By Axel Börsch-Supan, Director, Munich Center for the Economic of Aging, Max Planck Institute for Social Law and Social Policy; Irene Ferrari, Postdoctoral Senior Researcher, Munich Center for the Economics of Aging; Nicolas Goll, Researcher, Munich Center for the Economics of Aging; and Johannes Rausch, Senior Researcher, Munich Center for the Economics of Aging. Originally published at VoxEU

Retirement ages in industrialised countries have been rising over the last three decades as more people work later into their lives. This column focuses on Germany, examining this trend and the contributing factors. Despite comparable trends in health, educational attainment, and spouse’s labour force participation, these three factors do not appear to explain the rise in retirement age. Instead, changes to public pension rules seem to be the key driver.

Life expectancy has risen dramatically almost everywhere in the world. At the same time, the retirement age has fallen in industrialised countries, putting enormous pressure on their pension systems. More recently, however, working in later life has made a comeback. Employment rates of people aged between 55 and 64 have increased in most OECD countries since the late 1990s (OECD 2017), in a stunning reversal of the long declining trend that began in the early 1970s. The average employment rate for people of this age in OECD countries was 44% in 2000, and reached 58.4% in 2016.1 Will the current rising trend in labour force participation continue, reducing the negative consequences of ageing on fiscal sustainability, or will participation slow down again?

Explaining the causes of this stunning reversal of labour force participation at older ages is the current aim of the International Social Security Project (ISSP).2 The project scrutinises the interactions between social security schemes and retirement behaviour, covering 12 western industrialised countries (nine EU countries, the US, Canada, and Japan).

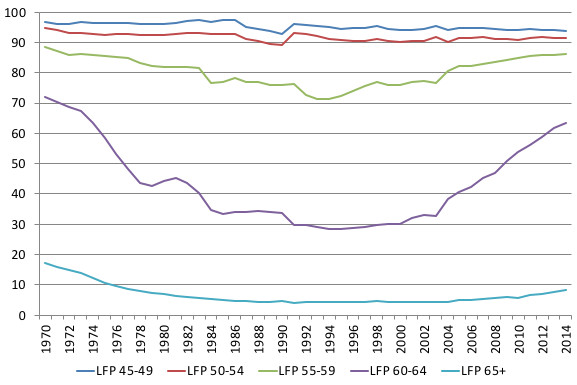

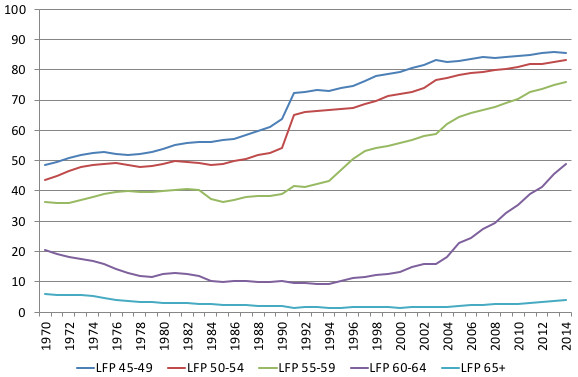

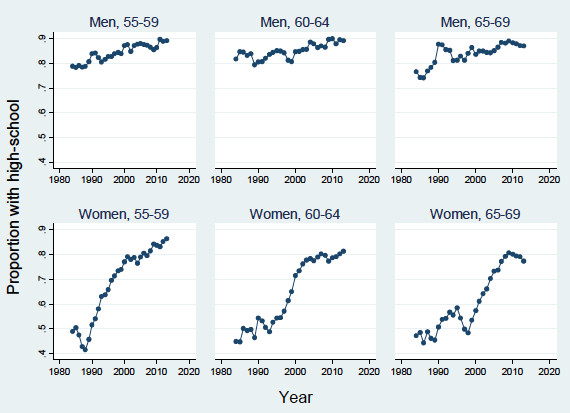

In this column we focus on Germany (Börsch-Supan et al. 2017), the country that has experienced the greatest increase in the employment rate among the 55-64 age group. Germany used to exhibit a relatively low level of old-age employment (38% in 2000 for the 55-64 age group). Fourteen years later, this rate has reached a stunning 69% (OECD 2017). Figure 1 shows this trend reversal among German men over 55. The picture is more complex for women, who experienced a rather constant increase among the 55-59 age group and a mild reversal among the 60-64 age group (Figure 2).

