Yves here. Remember the explosion of press coverage last year when incoming Minneapolis Fed member and former Goldmanite and Treasury official Neel Kashkari announced his intent to develop a plan to end the “too big to fail” problem. He not only was going to devote Minneapolis Fed researchers to his program, but solicited broad based public input and scheduled a series of conferences with experts and critics like Simon Johnson.

After the initial fanfare, the project went into a media black hole. I don’t recall reading anything about the conferences, despite the intent to include some high profile speakers.

And when the Minneapolis Fed announced its findings, the press gave it perilous little attention. The high level overviews I read didn’t make it sound terribly impressive. In fairness, that was because its key recommendation was one financiers were guaranteed to hate: greatly higher capital levels for really big banks. One of the merits of that idea was that it would result in high margin business that could be run safely (meaning they didn’t need much equity or could raise equity on a stand-alone basis at reasonable costs) would almost certainly be spun out.

Even so, the so-called Minneapolis Plan conceded that even those measures considerably reduce but not end too big to fail risk.

I was disappointed to see it neglect what many commentators, such as Richard Bookstaber and derivatives maven Satyajit Das, have described as the most important element to disarm: that of excessive interconnectedness, or what is often called “tight coupling”. And the big priority there would be greatly reducing the volume of bespoke over-the-counter derivatives. They are overwhelmingly are socially unproductive (as in the major use is tax and accounting gaming) and are high margin to the banks. Well-targeted transaction taxes would greatly curb their use. Instead, the Minneapolis Plan covers only institutions considered to be shadow banks by the Financial Stability Board and subjects those with more than $50 billion in assets to additional taxes meant to offset the tax advantages of borrowing. While this is helpful, it ignores that derivatives can create great leverage without involving explicit borrowing. In ECONNED, we documented how Magnetar’s subprime short strategy using various CDO tranches achieved 500 time leverage relative to the underlying subprime bonds and drove massive demand to the very worse subprime loans.

By Stephen Cecchetti, Professor of International Economics at the Brandeis and Kim Schoenholtz, Professor of Management Practice, NYU. Originally published at VoxEU

‘Too big to fail’ is an enduring problem for financial authorities and regulators. While forbidding government bailouts may be a popular move, the strategy lacks credibility. This column examines the proposals of the Minneapolis Plan to End Too Big to Fail. The plan has many virtues that tackle systemic problems and that build on the Dodd-Frank Act’s crisis prevention and management tools. However, further analysis of the plan is still needed to ensure that its measures aren’t circumvented.

We very, very much did not want to make the loan.”

Ben Bernanke testimony (10 October 2014) regarding the Federal Reserve’s emergency provision of credit to AIG in September, 2008.

More than six years after the Dodd-Frank Act passed in July 2010, the controversy over how to end ‘too big to fail’ (TBTF) remains a key focus of financial reform. Indeed, TBTF – which led to the troubling bailouts of financial behemoths in the crisis of 2007-2009 – is still one of the biggest challenges in reducing the probability and severity of financial crises. By focusing on the largest, most complex, most interconnected financial intermediaries, Dodd-Frank gave US officials a range of crisis prevention and management tools. These include the power to designate specific institutions as systemically important financial institutions (SIFIs), a broadening of Fed supervision, the authority to impose stress tests and living wills, and (with the FDIC’s Orderly Liquidation Authority) the ability to facilitate the resolution of a troubled SIFI. But, while Dodd-Frank has likely made the US financial system safer than it was, it does not go far enough in reducing the risk of financial crises or in ensuring credibility of the resolution mechanism. It is also exceedingly complex.1

Against this background, the Federal Reserve Bank of Minneapolis (2016) recently announced The Minneapolis Plan to End Too Big to Fail (‘the Plan’). While the Plan raises issues that require further consideration – including the potential for regulatory arbitrage and the calibration of the tools on which it relies – it is straightforward, based on sound principles, and focuses on cost-effective tools. In this sense, the Plan represents a big step forward.

The Problem of Too Big to Fail

The TBTF problem is simple. It comes down to this – facing the looming failure of a SIFI, a government can be expected to bail out the private institution’s creditors rather than allow the country to suffer an economic and financial collapse. The historical record is littered with examples of such bailouts. The 2007-09 experience, when US regulators did this repeatedly, is just the most recent example; and one that we should never forget.

