Yesterday, we looked at a section of a Stanford Law School conference at the end of March. The panel on pre-IPO funding included the SEC/s head of enforcement, Andrew Ceresney. In the question and answer section, Ceresney and a member of the audience, Marc Fagel, the former regional director of the SEC’s San Francisco office, now Gibson Dunn partner, asserted that SEC enforcement actions and speeches were changing the conduct of regulated firms.

As we’ll show today, evidence in the SEC’s own public records contradicts that flattering self-assessment.

The reason Fagel posed this question was’t simply to give Ceresney a softball after suffering the indignity of interacting with a lowly retiree, or to reconfirm Fagel’s solicitude for the firms subject to SEC oversight. It was also to try to throw cold water on the information presented by the first audience member to address the panel. As you’ll see, the speaker described how the agency has been letting major private equity firms off the hook for misconduct (you can also watch this segment here from 1:36:30 to 1:40:00)

Questioner: Hi. This is a question regarding private equity. One of the…Private equity has a lot of investments in pre-IPO companies so I feel like the question is relevant. Both Blackstone and KKR had recent enforcement actions and Blackstone was fined for not disclosing accelerated monitoring fees but KKR was not even though it was engaged in effectively the same behavior. KKR was fined for broken deal expenses but Blackstone was not even though they were engaging in the same behavior. So my question is to Mr. Ceresney here, is the SEC engaging in, uh, symbolic enforcement actions to send a message, or if you are guilty of, you know, of the same violation of, violations, should you expect an enforcement action? And so, what kind of resource constraint issues does that present for the SEC?

Andrew Ceresney, Director of Enforcement Division at U.S. Securities and Exchange Commission: Sure, um, I’m not going to ask your name [laughter] or your affiliation. No, I mean, you know, I’m guess just going to talk about publicly available information, I don’t know what information you have. I know what information I Have. We did bring obviously bring actions against Blackstone relating to accelerated monitoring fees and also legal discounts, you didn’t mention that, and well as a case against KKR relating to broken deal expenses and failure to disclose how they were allocating, et cetera. In each of those cases has different facts, different issues, but they do boil down to essentially um a failure to disclose information to their investors how they were allocating fees and what they were doing vis-a-vis fees. And we’re seeing, we’re seeing that, time and again, an we’ve seen it time and again, I think you’ll see more cases in this realm.

To me, you asked are we are bringing these cases just symbolic. No, I mean I think these have real victims, in the sense that the investors in the private equity firms ultimately were deprived of money they should have gotten and ultimately as part of these settlements they’re getting the money they should get and that is the primary purpose of these enforcement actions. Does that, do these enforcement actions have an impact on the industry as a whole? Yes, and we want them to have that impact.

And in fact as I said at the beginning tonight, in the private equity industry, you’ve seen tremendous change I think in response, really I think in large part to these actions post Dodd-Frank, now they’re being examined by our examiners, we’re in there, we’re in there to see, and information that investors thought that they had they didn’t actually have and now they’re actually demanding changes to partnership agreements and other things too in light of the information they’ve now learned, and asking questions that they didn’t ask before and I think that’s a great thing. I think it demonstrates, people always ask me how do you measure the effectiveness of your enforcement program, you know, is it just the numbers for enforcement and I always have to say it’s not just the numbers. It is the quality of the actions we bring and impact it has on the industry. And this I think is a good example of the impact it has on an industry.

Notice what happened. Ceresney didn’t deny the real issue, that the SEC is engaging in selective enforcement. Ceresney’s patter about “I don’t know what you know, I know what I know” insinuates that this challenge to the SEC’s enforcement actions is based on inside information, and Ceresney isn’t going to go there in his reply.

But Gretchen Morgenson of the New York Times broke the story of how Blackstone, Goldman Sachs, KKR and TPG were all taking what are now called accelerated monitoring fees on a single deal, Biomet, Thus the fact that KKR, which wasn’t sanctioned for taking accelerated monitoring fees, when Blackstone was, was not a state secret. Nevertheless, that misdirection was part of Ceresney’s pretext for not giving a straight answer.