Figure 1 Labour force participation by age group, men

Source: OECD

Figure 2 Labour force participation by age group, women

Source: OECD

Historical Trends of Labour Force Participation Determinants

One set of causes for the trend reversal in old-age labour force participation could be historical trends. Younger cohorts are healthier and have been better educated, allowing for longer working lives. Also, the role of women in society has dramatically changed, affecting the labour force participation of both genders. How much of the trend reversal can be attributed to these secular developments?

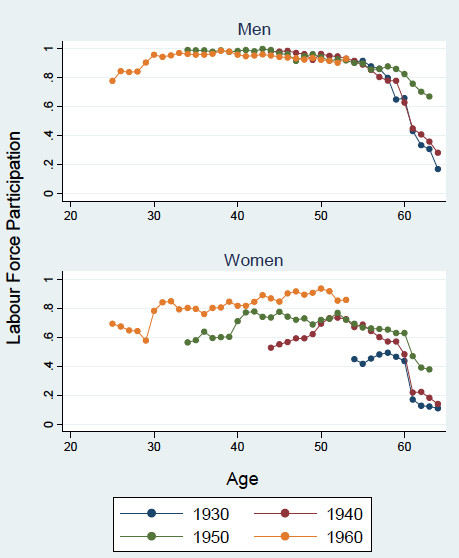

The answer is astonishingly little, at least for men. Figure 3 displays age-participation profiles by selected cohort groups. The labour force participation of men remains essentially constant for all birth cohorts considered up until the age of 55, and starts to diverge after this age. Labour force participation of women, on the other hand, is clearly higher the younger the cohort considered, at all ages.

Figure 3 Labour force participation by cohort and gender

Source: German Socio-Economic Panel (GSOEP)

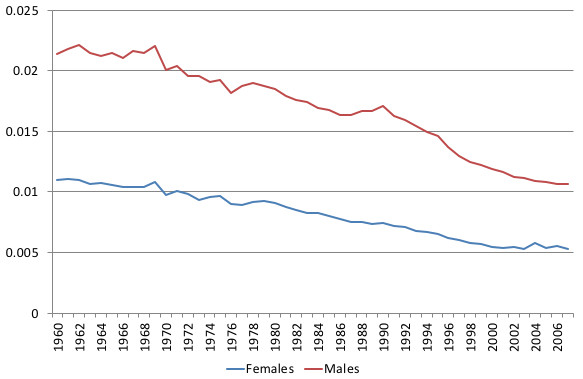

Digging a bit deeper into the historical trends, we first look at health. Figure 4 shows cohort mortality rates at age 60 by gender since 1960. It depicts a clear downward trend – during the last five decades, the mortality rate has halved for both men and women. We suppose that this declining mortality reflects health improvements also at earlier ages which, in turn, should generate a greater ability to work.

Figure 4 Cohort mortality rates at age 60

Source: Human Mortality Database

If we look at these trends in relation to labour force participation trends, we see that prior to the mid-1980s, when the relative longevity improvements for men were particularly strong for ages at risk of retirement, the labour force participation of this same age group followed a decreasing trajectory. When the trend reversed, it did so especially for the 60-64 age group, while remaining rather stable for those older than 65 even though longevity was rising in particular for this group. Regarding women, the biggest relative improvements have mainly affected women older than 65; however, this is the only age group among women where labour force participation has remained rather stable over time.

Educational attainment is another important historical trend and a crucial determinant of labour force participation. Greater education can be expected to increase the ability, willingness, and opportunities to work at older ages.3 Figures 5 and 6 show the trends for an upper secondary (high-school) and post-secondary (college) education by gender and age group. For both genders and in all age groups, the proportion of individuals with a high-school or college education has been increasing.

