By Randy Wray. Originally published at New Economic Perspectives.

By L. Randall Wray

This blog is based on the testimony I provided to the US House of Representatives. My written statement will be published in the Congressional Record (a version is also at the Levy Economics Institute: http://www.levyinstitute.org/publications/statement-of-senior-scholar-l-randall-wray-to-the-house-budget-committee. The full statement was co-authored with Yeva Nersisyan.

I will argue that the Federal Government’s deficit and debt are not so scary as we are led to believe.

Neither the deficit nor the debt ratio is on an unsustainable path. In some sense, chronic deficits and a rising debt ratio are normal.

They are not due to out of control spending—now or in the future. They serve a useful public purpose. In any case they are largely outside the control of Congress.

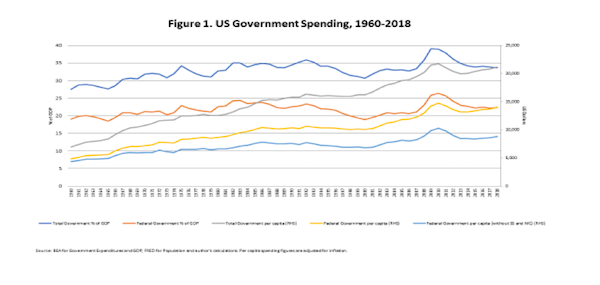

It is hard to imagine a scenario in which rising deficits and the debt ratio will create a financial crisis, lead to government insolvency, generate high inflation, or trigger an attack by bond vigilantes. Figure 1 looks at government spending from several angles but just focus on the red line—which is total Federal Government spending as a percent of GDP. It is essentially stable since 1960.

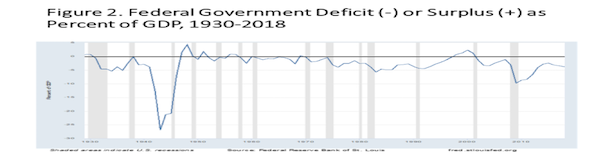

Figure 2 shows the deficit as a percent of GDP since 1930. Three things are apparent: we ran a deficit ratio as high as 25% of GDP during WWII; deficits are normal over the whole period—with only 2 short periods of surpluses; however, since the 1970s the swings are bigger and the average deficit ratio is higher.

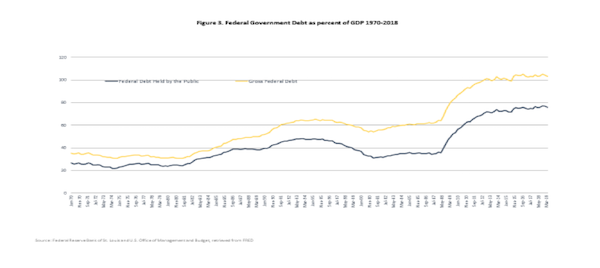

Figure 3 shows the debt ratio. The blue graph shows the debt held by the public as a percent of GDP. The long term trend is upward but there was a big boost due to the Great Recession; as well as after the Reagan and Bush Sr recessions.

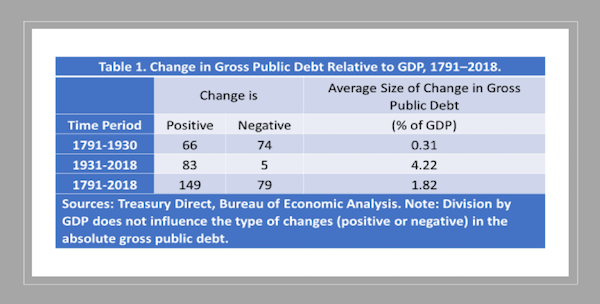

Table 1 (borrowed from Eric Tymoigne) shows that the long term trend is not new—the debt ratio has increased at an average pace of 1.8% since 1791. What has changed is that the rate of growth is higher since 1930. Before 1930 the debt ratio dropped in more than half the years—although the increases were bigger than the decreases. However since 1930 there have been only 5 years in which the debt ratio actually fell—and 83 in which it went up.

The next series of slides provides clues about this change.

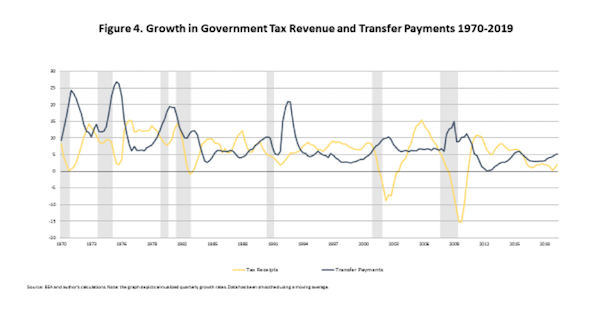

Figure 4 shows the countercyclical nature of taxes and transfer payments. Tax revenues grow in an expansion and fall in recession; transfers grow with a lag in recession and fall in expansion. However, the swings of taxes have become very much larger in the past 2 decades—falling off a cliff in a downturn. Interestingly, in the current expansion, the growth rate has been unusually low.

