Yves here. A consumption tax is one of those ideas that keeps being bandied about as a sort of magic bullet. Fortunately, it never seems to get beyond the occasional 50,000 foot article touting its supposed virtues and into tax bills. This article explains why the hidden premise is bogus. And that’s before you get to the fact that a consumption tax, which is basically a broader implementation of sales taxes, would be regressive.

By Steve Roth, a Seattle-based serial entrepreneur, a student of economics and evolution, and publisher of Evonomics. He blogs at Asymptosis, Angry Bear, and Seeking Alpha. Twitter: @asymptosis. Originally published at Evonomics

You often hear calls out there — mostly from Right economists but also from some on the Left — for a consumption tax in the U.S. As presented, it’s a super-simple idea: tally your income, subtract your saving, and what’s left is your consumption. You pay taxes on that.

We want to encourage thrifty saving and discourage profligate consumption, so what’s not to like?

Lots. Before getting into the idea’s economic virtues and vices, consider the accounting. Whaddaya mean by “saving”? Economists are deeply confused about that word, so it’s worth sorting through a bit.

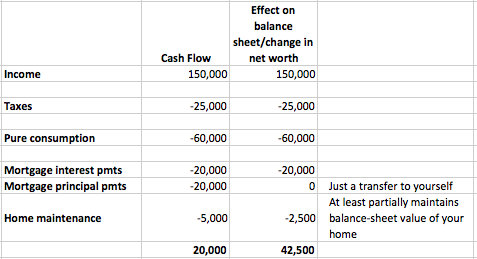

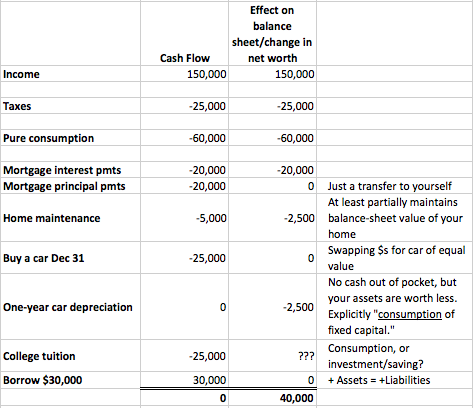

Start with a simple pared-down household. The only accounting complication is that they own a house:

How much did this household “save”? Should the interest payments count as consumption? The principal payments almost certainly should not (and could be treated that way under the rules of a consumption tax without a whole lot of work for homeowners and lenders…). But what about home maintenance? A new paint job increases your home’s asset value. Should you depreciate that asset value over some years? Or say you buy new appliances for your kitchen: You’re cash out of pocket, but your home is worth more. Are those purchases “consumption”?

This notion of some simple tally of your “saving” starts to look more complicated. We’re not talking “taxes on a 3-by-5 card” here. And this is not a complex household. There will have to be some complicated IRS rules for what counts as saving. (I won’t even touch here on various clever opportunities to game this system.)

An expanded tally raises some other tricky questions:

What if this family leases its car with an option to buy at the end of the lease, instead of buying? How do you account for that? And this doesn’t even touch the troublesome issue of health care: is it consumption? That’s how it’s tallied in the national accounts. But if Americans didn’t invest in maintaining their health, how prosperous would our country be? Should we tax health spending? If you get sick, your taxes go up. Hmmm.

I’ll leave it to my gentle readers to consider the details — what’s consumption, what’s saving, and what’s neither? Just to say: I can’t quite see how this family would do their taxes without a complete balance-sheet accounting every year, or some quite complicated rules for 1040 filing that result in essentially the same thing.

The rather childishly simplistic “just tally your income and subtract your saving” isn’t so simple when you think about the actual details.

The tuition line raises a particularly vexing question, and brings us back to the second question: what economic effects would we see from a consumption tax, under various accounting and taxation rules? Clearly, if you tax tuition, you discourage education. And consider more-prosperous families paying for private school. Are those families “consuming” more education than public-school families? Those households would be especially hard hit if tuition counts as taxable consumption — as would those private schools. Is that A Good Thing?

Much more broadly, though, the notion that saving is good and consumption is bad rests on some completely incoherent economic notions. For individual households and firms, sure: saving is prudential, and savings funds (at least some of) their investment. But that’s simply not true collectively. Individual saving, spending less than your income, has no effect on our collective wealth(that mythical stock of “loanable funds”). It just means you’re holding the assets in your account instead of somebody else holding them (if you spend instead of saving).

So the theory of collectively virtuous household-saving-funding-investment doesn’t make sense. And the empirics over many decades bear that out: higher saving rates have pretty much nothing to do with investment rates.

When you tax consumption, you discourage consumption, including some forms of so-called “consumption” —tuition, home maintenance, health maintenance — that arguably should be tallied as investment, at least in part. (In the national accounts, they aren’t, at all; they’re all consumption.)

And that raises a key question that cuts to the crux of economic thinking: why do producers produce stuff?