Figure 5 Percentage with high-school diploma by age group and gender, 1984-2013

Source: GSOEP

Figure 6 Percentage with college degree by age group and gender, 1984-2013

Source: GSOEP

Labour demand factors – such as unemployment, gross wages, and occupational composition – may be important drivers of older individuals’ labour force participation as well. Looking at unemployment of older workers, this seems to have been indirectly affecting the labour force participation of older workers through the effects of public pension and labour market regulations, rather than being a cause of early labour market exit in itself (Börsch-Supan and Schnabel 2010). Gross wages have clearly been increasing for both men and women, although growth seems to have slowed and even reversed, especially for men, during the 2000s. This trend characterises wages of all workers in Germany, however, as documented in Brenke (2009).

The final factor we consider is spouse’s labour supply. If couples have a preference for shared leisure time, we can expect a joint retirement decision. Even if we cannot rule out that married men could have responded to the increase in their wives’ labour force participation by postponing their exit from the labour market, we note that the trends for single and married men look very similar.

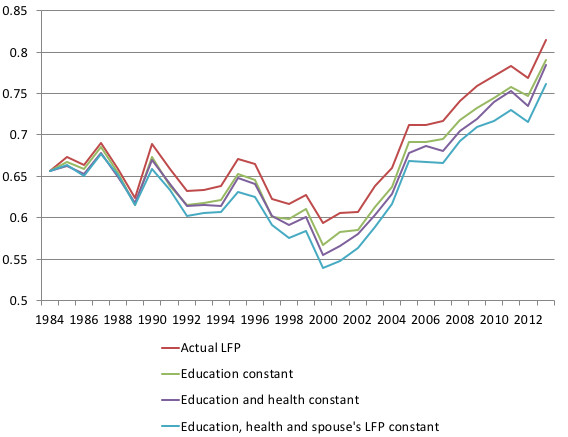

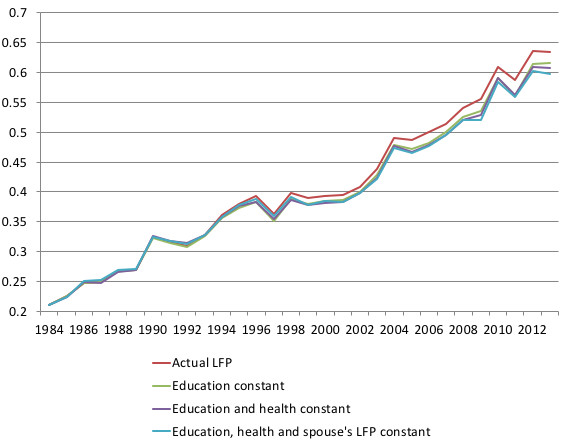

In order to more formally analyse the contribution of some of the most prominent historical trends – education, health and spouse’s employment – to the overall evolution of labour force participation, we perform a simple decomposition analysis, following the strategy used by Schirle (2008) (Börsch-Supan et al. 2017). Very broadly, this method consists of fixing a baseline year (in our case, 1984) and creating for any subsequent year counterfactuals of the participation rate, had each factor remained as at was at baseline. The counterfactual thus shows the evolution of labour force participation over this entire period had the historical trends of education, health and spouse’s employment had been absent.

Figure 7 shows the counterfactual labour force participation of men in the 55-64 age group for the period 1984-2013. The figure shows that the effect of education, health and spouse’s labour force status seems to have increased up until the end of the 1990s, and to have stabilised after that date. What is striking is that these variables do not explain at all the rapid increase in labour force participation registered after 2000 – the difference between actual and counterfactual labour force participation in 2013 is around 5 percentage points, as in 2000.

The picture for women (Figure 8) appears even less supportive of the hypothesis that education, health, or spouse’s employment are the main drivers of their strongly increasing labour force participation. The effect of education in particular seems smaller than expected in light of the steep increase in women’s educational attainment discussed above.