Instead, Ceresney shifted ground and mentioned the other types of misconduct the agency has addressed in its distressingly short list of private equity settlements to date. He gave the bureaucratic patter that each case was different (as in, “If I could only tell you, there were good reasons some firms got off and others didn’t”) and implied the agency was in fact being consistent. He also said SEC would be filing more cases.

But again, that does not mean, for instance, that a case against KKR for accelerated monitoring fees is in the offing. The SEC is still going through its initial examinations of private equity firms, and out of those are coming its initial enforcement actions. The SEC won’t conduct another exam of firms it has just reviewed and sanctioned for at least a couple of years. So unless a big media story puts pressure on the agency, it’s unlikely to give a second hard look at firms like Blackstone and KKR, who were part of its first round of exams and enforcement actions, any time soon.

Ceresney devoted most of his non-answer to an apple-pie-and-motherhood speech about what a great job the SEC has been doing in changing behavior. That would be nice if it were true. It isn’t, and it’s hard to believe that Ceresney didn’t know that he was telling a boatload of whoppers.

The SEC’s own annual filings from private equity investors, the Form ADV due in at the end of March, shows that private equity firms are continuing to engage, on a widespread basis, in abuses that the SEC regards as serious enough to merit fines. While those filings came in the very day Ceresney was on his panel, former exam chief Andrew Bowden was claiming (on what we believed was pretty dubious intelligence) in the late summer and fall 2014, well away from the ADV reporting cycle, to be learning of changes in behavior. Thus the SEC believes it has insight on changes in the degree of compliance on an ongoing basis, and further communicates it with the public. The Form ADV disclosures suggest the SEC needs to do a better job of cross-checking the self-serving palaver that lawyers for the firms it regulates are serving up, particularly in informal venues, versus what they say in the far more carefully crafted documents they provide to the agency

For instance, Ceresney mentioned an enforcement action involving “legal discounts”. The SEC fined Blackstone for failing to disclose accelerated monitoring fees and for legal fee discount abuses. Specifically, Blackstone negotiated legal fee discounts based on the volume of business it was generating, due largely to the activities of the funds it was managing on behalf of investors (buying and selling companies generates lots of legal fees). But even though the bulk of the legal work was taking place at the private equity fund level, Blackstone, the fund manager, was taking the biggest legal fee discounts for itself.

This year’s Form ADV submissions shows that a boatload of firms are admitting (present tense) to taking legal fee discounts. A few of many examples: Ares, Leonard Green, Hellman & Freedman, Silver Lake, JC Flowers, MS Capital Partners, Altamont Capital, ArcLight Capital, BV Investment Partners, Castanea Partners, Cresney & Company, Constitution Capital, Fenway Partners, First Reserve, Freeman Spogli, GI Manager, Riverstone Investment, Sumeru Equity Partners, The Gores Group, THL Managers IV, Technology Crossover Ventures, and TSG Consumer Partners. The relevant sections from the Silver Lake and Hellman & Freedman Forms ADV at the end of the post.*

Understand what this means. Ex post facto disclosure of an abuse is not a get-out-of-jail-free card. Investors are stuck in these funds. They can’t sell them in the secondary market without taking a meaningful hit. The SEC’s long-standing policy on investor protection is that disclosure must take place before the deal is consummated.

Bear in mind that the private equity firms could have written the disclosures to indicate these practices were a thing of the past if they’d actually cut it out as a result of the Blackstone fine. But the ones I’ve looked at are consistent with the conduct being ongoing.

So what do we make of confessionals to verboten conduct in these Form ADV filings? At a minimum, the firms regard the odds of them being sanctioned as being so low that they apparently don’t see a meaningful risk in admitting they are cheating their investors. To our knowledge, the SEC does not regard an admission in a Form ADV as a mitigating factor.

However, in addition to relying on the fact that the SEC won’t go after a comparatively small potatoes violation across the industry, so they are unlikely to be fined, the GPs may also seek to use well-known investor complacency as a defense. We’ve been told that some limited partners who read about the Blackstone legal fee discount settlement did look to see if that conduct violated the limited partnership agreement. It didn’t, one assumes because the general partners have succeeded in waiving their fiduciary duties. The only party that can assert a violation of fiduciary duty is the SEC under the Investment Advisers Act. The Form ADV disclosures may be intended to set up the argument, “Look, the limited partners know about this conduct and aren’t complaining. So how can you possibly think there is real harm here?” The flip side is that the investors have signed such one-sided agreements that there is no point in them complaining.

