The Financial Times has a generally good update on the state of the student debt bubble in the US. The article interesting not just for what it says but also for what goes unsaid. I’ll recap its main points with additional commentary. Note that many of the underlying issues will be familiar to NC readers, but it is nevertheless useful to stay current.

Access to student debt keeps inflating the cost of education. This may seem obvious but it can’t be said often enough. Per the article:

While the headline consumer price index is 2.7 per cent, between 2016 and 2017 published tuition and fee prices rose by 9 per cent at four-year state institutions, and 13 per cent at posher private colleges.

It wasn’t all that long ago that the cost of a year at an Ivy League college was $50,000 per year. Author Rana Foroohar was warned by high school counselors that the price tag for her daughter to attend one of them or a liberal arts college would be around $72,000 a year.

Spending increases are not going into improving education. As we’ve pointed out before, adjuncts are being squeezed into penury while the adminisphere bloat continues, as MBAs have swarmed in like locusts. Another waste of money is over-investment in plant. Again from the story:

A large chunk of the hike was due to schools hiring more administrators (who “brand build” and recruit wealthy donors) and building expensive facilities designed to lure wealthier, full-fee-paying students. This not only leads to excess borrowing on the part of universities — a number of them are caught up in dicey bond deals like the sort that sunk the city of Detroit — but higher tuition for students.

And there is a secondary effect. As education cost rise, students are becoming more mercenary in their choices, and in not a good way. This is another manifestation of what John Kay calls obliquity: in a complex system, trying to map a direct path will fail because it’s impossible to map the terrain well enough to identify one. Thus naive direct paths like “maximize shareholder value” do less well at achieving that objective than richer, more complicated goals.

The higher ed version of this dynamic is “I am going to school to get a well-paid job,” with the following results, per an FT reader:

BazHurl

After a career in equities, having graduated the Dreamy Spires with significant not silly debt, I had the pleasure of interviewing lots of the best and brightest graduates from European and US universities. Finance was attracting far more than its deserved share of the intellectual pie in the 90’s and Noughties in particular; so at times it was distressing to meet outrageously talented young men and women wanting to genuflect at the altar of the $, instead of building the Flux Capacitor. But the greater take-away was how mediocre and homogenous most of the grads were becoming. It seemed the longer they had studied and deferred entry into the Great Unwashed, the more difficult it was to get anything original or genuine from them. Piles and piles of CV’s of the same guys and gals: straight A’s since emerging into the world, polyglots, founders of every financial and charitable university society you could dream up … but could they honestly answer a simple question like “Fidelity or Blackrock – Who has robbed widows and orphans of more?”. Hardly. In short, few of them qualified as the sort of person you would willingly invite to sit next to you for fifteen hours a day, doing battle with pesky clients and triumphing over greedy competitors. All these once-promising 22 to 24 year old’s had somehow been hard-wired by the same robot and worse, all were entitled. Probably fair enough as they had excelled at everything that had been asked of them up until meeting my colleagues and I on the trading floors. Contrast this to the very different experience of meeting visiting sixth formers from a variety of secondary schools that used to tour the bank and with some gentle prodding, light up the Q&A sessions at tour’s end, fizzing with enthusiasm and desire. Now THESE kids I would hire ahead of the blue-chipped grads, most days. They were raw material that could be worked with and shaped into weapons. It was patently clear that University was no longer adding the expected value to these candidates and in fact was becoming quite the reverse.

And for many grads, an investment in higher education now has a negative return on equity. A 2014 Economist article points out that the widely cited studies of whether college is worth the cost or not omit key factors that skew their results in favor of paying for higher education.

Four year college graduation rates are falling, and education cost bloat is part of the problem. If you look at the annual reports of the National Student Clearinghouse Research Center, four year college completion rates as of the six year mark have been in general decline. The Economist article above mentions a 59% completion rate; oddly I can’t find the underlying report on the National Student Clearinghouse website, but Google footprints suggest it was for the 2005 cohort. The six-year graduation rate was 55.9% for the 2007 cohort, 55% for the 2008 cohort, 53% for the 2009 cohort, with a slight rebound to 54.8% completion for the 2010 cohort.

Low graduation rates in and of themselves make college a potentially bad bet. All of the 50,000 foot analyses of “if you go to college, you will make on average X more a year” are based on completing college AND getting a full-time job.

The Financial Times article notes:

But there are even more worrisome links between high student debt loads and health issues like depression, and marital failures. The whole thing is compounded by the fact that a large chunk of those holding massive debt do not end up with degrees, having had to drop out from the stress of trying to study, work, and pay back massive loans at the same time. That means they will never even get the income boost that a college degree still provides — creating a snowball cycle of downward mobility in the country’s most vulnerable populations.

College is also becoming a less effective vehicle of social mobility. The high average educational level of the US by world standards masks a sorry fact: older age groups have very high average educational attainment, while it has fallen sharply among the young. High college costs no doubt play a role, and more specifically, that college is becoming less effective as a vehicle for class mobility. From a speech last week by New York Fed president William Dudley:

Recent work by { Stanford economist Raj ] Chetty and his co-authors has investigated the importance of higher education in achieving upward mobility. They find that many highly qualified lower-income students do not attend selective colleges, while those low- and middle-income students who do—despite facing greater challenges—fare almost as well as affluent students who attend the same colleges. Their research also indicates that some colleges are better engines of upward income mobility than others, and that colleges that offered the largest number of low-income students pathways to upward mobility have become less accessible to them during the 2000s. As a result, higher-education’s contribution to increasing intergenerational mobility has diminished.

The Federal government is continuing to shovel money into student loans despite rising default rates and large scale collateral economic damage. The amount of student debt outstanding, at $1.4 trillion, is bigger than subprime debt on the eve of the crisis, $1.3 trillion.1

90% of student loans are government guaranteed. The Feds apparently prefer to rely on their power to squeeze borrowers relentlessly even when they clearly can’t pay. The article points out that of 44 million with student debt, 8 million have defaulted. But that understates the true default rate, since students defer payments while in school. The New York Fed puts the default rate at year end 2016 at 11.2%, with this very big caveat: “About half of these loans are currently in deferment, in grace periods or in forbearance and therefore temporarily not in the repayment cycle. This implies that among loans in the repayment cycle delinquency rates are roughly twice as high.”