Figure 7 Counterfactual labour force participation of men of age 55-64, 1984-2013

Source: GSOEP

Figure 8 Counterfactual labour force participation of women of age 55-64, 1984-2013

Source: GSOEP

The Role of Public Pension Rules

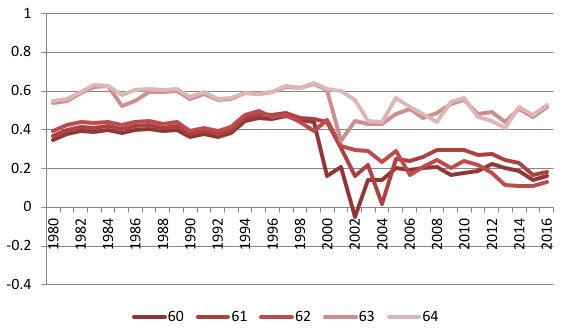

If it wasn’t health, education or women’s emancipation, what else has happened during the time of the trend reversal? We argue that public pension rules have played a crucial role (Börsch-Supan et al. 2018a). However, summarising the many law changes affecting labour force participation at older ages in a way that is conducive to quantitative analysis is not straightforward. We have taken an inventory of all policy changes that occurred since 1980,4 and compute accordingly the life-time value of public pension benefits as a function of retirement age. We relate the difference between the life-time value at a given retirement age and the life-time value when retiring one year later to the earnings of this additional year of work, and refer to the resulting number as an ‘implicit tax’ on working.

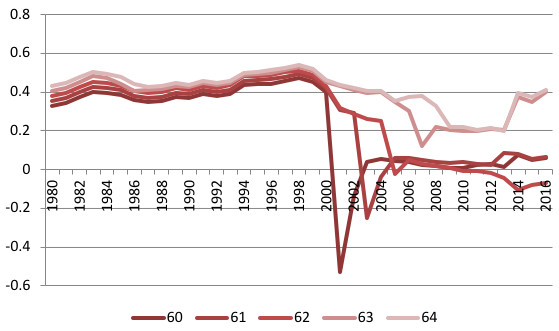

Figures 9 and 10 show that this implicit tax on working was very high until about 2000 for both men and women (40% or higher). The implicit tax then sharply decreased, especially for early retirement ages. Most of these effects were due to actuarial adjustments to claiming early benefits, which were introduced in 1992 and came into effect at the end of the 1990s. This cohort-specific intervention led to accentuated implicit tax rates at specific age steps. The conversion to a pension system with deferred taxation in 2005 has reversed this and resulted in slightly higher implicit tax rates again.

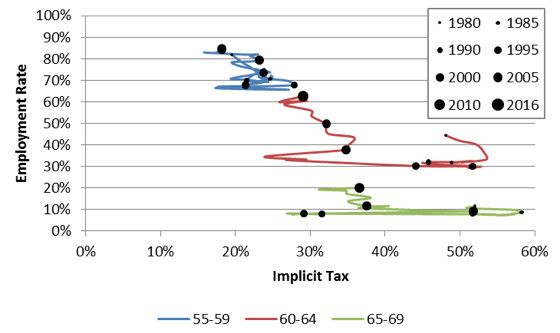

Figure 11 relates the change of the implicit tax rates over time to the prevailing employment rates of men for different age groups. The figure suggests a negative correlation between the employment rate and incentives to claim benefits early. In other words, as the implicit tax on working longer decreased, employment at older ages increased.

Figure 9 Implicit tax, men, median educated

Source: Authors’ own calculations.

Figure 10 Implicit tax, women, median educated

Source: Authors’ own calculations.

Figure 11 Employment rate and Implicit tax, men, by age groups and year

Source: Authors’ own calculations.

Conclusions and Next Steps

The evidence in Figure 11 suggests that much of the trend reversal of older men’s labour force participation may be explained by changes in public pension rules. However, this bivariate correlation does not control for the many other potential explanatory factors and the heterogeneity in the population. The next step for the International Social Security Project will therefore be a causal analysis of the role of public pension policies in shaping labour force participation. We are doing this by constructing, for each individual and separately for each country, time series of the implicit tax. We will then use these incentive variables, the macro variables considered so far, and other determinants at the individual level as explanatory variables in an econometric analysis of retirement and labour force participation.

See original post for references

It was not really necessary to undertake this study to come up with this conclusion.

For me it is not a suprise that most people choose to retire as soon as they can, which is in civilized countries, when they reach retirement ages. That is to say, when government tells them.

Of course in third world countries like the USA it might be different, as (poor) people are expected to die in their workplace.

“Work harder, die sooner”.