Simply declaring TBTF illegal and forbidding government bailouts may be popular, but it lacks credibility. TBTF is a classic problem of time consistency – a future government facing a crisis will renege on the promise not to bail out private creditors. If necessary, it will change the law, as the US Congress did when it approved the $700-billion Troubled Asset Relief Program in September 2008. As a result, today’s SIFIs and their creditors have a clear incentive to take risks that raise the chances of a financial crisis.

What to do? The answer is that we need a regulatory framework that severely reduces the probability of a crisis as well as the potential contagion from the resolution of troubled intermediaries. This may mean trading off economic efficiency for financial safety. But, as we have discussed in Cecchetti and Schoenholtz (2014b), the social costs seem likely to be lower than many argue.

A key virtue of the Minneapolis Plan is its realistic assumptions. The first is that SIFIs (designated or not) will be bailed out in a crisis; the second, that making the financial system safe will involve some up-front costs; the third, that a future government will be unwilling to impose losses on SIFI creditors during a period of widespread financial distress. Implicitly, the Plan further assumes that regulators are not capable of anticipating all the key vulnerabilities of the financial system, so that preventing future crises requires making the financial system resilient to all types of large shocks.

Key Features

The Minneapolis Plan has four key features:

- A sharp increase in requirements for loss-absorbing equity capital (not debt) at the 13 largest, most complex, and most interconnected US banks (currently those with at least $250 billion in assets), to be phased in over five years.

- A further sharp hike in capital requirements after five years for each bank unless the Treasury Secretary certifies that it is no longer systemically important.

- A tax on borrowings by shadow banks – based on the types of shadow banks defined by the Financial Stability Board (2015) – calibrated to match the increased funding costs of the ‘covered’ group (with a higher tax rate on shadow banks that the Treasury Secretary considers systemic).

- A relaxation of regulation on banks with up to $10 billion in assets. (As described in FDIC (2016), these make up 98% of insured US banks, but account for less than 19% of the insured deposit base.)

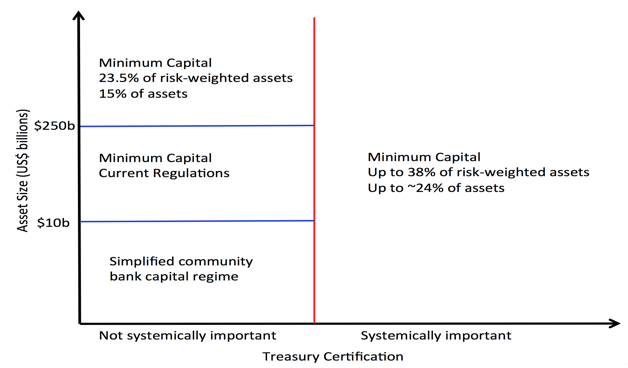

Figure 1 illuminates the Plan’s impact on the US banking sector. Following a five-year transition, covered banks will need to finance 23.5% of their risk-weighted assets (RWAs) with equity (formally Common Equity Tier 1).

Based on end-2015 covered bank reporting, the Plan translates the 23.5% RWA requirement into a pure leverage requirement (the ratio of common equity to total assets) for covered banks of 15%. For comparison, the FDIC’s mid-2016 Global Capital Index (FDIC 2016b) reports that the average Tier 1 capital ratio of the eight US global systemically important banks (G-SIBs) equals 13.55% of RWA and, under GAAP accounting, 8.24% of total assets. Moreover, after five years, unless the Treasury Secretary certifies that a covered bank is no longer systemic, its required capital ratio would rise by five percentage points per year to a peak of 38% of risk-weighted assets (equivalent to an unweighted leverage ratio of nearly 24%). Finally, banks with assets fewer than $250 billion and more than $10 billion would continue to face capital requirements as they are currently structured, while those banks with fewer than $10 billion in assets would face simpler, less stringent requirements.

Figure 1 Minneapolis Plan – capital regime for banks

Source: FRB Minneapolis (2016) Figure 1, and the authors.

