On the one hand, the latest public disclosure of misconduct by CalPERS executives and staff isn’t earthshaking. On the other, it was still significant enough to merit a Financial Times story. And it also illustrates a thumb-nosing attitude toward the law that has become a CalPERS trademark.

In a Financial Times FundFire article, Ex-CalPERS Exec’s Interactions With Pension Raise Red Flags [paywalled, no online source], Fola Akinnibi ferreted out that CalPERS’ Chief Investment Officer Ted Eliopoulos accepted the impermissible overtures of a former CalPERS employee almost immediately after he resigned and joined an asset management firm that was pitching business to CalPERS. As the article explains:

CalPERS’ former head of infrastructure investments Todd Lapenna, who resigned from the pension in December and officially joined StepStone in January, arranged a meeting between CalPERS CIO Ted Eliopoulos and StepStone executives to discuss the changing business immediately after joining the firm. Lapenna is subject to the California Political Reform Act, which prohibits lobbying by former employees for a certain period after changing jobs, according to emails and other documents obtained via a California Public Records Act request.

StepStone had been an infrastructure consultant to CalPERS, but abruptly and without explanation resigned from its contract in August of this year, even though the five-year agreement ran until February 2020. Author Akinnibi reported that StepStone was in the process of changing its strategy to give much more priority to asset management than consulting. CalPERS is attentive to the fact that consultants that are also money managers have a conflict of interest. CalPERS’ director of real assets Paul Mouchakkaa had noticed in October 2016 that StepStone’s promotional materials were touting its asset management prowess, particularly in infrastructure and real estate. StepStone had also stated in its SEC form ADV filed in March that being in the asset management and consulting business represented a potential conflict of interest. And StepStone said that was an issue with CalPERS. Again from the article:

“StepStone resigned its board advisor r[o]le because it determined that it could be more helpful to CalPERS in an investment advisor role, and in CalPERS’ structure a service provider cannot effectively be in both roles,” says the spokeswoman in an email.

To beef up its asset management business, StepStone had hired an infrastructure team from KPMG, including the team’s leader, James O’Leary, who then became head of StepStone’s infrastructure and real assets asset management initiative.

Recall that StepStone was still CalPERS’ infrastructure adviser during December 2016 and January 2017. But more important, the ex-CalPERS staffer LaPenna was subject to a two-year prohibition “aiding, advising, consulting with, or assisting a business entity to obtain a contract or contract amendment with his or her former agency.” From the Financial Times story:

On December 10, just days after Lapenna resigned from his post to join StepStone, O’Leary reached out to Mouchakkaa to pitch a new line of business to the pension.

“As you may know, since I have joined StepStone, I have been focusing on our business being an asset management provider, not a general consultant,” O’Leary says in the email. “While I am cognizant of our existing board advisory role at CalPERS (and will continue to support it), I do think our greatest value to funds like CalPERS will be around tailored investment solutions, leveraging my global team’s experience and reach.”

Lapenna, the former CalPERS employee, emailed Eliopoulos on January 12, via a personal email account, looking to arrange a meeting between Eliopoulos and O’Leary. O’Leary followed up a week later, looking to discuss “our new business model at StepStone, which is to provide SMA solutions to investment teams such as yours at CalPERS…” Neither Eliopoulos nor Mouchakkaa appear to have rebuffed any of the overtures, as per the documents released to FundFire…

Lapenna ultimately secured a meeting for StepStone executives with Eliopoulos to discuss the new “private market business model,” among other things, according to an email sent from his StepStone address.

