The brazenness of CalPERS’ corruption is breathtaking. And CalPERS’ captured board is all too happy to play along rather than do its job of protecting beneficiaries and taxpayers.

These statements may sound like hyperbole, but in light of the history and evidence we present in this post, it is difficult to reach any other conclusion. CalPERS is planning to hand over much if not all of its $26.2 billion private equity program (over $40 billion if you include committed funds) to an outside manager in a flagrantly uncompetitive process that flouts California government rules for procurement as well as CalPERS’ own requirements. We’ve previously estimated that this move would cost $50 million a year, with no reason to expect an improvement in returns beyond what CalPERS could obtain on its own at much lower cost. 1

We’ve embedded the vendor documents at the end of this post and will discuss them shortly.

As a Harvard Business School contemporary who has spent his career in investment management said, based on reviewing CalPERS’ materials:

For a public pension fund well known for corruption and “pay for play” activities, this under-the-coat activity is astounding. Every current and future pension recipient should question the Watergate-like behavior of CalPERS.

Last July, at a board offsite, CalPERS staff, with no explanation whatsoever as to why it was necessary or desirable to entertain this line of thinking, held a panel discussion on “private equity business models“. We have urged CalPERS to bring more private equity activities in house to save costs and increase the fund’s bargaining leverage with private equity funds, a direction that has been taken by many family offices, some sovereign wealth funds, and some Canadian pension funds.

But that is not what CalPERS set in motion. Instead, the discussion focused on creating a new “independent” legal entity to manage what was presented as a portion of CalPERS’ $40 billion private equity program. But even simple questions from the board, which was clearly not comfortable with the idea, exposed that even the thin sketch staff offered was incoherent.

Staff made it sound as if they were going to move deliberately, and said they would come back to the board hopefully by year end with a further discussion of legal structures. Instead, staff has moved aggressively, illegally, and in private to advance this plan as rapidly as possible. There is no legitimate explanation for such hurry. The only conceivable reason for the rush is to strong arm the board with a fait accompli.

As we describe in detail below, CalPERS is flagrantly violating both the spirit and the letter of state statutory requirements for purchasing third party services. Even worse, the process is obviously designed to steer this massive contract to a pre-selected vendor, which is almost certainly BlackRock.

Yet under state contracting rules, a party that has in any way influenced the design of a contracting process is barred from participating as a prospective vendor. BlackRock’s head of private equity, Mark Wiseman, was a participant in the July panel without his conflict of interest having been disclosed to the board. Bloomberg reported in September that:

The California Public Employees’ Retirement System is in discussions with New York-based BlackRock about managing some or all of its $26.2 billion in private equity investments…The discussions are preliminary…

So understand what happened:

CalPERS illegally entered into negotiations with BlackRock, without board knowledge or approval, and in violation of state contracting laws

CalPERS is now attempting to tidy up its lawbreaking by setting up a sham competitive process that is still flagrantly illegal

CalPERS has not obtained board approval for this solicitation, let alone for running a sham process. The published timetable shows that staff has no intent of doing so. This is a massive power grab by staff, since the amount of funds at issue is vastly in excess of the investment office’s “delegated authority”

While we have chronicled many examples of CalPERS’ disregard for regulations, laws, and its beneficiaries over the years, ranging from lying to board members and the public about its ability to get fee information and its own costs, to running a non-secret election that violated the California constitution, to running a kangaroo court to try to silence its lone board member who dared challenge bad practices, the stakes and dollars involved here are far greater than in any past abuse.

This course of action is not merely reckless. CalPERS has a history of criminal conduct with private equity managers. Its CEO is now serving a four and half year sentence in Federal prison for taking bribes and four current and former board members were implicated in a private equity pay to play scandal involving Apollo and four other fund managers. Instead of making sure it observes the law punctiliously in dealing with private equity managers, CalPERS is about to make its biggest private deal in history its dirtiest.

CalPERS Has Given No Reason Whatsoever for Handing Over Its Private Equity Program to a Pricey and Unnecessary Middleman….