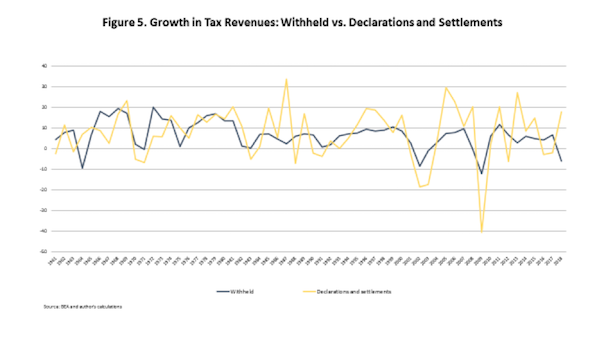

Figure 5 breaks taxes down into the withheld and nonwithheld types. Both swing with the cycle, but nonwithheld taxes swing more wildly especially in recent years. However note that under Trump, withheld tax growth has dropped like it usually does only in recession.

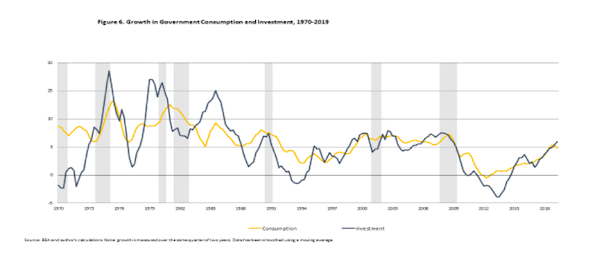

Figure 6 breaks government nontransfer spending into consumption and investment. Swings of these components do not follow a clear countercyclical path—if anything they are somewhat procyclical, rising in an expansion and falling in recession.

All in all we conclude that Federal spendingprovides a modest stabilizing role, mostly through transfer payments—but that has weakened in recent decades. Taxes play the bigger stabilizer role but they are more effective at reducing the drag in a recession than at pulling out demand in expansion.

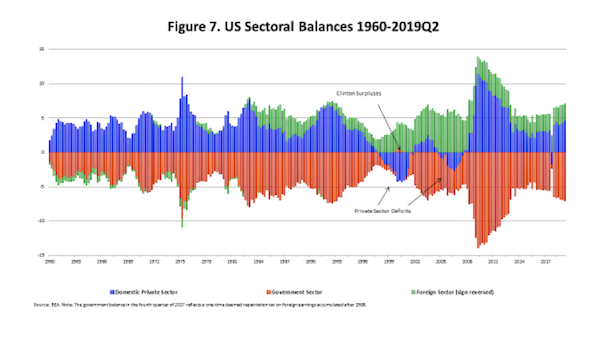

US sectoral balances are shown in Figure 7. At the aggregate level spending equals income by identity. One sector can spend less than its income (run a surplus) only if at least one other spends more than its income (runs a deficit).

The government sector taken as a whole is red. You will notice that with the one brief exception during the Clinton years, the red is always in deficit—below the line.

On the other hand, the private sector, including firms and households and shown in blue, is almost always in surplus. The exception was during the decade between 1996 and 2006 the private sector spent more than its income. This coincides with the period of the Clinton surplus.

The final sector, shown in green, is the foreign sector—or rest of the world. It has run a surplus balance since the Reagan years. That is because we run a current account deficit—to simplify we can say this reflects our trade deficit.

So the usual case is that the government’s budget deficit equals the sum of the private sector’s surplus plus the current account deficit (with its sign reversed). This is an identity.

Anyone who is going to argue for eliminating the budget deficit must tell us which of the other two balances is going to change so that can happen.

Are balanced budget hawks also advocating to eliminate the private sector’s surplus and run deficits again—as they did in the dot com and housing bubbles? If so, how will we avoid another Global Crash?

Or are they suggesting we’ll get the rest of the world to run deficits so that we can run a current account surplus? We’ve had a current account deficit for half a century—and the Trump Administration’s tariffs have reduced international trade but have not yet significantly reduced our current account deficit.

Even if we could control our imports, we can’t control exports.

Understanding sectoral balances leads us to conclude the Federal balance is not under close control of Congress because the outcome depends on the other 2 sectors. Even if we can control Federal spending (which has not been growing as a percent of GDP), tax revenues depend on economic performance—which also goes into determining the other 2 sectoral balances.

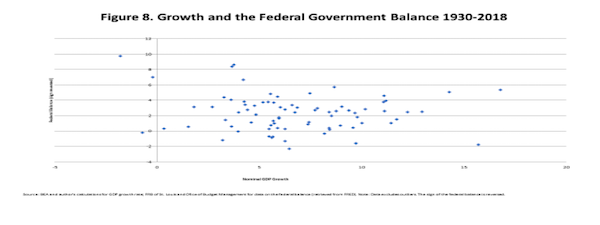

The budget deficit is endogenously determined—growing when the economy slows and falling when growth picks up. That’s not always the case but it is the best case scenario because it is stabilizing. Figure 8 shows the relation between economic growth (horizontal axis) and the Federal government deficit (shown as positive on the vertical axis). Surprisingly, there’s no obvious relationship.

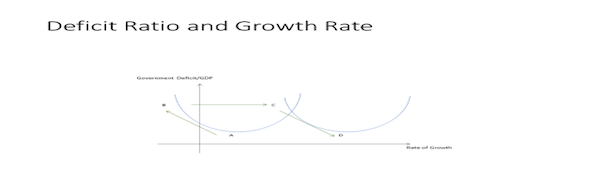

We can obtain the same deficit ratio—say 4%–with a wide variety of growth rates. We could hypothesize that we can move from a 4% deficit ratio to an 8% deficit ratio in either the good way or the ugly way—as shown in the next graph.

