By Gabriel Ahlfeldt, Associate Professor of Urban Economics and Land Development, London School of Economics and Daniel McMillen, Professor of Economics, Professor of Urban and Regional Planning, Professor at Institute of Governmental and Public Affairs, University of Illinois. Originally published at VoxEU

Cities around the world are experiencing unprecedented vertical growth, but there has been little study of the economics of tall buildings. This column summarises novel evidence on the determinants of the urban height profile and the cost of building tall, and derives implications for urban theory and policy. In contrast to standard urban economics models, there is a role for the supply side in determining horizontal land use patterns. Vertical expansion is unlikely to resolve affordability problems in growing cities.

Iconic metropolitan skylines, the widely visible signs of demand for density and the economic success of cities, are growing at an unprecedented rate. The past decade has seen the completion of 650 skyscrapers exceeding 200 metres. In 2015 alone, a record number of 106 tall buildings over 200 metres were completed, and this number is predicted to increase to 135 in 2016. From 2010 to 2015 the number of super-tall buildings – those exceeding 300 metres – has doubled from 50 to 100. Dubai’s 830 meter-tall Burj Khalifa set an impressive new record for the tallest structure in the world.

At the same time, many of the most economically successful cities have seen a steady increase in rents and housing prices. As young professionals are increasingly forced to share flats and first-time buyers are being crowded out of the market, providing affordable living space is becoming a policy priority in many cities. As an example, rising rents in London have become a prime concern not only for workers, but also for companies, coming second only to transport-related concerns. Ahead of the recent mayoral election, Boris Johnson (Conservatives) and Sadiq Khan (Labour) were directly competing over the best strategies for improving affordability (Evans 2016). While tall buildings are often criticised for jeopardising the historic character of neighbourhoods, a central argument brought up in their defence is that the additional supply brought by more intensive land use can mitigate pressure on housing markets. Yet, it is typically the most vertical cities that tend to be most expensive.

Theoretical research on the supply side of the urban economy dates back to the early neoclassical models in urban economics (Alonso 1964, Mills 1967, Muth 1969). These models predict that developers will substitute away from land as the price of land increases, which implies building taller. Empirically, however, the vertical structure of cities has remained understudied for a long time. Liu et al. (2015), among others, present evidence of a rent gradient within tall buildings, with particularly high premiums near the top. Little is known about the determinants of the urban height profile as well as the cost and limits of vertical expansion. In our recent paper, we attempt to fill this gap by analysing the relationship between the height of buildings, the price of land, and the cost of construction, focusing on tall buildings in Chicago (Ahlfeldt and McMillen 2017). Due to the absence of height regulation in most of its prime areas, Chicago is a good place to study the vertical structure of cities.

For our empirical analysis, we use a combination of micro-geographic data. From Emporis, a commercial data provider, we obtained a data set containing the exact locations, the year of construction, and the height of about 1,750 tall structures constructed since the 1870s. Additional information such as construction cost and floor area is available for a smaller set of observations. We complement these data with a novel micro-geographic panel data set of land prices covering the 140 years from the 1870s to the 2010s, which we compiled from various historic land value maps as well as from contemporary vacant land sales data. This unique combination of data allows us to match the height of a structure to the land price at the time of construction.

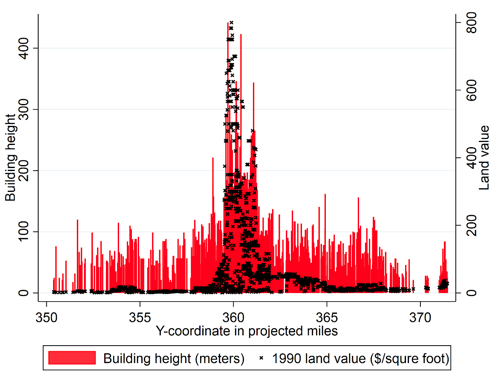

As shown in Figure 1, we find that land values and building heights are positively correlated, as suggested by neoclassic theory. The elasticity of height with respect to the land price at the time of construction is 45% for commercial buildings and 30% for residential buildings. The height elasticity about doubled over the 20th century. Following significant improvements in construction technology, developers now respond to increasing land prices by building taller at a much faster rate than in the past. Yet, building tall remains expensive. The height elasticity of construction cost with respect to height is about 25% for small structures (five floors and less), increasing in height, and exceeding 100% for super-tall structures.

The cost of height is higher for residential than for commercial buildings. This result is consistent with a larger loss of usable floor space as building height increases, and is reflective of some notable differences in the design of commercial and residential towers. Tall residential buildings typically have a smaller floor plate size (due to the need for more exterior walls), use different materials (e.g. all-concrete due to acoustic reasons), and have more complex facades (with balconies and sunrooms), all of which is not advantageous for the construction of very tall buildings.