One reason for CalPERS to move quickly and in secret for the biggest action it will have taken in its entire history appears to be to escape basic accountability. CalPERS has made no attempt to explain why it is pursuing such a radical action that is contrary to its beneficiaries’ interest as well as the behavior of other major investors in private equity. The fact that CalPERS has been unwilling to explain what it thinks it is accomplishing strongly suggests that its actual motives are illegitimate. CalPERS offered no rationale at its board meeting last July nor has it deigned to try to justify an unheard-of effort to shirk its basic investment responsibilities, which will cost beneficiaries dearly.

Not only has CalPERS’ board not approved this radical, indefensible experiment, the “Request for Information” embedded below shows that CalPERS board will not be given the opportunity to reject this program, but merely only to ratify one of staff’s nominated vendors.

The closest we have in the way of a rationale is an emotional, incoherent speech by CalPERS Chief Investment Officer Ted Eliopoulos last June. Eliopoulos he made clear he was very upset about being criticized and was unable to keep his staffers from being bothered.2

The wee problem is that Eliopoulos and CalPERS generally are unwilling to admit that the criticisms are fully warranted and they need to shape up. It is hardly uncommon for companies and other groups in the public eye like sports teams to be faulted when they make mistakes. The solution is to fix the problem, not wallow in self-pity and worse, set out to waste hundreds of millions of beneficiary and possibly ultimately taxpayer money so their feelers will no longer be hurt.

CalPERS’ response instead is to try to misrepresent what it is doing as something other than outsourcing or hiring a fund of fund manager. Anyone who has been in the investment business will see that despite CalPERS’ attempts to snooker its beneficiaries and state officials, the “partner” scheme meets the “if it walks like a duck and quacks like a duck” test. From the “Private Equity Strategic Partner” document:

It is important to note that with this strategic partnership initiative (Strategic Partnership or Partner) CalPERS does not intend to create a standard “Fund of Fund” relationship or consider this to be an outsourcing of responsibility. Instead, CalPERS desires to create a collaborative partnership where the Partner has investment discretion, but works with CalPERS PE Staff in the development of an annual allocation plan that CalPERS will approve.

Help me. So the fig leaf that makes this arrangement “not exactly a fund of fund” is that the fund of fund manager is required to preserve some employment among current CalPERS private equity staffers by having CalPERS staff work on an “annual allocation plan”.

Keep your eye on the money. The “Partner” has investment discretion. CalPERS is handing the keys to the kingdom over to them. Everything else is a ham-handed effort at improving the optics.

…Because There is No Legitimate Reason for CalPERS to Outsource Private Equity

Let us stress that there is no justification for CalPERS to outsource private equity, save perhaps for exotic, niche strategies. In its other activities, CalPERS correctly fetishizes minimizes costs, since any extra expenses multiplied over the long time horizon of pension fund investments creates a large drag on performance. Private equity is far and away CalPERS’ most costly investment strategy, where the giant pension fund has confirmed that fees and costs amount roughly to a staggering 7% per annum.

Astonishingly, CalPERS is out to make this bad situation worse. Hiring an outsourcing firm will create another layer of fees and costs, hurting performance.

Even worse, CalPERS will have even less accountability and control than before, by being one step further removed from private equity manager selection and oversight. However, this anti-transparency, anti-accountability feature is perversely a plus for CalPERS staff, since they will be able to do an even better job than now of refusing to provide information and hide from public oversight.

CalPERS is deciding not just to be a laggard but to regress. Other investors, even famously cautious and often clueless public pension funds, are embracing strategies to reduce fees and dependence on private equity middlemen. They are strengthening their internal skills, a precursor to doing more in house, reducing fees further, and improving their bargaining power. This is the most obvious way to improve performance, since those whopping 7% per annum costs make a massive dent in net returns. If an investor were to bring these activities in house, it would easily lower annual private equity costs to below 3%, and more likely 2%.

Moreover, any claim that CalPERS could improve performance more through an outsourcer than it could on its own is false.3

Given the size of CalPERS’ private equity program, the best it can reasonably expect to achieve over time is to meet index-level performance. While CalPERS has fallen short in recent years, its own consultant, Meketa, explained that it was the result of a self-inflicted wound: choosing to greatly reduce the number of managers, with the result that CalPERS invested primarily with large and mega buyout funds. They’ve underperformed, dragging CalPERS’ results down.

