Lambert here: Of use despite the deceptive headline, which promises a review of “health reform in the age of Trump,” while the article discusses only the ACA and Republican efforts to “reform” it, erasing efforts to pass Medicare for All at both the state and Federal level. To be fair, perhaps one should not expect too much from professors of “public policy” (for some definition of “public”).

By Thomas Buchmueller, Waldo O. Hildebrand Professor of Risk Management and Insurance and Professor of Business Economics and Public Policy, University of Michigan and Helen Levy, Research Professor, Institute for Social Research, Gerald R. Ford School of Public Policy, and School of Public Health, University of Michigan. Originally published at VoxEU.

Editor’s note: This column first appeared as a chapter in the Vox eBook, Economics and policy in the Age of Trump, available to download here.

The Affordable Care Act (ACA), enacted in 2010, was intended to address long- standing problems with the American system of health care and health insurance. Chief among these were spiralling costs and a substantial number of individuals – roughly 50 million in 2010 – without any insurance coverage. In addition, the exclusion of employer-paid health insurance premiums from income and payroll taxes raised the spectre of inefficiency along multiple dimensions, potentially reducing job mobility and entrepreneurship while bloating the benefits offered by employers, as well as raising equity concerns about an annual tax expenditure of over $250 billion that disproportionately benefits higher-income households.

In this column, we review the main provisions of the ACA related to insurance coverage and healthcare costs, including what is known so far about their impact. We also discuss the recent Republican attempt to ‘repeal and replace’ the law, which would have reduced and restructured both the ACA’s subsidies for the purchase of private health insurance and the Medicaid programme while eliminating many of the ACA’s taxes, largely benefiting the highest-income taxpayers. Although this proposal failed, it is unlikely to be the Republicans’ last attempt to dismantle the ACA; it thus provides useful insight into the views of the ACA’s opponents. We conclude by discussing ongoing challenges that face the US healthcare system.

ACA Coverage Provisions

The ACA took a three-pronged approach to expanding coverage: mandating increased access to employer-sponsored coverage for young adults, expanding Medicaid to all non-elderly adults with very low income, and reforming the non-group health insurance market for those without access to employer-sponsored or other coverage.

- The ACA young adult coverage provisions, which took effect shortly after the law was enacted in 2010, require employers who offered dependent coverage to make that coverage available to workers’ children up to the age of 26.

- The ACA Medicaid provisions were intended to expand the programme from one primarily benefiting children and parents in low-income families to one that would reach very low-income childless adults as well, beginning in 2014. Constitutional challenges from multiple states, however, led to a June 2012 Supreme Court decision rendering this expansion effectively optional. As of April 2017, 31 states have expanded Medicaid, while 19 have not.

- The ACA nongroup market reforms, which took effect in 2014, are intended to pro- mote competition by establishing regulated competition in a market that had long been hobbled by adverse selection. Insurers can no longer deny coverage or charge consumers higher prices on the basis of health status; premiums charged to older beneficiaries may not be more than three times what younger beneficiaries pay; and policies must cover a specified set of ‘essential benefits’. Low- and middle-income beneficiaries without access to employer coverage are eligible for advanceable, refundable tax credits for purchasing coverage in newly established ‘marketplaces’. The tax credits are pegged to both family income and the cost of coverage in a local market. Finally, consumers without coverage face a tax penalty (the ‘individual mandate’) that provides an additional incentive for healthy consumers to sign up for coverage.

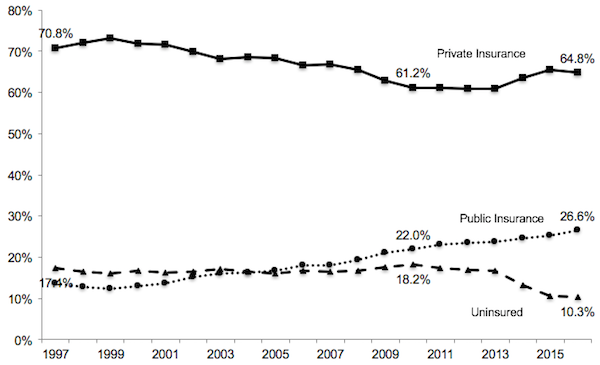

These coverage provisions have sharply reduced the fraction of the US population without coverage (Cantor et al. 2012, Somers et al. 2013, Antwi et al. 2013, Kaestner et al. 2015, Obama 2016, Frean et al. 2017, Zhao et al. 2017). Overall, the share of the non-elderly US population without insurance fell from 18.2% in 2010 to 10.3% in 2016 (Martinez et al. 2017); see Figure 1.