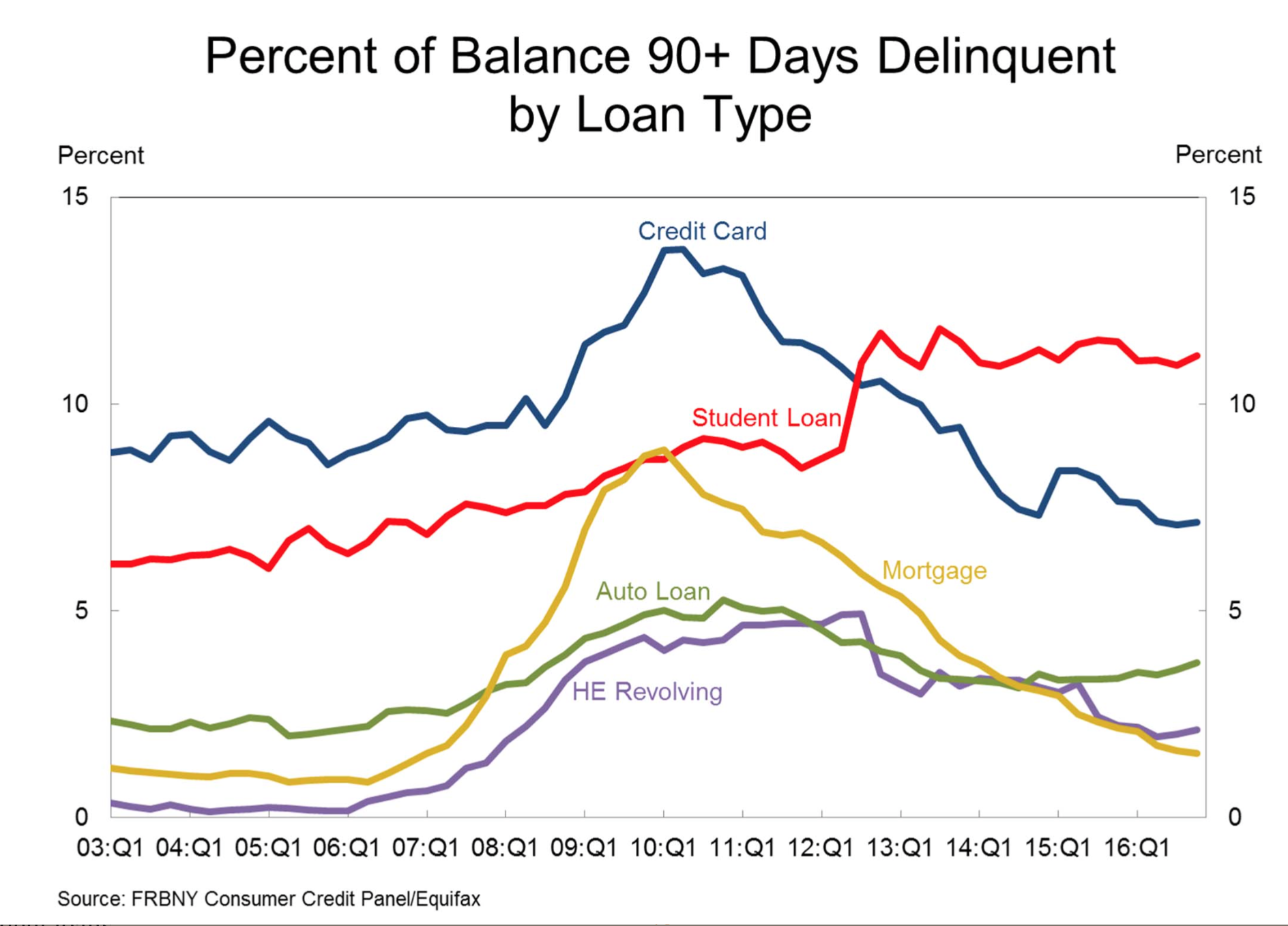

Ouch. See how high student loan default rates are compared to other types of credit even using the grossly understated “default versus total balances” approach:

It mystifies me why homebuilders and makers of consumer durables aren’t on the warpath against student debt. It has hit the point when even normally reserved Fed officials are sounding alarms; Dudley talked about the student debt overhang as an “economic headwind”. Anyone who has been paying attention has seen regular mentions in the business press that student debt is leading to lower household formation. Buying houses and having kids are engines of growth.

The Democrats are as much a part of the problem as Republicans. While the article assigns blame to Republicans for cutting support for public schools as a result of their successful campaign against government spending, let us not forget that higher ed cuts have also taken place in Democratic-controlled states like California. Tuition, room and board at UCLA is $34,000, and students can cut the tab to $26,000 if they live at home. While much cheaper than the elite college costs mentioned above, with 70% of US households having less than $1000 in savings, how many parents are set to spend a relative bargain price of $100,000 per child for college?

And the Democrats have been missing in action as far as anything other than tinkering at the margin with this problem. The failure of the former top bankruptcy law professor Elizabeth Warren to call for student debt to be dischargeable in bankruptcy is telling.

University towns are almost without exception deep blue enclaves. Academics skew Democratic in their political loyalties, and professors often operate as as extended think tank network supplementing formal Democratic party operatives. The Democrats are not about to cut the drip feed to what they regard as a key set of not just supporters but allies.

And this also explains another reason what the Democratic party apparatus was so eager to shut down Sanders and mischaracterize his overwhelming support among young people as “Bernie Bros”. The older Clinton cohort and the 10%ers that Thomas Frank calls out in his book Listen Liberal are either direct beneficiaries of a bloated, parasitic higher educational system or are affluent enough to pay for the social class and career advantages it can provide to their children. Universities are on the wrong side of class warfare and are doing what they can to divert attention from that sorry fact.

____

1 This data is slightly at odd with the New York Fed’s Consumer Credit report using year-end 2016 data. The Department of Education is not at all transparent and the Data.gov page that professes to have the report I need as of Jan 30 says, “No file downloads have been provided. The publisher may provide downloads in the future or they may be available from their other links.”

Yet another example of looting, umm, rent-seeking, it seems. This isn’t too surprising, as this is happening across broad swaths of society. I wonder just how much worse it has to get before the music stops.

Oddly, the phrase “for-profit higher education” doesn’t occur in this post.

Lower Ed is responsible for the majority of student debt and produces the highest default rates. By far.

From 2015:

It’s fun to beat up on the top tier schools,

but much of the carnage is way further down the socio-economic ladder.

Tressie McMillan Cottom to the courtesy phone.

Of course it does. It may be for profit, but it is still ‘higher education’. Or are they offering a high school degree. Even community colleges are still higher education even if they get no respect. It is probably the epitome of higher education as rent seeking grift. Let’s look at the way it does this:

It advertises.

It sells itself as the means to a better life. It sells itself as the way to degree while still working one/two/three jobs because you can ‘attend’ around your schedule. It sells its degrees as being a calling card. It is the higher education version of the telephone psychic.

And the biggest ‘help’ it gives its students is getting their financing, because at that point Phoenix has its money and other people are on the hook for the debt and the payment of that debt.

All because we in the US have to make money off desperation and need and have allowed the greediest among us to require a degree to

sell coffeebe a barista much less have a secure future.perhaps we should ban degree requirements for jobs like that.

If we made students debt dischargable, like it’s supposed to be, this problem would go away immediately.

Maybe top-tier universities have “only” a 10% default rate because our country’s elitism means that having an Ivy on your resume will get you in the door, while having a state university on there will get you laughed out of the office. That was the experience one of my friends had when he tried to find work on the East Coast. The elitist d-bags who refused to consider anyone for employment that didn’t go to an Ivy obviously also considered State universities to be “lower education.”

having an Ivy on your resume also means there is a good chance you come from money and those people do not to fail, even when they do.