Start at point A, which shows a deficit ratio of 4% with a growth rate of 4%. Now let’s cut spending or raise taxes in an attempt to cut the deficit. If this slows growth, we could move up to point B—with a deficit ratio of 8% and negative growth. That’s the ugly way to produce a bigger deficit.

That is the Japanese way. Whenever the economy begins to escape stagnation, the government adopts a new consumption tax that kills the recovery and causes the deficit to grow.

Or we can increase the deficit the good way, by embarking on a public infrastructure investment campaign. We move from point A to point C. The increased spending boosts the deficit and economic growth. However, as growth picks up, tax revenue grows and we shift down the arrow to Point D—with a lower deficit and higher growth.

That’s the good path to deficits. Of course that’s all hypothetical. We can actually trace the path of the combinations of deficits and growth in the following two graphs.

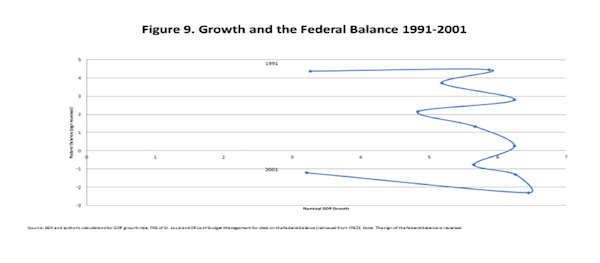

Figure 9 shows the decade from 1991-2001 as a relatively high budget deficit at the beginning of the decade boost growth, and maintenance of high growth shrinks the deficit over the rest of the decade until a surplus is generated. However, that killed the boom.

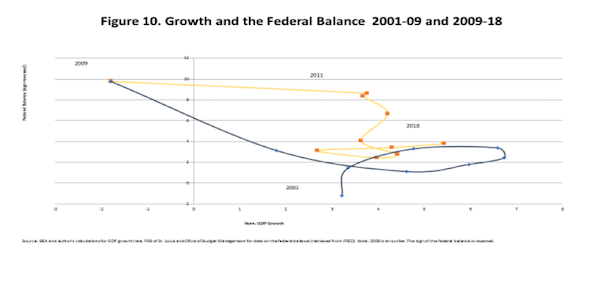

Figure 10 shows a loop-da-loop as the deficit rises after 2001, as the economy recovers until the mid 2000s, crashing into the Great Recession that drives the deficit to 10% of GDP in 2009. Over the next decade, growth settles in at a 3-4% pace and the deficit comes down to the range of 3-4% of GDP

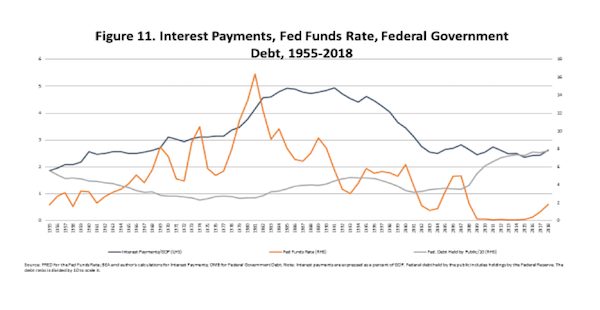

Figure 11 displays the interest on the debt as a percent of GDP—rising sharply through the mid 1980s and then settling at about 2.5% of GDP for the past 15 years. That is in spite of the rising debt ratio (grey line, which scales the debt ratio). The fed funds rate (red, right hand scale) is the main driver of the debt service ratio. That is why interest payments by government have remained low for the past 20 years even as the debt ratio has risen.

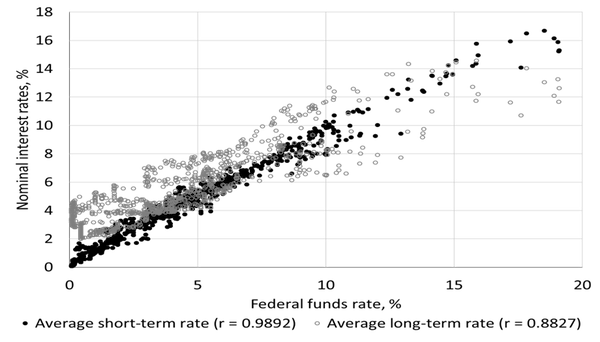

In case someone objects that while the Fed controls the federal funds rate, bond vigilantes determine rates on longer maturities, this graph shows that the correlation of the ffr to long rates is very high. And, of course, the Fed can perfectly control long rates if it is told to do so. (Thanks to Eric Tymoigne for supplying this graph.) The Fed is the only bond vigilante we need to worry about.

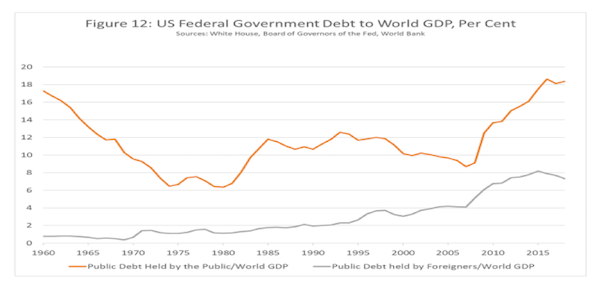

Figure 12 displays Federal government debt to world GDP. As a percent of global GDP, the debt ratio has gradually climbed back to where it was in 1960. In 1960, however, the world was on the Bretton Woods system, in which the US dollar was pegged to—and competed with—gold. Today the Dollar is the primary international reserve currency. The portion of Federal debt held abroad has been running approximately 40% to nearly half. Hence, the ratio of Federal debt to global GDP is less than 6%.

