In 2015, by dint of public criticism, the most important being a Sacramento Bee op-ed by private equity experts Eileen Appelbaum and Rosemary Batt, we were able to thwart a plan by CalPERS to greatly understate the risk of investing in private equity. The approach was a gimmick no finance-literate individual could honestly endorse: not allowing for higher risks and different drivers of returns. One of the bedrock principles of finance theory is that higher risk investments need to have the expectation of higher returns to justify investing in them. Among many examples, that’s why junk bonds have higher yields than Treasuries.

Less than two years later, CalPERS is attempting the same chicanery in new form, that of again seeking to understate the risk of investing in private equity. And the approach isn’t just cheeky but also has downsides. Private equity and public equities are now separate units, each reporting to the Chief Investment Officer. CalPERS staff has proposed combining them into one “equities” group. The excuse is that there are informational benefits to putting them together.

Why CalPERS’ Justification for Combining Private and Public Equities Does Not Add Up

The idea that there is any meaningful advantage to combining private and public equity management is spurious. There is a theoretical argument, that private equity is merely levered public equity and not a distinct asset class. While that is undeniably the case, the biggest risks in CalPERS’ portfolio are in private equity, due not just to the leverage but also the illiquidity, lack of transparency, complexity of contracts, history of cheating investors, and reliance on managers who are not fiduciaries. These are all distinct problems not present in public equities. It requires specialized expertise to manage them. And as we’ve documented over the years, CalPERS along with other private equity investors is often not up to the task.

By contrast, CalPERS’ investment in public equities consists of three activities: running a large in-house S&P 500 index fund, running large (everything at CalPERS is large) specialty non-cap weighted strategies and selecting some specialized outside managers, such as for foreign and smaller capitalization stocks. Running an index fund has absolutely nothing to do with private equity.

Even the activity that superficially has some resemblance to choosing private equity managers, that of selecting and monitoring public stock managers, is actually a very different task. Unlike private equity, where fund valuations are acknowledged to be gamed regularly over the life of a market cycle and a fund, and therefore not useful for analytical purposes, the management of public equities can be and is done in a far more rigorous manner. That doesn’t solve the problem that lack of manager persistence (the ability of seemingly successful managers to keep winning over time). That in turn means that it is a fool’s errand to try to pick managers can beat their markets. But there is a legitimate role for deciding how to weight various exposures (e.g., how much in emerging markets) and that is an important activity of CalPERS’ public equities group.

Having said all that, there are reasons to coordinate information across the groups, most important to make better portfolio decision. For instance, the private and public equity professionals both could decide to invest in energy funds, based on the pitch that now is a good time in the cycle to do so. But that sort of sectoral weighting should already be monitored by the Chief Investment Officer. It’s not the responsibility of the lower-level staff or even the head of each team. That means it does not take a restructuring to keep tabs on that and intervene if and when necessary.

In addition, even if there were any meaningful cooperation benefit to be achieved, combining units isn’t the best way to make it happen. In fact, putting professionals together with different task focuses is more likely to create dysfunction. The examples are rife, like the nearly two decades it took banks to figure out how to get investment bankers and commercial bankers to work together, or how mortgage servicers continue to fail in managing routine and default servicing under the same roof.

There other approaches for achieving more cooperation where it makes sense without a reorganization, including really easy stuff like co-locating staff, having weekly meetings where they discuss what they are doing, and setting up projects or task forces on particular common interests. In fact, having one manager without doing all of the far more important soft stuff is unlikely to lead people with very different job priorities to change their habits.

Finally, combining activities under a common manager where the day to day activities are very different is well nigh certain to produce negative side effects, such as poor supervision and the fact that common rules and procedures won’t work for both of the former units.

The proof of the pudding is that of the many private equity investors in the world, CalPERS staff appears to have found only three that also combine the management of private and public equities. And none of them are highly esteemed investors held out as models for best practices, like Yale or other top endowments.

What Are More Plausible Explanations for This Dubious Change?

The real reason is that both units will now have the same benchmark, a ludicrous and dangerous ruse. This will understate private equity risk, supporting important staff objectives. They include being able to tell interested parties that private equity is performing well by virtue of investment grade inflation. That supports putting more money into private equity than its potential justifies and ignoring its problems, like fund managers who cheat investors, tax abuses, and social costs like causing bankruptcies and cutting more jobs than similar non-private-equity owned companies. Private equity, like second marriages, has become an exercise in hope over experience.