Yes. On average, 50-60% of students at top-tier private colleges (really, their parents) are paying full cost, and will no matter how high costs go. Of the remaining 40-50%, almost all are middle to upper-middle class with very high levels of ‘social capital’ even before they enter, who come out of college with the credentials to, at worst, operate the machinery of the meritocracy. It would be a travesty if more than a small fraction of them became student-loan deadbeats.

Isn’t that amazing? Normal people struggle for upward social mobility while these imbeciles fail upward.

The public university where I work and from which I graduated *at a fraction of the current price* has successfully promoted itself as outranking all the Ivies internationally and all but Harvard and Yale domestically. Ironically my public school degree has more cachet than it did when I received it, when the quality of humanities teaching was better and truly meant something. Because the humanities don’t pay…

This is an important metric, but I want to know what percentage of students are in for-profit colleges and whether it’s an appreciable number of the overall defaulting student group.

This, to me, resembles the conversation about for-profit prisons: yes it’s a problem, but the public sector prisons are just as awful and far more people are in them.

From the Brookings paper, A Crisis in Students Loans? …, by Looney and Yannelis

which is linked to in the Inside Higher Ed article I linked to above:

This is, or should be, the face of the student debt crisis.

I hate this. It comes across like because I went to a public college I should just shut up because I could have had it worse. Same thing when they brake it down by race and gender. There is this implicit ‘your white male privilege should have been enough’ that comes along with that. You want to know why we aren’t in the streets protesting? That’s why.

Religion. The same blind faith that prevents business owners from seeing that crucifying their own target consumers on a cross of austerity is cutting off their nose to spite their face. Economics is not that complicated, but the basic principle that demand is necessary is a hard one to grasp for MBAs who have been meticulously indoctrinated to ignore it.

Given their acute Marxist-style class consciousness and their cargo-cult understanding of macroeconomics, I would be shocked if homebuilders/manufacturers drew the slightest link between their lost profits and their indebted customer base. Besides, it’s all so easy to ignore when you can just skip the demand curve and instead blow your ZIRP handouts on share buybacks and CDO ponies.

John 19, comrades: “We have a Law and according to the Law consumers must die”

It’s the “big pile of money” problem. There’s too much money floating around Wall Street looking for returns…So we get serial bubbles…Tech stocks…The internet…Mortgages…Student loans…Sharing economy… Rinse and repeat. The powers that be keep realizing that if the economy would show significant growth, that would ameliorate our economic problems. And they believe that not enough money is going into productivity improvements to do this. So they pump ever more money into Wall Street in the hope that it will promote growth. But of course all it does is blow another bubble and fund another round of the three “B”s: bonuses, buyouts, and buybacks. Which is why, to paraphrase Goering: “When a politician says ‘growth’; that’s when I reach for my revolver.”

As an indentured student loanee without a degree and long-time self-employed, the problem is even more sinister. I can no longer afford to do what I do for just any customer…I have to basically serve only the overly monied who don’t care how much something costs. I assume homebuilders and other makers of consumibles are too. Hence, no affordable housing, just millions dollar McMansions.

Forced to feed the inequity just to limp along.

The other important thing here is that the enrollment rates are no longer comparable to history, nor are the outcomes, due to the explosion of junk colleges and online universities. These schools do impact the downward trend in completion, but even of the students that DO graduate, many are left with expensive and worthless degrees.

Why haven’t Elizabeth Warren or Bernie Sanders proposed making student loans dischargeable in bankruptcy. Warren has proposed lowering interest rates on loans. Bernie has proposed making college free. But none of them seem to have proposed bankruptcy, which would be a “free market’ approach to lowering college education costs.

Great question.

Yes and if they did that it would scare the f*ck out of the banksters and that would make a heck of a difference, as they and the colleges would have to get together and deal with the fact that the whole thing has gotten out of control.

Bankruptcy discharge is an analog of the Greenspan Put in a way. If there is some artificial restriction on the ability to resolve an issue, then that distorts other aspects of that space.

When banksters knew they could run to Uncle Alan instead of minding their own house better, that option distorted their behavior to the detriment of everyone else.

When colleges know that their student customers have to pay and pay regardless of the purported value added, then they have less incentive to refine their academy and more incentive to expand it to the detriment of students, in particular. That also sucks a lot of potential out of many parts of the economy.

Upshot: When there is no mechanism to keep people and companies honest, don’t be surprised if they act how they are incented to act, regardless of the impacts on others, because markets.

Allowing bankruptcy for student loan defaulters is a bad solution. How are the ex students going to buy new McMansions and thus contribute to a healthy economy if they have a ten year blot on their credit history?

A far better solution is to simply imprison them if they don’t pay their debts. Creating millions of new inmates would have multiple benefits. Unruly prisoners can be controlled using the time tested methods of gas and bullets, while if they are left on the streets there is always the possibility that they will learn to act collectively and pose a threat to the Homeland. As lifetime felons barred from voting, the possibility that they might vote for something other than the DemoconRepugnant party would be eliminated.

One of the problems in the economy is that workers can’t compete effectively with low wage workers in Asia or Latin America– If wage levels were that low in the US they would simply starve to death. But by basing the remaining US manufacturing upon prison labor the US could realize tremendous gains in efficiency. Housing costs per worker would be slashed, the dairy industry would boom as demand for cheese skyrockets along with industrial agriculture companies that grow and process macaroni, Apple would no longer need to hire FoxCon in China to build IPhones if it had a sufficient supply of home-grown prisoners. Architects who design prisons, construction companies who build them, security system vendors, police who chase down deadbeats, even unemployed WalMart checkers who could become prison guards would all benefit from a booming growth industry.

Let’s make America Great Again!

You are missing the point. The threat of bankruptcy would make meaning principal writedowns attractive. Those provide far more debt relief that timid proposals like Warren’s tinkering with interest rates.

And if tons of people do wind up filing for BK, it becomes normal and less of a blot.

Plus banks love to lend to people with cleaned up balance sheets. The issue is more from the job market perspective, and for that, see the para above.

Didn’t think I needed to add LOL to this snarkfest!!!

Crazy Horse, you’re still living in France, right?

; )

–Gaianne

Students loans probably ought to be dischargeable, but that feels like an impossibility now because the impact of all that discharged debt would be so far-reaching. But that’s the way the system works: Close off all the escapes then let the problem get so massive that it’s impossible to undo the original cause. Before you know it, people forget that there was ever a solution in the first place and we learn to live as serfs.

Reducing the amount owed for public service of some type is an option for some student loans. (An option that Trump seems intent on removing.)

The options for dealing with student debt are not all the same.

Someone decided the Constitution was a Living Document, as opposed to a law. (ha. Not that that would matter: they just would not enforce the law, just as no one enforce 15 USC Chapter 1 against medical providers for lack of price transparency. )

But the Constitution isn’t a law.

But if the vast majority of student debt is federally guaranteed and administered through Sallie Mae, etc. that just means we the taxpayers eat the debt. I’m not necessarily opposed to using public money to help college kids, but IMHO, it would be better to simply not make the loans in the first place and get universities to control their prices.

“…and recruit wealthy donors) and building expensive facilities designed to lure wealthier, full-fee-paying students.”