Any entrepreneur will give you a simple answer: they produce stuff because people are buying it, and consuming it (either immediately or over time). So taxing hence discouraging consumption discourages production — of both short-term consumption and long-term investment goods. A consumption tax, compared to, say, a wealth tax or a land-value tax, is a direct assault on GDP and GDP growth.

Is that what Right economists had in mind?

The reality is that we need to tax rent seeking.

– Consumption taxes should go away for ordinary items

– I’m on the fence though on “sin taxes” (ex: tobacco, alcohol, etc); but we need an economic system that does not cause people to fall into economic despair in the first place

– To make up for the money, additional tax brackets should be added at the higher income levels, while tax at lower brackets should be reduced, or outright eliminated

– The mortgage interest deduction should be eliminated

– There should be steeply progressive capital gains taxes. At the top bracket, it should probable be >90%.

– Very steeply progressive inheritance taxes

– Tariffs strategically to protect domestic manufacturing

– A Tobin Tax and a tax to discourage High Frequency Trading

– Need to use tax law to deter Private Equity and Hedge Funds too (especially on carried interest)

– Land value taxes, as proposed by Michael Hudson

There will need to be heavy enforcement, especially against rich people evading taxes or using aggressive tax planning.

We need to enforce taxes on corporations too, because so many use tax shelters and when they repatriate at a lower rate, use it for share buybacks (ex: make the rich richer).

I especially endorse your third point about reducing or eliminating the lower tax brackets. This would have a significant effect on anyone who’s not a millionaire.

One vital thing you’re missing is a steep carbon tax. That would be the most effective thing we could do to address climate change.

It’s interesting the right loves the VAT but hates a carbon tax. They want to shift more of the burden to the poor and keep enriching the fossil fuel sector. Elites also love the VAT. It wa a bullshit tell when Obama said he could support a VAT.

Speaking of carbon taxes, should we tax people more for having more than one child, or any children? That is an interesting thought.

Add a carbon tax on all meat products?

I would oppose a carbon tax for meat products.

It hurts the poor disproportionately. It would worsen the problem of obesity and poverty.

https://www.institutefornaturalhealing.com/2011/04/the-economics-of-obesity-why-are-poor-people-fat/

The end result would be a situation where the rich eat meat, and the poor would find themselves eating more filler.

Hey, why not also add a carbon tax on all 7+ billion humans since they exhale carbon dioxide too, isn’t that an interesting thought.

As a taxpaying citizen who is burdened out the wazoo from being overtaxed, frankly I’m fed up with the notion of how to create a larger tax structure that will ultimately be hoisted onto the backs of the 99% who do the living, paying and dying in their communities. Living in Crook County, I’m taxed .07 cents per store bag (.05 to the county and .02 to the retailer– considering the cost of bags were already built into merchandise pricing– its cha-ching for the retailers). Then there’s the recent .01 cents per ounce on all sweetened and artificially sweetened no calories soda beverages including partial juice drinks, power drinks, soda fountain drinks, etc. This is basically a sin tax. Heck why not tax everything sweetened including bags of sugar– greed knows no bounds in crook county.

Next, my water bill is also taxed which seems to be a oxymoron since its still a public utility unless Rahm the Terrible has it up for auction. Did I mention garbage cans that were included into the utility bill are now an extra line item of $9.00 per month? How about Crook County real estate taxes where they decide the market value of your home (my home is worth what I paid for it and not a dime more until I sell it). Determining the current market value of the home didn’t generate enough grab bag goodies for Crook County, so they changed the formula to increase their windfall– using the pensions as their scapegoat of choice.

The highest combined state and local sales taxes: Chicago, Illinois: 10.25%. Everything is quadrupled taxed in Crook County while our fearless leader Rahm the Terrible sells off, privatizes, and/or leases publicly owned land and services to foreign consortiums. This includes taxpayer monies for education being handed to ‘charter’ schools basically Wall Street’s hedge funds grab at the education trough thanks to Bill Clinton.

I want accountability from Crook County and exactly where the tax monies are going rather than their sob story of never enough in the honey pot.

I really don’t understand the logic of citizens demanding to have themselves taxed, as if local, state and federal governments need any more ideas. Living in a midwestern state with deadly winters, I disagree with an notion of a carbon tax that penalizes every household for warming their homes. As it is, the cost of gas, electricity and oil rates are jacked up beginning in the Autumn through Winter and Spring. You talk about the burden of the poor who already fight to keep their houses warm as the utilities try to shut off their power. I’d imagine a ‘steep’ carbon tax will add fuel to many more freezing weather fire tragedies caused by people using their stoves/ovens and space heaters as a source of warmth.

most carbon taxes as proposed have ways to mitigate that.

As for the utilities jacking your rates up, are they private companies? In general public utilities do this much less as they really aren’t supposed to be about profiteering and usually have to justify such behaviors as they are supposed to serve a public purpose. However you might just be somehow stuck with an unaccountable one. But if it’s a say a city utility people might be able to push back on it politically.