These gains in coverage have reduced disparities in coverage and financial barriers to care (Sommers et al. 2013, Buchmueller et al. 2016, Courtemanche et al. 2017); increased utilisation of services (Busch et al. 2014, Meara et al. 2014, Wherry and Miller 2016, Miller and Wherry 2017); improved household financial security (Hu et al. 2016); and reduced hospital uncompensated care (Nikpay et al. 2015, Dranove et al. 2016, Blavin 2016). Moreover, despite some concern that the ACA would reduce labour supply or undermine the provision of employer-sponsored coverage, there is no evidence to date that this has been the case (Abraham et al. 2016; Gooptu et al. 2016; Kaestner et al. 2015; Leung and Mas 2016; Levy et al. 2016).

Figure 1 Trends in insurance coverage for non-elderly Americans, 1997-2016

Notes: Data are from the National Health Interview Survey as reported by Martinez and Cohen (2011) and Martinez et al. (2017). Figures represent the percentage of individuals with each type of coverage at the time of the survey. Public insurance includes Medicaid, CHIP, state- sponsored or other government-sponsored health plan, Medicare, and military plans. Private insurance includes plans obtained through an employer, purchased directly or purchased through local or community programmes. Because respondents can report multiple sources of coverage, the figures for a given year add up to more than 100%. The data for 2016 pertain to the period January to September. In all other years, the estimates are based on surveys conducted throughout the year

ACA Cost Control Provisions

The ACA was intended to control costs in two senses: first, by reducing (or at least not increasing) the deficit as projected by the nonpartisan Congressional Budget Office (CBO), which was critical to the ACA’s political viability; and second, by introducing a variety of policies aimed at changing economic incentives in the healthcare system with the goal of ‘bending the curve’ of health spending. The ACA succeeded in the first sense, more than paying for the increased spending associated with the ACA’s new programmes through cuts to existing programmes (primarily Medicare payments to providers and insurers) and increases in taxes (primarily on very wealthy individuals) over the initial ten-year window scored by the Congressional Budget Office (CBO 2010).

At this early stage, it is less clear whether the ACA is succeeding in bending the curve of health spending. The ACA introduced a number of programmes to move the Medicare programme away from fee-for-service payments and toward reimbursement systems that better align provider incentives to provide high-value care, such as the shared savings/ accountable care organisation programme and bundled payments for certain services. It is also true that the implementation of the ACA coincided with a period of historically low growth in US health care spending (Council of Economic Advisers 2016); the jury is still out on whether the ACA programmes are, in fact, reducing spending (Doran et al. 2016, McWilliams et al. 2014, 2015, 2016, Nyweide et al. 2015).

One ACA provision that is of particular interest to economists is an excise tax on high- cost employer-sponsored health insurance plans. This ‘Cadillac tax’ was designed not only to raise revenue, but also to give employers an incentive to consider more efficient benefit designs, and can be seen as a somewhat more politically feasible alternative to limiting the exclusion of employer-paid premiums. Nonetheless, the Cadillac tax remains in political limbo, having been postponed until at least 2020.

Repeal and Replace, Part I: The American Health Care Act of 2017

In March 2017, Donald Trump and Congressional Republicans moved quickly to make good on their promise to ‘repeal and replace’ the ACA. House Republicans drafted the American Health Care Act of 2017 (AHCA), which proposed major changes to the design of the ACA’s tax credits and to Medicaid.

Like the ACA, the AHCA included advanceable, refundable tax credits for the purchase of private health insurance. But whereas the ACA’s tax credits are based on income and the cost of coverage, so that most consumers are effectively insulated against large premium increases, the AHCA’s tax credits varied only with age, with older consumers getting slightly larger credits.