This could be the more relevant yardstick for measuring the debt ratio for the international currency reserve. The largest foreign holders of US government bonds are foreign treasuries and central banks; most of the rest is held in financial institutions and particularly in offshore banking centers. Other than the offshore banks, US treasury holdings are mostly accumulated by countries running bilateral current account surpluses against the US.

It is highly unlikely that the demand for US dollars is even close to satiation. International exporters often trade with the US because they want US dollars—often because they need them for imports or to manage their exchange rates.

Further, in the last global financial crisis, there was an immediate run to dollars, only relieved by massive intervention of the Federal Reserve—which originated over $29 trillion in loans, of which approximately 40% went to foreign banks and much of the rest went to private global banks. US treasuries are held as the safest financial assets in the world.

So, you can stop worrying about Federal government debt and deficits.

My biggest concern about America’s perpetual deficit spending is the fact that, essentially, the deficit pays for the military budget. I find that immoral. Think of the possibilities if we used the same amount of money constructively instead of destructively. The possibilities are endless. What if the American military was mobilized to fight climate change?

That’s the crux of the problem with MMT.

While the military example is more offensive, there’s nothing remotely ethical about the SNB creating “money” out of thin air and buying billions of dollars worth of stock, either. And the list goes on.

If the credit/debt that is created is not used wisely, then how on earth can one reasonably “stop worrying about Federal government debt and deficits.”?

I don’t see that as a problem with MMT.

Instead, a benefit of MMT is that it forces us to acknowledge the political nature of our government spending choices. It is the responsibility of our elected representatives. Not bankers or economists.

Instead of ‘How are we going to pay for that?’, we can move on to ‘Why are we funding X and not Y? Which funding choices will produce the greatest national benefit?’.

Those won’t be easily answered, but it sure beats pretending it is deficits that keeps us from housing the homeless, keeping retirees from starving, providing universal healthcare, or maintaining our infrastructure.

I disagree for two basic reasons. First, the grotesque priorities on display today are not the result of distortions due to budgetary constraints, they are a reflection of those in power serving moneyed interests. Why then, given the additional power to create even more debt, do you imagine that politicians might suddenly see the light, turn their backs on those who empower and enrich them, and return some semblance of fairness and wisdom to the expenditures of massive additional “cost-free” money?

Secondly, the belief, underscored by Wray’s conclusion above, that the rest of the world will continue to hold the Dollar in high regard is sheer fantasy. In fact, real de-Dollarization is occurring as we speak, and will accelerate as long as the U.S. continues to attempt to bully and destabilize the rest of the world for utterly selfish, and ultimately self-defeating reasons.

They already have the power to create as much money as they want. They do it all the time. They spent $14 trillion to bail themselves out during the GFC. They print money all day long for endless wars.

Deficit hawkery is only pulled out of the closet when the peasants want to spend money on health care and infrastructure. That’s the only time the deficit concerns anybody. It seems like you’re looking for fairness and wisdom from people who’ve already proven they have none. They’d be just as corrupt under any other system.

Crooked people can’t be made straight by mere rules.

There is no point switching to a non-MMT system since it would mean near-permanent deflation — and then we really truly wouldn’t be able to afford health care or infrastructure. But they’d still find a way to pay for endless wars and bailouts.

Side note – Dedollarization would make imports much more expensive and would result in severe pain. On the other hand, the US could essentially function as an autarchy if it chose. It wouldn’t be a bad thing to rebuild industry here at home instead of importing literally everything.

It is true that de facto MMT has been in effect for some time, but it is still more constained than it would be if officially adopted.

This:

“Crooked people can’t be made straight by mere rules.”

misses the point, which is that the system is badly broken, and “officially” adopting MMT won’t have the desired effects until it is fixed, irrespective of who is elevated into power.

Do you think, for example, that there would be profound changes in spending patterns if Bernie Sanders were to be elected? I don’t, but would be happy to be proven wrong.

Big money has a stranglehold on political power, and until it is broken, the deleterious distortions in spending will continue.

I do agree with your final paragraph.

The military-surveillance complex operates on MMT principles. Since when did anyone worry about where the money for the next Middle East bombing run was coming from? So you are eager not to have other interests make use of those principles?

Second, the rest of the world is delighted to hold dollars because pretty much everyone but the US runs on mercantilist principles, as in they want to run trade surpluses so they can employ more people at home. High employment rates and high wage rates lead to happy populations and high reelection rates.

But who will run the trade deficits to be on the other side of those trade surpluses, and in so doing, export jobs? The US does that.

That relationship INHERENTLY entails other countries taking US dollars. They are not about to give up the domestic jobs they represent any time soon.

Absolutely Yves. Capitalism ( in whatever form ) relies upon the creation of debt to continue . This was as true in 1780 as it is today . The formation of enough capital to build a factory was done by the creation of debt . The sheer quantity required made it so. Money is being created and destroyed all the time . The management of its creation and destruction is in the hands of central banks and their sub-contractors commercial banks . The central banks exist in a political/economic no-mans land where the politicians want to blame them when things aren’t going too well and take the credit when they are . The Question is this : how do we transition from a debt based system fuelling ‘ growth ‘ to some other system that is aligned with the non-growth world which is the Reality of living on a planet that is not expanding in size and all ( exploitable ) parts of it are known and those parts which have not yet been exploited but could be are found to be beyond the historic norms of the system ; i.e. profitable , e.g. fracking .

