By Silvia Merler, an Affiliate Fellow at Bruegel in August 2013. Previously, she worked as Economic Analyst in DG Economic and Financial Affairs of the European Commission. Originally published at Bruegel

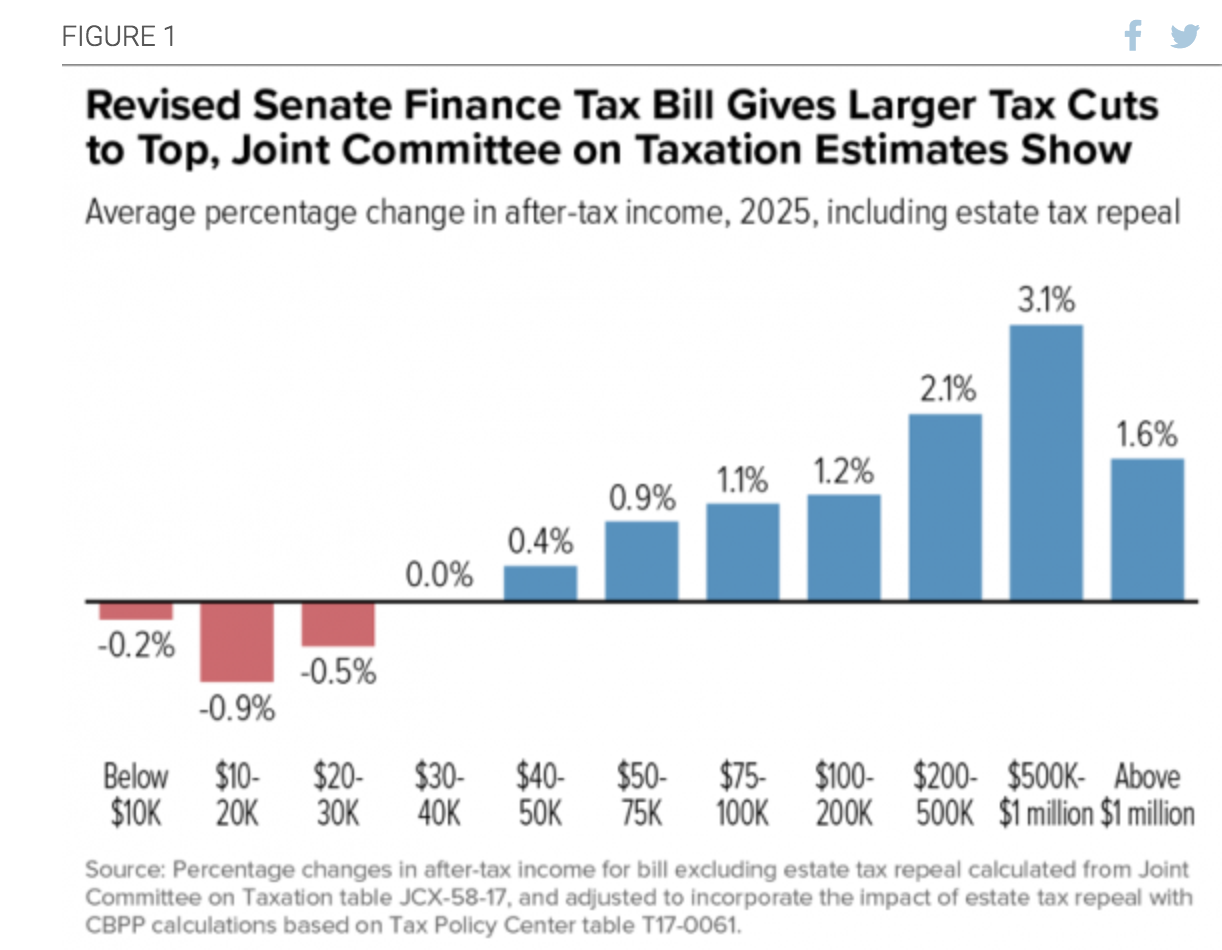

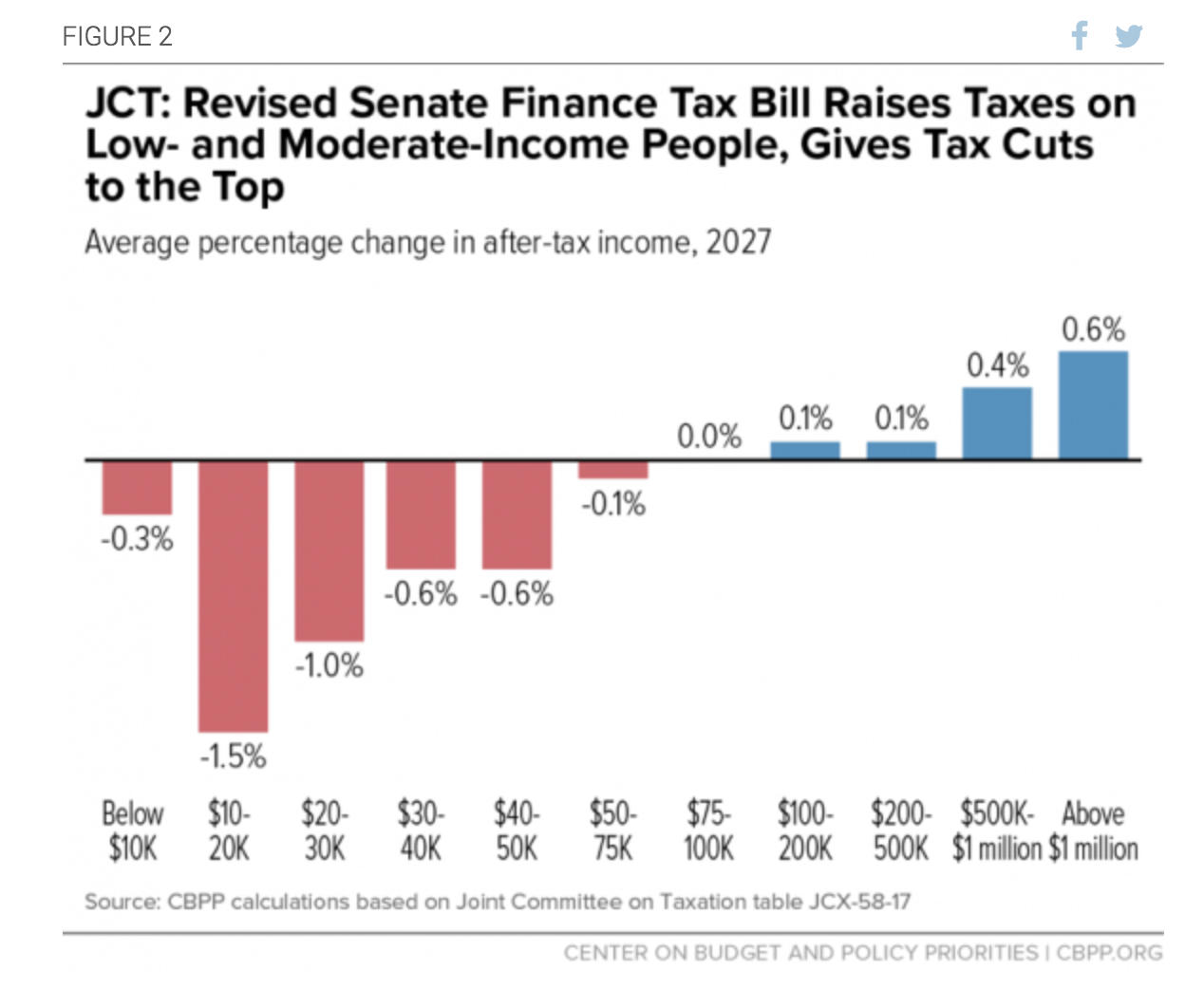

The Penn Wharton Budget Model has analysis (both static and dynamic) of the impact on the federal budget and the economy of both the original and amended House and Senate versions of the Tax Cut and Jobs Act (TCJA). The Centre on Budget and Policy Priorities looks at the distributional impact, showing that under the amended Senate bill, in 2025 (when most of its provisions would be in place), high-income households would get the largest tax cuts as a share of after-tax income, on average, while households with incomes below $30,000 would on average face a tax increase (Figure 1). By 2027, when many of its provisions would have expired, those at the top would still get large tax cuts, but every income group below $75,000 would face tax increases, on average (Figure 2). Despite raising taxes on millions of middle- and lower-income households, the bill would add $1.5 trillion to deficits over the decade due to its large tax cuts for high-income households and corporations.