Figure 1 Building height and land prices

Notes: The building heights in 2014 are from Emporis.com. The 1990 land values are from Olcott’s blue books. The y-coordinate is the vertical Cartesian coordinate in the State Plane Coordinate System (Illinois East).

These results have important implications for the determinants of urban spatial structure, as they suggest that there is a supply-side mechanism that promotes the typical land-use segregation observed within cities. The strong concentrations of economic activity that are typically observed within clusters – such as central business districts, sub-centres, or edge cities – are likely to be attributable not only to strong agglomeration forces, but also to a relatively lower cost of accommodating commercial uses in tall structures that minimise the use of expensive land.

Our results also have important implications for policymakers concerned with the affordability of their cities, as they suggest that it is difficult to combat escalating rents by means of skyscraper development alone. Beyond intermediate heights, the cost of building tall increases quickly and at an exponential rate. Ultimately, affordable space can only be provided if a city does not only grow vertically, but also horizontally. This is an important lesson for cities with already dense land use and binding urban growth boundaries such as London.

See original post for references

Suburbia was premised on mgf w/ ancillaries, mgf went poof, hence the trend to FIRE sector and the city renewal capital out lay… all this has long lead lines and heaps of demand pull….

…and let’s not forget “white flight”… Racism: the gift that keeps on giving.

The fact that initial 30-year financing in the U.S. permitted red-lining (denying loans to communities of color) didn’t help, either.

While buidling tall might not bring down housing prices building sprawl is hardly likely too either. All pricing comes down to supply and demand. In theory increasing the supply of housing will decrease the price but only if demand remains stable. But in cities like London with their mass immigration and housing market open to al foreigners there is no way to control demand for housing. Increasing demand means increasing prices unless supply can outpace demand which seems very unlikey.

Tall buildings don’t themselves cause prices to rise. They are a symptom of a pre-existing condition. Private deveolpers will only build tall in a situation where demand for housing is far outpacing supply.

The way to lower housing prices is to lower the demand for housing. Just look at Detroit.

All pricing comes down to supply and demand, if one ignores externalities and corruption and manipulation and manufactured demand and a bunch of other stuff that drives wealth transfers, often with massively little respect to Samuelson formulations of graphs and rules of economicus behaviors. “It’s only illegal if you can’t get away with it.”

Short form: the emergence and prevalence of a “pecuniary value system,” as C. Wright Mills put it.

This is very good. I attended a lecture by the NYU real estate department where a georgist (they are now lobbyists for real estate developers, reversing what Henry George actually advocated) where the NYU department head argued to replace a real estate tax with a land tax — claiming that skyscrapers had a NEGATIVE land value. Hence, they would receive an annual SUBSIDY out of rent levied on lower-rise buildings. (On website I think I have a summary of this meeting.) There actually is a play claiming that fiscal reality is the REVERSE of the chart. But in fact, if you look at the Federal Reserve’s Table Z, it often has a NEGATIVE land value for corporately owned real estate. (-$4 billion in 1994). This statistical anomaly is a result of the Fed’s “land residual” approach, after fictitiously increasing the value of buildings by the construction index rise. (I discuss this in The Bubble and Beyond.)

I get that the cost of construction of residential high rise buildings is more expensive than office towers, but to my mind the real affordability crisis comes from the ability of consumers to increasingly take on more debt and thus pay more interest to banks for housing and due to the mobility of foreign capital into real estate as a means of investment. Wolf Street has covered how capital controls and investigations in China have lowered demand for New York real estate and Vancouver instituted a tax that penalizes foreign home buyers that also reduced demand. Perhaps a real Georgist approach in combination with tighter controls on interest could improve the affordability of real estate, though that seems like a non-starter given the political power of the FIRE sector.

It is a bizarre world when the credit supply expands and the unwashed see ever decreasing income via – actual work – whilst only seeking remedy through equity speculation.

This compounded by Gates’ friction-less capitalism [digital capital] ascending land based capital.

G’day Mr. Hudson and Ta for your observations wrt the pickle with Georgists. Something I’ve sorta been wrangling with myself, your conformation of my suspicions is of great help. If I might ask is there any libertarian bolt on aspect wrt this observation from an ideological stance.

As an aside, if you have the time or inclination to respond, what might be your opinion on the AMI camp. I only ask because I’ve noticed more than a few throwing around your works and name to support their views. I only seek clarity on this issue to inform myself, in order to be more accurate wrt the information, don’t want to speculate or take a position that is inaccurate which might misrepresent your works.

disheveled… whether you respond or not thank you for your tireless works and increasing my knowlage through them.

Yes, interesting question re AMI. I would also be interested in an expansion of this issue from Mr. Hudson.