Wray acknowledges that there are good and bad ways to increase the deficit depending on the kind of techniques used (figure 8 and the discussion following). The need to prevent policy makers serving moneyed interests, and more generally to spend on things that will help the economy and contribute to societal goals rather than enrich their personal benefactors, is a separate but related problem.

However, the argument that such spending in deficit scenarios is always and everywhere bad (austerity) is just another example of that. It helps creditors, who are typically one and the same as the moneyed interests you refer to. Countering the false austerity narrative might not be enough to fix the problem (of misallocation of government spending) on its own, but it can help move us in the right direction.

You’re objecting to something that currently happens in reality. How is that the fault of MMT? Go blame the elites who own the government and run it for their benefit. They’re the ones who decide to print money for endless wars and bailouts. Believe me, they’d find a way to do that under a different monetary system as well. Neither gold nor fractional reserve banking can turn scumbags into saints.

The American (Imperial) military is, among other “missions” that include a whole bunch of self-licking ice cream cones (arms race that never has stopped, MENA wars and other fun and games), “mobilizing” to deal with climate disruptions. Mostly in the name of providing profit opportunities for corporations that can loot off the processes (construction and heavy equipment, engineering, Monsanto, Cargill, stuff like that.) And also working on “interoperability” with the militaries and “national police forces,” of a bunch of other places, for the Empire’s warfighting activities now and henceforth, and the Empire’s Global Policeman functions (being “the World’s Policeman,” as in the sense of things like the Summerdale Scandal, https://www.chicagotribune.com/news/ct-per-flash-summerdale-0707-20130707-story.html, Holman Square gulag, https://www.theguardian.com/us-news/2015/oct/19/homan-square-chicago-police-disappeared-thousands, Philadelphia and Los Angeles police scandals, https://www.thoughtco.com/move-philadelphia-bombing-4175986.)

The military is getting all prepared to control and funnel and do the necessary killing to deal with Volkerwanderung that is likely in the future. All laid out in their planning documents and doctrines, like this one: “Trends And Implications Of Climate Change for National and International Security,” https://apps.dtic.mil/dtic/tr/fulltext/u2/a552760.pdf

So, no need to worry. Debt will continue to be generated, and money into the global economy…

“…Volkerwanderung…”

See, I think that’s why they’re really building the wall that most people pretend to oppose. It isn’t to stop unlawful immigration today—-“conservatives” have had opportunities to reform the process for 20 years and have declined because they profit off of cheap labor. No, the Wall is an acknowledgement of Climate Change and the fact that it will cause massive waves of migration. Of course there are other anti-immigration policies going into effect with the same purpose.

What if the American military was mobilized to fight climate change?

Most Expedient way for the Military to fight Climate Change is to abolish the military. Especially all the Planes.

That’s probably not what you mean about using the military to fight climate change.

I did some research on this last night…..sort of a comparison between the US military machine and the rest of the world. I don’t think most people know about the following facts:

The US has 800 bases located abroad, located in 70 countries, on six or seven continents. Russia has 21 bases abroad, located in 11 countries, all based on the same two continents as Russia.

The US has 20 aircraft carriers, including 11 “full-size,” nuclear “CATOBAR” carriers and 9 short take-off and landing carriers. Russia has one aircraft carrier, a non-nuclear ship commissioned nearly 30 years ago that is presently undergoing repairs after a fire in dry dock. Russia’s carrier is in such poor condition that it is shadowed by a tug boat because it frequently breaks down. China has two aircraft carriers that are of the same class as Russia’s.

Since logistics is so important to the U.S. military, the U.S. Air Force has 455 aerial refueling tankers that allow it to position troops and supplies around the globe. Russia has just 15 of these aircraft, and China has 13.

Now, I’m not suggesting that the Russian or Chinese militaries are impotent or incapable of either defensive or offensive actions, but it is quite clear that our two countries are preparing for different wars, and only one of the countries is spending ludicrous and possibly economically-crippling amounts of money.

Here’s my question—-

Interestingly, six of America’s eleven big carriers (i.e., all of the carriers based on the East Coast) were out of commission and were in port in Virginia for repairs or refitting. Perhaps that’s an acknowledgement that we know they are sitting ducks.

Sorry, what is your question?

Yes, I came to the same conclusion. The US military is intended for force projection. Not that it does this well. Its hard to project force against a peer enemy. People might get hurt. But projecting force to ensure that you can continue to get oil or other raw materials cheaply is not so dangerous. That’s what carrier groups are for.

Plus, they are a great way of manufacturing consent among the poverty striken rubes. Those defense contracts can be spread around, and poor kids who volunteer for the military and shooting brown people can get health care and pensions or even college degrees.

The only real problem, is that the people who build the weapons have no real incentive to make sure they work or are cost effective. Particularly now the system in politically indispensable. Which is why nothing works well. See new refueling tankers or F35. Im not saying the F35 doesnt work. But its not cost effective. They spend way too much time on the ground in mandatory maintenance. And would go up in a puff of smoke the first time you took on a peer enemy.

Whats the phrase used here? “Self-licking icecream cone?”

Oh sorry—not sure how “Here’s my question” got in there or where I was going. I’m sure it was meant to be deleted, as my thoughts changed as I was researching and typing.

