By Enrico Verga, a writer, consultant, and entrepreneur based in Milan. As a consultant, he concentrates on firms interested in opportunities in international and digital markets. His articles have appeared in Il Sole 24 Ore, Capo Horn, Longitude, Il Fatto Quotidiano, and many other publications. You can follow him on Twitter @enricoverga.

Bitcoin, and cryptocurrencies more generally, consume huge amounts of energy.

According to an analysis by Digiconomist, Bitcoin alone is currently eating up nearly as much energy as the entire Slovak Republic.

Per the same site, the energy devoted to a single Bitcoin transaction could power 10 American households for a day. Keep in mind that Americans devour energy – in Italy the same transaction could power more than 50 households for a day.

It is worth remembering that there are three other virtual currencies not included in these figures.

The activity known as “Bitcoin mining,” as currently conceived, not only consumes energy quickly, but does so at a continually increasing rate. Continuing in this manner will lead to steadily more severe environmental consequences, absent changes in the relevant technological systems.

If you search for “Bitcoin” on Google, you get about 200 million results; if you search for “Bitcoin pollution,” you get about 800,000. One wouldn’t say that the media finds the environmental impact of Bitcoin mining a particularly thrilling topic.

To understand better the complexities and dangers here, let’s look more closely at the world of cryptocurrency mining.

Hard Labor in the Mines

“Miners” play a crucial role in every cryptocurrency system.

A cryptocurrency’s goals include (1) validating new transactions in a way resistant to fraud, and (2) enforcing a limit on how fast Bitcoins can be created and transactions validated.

The basic setup involves mathematical functions called “hashes” that are easy to calculate but hard to reverse. It is easy to compute the hash function even of a large amount of data, but it is very difficult to tamper with the data without causing major changes in the hash value.

In the case of cryptocurrencies, the large block of data is the records describing a collection of new transactions. All of the blocks together form a linked list (the “block chain” or “ledger”), with each block containing the hash of the block added just before it.

Suppose now that a hacker tries to modify a block. That will trash its hash value, and comparing the hash with the value that’s supposed to match it in the following block will reveal that something is wrong.

The way this regulates the speed of creation of new blocks is that a part of the new block’s header (the “nonce”) is not fixed in advance. It has to be chosen so that the new block’s hash will satisfy some sort of restriction (typically, starting with a certain number of zeros). The only way to validate the new block is to calculate hashes for every possible value of the nonce until you hit one that works.

In practice, there is a global contest to see who can solve the computing puzzle for a new block. The winner is paid in Bitcoin.

Solving the contest requires a ton of computing power (“work”). In this sense, the activity of a Bitcoin “miner” is not entirely dissimilar to that of an ordinary miner who toils in order to extract raw materials (gold, copper, silver) that will make it possible for a mint to coin money. For more details on this process, see for example here.

Miners Evolve

Digital mining has undergone substantial evolution. Once, it was the hobby of a few individuals who knew something about IT, trying to pump as much performance as possible out of their PCs. Today it is a capital-intensive industry that uses machines with hardware configurations designed specifically for mining.

As a result, a small number of large hardware manufacturers profits from offering the cryptocurrency industry their newest and most efficient equipment.

Meanwhile, single miners have turned into big mining conglomerates of various types.

Remote hosting systems and cloud-based mining services offer customers the possibility of getting involved with mining without having to deal with computing equipment directly – this is “virtual mining.”

There are also the big “physical” miners who over time have become increasingly structured, and now maintain large data centers throughout the world.

A third type of conglomerate has also developed, so-called “mining pools.” These involve individual and corporate miners who pool their computing power into virtual aggregates that aim to solve mining (hashing) problems more frequently and thus increase their profits. Pools subdivide their winnings in proportion to the amount of computing power each miner has contributed. Many of these pools have become professional organizations that go so far as to provide customer support services to their members.

The Better the Miners Become, the More Energy Gets Consumed

Imagine a mining computer capable of earning one Bitcoin each month. Then 10 such computers should in theory be able to earn 10 Bitcoins.