CalPERS does not need to incur the unnecessary cost of hiring a third party manager to reverse this error. Smaller and less well resourced public pension funds, such as those of Washington and Oregon, run bigger private equity portfolios than CalPERS does with smaller staffs. Does CalPERS really expect us to believe it is too dumb or too incapable to get back to where it was not all that long ago?

Finally, there is a reason, besides the higher cost, to expect CalPERS’ outsourcer to underperform. The best regarded large-scale funds of funds players also have well-regarded private equity funds. It’s one thing for KKR to allow JP Morgan’s fund of fund get its nose into the tent when JP Morgan is representing primarily high net worth individuals and small endowments. It’s another thing entirely when that fund of fund manager is representing a CalPERS and will use that to try muscle for more competitive insight. The result that unless CalPERS were to consider only boutique fund of funds (ones with seasoned professionals but no competing private equity investment business), CalPERS will be limiting itself to firms that are second-tier players in the fund of funds business. Hence, there is no basis for expecting better than index results.

CalPERS’ Board Has Not Approved This Move, and Staff Clearly Plans to Illegally and Greatly Exceed Its Authority

The “Private Equity Strategic Partner” and “Proposal Questionnaire” documents at the end of this post make clear that staff is in such a hurry that it hasn’t sorted out exactly what it wants except it wants out of private equity. 4 This sort of “fire, aim, ready” that leads to massive self-inflicted wounds.

CalPERS is letting the supposed respondents define all of the critical elements of the arrangement, making CalPERS a stuffee. It also puts CalPERS at a disadvantage to the extent that it actually bothers trying to negotiate the agreement, since the “partner” will presumably provide the investment agreement, when any competent attorney would insist that CalPERS draft it (one of the cardinal rules of negotiating is “he who controls the document controls the deal”).

Needless to say, the fact that there is no proposal that “partners” are bidding on, but instead a “tell me what you think I should want” means the board has not approved this process. We have confirmation from inside sources.

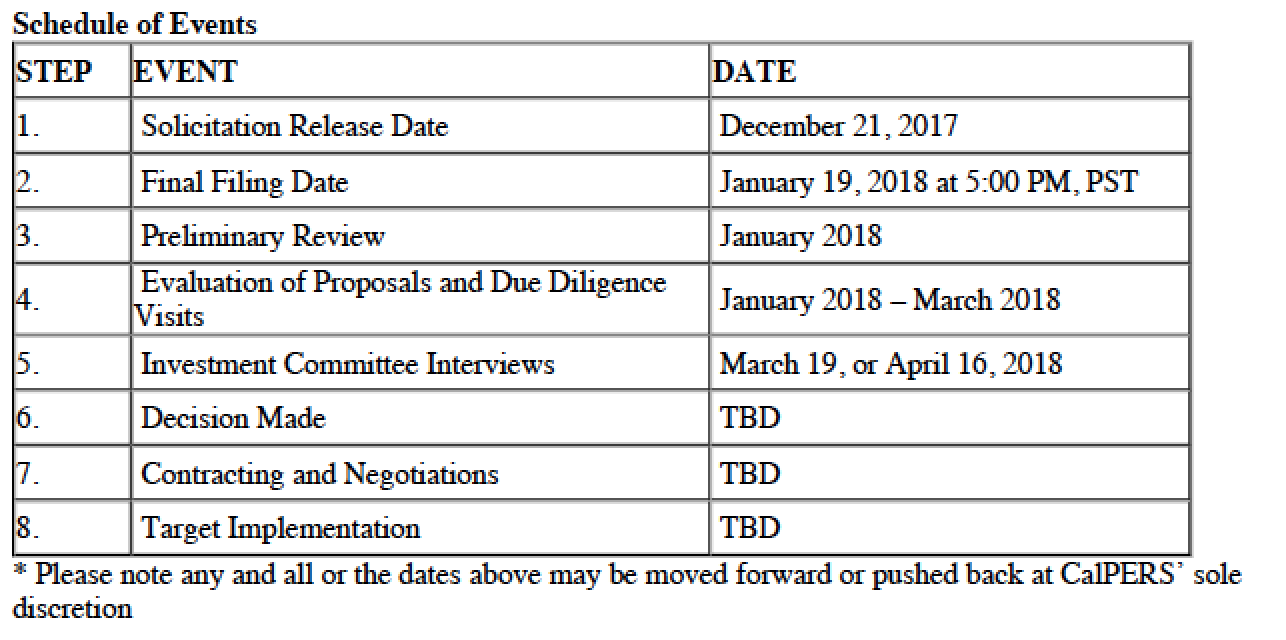

As you can see, the schedule has the board approving vendors when it hasn’t even approved the content of the proposal!