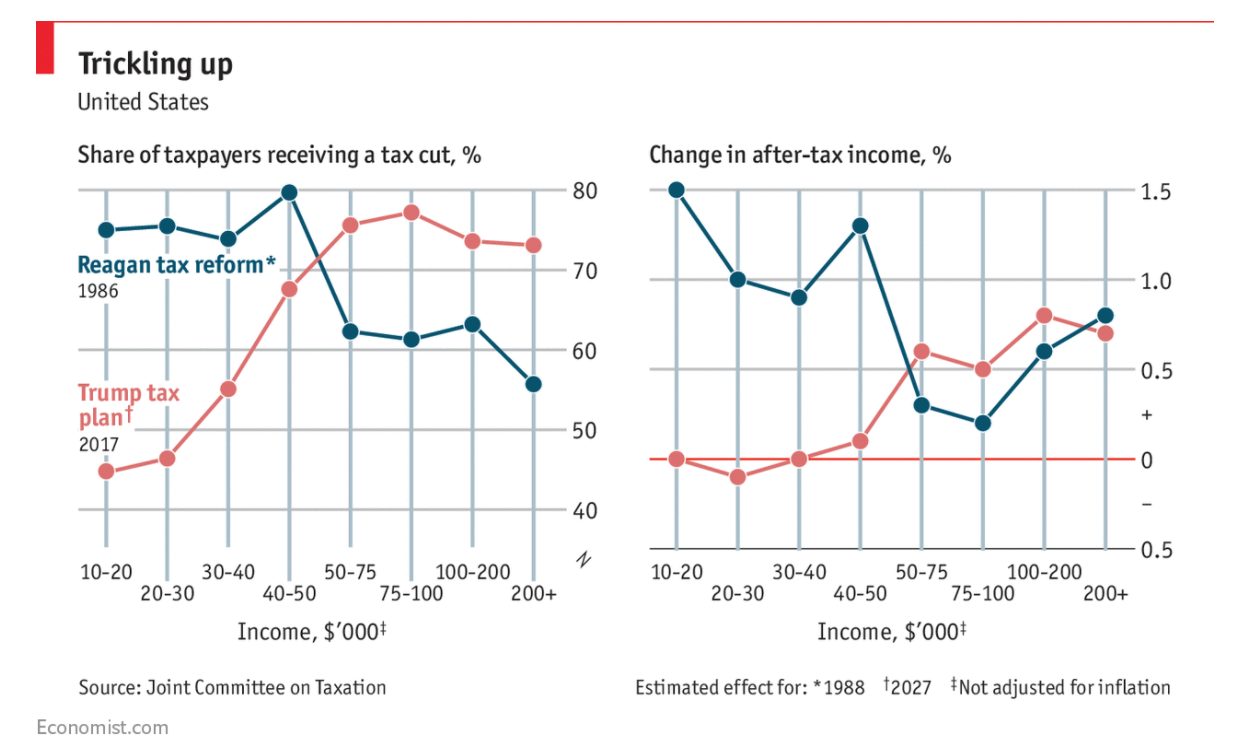

The Economist compares the current administration’s tax plan with the Reagan administration’s Tax Reform Act of 1986, as Republicans embark on yet another sweeping rewrite of the tax code, which many point to as a model to emulate. However, while the authors of the 1986 Act relied heavily on advice from professional economists, President Trump’s Treasury department is yet to find a credible study supporting its claim that tax cuts will deliver enough economic growth to pay for themselves. Instead of seeking bipartisan support, Republicans are using the restrictive procedure of budget reconciliation to try to push the legislation through on a party-line vote.

The substance of the current Republican tax proposal also differs greatly from the 1986 Act. Congressional Republican leaders originally promised that any reform would not reduce the federal government’s overall revenues, but the current plan is expected to raise deficits by as much as $1.5 trn over ten years. And, according to figures from the Joint Committee on Taxation, most of the benefits will go to the rich, unlike Reagan’s reform (Figure 1).

Figure 1

Source: The Economist

Paul Krugman does not agree with the Trump administration’s claim that cutting taxes on corporate profits would lead to an explosion in private investment and faster economic growth, whose fruits would trickle down to American workers in the form of higher wages. Even if some part of this story were true, there would be side consequences that are not carefully discussed. Nothing in the bill would make Americans consume less and save more, so the money for increased investment would have to come from abroad — from selling stocks, bonds and other assets to foreigners. This inflow of foreign money would drive up the value of the dollar and lead to trade deficits, which would have a devastating effect on manufacturing. Foreign investors would be earning profits and taking them home, so most of any growth coming from cutting corporate taxes would accrue to the benefit of foreigners. Corporate tax cuts wouldn’t actually do much to raise investment, but they would explode the budget deficit. So in an attempt to limit that deficit blowout, Senate Republicans are proposing significant tax increases on working families. Krugman has another post trying to quantify the effects on growth.

Jared Bernstein agrees that the plan is likely to lead to more outsourcing of U.S. jobs and a larger trade deficit. First, the tax plan moves to what’s called a territorial system of international taxation, which means the U.S. tax rate on the overseas earnings of U.S. foreign affiliates would become zero, exacerbating the incentive to offshore jobs. Next, the implausibly large estimates of economic growth allegedly triggered by the plan depend on large capital inflows leading to larger trade deficits. A higher trade deficit doesn’t have to be a drag on growth if other parts of the economy are picking up the slack. But it will unquestionably hurt manufacturers, as the capital flows put upward pressure on the dollar, making exports less price competitive.

Emmanuel Saez and Gabriel Zucman say the tax plan slams workers and job-creators in favour of inherited wealth. Republicans will claim that cutting taxes on wealthy business owners will boost economic growth and end up benefiting workers down the income ladder. The idea is that if the government taxes the rich less, the wealthy will save more, grow U.S. capital stock and investment, and make workers more productive. The evolution of growth and inequality over the past three decades makes such a claim ludicrous. Since 1980, taxes paid by the wealthy have fallen dramatically and income at the top of the distribution has boomed, but gains for the rest of the population have been paltry. Average national income per adult has grown by only 1.4% per year — a poor performance by both historical and international standards. As a result, the share of national income going to the top 1% has doubled from 10% to more than 20%, while income accrued by the bottom 50% has been almost halved, from 20% to 12.5%. There has been no growth at all in the average pre-tax income of the bottom half of the population over the past 40 years — during which time the trickle-down enthusiasts promised just the opposite.