This, I’m a recent grad (2015) and throughout my time. The aesthetic upgrades were constant. New massive lounges with fire places, stadium upgrades, flat screen TVs at every (I mean every) corner.

While classrooms and lecture halls (excepting the business school, a donation) were in a near state of disrepair, and hadn’t been upgraded for 20 years, and by the time I left many lectures and classes were run by a wave of Chinese profs who had such thick accents they might as well have said nothing.

I was lucky and largely missed the wave of unintelligible Chinese lecturers, but I sat in on 2 particularly egregious ones, and I have no idea why any administration would have hired them. It doesn’t matter if they understand the material if they can’t effectively communicate.

It was a race to boost appearance, and every new aesthetic feature seemed to mark a decline in educational quality.

I’ve seen this trend at my alma mater too. It started when I was attending 25 years ago – I remember being among those protesting to try to stop a new building from going up that we felt would ruin the character of the school. At the time I made the point that a new building wasn’t going to improve education and didn’t see the need for it since the school wasn’t planning on increasing enrollment.

25 years later they still haven’t increased enrollment but there are a lot more buildings all over campus and I can’t for the life of me figure out what they’re all being used for. We’re talking an expensive private liberal arts school here so I’m sure it’s a result of the practices described in the article – got to spend all the $$$ the wealthy alums donate somewhere and they sure as hell aren’t going to spend it by lowering tuition for anybody.

The buildings are vanity plates for the donors.

C’mon, let’s be reasonable. Where are you going to put all those new administrators without new buildings?

I’ve seen this also. Square footage at my alma mater has easily risen by 70% since I graduated back in the mid 1990s, while student enrollment has risen by less than 15%. And the same question came to my mind: What the hell are they using all this extra space for?

And I ain’t never going back to my old school.

California tumbles into the sea, that’ll be the day I go back to Annondale.

I had to take quantum physics from a Chinese prof and I couldn’t understand a word out of his mouth. Two huge unnecessary constructions while I was on campus; a Stadium and a student center.

One underreported expense added to the college bill is mandatory health insurance costs of about $300/mo. if you are not on your parents’ policy. That adds another $15,000 to the 4-year bill.

Having attended San Diego State U. in the ’70’s when tuition was about $100/semester and Junior College was free in Calif., it was disgusting to see all of the politicians criticize Sanders’ tuition-free public college plan. Many of the opponents were parents who benefited from low tuition, but apparently have no interest in seeing their children get the same break. Reminds me of the 65 and over crowd who opposed Medicare for All.

The college system is simply unsustainable, just like our healthcare system.

I’m not sure how many of Sanders opponents really were the people who attended state schools for a tuition that was the equivalent of a minimum wage salary or less. Call me wild and crazy but the Clinton supporters I knew had attended pricy universities (which back in the late seventies would have meant graduating with $14,000 worth of debt even with some financial aid at least for the two that accepted me. Yeah, I know that is a drop in the bucket compared to today, especially since that included room and board costs etc. Thing is that most of them had parents who could also cover that without mortgaging their house, but they still went “I” paid for college. They also have employer supplied health care and thought ACA was brilliant.

The college healthcare ‘requirement’ makes sense initially, as students in new germ pools get sick. The modern campus now outsources the healthcare monitoring to some for-profit insurance company that will try to force parents to prove why they think that they should be able to opt out of mandatory coverage.

Following is our cautionary tale in the University of California system.

Imagine that your own family coverage includes network availability a few miles from campus, but that isn’t good enough for the insurance rep since the name on that facility doesn’t match your provider’s company name. You have to threaten to sue and they finally relent and only then have the university credit your account for the shakedown fee. How many parents got taken because they just paid the quarterly tuition and fees bill without asking what was really in it? Is it any wonder so many people despise insurance companies?

I can’t for the life of me figure out why anyone would send their offspring through the Univ of California system. Way back in 1992-93, when my son and I were researching what universities and colleges he should seriously consider, we both realized that it was taking students five years instead of four to get through the UC system. The required courses for all students are not available to all students, as no one in the UC system sees to it that required course work is available in proportion to their necessity! (Hopefully, maybe that has changed?) Students end up having to wait out the situation, hoping that they will get a chance to fulfill their graduation requirements without having to spend an extra year in the system.

Then there is the housing situation. Californian large cities have the most expensive housing in the nation. Sure, the tuition might be cheaper than other schools in other places that force a young adult to incur the “out of state tuition” differences, but tuition is tax deductible and housing isn’t.

Fifteen years ago that catastrophic insurance would have been 2,000/semester.

Democrats are as much a part of the problem as Republicans

Academia — what an industry. If the state were directly paying peoples’ auto leases and cell phone bills, there would be controversy (as we know from the example of “Obama phones”). But wrapping itself in the mantle of goodness and righteousness, academia gets a gold-plated state subsidy. Predictably, this will send costs in New York’s perennially subpar, ramshackle state university system higher still.

Glad I don’t live in the PRNY (Peoples Republic of New York) no more. Cuomo’s folly resembles nothing so much as the John Lindsay administration in New York City (1966-1973) which presided over NYC’s slide into near-bankruptcy, even as it handed out free tuition at CCNY, generous welfare bennies, and countless other goodies and boodle.

As Carlos Santana said [hat tip Rabid Gandhi], those who cannot remember the past are condemned to repeat it.

There are many problems with Cuomo’s plan, but providing tuition free or even low tuition education itself is not the problem. We should be doing that. Same with decent salaries and benefits for working for the government. However not funding them properly and then making sure there is little grift off that funding is a problem. Think of it this way – the Second Avenue subway really is a good idea. Building it is hard and costly but it is needed. What wasn’t needed was speeding up the schedule to open one leg costing countless millions in overtime so Cuomo could get a photo op for his Presidential campaign. Or back in NJ, not putting the percentage of government employees that was required to fund the pension fund into said pension fund so that Christie Todd Whitman and the various following governors could have tax cuts skewing to the wealthy without breaking the NJ budget, thus causing a major problem twenty years later.

Funny how things like that work…or don’t.

Seriously, Jim?

You are afraid that providing a basic service like education is going to bankrupt New York’s economy? (I can imagine that you would have said that when New York opted for free high school too……) Well, if you are right that providing citizens basic services, like Lindsay did, bankrupts a city, don’t you think that maybe, just maybe, it isn’t the city or state caring for its citizens that is the problem, but how the economy is run that is the problem?

New York has no shortage of money to pay for anything – it is just locked up in the hands of the few. How did that happen? And is it acceptable to you that those few ultra rich people can keep enough other citizens away from basic needs so that any state trying to meet their needs will cause its economy to bankrupt?

I suggest you think more deeply about what the actual causes are and stop trying to pin the damage on those who were not responsible for it and have no way of ameliorating it….

employment and grad income standards have to be severely applied. Obama did get the for-profits out, but he exempted non profits.

“Cuomo’s folly resembles nothing so much as the John Lindsay administration in New York City (1966-1973) which presided over NYC’s slide into near-bankruptcy, even as it handed out free tuition at CCNY, generous welfare bennies, and countless other goodies and boodle.” Sure, neoliberalism, real estate planned shrinkage and restoration, and handing the city over to the financial sector are unmentionable. Its free tuition and welfare that are the problems worth talking about.