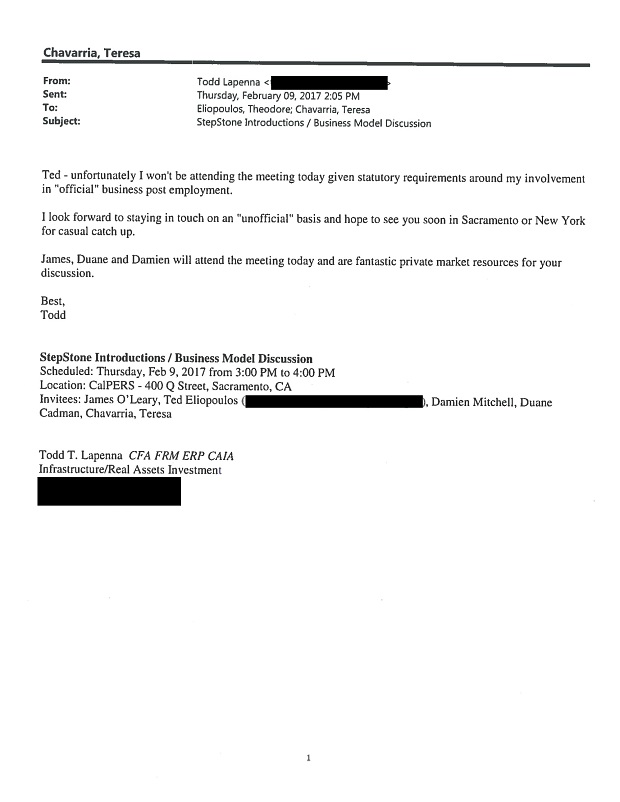

Lapenna did not attend that meeting. However, author Akinnibi published this document:

As anyone with an operating brain cell can tell, this is too cute. Departing CalPERS employees like Lapenna get firm written and verbal instructions on the legal restrictions on soliciting CalPERS business. Lapenna signaled that he knew what he was doing wasn’t kosher by first trying to pretend his business facilitation wasn’t really that by e-mailng from a personal account. Reporter Akinnibi points out Lapenna did it again with the February e-mail we reproduced above. Since when does anyone put their employer name and title in a personal e-mail? This was clearly meant to be seen as official correspondence.

Lapenna tried to have it both ways again by encouraging Eliopoulos to keep in contact with him in an “unofficial” capacity. It’s a no-brainer that Lapenna’s interest is to assist StepStone in winning more business with CalPERS, and that is clearly verboten under the California Political Reform Act. Even if Lapenna and Elopoulos had a pre-existing, shared, non-finanace interest, like they both sat on the board of a not-for-profit theater company, it would still be hard for Lapenna and Eliopoulos to steer clear of violating the law. As any provider of professional services will tell you, the reason most people participate in activities like that isn’t for the cause, it’s for the networking and informal selling opportunities.

Having said all that, the California Political Reform Act impose sanctions only on former employees, and not on government employees and officers who take lobbying and business pitches they know they should reject. So Eliopoulos was not the one at criminal risk in this impropriety. Nevertheless, he can’t pretend he didn’t know that any communication with Lapenna was not on the up and up. Eliopoulos was an accomplice to the violation. And CalPERS would have every incentive to release records that showed Eliopoulos rejecting Lapenna’s overtures, but Akinnibi says none were provided.

Elioupoulos is a lawyer. He’s been in politics for years. When his boss and mentor Phil Angelides left CalPERS, you can be sure both Angelides and Eliopoulos adhered strictly to the cooling-off requirements. Now it may have been that CalPERS, and even Eliopoulos himself, nixed Lapenna attending the February 9 business pitch, but they never should have been in communication, much the less even have scheduled a meeting with Lapenna.

The reason this incident matters isn’t just that it illustrates that CalPERS has a fast and loose relationship with the law. It’s also that Eliopoulos, remarkably, has managed to abandon virtually all of the parts of the Chief Investment Officer job that involve making investment decisions, and has turned it into an almost entirely administrative and ceremonial post. If he can’t even do that right, why is he still employed, much the less getting big bucks?

No wonder CalPERS board is determined to keep people like Flaherman and Brown off the board… even if that requires running illegal election processes.

Thanks for your continued reporting on CalPERS, PE, and pensions.

longer comment in moderation. Shorter:

Past time for CalPERS to lose its Accredited Investor status.

Thanks for your continued reporting on CalPERS, PE, and pensions.

Sorry regarding the comment. I don’t see anything in moderation or even trash. Sometimes Skynet eats Lambert’s any my comments Apologies.

Thanks for looking. Skynet has its own opaque and unaccountable ways. (much like CalPERS’ , imo.)

Thanks for looking. Skynet has its own opaque and unaccountable ways. (much like CalPERS’ , imo.)