Just taking a short blurb from Wiki

“”The institute is dedicated to monetary reform and advocates taking control of the monetary system out of the hands of banks and placing it into the hands of the US Treasury. Zarlenga argues that this would mean money would be issued by government interest free and spent into circulation to promote the general welfare, and that substantial expenditures on infrastructure, including human infrastructure (education and health care) would become the predominant method of putting new money into circulation.[1]

Research results are published in Zarlenga’s book, The Lost Science of Money. The book asserts that money did not emerge from barter between individuals, but rather through trade between tribes and as part of religious worship and sacrifice.[1] Though this is not the mainstream view, there are other scholars of money, such as Keith Hart,[2] who agree that money developed in this way. The reason this distinction is believed to be important is because, according to Zarlenga, it is the definition of money which determines how the public will allow the money supply to be controlled.

If money is a commodity to be traded, then all that matters is that the money is 100% backed by some commodity, like gold or silver for example. If money is credit, then it makes sense that bankers control it, as they do in the United States today. But if money is an artifact of law, whose value is derived from law (payment of taxes and legal tender laws) then Zarlenga argues it would only be proper for the government to issue, and control the money supply.[3] According to Zarlenga, it is this last definition that is supported by the history and nature of money. Government-controlled money is also postulated to be more stable than credit money or commodity money.””

it seems to have a lot in common with MMT and with ‘Debt: The first 5000 Years’

I think it also resonates well with Mary Mellor’s excellent book ‘Debt or Democracy: Public Money For Sustainability And Social Justice’

Basically to my eyes they seem to promote government control of spending over bank control.

Such as getting a social security check rather than taking out a loan.

Or getting free medical care vs going bankrupt with medical charges.

Wouldn’t a chart that compares price/sqft vs height reveal a bit more? From the text of the article, it appears that the taller buildings cost more per square foot of usable space. This would seem to counter the classical argument, no?

p.s. skippy: by mgf do you mean manufacturing???

Add to the chart sale price per sf and you will see the incentive driving all the real estate hedge markets.

By real estate hedge market I mean those city markets where the end beneficiaries of a decade of QE, after its been laundered through Wall Street or The City of London, swap obscene amounts of cash for “prestige” properties: it is now normal for Manhattan tower to have up to 4 floors of “penthouse”: the sale price for these is in the $10,000s+ per sf.

Excluding the cost of all the exported pollution, Manhattan development above about 60 stories has never been economic except in bubbles where cash purchase of branded property can float prices beyond any rational justification.

Before the dot com bubble, 60+ story buildings were vanishingly scarce, so long as the Fed maintains the bubble, they will be the new normal.

PS: developer cost to deliver that penthouse sf, while 3 times what it costs to deliver similar quality in a 5 story building, is only around $800-900 sf, so the margins are huge, even with stratospheric land costs.

A little OT, but a residential home builder (not high rises) told me that this is what drives the building of luxury as opposed to affordable housing — “They’re the same basic structure (which is where most of the cost goes), but you spend a few thousand more on fancy fixtures and nice veneer and then sell it for double the price”.

I welcome confirmation or disagreement…

Yup.

“finishes” is the term of art on every HGTV / home improvement show.

“Its got all high-end finishes, it should sell quickly”

Add a $300 faucet, sell the house for $100k more, or so they have you believe.

Finishes are all the buyer sees, so how would they know whether or not the construction is high quality (it is typ not). It’s a lucrative form of false advertising.

RE: Skyscrapers and Land Values: Evidence from Chicago on the Costs of Building Tall Cities.

Always forgotten: the vast amount of electricity required to pump out water seepage (NYC from Atlantic Ocean, Chicago from LK Michagan); if not done, skyscrapers will come tumbling down soonest!

NYC skyscrapers, at least the ones in Mid-town Manhattan, are bolted into the notoriously tough local bedrock. Ground water intrusion isn’t an issue.

However, I can’t vouch for Lower Manhattan or all the tall stuff they built on screw pilings out by the ocean in Brooklyn and Queens. Some of these buildings were built only a few hundred yards from the beach, including several massive public & subsidized housing developments.

The skyline from downtown to midtown supposedly reflects the quality of the foundation geology for supporting tall / not tall buildings. Maybe the shape of the skyline over time would reflect the change in monetary policy or sky high marginal returns from penthouses (sorry).

In my neighbourhood each real estate bubble brings development to previously undeveloped lots, on ever steeper slopes or with other drawbacks.

Has anyone noted that the builders of tall buildings (the Trump Tower was recently completed here in Chicago) are aiming their projects at the highest end of the market? Is anyone building tall buildings for ordinary people? When someone envisions selling or renting their units for great deals of money, the cost of the land becomes small by comparison. So, the cost of the land can be quite high and, well, meh. If the project is more modest, then the cost of the land will be under pressure to stay lower.