By contrast, one of the rare successes you can see in the current batch of Form ADVs is not the result of SEC action. Unite Here published a detailed study of questionable private jet usage by Leonard Green, including many flights to non-business locations like the Hamptons and the Virgin Islands on non-business times of year like weekends and major holidays. Leonard Green’s limited partnership agreement authorizes the use of private class travel. We’ve learned that two East Coast public pension funds pressed Leonard Green for answers as to who was paying for this flights and didn’t get straight answers. It’s likely that they had company. Leonard Green’s latest Form ADV says it is only charging its flights back to the fund at commercial rates.

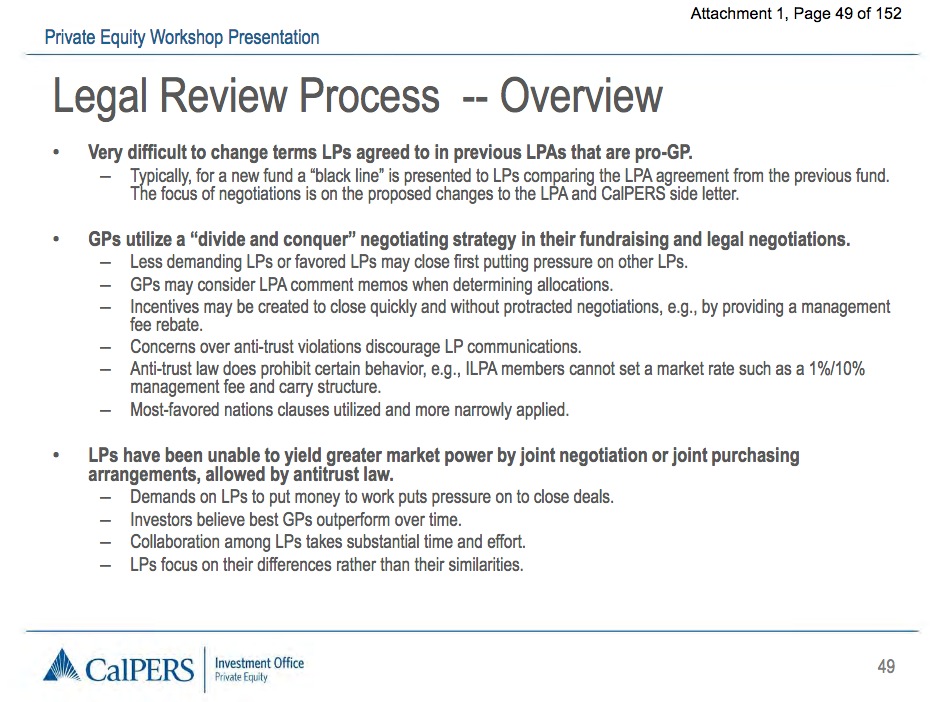

Ceresney’s response is dishonest in other respects. For instance, limited partners are most assuredly not demanding, much the less getting, changes in limited partnership agreements based on what the media and the SEC has exposed. As we’ve explained, citing experts, private equity limited partnership agreement are “take it or leave it” contracts. The little negotiation that does take place is on a few headline terms, like key man language and the percentage of portfolio company fees that will be offset against management fees. As CalPERS described long-form in its private equity workshop last fall, it is well-nigh impossible for limited partners to win improvements in terms that it has accepted in past deals from the same GP:

And that’s before you get to the fact that this is now a seller’s market for private equity, with investor desperate for returns committing even more money to alternative investments, above all, private equity. The Financial Times reported that the hottest funds are increasing fees and tightening other terms.

Similarly, the fact that the a group of state treasurers plus the New York City Controller wrote the SEC for help in getting more transparency in private equity is proof that to the extent that limited partner are asking more questions, they aren’t getting satisfactory answers.