The virtual currency world must therefore constantly keep in mind the potential problem of overproduction. The solution currently in use is straightforward: the more computing power is collectively brought to bear on mining, the more the “puzzles” to solve are made more difficult.

This ceaseless struggle between computing power and computing difficulty has led to a circle that may seem virtuous – but only if one ignores the impact on the environment.

Nothing Is Created, Nothing Is Destroyed

Now that we understand this virtuous or vicious circle, let’s map out where the major “real” miners are (i.e. the locations of the machines that actually do calculations and burn energy).

According to a University of Cambridge study, miners in just two countries account for the bulk of mining activity: China (58%) and the US (16%).

Mining consumes energy in two ways: energy directly consumed while doing calculations, and energy required by the air-conditioning units that keep the computers from overheating (gamer readers can relate to this by recalling how much a PC can heat up while playing a computationally intensive game).

Compare the huge server farms of IT and media companies (e.g. Facebook and Google) – here the choice of where to locate this large energy consumption tends to fall on areas where energy costs are low, and if possible also where there is cooler weather. Miners tend to make similar choices, with little interest in how the energy they consume is produced.

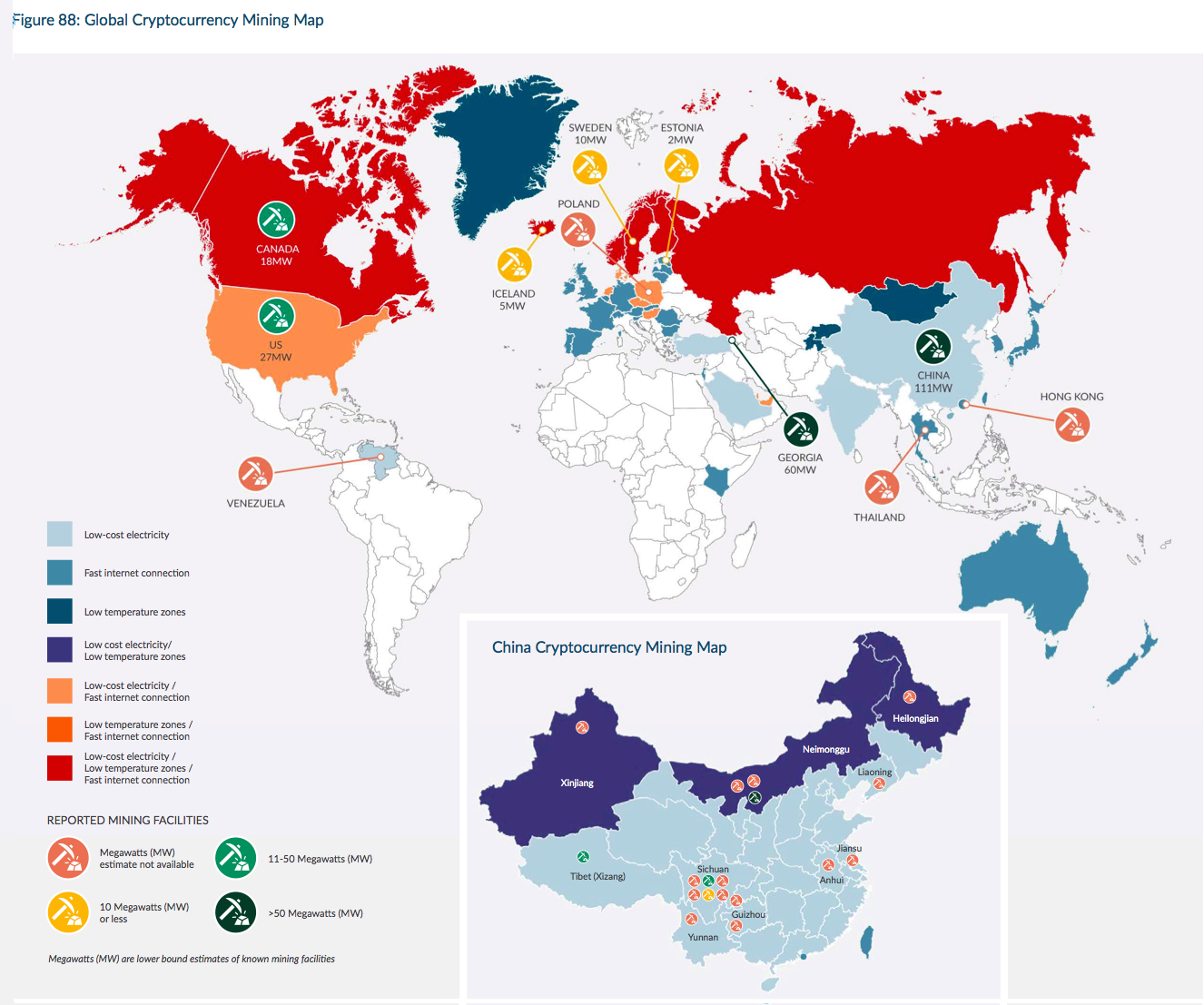

Miners want three things in a mining location: (1) low energy costs, (2) a cold climate, (3) fast Internet connections.

Regarding low energy costs, several countries (such as China, see the map below) have clear advantages.

On climate, northern Europe, Russia, Canada, and Alaska are the best options. As a matter of fact, little mining takes place in Russia, but mining in Canada is increasing.

For fast and reliable Internet access, it is essential to be in a country where networks have high capacity and are well-maintained and secure.

The following map (again from the Cambridge study) shows the interplay of these factors with mining activity:

How Is the Energy Produced?

As mentioned above, the US and China alone represent nearly three quarters of all mining activity.

With this in mind, it is important to remember that their energy markets are far from being environmentally sustainable.