Angry Bear notices that one of the arguments that Republicans are using to support their tax bill is that it will unleash investment, but the data says otherwise. Currently, most U.S. economic sectors are operating far below maximum capacity utilisation. Right now, it makes far more sense for companies to bring unused capacity back online rather than buy new equipment. Interestingly, mining seems to be the only industry where a boost in investment is possible. The counter-argument is that spare capacity is outdated; as orders increase, companies will be forced to add new, more modern capacity. The problem with this argument is that industrial production is actually very weak, so in order order to see an increase in capacity utilisation, we need industrial production to pick-up.

Martin Wolf says that the Republican tax plan is built for plutocrats. Republicans aim at slashing spending on nearly all of the non-defence discretionary spending of the federal government, plus spending on health and social security. In all, this is a determined effort to shift resources from the bottom, middle and even upper-middle of the US income distribution towards the very top, combined with big increases in economic insecurity for the great majority. How has a party with such objectives successfully gained power? Wolf thinks that we can see three mutually supportive answers to this question. The first approach is to find intellectuals who argue that everybody will benefit from policies ostensibly benefiting so few. Supply-side economics, with its narrow focus on tax cuts, has been the main theory employed, because it directly justifies tax cuts for the very wealthy. But there is powerful contrary evidence. The second approach is to abuse the law. One way has been to give wealth the overriding role in politics that it holds today. Another is to suppress the votes of people likely to vote against plutocratic interests, or even disenfranchise them. The third approach is to foment cultural and ethnic splits. The economics and politics of pluto-populism have stoked cultural, ethnic and nationalist anger in the party’s base. Skilful demagogues are able to exploit this anger for their own purposes.

Richard McKenzie writes on the EconLog blog that critics of the Republican tax plan don’t appreciate two major problems with corporate taxes. First, corporations don’t pay taxes, people do. These taxes also come partially out of the hides of consumers as corporate managers seek to offset any reduction in after-tax profits by charging higher prices. To the extent that corporate taxes reduce companies’ after-tax rates of return, investments in their production facilities will be impaired, curbing supply and further raising market prices. With curbs in corporate production attributable to the corporate tax, the demand for labor can be tempered, undercutting worker wages and fringe benefits. The proposed corporate-tax-rate reduction will likely pad the pockets of the rich by some amount, but it will also increase the disposable income of people all the way down at the bottom of the income ladder. Second, capital – financial and real – and goods and services are now more mobile across national boundaries than ever before. The growth in the mobility of firms, and the greater demands they face to be cost-competitive, means that governments have necessarily been forced to consider in the development of their tax policies the tax rates charged by other countries. The most important, powerful, and least-touted argument in favor of the Republicans’ corporate-tax-rate reduction is that the United States has the highest tax rate in the industrial world.

Ryan Bourne at the Cato institute believes that there is a lot for economists to like in the tax bill. On the efficiency and growth front, changes to the income tax code stripped away a whole host of small deductions and made significant inroads into some big ones too, as well as abolishing the AMT. The long-term consequence of the package of these reforms will be a combination of lower rates, fewer deductions and fewer people itemising. This will significantly reduce deadweight costs associated with taxation. The most important policy goal was a large permanent cut in the corporate income tax rate, and Bourne believes this will raise the level of GDP and wages. The other, final change of note is the planned repeal of the estate tax. Bourne argues that critics of the plan were wrong to say this was just about tax cuts without reform. The real debate for conservative economists should be weighing these efficiency gains against the consequences for the public finances.

To paraphrase the late Mario Cuomo: The rich took their tax cuts and spent the money on European vacations and fancy shoes. He was speaking of the Reagan tax cuts of the early 80’s. As I recall, those cuts blew a big hole in the US budget, which led to what was then the largest tax increase in US history. For a more recent iteration, the state of Kansas is offered for consideration. History repeating or rhyming?

…bought and sold republican majorities behaving as bought and sold republican majorities…many insidious features within…as we have already seen, devolution of ACA in Virginia causing $30,000. per year health insurance costs for family of 4, with $10,000. deductible…

and, it appears within tax bill is poison pill related to any future single payer movement….

but for once and all republicans prove they have nothing but propaganda interest in deficits…

What poison pill? I have not heard of this.

This commentary broadly parallels former Budget Director David Stockman’s takedown of the tax plan, published at the Z site last night. Stockman foresees a problem on the Senate floor:

Ah yes … the malignant R-word: never anticipated, but always a reliable precursor of several trillion in unplanned spending.

Unless we get an unprecedented 15-year economic expansion (which I would assign a probability of less than one percent), Trump or his successor will leave office in 2025 with $30 trillion or more of federal debt, up from $20 trillion now.

Spend and borrow, borrow and spend: it’s the time-tested R party formula.

Well the problem is that Ryan and McCarthy (House Republican Whip) have already given an answer to this “pay for it” by cutting Medicare and Medicaid. That will happen automatically thanks to existing rules but they plan to “get our spending in order” as a next step following this. That was, in fact, the plan all along.

I strongly suspect that behind the scenes this is exactly what they are promising the “Deficit Hawks” who have a long history of loathing Medicare and Medicaid. This bill, in some ways gives them the option of cutting that without actually voting to cut it directly.