I think there were two points there. 1. Yes, you are right: if we abolish the military and especially stop flying those 455 refueling tankers that burn over 11,000 lbs of fuel per hour, then that would greatly reduce the overall carbon footprint. 2. I don’t think average Americans have any idea just how overbuilt the American military machine is relative to all the other countries in the world.

And to your last point, yes absolutely—-our newest weapons systems are grossly inefficient. It’s telling how cheaper, tried-and-true aircraft like the B-52, the Advanced F-15, and the Super Hornet keep going like the Energizer Bunny, while the new systems remain in limbo. It’s almost as if cost-plus contracting models have some sort of inherent flaw. /s

The US military is intended for farce projection.

It’s a bluff. One day the bluff will be called.

Another description of “Aircraft Carrier” is “Target.”

Something about “One catches more flies with honey than vinegar” seems appropriate.

I realize this is just basic, dry, sectoral balances budget talk. And it makes sense that we don’t have to worry about Federal Gov debt and deficits that balance themselves. And we can afford to to the GND, M4A, etc. What I’d like Wray to talk about (assuming it isn’t completely irrelevant) is what happens to our “balances” when all the accumulated externalized costs (society and environmental) are included in the bottom line of sectoral balances. Right now we are having a free ride because all that particular “debt” – debt to society and the environment due to long years of neglect – has never appeared on any balance sheet. What I’d like to know, if it is possible, is what happens to economics when a great deal of government money is spent remediating the world if the remediation brings no profits and no taxable assets to the table. When it is all spending and no income (as we have come to know it – profits, etc), which I assume it will now be for a long time. Will the sectoral budget still balance out due to higher employment and wage taxes? Excise taxes? What if we designate societal and environmental improvements to be assets – would that balance things out?

Rather than worrying about how we’re going to include all those externalities in the accounting books, the bigger point is that we need to spend actual real world resources and energy to fix everything. Who cares about the accounting. It’s a human construct not a natural law. The real question is can we even afford — in terms of resources — to do the work that must be done to keep the planet habitable for civilization.

Given current population, lifestyle, and technology, it looks pretty certain we can’t.

Exactly

Real resources are the issue. We can create an unlimited amount of dollars but if there is a fixed set of stuff, we get inflation.

If there is surplus stuff (including labor) or capacity to produce more if there is demand, not so much

Spending wisely would help…

Accounting is important but mostly for entertainment value

Demand will rise as income rises.

Demand and supply will create an upward spiral.

Cynically, I’m pretty sure that if the choice was between an uninhabitable world and the death of a mere billion, very serious people would choose to protect their constituents and forget quite easily about everyone else. So, it isn’t really a question of both right-charging the balance sheet to protect the environment while still making sure resources are spit equitably. We all already know the degree to which capitalism splits resources equitably. I see no reason to expect anything new on that front.

Less cynically, humans are capable of taking care of themselves through subsistence farming, hunting, crime and other extra-economic activities. There are probably other unappreciated windfalls associated from the switchover to renewables, possibly including reduced incentive for conflict. (Sunlight is everywhere.) it is premature to proclaim us done for yet, as long as we don’t break the natural world. Malthus will have to be put off for a while longer.

We do need to get serious about ending the burning of fossil fuels though. The year without a summer, which ruined crops and led to widespread food shortage throughout Europe and North America was < 1 degree mean temperature change. We will be very lucky indeed to see only twice that out of global warming and it will take a long time to fix itself even after we bring new carbon emissions to zero.

Yes that was my point, you just said it better. My thinking is that our economy is so twisted and by its own standards and in debt so deeply that it could never get out so that we literally have to change how we create value in the first place. And imo it agrees with MMT – it’s MMT without the current baggage of arbitrary definitions of debt. And etc.

First point: No, these deficits don’t matter … until the Rest of The World decides to stop using the dollar. The trend is already in the wrong direction. The economic downturn we’ll have pretty shortly should accelerate that trend.

Second point: If deficits don’t matter and the Fed should be putting money in people’s pockets then how about we just cancel the Federal Income Tax and it’s Payroll Deduction? And we can stop taking money out of people’s paychecks for the Affordable Care Act too.

Third point: “My biggest concern about America’s perpetual deficit spending is the fact that, essentially, the deficit pays for the military budget.”

Issues of the legitimacy of the DoD budget itself aside, even under Reagan the Sum of All Deficits was 4.9T, and sum of the .Mil budgets was 4.2T, NOT including the State Department or the 17 intel agencies.

Nowhere in the article or the theory does Wray say that deficits don’t matter. (How you can look at figure 7 and conclude that he’s making that argument is beyond me – clearly that graph shows that they do matter). He’s arguing that reducing them to zero or below isn’t always sensible or desirable depending on the macroeconomic context. It does not imply that it would be OK to remove Federal Income Tax, any more than taking a blood test from a patient would mean it was OK to remove all their blood.

If the ROW stops using the dollar, imports will become more expensive. But it also means we won’t be draining dollars to the rest of the world. It means we won’t need to perpetually prop up the private sector with federal spending. So the deficit will start to solve itself. Yeah, adjustment will be painful especially since workers haven’t gotten a raise since the 70s. It’s pretty nice to be able to trade worthless paper for physical stuff — but it hurts domestic employment. I think most people would rather have a job than imported plastic crap.