I’m not so sure. I think attitudes are far more variable and each individual has a far more subjective view. Which is why I found a lot of surprises and a little confirmation of what I suspected in the results.

Of course in any survey or research such as this you are missing important information about the “Why?” because you get to know the raw metrics but not the underlying thought processes behind the millions of people they represent. For example, if some people work into their mid 60’s for purely financial reasons, what happens when some of them — inevitably — get sick? They still have a financial imperative but now can’t work. Do they keep trying to work however sick they are and literally work themselves to death? Or do some other hitherto hidden support mechanism kick in (such as family financial contributions which were always possible but prohibited by some other factor such as personal pride or a competing matrix of desperations?)

And I am not sure you ever can get to the nub of all these factors. I don’t even understand my own motivations. I have £250k in the bank and in 10 years I can draw a pension of £30k pa aged 60. I have no significant fixed outgoings apart from modest daily living costs so I can live comfortably for the rest of my life — even worse-worse case that from tomorrow I never earn another penny. And yet I fully intend to work until I am forced out, whenever time that is. However I know many people who have quit work on far more modest cushions of financial security in their 50’s — and even take on higher outgoings on risky propositions like starting their own businesses. So there is a huge amount of variation from person to person.

For me, while society continues it rapacious downhill drift into an ever and ever lower trust more criminally extractive vision of neoliberal Hell, I feel less and less secure and foresee higher and higher levels of savings needed in order to be able to come up with the necessary “protection money” to pay off the various racketeering which costs I am subject to. I would never have felt that way 30 years ago. So then, I would have stopped work given the same situation I now have. No way do I think that is a sensible thing to do in our current social, economic and political climate.

I’d agree – there is no ‘one fit all’ for a perfect retirement age, but sadly in the name of ‘choice’ all our options are being reduced year by year. Plenty of people neither want to retire and nor is it good for them. My father was extremely unhappy about retirement and in all honesty, never knew what to do with his time after – he loved his job and it gave him purpose. I recently met two ex bosses of mine who were reluctant retirees and immediately went into consultancy work just to get themselves out of the house (probably to their wives great relief). Its not just ‘bosses’, a friend who is a very skilled carpenter technically retired a couple of years ago with a decent pension (he taught as well in a college), but never really stopped, he likes it too much. My oldest brother was forced into early retirement through ill health from his very physical job as an offshore oil rig drilling foreman. He hates being off the rigs and now voluntarily does a zero hours job for a phone based marketing company. I nearly choked on my beer the time he said ‘I love zero hours contracts, I just work when I feel like it!’

But plenty of people (like me) just can’t wait for it. But like you, I get more and more worried about whether my ‘real’ pension will be there in reality, so like most people I know, I’m hedging my bets, and will in reality probably keep working on a free lance basis. Although in Germany protections for retirements are much stronger so far as I know than in the ‘anglo’ nations, I suspect a major driver in the trend is a general unease about whether your pension will be all it seems until you hit the grave. Its an entirely rational fear.

Who’ll show solidarity?

The ones hating their job agreeing to work longer so that the ones who loves it can get to work longer?

or

The ones loving their jobs agreeing to earlier retirement so that the ones who hates their job can retire earlier?

The ones ruling loves their jobs so the outcome seems to be a given, however, what would the outcome be in a democracy?

I think shows how far the rising damp of insecurity has progressed when someone like you admits to these fears…from one of the top 20% in a developed western welfare state.

I wonder how few will be able to out run the ruin being prepared for us.

Re “Life expectancy has risen dramatically almost everywhere in the world. At the same time, the retirement age has fallen in industrialised countries, putting enormous pressure on their pension systems.” Why is this put this way? Aren’t the pension programs designed to fit the situation? I have a public pension and followed along as I worked. The pension fund regularly reported why they were doing what they were doing and it was all based on longevity projections, retirement age projections, etc. When the 2008 crash occurred I received a letter from the fund indicating that all was well as they were prepared for such events, maybe not quite so severe as this one but prepared … and they were.

Why the loaded language (“putting enormous pressure on their pension systems”) if not to be preparing for an argument that pensions need to be cut?

What happens when we outlive our savings by many decades?