I have never understood why people think a carbon tax has any serious effect on environmental activity, and I’ve read several articles noting they are ineffective for the simple reason those who are the worst offenders simply to what they’ve always done—pass it along to consumers. So, to me, it’s little more than “environmental theater.” I’ll gladly entertain any explanations that show it’s had any real effect on operations of those who do have to pay it that actually reduce carbon.

>– Land value taxes, as proposed by Michael Hudson

This is sorely needed, especially in the speculator-riddled cities on the west coast.

Economic rents are one of the most powerful but least understood concepts in economics.

Consumption taxes under the Fair Tax _do_ go away for “ordinary” items due to the “prebate” which every citizen from homeless Joe right up to Bill Gates receives every month. Its size is determined by living status such as “single”, “married”, “married with X dependents”, etc.

The Fair Tax does not tax “sin” items extra.

The Fair Tax totally disregards income levels, and taxes purchases only, at the same rate no matter who you are.

The Fair Tax does not tax mortgage interest, mortgate principle, or any other time payment like auto loans.

The Fair Tax does not tax capital gains. The Fair Tax is a consumption tax, and capital gains are investments and income. The Fair Tax does not tax income.

The Fair Tax does not tax estates. The Fair Tax is a consumption tax, and the estate proceeds are income, not to be taxed.

The Fair Tax has an effectively “built-in” tariff that, instead of raising taxes on imports, which would be illegal under the World Trade Organization rules, instead eliminates taxes on our manufacturers, allowing them to lower their prices an estimated 11% – 19%. So, a foreign-built SUV at $35K and a Toledo, Ohio-built Jeep Cherokee would be $35K for the foreign-built SUV after the Fair Tax and $29,350 Jeep if they can lower the price as much as 19% or a $31,150 Jeep if they can only lower the Jeep price by 11%. The good news that in a few years after Fair Tax passage, the foreign-built SUV wouldn’t be foreign-built any more, because its manufacturer would rush to open a plant in the USA to build it here for the tax advantage, and would employ a pile of US citizens to help him build it. That’s a win-win.

The Fair Tax would require must less enforcement than income taxes, because it would be enforced against retailers who collect the tax. While there are something like 142 million paychecks in the USA that need to be watched for tax cheating, there are far, far fewer businesses that would now be collecting the Fair Tax.

I chuckled when I read that corps will reduce prices when their taxes are reduced/eliminated. The only thing corps are going to do with a sudden ~15% increase in income are things like giant dividend payments, stock buybacks, and swelling the size of existing golden parachutes. Heck, a few might even spread out the windfall over several quarters to better manage the upward trend to the stock price!

I’m in a pretty darn high tax bracket myself, but I prefer not to join forces with a twisted shade of Ayn Rand to kill the concept of Noblesse Oblige.

Think about it. You’re Chevy. You think you’re going to keep your SUV at $35K, when Jeep knows it can knock the socks out from under that with a $32K Cherokee? You can try, but you won’t sell many of your $35K SUVs when the public can buy a $32K Cherokee. Its how competition works in the marketplace. If you think that industry can sent the price of their product to whatever they feel like, then why don’t Chevys cost as much as Rolls Royces? Its because the public won’t / can’t pay that much. And when your competition can lower their prices, and they do, and you don’t, you’re just not going to sell a lot.

Competition works. You can also look at Wal-Mart. They are known to pressure their suppliers to cut costs wherever possible and then sell it to us at some of the cheapest prices. When corporate taxes go away under the Fair Tax, they are going to apply that same pressure or more for their suppliers to remove that former tax component from their costs to Wal-Mart.

Now do you think Target, Best Buy. And others are going to let this idly happen? No. They will expect the same cost cuts from those same suppliers as Wal-Mart. Let’s say Wal-Mart does try to hold prices higher artificially, that leaves the door wide open for those other competitors (who also have reduced business costs) to come in and advertise higher quality at “Wal-Mart prices.” For them to artificially hold prices up will open them up to anti-trust investigations and lawsuits.

There is one slight error in Dave’s explanation, though. There will be a tax on things like mortgages, investments, insurance, etc. No, not on the entire payment, but on the service fee portion of your payment as all services will be taxed the same as other new goods.

The one part I disagree about is the land value tax – it’s worth looking into.

Anyways, here is Michael Hudson:

http://michael-hudson.com/2009/02/a-tax-program-for-u-s-economic-recovery/

I have a question. How would they measure the amount of money that someone is saving? The money invested into stock markets, pension plans and the like?

What if I keep the cash under the pilow? Isn’t it saving?

Would a consumption tax be another way of forcing people into stock markets? Forcing households to funnel savings to wall street? Also another step in the war against cash?

Just wondering.

They don’t measure how much you’re saving under the Fair Tax, they only tax what you’re spending on new items for sale at retail, and services. Since savings isn’t either of those, it doesn’t get taxed.

Your cash under the pillow would go untaxed until you spend it on a new item for sale, or a service.

