By Gaius Publius, a professional writer living on the West Coast of the United States and frequent contributor to DownWithTyranny, digby, Truthout, and Naked Capitalism. Follow him on Twitter @Gaius_Publius, Tumblr and Facebook. GP article archive here. Originally published at DownWithTyranny

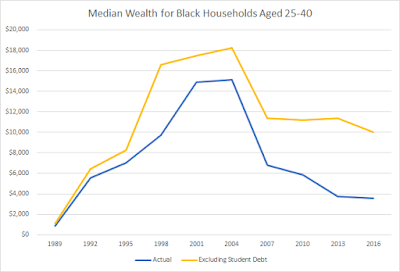

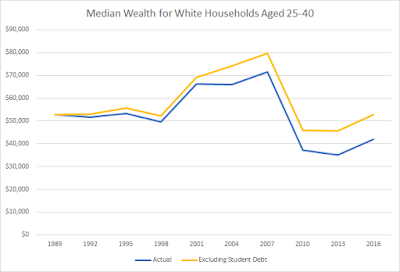

Compare the two charts above. They show median wealth of households headed by black individuals (top chart) and white individuals (bottom chart) between the ages of 25 and 40 in successive waves of the triennial Survey of Consumer Finances, with and without student debt. (Credit to Matt Bruenig for preparing these data from the SCF.)

As an interim addendum to our short series, “Killing a Predator — Cancelling Student Debt” — Part 1 here, Part 2 here — consider the observation above by Marshall Steinbaum, one of the co-authors (with Stephanie Kelton, Scott Fulwiler, and Catherine Ruetschlin) of the Levy Institute paper on student debt cancellation we’ve been looking at. It comes from a more general piece Steinbaum wrote for the Roosevelt Institute discussing his Levy Institute paper. I’d like to focus here on just that observation.

Before we look at more of what Steinbaum wrote, please note three things about the charts above.

First, consider the differing degrees to which student debt subtracts from the wealth of young black households and white households. The takeaway from that should be: No, canceling student debt would not mainly benefit the rich. It actually disproportionately benefits black households when measured as a percentage of household wealth.

Second, look at the vertical scales of the two graphs, their Y-axes. The numbers are not the same. The top charted point (peak of yellow line) for young white households is $80,000. The top charted point (peak of yellow line) for young black households is slightly more than $18,000. That’s a peak-to-peak wealth differential of greater than 4:1.

Worse, the actual wealth of these black households in 2016 is less than $4,000 (blue line, top chart), compared to more than $40,000 for white households in the same year (blue line, bottom chart). In other words, the 2016 wealth differential is more than 10:1.

Canceling all student debt would bring that differential down to “just” 5:1 — still shameful for a society like ours, but it shows what a great boon student debt cancellation would be for young black households.

Finally, note that while from 2013 to 2016 white wealth for these households has recovered somewhat from the Wall Street–caused “great recession,” black wealth has recovered not at all.

Now Steinbaum:

One thing that immediately becomes clear upon investigation of the student debt crisis is the extent to which it is a creature of this country’s legacy of racial discrimination, segregation, and economic disadvantage patterned by race. My prior researchwith Kavya Vaghul found that zip codes with higher population percentages of racial minorities had far higher delinquency rates, and that the correlation of delinquency with race was actually most extreme in middle-class neighborhoods. What this tells us is that student debt is intimately bound up with the route to financial stability for racial minorities.

In that work, we ascribe this pattern of disadvantage to four causes: segregation within higher education, which relegates minority students to the worst-performing institutions, discrimination in both credit and labor markets, and the underlying racial wealth gap that means black and Hispanic students have a much smaller cushion of family wealth to fall back on, both to finance higher education in the first place and also should any difficulty with debt repayment arise. The implication is that while higher education is commonly believed to be the route to economic and social mobility, especially by policy-makers, the racialized pattern of the student debt crisis demonstrates how structural barriers to opportunity stand in the way of individual efforts. Insisting that student debt is not a problem amounts to denying this reality.

Looking at the time series of median wealth for households headed by black and white people between the ages of 25 and 40 (what we refer to as “white households” and “black households”) in successive waves of the Survey of Consumer Finances (SCF) [see charts above] reveals these racialized patterns. … By this measure, the racial wealth gap (the ratio of the median wealth of white households in that age range to the median wealth of black households in that age range) is approximately 12:1 in 2016, whereas in the absence of student debt, that ratio is 5:1.

Moreover, while overall net household wealth levels for the non-rich increased between the 2013 and 2016 waves of the SCF for the first time since the Great Recession did violence to middle-class wealth, rising student debt weighed in the other direction—especially for black households. The time trend from these charts is clear: Student debt is increasingly burdening everyone, but that burden disproportionately weighs on black households.

Steinbaum refers to another study to explain why this is the case (emphasis mine):

A 2016 paper by Judith Scott-Clayton and Jing Li offers clues, since it tracks the debt loads of black and white graduates with four-year undergraduate degrees. They find that immediately upon graduating, black graduates have about $7,400 more in student debt than their white counterparts. Four years after graduating, that gap increases to $25,000. The crucial difference is simply that white graduates are likely to find a job and start paying down their debt, more-or-less as the system is designed, but black graduates are not—they carry higher balances, go to graduate school (especially at for-profit institutions) and thus accumulate more debt, and subsequently earn no better than whites with undergraduate degrees.