At the same time, the AHCA would have relaxed the ACA’s restriction on charging older consumers higher premiums, so the net impact would have been to raise premiums for older consumers, lower-income consumers, and those living in high-cost areas.

The AHCA would have made even larger changes to the Medicaid programme, changing it from an entitlement for which the financing is split between the Federal government and the states to essentially a ‘block grant’ model.

The CBO projected that the AHCA would cause the number of Americans without health insurance to increase by 18 million in the first year the policy was in place. By 2026, after the elimination of the ACA Medicaid expansion and of subsidies for insurance purchased through the ACA marketplaces, that number would increase to 32 million (CBO 2017).

Editor’s note: This column first appeared as a chapter in the Vox eBook, Economics and policy in the Age of Trump, available to download here.

The AHCA can be seen as an attempt to find a middle ground between hard-line conservatives who wanted to repeal the ACA outright and more moderate Republicans who were uncomfortable returning to the pre-ACA status quo. At the time of this writing, the Republican leadership is working to find this middle ground. In March, they chose not to put the bill to a vote when it became clear that it would not pass. In May the bill was modified to make certain parts less objectionable to conservatives, and other parts less objectionable to moderates. Whether this compromise will attract sufficient support in the Senate remains to be seen.

What’s Next?

The Trump administration and Republican leaders in Congress must now decide what chapter they will write in the ongoing book of health reform. They may interpret this assignment narrowly or broadly.

A narrow interpretation would lead them to focus on the question ‘what should we do about the ACA?’ On this question, there are three paths they might take.

The first is to continue trying to craft major reforms to repeal and replace the ACA. The experience with the AHCA suggests that this will be a very challenging task politically.

A second path would be to eschew major legislation in favour of quietly starving the ACA, for example by refusing to actively encourage insurers and individuals to participate in the marketplaces and discouraging additional states from expanding Medicaid. Since Republicans took control of Congress in 2011 they have claimed to be pursuing the first path, introducing numerous bills to repeal or replace the ACA. However, since there was no chance of this legislation being enacted with President Obama in the White House, these bills were political statements rather than serious legislation. As a result, their actual strategy was more along the lines of the second path.

A third path would be to acknowledge that the ACA, from an economic perspective, already represents a moderate, market-based approach to providing coverage to tens of millions of Americans, and to assume a role of stewardship for making these programmes work. This would involve fully funding cost-sharing subsidies for low-income households in the marketplaces (currently under legal attack by House Republicans); enforcing the individual mandate; extending and funding a federal reinsurance programme in order to encourage private insurers to remain in the marketplaces; and working with the 19 states that have not expanded Medicaid to find approaches they can embrace, building on the success of Republican-led states like Michigan and Ohio that have expanded Medicaid coverage through waivers.

There is, however, a broader view that this Administration might take on health reform. This broader view would require them to move beyond the current focus on the ACA to consider the problems the ACA was intended to solve.

The Administration might, for example, try to do more to address the long-run cost problems facing the Medicare and Medicaid programmes. Ideally this would be achieved not simply by pushing costs onto beneficiaries or state governments, but would also include a search for solutions that yield higher value for the government’s dollar. These solutions might involve the private provision of publicly-subsidised coverage – as in the ACA’s health insurance marketplaces, Medicaid managed care, or the Medicare Advantage programme – or they might involve the design of better provider payment models for publicly provided coverage, as in the ACA’s Medicare Shared Savings Program.

The broader view might also include an effort to impose some order on the complex tax treatment of private health insurance. The current patchwork system involves a regressive exclusion for employer-provided coverage, progressive refundable credits for marketplace coverage, and a politically unstable excise tax on high-cost employer plans to be implemented at some future date.

Huh?

“The (Trump) Administration might, for example, try to do more to address the long-run cost problems facing the Medicare and Medicaid programmes… These solutions might involve the private provision of publicly-subsidised coverage – as in the ACA’s health insurance marketplaces, Medicaid managed care, or the Medicare Advantage programme – or they might involve the design of better provider payment models for publicly provided coverage, as in the ACA’s Medicare Shared Savings Program.”