I live in a 39 story building right on Lake Michigan. It is an upper middle class building and is quite affordable. If such buildings were built for lower middle class people, they would be economic, but not anywhere near as profitable. So, the data presented here do not represent cause and effect phenomena as the builders of said buildings design them for a market segment and, if designed for richer people, will raise the value of the land as a matter of course. Is anyone claiming that all of those “projects” built late in the last century were driving up the cost of land in their vicinity? I think not.

I think you’ll find that in most circumstances the costs of building high do preclude people on average or low incomes – the ‘hidden’ costs of building high, such as extra services and so on, tends to put a floor on the cheapest apartments you can build. The fact that your building is ‘affordable’ may not necessarily be a reflection of building costs, maybe more just local demand factors.

As for your first point, buildings like the Trump Tower may indeed be driven more by special factors such as vanity, etc – the Skyscraper Index strongly suggests that they rarely make money.

In Chicago, the inclusionary zoning ordinance was recently tightened, so that in many (most) cases projects over 10 units have to set aside usually 10% of their units, if rental, for those 60% or less of area median income. The on-site requirement is stricter now too, meaning they can’t buy out of their entire obligation and must build at least some (in some cases, all) of that requirement on-site. The developers are still developing. So, I assume it is still quite profitable for them to build. I don’t know if it would be profitable to do an entire building at, say, 100% of AMI versus what is usually multiples of that, but I imagine the “red tape” and “all those bureaucratic extra costs” are really not as much as they complain about. My 2 cents.

There’s been lots of vertical development for poor to middle class folks here in NYC. Most public housing here is over 6 stories, we have many hi-rise co-ops built by labor organizations, Met-Life’s post ww2 housing developments and limited equity Mitchell-Lama co-ops/rentals.

They were all built many decades ago in a different political/economic climate. Nowadays developers build vertically for rich guys and portion off X number of apartments for affordable housing to get a tax break from the city.

I’ve worked on a couple of ~12-story residential buildings in DC that were put up by out of town developers. New resi buildings in DC have been largely rental since 2008, but my buildings have big name design architects, incredible amenity packages, big budgets, and high quality construction. They’re oriented toward a young-ish crowd. The rents are astronomical, but supposedly the completed ones are mostly rented. I don’t know how.

The concluding swipe at London’s “binding urban growth boundaries” and their citation of Hsieh and Moretti’s “Why do cities matter?” (which is however a pro-density screed), suggest that the authors of this paper object to regulations that constrain development. Where’s the evidence that in a hot market such as London, a sprawl-friendly, supply-side approach “reduce[s] affordability problems in growing cities?”

I agree that the conclusion is simplistic, but its certainly true that London has quite a rigid Green Belt boundary. The city sprawls, but not on its fringes, but on the wider commuter belt to outer parts of the commuting belt, in towns like Reading or Brighton. Essentially, demand seems to try to find a weak link in the regulatory belt, such as development hungry outer areas, leaving other areas very undersupplied. The huge problem in the south of England is the reluctance of developers and Councils alike to pursue high quality high density (which is not the same as high rise) developments in areas well served with public transport. Developers hate doing anything other than their profitable 3-4 bed semi-detached with 2 car garage model, this is the prime driver of sprawl.

If you look to the Netherlands as an example, their suburbs are often developed at 2-3 times the density of a typical UK suburb, and often (in my opinion) much nicer for it. But the Dutch are unafraid to build at their city boundaries, going for steady outward growth.

I find the conclusions a little confusing, but maybe its just me, I’ve always thought it was pretty self evident that the supply side was as important as demand in driving central urban development.

Its something that has always intrigued me as to why some cities seem to build high despite apparently relatively ‘cheap’ land and without a strong financial demand driving it (and yes, of course there are many other variables, such as regulations, cultural issues, geology, transport availability, etc). Bangkok, for example, has many more high buildings than you would expect for a fairly poor country, while in Japan there has been a strong tendency to avoid high residential developments. China is packed with very tall apartment developments, despite overall urban densities being relatively low compared to, say, South Korea or Japan.

Even in areas with very high land values, high buildings don’t always make sense – in Dublin, for example, studies have shown little or no interest by developers due to high construction costs. High rise residential in the UK seems to be restricted to either end of the spectrum – either packed in student blocks or public housing on the one side, or super expensive London investment vehicles at the other extreme. It may be perhaps that certain types of system build houses (i.e. for the relatively poor) can be delivered at a relatively low cost at certain times of the development cycle.