What this suggests is that any given educational credential is less valuable to blacks in a discriminatory labor market (probably because they attended less well-regarded institutions with weaker networks of post-graduate opportunity, and also because even assuming they did attend the same institutions as their white counterparts, outcomes for black graduates in the labor market are mediated by racial discrimination). … The assumption that debt-financed educational credentialization represents constructive wealth-building and social mobility thusreflects a failure to comprehend the landscape of race-based economic exclusion.

The interaction of student debt with “race-based economic exclusion” provides a powerful argument for student debt cancellation all on its own. Something to keep in mind as this idea enters public discourse.

Student debt and its cousin consumer debt are means toward semi-voluntary servitude. With apologies to Willie and Waylon, Parents, don’t let your babies grow up to be serfs.

Anecdote is not data, but I am where I am because of my ability to fund my education in significant part via the maximum allowed student loans. The semi-voluntary servitude that resulted in was brief as I paid them off but well worth the resulting engineering degree. A degree in underwater basket weaving while perhaps personally fulfilling is not quite as marketable and students seeking to take out loans for such degrees should be counseled accordingly. That said, I am all for making student loans dischargeable in bankruptcy, forgiven via service (conservation corps?) or obsolete via a free higher education program like many nations in Europe. The education choices our youngest citizens make shouldn’t define the rest of their lives as debt serfs. As the charts in this article highlight, we have a long way to go in our society to achieve real equal opportunity. Will student loan cancellation help? I don’t know. We give multinational corporations profit repatriation jubilees (basically debt forgiveness) that cost a pretty penny for no benefit so I’d say it is definitely worth a shot.

I am where I am from my ability to fund my engineering degree with student loans. Except where I am is worse off than when I graduated in 2008, from a state school with $120k in debt. It took me 4 years to get a job in my field that paid $20k a year less than the average starting salary when I signed for my loans. 4 Years after that I had finally added that $20k back on in raises but still was at around negative $100k with half of that on credit cards because I have never in my life made enough money to meet my living expenses and debt payments. Than I just got so depressed about my pathetic finances that my performance at work suffered and I lost my job. 2 years of applying for more jobs whenever I have managed to be not too depressed to do so has gotten nowhere because every round of rejections kicks off more depression. At 33 my 65 year old dad (who had a huge part of his retirement nest egg totalled by hurricane Sandy) still has to cover the minimum payments for me on most of my loans because only a few of them were federal and the rest refuse to offer any kind of flexible repayment options and since he cosigned all of them he’s screwed if I default. Which just adds to how worthless I feel all the time.

Getting jobs has nothing to do with what you know and everything to do with who you know, plenty of kids I was much smarter than in school not only had mom and dad pay for 100% of tuition out right but then got strings pulled to make sure they got the handful of jobs on offer as the economy fell off a cliff. The reason black people suffer in the job hunting process is because just like me they don’t have connections to hook them up. Every last bit of this miserable country is rigged to favor the people who need it least and nothing will ever change.

I am so completely sick of everyone thinking that it’s only the kids with “worthless degrees” that suffer with our neofeudalism student debt enslavement. I’m also sick of being made to feel like my suffering under debt bondage is some how less horrible because of some magically white privilege. Every big company out there would love to have more diversity hires because that is something they can brag about. POC face much more discrimination at low skill jobs than high skill ones. Of course the fact that I’m gay is the one diversity nitch not mentioned on job applications.

Since Bill Clinton signed the H1-B expansion, the value of an Engineering Degree has fallen by around 50%. (That was September, 2000, by the way.)

Nobody in Silicon Valley tells their children to get a degree in Computer Science any more. That pretty much tells you how it is going.

I feel sorry for anybody who goes to college and borrows money to get a CS or EE degree. It is simply not a good investment.

IMHO, writings on division of society into racial categories will often forget that racial division is a subset of class division, and race being easier to see and ‘mark’ makes it easier for the elites to use as an exploitation measure.

Would it not be entirely constructive to attempt the elimination of class societies so as to lift both blacks and whites to a ‘standard’ level of economic and social justice? This would not reduce in any way the need to institute a compensation for past discrimination, and especially to support compensatory educational and social programs that notify all of society that this period of degradation is over. But it would enhance the support of those classes at the bottom for all programs that lift the general population, against identitarian policies that can be seen as discriminatory against them.

My second question would be: is this possible under capitalism as we know it now? I reserve judgment and defer to the vox populi.

Oh, yes. Racial division is a subset of class division. I suspect that if this study were repeated for “rural vs. urban residents” or “students from economically-depressed communities vs. economically growing communities” instead of the racially-based “black vs. white” comparison, you’d get substantially similar results.

From the National Center for Education Statistics:

From the Cleveland Fed:

Not that STEM degrees are the answer to all problems, but borrowing money to obtain a degree in a low paying field may not be a wise choice.

It looks like from 1989 to 2016 median black wealth increased 300% while median white wealth declined 20%.

Help me. When you start at zero, you can have large percentage increases and still be at the functional equivalent of zero, and a median net worth of under $4K fits the bill.

More reasons to #juststoppaying?