In addition, more permissive metrics serve staff at the expense of beneficiaries and the California taxpayers that backstop CalPERS’ pension payments. Staff members can mislead the public about how well they is doing their jobs by measuring performance against unjustifiably flattering benchmarks. Those same benchmarks serve as the basis for bonus payments. So setting benchmarks too low allows CalPERS’ investment staff to mislead the public, most importantly the not-very-finance-savvy legislature, as well as earn “performance” bonuses that they would find harder to achieve with more honest measurement of risk-adjusted returns.

If CalPERS’ board members endorse this scheme, that would provide yet more proof that aside from JJ Jelincic, they are either not competent to oversee CalPERS or are too lazy and captured by staff to perform their fiduciary duties. Neither conclusion is pretty.

The fact that CalPERS’ staff can get its consultant to endorse these recommendations does not prove that they are sound or intellectually defensible. As we pointed out in our critique of the 2015 scheme that we thwarted, the incentives of the consultants do not align with those of the beneficiaries:

We’ve described the important role that consultants play in defending and thus perpetuating dubious practices in private equity. As much as these advisors nominally serve limited partners like CalPERS and its Sacramento sister, CalSTRS, which is the second biggest public pension fund investor in private equity, their true loyalties are to the private equity industry.

As we discussed at length in a recent post, How CalPERS’ Consultant, Pension Consulting Alliance, Promotes Intellectual Capture by Private Equity, firms like Pension Consulting Alliance (PCA) are inherently subject to the biggest conflict of interest of all: that of needing to validate that the idea of investing in private equity is ever and always sound…

Recall that CalPERS has failed to meet its private equity benchmarks for the last ten, five, three, and one years. CalPERS is widely considered to have ready access to fund managers and to be disciplined about fund selection. It’s hard to think that many investors would do meaningfully better than CalPERS; indeed, PCA said in September that CalPERS did better than an industry peer group index.

But private equity is a high-risk, hoped-for high-return strategy. And yet the benchmarks that have been used in the industry for decades show that private equity hasn’t deliver the returns that go along with the risks..

CalPERS has not just fallen short of these targets. It has fallen short by a gaping chasm of several hundred basis points for the ten, five, three, and one year measurement periods.

The very fact that CalPERS’ private equity returns over the past decade have been hundreds of basis points below CalPERS’ benchmarks says that private equity falls massively short in giving enough return relative to the risks involved. Shorter: Private equity cannot be depicted as a sound investment.