According to the U.S. Energy Information Administration (EIA), 73% of China’s energy production in 2016 was based on the consumption of coal and other fossil fuels. Although the EIA estimates that China’s coal consumption will eventually stabilize, through 2040 we are looking at consumption that is at least 40% based on fossil fuels.

Thus, for example, the Bitmain group bases its mining activity in the Chinese region of Ordos, and it satisfies its demand for energy by using local coal-based energy production.

The US (the base of almost one sixth of cryptocurrency mining) is also heavily dependent on fossil fuels. Between coal and natural gas, more than 64% of American energy production depends on polluting, nonrenewable forms of energy.

Solutions?

Recently there have been indications that the electrical company of Sichuan intends to disrupt the supply of electricity to cryptocurrency miners – it has in fact started to raise prices for large consumers. This is perhaps a wise move, but the result might only be that miners relocate elsewhere.

Bram Cohen, the inventor of the BitTorrent system for file sharing, has proposed a radical way out. A few weeks ago, Cohen announced that he is working on a new system, whose goal is to base verification on “Proof of Time” and “Proof of Storage.”

The existing cryptocurrency verification system is based on “Proof of Work,” i.e. making sure that verifying a new block requires a certain substantial amount of computations (“work”). Cohen’s intent is to develop a system in which verification is based not on energy consumption but on hard disk space that miners keep free over time.

The idea is an intriguing one and its proponent already has on his resume the creation of one innovative approach to distributing data.

However, in the absence of changes along these or similar lines, the problem of the energy demand of Bitcoin and other cryptocurrencies is a real and growing one.

If today, with Bitcoin at $8000, Bitcoin rivals the Slovak Republic in energy consumption, think about what will happen if (as its optimists dream) Bitcoin reaches $40,000.

Currently, the matter is straightforward.

Whoever uses Bitcoin is a polluter.

Tell them to stop.

An earlier version of this article, in Italian, was published by Forbes and can be read here.

Fiat money, gold… from the rain?

From the rain?

mmm i read manna can come from the sky, but gold and fiat money from the rain well i’m not updated. kindly can you supply me some link about this topic?

thanks

Enrico

Isn’t he saying that the production and use of fiat money and gold also entails the burning of an enormous amount of energy?