Of course, its also noted that super high buildings are correlated with the most extreme end of bubbles. Certainly if you travel in big asian cities its a feature that most seem to have a few hulks left high and dry from whenever the last bust was. You can still see this in Ireland too. It may be I think that the supply side is most important when credit is cheap as developers think they can ‘create’ a demand simply by building something – most super tall skyscrapers for offices are sold on the basis of being a particularly prestigious address – this rarely comes to pass, as nearly all the most famous commercial skyscrapers, from the Empire State Building to Taipei 101, have been commercial failures. I suspect that much the same applies to many other uses – there are plenty of rumours floating around that high profile buildings in London (such as the Shard), have been commercial flops.

I could make almost no sense out of what they were trying to say. I think it was “the higher you make the building the more each sq ft costs”?

And the conclusion was, again I think, that was good for commercial buildings but bad for residences?

Well duh. Seems like they, as usual, totally ignored the infrastructure needed to support suburbia. That is if they were talking about suburbia as a replacement, hard to tell. And it isn’t just to cost of the (crappy, asphalt) roads that you need for edge city expansion, the cars you need (biking/walking/mass transportation don’t work well), but the loss of nearby farmland and the habitat that supports, well everything.

Tell your spouse that your family needs a Miata, not a minivan, on the single point that uses less gas. Because yeah, if you judge by one metric things do seem to come out the way you’d like. But see how that goes with the SO. His/her single metric might be “what a jerk”.

But again, if the conclusion is “big buildings are more useful for commercial than residential purposes”, well, yeah. There’s a massive gray area between those two points…. like, you know, why can’t a building do both?

“Due to the absence of height regulation in most of its prime areas, Chicago is a good place to study the vertical structure of cities.”

Maybe I’m missing a big slice of this article, but if you are going to study Chicago, you should say which neighborhoods you are factoring in. In fact, in most of Chicago’s neighborhoods, there are height requirements. I guess that most of the city must not be “prime.” (That attitude certainly explains the behavior of our elites and Rahm + gang.)

The skyscrapers in Chicago are part of the city’s peculiar geography. Chicago isn’t exactly flat as a pancake. In fact, the dividing line between the Great Lakes Basin and the Mississippi Valley runs along Narragansett Avenue. Further, the Loop was always limited psychologically by the ring of elevated train tracks and geographically because the Chicago River turns south and becomes the western border of the central business district. So geography becomes a factor in land prices.

The narrow band of skyscrapers that runs from South Shore neighborhood up to Rogers Park neighborhood follows Lake Shore Drive and the lakeside parks. Within a few blocks of this facade of skyscrapers, the average height of buildings drops to typical Chicago levels: Three-story three-flats and six-flats.

McMillan should know this. He’s at UI Chicago. Are they studying the Loop, West Loop, and North Michigan? Streeterville? (I just walked through a stretch of Streeterville, which was once mainly a sandbar, and it is now chockablock with tatty high-rises of various kinds.)

An interesting subject – the relationship between building high and land usage costs, but as the comments above point out, a bare surface scratching of all the diverse factors that can define this relationship in so many different situations. I would like to know how maintenance costs affect the economics of large buildings as they age. What’s the tradeoff between not having to maintain 200 roofs vs the enormous cost of getting crews and materials up to, and discarded old materials down from, the top of an older skyscraper? Or do developers just calculate a realistic lifespan for any new building and figure it will be torn down and replaced once the maintenance costs get too high? Of course, no one knows what conditions will be like by then, so there’s always the prospect of cities being stuck with a bunch of abandoned super sized structures that are too costly either to maintain or to tear down. Where I live in Gary Indiana, the once glorious tall buildings (most less than fifteen stories) from early in the twentieth century are almost to a one, crumbling eyesores in the twenty-first century.

This is an important topic – here in Dublin there’s a big push for relaxing regulations on tall buildings, and I am extremely skeptical that it’s largely something being pushed by developer lobbyists – but this article fails to provide useful facts or talking points, for countering that narrative. Need more on this topic.

Worth a look (Michael Hudson):

