Yves here. Waiting for Seriously Bad Stuff to start happening in China has long had a Waiting for Godot quality to it. But no large-ish export and investment led economy has made a crisis-free transition from that model to being consumption led. And China’s continued use of debt to keep its current model going says it hasn’t figured out a was to facilitate an economic restructuring of the needed magnitude. On top of that, the growth-dampening impact of its one-child policy is going to start to bite soon.

By Leith van Onselen. Originally published at MacroBusiness

Fairfax’s Matt Wade is the latest to warn on China’s debt time bomb:

Many thousands of Australian jobs depend on the health of the Chinese economy…

For some years now China’s economic growth has been underpinned by an explosion in corporate lending. China has accounted for half – yes half – of all new credit created globally since 2005 according to the New York Federal Reserve. That’s a huge share for an economy that now only accounts for about 15 per cent of the global economy.

Alarm bells rang last August when the International Monetary Fund pointed out the trajectory of credit growth in China was eerily similar to countries that experienced painful post-debt boom adjustments in the recent past. This includes Japan in the 1980s, Thailand prior to Asian Financial Crisis and Spain prior to the European debt crisis.

The sheer pace of lending growth makes it likely many loans are going to marginal borrowers or unviable projects. A recent Oxford University study that evaluated 65 major road and rail projects in China concluded just 28 per cent could be considered “genuinely economically productive”.

The rapid expansion of China’s less regulated “shadow banking” sector adds to the complexity. The Reserve Bank has described China’s financial system as “increasingly large, leveraged, interconnected, and opaque”…

The best outcome is for what economists call a soft landing. Under this scenario Chinese authorities would accelerate reforms, somehow scale back credit growth and clean up bad debts while economic growth keeps humming along at a healthy rate…

But as economist George Magnus, an associate at Oxford University’s China Centre, says “you can’t resolve a debt problem peacefully”.

…slower Chinese growth… would hit Australia in two ways, first by reducing the price of the commodities we export but also by reducing Chinese demand for Australian goods and services.

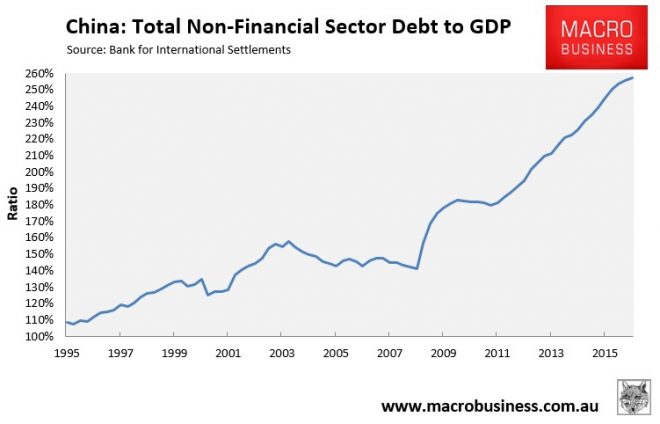

To put China’s debt build-up into perspective, here’s a summary chart using data from the Bank for International Settlements:

Note the explosion in Chinese non-financial sector debt over the past decade.

As noted earlier by Houses & Holes, China will hold a long-delayed key financial work conference later this month, which will focus on financial security in the run-up to an expected changing of the top Communist Party guard later this year. The big issues up for debate are expected to include an overhaul of the financial regulatory regime, financial security and opening up of the financial markets.

If Xi Jinping’s poliburo takes another crack at reform then Chinese growth could really slow and the bad loans could turn unruly.

The Chinese debt time bomb continues to tick.

There are going to have to be massive write-downs I think in response to this.

The difficult to answer question is what the spillover effects will be. The rest of the world will be affected. The unknown is just how severe it will be.

I keep thinking that China could actually enable a debt jubilee. Most of the debtors are state actors, so why not just wipe the slate clean and start all over again? Obviously there still remain problems in that the state party cannot possibly measure all the inputs needed to manage such a large economy effectively. Ian Walsh discussed this in a recent essay on the fall of the Soviet Union, and the likely fall of the capitalist west in the next few decades. China must grapple with how to productively invest money and tamping down on rampant corruption and looting. No easy task while trying to retain legitimacy and centralized control over such a massive country.

If public sector loans benefited only corrupt officials, that jubilee might set off a revolution.

People don’t take kindly when a mayor borrowed money to buy land from his relatives, for example, and gave himself generous benefits.