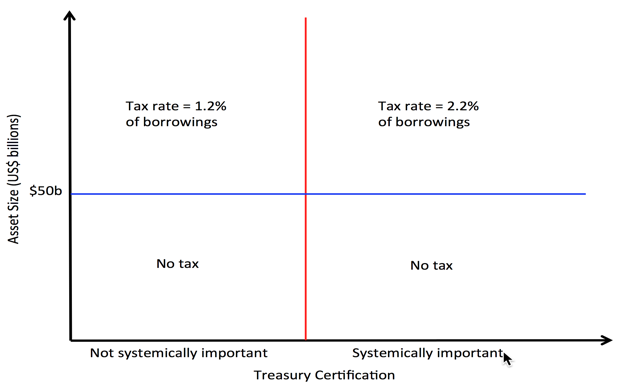

The tax regime for shadow banks is simpler than the capital requirements (see Figure 2). The universe of institutions covered includes the types of nonbank intermediaries monitored by the Financial Stability Board (e.g. Financial Stability Board 2015). The tax applies to firms with more than $50 billion of assets. There are only two tax rates: 1.2% for firms certified by the Treasury Secretary as not systemic; and 2.2% for the rest. This two-tiered tax is intended to mimic the additional funding cost arising from the two-tiered capital requirements for covered banks. A portion of the shadow-banking tax (an estimated 0.4 percentage points according to the Plan) merely offsets the US tax subsidy that permits deduction of interest payments, but not dividends.

Figure 2 Minneapolis Plan – tax regime for shadow banks

Source: FRB Minneapolis (2016) and the authors.

Virtues of the Plan

In addition to its realistic assumptions, the Minneapolis Plan has several other virtues. The first is its clarity in matching objectives with tools. It relies on equity capital, not only as the surest shock absorber in the financial system, but also as a device to induce large banks to shrink, reduce their complexity, and become less interconnected. A covered intermediary funding 38% of risk-weighted assets (or nearly 24% of overall assets) – the long-run default requirement unless the Treasury Secretary declares the bank to no longer be systemic – would have a buffer sufficient to dramatically reduce its chance of failure even under extreme stress.

Second, the Plan anticipates a prime mechanism for its circumvention – the migration of risk from banks to less-regulated shadow banks, some of which already are systemic. It aims to levy the same constraint on the systemic activities of shadow banks that it does on covered banks. Again, the Plan takes a simple approach – its broad tax on the borrowing of shadow banks is designed to mimic the additional funding cost that higher capital standards impose on a covered bank.

Third, unlike some proposals, the Plan acknowledges Dodd-Frank’s continued role in ending TBTF. Dodd-Frank’s stress tests would help verify compliance with capital standards, discourage ‘covered banks’ from loading up on systemic risk, and help identify efforts to conceal risk (say, by shifting it off balance sheet or by using derivatives to create synthetic leverage). Similarly, living wills would still encourage large banks to make themselves simpler and less connected, and facilitate their resolution.

Fourth, by focusing regulatory attention on the largest, most complex, most interconnected institutions in the financial system – as of midyear, the eight US G-SIBS alone held assets worth $10.7 trillion accounting for nearly 70% of all commercial bank assets – and by penalising the most systemic shadow banks through a supplementary tax regime, the Plan would allow regulators to relax the constraints imposed by Dodd-Frank on the vast number of small institutions that pose virtually no threat to the financial system as a whole (Cecchetti and Schoenholtz 2016c).

Fifth, the Plan exhibits appropriate humility regarding the calibration of its capital requirements and tax rates. Society will benefit from learning by doing, so long as we take account of the financial system’s response to further substantial increases in capital requirements.

Sixth, the Plan requires that the benefits of the new regulatory regime exceed the costs. Accordingly, it does not try to eliminate financial crises, but instead aims to reduce their frequency to an acceptably low level (specifically, once in 100 years).

Finally, the Plan allocates discretionary power over the US financial system where it is most likely to be effective – to the Treasury Secretary. The Secretary can command the resources necessary to judge whether a financial intermediary is systemic and can enforce her decision.

Weaknesses of the Plan

So, where are the weaknesses in the Plan? First, are the thresholds for covered banks ($250 billion of assets) and for assessment of shadow banks ($50 billion of assets) appropriate? Such arbitrary numbers always invite regulatory arbitrage. Second, the list of shadow banks is open to debate. Which types of institutions should be in and which should be out? At the moment, the Plan excludes insurers, despite evidence that some insurers engage extensively in shadow banking (Cecchetti and Schoenholtz 2016c). Finally, how can the tax on shadow banking be implemented so as to minimise circumvention (say, by an institution shrinking below the minimum asset size to be covered)?