Your second point – Cancel FICA and ACA? Sounds good to me. Both are very regressive taxes.

Why do you think it would matter if the rest of the world stopped using the dollar? I think that would actually be good for most of the US. It would result in the trade deficit shrinking, which would boost US manufacturing and employment, while also allowing the government deficit to shrink in kind.

A major factor as to why the rest of the world uses the dollar is because the US has been willing to run a trade deficit on perpetuity, thereby providing a constant outflow of dollars for other countries to use. This is a policy that a mercantilistic regime would not condone. A major outcome is a “strong” dollar, which mostly benefits wealthy individuals whose assets are easily convertible to dollars.

I don’t know if it the ROW not using the dollar would be good or not but it won’t be fun, at least not at first, and it IS a problem we need to face. And we have done ourselves no favors by sustaining this using coercion. You’re quite correct that the world HAS been demanding dollars since WWII.

At the time there were demands only we could satisfy but this has ended, especially since we’re no longer a unique source for, say, advanced fighters, very large transport aircraft, docile small passenger aircraft (HA! hahahahaha….*sob*) , or advanced semiconductors.

To what degree does the conclusion of the article depend on the existence of the petrodollar system (e.g., as in the reference to international traders needing dollars)?

I’d like to see that elaborated too. I think thereupon hinges the entire geopolitical future of the US.

My laic take is, probably a lot. If the petrodollar system disappears or the dollar’s role is seriously diminished, then it is possible to suspect the dollar will fall and import costs to the US economy will likely go seriously higher across supply chains for raw materials, technology, and consumer goods.

This will likely have a seriously depressing effect on the economy and will reveal that the US has been swimming economically naked for decades, having dismantled its industrial base and failing to update its technology and high added value edge, in contrast to countries like Germany, Switzerland, Japan, Netherlands, who have managed to maintain theirs ( despite using a foreign currency like the Euro (SUI not using Euro but being tiny and yet managing to maintain strong currency), and paying for their energy and supply chain again with a foreign currency (dollars)).

so if the petrodollar goes, yes the US still remains a monetary sovereign, but the demand for treasuries and dollars will drop precipitously, raising costs across the economy and crushing the purchasing power of US labor. Then it will have to pull itself by the bootstraps and up productivity and start to export a lot more, ( preferably not commodities like oil and gas but high value add like Germany, otherwise it will start looking a lot like Russia), to preserve a standard of living. What the deficit will look like in susch a scenario I cannot conjecture, but likely it will be very large, as it will be concurrent with serious stagflation.

Exports are a cost — the point of retooling America would be to produce materials for the consumption of its own people.

Unlike the last 50 years or so of oligarchs deindustrializing the peons and offshoring production while engaging in reckless financialization.

Not at all — the entire petrodollar paradigm is an exercise in magical thinking.

The petrodollar has nothing to do with the federal government’s ability to pay back debt issued in its own currency.

Noticeably absent in the discussion is suppression of the real interest rate by the FED. Sure the debt/deficit do not matter when the interest rate is held near 0%. All previous annual debt/GDP ratios had appropriate interest rates to limit out-of-control government spending. These are uncharted waters.

It appears you are new to this site. There is no need for the Federal government to borrow to fund spending. It’s a political convention that is a holdover from the gold standard era. The Fed and Bank of England have both described how governments that issue their own currency can always pay their bills or any bonds they choose to issue. They will never go involuntarily bankrupt. They can create too much inflation, but the US has so much economic slack (despite what the press would try to have you believe about labor markets….would you seriously have people working for Uber or in Amazon warehouses if the job market were strong? There is tons of what economists call “involuntary part time workers,” people who want to work full time but can’t get a full time job). Taxes serve to drain spending and demand and serve as a check on inflation.

Note that this picture is not true for “currency users,” meaning people like you or me, or government bodies that don’t create their own currency, like states, cities, and governments like Germany and Spain that use the Euro, not their own national currency.

Nice compilation of stuff Wray and Kelton have been saying for quite awhile.

My only reservation is whether or not the committee even understood the presentation. The graphs were illegible, and statistical jargon needlessly applied, such as ” This is an identity.” when breaking down the budget deficit. Zero-sum game might have been better understood. :-)

Here is my simplistic comment/question. The first U.S. dollar was printed in 1914 along with the creation of the Federal Reserve Bank. With the Bretton Woods Agreement, the United States became the World’s reserve currency. However, for decades, many (not all) people from around the world had a favorable view of the United States and believed our citizens would act as “humanitarians” in conflicts. The myth of the “American Dream” also resulted in a favorable view for many. Then we became the country of “greed is good” and endless wars.

Today, the rest of the world views the United States as the greatest threat to peace on the planet. It seems to me that once a country becomes the greatest threat to peace, the rest of the world might want to consider having a different reserve currency. We can continue bombing, sanctioning and delivering “coups’ to the rest of the world, but, at what point will they say “enough” and it’s time for a new reserve currency?

I agree that under current conditions, we don’t have to worry about the Federal deficit/debt. Maybe we could even consider a debt jubilee. But, what happens to our country if we are no longer the World’s reserve currency and U.S. Treasuries aren’t considered “safe”.

Three comments. First, the dollar did not become the reserve currency as a result of Bretton Woods. Bretton Woods was a gold standard; the dollar was priced in gold until Nixon effectively took the US off the gold standard.

