By Jomo Kwame Sundaram, former UN Assistant Secretary General for Economic Development and Anis Chowdhury, former Professor of Economics, University of Western Sydney, who held various senior United Nations positions in New York and Bangkok, and Zera Zuryana Idris of International Islamic University, Malaysia. Originally published at Inter Press Service

Although quite selective, targeted, edited and carefully managed, last year’s Panama Papers highlighted some problems associated with illicit financial flows, such as tax evasion and avoidance. The latest Global Financial Integrity (GFI) report shows that illicit financial outflows (IFFs) from developing countries, already at alarming levels, continue to grow rapidly.

Illicit Financial Flows Growing Rapidly

With international financial liberalization enabling investments abroad, ‘legitimate outflows’ have also been growing rapidly, heightening macro-financial risks to countries. Many of today’s financial centres compete intensely to attract customers by offering lower tax rates and banking secrecy.

It is generally presumed that IFFs are related to tax evasion and corruption. Such financial flows largely involve financial service providers, law offices and companies with transnational activities, often involving investments in real estate and other assets worth billions. Besides enabling governments and legislation, legal and accounting firms as well as shell companies have been crucial.

The GFI report estimates that developing countries lost somewhere between $620 billion (bn) and $970 bn in illicit outflows in 2014. The Washington-based think tank found IFFs from the South to be 4.2-6.6% of total developing country trade for 2014, while inflows were 9.5-17.4%. Total IFFs of all developing countries in 2014 were estimated at $2,010-3,507 bn.

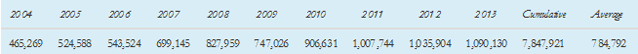

Illicit financial flows of all developing countries, 2004-2013

During 2005-2014, IFFs from the South were 4.6-7.2% of developing countries’ total trade, while such inflows were 9.5-16.8%. GFI attributes about 3.3% of IFFs over this period to fraudulent trade mis-invoicing or ‘transfer pricing’.

China, Russia, Mexico, India and Malaysia lead all countries in illicit capital flight. Since 2012, emerging and developing countries have lost over a trillion dollars yearly that could invested productively in industry, agriculture, healthcare, education, or infrastructure.

Methodological Doubts

GFI estimates have been criticized, e.g., for making unrealistic assumptions about trade-related transport costs and ignoring other explanations for ‘errors’. For instance, estimated GFI outflows include IFFs and trade mis-invoicing estimated from inconsistencies in trade data.

For GFI, ‘leakages’ (errors and omissions) in the balance of payments (BoP) are a type of IFFs. It assumes that all unreported leakages in inflows and outflows of a country are illicit. While long associated with capital flight, such BoP leakages may include legitimate reporting errors, as the report recognizes. But as such leakages only account for a small fraction of total IFFs estimated by GFI, they are not likely to appreciably affect overall estimates.

Criminal Activities

IFFs in developing countries may also be due to transnational criminal activities, which GFI estimates globally for 2014 as follows: counterfeiting ($923-1,130 bn), drug trafficking ($426-652 bn), illegal logging, ($52-157 bn), human trafficking ($150.2 bn), illegal mining ($12-48 bn), illegal fishing ($15.5-36.4 bn), illegal wildlife trade ($5-23 bn), crude oil theft ($5.2-11.9 bn), small arms and light weapons trafficking ($1.7-3.5 bn), organ trafficking ($840m-1.7 bn), trafficking in cultural property ($1.2-1.6 bn), totalling $1.6-2.2 trillion.

‘Legitimate outflows’ have also increased rapidly in recent years. Besides the decades-old promotion of tax exemption for ‘free trade’ or export-processing zones, some emerging market economies have recently promoted and enabled outward foreign direct and portfolio investments.

Such capital outflows are said to balance portfolio investment inflows increasing foreign ownership of emerging market economies’ corporate sectors. But such ‘balancing’ provides no protection in the event of financial panic and a rush to exit. The push for ever greater financial liberalization thus exposes them to greater fragility and vulnerability.

Participating in such a ‘race to the bottom’ by offering tax loopholes typically involves making ever more concessions to the rich and powerful. Rich countries have been quite selective in administering anti-bribery rules, and rarely take effective action, e.g., to prevent anonymous companies being abused, as highlighted by last year’s Panama Papers revelations.

International Cooperation Needed

The nature and scale of illicit flows mean that international cooperation is urgently needed. While progress has been slow at the United Nations, the cooperation of the International Monetary Fund and other multilateral institutions will be vital for progress. If not, rich countries will continue to ‘call the shots’ through the OECD ‘rich country club’, which has been dominant on international tax matters.

Peak national authorities should work closely with different bodies like the central bank, tax revenue authorities, customs authorities and police to enhance tax collection, increase government transparency, improve natural resource control by government, and enable public scrutiny of revenues and other public accounts.

Such efforts will require more evidence and modes of investigation, as well as the cooperation of all relevant parties. Ultimately, political will, especially to take on powerful vested interests, will make the difference.

Further international financial integration after the 1997-1998 Asian financial crises and the 2007-2009 global financial crisis has resulted not only in fast growing financial outflows from the South, but also in greater vulnerability to new sources of volatility and instability.

$150 bn in human trafficking…..collectively, we are the pits.

It was the illicit trafficking in animals that got me.

I suppose a lot of the people doing the initial wrongdoing are simply desperate.

But the fact that there is such desperation in the first place…

Thank you, Clive.

It’s rarely discussed that many game parks or much of the land that forms part of game parks are privately owned, often by foreign investors such as Richard Branson. A small park in Kenya is owned by a former school classmate and her husband, both from the Home Counties.