Our bottom line is that, while the Minneapolis Plan needs much further analysis (and probably considerable tinkering with its parameters), the broad design provides a solid basis for legislation that would advance the public goal of making the financial system safe in a cost-effective way. The key is to strengthen the resolve of future policymakers to do what the Federal Reserve could not do in 2008 with AIG – deny emergency credit even in a period of financial distress. By reducing the probability of the politically corrosive bailouts that TBTF engenders, the Plan also would help restore confidence in a critical tenet of capitalism – that risk-takers in the financial system not only profit from success, but also bear the full costs of failure. Absent such confidence, it is entirely possible that the extraordinary benefits of free enterprise and competitive markets will disappear.

Authors’ note: An earlier version of this column appeared on moneyandbanking.com.

See original post for references

1. For those of you who doubt me, here is the key section of ECONNED. To get the whole picture, you need to read all of Chapter 9 plus Appendix II. I’ve spared you the geeky footnotes.

It is also a source of considerable personal frustration that a source gave me a key component of the picture which didn’t make it into ECONNED due to the incredible crunch to put the book to bed (I had a hard deadline of six months from getting the offer to getting the completed draft manuscript in, and never thought I’d wind up stumbling upon a major story and including the reporting in the book). I was told repeatedly that Magnetar was responsible for 50-60% of subprime demand in the toxic phase but could only firmly explain 35% in the book and attributed the rest (as you will see below) to artificial spread compression.

In fact, warehouse line hedgers bought roughly 25% of subprime CDS. Firms like Bear Stearns provided “warehouse lines of credit” to subprime originators like New Century and Indymac to allow them to purchase subprime loans. The artificially cheap subprime CDS generated by the Magnetar trade allowed them to think they were hedging this risk successfully and thus meant they kept financing these supbrime loans even when they were having more and more trouble with finding investors for the subprime securities and the loans the subprime originators were sending to be packaged were often unacceptably drecky. Yet the Bears of the world were not willing to reject them because there were so many they knew if they did, New Century et al would fail (which they did anyhow, but people in institutions have a bad reflex of thinking that kicking a can down the road is preferable to taking losses now, even if the eventual cost is considerably higher).

That is a long way of saying you get to the 50-60% total if you include the impact of hedging of warehouse lines.

From ECONNED:

What most commentators have missed, but the industry understood full well, was the massive leverage involved. Even though Magnetar provided only the equity layer, a mere 5%, perhaps even less, doing so made the “higher” 95% of the CDO possible. We will use $30 billion for the size of their program. It extended from mid-2006 to mid-2007, but the bulk of the subprime mortgages referenced in the deals were probably 2006 vintage. This seems particularly likely given that in 2007, investment banks that were long subprime inventory were desperately unloading it into CDOs, and many of those bonds were 2006 issues.

So to make the calculation simple, we’ll assume 20% was comparatively benign stuff and exclude it from this computation. That is consistent with Lazard Asset Management’s finding that by the second half of 2006, over 80% of the assets of mezzanine CDOs were subprime, up from a mere 60% in the first half of

2005.62We are assuming that 80% of the remaining assets in the CDO was synthetic, which means only 20% of the subprime component was actual BBB tranches of subprime bonds.Further assume that 80% of the subprime component of these CDOs was 2006 vintage BBB subprime tranches. You get:

($30 billion ×80% ×80% × 20%) / 3% = $128 billion

Although this is just a back of the envelope calculation, $128 billion is 28% of the total of $448 billion in subprime mortgage backed securities issued in 2006.This calculation assumes that 20% of the BBB subprime tranches were from 2007, so you have an additional $32 billion of subprime demand generated

that was excluded from the estimate of 2006 subprime mortgage demand.We have ignored the fact that, of the 20% of supposed semi-decent non- subprime stuff circulating in the second half of 2006, as much as half, or 10% of the total, could be and often was lower rated tranches of mezz CDOs. Including that would intensify the impact of Magnetar’s deals. When you allow for the concentrated effect of BBB CDOs in the remaining 20% non-subprime, plus the fact that the program size was probably higher than the $30 billion reported in the Wall Street Journal,it is entirely plausible that Magnetar deals account for 35% of 2006 subprime issuance, or more.

How can that possibly be? It was leverage, spectacular leverage. If you look at the non-synthetic component, every dollar in mezz ABS CDO equity that funded cash bonds created $533 dollars of subprime demand.