Second, the US does not need to borrow to fund its spending. This is a mere political convention. The Treasury can net spend directly. The US will never run out of dollars. It can always pay any bonds it chooses to issue. The risk is generating too much inflation, which is a real resources issue (the possibility that government net spending would generate more demand than the economy could satisfy). Taxes drain demand and are a way to keep inflation under control.

So the US does not depend on the kindness of foreign investors.

Third, the reason foreigners wind up holding dollars is because we run trade deficits with them. Politically, they like that because trade deficits are tantamount to exporting jobs. They can have more jobs in their country via being exporters than their economy would be providing otherwise.

It is the continued willingness of the US to run trade deficits that accounts for the reserve currency status. That is what gets dollars into the hands of foreigners and enables them to transact in dollars.

But isn’t the US able to afford trade deficits only because of a strong demand for the dollar, i.e. the petrodollar system?

If that goes, would and could the trade deficits persist?

In other words, isn’t the establishment smart to be running a petrodollar-protection based foreign policy, in the absence of more sustainable and peaceable options (a productive, high-value added economy)?

A trade deficit is like tribute — people around the world are giving you real resources in exchange for US “tax credits” (that’s functionally what a US dollar is — something to pay taxes, fees and fines denominated in $USD). The problem of mass un-and-underemployment then occurs when the federal government fails to run a sufficiently large fiscal deficit of its own to counteract the unemployment engendered by domestic consumption that is not matched by domestic production.

Hence the core MMT call for a Federal Jobs Guarantee

Any really broad based spending that gets dollars into the hands of spenders would work.

I favor block grant infra in areas with highest unemployment.

Poverty is best fixed by jobs. Instead of just handing out money, we should get something of value for it, such as a high energy super grid, infrastructure improvements, a CCC, and maybe buy a pile of ICE clunkers to send to the crusher.

One of the most insidious problems with starving the middle class to line the pockets of the rich, is when you need the middle class to spend some $$ to solve some problems, such as rooftop solar or buy a EV, they remind you that they are bloodless turnips and have been so for 30 years.

>>”The problem of mass un-and-underemployment then occurs when the federal government fails to run a sufficiently large fiscal deficit of its own to counteract the unemployment engendered by domestic consumption that is not matched by domestic production”

Thanks, good point. Very nice summary. I will save it. It illustrates the relationship between the deficit, employment, domestic consumption and domestic production.

There is no such thing as a “petrodollar system”. Please stop.

Please read my comments above. Countries do not “demand dollars”. They want to run trade surpluses. The US is the only country willing to run sustained trade deficits. Those exporting countries wind up holding dollars because they CHOOSE TO and WANT TO export to us. If they were to sell those dollars, their currency would go up and the dollar would fall, making them less competitive exporters to the US. Also many countries choose to hold large FX reserves so as to be able to prevent a currency crisis (they do NOT want to have to submit to the IMF).

Yves: Thank you for your comments. I understand the concept of never running out of U.S. dollars as explained by MMT. I also understand the relationship of trade deficits to our reserve currency status. But, my question remains, what happens to our country if we are no longer the World’s reserve currency and U.S. Treasuries are not considered “safe”? Can an assumption be made that we will always run large trade deficits and therefore maintain our reserve currency status? What are the repercussions for our country (good and bad) if we lost reserve currency status? Yes, we could still print all the U.S. dollars we want, but is it safe to assume the rest of the world will always demand U.S. dollars?

If America stops running large trade deficits, it will be relying on its own productive capacity to meet its own consumption. If this means lower un-and-underemployment, the federal government won’t have to run such large deficits.

Are you questioning America’s productive capacity?

Absent things that it cannot produce by itself, what does America care whether or not the rest of the world wants its currency? What does America care which currency foreigners wish to hold?

Curious cynical view from an unlearned one: MMT would be hugely inflationary if it rolled out to every man, woman, and child through a series of social-justice and full life cycle sustainability initiatives?

As to Military Monetary Theory, and even the Fed’s QE4, these actions/ expenditures roll out to a very small segment of the US population, so are not particularly ‘inflationary’. And the ‘products’ are ‘spent’ in foreign lands, mostly single use.

Trickle-down, being what it isn’t, maybe there are some multiplier effects in the present regime, but it seems pretty limited and hardly universally beneficial, hence not inflationary?

If MMT were to roll-out in the form of Universal Health Care, Green New Deal, re-tooling our economy, that would go to nearly every household, and it could be inflationary?

I guess the other side of the MMT coin from rationalized largesse and spending, would be targeted taxation.

Jeeze, if we simplified the tax code, eliminate the health insurance industry, we’d create a class of underemployed left-outs…. There would be administrators and bodies available to the workforce- coupled with computing power, we probably could make the numbers work…

My gut tells me this- somethings gotta give…

People work too much. Make them work less, pay them the same – it can work very well, there are examples. If only there was an understanding that other worlds are possible

In real, non-cash terms, our wealth is the sum total of our work product. We can turn efficiency improvements into less human work, or more real wealth. Pretty much every time we collectively choose wealth.

However, that is society as a whole and you are always free to go the other way, if you want. You can take a part time job, live in a tiny house and go to the library a lot. …as long as you are in good health and avoid legal trouble. When facing having your liberty or life taken prematurely, we will see if you can tolerate legal and medical professionals who similarly prefer to work less on your behalf. Would you rather your doctor spend his time treating you or on the golf course? Fair is fair, right? If you get a 20hr work week, they should too.

There is a cost.