Have you noticed on TV how locals rarely feature in segments about game parks, poaching, wildlife etc. unless as wrong-uns. It’s often an outsider piping up.

As you say, they are desperate. A couple of years ago, one of usual suspects who pontificates on the UK MSM, without actually knowing much, suggested that locals be relocated from game parks so that animals could survive. Owen Jones appeared not to realise that such locals had survived alongside wildlife for millennia and the decline in numbers, poaching and impoverishment coincided with the arrival of imperialists.

Wildlife poachers, at least here in SA, recruit their ground level operatives (I.e. the guys who actually track, kill and de-horn the animals) from impoverished communities living around the wildlife reserves. They’re highly sought after for their knowledge of the landscape and behaviour patterns of the animals (and in some cases, affinity with the animals), and of course the abject abject poverty which makes them easy prey for the high level operatives who run the distribution level of the value chain (and more often than not, foreign nationals).

Yes Clive desperation & I fully agree with all three of you in the sense of victims being forced into creating more victims. I suppose that my comment is meant in the sense that we as a species are all part of that which creates these evils in the first place.

It all reminds me of the situation during the height of laissez-faire in19th century England which was fairly well illustrated by a BBC documentary which featured people pretending to live in a courtyard slum at different levels of precariousness. Basically everybody ripped off those below them as they had no other choice in order to survive within a system which was almost impossible to climb out of. At the bottom was the single parent female whose only recourse was to sell her body to avoid starving.

Everybody’s scum of the earth but for the most part only a blameless symptom of a largely ignored disease.

Yes, a disease called human overpopulation, which is at the pointy end of our progressive extinction of other species – not just the high profile species in Africa. Until such time as we control our own populations, the loss of other species, both plant and animal ,will continue until the planet is unliveable for us too.

According to the African Union, there’s an $80bn drain of capital from the continent annually from IFF. Concomitantly, there exists incessant lobbying for capital controls to be abolished where they exist, enforcement mechanisms are either lax or routinely sabotaged/”bribed away” and transnational corporations employ the carrot (promise of FDI inflows) and stick (threats of exit and divestment) approach to whip dissenting governments back into line. Multinational consulting firms sit at the very heart of this intractable trend, offering advisory services that exploit legal loopholes and grey areas to legitimize capital flight on a massive scale, while ratings agencies wield so much power they can trigger panic induced currency exits with just a threat of a downgrade (again to whip dissenting governments back into line). IFF is a feature, not a bug, of financial liberalization.

Thank you and well said, Thuto. The infrastructure exists to maintain colonial rule by stealth, including buying local elites.

I can’t comment about other AU states, but in Mauritius, whence came my parents and an SADC member state like RSA, interest rates and the rupee were kept high for many years, often crippling exporters like textiles manufacturers and fish processors, so that investors and the kleptocrats who hijacked the country at independence could minimise their foreign exchange risk when exporting capital.

One former finance minister owns an apartment, worth about £1m, overlooking the Tower of London, Tower Bridge and City Hall. A front man for political and criminal interests owns a hotel in Fitzrovia, the part of London at the back of Oxford Street. A former prime minister and son of a former prime minister (Mauritians are intimidated by dynasty and hereditary so-called socialists) owns homes in Kensington and Surrey.

Thanks Colonel Smithers, your “infrastructure exists to maintain colonial rule by stealth” characterization is quite apt. For many African countries, the current account is perpetually languishing in deficit mode, with balance of payments rather than trade deficits driving this trend (studies suggest that hitting a 5% current account deficit is often a strong signal that speculative investors will trigger a currency run) so countries can find themselves caught in a vicious cycle where capital flight drives panic currency runs induced by widening current account deficits.

Speaking of despots/frontmen parking their ill gotten gains in ultra high end London real estate, it strikes me as odd that the UK has taken it upon itself to investigate one of the candidates in the upcoming leadership race of the ANC for money laundering via London (she’s alleged to have received money from a family that uses British banks to clean its money). A government presiding over the global hub of money laundering investigates individuals in a former colony for money laundering through this self-same hub!! Ironic

Thank you, Thuto.

I have been following that story out of general interest, but also because of what I do in the City and who I have worked and work for, and the similarity with Mauritius.

It is richly ironic, as you say, especially as one of the banks was set up with drugs money in a former colony and owned and run by the ancestors of people who are now aristocrats, related to the royal family and provided a recent prime minister.

What bank and family are these please?

Some professional interest here.

Mere pikers. The Nigerian leadership has real estate holdings around the world, and have “exported” enough revenue which if spent in Nigeria would lift it to almost fist world standards.

The last estimate I saw of “stolen wealth” for Nigeria’s oil was $500 Million. It is probable this number has reached the billions by now.

Of course, the Saudis’, that fine, noble and considerate set of rulers, have not stored their wealth overseas and heavily invested at home.

The ex-minister of oil in Nigeria was arrested in London in 2015 after billions went missing in the coffers of the oil ministry during her 5 year tenure. Real estate holdings from London to New York to Houston to Lagos, worth hundreds of millions, and luxury yachts, have been seized in an attempt to recover some of the funds.

It was GFI that originally stirred my interest in this subject and its founder, Raymond Baker’s, important book “Capitalism’s Achilles Heel.”

I think a more perfect world would require every company to incorporate itself in each of the countries it does business. The concept of foreign companies under different regulatory requirements and accounting rules to local companies should stop.

That would complicate if not end the multinational company’s predilection for transferring costs and expenses between jurisdictions regardless of the real situation and facilitate the payment of appropriate levels of tax in every jurisdiction. It has been audit based accounting that has denied poor countries the revenue they should get and allowed the MSM to slur their names.

+1, I couldn’t agree more.