To say it plainly, China cannot keep growing at the same pace without increasing its debt burden. The longer it keeps current growth rates, the more painful adjustment

According to the OECD: “Economic growth is projected to hold up in 2017 and 2018, partly thanks to the impact of earlier fiscal and monetary stimulus.”

Like many, I’ve been anticipating Bad Stuff in China in the nearly 20 years since I first visited. Even in the 1990’s it looked like an economy built on debt (lots of clearly stupid investment), and it still hasn’t happened. But slowly but surely it does seem like the debt bomb is building up to a stage where it has at most a couple of years left in it.

I do wonder though if the general assumption that demographics will be a problem is really true. The one child generation is now coming to adulthood, but it might actually be a positive thing, as a shortage of workers could drive up wages and so aid the transition to a more balanced consumer based economy. It does seem that the loosening of the one child policy won’t lead to a big rise in birth rate, so that doesn’t necessarily mean a big rise in the dependency ratio. Lots more retired people of course, but in China many retired keep working, just at a lower rate, so its not necessarily going to be a big drag on the economy. And China has an even worse health system than the US (that takes some doing), so to be cynical about it, the retired don’t hang around too long.

I suspect though that a debt crisis won’t actually be a ‘crisis’. China has enough tools to drag out the problem so its more likely to lead to long stagnation Japanese style rather than an all out panic and crash. But certainly Australia and other commodity exporters will be big losers. China will cut out imports of coal and steel as a first priority if the economy slows down, keeping people in jobs will be their main focus (not because they love their workers of course, but because they fear them).

The chinese goverment may have the tools to control a crisis, nevertheless humans are very capable of corrupting the system. Vested interests may interfer with those tools and I believe this has been ocurring so far. The result is that it is, and will be, increasingly difficult to control the debt bomb. For instance, the shadow banking system is a financial outgrowth that can prove difficult to control.

I don’t rule out a crash.

Yes, the opaqueness of the Chinese system means there could be all sorts of nasty surprises lurking that never appear in official (or even unoffical) figures. Based purely on anecdote, I think the big ‘informal’ banking sector (as opposed to the ‘shadow’ banking sector) hides a lot of Ponzi schemes which could unravel in an uncontrollable manner if the economy went into serious reverse. As one Chinese friend put it to me ‘everyone in my town owes money to everyone else’.

My first wife was Chinese and my in-laws all lived in China – at one point her parents were the victim of some kind of investment fraud and lost most of their life savings. My ex told me that kind of stuff is very common in China, and the scams were on all levels of society.

“It does seem that the loosening of the one child policy won’t lead to a big rise in birth rate”

I go the same impression while there recently. A number of young adults talked about putting off marriage and wondered why anyone would want more than one kid. “I would rather be crying in the back of a BMW than happy on the back of a motorcycle.” (Kids are expensive.)

What did you see as the stupid investment when you where there in 1990’s? How did that work out for them?

I walked though about a mile of a just built ghost city (town) along the Yangtze River. Nobody lived there. At one point I was completely alone a the street with just a chicken wandering by. I heard a dog barking in the distance. The street was lined with empty shops on the first floor and apartments above them. From the outside the construction looked nice.

I was driven past other places that looked empty and where much larger, huge sections of tall apartment blocks but never saw them from close by.

“not because they love their workers of course, but because they fear them”

who needs them to love us?

Why are Chinese workers feared there, and not other countries leading to ‘keeping people in jobs’ not being the main focus?

The stinger in the one-child policy is the selection, one way or another, for males. I know of an organization here in Toronto that provides lessons in Chinese language and culture for Chinese children, mostly (all?) girls who have been adopted by Cdns. I have read that many young Chinese men find matrimonial prospects severely limited by lack of young ladies.

So, how will the play out in the future? Adopted girls repatriated? Importation of those Russian and Philippine mail-order brides I keep getting ads for? Chinese bachelor farmers, ironworkers, factory workers, bureaucrats? Gentlemen couples cloning? Watch for it!

I expect a big cancer die off

Ciggs, 2.5PM and heavymetal/chrmical contamination

I think our western media problem with China is we don’t control the actions of the central bank so we are constantly doubtful about what they might do. This article focuses on China but it might just as well have focused on many others.

What we have always done with unpayable debt is transfer it to some account in the central bank which links to nothing and forget it. Problem solved.

I don’t much about China but can’t they do what every company under the sun does when they have bad financial news: wait for an external event and blame the problems on it. If a company has a bad quarter they make it really bad.