Energy involves entropy. And entropy involves … no free lunch. BitCoin doesn’t change that, nothing can. Any rational or sustainable approach, has to accept reality as it is, and move forward from there. Wishful thinking won’t do it. Tulip mania strikes again.

BitCoin etc is how the West (and China) becomes Zimbabwe. No trillion dollar platinum coin for you, just bits (and pieces). Eventually all resources will be sucked in, starving the rest of the economy. Financial zombification like 2009, only much greater. Both cases, enabled by State intervention.

The post starts out by stating the energy consumed by a bitcoin transaction. But the rest of the article is about the cost of mining. Is the energy cost of bitcoin transactions also increasing over time?

I’m not totally sure, but things I’ve read (including this article) suggest that transaction validation is mining:

An article on Wolf Street said that validation these days is rewarded by mined Bitcoin and by transaction fees, and that as more of the possible Bitcoin had been mined, transaction fees would predominate.

yes you are correct.

the energy cost of bitcoin mining is increasing exponentially over time and represents an apocalyptic environmental hazard if it’s not stopped…briefly:

According to Digiconomist’s Bitcoin Energy Consumption Index, as of Monday November 20th, 2017 Bitcoin’s current estimated annual electricity consumption stands at 29.05TWh. The Bitcoin Energy Consumption Index estimates consumption has increased by 29.98% over the past month. If that growth rate were to continue, and countries did not add any new power generating capacity, Bitcoin mining would:

Be greater than UK electricity consumption by October 2018 (309 TWh)

Be greater than US electricity consumption by July 2019 (3,913 TWh)

Consume all the world’s electricity by February 2020. (21,776 TWh)

Of course, bitcoin cannot grow exponentially until 2020 if those estimates are correct. But there are consequences in “real life”. If bitcoin energy consumption continues to climb exponentially for some time, energy prices would increase wherever mining operates. The article says that Sichuan authorities decided to rise energy prices for large consumers to get rid of bitcoiners. It also says that they can move operations. Nevertheless, the larger they grow, the more difficult to move and at some point it must stop growing this way. Energy looks like the commodity that will stop it.

that’s why i suggested, in the end a different approach with POS or POT rather than POW

> Is the energy cost of bitcoin transactions also increasing over time?

Yes and no. The money being poured into Bitcoin mining is still increasing (but that too may ultimately plateau).

Re energy cost per transaction, the article takes a rudimentary calculation (energy burned divided by number of transactions recorded to the blockchain per day) and declares that “the energy devoted to a single Bitcoin transaction could power 10 American households for a day”. Whilst technically true it ignores all off-chain transactions (the buying and selling on exchanges, for example) and so-called layer 2 transactions (where 10s or 100s or 1,000s of real bitcoin can/will be represented by single channel opening and channel settlement transactions) and it misleads as to future cost (since energy burned and transaction volume are not linked in any meaningful way — future transaction volume growth will lead to a lower result in the calculation above).

A demand for what?

A token of future riches?

And what problem does it solve?

As it grows and divides, its just the dream of a gold standard.

It looks like open source bullshit to me.

An alternative,NG currency, hardly addresses the problems/aggressors we face.

There is also a significant amount of Bitcoin mining being done by Bot Nets, thus spreading another sort of pollution that has a major impact on private networks.

So far, the history of Bot Net infection/recruitment has been one of a steadily increasing payoff for the clandestine harnessing other people’s hardware for financial gain.

Sort of reminds me of some other internet business models, except for the lack of a dopamine payoff.

From Kaspersky, via Coindesk reporting;

Kaspersky is reporting that 1.65 million of the machines its software protects have been attacked with bitcoin mining malware, that’s more than double the number just three years ago.

Keep in mind this is just the number that Kasperski’s software is reporting.

This report mentions that the malware is attacking even IoT devices, and PCs too old and or weak to actually work for mining bitcoin, and that it probably results in devices that are too busy mining to do anything else, and battery lives that suddenly fall off.

What’s maybe more interesting is the fact that the botnet owners are probably not making much more profit off their network of low performing machines than they would if they devoted their servers to mining directly.