:) ^^^

These sort of anti-corruption laws limiting how ex-government workers can interact with their former agencies on behalf of their new employers are routinely ignored. Usually you’d have the ex-worker under some nominally unrelated project/role, and then everything related to their former agency is done off the record. Lapenna showed extreme incompetence in not doing a better job of hiding it. In an e-mail where you’re CC’ing other people? “Unofficial” in big ol’, ironic quotation marks? Mindbogglingly stupid.

California has extremely tough anti-corruption laws, and my understanding is that they normally result in a blanket prohibition in dealing with CaLPERS during the stipulated period.

Right, they’d get placed on a contract for a different client. But that’s not going to stop the people at the company working on the CaLPERS contract from swinging by and having a chat about CaLPERS. As long as nothing is on paper, nothing can be proven. And so much of the value there in the ex-worker tends to be institutional knowledge; call this person, they have such and such’s ear, or they’re the one that can get something expedited, etc. They don’t need to be directly working on it in order to provide value.

That doesn’t work under the California Political Reform Act. It has very strong prohibitions against former employees having any business contact with a government body to advance the commercial interests of any third party. They ex employee most assuredly IS prohibited from talking with CalPERS for the cooling off period. You utterly missed that Lapenna was ALREADY working for a consultant to CalPERS, and any contact with CalPERS was prohibited.

Yes. All well and good. Is anybody going to do anything about it? Are those “very strong prohibitions” going to be enforced? It appears not. Rather like the U.S. Treasury’s Comptroller of the Currency in his regulatory role ten, fifteen, years ago. Thank you for informing us, but the ongoing story is quite discouraging.

Yves, Calpers is about average for a Californai agency when it comes to corruption and incompetence, and Eliopolous is acting in a way which is considered perfectly normal by members of our political class.

Do you really expect him to be held to the same standards as “Ordinary folks”?

So you think it’s fine to engage in misconduct? That is what you are effectively saying.

CalPERS has not historically operated this way, and you don’t appear to understand why. CalPERS has a $300 billion pot of money. It also had a bribery scandal in 2009 that led its CEO to go to prison for 4 1/2 years. CalPERS has historically complied carefully with this rule. Having the CIO operate this way is consistent with a much more rule-breaking attitude under the current general counsel, Matt Jacobs.

CalPERS has not historically operated this way, and you don’t appear to understand why.

CalTURDS has acted this way, fraudulently, going back more than 20+ years. SB400 in 1998-99 was straight up fraud. It could be prosecuted under RICO laws by the Feds, or the State AG (we know the State AG is NOT gong to prosecute); and even privately by member muni’s who are a part of CalTURDS. What CalTURDS should do, and what they actually do, are contrary to each other. They certainly did not “historically” operate using benchmark fraud, but they do today and have been for 20+ years; that is the bottom line.

Did everyone see that Sen Sherrod Brown is introducing a bill so that the federal govt can provide loans to allow the under-funded pensions to borrow money from the fed govt?

I called his office today and told him he, of all people, know who took the money. The pensions were robbed just like the homeowners were. So, now the fed govt must be concerned about real torches if the pensioners (judges, govt employees) can’t receive their retirement money.

Sen Sherrod Brown 202-224-2315.

This isn’t underfunded public pensions like CalPERS. This is ONLY underfunded multi-employer private pensions, which is a relatively small category.

If they get this one passed, that would be an easy escalation to pass one for the rest of the pensions. It’s shameful. Sherrod Brown should know better.

Let’s watch what California Attorney General Xavier Becerra does about this well-documented article from one of the most relied-upon news sources on the planet! He will doubtless overwhelm the thundering cacophony of grass growing outside the state capitol building with the mighty thunder of the righteous wrath of our one-party state.

Oh, please Mr. Becerra, think of the humanity! It would be so MEAN to send an upstanding man like Mr. Lapenna, who is just trying to help-out one of his close personal friends, to one of our fine prisons, where petty offenders are so stacked-up that until recently 50 men had to share a single toilet…

Teddy is the golden boy and knows it. Zero investing experience, zero accomplishments yet becomes the CIO of the largest pension in the US based on his last name and who he knows……

Calpers compliance hires over the past few years are really just a grand facade if this type of thing is happening, just imagine all the stuff we dont know about……..yet