As insidious as what you say sounds, it is difficult to interpret Ryan’s zeal for this obscene and pointless tax cut except in light of Ryan’s stated loathing for anything Social Security. He seems to be cynically depending on deficit hawks to cut Social Security benefits (Medicaid then Medicare then pensions) in order to fix the burgeoning deficit that THEY want to create.

You gotta wonder whose government the Congress represents.

“You gotta wonder whose government the Congress represents.”

Actually, it seems perfectly clear to me: name a new policy being pursued by anyone on the hill that will do anything for anyone but the super-rich. There is an obvious and small group of elected officials who will be behind anything you find, and that group is far removed from effective power.

What passes for “moderate” at the moment is those who are mildly embarrassed by how much their super-rich funders want to take from everyone else. And they’re not arguing, “don’t do it!” their asking what cloak or smoke screen they can do it under to get re-elected again without having to give up any of the perks they get from their funders.

Congresscritters are all in thrall to their donors. Notice that news reports no longer talk about voters? Now it’s all donors, all the time. The billionaires are running the show, and they are pathological in their greed. I do not use the term lightly. They either don’t realize or don’t care that in their endless desire for More they are destroying the very society that made them possible.

The average citizen probably tunes out tax discussions after a few sound bites, in part due to mistrust of Congress and their self-serving minions, and in part due to what may be perceived as specialized terminology (e.g., those horrible tax forms revised for every April 15, marginal rates, tax expenditures). They may feel that they have no control over what happens and so just want to see what they will have to spend when the dust settles (can they still afford bread, or maybe splurge on a trip to the circus). There may be resources showing the following already, so please let me know.

Pundits comment, for example, about the bottom half not paying any net taxes or the top X percent paying Y percent of all taxes, so why not demystify those and show the number and dollar sizes of the cohorts in addition to the relative changes? What may be of interest to them would be graphics showing the following:

Who earns how much pre-tax, that is how many thousands or millions of people are in the various income and population cohorts.

Who pays taxes of how much of that, to show their take-home pay, and difference.

How their tax payments relate to the overall tax collection.

All they really want is truth, not sophisticated PR. Why would they believe that any repatriated money would be reinvested to trickle down? If anything, the recent election and media stories would seem to point toward rampant self-interest spouted by people with nicer clothes and haircuts.

Reaganomics/Supply Side/Trickle Down economics is a lie, has had 37 years to exhibit that it is a lie, and is nakedly indefensible by anyone who is paying attention. It has been a complete and abject failure at its stated goals (public position), while accomplishing its actual goals (private position) with flying colors.

“Trickle Down” is accurate only in that this system can accurately be described as the rich pissing on the poor.

Every president for 37 years has cut taxes on rich people and corporations, then claimed “fiscal responsiblity” was the reason we had to destroy the (inferior to European nations even at its peak) social safety net. Their victory has been so complete that stealth republicans have been nominated to the Democratic presidential ticket every year since 1992.

All that said, I fully expect some version of this bill to pass and the criminality to continue. Someone please give me a reason to believe otherwise. Please.

Trickle down has a disastrous history going back 100’s of years in the USA and millennia world-wide.

Trickle down of what? It’s certainly not money.

Trickle down of what? We can’t say what it is. Because this is a family blog.

It has been my opinion that it is the taxes that trickle down. When tax cuts for the rich are paid for by decreasing discretionary spending states and local government receive less money. To make up for shortfalls they either increase taxes (or fees) or decrease services. Remember that most state and local taxes are regressive.

Anecdotally, I discussed with a conservative county commissioner why fees for meals on wheels had had a dramatic increase. He reluctantly admitted that it was due to cuts from federal matching funds. So essentially the tax cuts for the rich were paid for by the disabled and elderly.

You can find your senator by state here: http://www.senate.gov/states/ And you can find your local representative here: https://www.house.gov/representatives (see the zip code lookup at the upper right-hand side of the page).

When you call ask to speak to the aide who deals with taxation. They may offer to take a message, I usually try to insist on speaking to the aide but a polite message reminding them of their promises. You can also try to target one of the ones who are

holdoutsplaying coy such as:Corker Who says he is worried about the deficit.

Flake Who says he is worried about the deficit.

McCain Who says he is worried about the deficit and who earlier this year demanded a return to “regular order” with appropriate hearings before votes take place.

Collins Who says she is concerned about ending the ACA and the mortgage deductions but says that she believes Trump when he promised to fix the ACA.

Murkowski Who says she is concerned about ending the ACA but appears to “believe in freedom” more and is sated by the fact that they promised to open up more oil drilling in exchange for her vote.

As a followup I just tried McCain, Murkowsky, and Burr. McCain’s office sent me to voicemail immediately. Murkowsky said “we are experiencing higher than usual call volume” and put me on hold. And Burr simply gives a busy signal.

If you can wait until the weekend, call McCain’s office then. I’ve had no problem getting through.

Or you can call one of his AZ offices. That works too.

Always call the local office. Makes you look like a constituent too.

Oddly enough I’ve never had a good experience with my Senators’ local offices. Perhaps it is their staffing choices but they always plead ignorance of actual policy and take messages which are never returned. I agree that it does help in looking like a local but at least I’ve been underwhelmed.