Isn’t IoT great!

On the networks that I support employees and guests IoT devices will eat as much bandwidth as I can give them, if I dial up the available bandwidth on the employee and guest networks, it is soaked up instantaneously, and would stop our business dead in its tracks if I didn’t throttle it down.

Just to be clear here, I’m describing the issue of people walking around with devices that have been compromised and their owners are oblivious to the fact.

Why does that not surprise me?

I focused my interest on the data available, that unfortunately don’t map all the scenarios.

We can play this game with anything.

How many coal miners must die per annum to boil water to make pasta for Italians? Since we know miners die annually and an ascertainable amount of coal is used to boil water, we could reasonably find how much mortality each bowl of spaghetti “causes” with a little more internet research and computation.

Then we could state Marco Polo, falsely attributed as being the first importer of pasta to Italy, is responsible for more deaths than Pinochet but not as many as Pol Pot.

Everyone who eats pasta is a polluter and murderer. Tell them to stop.

I love NC, but this article is weak. More interesting topics would be comparing how much it costs to process a check at a bank versus a BTC purchase transaction or giving us some insight as to how that BTC cost will likely decrease as other transactions have.

For what it’s worth, I think that cooking pasta for Italians (or for anybody) is more useful than bitcoin “mining”. People need to be able to live their lives, and as a non-meat food source, pasta production releases fewer greenhouse gases than some other types of food production. I have trouble conceiving anything useful about bitcoin.

I tend to agree here. I bet far more energy is consumed by video games than BTC, but there isn’t much handwringing about Nintendo’s or Sony’s contribution to pollution.

Ben Around, see my comment above…

Not an electrical engineer so my analogy may be off, but I think it’s akin to the way your household appliances consume energy. You can leave your lights on and they won’t consume nearly as much energy per hour as your electric stove. Your clothes dryer* sucks up more energy than anything else in most people’s homes.

Bitcoin mining is like operating your dryer full time.

* I learned about how much energy various appliances use during the ‘drought’ in Seattle back in the late 90s/early Aughts when news broadcasts were trying to get people to conserve energy to avoid the entire region not having enough power. If you’ve ever lived in Seattle, it rains all the time. I looked out my window and saw greenery everywhere and lots of moisture while the news was proclaiming said drought. Shortly afterwards we all found out that Enron traders were manipulating the entire West Coast electricity supply. I don’t remember the news ever making the connection and admitting the drought they were fearmongering about didn’t really exist. But who are you going to believe, the authorities or your own lying eyes?

Spare us the Bitcoin defenses. It is your comment that is weak. The article says Bitcoin already consumes more electricity than Slovakia consumes in a year (Ireland is another reference point) and unlike other forms of transaction processing, will inherently consume more energy per transaction, and at an exponentially rising pace. This is the complete opposite of any other form of transaction processing, where costs have declined dramatically over time.

Using electricity is less than ideal presently because of humanity’s reliance on fossil fuels. Therefore, the focus needs to be on getting to a point where all electricity is generated by renewables/zero-emission fuels.

A currency system that requires transactions to be confirmed N times, with computer-intensive algorithms, is always going to be much more energetically innefficient than single-confirmation systems. Little to argue here.

But key benefit of BTC is not being eco-friendly. Its key benefit is to provide protection against goverment/banking intervention. Like other eco-unfriendly things (e.g. eating a bistec), it should be used with awareness and be costly for the users.

The problem is that BTC is free-riding cheap energy cost. And this is possible because the ratio BTC_price/(energy_cost * computation_work) is still possitive. Eventually we will reach a computation peak, where mining is not profitable at any energy cost, so transations will be paid only by fees. This will create a “BTC transaction” market where the miners will have to do hard competition among them, and many will simply give up.

If BTC survives this peak, probably only a limited group of big, efficient miners will exist, and they will be charging high fees. This will reduce the BTC pollution by reducing the number of transactions and the number of confirmations per transaction.