Is it any wonder than anyone in the United States who had a pulse could get a mortgage?

And we’ve only discussed the cash bond component. Remember, 80% of the deals are assumed to be synthetics, meaning they consisted of credit default swaps against (“referencing”) particular subprime bonds. The total synthetic component in this example was $30 billion ×80% ×80%, or $19.2 billion no-

tional amount of credit default swaps on BBB tranches.That may not sound as sexy until you work through the implications. This $19.2 billion is in addition to existing subprime bond exposures. The resulting losses never would have occurred without the use of credit default swaps. On top of that, anything that happened with those BBB tranches was hugely geared.

The synthetic component created demand for subprime loans by a less direct mechanism, by compressing credit spreads. That is a fancy way of saying they lowered interest rates.

Credit default swap spreads and cash bond spreads are linked via arbitrage. If credit default swap spreads tighten, that is tantamount to having the price of the credit default insurance drop. The protection writers (guarantors) receive less, and the protection buyers pay less. When that happens, spreads on the related bonds drop, which lowers the cost of borrowing.

Ummm….didn’t Brussels pass a law within the past year or so that supposedly forbids “government bailouts” of TBTF European banks?

And didn’t the Italian government just re-capitalize (aka bail-out) Monte dei Paschi di Sienna last month?

I have a premonition that any such “law” or “rule” passed in the US would be just as easily ignored.

I’d advise that anti-trust legislation should be used in addition to those requirements. Break the banks into small enough chucks such that any collapse of a few banks would not endanger the entire system, even if it does prove damaging.

It would also prevent concentration of bargaining power in the financial sector.

There also need to be real penalties. The banks for example manipulated the LIBOR rate. I don’t recall any banking executives going to jail for that. The point is, as it stands the banks get away with whatever they want.

The coming corporate tax reduction is an opportunity to make tax/accounting gaming far less profitable. This would limit undesirable derivatives and loosen financial institution coupling. Is anyone working on the problem from this angle?

over my head. the solution seems too patched up. higher capital requirements to prevent extreme gambling? when the entire fabric of finance is gambling? – “synthetic leverage” is a bizarre term in such a synthetic world. or we could always make gambling legal for private finance and separate them completely from sovereign money. never mind. I hate this stuff.

I think the drama is more correlated to interconnectedness and the speed of information now days [feed back loops].

Disheveled…. the biggest being “everything is a market” therefore everything must respond as a market thingy…..

Skip

I think my minor quibble is that feed forward loop is a better characterization. Feedback is more naturally stabilizing, Feedforward depends on correct assumption (rational) in an unrational systems (society/marhets/economy). When you get it wrong, feedforwad explodes the system. ” it all eorked ’til it didnt”

“Feed-forward, sometimes written feedforward, is a term describing an element or pathway within a control system which passes a controlling signal from a source in its external environment, often a command signal from an external operator, to a load elsewhere in its external environment. A control system which has only feed-forward behavior responds to its control signal in a pre-defined way without responding to how the load reacts; it is in contrast with a system that also has feedback, which adjusts the output to take account of how it affects the load, and how the load itself may vary unpredictably; the load is considered to belong to the external environment of the system.

In a feed-forward system, the control variable adjustment is not error-based. Instead it is based on knowledge about the process in the form of a mathematical model of the process and knowledge about or measurements of the process disturbances.[1]”

Not quite. There’s a missing qualification in that feedback can be either positive (amplifying, destabilising) or negative (stabilising – in general).

I’d – hesitantly – suggest that leverage => +ve FB and increased capital requirements (esp. relative to assets) => -ve FB.

Bankers are like puppies and you need to rub their noses in their own excrement to teach them how to behave. When they leave a mess behind they need to be punished.

The FED has been bailing out US banks since the S&L loan crisis and every new bubble is bigger than the last, you need to rub their noses in their own mess.

The FED’s puppies are never going to learn to stand on their own two feet when it keeps clearing up their mess. No wonder they need TBTF.

“What have my naughty little puppies been up to? Look at all that toxic waste you’ve generated in mortgage backed securities, let me clear it up for you.” the FED 2008.

The puppies need training, rub their noses in the mess they leave behind.

We need “Bail and Jail” laws. It’s fine to bail out the institutions since that will happen anyway. What is needed is consequences for the players. Throw a bunch of the top dogs into Supermax and the rest will come to heel pretty quick.