I don’t see any incentive for people to use a particular savings instrument under the Fair Tax. It would still be evaluated by the individual as to whether he wanted to save with stocks, bonds, a CD, a bank account, or keep it under the mattress.

Wow. Thanks for this. I always thought the consumption tax was basically a fat sales tax. You but stuff and it is taxed at point of sale. This article makes the idea of a consumption tax absolutely untenable.

This article …

The right way to do a consumption tax is at FairTax.org:

Every person living (and visiting) in the United States pays a sales tax on retail purchases of new goods and services, excluding necessities due to the prebate. The FairTax rate after necessities is 23% compared to combining the 15% income tax bracket with the 7.65% of employee payroll taxes under the current system — both of which will be eliminated!

Important to note: the FairTax is the only tax plan currently being proposed that includes the removal of the payroll tax.

For the first time in recent history, American workers will get to keep every dime they earn; including what would have been paid in federal income taxes and payroll taxes. You will get an instant raise in your pay!

The FairTax provides a progressive program called a prebate. This gives every legal resident household an “advance refund” at the beginning of each month so that purchases made up to the poverty level are tax-free. The prebate prevents an unfair burden on low-income families.

Tax evasion and the underground economy cost each taxpayer an additional $2,500 every year! But by taxing new products and services consumed, the FairTax puts everyone in the country at the same level at the cash register. Further, only legal residents are eligible for the prebate.

The IRS is No Longer Needed: No more complicated tax forms, individual audits, or intrusive federal bureaucracy. Retailers will collect the FairTax just as they do now with state sales taxes. All money will be collected and remitted to the U.S. Treasury, and both the retailers and states will be paid a fee for their collection service.

The FairTax treats every person equally and allows American businesses to thrive, while generating the same tax revenue as the current four-million-word-plus tax code.

Problem: I support the “payroll tax” because that is part of what backs Social Security. I would accept NO system that undermines in any way, shape, or form (nor tries to destroy it outright) Social Security.

Any tax reform must be progressive (the rich must pay more than the lower income levels) and do nothing to undermine safety net and retirement programs (Social Security, Medicare).

Today, Federal taxes don’t pay for Federal spending. The payroll tax “backs” Social Security in a political senses, as FDR understood when he originally sold the program. But it does not in an economic sense.

The issue here is that the idea that the currency issuer (the Federal Government) can go bankrupt, must borrow, and all that, is destructive because it keeps the country in the “austerity box” (which a balanced budget amendment would turn into an austerity coffin).

So the tradeoffs from FDR’s political choices are significant and damaging.

I agree that the idea that the currency issuer (the federal government) must borrow is destructive. But I’m convinced that you weaken your case when you say that federal taxes don’t pay for federal spending. It’s correct to say that federal taxes don’t pay for money creation, so that the first time that the money is used, it does not come from taxes. After that, taxes do finance much federal spending.

Even if I’m wrong, if your goal is to put an end to the unnecessary and harmful borrowing that the federal government indulges in, you should avoid saying that federal taxes do not fund federal spending. That distracts people from the main point, which is that borrowing is unneeded and harmful.

Lifting again from FairTax.org:

Like all federal spending programs, Social Security will operate exactly as it does today, except that its funds come from a broad, progressive sales tax, rather than a narrow, regressive payroll tax. Employers continue to report wages for each employee, though, to the Social Security Administration for the determination of benefits. The transition to a reformed Social Security system is eased while ensuring there is sufficient funding to continue promised benefits.

Meanwhile, Social Security/Medicare funds are no longer triple-taxed as under the current system: 1) when payroll taxes are initially withheld; 2) when those withheld payroll taxes are counted as part of the taxable base for income tax purposes; and 3) when the promised benefits are finally received.

The payroll tax is our most regressive tax. It taxes poor people from the 1st dollar they make and stops taxing the rich after they’ve made around $130K or so (don’t know the current cutoff… around there somewhere.) So, Warren Buffet ends up with a 17% overall tax rate on his millions salary, while Joe-Almost-Homeless making $12K a year sends 7.65% of his $12K, or $918, to DC while his employer sends another $918, which he got by lowering Joe’s wages by that much, to DC for him as the “Employer’s Share.” Employers, BTW, do not pay taxes, they COLLECT taxes, and they collect them from us by charging us more for their products, lowering our wages if we work for them, and reducing their stock dividends if we buy their stock.

The Fair Tax, the most often proposed consumption tax, sends 35.4% of everything it collects into the Social Security / Medicare support. Note that, due to a mechanism called the “prebate”, Joe doesn’t pay a penny of Fair Tax, because the prebate he would receive every month is enough to pay for all his spending up to the poverty level. Joe-almost-homeless is making exactly the poverty level wage, and so pays exacty $0 Fair Tax.