An educated populace is a public good — which is why so many neoliberals prefer to eliminate it. Barring that, they are happy to simply act as gatekeepers and make education unattainable for the masses, who should be content to stay where they are and pay their auto loans and cell phone bills.

And by the way, neither auto loans nor cell phones contribute to the public good.

George Santayana

…I think he means Johan Santana. He pitched a No Hitter for the NY Mets :).

Oh, come friggin’ on.

The reason NYC nearly went into BK was the end of regulated commissions +the oil shock. If you think the recession in the US was bad then, and it was very bad, on Wall Street it was vastly worse. Tons of firms failed. And quite a few firms had also failed in the back office crisis of 1969-1970, when Wall Street was booming.

NYC tax revenues even then had 50% (yes, no typo) dependent on a mere 10,000 households well into the early 1980s. As their income went, so went the city.

All states subsidize state universities… because they own them. I hate to be pedantic, but the idea was that education was to be a public good.

Your comparison to autos and cell phones is truly weird. Yes, as your “people’s republic” reference suggests, it’s socialism. Always was. Especially for the post-war folk who enjoyed the GI Bill to supplement that free and cheap tuition.

This during the Cold War with the Soviet Union.

Hello? Land grant universities? What bizarro blend of libertarian coolaid are you chugging?

J.T.Gatto: “Looking backward on a thirty-year teaching career full of rewards and prizes, somehow I can’t

completely believe that I spent my time on earth institutionalized; I can’t believe that centralized

schooling is allowed to exist at all as a gigantic indoctrination and sorting machine, robbing

people of their children. Did it really happen? Was this my life? God help me.

School is a religion. Without understanding the holy mission aspect you’re certain to misperceive

what takes place as a result of human stupidity or venality or even class warfare. All are present in

the equation, it’s just that none of these matter very much—even without them school would

move in the same direction. Dewey’s Pedagogic Creed statement of 1897 gives you a clue to the

zeitgeist:

Every teacher should realize he is a social servant set apart for the maintenance of the proper

social order and the securing of the right social growth. In this way the teacher is always the

prophet of the true God and the usherer in of the true kingdom of heaven.”

“Why haven’t Elizabeth Warren or Bernie Sanders proposed making student loans dischargeable …”

In a word, ENLISTMENTS (MIC)…

But the greater take-away was how mediocre and homogenous most of the grads were becoming. It seemed the longer they had studied and deferred entry into the Great Unwashed, the more difficult it was to get anything original or genuine from them.

The IT company I work for is currently looking to hire some recent college grads. We’re more than happy to train people as our work is specialized and on the job training is about the only way to learn what we do. One thing I noticed looking through the resumes and interviewing is how few of these young people have any sort of real ‘job’ experience. All have had internships or volunteered with a charity or tutored in a lab or something similar. Very very few have ever held a part time job after school. Now, I have to hire someone with the expectation that somewhere down the line I’m going to throw them into the deep end of a client facing IT support position. If the choice comes down to a 24 year old with a Masters in CS or Math or something similar or a 24 year old with an AA who has been working in retail or as a bank teller for 4 years, I’m going to take the chance and hire the one who has at least worked under pressure before, even if their degree is less impressive.

If you’re in college now and you have never held a job that supplies some sort of paycheck go and work & make sure it goes on the resume. As lowly as a job at McDonald’s may be it at least tells me you’ve been around potentially angry customers, had too many orders come in at once, etc. Don’t short change yourself by not having this sort of experience.

While I appreciate your comment, I feel the need to add that my experience is that as soon as you put a low-wage or manual labor job on a resume, no one will consider you for anything else. I call it resume-lock. You sound like an exception, but my experience is that mostly, you can only get hired for whatever you already know how to do, or already have on your resume. If those things involved shovels and brooms, that’s about all your going to be able to get going forward, barring some random stroke of luck. Just sayin’…

I feel the need to add that my experience is that as soon as you put a low-wage or manual labor job on a resume, no one will consider you for anything else.

Boy, if that’s true it certainly explains a lot about US management.

I really hope that resume-lock isn’t widespread, but I have the feeling you are correct. The best people I’ve hired have had almost no formal IT experience. They just had they ability to learn and handle themselves under pressure.

That’s exactly how it is. Who looks at somebody’s resume that’s all housekeeping and construction and thinks they might be good for an “intellectual” job? Very few people. But imagine you’re in HR and you’ve got 20 resumes to sort through and you have to narrow it down to 5 to interview so obviously the first thing you do is go through the stack and toss everyone without relevant experience…well, maybe not you Toshiro (loved you in all those Kirosawa flicks, btw!), but a lot of people. I don’t actually hold it against those doing the hiring necessarily, as there is a good bit of logic to it. It’s a systemic problem. We’ve got way more good people than good jobs, so no matter what we do a lot of us are going to be fu…under-utilized.

> way more good people than good jobs

It’s almost as if our economic system destroys value…

I think diptherio hit the nail on the head, and that in this economy perception is reality. The lock-in is the perception – low status jobs suggest a low status worker.

While I appreciate Diptherio’s comment, and recognize how unrealistic what I’m about to suggest is, I’ll say it anyway: everyone, at some point in their lives, no matter their status/income levels, should have to do shit work when young.

Laboring, cleaning, retail, whatever: some of the arrogance and entitlement of the 10% might be tempered if they had to spend a year or more making ends meet while doing hard physical labor that pays poorly. It might give them a little more understanding and compassion for those who have to do this work for years and years.

Think of it as a form of National Service.

Sorry, but there is a world of difference between slumming for a year and actually having to live that life knowing that it isn’t going to get better. Slummers always know that if things get tough, there is a daddy to run back to or get a loan from. And if they are hungry, why mommy will feed them. They have safety nets so failing really isn’t going to happen to them. Can you say that about the people who have to live that life every day?

And I am curious – why do you think the 10% should only spend a year doing what other people have to do for all of their lives? Do you really think the 10% learns anything, except that it is better to be privileged?

What did Elton Musk learn from his short time (1 month) of trying to eat on $1/day? Anything? Other than using his business connections to take up for the slack in his eating? (Yea, I am sure he stopped going out to eat with his business friends…..and I wonder what foods he had on hand before he decided to play that game.)

Wouldn’t it be better to change the economy so that slumming isn’t a “thing”?

In the “star talk” podcast, Elon Musk makes it seem like he lived off ‘$1/day’ in food while he was in school or shortly after. I don’t think he had many business lunches during that time in his life.

Besides, is he even a good focus for ire? At least he’s doing something with his money that might benefit humanity, you’d be hard pressed to make the same argument for others with 10 digit net worths.

“doing something with his money that might benefit humanity”

Like this?

Electric Car Workers Accuse Tesla of Low Pay and Intimidation [David Dayen]

I’m not sure that ‘slumming’ does much to solve problems of entitlement, based on my experiences in food service working with trusties who just wanted extra walking-around money. However, I do believe that people who have worked shit jobs tend to have greater capacity for empathy than those who haven’t; or at least, people who have worked in food service treat their waiters/bartenders a hell of a lot better than those who haven’t.

