by governments which can be used to support useful public programs like single payer medicine and affordable education.

Industry is more difficult but considering the amount of publicly funded research that went into Apple as an example, there can be better distribution of these profits. Walmart employees on food stamps while the execs make millions is also an example of poor profit distribution.

“The Culture of Contentment,” one of the last published writings of John Kenneth Galbraith, 1992, is highly recommended…

“At the opening of his elliptically acerbic critique of America’s current economic state, “The Culture of Contentment,” John Kenneth Galbraith observes that one of the most enduring lessons of history “is that individuals and communities that are favored in their economic, social and political condition attribute social virtue and political durability to that which they themselves enjoy.”

Christopher Lehman-Haupt, April 6, 1992 New York Times review.

Trying to reach the Murray ‘blog-site, I find that the link to the source site is broken: starts with “hhttp”

Fixed, thanks.

This illustrates why lower real interest rates lead to asset price inflation. But, the decisions to buy a new investment good– ie. investment as opposed to changing ownership — is different. Lower interest makes the financing cheaper while the price should not change much assuming some degree of choice, or competition if you will.

Murray’s argument is a restatement of Zeno’s paradox of the Tortoise and Achilles, in which the Tortoise informs Achilles, “You can never catch up” (because the distance between them keeps successively halving, but never goes to zero).

It seems logical. But in the real world, Achilles does outrun the tortoise. And businesses do decide investment plans based on the marginal return of added equipment.

If you read his argument, he didn’t say that lowering interest rates had no impact on investment, but that the impact on the impact on the value of property rights dominated.

Also per the comment above in the thread, some companies do not in fact lower their investment return targets (or in the case of CalPERS, their return targets) in lockstep with interest rate declines. And as important, it has been WIDELY shown (see Andrew Haldane for one of many illustrations) that companies set return targets well above the level that are economically justified. Kalecki discussed this in the 1940s: Businessmen do not seek to maximize profit, because that would lead to full employment, which would reduce their bargaining power relative to labor and also their social status relative to labor (they’d still have more but not as much more). They balance their profit needs against their strong preference for more power over workers. The policies that result from that are shallower growth, which leads to lower and lower interest rates as central bankers try to fix a problem they cannot in fact fix, and eventually negative interest rates and income subsides.

Which is precisely what has unfolded.

The policies that result from that are shallower growth, which leads to lower and lower interest rates as central bankers try to fix a problem they cannot in fact fix…

…and are in fact cluelessly exacerbating…

Yes, Yves, you are correct, there are a lot of theoretical reasons as well as empirical evidence that a reduction in real interest rates or (nominal ones) have little effect on investment but it generally can have a large effect on assets values directly and indirectly by encouraging a speculative spiral.

The problem I have with the article is this paragraph:

Let me summarise. First, standard theory has machines earning incomes and ignores the system of property rights it attempts to model. Second, once you incorporate a system of property rights these right have values, and the value of these rights must be added to the cost of machines to calculate the economic (opportunity cost) of capital. Third, once you have done this, changing the nominal interest rate (or even nominal rate minus inflation) changes no investment incentives, as all property rights holders immediate gain the value, which becomes a cost of investment. Finally, other factors that effect the cost of delaying investment by owners of property rights probably have a larger effect on investment, and in fact decreasing interest rates decreases the cost of delaying investment.

Particularly this idea (and the conclusion that follows): “the value of these rights must be added to the cost of machines to calculate the economic (opportunity cost) of capital.” I do not know of any evidence that the cost of machines increases due to decreases in real interest rates.

Why lend money outside of your family or friend group if you do not get interest on that money, which you then do not have to use within your own family and friends group?

The incentive to lend money is in interest. This is why we understand and have tolerated Finance Banking. Not even Michael Hudson is fully against Finance Banking. The problem today is that it has become too dominant. He recommended Finance Banking practices be 20 percent of the banking activity, not 80 percent or more, as is the case now as we see in Greece.

Or all that was equity, was turned into debt.

Interest on money was and is supposed to support my mother in law. Your mother in law, your mother and father, who made some money, got the deed to some property, and can’t work anymore, and lend the family money out at interest so they survive well enough, and something is left to pass on.

Squeezing those with reasonable wealth out of banking into god knows what so they can survive past working years on what was given them for that purpose, just means they get robbed.

Big Fish eating Little Fish, where the Big Fish get bigger and bigger and a Big Fish is bigger and bigger as smaller and smaller is debt deflation.

None of the numbers make sense. Yanis Varoufakis was not allowed to say “No.”

The US is not as bad off as the EU because it has not been completely dismantled in favor of the parasites. The parasites, the Financial banks do what they do, because they can.

What you want is balance and reason, not imbalance and stupidity. Corruption of the Insurance industry as represented in the converting of the taxpayer into the reinsurer of the reinsurer is the final frontier, or was.

The Insurance companies are supposed to have more money than the bankers.

The Finance banks love not giving anybody any of their money. No interest is to come to anyone but them. This is an unsustainable system because it is robbery.

Chris Hedges, a very smart and moral man, his Divinity degree oozing from every pore, says Revolution is the Imperative.

We actually did have a Revolution which actually did take effect by 1790.

By 1840 and on then till the mortgaging of slaves, human machines whipped to produce cotton, was obviously in need of end. We had a Stalinist system before Stalin went to robbing banks.

All throughout the ones with deeds followed Petty. “Don’t pay workers anymore than what it will take for them to survive to simply be machines and work, or they won’t work, because work sucks.”

On the one hand wealth comes from growing or making things, but on the other it comes from interest, making everyone give more and more to the banks.

WaL Mart, even Wal Mart saw sales go down, as a sign the whole thing is coming apart.

How do you have an effective revolution and keep the drugstores open? That is my question.

The only way I see to do that is to make USPO Service Banking a reality, fast, no matter what happens in the elections. What you want is what Michael Hudson tells you we must have.

David Cay Johnston tells you, and the rest of us, the individuals who are rich must pay their taxes. That is why Piketty called for Banking Transparency.

All that the US has now for certain is its Armed Forces. What has it been doing with its armed forces? Winning control of areas that weren’t dominated by its propaganda, and then giving that territory and its resources to the oil corporations.

If Saudi Prince F wants to play Econ War with the US, and Obama promises to veto the right to sue, over 9/11, maybe it is time to go ahead and destroy the Saudi Armed forces. Screw the Petrodollar. The gift of Kissinger & Nixon died in Yemen, already. If I am Rome, hell I had better act like it.

If your armed forces don’t even provide the spoils of war to the people paying for those wars, what good are they? The Corporations say right out they are Multinational. That means effectively they could give a damn about the people who see working for the Army as the best job around.

It is all wage slavery, and it is now wage slavery gotten to such a level with such a grasp on the throats of the working classes that they lust for apocalypse and the real jungles are preferable to the invisible hand that is debt.

If we go on this way, with nukes all over, we end up with Apocalyptic Riot.

(I declared war the other day. Day before yesterday. All for war, except that one that the Beatniks knew changed it to a no win situation.)

I had little grasp of what the hell the writer said with one egg inside the other egg. I saw no mention of anything but interest here and interest there.

In a civilized system, the one being dismantled, to have a real business, you buy insurance first. No asset regardless of what the government banking polices are is worth more than its insurance value.

That is real to me.