On the other hand, the Fair Tax does not stop collecting itself at $130K like the payroll tax, but taxes everything that the rich spend, and again, sends 35.4% of that into the social security system. So, with the Fair Tax, the poor pay the least, and the rich pay the most. Donald’s Boeing 757 retails around $100,000,000, so he would have, had he bought it new, sent $30,000,000 additionally to the US government in Fair Tax, and that would have supported the social security system to the tune of $10,620,000. Donald bought his 757 used, from a Dutch airline, but the Fair Tax is still collected on things that were used in business (the Fair Tax does not tax the wealth creation mechanisms of industry) when they are sold to private citizens like Donald. While Donald is into business in a big way, it is not an airline business, and so would be called a “conversion”, and the fair market value of a 757 at the time would have had to been taxed by the Fair Tax.

Wow, do not try to sell this BS as a progressive or fair system.I bet you are part of an organized effort to sell this idea to the public…People must be careful each time somebody presents himself under an orwellian -like name such as “FairTax” or “Citizens United”.

Yeah, high income brackets would love this approach, and the working and middle classes would be screwed again.

No, the truth is that a sales tax does not treat every person equally, as low-income people would pay a much higher % of their income in taxes.

I have another idea: tax rent-seeking activities and tax Land Added Value. Then untax labor and industrial profits.

The writer give a totally wrong impression of the consumption tax known as the Fair Tax.

In actuality, the poor end up paying $0 due to a mechanism in the Fair Tax that is called the prebate. The prebate sends enough money to each US citizens and legal resident to pay the Fair Tax on spending up to the poverty level for that person’s living situation – single, married, married with X dependents, etc. So, Joe-almost-homeless, making $12K a year, would receive enough to pay for his Fair Tax charges on all he spends. That doesn’t happen with Joe’s payroll tax, that ends up sending $1836, or $918 direct payroll tax and $918 “employer’s share” payroll tax that his employer reduced his wages to pay for, to Washington DC. Joe is wrestling with one of the most regressive taxes we have RIGHT NOW, and the Fair Tax would save him from it.

Of course Joe most likely doesn’t spend everything he makes on _new_ goods and services, he probably buys some used stuff. Used things aren’t taxed, so clothes at Goodwill would be tax free to Joe. Also, if Joe is doing things where he needs tools, and gets them at a pawn shop instead of Sears or Lowes, he doesn’t pay Fair Tax on them either, because they’re used items.

The high income tax brackets would get hammered, because they are profligate spenders. While people can probably identify 1 or 2 really smart and frugal rich guys that might get taxed less than income taxes (although that would be hard, with the payroll tax going away at $130K, which is a big tax expense, and the myriad instruments that the rich use to avoid the other taxes) the Fair Tax instead taxes their spending on their baubles. So maybe Warren Buffet lives frugally and might make out, but Michael Jackson didn’t, he spent it all, and then some, and was in debt which caused him to have to plan yet another world tour, which arguably killed hip. Evel Kievel blew it all. Nick Cage was told by his accountant that if he was going to live the lifestyle he was living, he would have to make 8 movies a year instead of 7. Lottery winners are famous for blowing it all. The rich spend out the wazoo, and avoiding the Fair Tax would be way harder than lying on a tax form or hiding it overseas.

I don’t think it’s true that the rich typically blow through it all. Many of the recently “rich” such as many of the entertainers and sports figures who began from relatively modest means, will only be earning like this for a relatively brief time, and aren’t used to having and protecting all that money probably might. I think that the oligarch class, the American proto-aristocracy, the families who have been rich for several generations, many of the dot-com-style billionaires who are likely to get a good handle on their money long before they blow it all, and such like, they’re going to wind up paying much, much, and several more “much-es”, less as a percentage of their income than the middle class which will once again shoulder the burden as it gradually shrinks under the load.

If we want to collect taxes at all it is hard to see how any tax on luxury goods will do so anywhere near at the rate the income tax does, unless it is very broadly defined ie all clothes are “luxury goods” etc., sometimes there are cheaper alternatives (if you don’t mind spending much of your time in thrift stores looking for finds etc., and that is a tax on time, but more power to those that do) but we still do need to be dressed to live in this society so really – some luxury!

Btw is renting a house or apartment counted as consumption? Because at that point one is just driving people to homelessness and we already have a massive homelessness problem as is. Anyone who wants to tax already high rents, uh I want to shout obscenities and that point, but I will merely say: it is a very bad idea.

Tax the rentiers not the renters!

And no the national poverty rate really doesn’t work nationwide, in fact it’s actually not a *living wage* in most of the country never mind more expensive areas.

This “Fair” Tax would be extremely regressive.

The rich save a far higher percentage of their wealth than the rest of us. Most have little to no savings. Why? Living costs have exceeded wages in terms of growth rate.

What they save and don’t use for consumption, they don’t get taxed. The rich would have a lower effective tax rate under this idea.

Life is regressive.

Take taxes completely out of the picture. The rich will still be able to save most of their money if they choose, while the poor spend most of it and able to save very little. There is no way around this fact.

If anything, the Fair Tax lessens the regressiveness of life, as it is in effect a luxury tax. Poverty level spending is untaxed so everyone can provide the basic necessities for their families, and then only taxed on new goods and services above that. As your spending goes up, so does your effective tax rate and total tax burden.