Yves, I have a simple question. I’m in agreement that the tax cuts will not be very stimulative, but why should we worry about federal deficits? I feel we should be worried about other issues related to the tax cuts rather than the federal deficits they will create. Your thoughts?

“Deficits don’t matter” — D. Cheney

Take it from one who knows.

R. Cheney; “You obviously don’t know anything about economics”, to at time, new Congressman Inslee “questions”, democratic party representative to bush-cheney secret energy meetings, ENRON…(Inslee being economics grad)

“Free Lunch”; David Cay Johnston

I fax them,, via fax zero, and email them, and call them. Innundate them. I remind them how unpopular the bill is as well as how unpopular this POTUS polls.

I am not at the stage where I can do nothing.

I managed to get through to leave a message in McCain’s office. Burr is still a busy.

I spent plenty of time in the DC congressional offices a few years ago, once after the newtown incident when the gun restriction was back in play (phone’s ringing off the hook).. Friday afternoon it really slows down. You should have the best luck during that window from noon to 4:00pm EST.

I take the reason as being all the people that are visiting those offices, are doing it for a living (lobbyists of one form or another) and want to catch the afternoon flight or train ride back to where they came from.

Also in the morning say 7-8am EST before things get going you can usually get through on the phone too. All the people answering the phones are beautiful college age individuals (male and female), that spend all day getting their ears chewed, and taking notes (clickety clack fast typing) of what is said over the phone. Very interesting to see.

The more effort you spend as a constituent on outreach to congress, the louder your message. Email is worth nothing, a call is worth little more than nothing. A visit to the local office is worth a lot, and a visit to the DC office trying to get a meeting with the legislative advisor is priceless.

This is another reason why the middle class and poor are not represented well. They have non of the resources (off work time and/or money) required to effectively engage their congress critters.

My 2 cents

Thanks, Tim. I too spent years in Congressional offices, but years ago [let’s just say it was before e-mail] and endorse the points you made. I’d add:

*keep it short and to the point. Your communication/”argument” is NOT either going to reach the Senator/House member nor “convince” them. Just make your point re “vote against the tax bill because [one point].”

*you’re not limited to one destination for your correspondence. Contact the DC office AND the local office. If for a Senator, OFFICES; there are probably several in your state.

*you’re not limited to one form of correspondence. Send a postcard; make a phone call; write an e-mail. Thanks, Tim, for your affirmation of the “priority” with which various forms of correspondence are weighed.

*contact friends & family and ask them to communicate. Even offer to help them. As you point out, Congressional offices keep a “tally” and brief notes, so a flood of “oppose the tax bill” with succinct reasons will be noticed.

*As you say, a visit to the local congressional office weighs greatly. [This is also why Congress-critters hate those “district meetings” that constituents attend.] If there’s any way you can go, do so. Ask for an appointment with the legislative director or person who handles “tax matters” or pending legislation.

Again, thanks Tim, and good luck to all.

Trump’s Tax Promises Undercut by CEO Plans to Reward Investors [Bloomberg]

Pretty damning, although weirdly the phrase “executive compensation” does not occur in the article.

In any case, once Collins, Corker, Flake and company finish preening for the cameras, it’s a done deal.

If you have a load of share options, then share buybacks – boosting the stock price – are a great way of indirectly paying yourself.

Of course, an old fashioned investor might want to see companies investing in growth rather than buying their own shares (nothing better to do?)..

…”the president’s” actual goal is no economic crash prior 2020 election cycle…seems this is where he has his bet…

of course it’s a “win-win-win” to-from republican donors and variety of other within bill…including end ACA..

The Urban-Brookings institute released a new calculation on the effects of the bill (see here. Like the others it projects a modest initial increase in economic demand whcih is then eaten up by deficits. One of the more interesting points is that they cite some of the things that they are considering which drive the increase:

So the gains come not from “investment” so much as people working even more at low wages. How exactly is that a help to the middle class? (sarcasm).

I always find it interesting when studies predict that a person not working or working at a low wage job, would consciously decide to find a job or work more hours if there income tax rate was lowered. Do people in such situations really sit down and say to themselves, “My low wage job is killing, but I’ll ask my boss to work more hours if I can pay less in taxes” or “I have been out of work for a year and given up looking, but if my tax rate goes down I’m going to go out again and start looking for a job”.

There are really two distinct components to this tax plan – one for individuals and corporations, and the other for plutocrats.

The individual and corporate component aims to modestly lower taxes by shifting its burden between income levels and probably growing deficits which they think can be offset by some higher growth inspired by this plan. I think one current projection estimates it cumulatively distributes $1.5 trillion of savings to business and individual taxpayers over the next decade.

The plutocrat component, however, is an immediate and infinitely larger per capita tax break that centers around repatriation. For over a decade large corporations, and hedge funds have been deferring taxes on some portion of their profits in legal entities that are registered in overseas jurisdictions. These profits are currently invested in bond markets, and its owners cannot spend this money until all deferred taxes have been paid.