Oh yeah, for-profit-operators siphoning off taxpayer money for “capitated” services always reduces cost–by reducing medical services to patients, And Trumps republican buddies can be counted on to deliver.

What a load.

I 100% agree that the US must move to a single payer system — and I believe that the current unsustainable growth in healthcare costs has put us on a path that will eventually lead towards that. Several projections have been made that employer-provided healthcare will cost employees about 30% of pre-tax income within the next 5-10 years, and people with employer-provided healthcare form the largest group in the US and also include a large fraction of those currently opposed to single payer.

However, healthcare costs in countries with single-payer are also growing faster than the rate of inflation. It is fashionable for single payer advocates to criticize alternative payment models, but if single payer is to finally become reality within the US then winning political arguments and policy making will have to contend with how to humanely ration healthcare and constrain rent-seeking costs. The massive savings from reduced administration due to a single payer system is not enough in and of itself to stop cost growth, and so the question that single payer advocates will have to answer is how can a sustainable system be structured.

Of course they criticize APMs since the evidence to date is these APMs are largely a dismal failure.

The word reform when used by people in Washington is an oxymoron. Labels on legislation usually imply just the opposite of what the bill does. These a Orwellian in that they use a description to make something that is worse sound better.

I liked this article, but I thought it odd that the authors seem to have overlooked any single-payer option. For over half a century, Republicans and the AMA, have groused about “socialized” (inferring communist) medicine not providing quality care, leading to rationing care, death panels, and long waits. The data from other countries’ systems are simply not there – just the odd anecdotal horror story. We do not have horror stories in our current systems of care? Most of my adult life, my healthcare has been provided by the only US sanctioned single-payer healthcare system – DOD’s TRICARE. On active duty, I rarely saw the same doctor as my last visit, my surgeons were all strangers to me, and yet, at 70, I am still here and healthy for my age. Alas, TRICARE costs too are increasing for DOD, but for now, not for me.

Nearly all prosperous countries (all of the EU) have single-payer healthcare. It costs them less to provide, and research shows its beneficiaries are healthier than the average American. We have a house in E. Europe where we escape the summer heat of Florida. I do not observe waits to see the local doctor to be any longer than in the states (30-90 minutes). The doctors all seem to be well-trained. Any co-pays are pocket change.

US politicians, Republicans especially, slam single-payer/socialized medicine/national healthcare models as depriving citizens from their “right to choose their doctor.” This is a disingenuous if not fatuous criticism. First, probably 40% of Americans receive care from systems in which choice is constrained (Medicaid, the military, the VA, emergency departments, and many HMOs). Second, very few people regardless of wealth are competent to judge the expertise of their primary care physician, much less the specialist to whom their primary doc refers them. No national healthcare system denies a patient the right to refuse care for any reason.

Related to one’s “right to choose” is reticence on the part of many in the top 30% of the economy to give up their “Cadillac” healthcare. This is an invented concern. The wealthy in any country with a national healthcare system are free to pay more for “private” providers, and many have health insurance that closes the gap between what their providers charge, and what the national system will pay. Thus, even with a national healthcare, single-payer system, the health insurance business would survive, albeit smaller in scale. Let’s not lose sight of the fact that 60 years ago, health insurance of any kind was rare.

Admittedly, the single-payer national healthcare option sustains a two-tier (unfair) system. So what? What we have now is at least a 4-tier system full of price-gouging hybrids that are unfair to everybody. In any national healthcare system, the rich will always be able to pay for better access to care – ask Putin or May. However, politically, if people understood that tax-payer-supported, single-payer national healthcare does not bar them from buying alternative care (even if they cannot afford it), I would think that this would make single-payer a more popular option on the Hill. It’s at least less communistical.