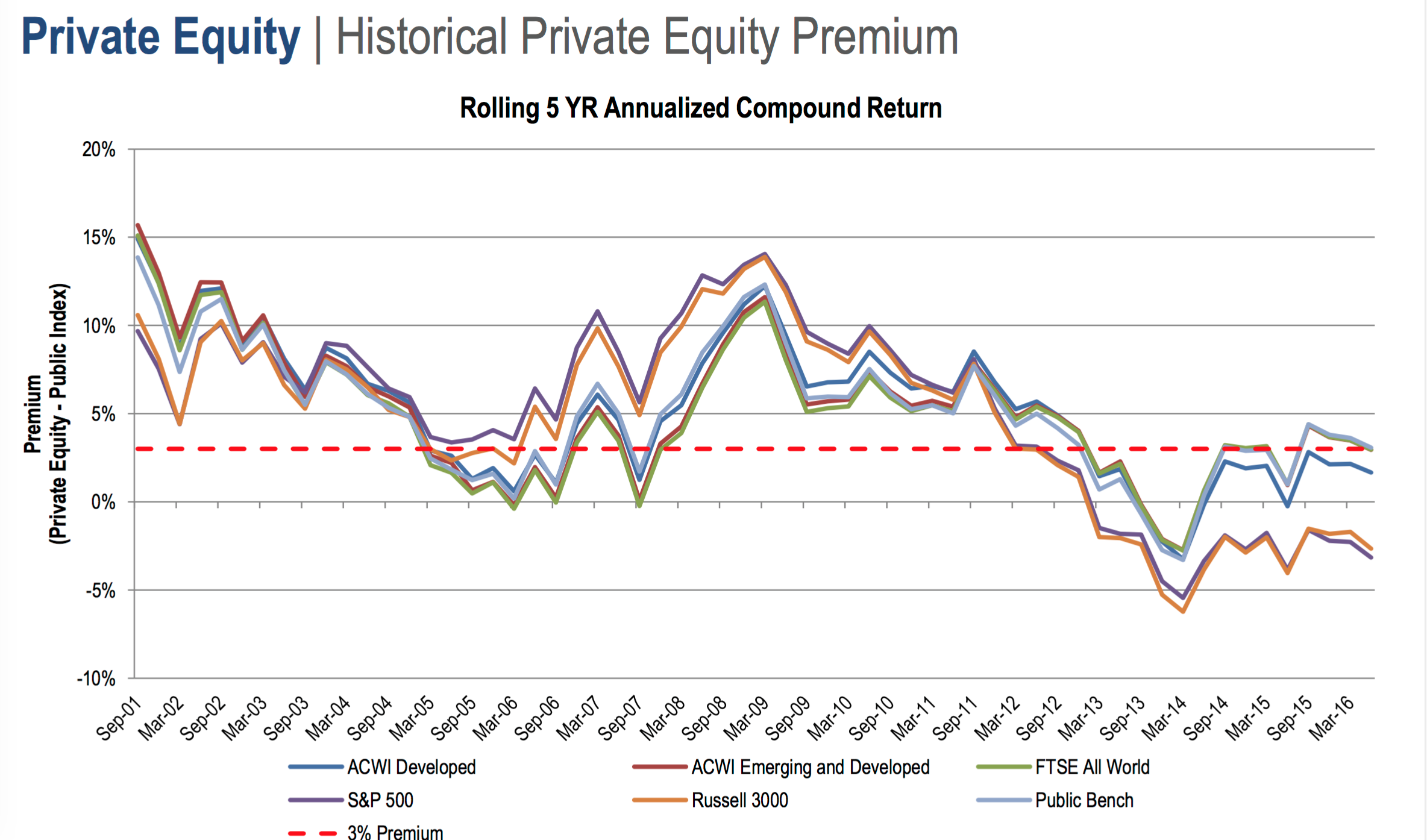

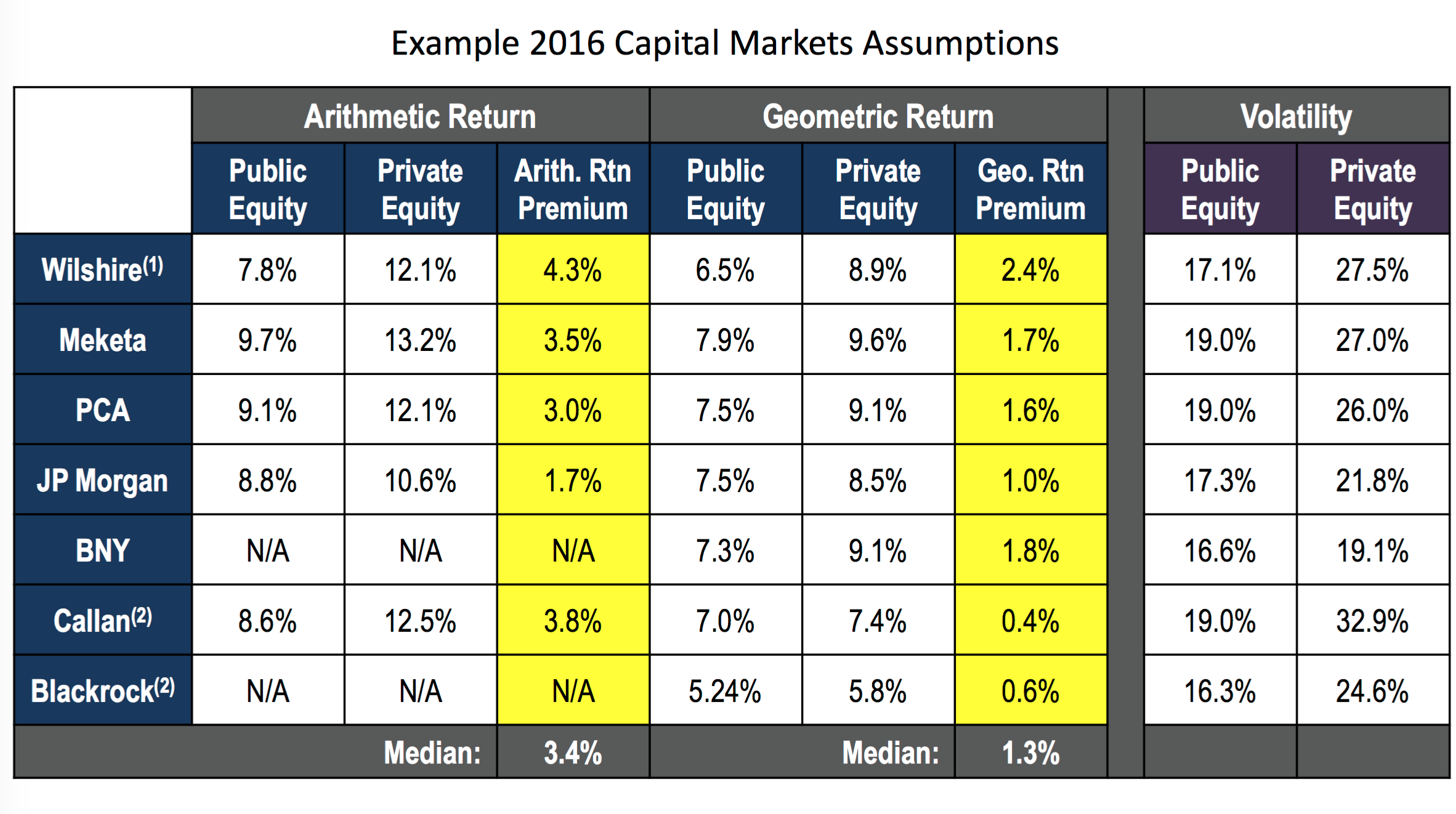

The latest gambit is a variant of the 2015 scheme, with a new consultant, Meketa, carrying the water for CalPERS’ staff. Again, the approach is to ignore private equity’s much higher risks, such as leverage and illiquidity. The conventional rule of thumb is that the risk premium should be 300 basis points (3%) over comparable public stocks. That ought to be medium to smaller capitalization companies, but investors often game their performance by using the more flattering S&P 500, which generally shows lower returns. Some private equity investors, like North Carolina’s former chief investment officer Andrew Silton, also argue that the 300 basis point premium is too low (a higher premium means a higher return is required to invest in private equity.

Private Equity’s Flagging Performance and CalPERS’ Planned Cover-Up

Let’s get to the obvious problem with the bridge that CalPERS’ staff is trying to sell to its board. If private equity is so similar to public stocks that you can use the same benchmark for both, why be in private equity at all? Why accept the higher fees and risks?

Ironically, in a April Investment Committee presentation, CalPERS admits that private equity hasn’t been earning enough to meet its idiosyncratic risks of late, measured against a host of equity indices:

So the solution, as in 2015, is to come up with a way to gin the return measurements rather than admit that there is an underlying problem. The share of private equity relative to the total global equity market has more than doubled since 2004. Too much money is chasing too few deals, crimping returns.

And in fairness, CalPERS has been taking some measures to address this problem. It has cut its private equity allocation, formerly as high as 14%, to 8%. It is also looking at bringing private equity in house. If it did that, it could boost its net returns easily by 2% or more, making private equity a much more attractive proposition. But that remedy is years away.

CalPERS’ attempts to deny that they are gaming the benchmark. From page 15 of the April presentation:

Benchmark shift due to underperformance?

– No, making an explicit link to the investible alternative (opportunity cost)

This is illogical. First, as we stressed above, a fundamental principle of finance is the risk/return tradeoff. “What else could we invest in?” is not the right question. “What we could invest in that is of similar risk?” is what they should be looking at. And it’s not global equities.

If CalPERS were going about this in an intellectually honest way, it could construct a public market proxy for private equity. But that would confirm what CalPERS is desperate to hide: that the pension fund is underperforming market risk and paying way too much in fees. From a 2015 post:

…the very long term, illiquid nature of private equity investments allows limited partners to fool themselves about how realistic it is for them to achieve their desired returns, and there’s a well-honed industry of private equity professionals and consultants who stoke those illusions.