“Sorry, but there is a world of difference between slumming for a year and actually having to live that life knowing that it isn’t going to get better. ”

+1000

it’s the hopelessness.

Will S & jrs

I can testify to the difference between slumming and poverty. In the mid 60s when I was hippie hitchhiking across Canada I met and worked temp jobs with a variety of people: junkies and alcoholics who were still buying their fix rather than stealing it, poorly educated first nations guys who had to work anything they could find, down on luck drifters who sent half their daily earnings to some evangelist or other, dropouts like me who wanted some life other than what I’d had, and a few Canadian and US slummers, along with some remittance kids from Britain who were mostly doing it for kicks, but who had that confidence that daddy’s money was always there.

How about shifting the time frame and the target? Every politician, every six years, has to take a year off to do that kind of work. It might increase their reality contact and improve their approach to policy, or it might function as de facto term limit for those who didn’t want to repeat the experience.

Love it! 4 years of poorly paid retail as the first thing everybody does out of college/high school. I’ve had the thought quite a bit lately, now that I’m working with educated activists, that almost none of them understand what it’s like to live on a pittance, get no respect from anybody (“what do you do for a living?” “clean toilets.” “oh.”) and have no hope of ever doing anything else. You want a recipe for depression and/or anger? But the well-meaning, well-educated libruls sit around wondering why poor people are so angry and drug-addicted and why they voted for Trump…and decide it must be ’cause they’re just dumb or evil.

Dimitri Orlov had a classic bit of this obliviousness in the video yesterday. After suggesting that everyone quit their jobs and live on a boat, like he’s doing, John Michael Greer pointed out that it’s not exactly that easy for people who have never had a high-paid career. To which Orlov responded that anybody can do it, which he proved by telling the story of a friend who, “used to work at Bear Stearns.” If he can quit his job and live comfortably on 20 acres of land, why can’t everybody? {facepalm}

People like Dimitri could benefit greatly from your plan, but unfortunately, it still wouldn’t give the experience of coming out of generations of poverty and depression. You can walk a mile in someone else’s shoes, but you still won’t know what those shoes feel like on their feet, if you see what I mean.

Well, I for one am heartened to hear you say that, since I’m planning on returning to school to pursue a career in IT having realized I really love working with computers in general and SQL in particular, and I’ve been spending a lot of time worrying recently if an AA would be enough or if I’m going to have to make the dive for a 4-year. In particular, a BS is likely to take me longer because I’ll have to continue the food service slog in the meantime. Here’s hoping there are more people out there like you!

(I like your handle, BTW…)

I’d be a homeowner right now if it weren’t for student debt. That’s ok though, they can just sell it to Wall Street.

Don’t worry in about 10-20 years they will start handing out home loans again to everyone and after defaulting they will sell it to Wall St.

State cuts in funding to higher education here in Illinois have led to to large tuition increases.

I live in the second most indebted town, in the most indebted county, in the most indebted state

in the nation.

What could go wrong?

There has been talk here in Colorado, a state which has chronically underfunded higher-education, that there may come a point where there is no more state-funding of higher-education at all.

And there is a secondary effect. As education cost rise, students are becoming more mercenary in their choices, and in not a good way. … The higher ed version of this dynamic is “I am going to school to get a well-paid job,”

It is hard to understate this dynamic. Here at the local U, with a long storied reputation for student activism, there is now almost none. There is a small group that continues to put the pressure on the athletic dept (huge standalone money-maker which passes on virtually nothing to the rest of the U) to limit (overseas) sweatshop production of U-braded apparel. And the expected support for anti-racism and anti-LBGTQETC. But no peep at all on domestic issues of class. Even the minimal peeps on tuition and student-loan debt originate overwhelmingly from a meritocratic middle-class perspective. And no anti-war movement AT ALL.

One huge change has been the composition of the out-of-state student body. As college costs have sky-rocketed, (formerly) high-quality State U’s have dramatically upped out-of-state tuition and eliminated financial aid for out-of-state (non-athlete) students. The result here has been a huge change: whereas the student movement in the 60s and 70s had a large component of kids, many working class, from the Chicago suburbs and the East Coast, kids coming here from those places now are overwhelmingly 1) wealthy and 2) career-oriented.

OTOH, or not, there is still much optimism about traditional politics. Bernie was quite popular with the students. Which I think is a good thing.

Bernie’s on tour with the democrats now, trying to rebuild their image. Not sure he was good for anything except herding people disgusted with the democrats back into the party. (That was the goal anyway, how well it works remains to be seen.)

Meanwhile the Clinton fans are all calling DNC HQ and complaining about Bernie and threatening to stop donating if he isn’t removed.

Seems like a well timed distraction to me.

If the white, female middle aged professionals who make up the core of the Clinton camp get their way on this, the Democratic Party will have plenty of funding – and very few voters – by 2020.

There is a swarm of them out there. The election is long over, but I’ve continued to receive pep talk fundraising emails from Clintonite Wellesley alumnae whom I never knew in college and who never interacted with me during our prime work years. They have apparently semi-retired from whatever over-remunerated pseudowork they did to become shills for Hill.

Their priorities are frivolous, and their missives display a repellent lack of awareness of (or disinterest in) the real hardships faced by the average American. I haven’t yet told them that I’m actually a Berniebro.

I always liked “Bernie Bro”. I never knew it was created to be a pejorative. Too late! I like it!

I’m a Bernie Bro, I don’t care who thought of it. If it was some Wellesly Lesbian Sadist who wants to castrate republican rednecks and bomb the entire middle east from Morocco to India,. I don’t care.

I still like it. “Bernie Bro”. I like it! That’s the funny thing. When somebody tries to insult another person and that other person feels amused instead. That’s good. Where did the insulter go wrong? Hahaha. Was it a failure of cunning? A failure of categorization? A failure of psychological insight? An amusingly embarrassing anachronistic etymological analysis — perhaps one so devoid of comprehension that it wouldd have gone awry in any age or time? Probably.

That’s why they lost! All of it. Duh. Hahahah

Just did an episode of “The Outer Limits” radio show on KBGA, Univ. of Montana’s student radio station. There have been protests, and even a mini-occupation of the quad, by students here over a proposed 23% increase in tuition. You know, cause enrollment is down…makes perfect sense.

I come in around the 40 minute mark (under my other pseudonym, “Bartleby”) to interview a prof. and a couple of protesting students. We didn’t arrive at much of a conclusion, but you might find some interesting thoughts in here:

http://www.mixcloud.com/outerlimitsradioshow/canary-on-the-campus-an-oval-occupation-outer-limits-8-april-2017/

The Outer Limits was a pretty cool TV show. It must be on Youtube. That and the Twilight Zone. Although I think the Twilight Zone was probably somewhat higher in artistic merit. It really was quite amazing. That’s what TV was made for. Or rather, art likee the Twilight Zone elevated TV far beyond a static box. Outer Limits wasn’t quite as good but it was good anyway. The TV show I mean. I remeember as a kid getting nervous when the Outer Limits said it was taking over the TV. I sat there and got nervous and a little scared of the Outer LImits. It seemed like a dangerous place and you were going there unleess you got up and lefft the room. Which was out of the question! That was what made me scared. I thought “Now I’m stuck here of my own accord. And something weird is going to happen.” Then the Outer. Limits would come on. At any rate. That’s what reality is.