I’d guess that China will wait until the United States goes boom due to the log in its eye and then crash all of the Chinese bad debt blaming the US and the west, like a massive game of chicken.

Maybe I am overly optimistic but it seems to me like the growing alternative to the post WWII financial regime will potentially introduce a new model OUTSIDE of what we have now. The whole China “Debt bomb” mantra that is defined using the current paradigm might be bypassed or rendered inconsequential in a new paradigm developed by China and its growing group of financial allies (think Russia, BRICS, Iran etc).

Taking a longer view, the west can not accurately assess the inner working of this new strategy due to lack of inside information.

Here’s a contrary view that may be worth a look.

Rather than quote the entire article here’s the link.

https://www.unz.com/article/chinas-financial-debt-everything-you-know-is-wrong/

thanks for this link, Carolinian. I can’t really understand the figure about “non-financial” debt in China without the information you linked. The comments on that article were mixed – one that China is less indebted than other countries and another that even so, China has tons of euro-debt. What never gets discussed is probably the most important point of all and that is what happens in the long run. When China has done all its high speed trains and livable forests (my fave) – what happens economically when China settles down and provides social security and good medical and etc. The position we find ourselves in today. But since China has a tradition of public purpose spending/sharing I think they will make that transition more gracefully than we are doing with our most disgraceful congress.

That article makes the classic error in seeing modern Chinese capitalism as somehow having unique characteristics. As those few economists with a wider historical overview (Michael Pettis as an example) have pointed out, the Chinese strategy is straight out of the playbook used most notably by the Japanese, but can be traced right back to 19th Century Germany.

Details change according to country of course, but there is no reason whatever to think that China has somehow created a model that defies normal economic rules. The blurring between public and private ownership of banks and big companies that you see in China is little different from late 20th Century Japan or South Korea, just with a balance shifted more towards public ownership. This may give the government more leverage when it comes to resolving a debt crisis if and when it arises, but it won’t prevent a crisis if the underlying economic logic leads to one. The only ‘new’ thing about the Chinese growth miracle is the sheer size and scale of China itself.

I’m not sure you can examine “debt” without thinking about the debt-based money at its heart, we all get to pretend for the moment that debt is sustainable (i.e. serviceable from cash flows by the debtor) because rates are hyper-low and because we have a brand-new central banking paradigm at work. CBs used to be concerned with liquidity, not solvency, during crises they stepped in with “abundant liquidity to quality debtors at high rates”, i.e. if the bank was basically solvent (able to service debt) but temporarily illiquid. Nowadays we have CBs that step in as market participants to shore up solvency for all kinds of debtors. They’ve taken it to far extremes: in 2009 the Fed provided $174B in credit to Citi on the day they could have bought 100% of the Class A Citi common stock for $4B. They gifted Harley-Davidson and GE and unknown others billions in credit. The problem of course is that they do not have to tools or the expertise to make risk underwriting decisions: they just buy up all bad debt from all issuers (unless you’re Dick Fuld of course). Bernanke should have had “The Courage Not To Act”, to let bad debt clear, a few years of pain and then back to the races.

Where it all shows up of course is runaway asset inflation, and price inflation masked by new ways inflation gets measured. Ask anybody on the street if they would want to pay prices from 3 years ago for *everything* and they would jump at the chance. So the central and only real mission of the CB, the defense of the value of the product they oversee, has failed spectacularly.

Is it that a lot of the lending is between the state and state own enterprises that is supposed to make it different?

If I understand corporate politics, when each subsidiary is responsible for profits and more importantly bonuses, there is no forgiving of any debt.

Looking at how a new chairman is chosen every few years, there are many power centers in China. And you wonder if their Army would forgive easily the money their Navy owes it, even if the Politburo orders it.

China Can MMT their way out of debt.

https://www.adb.org/publications/monetary-and-fiscal-operations-peoples-republic-china-alternative-view-options-available

And the demographic cliff…. How many poor overpopulated neighbors do they have? How many ghost towns?

I know it will earn me a yellow card here at NC, but I’m going to comment without reading the article, because I am officially done reading anything MacroBusiness has to say about China. Whenever I have expended any time and energy on their China articles, any salient points MB have to make are inevitably so tainted by their anti-China, anti-Putin, pro-Yankee Red Scare bias that it reduces MB’s sole value to the level of Fox or MSNBC.*

Sorry to be a naysayer, but (as PlutoniumKun has noted elsewhere) time is much better spent on articles by Michael Pettis or others who are more level-headed in their analyses.