As one who worked at a school of public health in the 2000s, I offer the following comments. First and foremost, at most schools of public health faculty salaries are supported anywhere from 50% to 80% by grants, not by the university itself. This produces a bias public health academics are either unaware of or loathe to admit to: they “study” health policy from the point of view of their funders. Accordingly, we get this as the opening sentence of this essay: “The Affordable Care Act (ACA), enacted in 2010, was intended to address long- standing problems with the American system of health care and health insurance.” As most NC readers know all to well, this is simply not what the ACA was designed to do. In 2014 I wrote an article titled, “PUBLIC HEALTH’S RESPONSE TO DECLINE: LOYALTY TO THE 1%.” I see nothing in this above article to disconfirm my contention that, “… public health organizational leadership and academic researchers either blithely ignore or erroneously frame … indicators of cultural decline and corruption as the unfortunate fallout from “The Great Recession.” I suggest these leaders are trapped in a tightening contradiction between the field’s mission, protecting the health of the entire public, and acquiescence to social policies that serve the (private) interests of the 1%.”

Addendum: At most -if not all- schools of public health new faculty, including newly minted PHDs beginning their careers, will not be considered for hire unless they are bringing grants with them to the school. In essence, this means they must already have financial support from grants if they hope to be hired. This practice began in the late 2000s.

DanB, could you provide a link to your article? I would like to read it and be able to share it.

I do not put links into comments here because they sometimes get caught up or disappear in moderation. So, if you wold not mind, please google the title, ““PUBLIC HEALTH’S RESPONSE TO DECLINE: LOYALTY TO THE 1%” and to should come up. It’s at the Resilience website. Thanks.

here is link to DanB’s “PUBLIC HEALTH…”

http://www.resilience.org/stories/2014-12-16/public-health-s-response-to-decline-loyalty-to-the-1/

I stopped reading the article after the sentence “The Affordable Care Act (ACA), enacted in 2010, was intended to address long- standing problems with the American system of health care and health insurance.” . What BS! The ACA was intended to fool people into thinking that it was in the public interest. The shysters who ramroded the legislation were all in on the payroll of the Insurance, Hospital and Medical leaches. Obama the shyster in chief went to great lengths to exclude any group in favor of single payer. The Democratic shill group who championed single payer did a 180 right on cue and the rest is history. That they allowed two years for it to come into force (right after the 2012 elections) was a tell tale sign of how flawed the bill was. After shoveling millions to large software companies, they came up with a Kludge. Knowing fully well that the Repricks would cut the feet under the ACA by cutting medicaid, they still built it on feeble medicaid price supports. None of the provisions helped the poor who would need healthcare. With total outlays in payments to insurance cos. and deductible/copay approaching $14,000 per year, how could the poor even benefit. Now Lord O’s cashing in on every speech and the Obots still apologize for him. “It’s the Republicans; he wasn’t allowed to enact single payer”. Real Sick!

I suspect that’s also true of the salaries of many economics faculty members — maybe political science as well. A couple of weeks ago, I quoted from page 448 of Dark Money by Jane Mayer:

That does seem to be the state of our intellectual world. This is an intriguing find Lambert. Parts of the article are really well reasoned and explained, while other parts are obvious (sub)missives to the power structure that shall not be challenged.

I almost laughed out loud when I read that. The American electorate voted for sweeping change in 2006 and 2008. PPACA wasn’t a problem solving effort. It was intended to prevent the public’s desire for change from translating into policy action in the healthcare sector.

The authors seem ignorant even of the PR framing around the politics of health insurance reform in 2009. The messaging was not targeted at the health care system. The Dem leadership specifically presented it as health insurance reform and went after anybody proposing more substantive reforms to the actual system of health care. It was remarkable, for example, when Daily Kos turned on then Representative Dennis Kucinich because he meekly tried to hold out for actual health care reform against the Dem juggernaught of faux insurance reform or when the vaunted OFA bus tour for health insurance reform explicitly omitted single payer and national healthcare from being listed as potential options on their survey handed out to people attending rallies or when President Obama went on national TV and said that abortion isn’t a healthcare issue.

Exactly right. The central feature of the ACA is the mandate–a Hillary proposal that Obama the candidate said he opposed but then embraced as president. The ACA was designed to compel more people to participate in a broken system with Medicaid expansion as a sweetener. As a “market based” solution that forces people to participate in the market (on pain of penalties) it is utterly incoherent and is just a way of taxing people without calling it taxes. We are taxed to support a bloated and equally incoherent MIC and the medical industrial complex has been added to the mix. So much for democracy.