Everyone who drives a car is equal in environmentally-destructive power to the CEO of Exxon. Stop driving cars, ya ruthless bastards.

‘… today, with Bitcoin at $8000, Bitcoin rivals the Slovak Republic in energy consumption …‘

That’s so last week. Bitcoin is currently quoted at $9,865 as the “dance of the round number” commences approaching $10,000.

Meanwhile, the search for the elusive Satoshi Nakamoto continues:

For the record, I’m not Satoshi either. :-)

…is $10k the emperor’s new close?

Sorry for the delay. it took me a while to map the scenario bitcoin so in the meantime it arose further.

The bitcoin phenomenon is fascinating. I find it remarkable that goldbugs cannot make the connection between their particular mental illness and bitcoin mania. Fascinating.

To pose just one obvious question, are you are unable to distinguish between ~400 weeks and 4000 years?

So why is it still not obvious that crypto-currencies are huge ponzi schemes? Electricity wasting, CO2 pumping, ponzi schemes to boot.

Not a rhetorical question BTW. Anyone have any ideas that don’t sound like the typical libertarian and techno-utopian jargon laden, “its mathematically defined/protected and the government can’t control it” crap I keep hearing ad nauseum? I’ve been reading way too many suspect articles pushing it with authors that don’t seem to understand how currencies work. Hence, my thinking it is a classic ponzi scheme.

I really am not one to dismiss things outright that have an immense following (there must be some “thing” there). I get the dot-com bubble, and I get the 2008 real estate bubble (these were bubbles tied to some kind of material asset or assets), but cryptos have me pretty confounded. WRT cryptos, the faith in it is all in the faith in it, 100%.

One Bitcoin is now worth $9942. It lost $13 since I checked earlier this afternoon. As far I am concerned this is lost energy due to digital ether mania. Together with flaring of natural gas at oil fields, they are a waste of energy that contributes to world’s increasing pollution. Both are proof that the increase of the wealth of the rich has total priority over societal good. This is not sustainable.

I have a question. Is there any evidence that Bitcoin is being used for purchasing physical gold?

Yes, see e.g. Vaultoro or Peter Schiff’s SchiffGold. There are undoubtedly people using physical and paper gold to buy bitcoin too.

Steve Keen just did a good video apparently at a BTC conference “Can Crypto Currencies be Money? My talk at BitBrum on November 19 2017”

https://youtu.be/0UVpYEP_TbE

Whoops, looks like somebody made CHS’ [family-blog] list.

I ‘bit’ – followed your mysterious ‘ CHS list’ link. So, is this guy someone important? I dn’t know what to make of his poor argument. Except for the word strawman.

would love to see an analysis by someone qualified to do so on the Charles Hugh Smith link

the numbers being discussed are pretty stupendous

So what’s the problem that bitcoin is trying to solve?? There’s something seriously wrong with nerd culture.

Gosh, lots of problems. Where to start? I suppose at a minimum, the double-spend problem (a computer science issue previously thought impossible to solve) and the sound money problem (in particular, the idea that money can be too easily inflated away). It has solved the first, it is _trying_ to solve the second.

Perhaps serendipity will solve this problem? I am no expert but to my eyes bitcoin is in bubble territory. When the bubble blows there will be a massive outcry and presumably and the market will disappear.

I’m a software developer and have been studying cryptocurrency (and the underlying “blockchain” technology) lately. The communities around the various “coins” are well aware of the energy consumption issue and have been working on it for several years. (I haven’t seen Bram Cohen mentioned anywhere, by the way.) The current “proof of work” consensus mechanism is far from the only option, and Ethereum, the #2 coin by market cap, will be rolling out “proof of stake” (which doesn’t throw away energy) sometime next year. The others, including Bitcoin, will have no choice but to make similar changes. So this whole problem is temporary.

As for the “problem being solved”, blockchain creates a public ledger that can’t be faked or hijacked (sparing the details) and so it can eliminate the need for a trusted central authority, such as a bank, or ebay. There are many possible applications, some commercial, others anti-commercial (individual freedom and privacy).