*n.b.: this is not to say that understanding how rank partisans like MB/Fox/MSNBC think is not worthwhile, but wouldn’t, for example, a Pettis post engender a much deeper debate?

I do think that microbusiness is quite good on current trends (at least so far as I can tell, I’m not exactly an expert on Australian business). Some of the comments on China are close to the borderlines of racism, although I suppose you can put that down to Aussie bluntness. But I’d certainly much prefer writers like Pettis, who take a much broader (historical and economic) perspective of China and Asia as a whole. I do suspect though that many writers such as Pettis have to engage in a little self-censorship if their work is in China, the government there is not beyond retaliation against academics who rock the boat, even foreign ones. I like that NC widens its net so we don’t get too caught up in confirmation bias here btl.

I enjoyed the range of comments, quite insightful. Leaves me feeling as though I am just a “student” observer of a complex culture many thousands of miles away, with all the caution that ought to imply.

High stakes and few certain handles on what is actually going on.

Is all that Chinese investment in Western Real Estate just good prudent investing, or something more desperate, a strong clue, an answer to the questions posed here? Like Joe Kennedy’s moves before the crash of 1929.

My gut feeling is that almost all small scale Chinese property investment in the west is motivated by risk hedging (i.e. having a foreign bolthole) and money laundering of one form or another. I’ve come across quite a few Chinese buyers of western property and almost none have any interest in running them as conventional investments (i.e. renting them out to maximise revenue). They are kept empty or rented out cheap to relatives or friends.

Yes, quite. Now for some questions:

How much debt is denominated in China’s currency?

How much is public sector debt in Chinese currency? (Per MMT this is not debt, it’s money)

How much is private sector debt in Chinese Currency?

How much is US dollars?

How much is public sector debt in US $?

How much is private sector debt in US $?

It appears the article is being provocative (aka: The Sky Is Falling, buy Umbrellas), and possibly presenting invalid assertions, given China’s large US $ reserves, the ability forgive private debt in Chinese currency, and, if the MMT explanation of pubic debt be true, the amount of “debt” may be grossly overstated.

Numbers please, and less arm waving.

MMT seems to be constitution-dependent.

For example, if the Chinese constitution is that the government can create new fiat money, but it belongs to the people (of the People’s Republic) to be spent into existence, then, the Chinese government can in fact go bankrupt, and has to be run like a household.

On the other hand, if the Chinese constitution is that the government’s newly created money belongs to the Communist party to be spent into existence, then, the party can not go bankrupt, and it can only go out of business in a revolution, in which case, the people is left to survive on worthless paper money (at the mercy or kindness of stranger, the new ruler).

Typically, a regime can be overthrown, after spending lavishly (and in the name of helping the people no less), but foreign loans must be repaid by the people…The people, always, get the short end of the stick.

The people get to pay for the sins of the previous government and government officials who can always flee to another paradise, and never the joy of the hard work (burden) of spending money into existence. The people know not that Arbeit Macht Frei.

The People Abide and Endure.

Almost all Chinese debts are internal and dominated in yuan. But China has at least $20 trillion domestic deposits (at least 130 trillion yuan). There is little debt in U.S. dollar. On the contrary, China has $3 trillion FX reserve, of which $1 trillion are U.S. Treasuries. A lot of countries are probably in a much worse shape than China and will implode before China ever does. If you do not see those countries blow up first, then China should be fine. And finally, with 6% growth rate, China probably can grow out of what ever debt trap they are facing.

“Waiting for Seriously Bad Stuff to start happening in China has long had a Waiting for Godot quality to it. ”

You win the Internet today :)

Same thing with Japan.

China is a ‘command Economy’ with creative accounting at it’s disposal all the time! Combined with the opaqueness of their markets. things can go on, more than any one’s speculation! Does any one even believe any sort of data coming out there? But investors are not perturbed b/c of the PUT by POBC!

Extend & Pretend and kick the can for another decade or two, will go on! This is also true of most of global Banking system elsewhere! The perception is the reality since ’09! ALL CBers are good at managing that perception!

WRONG!

China’s total debt to GDP is about 375%, same as the U.S. according to a recent presentation by Lacy Hunt. China on the other hand is not engaged in endless war, the most economically wasteful activity possible. Furthermore China now has first class modern infrastructure unlike the U.S. which has the infrastructure of a third world banana republic. China is growing at 3 to 4 times the rate of the U.S. and will continue to do so for the foreseeable future so its debt load is far more manageable given that growth. China generates excess foreign reserve every month so it faces no threat from foreign creditors. China is a tightly controlled economy and any problems can be stage-managed by the authorities in ways that are not possible in the West. As the article in the following link explains everything you think you know about China is wrong. There is a propaganda war at play here. Look at China so as not to look at the problems here.

https://www.unz.com/article/chinas-financial-debt-everything-you-know-is-wrong/

Huh?