The Timetable Makes Clear the Process is Cooked to Favor One Vendor

Anyone with an operating brain cell can reach an even more obvious conclusion from the schedule above: that CalPERS isn’t even making a credible pretense of running a competitive process. No one launches a major or even minor procurement process right before the Christmas/New Year holidays unless the intent is to hand the deal over to a pre-selected party.

As a contact who has been a top-level professional in the fund of funds business for nearly 30 years wrote:

Who did BlackRock buy off – clearly someone is getting a new Mercedes.

Moreover CalPERS also makes clear it is discouraging interest. The “Strategic Partner Review” document states: “The process is very targeted, and will only be open to those that CalPERS invites to participate in the process.” When caught out by Sam Sutton of Buyouts Magazine, CalPERS then tried to take the position that it would consider unsolicited proposals. That is an insult to intelligence. The response required is a ton of work. Who is going to bother when CalPERS has clearly done the equivalent of putting up signs that say, “Only tall white men need apply”?

Our fund of funds expert pointed out that the respondents may run into regulatory problems overseas:

Many of the pre-selected firms should worry about the UK governments lawsuit against “consultants” not being independent in judgement.

As if this isn’t obvious enough, CalPERS has biased the process in other ways to favor BlackRock. For instance, it requires respondents to have offices all over the world and to have been in the investment business for more than ten years. Yet there are private equity firms with assets under management comparable to or larger than CalPERS’ program that operate only out of the US, yet invest globally. Leonard Green fits that profile and has only a single Los Angeles office.

Similarly, the relevant criterion for longevity is not how long the firm has been in business, but the depth of experience of the individuals who will be tasked to the business. Specifically, while BlackRock has been an investment manager for decades, it is a newbie to alternative investments and hired Mark Wiseman, the head of its private equity investment area, less than two years ago.

How CalPERS’ Process for Hiring a Private Equity Outsourcer Violates State Laws

Most California state bodies are subject to regulations on contracting overseen by the Department of General Services. It has an entire chapter on “Competitive Solicitations“.

CalPERS will no doubt contend that it is not subject to state contracting laws5. But those state laws set forth the legal standard that the legislature has deemed necessary to prevent fraud and assure that taxpayer monies are spent prudently. CalPERS, as a fiduciary, is held to a higher legal standard of care than other state bodies. Thus while the state laws may not be directly applicable, they set a minimum standard for CalPERS given its more stringent requirements, including an explicit Constitutional requirement to minimize expenses.

It is painfully obvious how crooked this “private equity partner” solicitation process is. Consider these overarching requirements from the Department of General Services:

Competition is one of the basic tenets in State procurement….Procurement activities must be conducted in an open and fair environment that promotes competition among prospective suppliers.

Buyers conducting competitive procurements shall provide qualified suppliers with a fair opportunity to participate in the competitive solicitation process,…emphasizing the elimination of favoritism, fraud, and corruption in awarding contracts.

If you skim the Department of General Services’ rulebook for competitive bidding, you will see other ways in which CalPERS is playing fast and loose. For instance, CalPERS is attempting to depict its stealthy-as-possible proposal process as a RFI, presumably a Request for Information. As Section 4.A2.3 explains, RFIs are used to survey the marketplace to see what vendors and services could be accessed, and as a result, RFIs are also typically short. But that isn’t even remotely what CalPERS is doing. It clearly thinks it knows all it needs to know and is going to entertain proposals only from pre-selected providers.

Similarly, the Department of General Services also sets forth what a request for proposal looks like. One of the critical elements is a price for services, which is absent here, since among other reasons, what the services will be is bizarrely being left up to the bidders.