The article well summarizes the abject corruption of US politics by an utterly selfish and hypocritical oligarchy. Those who cannot see the need for reasonably efficient universal health care are not citizens but traitors. They should be starved to death in cages in public squares.

+1,000,000

+1e09

Research funding bias: as Dan points out, these guys are ‘talking their book’.

Reminds me of our local public television 1/2 hour Sunday evening garden show, paneled by profs at the local State University (Ag/Engnrg) school. Discussions seems to almost always devolve to chemical solutions. Few ‘natural, holistic, organic, chemical-free’ solutions to the call-in questions.

Good luck getting policy wonks in an ivory tower who are funded by an obscenely rich health insurance industry to talk tax-funded single-payor.

One thing I notice that is NEVER mentioned anywhere is the waiver of participation, ‘riding naked’ option f insurance premiums exceed 8% of gross income. It seems to me that almost every American could argue this one, and the ACA and insurance deal would fail immediately.

Go ahead and look at the lowest-cost unsubsidized Bronze plan available for your zip code for your age.

Show of hands for how many of us have taken this option, out of necessity, and a grim resignation that if catastrophe hits, we’ll wish it didn’t and roll with it- like the vast majority of the third world. Exceptional Americans. I can’t be the only stooge in that class, can I?

The care/ insurance debate is not happening around America: any time I bring it up across the fence, at the dining table, on the street, in my work-related travel, people in my circles just don’t want to be bothered by the nitty-gritty. Might be they are revulsed by my rabid opposition to health insurance.

From my perspective, we need to eliminate the word insurance from the discussion.

You simply cannot insure the health of a mortal fallible critter. It is irrational.

So, lets talk about care, cost of care, and cost shifting. Or, more accurately, Utility functions. When, as a society, might we agree that all of our citizens have a right to health CARE?

With the privatization, greed is good direction since the early 80’s, how will we get folks to agree again on the notion that there are acceptable public goods/ utilities?

To me, health care, and access to care for all is a perfect modern societal utility. Regulate and proscribe costs, profits, eliminate the parasitic ‘insurance’ sector. Mandate that the system accessed by the collective ‘we’ is the same one available to our congress and upper-level government bureaucracy/ policy makers.

And, ‘because markets’, mandate that the first $2,500 to $3,000 per individual per year is paid out of pocket, NOT by employers, NOT by the government– no tax benefit/ deduction. Pure hard dollars- no obfuscation. Feel The Pain of paying for that check-up, the eye exam, the cleaning of teeth and dental exam. Mandate everyone have that annual maintenance. Fund the relative few who can’t afford it.

Force us to shop providers, incentivize behaviors that monitor and moderate our lifestyle choices and the impact of those choices.

In addition to ALL paying first dollars out of pocket, We ALL also kick in a monthly fee to a single collective cost-shifting catastrophe pool.

The pool is held and managed by US, NOT United Health Care, Blue/Blue, Cigna.

Pareto’s rule of 80/20 kicks in. 80% of us somehow can around $2-3K per year for direct care- preventive, maintenance type care.

We presently subsidize those who can’t afford it; tweak that to make it as efficient and fair as it can be, and keep it going.

If everyone knew they were backstopped, you might see more folks freed of ‘dumb jobs’ that are taken solely out of the fear of the health cost-induced bankruptcy financial ruin. There may be more job creation. Certainly more self-actualization. A robust competition by providers of care would emerge- quite the contrary to the recent consolidation that has occurred under the ACA (competition died) .

As for utilities, we accept fire and police, and that is about the present limit. “Because Markets”, we now see privatization of central services like sewer, water. It may be a an uphill battle to convince folks of the legitimacy of CARE as a basic American human right, that all of us, regardless of age, race, creed, color, are indeed brothers and sisters and give a rats bum for each other. Bernie got it right- we do not seem to be a compassionate Nation. Maybe we can start? We have some leaders that are making a strong case for a new direction.