Real Estate 4 Ransom

Rising Real Estate Prices

and…from the Congress on New Urbanism: The Unbearable Costs of Sprawl

I found this article fascinating but troubling because it by and large ignores historical factors. There is, in fact, a small historical literature on the economics of tall buildings that economists may well find insufficiently sophisticated. Yet a book such as Carol Willis’s Form Follows Finance (1996), which deals in part with Chicago, do offer insights that can put number-crunching in perspective. The article looks at Chicago tall buildings from the 1870s through 2015 without considering that that century and a half encompasses several distinctive periods of development in city expansion (including demographic shifts; other commenters have mentioned how the authors ignore at their peril differences between neighborhoods and geology/hydrology as factors in tall building cost), in the conduct of business, in economic trends (pre-and post-1929, for example, or pre- and post-1973), in approaches to finance, in engineering and construction techniques, and most pertinently in communications (perhaps the overwhelmingly important factor in the formation of The Loop but also dense, tall business districts in many cities; and in recent years the ever augmenting costs of wring for telephones and internet). To me, the natural hypothesis would not be that the economics of building in Chicago in 2000 were the same as those prevailing in 1870, thus entailing consideration of just one big data set, but the opposite (requiring several data sets to be compared). For me, anyway, using land values from 1990 and building heights from 2015 while paying no attention at all to construction dates, casts doubt upon the findings. Mixing the apples and oranges of commercial and residential structures (to say nothing of the mixed-use tall structures of which Chicago has some examples of international note (John Hancock Tower, etc.) makes for even more of a muddle. A final source of my dissatisfaction here is the missed opportunity to explore different sorts of use value embodied in the interior spaces of tall buildings, particularly those used for housing. Obviously, merely providing shelter does not account for the use of nearly all the available ‘residential space’ in apartment towers (excluding, perhaps, towers built specifically as public housing, of which Chicago has many examples that presumably found their way into the sample, alongside luxury towers). Use-values also lie in apartments as places for parking money, as instruments for laundering money, as trophies, as speculations, as pieds-a-terre, etc. Apart from the values of their interiors, but of course related to them, is the advertising value of a building arising from its tallness as such (well documented in the case of Chicago’s Sears Tower).

When it comes to affordability, the main consideration is that the authorities can create money much more easily than rest of the people can produce real goods and services. The money cost of land and housing will therefore tend to become unaffordable to anyone who must produce real goods and services in order to make their living.

The only salvation is to become an owner, but salvation itself gets bid up in price, until only those especially favoured by the authorities can attain it.

Nevertheless, most 21st century Occidentals remain under the impression that their culture is secular and rational. Meanwhile, towering edifices rise to exhibit the glory of the authorities, from the heights of which they are inspired to issue their vision statements.

Every civilization has its collection of temples in its cities. One glance at any CBD would instantly reveal the location of the acropolis–and of which gods we worship.

On the other hand, if modern Occidentals were somewhat less religious and more practical than they are today, then they might ask themselves how best to obtain the economies of scale that come from city-building, while avoiding the diseconomies of urban scale, whether those diseconomies manifest as super-density or sprawl.

If we ask how best to keep growing a vast urban area, then I think we’re already going wrong. It’s better to build several geographically distinct urban centres, and to keep them distinct, than to keep growing any given conurbation. A simple polis is more efficient–that is, for most of its inhabitants–than is a megalopolis.

This article completely misses the point of the infrastructure that supports high rise development; subways and utilities. Besides elevators, there must be horizontal mass transport. In Washington DC, new high-rise apartment buildings are sprouting up within walking distance of Metro which is suffering from real money problems and a decline in ridership. The public sector and the best use of land is ignored in today’s mad rush to make money.

High rise dwellings come with a construction overhead and large maintenance cost – Elevators or Lifts.

The higher the building the greater percentage of each floor is consumed by elevator space.

Elevators are a nightmare to maintain, because they have all the characteristics which helps machines fail, they start and stop frequently, and the elevator shafts become fouled with dirt, sticky dirt from us Humans and elevator lubricants.

High rise works well for those animals adapted to living up high – most birds and some arboreal animals.

High rise dwellings work better with a public transport and car elimination mandate. Eliminating the need for 8 parking spaces per car in called for in modern US city building codes would lead to much better land use.

The Canadians understand high density cities. The US, with the “two cars per family” mentality, does not.

Above Ladder Level: unsaleable.

Is it rational to live or work above the level that a the fire brigade/department can rescue you from with their ladders? If your answer is yes, your version of rationality is radically different from mine.

My attitude to fire changed when I was a part of the technical crew on an offshore seismic oil exploration survey ship. I found myself part of the fire fighting team with zero training – something I had signed up for without due dilligence on my part. There were a few false alarms and push never came to shove, but the experience certainly re-focused my mind!

Check out the aluminium cladding scandal and the Grenfell and other fires for other rationalities.

Pip Pip

Synoia, I’m having trouble understanding you. You’re saying that elevators/lifts are a major cost factor for tall buildings, yet in the US today, every new building must have them to comply with ADA. Do they really alter the economics of very tall buildings?

Also, I have spent time in and studied Canada, and I cannot see how Canada’s land use and transportation policies are much different from those in the northern states. The biggest difference between Canada and the US is Canada doesn’t have the South, the Southwest, or the lower Midwest. What are the policy differences you see nationwide between the US and Canada?

The ADA elevators in low rise bldgs don’t generate a lot of service calls as they’re hydraulic. The high-rise cars on the other hand are a horse of a different color.

I work in high rise building maintenance and we frequently call our elevator service contractor for work. We have a tech on-site just for the elevators 2.5 days per week and a staff of six to maintain all the MEP systems. For reference, I work in a million sqft office high tower.