I just heard this morning that New York is making tuition free in all public colleges and universities. It was so astonishing to hear of Bernie’s proposal being implemented I almost felt as if I’d dreamed it, but I’m fairly sure it was on Democracy Now and not just in my dreams.

On the subject of cost, what is not emphasized is that US corporations look for lower cost educated labor, be it via moving operations overseas, outsourcing via the internet or insourcing via H1-B’s.

If one looks at education from the ROI standpoint, which is frequently how the “must go to college” crowd does, the capital investment in a robot, the capital investment in a non-US based educated worker, and the capital investment (the costly college degree) in a native US worker should be a major determinant of the required “operating cost” price of the future labor from each and their interchangeability.

Cost minded corporations will be seeking the lowest cost labor solution, and will likely be unconcerned how expensive it was for the native US worker to pay for their education.

If a nation can educate their youth inexpensively, fewer societal resources are consumed in the process.

That is the flaw in Bernie Sanders “free college for all” program.

If the existing high cost of producing an American college educated worker is simply moved into the government’s budget, probably other government expenditures will be decreased (infrastructure, basic research, health care),

One can look at how American manufacturing was labor arbitraged with foreign labor.

The same is occurring with foreign educated labor as workers are imported, jobs exported or foreign entities acquired by US corporations..

The USA has to become a leader in lower-cost education (on-line?) and possibly move to a continuous life-long education process rather the “trust us, go away for four years and one is set for life” model.

Maybe we can re-purpose the American media in this task and away from pimping for more foreign wars?

This is a valid criticism of Bernie Sanders’ “free college” idea. I would also add that the problem extends beyond business arbitraging labor costs– the burden of training is increasingly falling on workers, rather than something that is provided by employers. It’s very hard to train for jobs that don’t exist or jobs that current exist but may not in future.

I agree that we might be served moving towards learning as continuous process rather than a one-time thing, though that doesn’t mean 4 year degrees necessarily have to go away.

> Cost minded corporations will be seeking the lowest cost labor solution, and will likely be unconcerned how expensive it was for the native US worker to pay for their education.

What you propose is a race to the bottom.

The other option is to increase the friction involved in hiring or moving your business overseas. Why should you still be able to sell your products on equal footing with domestic enterprises? What law of the universe demands it?

The American System was based on high wages, high productivity, and tariffs. Right now we have none of the above.

The main factor in the rise of published tuition has been the rise in incomes at the top. Published tuition rates are based on the incomes of those who can afford to pay full price. Net tuition, what students actually pay, has been flat since at least 2000, but discount rates have risen substantially. The rise in discount rates goes back at least to the 1990s. The system is scandalous, but it’s important to look at what students actually pay.

The Federal Govt continues to shovel money into the system because it continues to be profitable. The system scandalous, but sustainable. Of course, policy makers are looking to make it more profitable, which they’ll do by limiting access to lower income people. So they’ll stop funding “Larry’s Barber College” in Chicago, which has a nearly 50% default rate. It’ll be interesting to see who makes the cut:

https://nslds.ed.gov/nslds/nslds_SA/defaultmanagement/search_cohort_3yr_CY_20_13.cfm

The main problem for policy makers is that universities are one of the few things standing between them and the pitchforks. Where do those people go? There are no jobs for them. Scandalous, but sustainable. $1.4 trillion is a big, scary number, but what is it expressed as a percentage of all future income of all borrowers? That’s why I say the system is scandalous, but sustainable. All the more scandalous because it is sustainable–there’s a lot more potential to squeeze the victims (by amortizing loans over 40 years instead of 10 and keeping monthly payments the same).

The “high tuition, high discount” model is definitely not helping things. For one, it greatly increases the uncertainty around the question: “How much will my education cost?” You used to be able to look at a standard tuition table, but now you have to ask about potential discounts and the tuition hikes you’ll likely see over the course of your education. Stepping onto used car lot involves less uncertainty than college does these days.

The other things is that the parents of the rich kids may eventually get fed up and quit paying tuition rates that are several times the actual cost of the education. After all, even rich people don’t appreciate getting ripped off. What happens to the university’s bloated spending plan then?

> And there is a secondary effect. As education cost rise, students are becoming more mercenary in their choices, and in not a good way.

Just one data point, when I went to engineering school in the seventies, well it was post the bomb, post Vietnam war, and us engineers talked about building buses and infrastructure not weapons.

Fast forward 3+ decades and I am literally stunned not just at how unethical Uber is, all throughout the corporation, but at reading comments at reddit and HackerNews from Uber’s engineers and others, literally rationalizing Uber’s corrupt, often illegal and exploitative behaviors because: 1) Their department is clean and it pays good money, and 2) Taxi medallions are so horrible it justifies law breaking.

I just have no idea what engineering or STEM schools no longer talk about engineering ethics, but I find it terribly sad, and terrible for society.

But I do think some of it is explained by the high costs of college.

I work in another up and coming commercial STEM field and also find the same lack of ethics. It seems to take just one or two to start and then it’s just a matter of like attracting and hiring like. I saw the same thing leading up to the tech bust of 2001. In every case I’ve seen, though, immigrants were at the center of it.

A contributing factor to dropping enrollments is demographics. There are fewer kids entering college now because there are fewer kids: http://www.indexmundi.com/united_states/age_structure.html. The size of the generation coming after the “millennial bulge” is SMALLER.

Of course, prudently-run universities would have planned for this and slowed down their building and hiring sprees. Alas, it appears that nobody was paying attention to demographics, and the only “solutions” to the problem are to lower enrollment standards and raise tuition rates. Cost-control efforts in America’s beloved universities?!? Hah.

The true solution to this is to implement lending standards: Look at a student’s test scores, class rank, field of study, and current debt burden. Also look at the academic department and university the student attends. Determine the probability of successful loan repayment. If the chance of repayment is less than 85%, then DENY the loan.

And how do you estimate the probability of successful repayment? With a multi-parameter logistic regression analysis. Having issued millions of loans, the Department of Education easily has enough data to build a model with decent predictive capability.

Loans would be most frequently denied for programs that have high tuition costs and whose graduates achieve poor earnings after college. You want to borrow $200k for a degree in motivation speaking from a crappy Trump-U knock-off? Loan DENIED. You want to borrow $15k to wrap up a masters in biochemistry from a top-notch school? Loan APPROVED.

Right now the US Department of Education (source of over 90% of student loans) says “YES” to pretty much everybody, regardless of the quality of education or repayment prospects. Is it any wonder that our colleges and universities are abusing it? Saying “NO” sometimes would do wonders to improve this grotesque situation. That, and restoring bankruptcy protection to student loans.

Not everyone knows what they want to do when they go to college and even when they do go to a good school for engineering there isn’t any protection from Wall Street throwing the economy off a cliff and destroying job prospects and future pay rate.