I first ran into Buchmueller in an October 2012 article in the National Review Online (1). Buchmueller had served as Obama’s point man on ObamaCare on the Council of Economic Advisors during the early stages of the implementation of ObamaCare, and offered the amazingly cynical (on Obama’s part) viewpoint that Obama had deliberately left out of ObamaCare any real elements of cost control, figuring instead that real cost control would only become possible when prices became so outrageously high that the people were screaming for such controls.

The article also links over to a very worthwhile interview with Buchmueller in a UM alumni publication (2, PDF)

(1) http://www.nationalreview.com/agenda/331777/interview-tom-buchmueller-reihan-salam

(2) http://www.bus.umich.edu/NewsRoom/BusinessSchoolPubs/DividendAlumniMagazine/Fall_2012/Dividend_FALL12.pdf

Of course this “costs must get higher before they can get lower” idea could also just be a convenient excuse for Obama’s unwillingness to face the medical community head on and tell them they have to eat less so that others might eat at all.

I quit reading after the first sentence …

The intention of the unaffordable deathbed act (ACA), forced upon a desperate and trusting public in 2010, was, and continues to be, GRIFT !! …

… Of course, these … uh .. ‘professors’ got their’s, to be sure …

Just more pablum spewn from on high to us ignorant sheep penned in the dirt !

“These solutions might involve the private provision of publicly-subsidised coverage – as in the ACA’s health insurance marketplaces, Medicaid managed care, or the Medicare Advantage programme – or they might involve the design of better provider payment models for publicly provided coverage, as in the ACA’s Medicare Shared Savings Program.”

Truly:WTF?

Do these idiots not read the existing health care science? All of these so called solutions have already been shown to be failures…

If I recall correctly in the past countries cut cost by roughly half when instituting national health care. That’s the cost curve I’m looking for! Controlling cost curve from there on has been tricky but better under these systems.

Story told to me just this morning. Young man (mid twenties) with probable hernia. No job because he’s in too much pain. He most likely got the hernia last year working for a zip-line company – catching giant fat Americans at the end of a 50 mph rope zip all day every day can do that. Anyway his mother finally said enough is enough were going to the local walk in clinic. Walk in clinic is booked until mid September. So is the other one in town, a town of two thousand people with a small hospital, several expensive clinics for insured people only and two cash walk-ins… booked for months! They finally find one accepting people an hour away in a larger town.. owned and operated by a nurse practitioner. She never touches the young man… simply looks up symptoms he tells her on her computer as anyone might do at home and says you could have cancer… go to the emergency room.

So he’s back at home waiting in pain and uncertainty to find out if medicare will approve him. If and when they say yes, it will take at least another month before it kicks in. Dog knows how long after that someone might see him, actually perform health care.

@Toolate:

What you said.

What I said!

Seriously, these guys should be banned from writing, saying or thinking anything remotely related to health policy.

I met a University of Chicago credentialed jerk like that at a health insurance symposium back in 2011 or so. Before the presentation, I told him that Obamacare does nothing, nothing, to contain medical costs. I told him it will be too expensive for people to use their health insurance, particularly chronic care patients.

He proceeded to get up and deliver a speech, with delusional PowerPoint graphs, babbling about bending the cost curve etc. Some more babble about markets. Despite being completely and utterly wrong about everything, I’m sure he retains his tenured seat and grants, etc.

I’m thinking cages in the public square.

The device you see iis called the “Stocks.”

It’s operation is historically fueled by rotten fruit.

Personally I favor medium sized potatoes as fuel. Followed by the occasional sugar beet.

The ACA was designed to paper over structural flaws in the Health Care “System,” and enhance the image of Barack Obama and the Democratic fellow travelers swimming in his wake. By luck, in 2014, I benefited from it substantially.

I also benefited from the ACA in 2014 – here in California. We had no medical insurance before ACA for the previous several years. I was able to get an ear operation with ACA. Blue Shield became our subsidized provider – they were awful – terrible service – lied regularly.. but at least the operation was performed.

We were then shifted over, based on income, into the ACA Medicaid expansion – called Medi-Cal – in 2015. This is managed locally by a non profit called Central California Alliance for Health – and this has been the best medical coverage I have had in my life (I’m 62) – prompt responses, courteous – and no bullshit. Feel blessed… Sad to see it go… as it looks likely.