But it’s going to be hard to keep those fantasies alive when academics show how to beat private equity returns with much cheaper public equity strategies. Matthew Klein of FT Alphaville summarizes a new paper by Brian Chingono and Dan Rasmussen that shows how to exceed the average private equity fund’s return by a solid margin. We’ve embedded the article at the end of the post…

The Chingono/Rasmussen strategy, in simple form, seeks to replicate what private equity funds do with a portfolio of public stocks by creating a portfolio of leveraged but low-priced yet solid cash flow generating firms. They focus on midsized stocks, in the 25th to 75th percentile of market capitalization, that are cheap (bottom 25% in enterprise value to EBITDA terms) and are leveraged more than average. The academics then tested several ways for selecting the best performers from this bunch. They found the best measures to be sales growth relative to assets and debt repayment ability (as in cash flow relative to debt levels). The only anomaly seems to be that rejiggering the portfolio annually in the 4th quarter produces sub-par returns; all the other variants produced impressive results of an average of 9.1% to 11.7% outperformance. That puts private equity to shame.

In other words, CalPERS staff is lying to itself and the board when it says this benchmarking exercise is about using an “investible alternative”.

CalPERS is Gaming Private Equity Benchmarks in Other Big Ways

Another way CalPERS measures private equity performance is to compare it to its other investment strategies. But with these metrics, CalPERS continues to engage in a sleight of hand that academics, a former chief investment officer, and your humble blogger called out in 2015. Again, it makes private equity look better than it is by understating risk.

Volatility is a measure of risk. For instance, if you follow the financial media at all, you’ve probably encountered the VIX index, which is a crude measure of stock market volatility, as a “fear index.” Higher levels of the VIX mean higher perceived risk by investors.

Similarly, higher volatility assumptions mean that more risk is being attributed to the investment strategy.

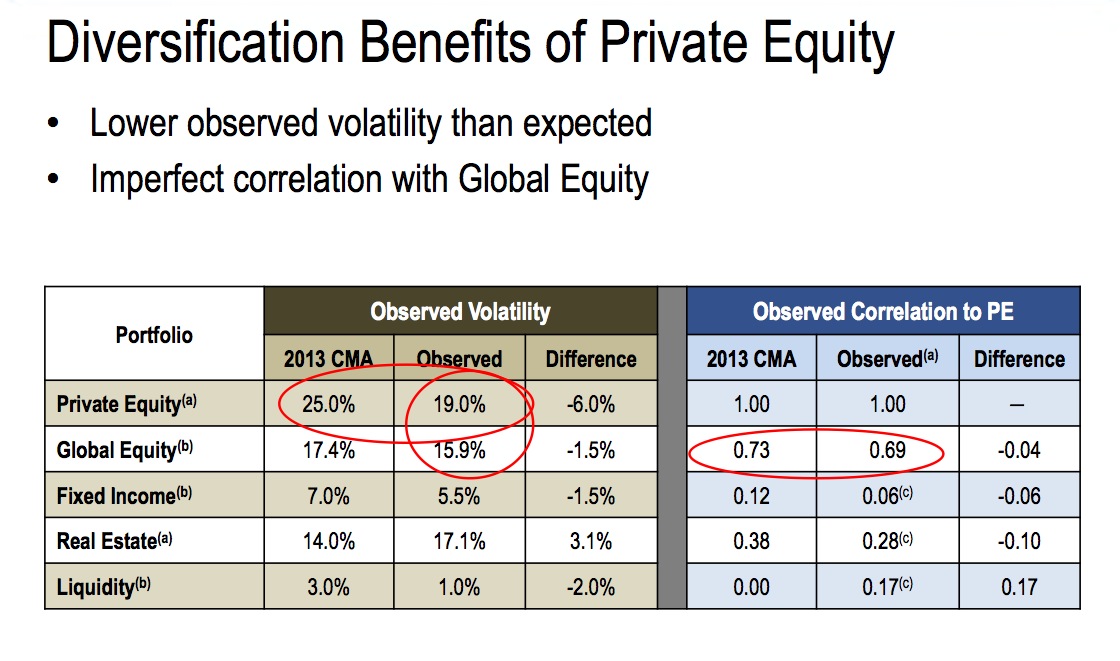

CalPERS is conning its board by not using the higher volatility assumptions prepared by its consultants, and instead substituting a bogus “observed volatility” measurement.