No, they don’t. But is it a good idea to burden aimless young adults with a six-figure debts to help them figure it out? People who are undecided should only be approved for smaller loans until they figure out what they’re doing and whether or not they have a reasonable chance of paying any additional debt they’re likely to incur. Too many people are losing their futures to this increasingly corrupt racket that our universities are running.

When debt burdens are getting too high, the most obvious and useful course of action is to QUIT LENDING so damned much! Only the US Department of Education has the power to make this happen. And if the Feds were smart about it, they could help students ensure that they get the most bang for their buck. That’s what data-driven lending standards would do.

Without standards, all we have is the status quo: Lending ever more money to cover ever-rising tuition rates. A great many students have regretted borrowing so much (http://www.finra.org/newsroom/2016/study-finds-1-3-student-loan-holders-payments-due-are-late-payments-and-more-half), and it’s only going to get worse as tuition rates continue their relentless climb upward.

The purpose of the lending standards is to protect the STUDENTS, not our hapless government. Without limits, you’ll see an ever-larger number of students borrow more money than I did for my HOUSE, even though most will have no credit rating, assets, or job history. And an ever-larger number of them will be financially ruined in the process.

Would the protection provided by data-driven lending standards be perfect? Of course not. There would be both false positives (lending to somebody who can’t repay) and false negatives (denying a loan to somebody who could repay). But it would be way better than what we’ve got today.

And it is quite telling that even the customer service positions in various student loan companies are now handled by workers living in third world countries. Architectural assignments are now going to architectural firms overseas. Jobs relating to research involving advanced chemistry degrees are also as likely to be found in American companies based in Singapore as in Milwaukee. And of course engineering jobs are overseas as well.

Four and five years ago, many college freshman were told to try out the health field. It will be interesting to see if the employment market place is facing a glut of nurses, physical therapists and such in the market right now.

Well, the purpose of college is to keep young people out of the job market a few extra years. From the perspective of the Powers That Be.

Your 18-year-old Motivational Speaker degree seeker is going to be out there causing unrest unless you give him a living wage or a spot in a 4 year program. One of those costs you money, one of them costs him money. Which are you gonna choose?

Why is everyone assuming that there is a foundational collusion between “education” and “making money”? That may be the condition of American education, which has been developing for more than a century here, but now such purported collusion is shedding light on the follies of doing education as a sector of business.

Rendering you able to serve the society by training your mind–learning how to think well and then examining your world and practicing your intellectual skills–is supposed to be the purpose of education. Properly educated people think critically, are well-informed, and know how to build themselves and their own position into their view of how their (our) world works. This brief description opens onto what used to be meant by the phrase “critical thinking.”

Education has nothing to do with learning how to make money or service the people who make money. No job training, wealth-enhancement, learning how to conform to economic expectations, employers’ conditions, etc.

We have re-cast “education” as “job training.”

This society hasn’t had the benefit of real education since at least the time of Dewey’s bone-chilling assessment of the “purpose” of education quoted by NoBrick above, but the “job training” bit has metastasized within our educational system during my lifetime.

People are basically going to spend most of their lives (and most of their waking hours) working for money, more hours than almost anywhere else in the world, unpaid labor won’t count in GDP or to pay the bills. It you don’t work neither will you eat – their survival will depend not on the content of their character, or the ability to think in some abstract sense, but on the ability to find work! Their whole entire lives will actually be centered on paid work in most cases, little else will matter.

So why should anyone be surprised that in THIS type of society college too will focus on work? It’s not an anomaly, it fits right in to the system it is part of. It would in fact be a surprise if college was some pristine exception.

Dudley aside, maybe this isn’t much of an issue at the top is because indebtedness doesn’t touch, or substantially affect anyway, the top x%. Is student debt a meaningful indicator of the 1% – 99% fault line?

Looks like the American education system is going the way of the British school system – which was not about education so much as about class segregation and “networking.” You don’t attend college to get a good education, but to meet the right people from the right families who will further your career. Aristocracy, not meritocracy. If you don’t attend the right schools, you’re relegated to the servant class.

The engine behind this transition has been the corporatization of higher education (1), a philosophy dating back to the Reagan years with the institution of Bayh-Dole intellectual property rules(2), followed by the massive tuition increases of the Clinton-Bush years.

(1) http://time.com/108311/how-american-universities-are-ripping-off-your-education/

How American Universities Turned Into Corporations, Andrew Rossi, May 21, 2014

(2) http://www.goodreads.com/book/show/1476144.University_Inc

Univesity Inc.: The Corporate Corruption of Higher Education, Jennifer Washburn, 2005

A few steps in the right direction would be to put all federally-financed research results into the public domain (at least free licenses for all American citizens), and allow students to get out from under student loan debt by declaring bankruptcy, and put in more free higher education programs for the top 10% of graduating high school seniors who attended public schools.

Some good ideas there, I think, but I also think that, if quality education is possible, it should be made available to everyone, not just the smartest 10%.

Since in the present state of affairs what passes for “education” in this country is really just phase I of a person’s career in “business”, maybe we should look at the costs in the same way. In other words, what you pay for college is just another business expense; or your very own business or business debt. Wouldn’t that help the debt write-off under bankruptcy?

Some of the for-profit schools are bona fide frauds.

Those monies need to be clawed back…

And the national authorities ought to pursue these systemic scholastic frauds with great vigor.

Here’s a question: both education and healthcare are substantially paid for by the Feds. Why is it that medicare can simply set a price for doctor and hospital services, and say “if you want to participate in medicare you must accept these payments”, yet they can’t do the same in education? Why not say “if you want to participate in the federal student loan program, you will accept a maximum payment of $15k/yr”. Even the top-rung Ivies can’t get 100% full pay students, which means they’d be forced to accept at least some people at cheaper prices (just like hospitals charge different insurance companies different rates).

This is, BTW, what actually happened in medicine. In the 70s/80s, medicare just paid the “usual & customary charge” i.e. whatever doctors and hospitals billed. This led to rampant price increases among providers, until medicare finally switched to the RBRVS system, which dictates prices. While there are plenty of problems with that system, the fact is that medical inflation is now significantly lower than higher ed inflation.

Paying off every student loan outstanding would cost $1.4 trillion. That sounds enormous, and it is- but the total cost of the F-35 Joint Strike Fighter boondoggle is already projected to be $1.5 trillion, and counting.

The fighter will never work, and all those students already do. So which one is the better investment?

Yves,

Professors and college administrators children are shielded from this debt as most can take advantage of tax free tuition remissions from fellow institutions. And every time this very generous windfall is about to be taxed legislators find lefty administrators in their office explaining how in general they support taxes, but just not THIS one. And on the way out the door they ask: “So representative Smith, your daughter is a high school junior, no?” “Would she enjoy a personal tour of EliteU and a sit down with our admissions director?” And “good luck with the vote!”

“Now THESE kids I would hire ahead of the blue-chipped grads, most days. They were raw material that could be worked with and shaped into weapons. It was patently clear that University was no longer adding the expected value to these candidates and in fact was becoming quite the reverse.”

I don’t think I’ve read anything more dehumanizing in my entire life.