So not only is the board being railroaded into picking providers for a process it hasn’t approved where its approval is clearly required, but the sham competitors aren’t even going to be put through a process requiring them to provide a price, let alone their best price.

The board is thus sitting pat as staff engages in flagrant violations of governance and fiduciary duty:

Allowing staff to vastly exceed its delegated authority

Falling greatly short of state government standards for contracting. Given both its status as a fiduciary and its history of corruption at the highest levels, CalPERS should adhere to the state’s guidelines and have good reasons for when it deviates (like “bidding out for paper clips would cost more in staff time than any conceivable savings”)

Failing to understand its investment costs. One of the basic requirements of a fiduciary is evaluating the costs and risks of an investment strategy relative to its returns. CalPERS’ own consultant, CEM Benchmarking, found that most public pension funds, and CalERS was one of them, were recording only about half their private equity costs. Inserting another middleman and layer of fees further increases this opacity, running counter to the board’s and beneficiaries’ interests. We’ve published an estimate of what the costs are likely to be. 1 It’s a disgrace that nothing similar has been presented to the public or the board.

If Ted Eliopoulos is unhappy about how the press is treating CalPERS, launching a process that looks designed to hand the private equity keys over to BlackRock is only going to make his PR problems worse. As a story in Axios yesterday, CalPERS asks for private equity help, concluded: “Bottom line: Never mistake big money for smart money.”

But as we have pointed out, the idea that CalPERS is merely incompetent is the most charitable conclusion one can reach from this fact set. The seasoned investment management professionals that contacted us see this “partner” program as explainable only if some sort of payoff is involved. It may not be a car or bags of cash, but the sort of reward our society perversely tolerates, like a highly-paid post-CalPERS sinecure.

We’ve long said that staff being in control of $300 billion with no budgetary checks and obviously inadequate supervision is a governance disaster in the making. This “partner” selection process is so clearly rancid that CalPERS board and beneficiaries need to put a halt to it and demand real answers, not the facile brushoffs that staff routinely provides. If not, the legislature needs to wake up and hold hearings.

______

BlackRock would be acting as a “middle man” standing between CalPERS and private equity managers, and this role doesn’t come cheaply in the marketplace. Even if CalPERS is able to negotiate heroically and ends up paying BlackRock 20 basis points (0.2%) in annual management fees, that would amount to more than $50 million a year. On top of that, BlackRock would typically receive a cut of profits.

These costs would be substantially larger than the approximately $5 million annual expense of the internal CalPERS private equity team that BlackRock would replace. In addition, it is likely that BlackRock’s compensation will rise over time, as CalPERS will likely pay a much lower fee for BlackRock to monitor legacy investments made by the CalPERS team compared to the compensation paid for new investments sourced by BlackRock. Over time, the CalPERS-sourced investments will be harvested and replaced by BlackRock-sourced ones, likely leading to large cost increases.

This estimate was confirmed via CalPERS’ response to a Public Records Act request on its real estate outsourced manager, GI Partners. GI gets a minimum of $10 million annually for acting as the oversight manager, plus potential success fees, one of which is related to cash yield on the portfolio and the others of which are for achieving process-oriented goals. That portfolio is roughly $5 billion. Extrapolating from that puts the PE portfolio oversight cost for BlackRock or whomever CalPERS hires right at the $50 million base fee estimate (the private equity portfolio is roughly $25 billion).

2 As North Carolina’s former Chief Investment Officer, Andrew Silton, observed, one of the jobs of a CIO is to keep employees focused on their work. He viewed Eliopoulos’ complaint as additional evidence of leadership problems at CalPERS.

3 That admittedly assumes that Eliopoulos would be willing to make the effort. He clearly isn’t. Outsourcing a $26 billion program is an unjustifiable solution to the real problem: that Eliopoulos is clearly out of his depth, has been handing off the “investment” work of being a Chief Investment Officer and has turned it into an administrative role that does not deserve anything approaching his current pay level. But rather than see this private equity outsourcing scam as the final, indisputable proof the Eliopoulos is willing to sell out CalPERS to save his hide, and he therefore needs to go, CEO Marcie Frost and the captured board are willing to let him do even more damage to beneficiaries and California taxpayers.