The poor get a break, which is an unalloyed good, of course!, but only to distract from the fact that the rich get a huge break. Once again the major burden falls on everyone above the poverty line who doesn’t have the very substantial income it takes to save a great deal. “Pay no attention to the man behind the curtain!”

“Take taxes completely out of the picture. The rich will still be able to save most of their money if they choose, while the poor spend most of it and able to save very little. There is no way around this fact.”

but the fact is easily mitigated to make it fairly meaningless, estate taxes beyond a certain point to vastly reduce inter-generational transfers of wealth, plus a safety net for the things most people save for (like retirement, increase social security, etc.) to make savings less important.

VAT (Value Added Tax) is popular in Europe and many other countries. It is a tax on spending on goods and services and is the most widespread tax on consumption. What has been its effect? It makes everything more expensive but doesn’t really discourage consumption since it’s applied to everything.

(Outside the Eurozone I suspect that its introduction was not motivated as a tax but instead as a way to force all transactions to be recorded and reported to the state. Inside the EZ, of course, it’s a source of revenue for governments that lack a sovereign currency.)

VATs wind up collecting the same amount of tax in the end as a simple sales tax and are way more expensive to administer. They are a really bad idea.

What about food? Medicine?

Perhaps in singlepayer states medicine is irrelevant and covered by the singlepayer system, but a VAT on food or meds is unacceptable.

Exemptions vary between EU countries (in terms of how they interpret and implement agreed-on policies). Medicines and food are exempt. However, what is defined as “medicines” and “food” has variations between countries. E.g., in some countries flat/crisp breads aren’t considered “food” so they have VAT. Ditto for anything with chocolate!

“Medicines” might depend on a country’s specific laws (so alternative health products might or might not be VAT exempt). Medical care exemptions now applies only to MDs and not chiropractors, acupuncturists, homeopaths or counselors. Depends on the country.

VAT exemptions are pretty complicated if you look into it. For example, paper products like books are VAT 0% and printed paper products like a calendar are VAT 23%. Whether or not you must charge customers VAT also depends on your gross sales.

Each EU country has its own VAT rates and different services and products. E.g., in Ireland electricity and any kind of repairs have a lower VAT rate than the phone bill. Recently, certain sectors were given a lower rate to encourage tourism (restaurants, hotels, hairdressers).

It can be a way for powerful lobbies to favor their own sector and hurt competing sectors.

The Fair Tax, via the prebate mechanism, ends up costing poor people $0 as the tax for their food, because they’re buying food frugally by necessity. Their food comes out of their maybe $12K a year salary, or from public assistance, and the prebate mechanism is enough to pay for the Fair Tax on spending up to the poverty level. And, of course, the public assistance monies are not taxed by the Fair Tax either.

Rich people eating steak and truffles are going to get hammered by the Fair Tax, because their food spending is going to be waaaay above poverty level. They will begin paying 30% exclusive / 23% inclusive rate on spending they do above the prebate. The rich spend like the dickens, so they’re going to get hammered. This is as it should be, they can afford it. And, if they don’t like it, they can control their taxation by not spending so much. That makes the Fair Tax even more fair, but I won’t hold my breath waiting for Joe Fat Cat to give up his boat or airplane purchase just because of the tax.

You still ignore the fact that for the truly wealthy, those who have the power and the culture of maintaining their wealth for generations, their savings power far exceeds their spending, so the tax-on-consumption-only you’re proposing works strongly to their benefit, in fact, more strongly than for anyone else, probably. -Huh!?!- In you’re example above somewhere the “rich” you list are a few entertainers who notoriously blow all their money. I don’t think they make a sufficient representative sample of the rich, or “1%”.

I suspect you are completely right about the wealthy, most are not rich entertainers and sports stars blowing their money. But of course we need hard data here but I suspect it’s hard to get on the wealthy as they play games with their money that people whose incomes are wages or social security can’t play. So wealthy people’s wealth can be hard to track.

And for most people unless they go into something like wines, there is a HARD limit to how much they can pay on food period. Yes it’s more shopping at say Amazon’s Whole Paycheck than at the ethnic supermarket, but that is NOT what distinguishes the wealthy from the middle class and there is still a HARD limit on how much one can pay for food. Anyone who thinks that what makes one rich, has ceased to even talk about the rich and is maybe talking about the upper middle class at best. The wealthy have their own estates on which they grow food oftentimes etc.. Tell me, how do we plan to tax that? Well property taxes at least get some of it!

Even truffles are only so expensive, can get some for around $50, maybe not the best use of money but let’s keep perspective, having $50 to blow does not make one wealthy.

By the by if property one already owns is not taxed (although most states do), a rich person could spend 12k of extra money on food that a poor person has just spent merely to meet their rental payments and keep a roof over their head (and that is not even high rent for most urban areas at this point). The rent even if it itself wasn’t taxed could max out the 12k of tax exemption so fast it’s not funny, and then one still needs to eat! At least presently food is often sales tax exempt.