Instead of a gold standard of care for our well being, we get the silver-plated variant?

~~~~~~~~~~~~~~~~~

Tens of thousands of new centenarians in Japan will have to make do with a cheaper version of a celebratory sake cup traditionally awarded by the government, as the country counts the cost of the large number of people reaching the milestone.

For 50 years, Japan has honoured centenarians with a silver sake cup and a congratulatory letter from the prime minister.

But the 31,747 people who are eligible for the gift this year – a rise of 4.5% from last year – will instead be presented with a silver-plated cup rather than the usual sterling silver vessel on Respect for the Aged Day on Monday.

The government reduced the diameter of the cup, called a sakazuki, in 2009 to cut costs amid a dramatic rise in the number of people making it to their 100th birthday.

Japan had just 153 centenarians when records began in 1963, and as recently as 1998 the number stood at just 10,000. It exceeded 30,000 in 2007, rising to more than 60,000 last year.

https://www.theguardian.com/world/2016/sep/16/japans-centenarians-hit-by-austerity-as-numbers-soar

More like a tin cup retirement for far too many.

Just another class driven issue…the issue of working past a retirement age is a cosmic question for the top 20 percent of those working. If you do heavy lifting or stand on your feet all day long or are trapped in meaningless low end cubicle world, you want the torture to stop as soon as possible.

I am not sure I totally agree with the conclusion that much of the trend is down to public pension policy. It is certainly an element but there are numerous factors and some of those may be more important than public pension policy.

Private pension policy by firms plays a part with the disappearance of defined income pensions and reduced contributions. Policy minimum standards have now become the norm , so perhaps policy plays a part. Standards designed to underpin private pensions have perversely acted to reduce standards.

Investment returns especially when considering charges have been pretty poor over the last fifteen years for certain age demographics. Here I am talking about capital destruction due to the financial crisis at a key saving point for certain age demographics.

Very low interest rates and the need to save more and work longer are also feeding through to the velocity of money. A positive feedback situation which might not be at the forefront of policy.

Wages which don’t keep up with real inflation puts downward pressure on abilities to save. Here a policy of talking about core inflation, rather than real inflation and its use for wage setting , works to increase inequality. Inequality which sees money parked on the sideline rather than invested, affecting the velocity of money and hence rate setting policy.

Computers and robots replace workers with the result that reduced tax is collected. Reduction in taxes leaves less ability to afford public pensions.

Reduction in labour protection, reduced redundancy payouts mean less wage negotiating power, with less being put into pensions.

These are just some ideas that could be thrown into the pot as contributors without considering second , third and fourth order effects. In my opinion it is dangerous conclusion to say much of the trend and would have preferred if they had used the words significant contributor.

I don’t see how these studies help in any way in describing the social pressures that are building up over time, let alone provide solutions. It seems like a misguided use of science and technical competence. One more example of the limitations Big Data and the futility in analyzing numbers disconnected from any specific purpose. It is looking for answers in the numbers which reminds me of astrology. You can spend your life doing it, and can be socially rewarded for the activity, but beyond that, so what.

Although Carl Rove disgusts me, but he made an important observation that is lost on most people, but cuts to the core of the current social dilemma, if not to humanities ultimate future. “We’re an empire now, and when we act, we create our own reality. And while you’re studying that reality — judiciously, as you will — we’ll act again, creating other new realities, which you can study too, and that’s how things will sort out. We’re history’s actors . . . and you, all of you, will be left to just study what we do.”

Rove’s view centered on American Exceptionalism, but hold for any Empire or power. It stands for an Oligarchic elite and their followers. It seems the goal of life has evolved into the process of keeping out of the maw of Empire- or dedicate oneself to the rise of a new power. Or to be a global cosmopolitan and play all sides. All the while the world is thoughtlessly ground down.

We are all actors in a play, and until a social institution can be constructed to safeguard some agreed upon basis for existence, we are at the mercy of individuals with greater drive for action or clever enough to leverage the power they wield.

The unspoken truth is Save Yourself. Narratives and justifications are built up around that premise. Save Humanity or Save Life on Earth is just a dim echo in the din. Also, deep in the background is the sound of laughter.

Didn’t understand how they calculated this implicit tax. Does it mean that the benefits can only be claimed when one stops working?