4 It looks silly to put out such an up-in-the-air request as this:

As a result, the responses to this Solicitation should include a proposal for a partnership that only covers co-investment opportunities as well as a proposal that would allow the

partnership to invest in a full breadth of investment opportunities (funds, separately managed accounts, secondaries and co-investments).

5 CalPERS will likely invoke on its so-called “plenary authority” pursuant to Article XVI, Section 17 of the CA Constitution. CalPERS has taken the position that the provision exempted it from the state budget and procurement and personnel processes. The argument was that the CalPERS board could not have plenary authority over administration of the fund if its authority in these areas was subject to the authority of other parts of the state bureaucracy. However, the state controller sued and won a challenge arguing that CalPERS’ plenary authority did not allow CalPERS to pay higher than civil service scale to our employees. While CalPERS was arguably on the thinnest ice in claiming it was exempt from state personnel laws, after the controller’s successful suit, CalPERS and the other California public pension funds went underground with their “plenary authority” argument. However, it appears that other parts of the state bureaucracy have continued to allow CalPERS to exercise independent budget and procurement authority when it might not survive a formal legal challenge.

CalPERS Proposal QuestionnaireCalPERS PE Strategic Partner RFI

California doesn’t have much use for either the Constitution or the Rule of Law.

Anyone surprised by this move by CalPers hasn’t been paying attention and anyone who thinks CalPers is a particularly corrupt part of State Government is naive.

It’s going to get very ugly over the next few years.

With all due respect, your perspective is simplistic and defeatist. CalPERS has in fact been shamed into backing off from a number of bad ideas, such as going to absolute returns to measure private equity, which would have been a terrible precedent, mis-reporting its private equity costs, and is also about to reverse its non-secret ballot. CalPERS was also embarrassed into reporting its private equity carry fees, a change described as a “landmark,” and Treasurer John Chiang was pressured into sponsoring private equity transparency legislation. The fact that CalPERS is sensitive to bad press is a very important leverage point.

Hi Yves,

One minor quibble. Back when I was in presales (for IT equipment & services), we had a very big customer, and they had the very bad attitude in handing out RFPs and RFIs typically just before holidays, and expecting an answer just after.

They did this on purpose, because if our company (or its competitors) weren’t willing or able to mobilize a team to score a win, how they could hope the same company willing to mobilize a team when disaster would strike, where the customer support teams put in awful tons of work, but get little money in return?

This is not at all the same. Did you miss that the vendor is being asked to propose what the deal will be and will have investment discretion? CalPERS won’t be able to make any demands. It will only get what is its contract and has already asked the other side to set the terms.

‘One of the critical elements is a price for services, which is absent here, since among other reasons, what the services will be is bizarrely being left up to the bidders.‘

One of the biggest investment trends of the 21st century is the “Vanguard effect” of fee competition. This has driven down the expense ratio on BlackRock’s iShares Core S&P 500 ETF to 0.04% to compete with Vanguard’s S&P 500 ETF, which charges the same rock bottom 0.04%.

Fortunately BlackRock can make up for their loss leader S&P 500 ETF by signing far more profitable (for them, not for the hapless beneficiaries) deals with public pension funds, where the fees are rich and the relationships are incestuous and cozy.

Peruse the annual report of any public pension fund and you’ll find partnerships so obscure (or deliberately mistitled, as Yves has documented) that they don’t even turn up in an internet search. Beneficiaries can’t even find out what asset classes they hold. And one has to wonder whether investment staff have any better handle on what’s inside the black box from quarterly reports.

Stuffing public pensions full of opaque, costly partnerships is a looting operation, plain and simple. They can get away with it while markets are ebullient — FY2017-18 has the makings of a great year, six months in. But us jackals are waiting patiently to rip their guts out when they go over the waterfall in the next crack-up. :-)

Thanks, Yves. Really appreciate your tenacity in highlighting all of the issues with CalPers.

And I agree with one of your comments, above, that CalPers has been forced to make changes when isssues of concern are highlighted often enough in the right places.

Keep up the good work. I’m hoping the new Board member, Ms. Brown (I think), can participate in standing for better work done by CalPers.

