By Nick Cunningham, a Vermont-based writer on energy and environmental issues. You can follow him on Twitter. Originally published at OilPrice

If the whims of oil speculators are anything to go by, then another oil price downturn looks increasingly unlikely.

Oil prices have gained more than 80 percent over the past three months, bouncing off of $27 lows in February to hit $50 last week. Those sharp gains raised the possibility of another crash in prices because the fundamentals still appeared to be bearish in the near term.

By early May, oil speculators had built up strong net-long positions on oil futures, extraordinary bullish positions that left the market exposed to a reversal. Speculators had seemingly bid up oil prices faster than was justified in the physical market.

But the physical market got some help. The massive supply outages in Canada (over 1 million barrels per day) and Nigeria (over 800,000 barrels per day) provided some support to prices, erasing some of the global surplus.

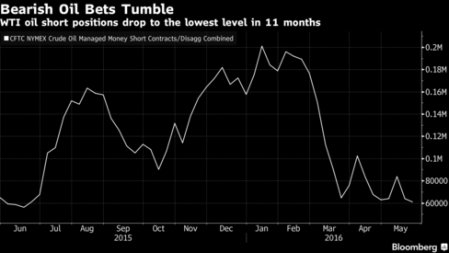

Now speculators who had started to short oil in May have retreated, pushing short bets down to an 11-month low. “If you’ve been short since February this has been a very painful ride,” Kyle Cooper, director of research with IAF Advisors and Cypress Energy Capital Management, told Bloomberg in an interview. “There are always a few die-hards but otherwise you’d want to get out. This is indicative of the improving fundamentals.”

With the supply outages, along with some early signs that the record levels of crude oil inventories are starting to come down, prices are on firmer footing than they were a few weeks ago. $50 oil no longer looks expensive. “The confidence of the shorts has been shattered,” Phil Flynn, senior market analyst at Price Futures Group, said in an interview with Bloomberg. “A lot of bears continued to bet that prices would fall well into the rally. When relatively bearish banks like Goldman Sachs changed to a more bullish outlook, bears noticed.”

The next big catalyst is the OPEC meeting that begins on June 2, although there is a general consensus that very little will be agreed on at the meeting. Saudi Arabia has shifted course over the past two years, downgrading its faith in the oil cartel as a vehicle for its oil policy. Riyadh’s extraordinary plan to gradually shift its economy away from oil as its almost sole source of revenue should be read in conjunction with its decision to step up production in the face of an already oversupplied oil market. Working within OPEC for to pursue price stability makes sense if Saudi Arabia expects predictable demand for its oil – keeping production on the sidelines works to its advantage because its assets would only gain value over time.

But if Saudi Arabia thinks that the world will start to attack oil demand via alternatives such as electric vehicles and efficiency – and there are signs that Riyadh is concerned about the sustainability of long-term demand – then monetizing its oil assets today by producing at higher levels is a more prudent approach. In short, Saudi Arabia is no longer willing to play the role of price stabilizer, which means that cooperating with OPEC members is not as useful as it once was.

In any event, at this week’s meeting at least, there will likely be no change of course. OPEC members will continue to produce as much oil as they can, battling for market share. One can argue with the wisdom of that strategy, but the markets are indeed balancing on the backs of high-cost producers. The U.S., for instance, has lost 900,000 barrels per day since peaking last year. And with oil back at $50 per barrel due to supply shortfalls in non-OPEC countries, there is little reason for Saudi Arabia to change tactics.

Of course, the markets are already pricing such an outcome into the market. Although OPEC has had a knack for springing surprises on the oil markets over the past few meetings, barring any unexpected agreements WTI and Brent probably won’t move much from the developments in Vienna.

Here’s the graph we need to be watching: Arctic Sea Ice Extent —

http://nsidc.org/arcticseaicenews/charctic-interactive-sea-ice-graph/

What’s more relevant is when a yuuuuge piece of ICE slides off Greenland and generates a Tsunami which wipes out New York. Or Northern Europe.

Climate change will not be a smooth transition from yore until hence +n deg C. There will be Catastrophic Events.

Agreed. Salt water intrusion into the groundwater sources of major eastern nations’ food producing locales, such as India, Bangladesh, coastal China, as a result of sudden rises in sea levels, will be major societal stressors. Greenland is closer to us, but I’d argue that Antarctic ice flows will have a greater impact world wide.

What’s funny in a sick way is that these problems were predicted years ago, and nothing substantive done about them. I’d venture to say that Global Warming is a case study in the failings of the ‘market’ system.

Oh, but “something” WAS done about those predictions and awarenesses: They were systematically repressed. By people who are like the executives of Soylent Corporation in the movie: They know they are going to be among the last generation of humans, that their and their predecessors’ corporate actions to extract and loot the planet leave little for humans to do but eat themselves (except for said executives, who have the very best of what’s left), and they need to kill anyone who would think to wake the mopes up to the end-game situation that one awful self-serving part of the human species has “innovated” and “creatively destroyed” all of us into…

All that propaganda effort, by the very few people who know what’s coming, but also know they can stave off any consequences, for their precious individual selves in their personal self-serving lifetimes, so who among them gives a sh!t? Al “Inconvenient Truth Seventeen Homes Bigfoot Carbon Footprint” Gore? Warren “There’s a class war going on, all right, and MY CLASS IS WINNING!” Buffett? Yep.

“Soylent Green … is… PEOPLE!”

Its interesting – I’ve been baffled by the apparent confidence of the markets in rising prices, and so far it seems they’ve been right. But I think we’ll only know for sure later in the year. I suspect $50 will be the signal for a lot of struggling tight oil operators to open up their fracked but sealed wells, so there might be an unpleasant surprise for the bulls in the US market, if not elsewhere.

oil bulls were saved by the Fort McMurray wildfire and the Niger Delta Avengers; see the graphic from Goldman here: http://focusonfracking.blogspot.com/2016/05/update-on-oil-prices-whats-moving-them.html

I suspect $50 will be the signal for a lot of struggling tight oil operators to open up their fracked but sealed wells

Most probably you are wrong. LTO producers lost access to unlimited financing from Wall Street. They can’t finance expansion from their cash flow (which is still negative), so they are cooked. Wells you are talking about were drilled, but not fracked. Drilling is only one third of the total cost of the well. So those two-thirds that are needed to complete the well is a problem. And will the particular well generate positive cash flow if oil price remains in $50-$60 range is another problem. Money spend on drilling are debt. Most shale wells will not compensate with their total production the amount of debt and interest.

They need around $80 per barrel to revive their operations.