You say that because it is applied to everything it doesn’t discourage consumers? That doesn’t make any sense.

I beg to desagree: It DOES discourage consumption. Imagine that every single item you need/want becomes 20% more expensive… that wouldn’t have any effect? yeah sure…

VAT is the most unfair and regressive tax that exists right now in Europe.

“VAT is the most unfair and regressive tax that exists right now in Europe.”

Agreed! VAT hurts the poorest the most. By a long shot.

The Fair Tax, by untaxing a person’s income, will cause a boost in take-home pay of probably around 20%. OTOH, the cost of American-made goods should fall to the point that, after the Fair Tax is applied, it will probably be only about 9% more than it was before. So the person that is standing in front of the sales counter looking at an item that used to cost $100 now costing $109, with $120 in his wallet where he used to have only $100, I’m willing to bet will buy the new, effectively-lower-priced item anyway. No, I don’t think the Fair Tax will hurt purchasing in the USA of US-manufactured goods. It might hurt Volvo sales if they’re not manufactured here, but that won’t last long, because in a year or 2, they WOULD be manufactured here, and cost less than they did before, and Joe would buy one if he wants it.

My objection to a (broad based) consumption tax is that it treats all goods & services as “equal”. So the purchase of a Rolls Royce is equal to that of a loaf of bread ? Both receive (say) a 10% tax ? Sales taxes should be selective — and, yes, it does make it much harder to administer. However, the equity outcomes are worth that cost.

I largely agree with Altandmain: the taxes referenced would make a consumption tax unnecessary.

Actually, it doesn’t treat them as equal. A loaf of bread is a basic living item that would have the cost of its Fair Tax already sent to the US citizen or legal resident alien by a mechanism called the prebate. No one would be a penny on a loaf of bread. The Rolls, on the other hand, would be hugely expensive, and bought with monies that start getting taxed after a person spends up to the poverty level. So, a $300,000 Rolls (I don’t really know what they cost) would be bought with money in excess of living expenses which are prebated to the citizen or legal resident alien, and would be taxed at 30% exclusive (300,000 + 30% = $390,000) or 23% inclusive ($90,000 being about 23% of the $390,000 total price of the Rolls plus the Fair Tax.) What this means is that the rick are going to get hammered when they spend. Its OK, its not required to spend like that, and if they don’t want to pay the tax, then they have the option of not buying the item for sale. The Fair Tax is, then, 100% avoidable, if you want to “live low.”

“The rich” will not get hammered when they spend. Simply, they’re Incorporated undoubtedly with parent-subsidiary structures (not to mention trust fund babies loopholes from crib to casket) my friend. Become a business and you can purchase and/or lease the item(s) from houses to business work vacays, cars, jets, islands- think virgin airlines mogul Richard Branson who’s home is also a private resort for the beautiful peepasites. Plus the added bonus of depreciation on businesses properties including rolls royce, jets, luxury yachts, etc… are expensed. Even their charity parties, donations, and gifts to private and public NPO’s are a boon for them as tax write-offs.

BTW, the rich stay rich by spending other peoples’ money and leaching off their hosts.

You are missing the point that with the FairTax, there are no tax write-offs. You are thinking of the FairTax as if it will exist within the current tax climate/tax system. It won’t. The current tax system will be entirely wiped away with the exception, I believe, of excise taxes (that’s what I recall from my last reading of the entire FairTax bill, which is around 120 pages long). Depreciation and other complex aspects of current tax law would also go away. We are talking a totally new system unlike the current system in practically every way.

Yes businesses are exempt from taxation, and it works one of two ways.

In both cases, the business has to register with the state to get the exemption status, which opens them up to audits. One way they exempt themselves is by providing proof of business exemption to their suppliers to make purchases tax free up front. I.e. Wal-Mart buying paper goods and detergents from Proctor and Gamble to sell in the store. The other way is to pay the tax at the retail level, then submit that receipt to the state for refund. I.e. The contractor that just remodeled my home and purchased the garage door opener I requested from Home Depot.

So how would the rich, or anyone, try to evade the tax through fraudulent business expenses? If bought tax exempt from a supplier, it can easily raise red flags in an audit and additionally opens up both parties to conspiracy charges. If bought at the retail level and submitted to the state for a refund is just begging to be caught.

Will some evasion happen? I’m sure it will. Will it be anywhere near the amount that goes on today? Not a chance. From a compliance standpoint, sales taxes are always going to outperform income taxes; especially in today’s growing economy of non-traditional wage earners.

Would the prebate be enough to allow me to buy a non toxic loaf of non toxic organic bread at an organic price? Or would the prebate only be enough to pay for a loaf of toxic petrochemical bread with Roundup in it from all the Roundup sprayed on the wheat in the field to get it to all dry down at the same time for ease of one-pass combining?

Yes well said.

Whenever we hear the phrase ‘consumption tax,’ we should replace it with ‘production tax.’