“Bankers are like puppies and you need to rub their noses in their own excrement to teach them how to behave. When they leave a mess behind they need to be punished”

While I understand your point, I would say, “No, no, no!” Never ever do this to a puppy. It doesn’t “teach” them anything. If they are having accidents in your house, it’s YOUR fault. Educate yourself on proper potty training methods.

Rubbing a bankster’s nose in poop though? Got not problem with that. Banksters could use some ‘education’ by being jailed. And control frauds are not the fault of consumers.

If my dog has an ‘accident’ X, then ‘it is my fault’? Is this because dogs lack agency?

Kashkari? I have complete confidence in that stooge!

Thank you much for this post. When Kashkari’s proposal was announced, I expected to see something in NC about it, and was disappointed when it was not even linked to. Well here we go, and at a satisfying level of detail to boot. The one thing not addressed is whether the ‘Minneapolis Plan’ has any legs politically, or is destined to just disappear.

I don’t think “TBTF” is really viewed as a problem any more, we now have well-established bail-in regimes in the EU and the US that can re-float billionaire bank bondholders and re-fill banker bonus pools in a jiffy. You go to the bank on Friday and they say you have 100,000, oops on Monday it’s 75,000. CNN blares nonstop on why that’s a really good thing, and Beyonce or somebody writes a song about it

The ‘Heads I win, tails you lose’ game will continue to be played and someone has to be very naive, stupid or bought (possibly a combination of all three) to believe that they can come up with rules for the ‘Heads I win, tails you lose’ game that cannot be gamed.

If something is needed to be that closely regulated and monitored then it should not be allowed to be in private control.

“If something is needed to be that closely regulated and monitored then it should not be allowed to be in private control.”

Hear! Hear!

The only solution is to nationalize the banks.

Murica itself is too big to fail. Ohio, etc needs to become countries in its own right.

So what’s wrong with antitrust? Why are these financial institutions allowed to get too big?

I can tell you what’s wrong with antitrust: existing law (still on the books, as far as I know) depends on agency judgement. Consequently, some administrations never judge anything to be too concentrated, while others are just inconsistent.

It would work a lot better to simply set a hard-and-fast limit on size. Personally, I favor doing this with a steeply graduated tax based on size, but a direct limit would work, too. Companies would “grow” by spinning off divisions, and probably quite profitably. Obviously, the principle applies to more than just finance, but at the moment finance is the most urgent.

A size limit wouldn’t substitute for Glass-Stegal (sp?) type restrictions, and at this point it’s pretty clear that all but the simplest derivatives should be banned. Another problem was a proliferation of new, opaque financial “products” that weren’t regulated. We should ban that, too; nothing unregulated should be sold.

Frankly, although its ideas might help somewhat, the Minneapolis plan sounds like very Clintonesque picking around the edges of the problem – essentially as an excuse for not really addressing it. But given the political climate, really addressing it may well be saved for after the next collapse. And probably a few heads in tumbrils.

How long has Neil Barofsky maintained his code of silence after being ballsy enough to call out both the Paulson-Cheney-Bush and Geithner-Obama-Biden-Schumer administrations while he served as lightning rod and Special Inspector General in Charge of Oversight of TARP? I recognize after resigning he both wrote the vastly under-cited BAILOUT: AN INSIDE ACCOUNT OF HOW WASHINGTON ABANDONED MAIN STREET WHILE RESCUING WALL STREET and then likely did some edjamacating while teaching at NYU.

However, since leaving NYU for a plum partnership at Jenner & Block LLP he’s barely been sourced or offered anything on the further unraveling of the regulatory architecture he used to prosecute what few Mortgage Fraud criminal cases he notched before the TARP bail-out in the U.S. Attorney’s Office for the Southern District of the State of NY.

Even if Barofsky has chosen to serve Wall Street rather than Main Street himself, isn’t his record and work within the belly of the beast worthy of occasional referencing? After all, he didn’t wind up taking any conflicted interests to the market-place of ideas represented by Trump U. or

http://www.motherjones.com/politics/2011/08/lowell-milken-institute-ucla

{Creative Commons Copyright}

Mitch Ritter\Non-Aligned Paradigm Shifters

Lay-Low Studios, Ore-Wa

Media Discussion List

Gee, I have a 2 point plan: 1. Reinstitute Glass Steagall; 2. No government assistance unless executives and board members are stripped of their personal assets.