First, China has riots on a regular basis, against its heavy pollution, whenever growth slows down too much, whenever pollution rises too high.

Second, China has become very aggressive regarding the South China Sea and is spending heavily on its navy.

Third, total debt to GDP is not a relevant metric, since it includes government debt plus emerging economies (and China is still emerging, it has tons of underdeveloped rural areas) are widely viewed as unable to carry the same level of debt as advanced economies. Steve Keen, one of the very few economists to predict the 2008 crisis, puts China at the top of the “zombie to be” economies list. The core of his analysis:

http://www.nakedcapitalism.com/2016/06/steve-keen-zombie-to-be-economies-and-the-walking-dead-of-debt-include-china-south-korea-canada-finland.html

Fourth, you don’t have to be investing in war to be making wasteful investments. Ghost cities will do. The warehouse properties are too expensive to be purchase or rentals for the peasants who get jobs at places like Foxconn. Even if they eventually rise and have enough income in 20-30 years, the apartments won’t be fresh and will require all sort of additional investment to suit then current tastes…assuming they are in the places people want to live then and can be retrofitted. Similarly, it’s been documented that a fair chunk of China’s advanced industrial investment isn’t economically productive, as in it won’t make a profit on the investment cost (as in they overly invested to serve narrow markets, and/or the market share they have depends on dumping and if they try bringing prices to profitable levels, buyers will shift purchases to other vendors because the Chinese have quality problems).

Fifth, did you manage to miss that China was depleting its FX reserves in 2015 and 2016, to the degree that the IMF issued a warning?

On fourth, beyond the malinvestment in unfinished buildings, I anticipate a high failure rate of concrete structures that will not survive their planned investment life due yo rip and run construction. When construction corners can be cut, they are cut in spades in China

1. Most riots on the Chinese streets are directed at specific grievances such as back pay, location of garbage incinerators etc. As China’s legal institutions mature, street riots will decrease. Most Chinese saw their incomes increased 10-20 times since 1980. Currently China has a home ownership of 80%. So most of Chinese are stake holders for a stable society. Few of them are stupid enough to see their income, home and their life-time savings destroyed in a color revolution.

2. There are so many U.S. military bases surrounding China, what China did so far in the SCS is not much in comparison. In fact, Vietnam has occupied more islets in the SCS than China does.

3. With China’s growth rate, they can take a little more debt burden.

4. Ghost cities in China are filled in 2-5 years with few exceptions. China’s current urbanization rate is slightly greater than 50%. To increase that to 75%, China needs to build urban housing for another 330 million people.

5. I guess the warning is no longer in effect?

China and Japan are leading the way in declining birth rates. This is nothing but good news for the planet.

Now if the US and India would get on board, a billion less people just might save the planet.

Yeah, but you know Harvard Business School will put up a fuss if the birth rate drops any further. Like clockwork.

A cursory study of the history of Chinese currencies reveals a very broad variety of currencies have been used in China over thousands of years, from tea bricks with the emperor’s stamp on them, to variously shaped metal coins, paper, and now electrons. There is a reason the Chinese people value gold and real estate as storehouses of value, but I would not underestimate the capacity of the government of China and its central bank, to manage that nation’s money.

The government of China can create as much sovereign currency as it chooses to create, but to date it has been quite restrained in terms of the total amount of direct sovereign national debt money it has issued. However, I suspect much of the “private sector” debt outstanding is in fact debt owed by state-owned enterprises, which the government of China can choose to either honor or default on and thereby destroy the debt-backed money should inflation become an issue. In that sense, recognition of the debt impairment would be conceptually similar to taxation.

IOW, despite the massive level of malinvestment in terms of generating positive ROI, I believe the status quo can be perpetuated for some time and do not view an economic crash in China as either imminent or inevitable. But what I do find interesting at this juncture is the effort of China’s government to supplant the petrodollar with the petroyuan.

I found this link informative on the pressure the government of China is exerting on the Saudis to abandon the petrodollar as China’s demand for imported crude oil recently surpassed that of the US. I suspect this has also not escaped the attention of US policy makers.

http://cj.sina.com.cn/article/detail/6246113450/273311 (In Chinese, so I used Google Translate.)