In the case of hedge funds, these profits accumulate over a decades worth of the 2% annual cut of all client assets from their ‘two and twenty’ compensation structure (the ‘twenty’ portion incidentally falls under the ‘carried interest’ tax loophole). Hedge fund owners, and some of their employees, will have to pay accumulated taxes estimated to be between $25-$100 billion when this tax deferral expires in April 2018. This deadline is a likely motivation behind the legislative urgency to repeal the Alternative Minimum Tax, which will retroactively remove years of deferred taxes that hedge funds owe the government. Its speculated that this tax deadline is the reason that former hedge fund manager George Soros transferred $18 billion to his Open Society charity last month.

In the case of large corporations, these profits accumulate over a decades worth of fees to foreign subsidiaries which own all their intellectual property rights, and profits from overseas sales. There is currently $2.5 trillion of deferred tax profits residing in these legal entities. This tax plan calls for a Tax Holiday which allows the repatriation of ‘overseas’ corporate profits at a deeply discounted tax rate. Many of these companies have a concentrated ownership by plutocrats with names like Bezos, Gates, Ballmer, Allen, Page, Brin, Schmidt, Zuckerberg, Powell-Jobs, Cook, Ellison, Walton, Knight, Murdoch, and Buffet. The last Tax Holiday we had in 2004 (when less than $500 billion was deferred in these subsidiaries) allowed Microsoft to repatriate $32 billion, which they immediately distributed as a special dividend that paid Bill Gates $3.3 billion, and Steve Ballmer $1.2 billion.

What this amounts to is a tax plan that will shift tax burdens to modestly reduce taxes for some groups, while at the same time facilitating billions of dollars in immediate cash payments to the wealthiest plutocrats on the planet because of its Alternative Minimum Tax repeal, and overseas Tax Holiday. As for promoting growth, watch for the response when Gary Cohn asks CEO’s “If the tax reform bill goes through, do you plan to increase investment – your company’s investment, capital investment?”.

With respect to this point:

I’m afraid that I just don’t see this argument as valid. Yes companies seek to avoid taxes at all costs and seek to pass on costs to consumers. But that is hardly an argument for letting them off the hook. And that does nothing to justify the top-loaded nature of these cuts. If anything that fact argues for increasing the top-tier tax rates and repealing things like the carried interest loophole. It does not argue for shifting the burden down to those who can least afford it and who, in McKenzie’s argument, pay the costs of corporate taxes.

By the same token it is not clear how this would do anything about the capital shifting. If you respond to the mobility of capital by giving in and lowering the share that capital pays that does not give them an incentive to do more. By this logic the upper income tax cuts and the tax holiday should have produced massive investments and wage growth. They did not.

I would hardly call this the “least touted” since they mention it ad-nauseum. In point of fact we are not the highest taxed in the world when you consider total taxes and actual tax receipts. We only have the highest income rate on paper. That is a key difference that McKenzie seems to ignore (perhaps on purpose).

If corporations are people for speech purposes, they should pay the same tax rates and have all the same legal liabilities and responsibilities as people, too. Either they are people, or they are not.

+1000

T.D.,

..language excerpted by fundamentalist supremes (“citizens united”) was not taken as they purported from 1880’s legislation, rather from preamble to legislation; info available, Jack Beatty’s, “Age of Betrayal-Triumph of Money in America, 1865-1900”, pages 200-210, among other resources…

and btw, if $$$$ = speech, speech isn’t free…

Impact of the Tax Cuts and Jobs Act on Families with Young Children [Tax Policy Center]

More evidence, as if any were needed, that the Culture of Life™ begins at conception and ends at birth.

I love this distinction to “non-defense” spending; where are the cuts to the “jumped-up general-isimos and the carrier admiral-isimos” and the plutcrat fixers for “flying turd” airlines?

Or is it that our two huge bordering oceans have just disappeared?

My understanding of the House and Senate tax bills is incomplete. However, both seem like giveaways to the top 10% of pass through entities (measured by revenues), and both are possibly a tax increase on the bottom 90%.

According to this CPA, the House Bill would apply the 15.3% FICA tax to all passive pass through income. In other words, if you own a rental property or two, and are in the 15% tax bracket, your taxes on that income would double.

https://greentradertax.com/why-the-tax-cut-may-disappoint-owners-of-pass-through-entities/

This site thinks that the House Bill allows ALL passive income to be taxed at 25%. In other words, someone who has one or two rental properties and modest other income may see their taxes increase by MULTIPLES. I have read other places that the Senate Bill is in accord with this.

https://www.natlawreview.com/article/tax-cuts-and-jobs-act-update-key-differences-between-house-and-senate-bills

So it appears that all those investors who bought properties for cash and rescued us from the the real estate crash are going to get a rude awakening.

I think if every landlord who owns 1-5 rental properties and is going to get skewered by this deal votes against Trump in 2020, he’s out. There are nearly 23,000,000 landlords in the US. Some are larger than 1-5 units, but it appears to me there are enough to put Trump on the street in 2020.

What Republicans say when asked why their tax bill benefits the rich most of all [WaPo]

Lots of Palinesque word-salad in defense of class

warfaregenocide,but the winner has to be:

A good reminder that the “or” in “Stupid or evil?” is nonexclusive.