Nothing can be produced unless it is also consumed. The idea of a ‘consumption tax’ is of course to tax the production of useful goods and services and subsidize parasitic finance and the super-rich. It keeps popping up because it is so obviously regressive.

One is reminded of the classical ‘paradox of thrift,’ and Malthus’ warning that what is certain is that if everyone was content with the meanest bread and water, then nothing better would ever be produced.

The only time a ‘consumption tax’ makes sense is when high population densities make natural resources expensive. So, we need to price the cost of fresh water higher than the cost of pumping it in order to prevent over-use. But in that case the tax (or fee) should go directly back into the public treasury.

More please.

A consumption tax is used to replace other tax regimes. In the US it would be used to shift public finance contributions away from high incomes and wealth and toward day to day living by the bulk of society (who annually spend a higher proportion of their income, and a much much higher proportion of their net worth, and would have an even harder chance of attaining increasing ir even positive net worth as a result.) That is not economically sensible.

And think of the baby boom generation across the globe, the ones facing retirement at a time when they have less or little income – this shift woukd be unfair and also economically stupid.

So more articles about consumption taxation.

The Fair Tax would make sense only if there was a Debt Jubilee that preceded it for ALL non-secured debt (As Michael Hudson has found in many ancient and some not-so-ancient societies through his recent research). With a clean slate, everyone could afford the 23% tax-on-everything scheme (At least for a year. Then the we would have another Debt Jubilee and start over.). Of course, the unemployed lower economic strata would still need government subsidies as they would have no income with which to purchase said goods and services, so maybe a 30% tax would be required. But boy, the rest of the USA would be in consumer heaven.

You are forgetting that right now everything is taxed 3 and 4 times through the various companies and processes of production and transport. Dale Jorgenson, Ph.D. at Harvard, found the embedded cost of all these current taxes represents roughly 22% of a product’s final cost (on average). Remove those taxes, and the prices of goods will not rise greater than the spending power of newly empowered individuals holding their full paycheck for the first time in their lives.

I like consumption taxes because everyone has to pay, not just ‘the little people.’

Sorry if someone already raised this, but:

Wait a minute – why is the principal payment on a mortgage (or other loan) not savings? It reduces your debt and improves your asset balance.

When we received an inheritance, the first thing we did was pay off our mortgage. It happened we were paying rather high interest (this was a while ago, like 20 years), so it was an especially good investment; but how else could you “receive” (ie, save) a retail rate of interest, with zero risk? Investment = savings, certainly for a household.

“Just a transfer to yourself” makes no sense. It’s a transfer to your lender.

VAT is a sneaky backdoor tax on Tax free Roth IRA and Municipal Bond income!!!

I have been involved as a FAIRtax activist for several years now in the development of a calculator which compares the effective tax of the proposal with the effective tax of the current income tax. Bottom line apples to apples comparison shows the group we would normally think of as the middle class enjoying a savings of several thousands of dollars per year.

What would you realistically expect the average American family to do with those savings? Two choices, either spend more, or save and invest more. Either outcome is a win/win.

If one thinks the US economy is too big and too carbon emissive because it is too big, a consumption tax would be a good way to shrink the economy and shrink the emissions. Under a 20% purchase tax, people would eventually figure out that their money loses an instant 20% of its value upon the moment of their spending it. Those who are in any position to wonder about anything at all will begin to wonder . . . why even bother to earn the money to begin with if it immediately becomes 20% worthless upon the moment of it’s spending? They will perform as much of their economic/survival activity as they possibly can in the barter and subsistence production activities that are available to them.

If you work for money which is fated to be worth 20% less than the stated face value of the bills and coins when you go to spend it, then why not work directly for personal survival goods and wealth if you can? If you can grow personal food in your own personal yard, you won’t have to surrender 20% of the food you grow to the taxing authorities every time you want to eat some of it. If you eat a thousand dollars worth of vegetables in a year, you lose $200 for trying to spend that thousand dollars on vegetables. Whereas if you try to buy a hundred dollars of fertilizer for your garden, you lose $20 dollars and only have $80 for fertilizer. But if that $80 worth of fertilizer enables you to grow a thousand dollars worth of food in your own yard, then you get to keep and eat the whole thousand dollars worth of food without having to pay a 20% food consumption tax on it every time you go to eat some. Spending just enough money to buy fertilizer allowed you to reduce your money-consumption tax down to $20 instead of $200. Eventually you will wonder why you even bother to work enough to make the thousand dollars you don’t have to spend $800 of on food any more. You will figure out ways to do the least possible per cent of your work in the money sector.

A consumption tax would allow suburbanites to retreat into partial peasant subsistence. The same consumption tax would drive urbanites into partial pauper famine and starvation. A consumption tax would make legacy suburban sprawl look pretty good if you were lucky enough to already live in a legacy house-and-yard in a legacy suburb.

A consumption tax would help America live out its own version of Dmitri Orlov’s collapse of the Soviet Union. If we are really serious about resource and energy conservation, and shrinking our big carbon footprint to a little carbon pawprint, a consumption tax might shrink the economy enough to help us get there.