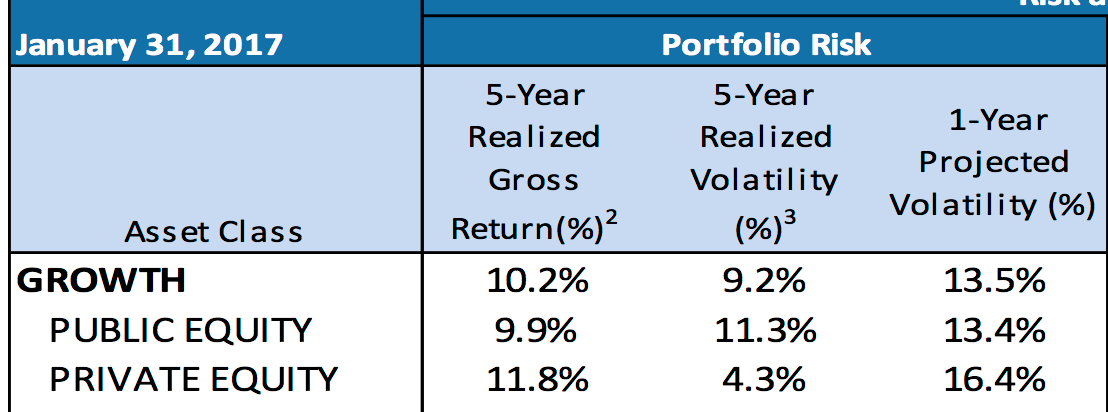

In the April board document on page 22, CalPERS shows the expected volatility measurements recommended by its consultants, Wilshire and Meketa, along with other estimates. Bear in mind that the models that investors like CalPERS use to measure portfolio-wide investment risk are supposed to used expected volatility. Look at the far right column, the volatility assumption for private equity. And as an aside, notice how different those figures are from the public market assumptions, which again demonstrates why subjecting private equity and public equity to the same benchmark is a dreadful idea:

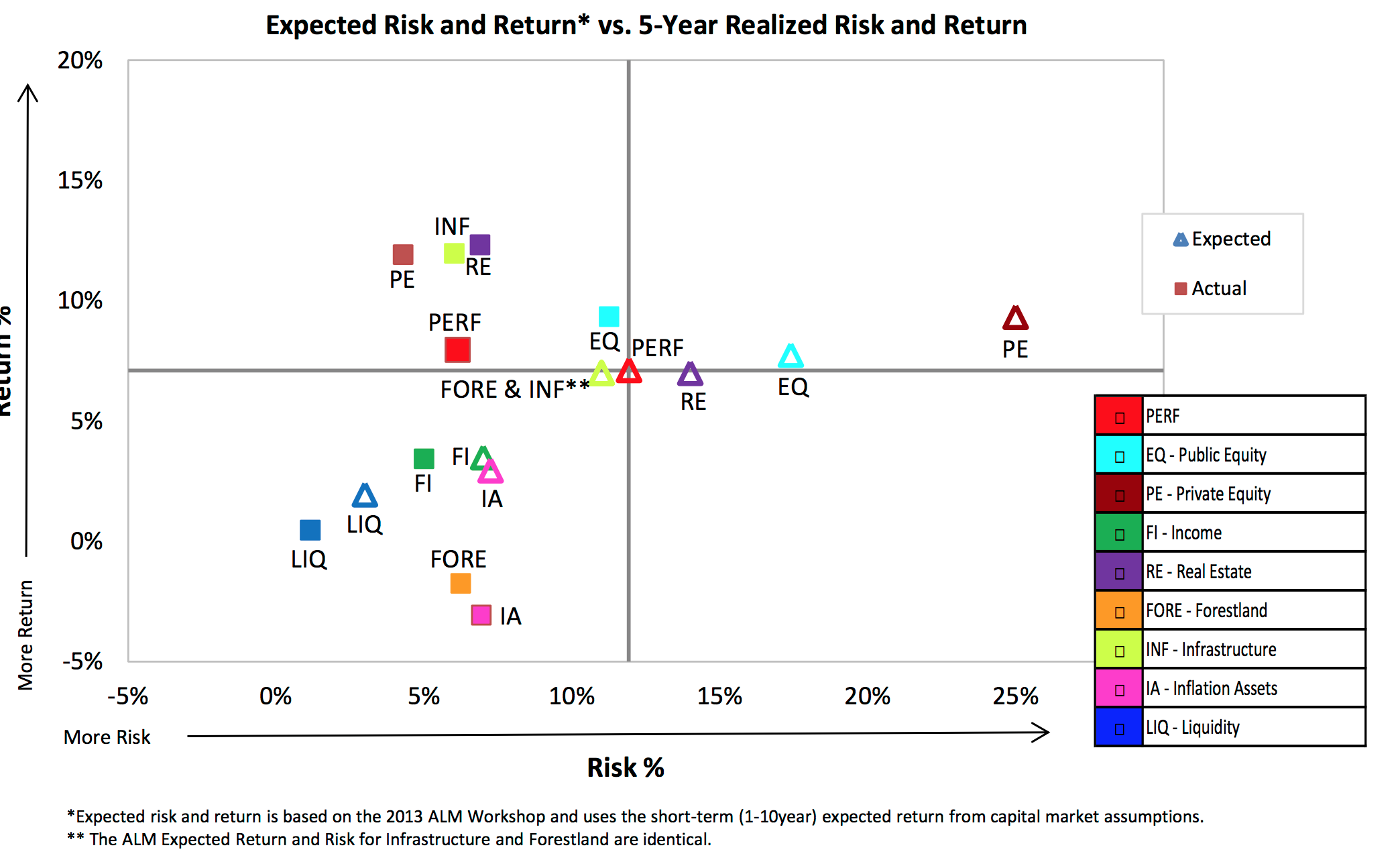

But what is CalPERS’ official policy risk measure, the one it uses to prepare charts that tell the tale that private equity is doing better than its risks? Here is CalPERS’ Strategic Asset Allocation Review from the end of February. This complicated chart is meant to show how investments did versus expectations. It takes a bit of doing, but find the symbols that correspond to private equity:

You’ll see that private equity outdid projected returns a smidge, but went from the way right of the chart as being forecast to be the most risky investment strategy in 2013 to supposedly turning out to less risky (further left) than anything except for cash and other “liquidity” investments! How could that possibly have happened?

This slide from a 2015 presentation clears things up:

Look at the far left column, the “2013 CMA” assumption for risk in private equity of 25%, versus the “observed volatility” of 19%.1 Remember, lower volatility = lower risk. Notice that 19% is also way lower than the 2016 assumptions CalPERS’ consultants had for 2016, of 27.5% and 27%. The CMA assumption of 25%, which reflects private equity’s high risk, is what was used to generate the maroon triangle on the extreme right of the busy chart.

And what led to the greatly reduced risk? Using an even lower volatility figure than the 19% “observed vol” of 2015. From the final page of this document:

The one-year volatility is 16.4%, over 10% lower than the levels CalPERS’ consultants have been recommending, and lower even than the indefensible “observed vol” of 2015! No wonder private equity suddenly looks super safe! CalPERS has cooked its numbers to an astonishing degree.

Readers may recall that a media outcry over how CalPERS had changed how it measured its investment costs, and then tried to tout a total cost reduction that included a $121 million accounting change. CalPERS was forced to walk that back and revise its press release.

Yet proving how deeply CalPERS’ board is invested in not doing its job of riding herd on staff, board member Richard Costigan twice tried to defend the indefensible cost reduction claims, protesting that staff would never play games to boost their compensation. Oxford Professor Ludovic Phalippou rejected that idea out of hand:

What is proven though is that whenever there is a financial incentive for something people spend their time thinking about how to game it. It is like that everywhere. Tons of research has shown this repeatedly. It is highly counter-productive.

The presentation above should help convince you that misrepresentation with data is routine at CalPERS But it also show that it’s often well disguised, and CalPERS’ captured and unsophisticated board, save JJ Jelincic, has no interest in becoming savvy and vigilant enough to put a stop to the snow job.

___

1 More on why “observed volatility” is bogus. First, our comments from a public board meeting in November 2015:

Unfortunately, observed volatility is fictitious volatility. Public markets prices are based on real trades. Private equity valuations aren’t. For example, there would have been no bid for most private equity portfolio companies or the funds themselves at the height of the crisis, on September 30, 2008. Yet the reports don’t show that.