Basically it comes down to the fact that Trump has totally betrayed the economic despair faction of his base. In a few years from now the evidence of this failure is going to be so much more obvious that even the Trump zealots cannot ignore it.

The only question is, can the Democratic Party be taken over by the left to appeal to the economic despair voters?

Certainly the Establishment won’t do anything. They are the very cause of the problem to begin with.

…republicans, having gotten what they wish from trump, in end will scapegoat him for their accomplishments…as well as, those voters allowed choose him over horrible candidates in first place..

..therefore, trump is perfect for republican party in all ways..

What is missing from the Mr Apple gets a tax cut and he will create many new jobs, but there is no guarantee that the jobs will be created, and if not is the money to be refunded?

How about an account say 5yrs pay. Either in US gov bonds or Insured annuity. That would create some stability to the employee. Why fire someone after 5 years when termination will also cost several years $$.

And what do I see being tossed around as an argument for this tax plan? Something with a bunch of blather and 100 economist’s signatures in an opinion piece from Business Insider.

http://www.businessinsider.com/trump-tax-reform-opinion-congress-pass-2017-11

Thank you Yves, for this useful and readable summary.

I think that Saez and Zucman sum-up this tax bill best — it is designed at its core to accomplish the one thing that the founders and great leaders of our nation always detested most. It is designed to create a rentier aristocracy of inherited wealth and to fleece all who create and all who toil. It benefits spoiled worms like the Kochs and the Trumps — who have never put in an honest day’s work in their entire worthless lives.

It is in a word: Un-American.

GOP’s foundational argument: Corporate tax cuts = More jobs

To my knowledge there is no empirical evidence to support this claim. Based upon my own anecdotal experiences watching/listening for years to Bloomberg, MSNBC, et al, a majority of the excess US corporate cash generated by lower tax rates and repatriation will be utilized in 3 ways:

1. Acquisitions

2. Dividends and stock buy backs

3. Continuing cash buildup in corporate war chests

(BTW…corporate bonuses will probably also begin to soar due to the accidental loophole left in the new tax act that won’t penalize egregious senior executive pay)

Analysts, in general will probably continue to press for strategic acquisitions (with the criteria being that anything under the sun will qualify as being strategic) but would also deign a buildup in the corporate cash war chest as a less than honorable (but acceptable) fallback, while activists will obviously continue to stamp their feet and continue to demand special dividends and share buybacks.

Not sure how this could ever possibly translate into more jobs.

If Republicans actually expect lower taxes to lead to higher revenue, why do they never expound on what we should do with all that extra money? And do they have in mind some “crossover point” at which they admit lower taxes will to lead to lower revenues?

Be interesting to interrogate them on that point, loudly and in public. :-)–

Of course what will really happen when revenues dive is Republicans will scream bloody murder about the deficit and the “desperate” need to cut programs that assist lower income folks — instead of simply raising taxes back up to where they had been all along on higher income people. And then they can re-initiate the sham-cycle over (and over) again as many times as they can get away for it.

Be interesting to interrogate the Republican party loudly and in public in advance as to what their response to lower tax revenue might actually be. :-O

Actually Bush II did promise to use added revenue to pay down the deficit — which is funny because, when he replaced Bill Clinton, surplus tax revenues (much fueled by the dot-com boom) were already paying down the defict. GW cut taxes: revenue dived down and debt spiked skyward …

… while the excessive tax savings the rich could not spend on themselves ended up being loaned to others thru loony bank lending schemes which fueled the real estate and stock market busts — which led to the deepest recession since the Great Depression.

* * * * * * * * * * * *

See Barry Ritholtz [and Wall Street Journal] seriously put the lie to Republican tax cuts:

http://ritholtz.com/2017/11/tax-cuts-dont-reduce-debt/?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+TheBigPicture+%28The+Big+Picture%29

Today’s Ian Welch post is spot on. Apologies if someone has already posted this.

http://www.ianwelsh.net/money-is-power-and-billionaires-can-subvert-democracy/?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+IanWelsh+%28Ian+Welsh%29

“The biggest problem with vast wealth isn’t that it directly makes other people poor, it is that it makes rich people disproportionately powerful. They have so much money that they can buy the state.”

DONE. And most people don’t know it.

The point has been made here before – bigness itself is a problem.

A big chunk of mass will bend something as beautiful and divine as light itself.

My spouse (Mrs. redleg) teaches at a private school. Today the Head of School had a meeting with the department heads and warned them to expect a mass exodus of teachers if the tax plan passes because it will make tuition remission taxable income.

At her school, they underpay the teachers but give a large >75% tuition remission for faculty/staff children to attend the school. The head of school expects this to be a large enough penalty to lose a critical mass of faculty. Teaching jobs are generally posted early in a calendar year, so if this passes before Christmas and the teachers pay that tax by April 15th, a lot of teachers and kids at private schools will be changing schools.

Apparently this applies to graduate students too, where remitted tuition will count as taxable income. As if the loans weren’t enough. Grad school for me was a long time ago so things might have changed, but I never factored tuition not paid into my taxes when I was a TA and RA.

I have yet to see this mentioned anywhere.