Moreover, CalPERS’ and CalSTRS’ continued protectiveness of general partners suggests that little has changed despite the SEC airing industry dirty laundry. In addition, the big wake-up calls to investors haven’t come from the enforcement side as much as the former head of examinations Andrew Bowden’s speech setting forth the extent and severity of private equity abuses in May 2014. That and follow-on in-depth exposes at the Wall Street Journal and New York Times did get investors’ attention. But as we pointed out at the time, by September 2014, Bowden was already walking back his tough talk, at least in part because investors weren’t acting on the SEC’s revelations.

Last but not least, Ceresney seemed bothered by being asked a question by someone who was clearly technically knowledgeable about private equity and the SEC’s enforcement actions yet apparently not working in or on behalf of the industry. He is presumably accustomed to questioners who are either unsophisticated members of the public or securities industry professionals who have predictable interests (i.e., they are seeking clarification on issues in play, they are pressing the SEC to be even more company-friendly). And he apparently was not alone in being put off by the drift of the query. This is the screenshot right after Ceresney finished his reply:

Yet again, we have more confirmation that SEC is content to engage in a “peace with honor” strategy as far as private equity misconduct is concerned: Say you intend to go to war, beat a hasty retreat, but nevertheless declare victory. But as with Vietnam, too many people are watching for the SEC to get away with celebrating a climbdown.

_____

From the Silver Lake Form ADV:

The Adviser and the Funds will generally engage common legal counsel and other advisers in a particular transaction, including a transaction in which there may be conflicts of interest. From time to time, members of the law firms engaged to represent the Funds invest in the Funds, and also represent one or more portfolio companies or investors in the Funds. In the event of a significant dispute or divergence of interest between a Fund and the Adviser, the parties may engage separate counsel in the sole discretion of the Adviser, and in litigation and other circumstances separate representation may be required. Legal counsel of the Adviser and the Funds renders legal services to the Adviser and the Funds and does not represent the interests of any investor in a Fund. Additionally, the Adviser and the Funds and the portfolio companies of the Funds engage other common service providers from time to time. In such circumstances, there may be a conflict of interest between the Adviser, on the one hand, and the Funds and/or portfolio companies, on the other hand, in determining whether to engage such service providers, including the possibility that the Adviser will favor the engagement or continued engagement of such persons if it receives a benefit from such service providers, such as lower fees, that it would not receive absent the engagement of such service provider by the Funds and/or the portfolio companies. In certain circumstances, advisors and service providers, or their affiliates, may charge different rates or have different arrangements for services provided to the Adviser or its affiliates as compared to services provided to the Funds and/or the portfolio companies, which may result in the Adviser or its affiliates receiving a more favorable rates or arrangements with respect to services provided to it by a common service provider than those payable by the Funds and/or the portfolio company, or the Adviser or its affiliates receiving a discount on services even through the Funds and/or the portfolio companies receive a lesser, or no, discount. For example, both the Adviser and the Funds benefit from a 10% discount from our primary outside

law firm for non-transactional work. In addition, time spent by attorneys in such law firm’s personal planning department, whether for transactional or non-transactional matters and whether for the Adviser or the Funds, is billed at a 30% discount to the law firm’s regular hourly rates, reflecting what we understand to be the law firm’s prevailing market rate for those lawyers’ services. In practice, this 30% discount tends to benefit the Adviser and individuals affiliated with the Adviser as the Funds do not have a regular need for personal planning advice.

From the Hellman & Freedman Form ADV:

H&F and the Funds will generally engage common legal counsel and other advisors in a particular transaction, including a transaction in which there may be conflicts of interest. Members of the law firms engaged to represent the Funds also from time-to-time represent one or more portfolio companies or investors in a Fund. In the event of a significant dispute or divergence of interest between Funds, H&F and/or its affiliates, the parties may engage separate counsel in the sole discretion of H&F and its affiliates, and in litigation and other circumstances separate representation may be required. Additionally, H&F and the Funds from time-to-time engage other common service providers. In certain circumstances, the service provider may charge varying rates or engage in different arrangements for services provided to H&F, the Funds, and/or the portfolio companies. This may result in H&F receiving a more favorable rate on services provided to it by such a common service provider than those payable by the Funds

and/or the portfolio company, or H&F receiving a discount on services even though the Funds and/or the portfolio companies receive a lesser, or no, discount. This creates a conflict of interest between H&F and the Funds in determining whether to engage such service providers, including the possibility that H&F may favor the engagement or continued engagement of such service provider if it receives a benefit from such service providers, such as lower fees, that it would not receive absent the engagement of such service provider by the Funds. In addition, H&F and its related persons, in certain instances, receive discounts on products and services provided by portfolio companies, customers and suppliers of such portfolio companies and/or service providers of Funds.