You can’t… it’s invalid to use data complied by two different methods to calculate standard deviations or correlations…

And if you think that conclusion is unreasonable, your own consultants, Wilshire and PCA, use higher volatility assumptions, as do top players like Goldman, JPMorgan, and Yale. And those volatility assumptions are based on studies that used actual cash flows from private equity, not the GP valuations.

Second, confirmation by other experts as described in a December 2015 post. First, from private equity researcher Peter Morris:

Pretending that private equity fund valuations are as meaningful as stock market prices is just silly to begin with. Going one step further by using so-called “observed” values for private equity is a sign of desperation…

If CalPERS is happy with a leveraged play on the stock market, it should look for cheaper and more convenient ways of getting it. Finance is chock full of clever financial engineers who will be only too happy to help. The other alternative is for private equity managers to reduce their fees and return a more appropriate share of their profits to the investors whose money actually lies behind all this. The current terms of trade in private equity reflect a betrayal of fiduciary duty.

And from academia:

And remember, that CMA 25% assumption [which recall is higher than the 19% “observed volatility” in 2015 and this year’s 16.4% assumption] is lower than the ones provided by CalPERS’ own hired guns, PCA and Wilshire. And it is also lower than the result found in an important paper by Ang, Chen et al., using actual limited partner cash flows, which again shows volatility higher than the CalPERS 25% CMA assumption.

Minor editing flaw: last ‘graph before heading “What Are More Plausible Explanations for This Dubious Change” duplicates earlier text.

Thanks. I launched the post prematurely and I caught it shortly after you commented.

Great post. CalPERS latest attempt to muddy the reporting waters creates a new PE category:

Panglossian Explanation.

Thanks for your continued reporting on PE and CalPERS.

You have exposed a strategy designed to make transparency meaningless. With public and private equity thrown into one pool, CalPERS will soon be issuing reports to their board and the public that hide the truth. CalPERS is not a leader in this tactic. My home state of North Carolina adopted this strategy some time

a go. Excellent post.

Other than that, what could possibly go wrong? Extend-and-Pretend; IBG/YBG (I’ll Be Gone/You’ll Be Gone) seem to be the benchmarks that the political hacks on the CalPERS board are most interested in. The ballooning of PE exposure at CalPERS was driven by “Placement Agents” who were lobbyists kicking-back to elected officials and political parties. California no longer has an effective investigative news media, and none of the money has been followed. Heaven forbid that a climber like former-AG and now-US Senator Kamala Harris would investigate; in fact she refused to oversee CalPERS.

This is one of the best-researched and written reports on the problems at CalPERS yet. Their response is to double-down on obfuscation. Isn’t Costigan the same board member who defended the gaming of bonuses by claiming that staff are underpaid? Why suffer the optics of paying to attract honest, qualified managers, when you can just let the dunces willing to live in the (quite literal) backwater of Sacramento rip-off your members and beneficiaries?

This is an outrage.

It seems that the Chingono & Rasmussen paper didn’t get embedded at the end of the post as intended. Here is a link to it:

Chingono & Rasmussen could be viewed as another contribution to the “smart beta” literature. It’s a crowded field. And disappointingly, few smart beta algorithms work as well post-publication as they did in hindsight.

In any event, Calpers isn’t going to touch this “DIY PE portfolio” because of its horrific 78% drawdown during the 2008 crisis, mentioned in the FT commentary. A lovely feature of PE funds’ quarterly reporting and self

cookedadministered valuations is low, low drawdowns that public pension sponsors just can’t stop raving about.Mirabile dictu, Cambridge Associates’ private equity index declined but 25.2% from 4Q 2007 to Q1 2009, versus a 43.7% smash in the Russell 2000 small-cap index over the same period. Download the Cambridge report and see for yourself on page 5:

Now, it might seem counterintuitive that leveraged private small caps would hold up better in a crisis than their unleveraged public counterparts. But such quibbles are the hobgoblin of little minds.

We are dealing with financial alchemy here. Best not to peer behind the green baize curtain where the PE wizards work their potent magic. ;-)

Sorry, the embed was in the post I quoted, I didn’t re-embed it and should have edited that bit out.