A key issue is that the higher a building is, the ratio of floorspace devoted to services compared to ‘useable’ floorspace rises. I can’t recall the exact figures, but somewhere around 20 storeys or so more than half of the floorspace becomes service (i.e. lifts, ducting, stairwells), compared to office or residential space. You’ll find some UK costings here.

I’ll correct myself there, my figures aren’t right, you have to go much higher than 20 storeys before you get to 50% services – but the general point is correct, the amount of saleable/lettable space shrinks the higher you go, and service costs increase.

I think there’s a huge limitation to this study, namely that they are studying the US where building is regulated to favor property owners (as opposed to ensuring housing as a right or social good) creating many market distortions.

“Due to the absence of height regulation in most of its prime areas, Chicago is a good place to study the vertical structure of cities.”

I do not believe that Chicago is a real estate free market for tall buildings. Even if the city of Chicago is relatively less restrictive, there are still significant restrictions in areas that are not “prime” and in other municipalities of metro Chicago that then put pressures on the core city.

And again:

“The height elasticity of construction cost with respect to height is about 25% for small structures (five floors and less), increasing in height, and exceeding 100% for super-tall structures.”

Correct me if I’m wrong, but the authors seem to be saying that medium-tall high rises are most efficient. Yet the authors seem to take it for granted that you can’t just build more of these buildings. But that’s only because of development restrictions, particularly in suburban municipalities and some residential neighborhoods.

I’d rather the authors have studied a city in East Asia, like Bangkok or Seoul. Seoul in particular *has* largely solved the housing affordability problem by putting the vast majority of residents in 5-30-floor high-rise apartment blocks. There are still great price differences among buildings and locations, but those are due to amenities in the buildings and the prestige and amenities offered by certain locations.

And this didn’t happen by accident. For a half-century the government of Korea has made housing every citizen in a dignified way a national policy priority and enlisted the chaebol on its behalf (most of the apartment buildings were created by Samsung, Hyundai, et al). To my knowledge, the US has never known anything remotely similar. Shame on us!

I really don’t see the argument at all. I can agree to the “building tall is building expensive” bit, but when Land value gets super–high building squat doesn’t make the rents any cheaper. Correlation is not Causality, and one of the alternate options in correlation is that the two correlated things have a route cause. What could that be? Well how about this sentence:

Well then, is it height causing the rent problem, or is it the fact that the city is economically successful, which means that local inflation will run much hotter then elsewhere as jobs are paying more, and more people are moving there to get at said jobs, repeat in a positive feedback loop. In short, yes those high-rise rents are astronomical, but how high would the rents be if those buildings were that much shorter? I would bet they would be staggeringly higher. Nothing I am seeing in this argument can disentangle the (more likely IMHO) possibility that high-land values and high rent come before high buildings, and that the high buildings may actually help mitigate the issue if only slightly.

The other issue not adjusted for, is how much is just speculative bidding up of rents and condo costs in high buildings? I bet that is a huge part of it. Take away the gouging land lords and endless flippers and I bet the cost correlation will go down quite a bit. That would mean that the solution isn’t “build shorter buildings” it but instead regulate appropriately with taxes to crack down a bit on empty meaningless condo flipping (see Miami), and people like this.

Also as the article focuses on costs I have a counter question. What costs more in total (“in total” = public + private expenditures) over the long term: Building expensive tall buildings which do indeed cost more per floor to construct then short ones, or building huge sprawl that will require a massive expansion in city services and infrastructure, and extend commutes and their associated pollution?

I am afraid I don’t buy this article as I find it a bit myopic in its analysis and I believe it fails to account for many of the real issues at stake.

Here in the San Francisco Bay Area there is plenty of work, a bifurcated work force split between the very well paid tech workers and wealthy investors, then there’s everyone else. I also think that a fair amount of housing is bought and then left empty. Add the NIMBYs who don’t want any new construction, especially dense ones, and even a hint of ‘low income housing (even set asides) brings out every kind of race and/or class based bigotry spewing unashamedly. Nevermind that making less than about 80k year makes one qualified for low income housing which is hardly white trash territory.

If they were actually serious about building real high, or mid, density housing and actually do all the public transportation they keep saying that should/will be done they cost would be still be too high, but the large number of employed homeless would probably disappear.

Like that’s gonna happen. All the socially concerned liberals around here are just blasted hypocrites all concerned about the poor and the oppressed, but only as long as they don’t have to live near them.

In 1996 here in Oak Park public officials tossed out our zoning code and replaced it with the Planned Unit Development Ordinance. This allowed them to transfer the property rights of neighboring owners to out of town developers who then built 22 story monstrosities in the Frank Lloyd Wright Historic District. They promised us taxes would go down because these super buildings would generate a property tax boom. Instead property taxes have increased 300-400%. Then, after the building is up and leased, it’s sold to another investor. This investor then hires lawyers who protest their property taxes in the most corrupt property tax system in the nation and guess what. They win, we loose.