Yet another great post. Continuing to admit that they are still taking fees which the SEC has already taken enforcement action on is likely a lame way to avoid admitting guilt. The problem that the SEC faces is that nearly every PE firm in the industry has engaged in defrauding and/or misleading their investors. And since the lawyers representing the PE firms know how the game is played with the SEC when faced with a “we are all guilty therefore none of us is guilty” situation, most PE firms know that many of them will get a deficiency notice at best at which point they will stop that bad practice. Then the firms and their lawyers will dream up new ways to take back what they gave away, but this time LPs will be on notice so the whole thing will be on the up and up. A win for the LPs staff, GPs, lawyers, consultants and SEC, but a big rotten egg for firefighters, teachers, police officers and the rest of us poor saps. And meanwhile the .1% will get richer and the pension funds will continue to be underfunded.

You don’t want to mess with Mary Jo – unless your name ends with L.P.

Yves,

This is a textbook example of your value-add. It is all out of my lane but I can tell how much time and concentrated analysis you had to put into the research behind this post. Not to mention mind numbingly boring reading material.

It is a pity that you lack a research staff to help you. Keep up the good fight.

P

The pattern of SEC actions on private equity mirrors its actions on the RMBS debacle. The SEC reached a settlement with each bank on one or two RMBS cases, dropped the rest, and didn’t bother to investigate to determine how many times the same conduct was repeated, or whether any humans should be charged with crimes. In the same way on private equity, they reach a settlement with one firm on one issue, another on a different issue, and drop all the other potential charges, and do not even think about the possibility of multiple counts or criminal charges. Then they go to conferences, get plenty of attaboys from the industry, pat themselves on the back about their marvelous work, and get defensive when anyone asks a decent question.

Yesterday Yves pointed out how they act on the other sice of the revolving door: Marc Fagel, who Yves Smith featured yesterday, puts into words the attitudes they held at the SEC. Ceresney obviously shares those attitudes, as he claims that he has secret knowledge that behavior changed, when it obviously hasn’t. Of course, Ceresney came to the SEC from the other side. These people are so thoroughly captured by the industry they don’t even see it when they are caught on tape demonstrating their contempt for investors and especially fiduciaries like the public pension plans that have been begging for enforcement actions from the SEC with no success.

The SEC still believes that markets police themselves, despite the mountain of evidence to the contrary. They are a national disgrace.

This is phenomenal reporting — but I’m chilled to my bones by the hopelessness of the situation when the White House and Congress have shown themselves to be completely unresponsive to public pressure. No wonder, as they are feeding at the same trough as the “revolving door” boot-lickers who play pretend at enforcement. Until enforcement division lawyers at the SEC are treated like judicial officers and barred from outside employment for life (with civil service guarantees, attractive salaries, and healthy pensions), they will continue to treat their oaths of office as the opening of extended job interviews with the very people who they play-act at overseeing.

The other problem exposed here is the desperate state of an economy that is no longer based on extraction or production — it is simply a carcass being picked-over by hyenas and vultures. Human instincts at their basest.

I’m sure that the limited comments here are due to the depressing prospects for change at the SEC under either a Trump or a Clinton presidency.

+1. Stopping the revolving door is critical for reforming the system for all the reasons you point out. Thank you for spelling it out with such clarity.

Same thing is needed for all regulatory agencies–how else can regulatory capture be prevented, when carrying out regulatory duties in a diligent, ethical way is perceived as a career-stifling approach?

re: the economy being “simply a carcass being picked-over by hyenas and vultures” – you might appreciate this new post on the Inverted Alchemy blog, “Zombie Capitalism”.

The revolving door at the SEC is an abomination. Directors of Nonenforcement such as Robert Khuzami and Andrew Ceresney should be investigated and prosecuted for obstruction of justice. Ditto for their DoJ counterparts such as Lanny Breuer, Eric Holder, and Loretta Lynch.