Thanks for doing this. It’s important.

I’ve followed your coverage of CalPERS for some time and commend you for it.

I keep coming back to the same question regarding the CalPERS’s staff making these decisions and attempting to ram them through their own supervisory board. To quote Butch and Sundance: “Who are those guys?” Who are their patrons in the California power structure and national finance community? What power or money do they gain by their actions?

The old dodge of forming a committee to make an unpopular decision, while offering said committee members and organization a plausible deniability for a potentially bad outcome of the decision, has been taken to the next level by CalPERS, it would seem. $50 mil loss (er, fees) per year for plausible deniability probably looks like swell deal to the CalPERS staff.

“Will no one rid us of these troublesome public questions?” -not Henry II.

(Hard to believe the CA pols aren’t aware of all these dodges. If they are aware and look the other way then what does that say about the CA pols? rhetorical question, of course. )

Thanks for your continued reporting on CalPERS, PE, and pensions.

Donald Trump’s promised infrastructure reinvestment boondoggle – a slew of so-called public-private partnerships that seem destined to privatize public infrastructure and profits from it, while keeping its costs public – seems destined to follow CalPERS’s corrupt process.

You would think that Gov. Brown would be aware of all this and would at least attempt to speak out about it one way or the other considering State Employees are enrolled in this pension fund.

I’ve written him 3 times through his web contact form regarding your articles and how it will affect CA State Taxpayers whether they are enrolled or not, and all 3 times I checked the box asking for a reply.

I have yet to hear one single word. Does that mean he has no control over all this, or does it mean that he just doesn’t care?

The staff’s behavior seems to imply the money is already gone and that their actions are intended to cover up a loss. They are hoping no one will notice. Otherwise, what’s the rush?

When/how does Ted cash in for this? Or is he just working for Hookers and Blow?

The socially acceptable way: revolving door. Unlikely to be as crass as him going to BlackRock or whoever is designated the winner, but a party in their sphere of influence.

Since this is my first comment on your site, let me first thank you, Yves, for your reporting, which I have read over the years, going back to the days of CalPers investments in toxic mortgages, CDO’s, etc.

As a CalPers member, your article concerns me greatly. It looks like collusion is going on to rush a transfer to Blackrock or other private fund manager. My question is what strategies do you think are most effective for stopping this move? I am considering:

1. contacting my California State representatives (who may be more communicative than Gov. Brown, contacted by JCC)

2. contacting the California Atty. General. If in fact CalPers is acting in violation of Calif. law, then AG Harris could issue an injunction, or even threaten legal action against CalPers Board members who act illegally.

3. file a lawsuit as a CalPERS member claiming failure of fund managers to act with due diligence, and/or ethical breach

Do you have any thoughts as to which of these would be most effective?

Thanks.

Thanks so much for asking!

The people you should write (and it can be the same letter) are:

1. Treasurer John Chiang and State Controller Betty Yee, both of whom are elected officials and sit on the CalPERS board.

Chiang’s e-mail: john.chiang@treasurer.ca.gov

Yee’s e-mail: b.t.yee@sco.ca.gov

2. Your representatives, as well as the heads of the committee in that oversee pensions in the Assembly and Senate. In the Senate:

Senate Public Employment and Retirement Committee

Senator Richard Pan, Chair

Senator Mike Morrell, Vice Chair

In the Assembly:

Public Employees, Retirement, and Social Security Committee

Assembly Member Freddie Rodriguez, Chair

Assembly Member Travis Allen, Vice Chair

If you are willing to participate in a lawsuit, that would be very helpful. I don’t think the situation is quite ripe but it is coming soon. If you are an attorney and able to file a suit or help fund one or act the lead plaintiff, any would be helpful.

The State Attorney general is useless. It defines its role as defending state agencies like CalPERS. Recall it was Federal prosecutors that went after CalPERS in its 2009 pay to play scandal.

I’m a small business owner who’s lived in California all my life. CalPERS is one of the main reasons I’m planning on leaving (and I’ll be taking my businesses with me). Apart from the ever-increasing hostility of the state’s employment law and regulatory environment, I’m tired of watching my own retirement plans get devoured by public employee union cronyism.