P.S.: Michael Hudson is a god that walks the planet.

I’m not sure what the conclusion of this article is, beyond observing that higher land costs lead to taller construction (I do give them credit for trying to measure the elasticity coefficients though). Beyond that, they do very little to answer anything about affordability.

I have 2 main criticisms. First, height does *not* automatically imply increased density. As measured by amount of usable space per sq. ft. of land, many skyscrapers are actually less dense than shorter buildings, because tall buildings frequently have to set aside a lot of their land as park space, etc. in exchange for building high (plus the increased ratio of service/non-useable space to rentable space that the authors mention).

For example, the Chicago Spire, a defunct project to build a 2,000 ft residential skyscraper, actually contained less usable sq. feet than allowed by the original zoning which allowed two shorter buildings to be built.

Similarly, the overall density of Chicago is less than the density of Paris, because Chicago has a very small area of essentially unlimited zoning (downtown and adjacent neighborhoods) combined with extremely strict zoning almost everywhere else, precluding basically anything except single family homes (the famous bungalow belts). In contrast, Paris has a uniform height restriction, but the entire city is built to that height and density.

So height, while maybe an approximate indicator of density, isn’t perfectly correlated with density. There are other ways to promote more efficient land use, and bigger problems with zoning policy than just height restrictions.

Secondly, while focusing on a single city is useful, since you can’t run experiments on a city, you need to do comparative analyses as well. And rather than comparing across history in one city, it may be more useful to compare multiple cities in the same era. For example, why is the Bay Area so expensive? Aside from the city of SF itself, the Bay Area is not landlocked. It has about the same population as the Chicago region, and about the same GDP output (if you combine SF/Oakland MSA with San Jose MSA). And yet housing and commercial real estate costs are much lower in Chicago. My guess is that land use restrictions are much tighter in SF. Years ago, SF voters passed a hard limit on total construction: every year, no more than 950,000 sq.ft. of office space can be constructed. That’s barely one big skyscraper.

Similarly, in the 1980s, Tokyo had a reputation as being one of the most expensive cities in the world. But now it’s not even in the top 10 (housing costs are about the same as Chicago, which is considered an incredibly cheap “big city” even just for the US). Maybe because the city, dealing with explosive population growth, has more housing starts (142k in 2014) than the entire state of California (84k) or even all of England (137k).

OTOH, Hong Kong has a mixed policy of private development coupled with extensive govt-built public housing (which isn’t just for poor people). It would be helpful to see what their results have been.

IMHO, the answer to rising demand is to build. Even luxury, high end stuff helps because it pushes down rents on last year’s must-have luxury apartments helping to hold down prices across the cost spectrum. But that building doesn’t have to be skyscrapers (although I personally like them) as long as the overall goal of liveable density (which requires not just zoning, but adequate transit, open space, etc.) is achieved.

The ultimate solution I think is to build more smaller to medium sized cities than a single mega city.

Sprawl is not a good thing, neither is building these supertall structures that people of middle class or poor means cannot possibly afford. These mega cities with their supertall structures seem to be playing a role in worsening the role of inequality.

The NIMBYs tend to prevent lower end housing, while the rich shut out the rest of us. The NIMBYs really just want their properties to appreciate like crazy and not pay any property taxes. They are usually the top 10%ers trying to lock out the rest of us. The rich that control the super high structures won’t be paying much, if any taxes and keeping us lowly plebs.

One big takeaway is that we cannot trust developers. They are dishonest liars who only care about profit.

It’s true that the developers and to a lesser extent the landlords/property owners are overly powerful in San Francisco proper, add the nimbys throughout the Bay and people like me are screwed. It’s looking like the 10% are coalescing around the increasingly corrupt and interconnected wealthy who, just like elsewhere, have gradually gained influence in California, who really don’t care to do anything actually useful for everyone else. I need to do some research on it and probably will for a later paper.

I don’t buy into this analysis completely. Los Angeles real estate is expensive because of the constraints for adding new supply. They need to go more vertical like most mature cities in the world. Horizontal expansions occur for major cities, such as Chicago, are on the non-commutable periphery.

Most of the time, the new units added are not the affordable units. But addition of more units, makes secondary Class B and C properties more affordable. One factor that hurts affordability is the re-positioning of older apartment buildings – where rents are being raised.

Chicago is the city where I live. There are plenty of neighborhoods where housing is more affordable – most of the southside. But demand (especially for the wealthier segment) falls on the northside.

There is nothing you can do about housing scarcity in desirable neighborhoods. Except maybe build vertical.