Lambert here: Readers, I apologize for the original post I had promised; unfortunately I had a formatting debacle that I couldn’t climb back from in time. I chose this cross-post since readers both because it concerns European stability, and readers might be interested in comparing the metrics for European core and periphery to those for out own coastal metropolises and flyover states.

Nauro Campos, Professor of Economics, Brunel University London; Research Professor at ETH-Zürich; and Research Fellow, IZA-Bonn, Corrado Macchiarelli, Lecturer in Economics and Finance, Brunel University London. Originally published at VoxEU.

The protracted economic crisis in Europe fuelled demands for a deeper understanding of the dynamics of ‘core’ and ‘periphery’ in the EU, and in its Economic and Monetary Union (EMU) in particular (De Grauwe 2018). We introduce a new framework to study these asymmetries, generating a novel, theory-based measure that is time-variant and continuous (i.e. it departs from static binary classifications of core and periphery). The framework captures the probability of a country being classified as peripheral. We construct it for a set of European countries for every year since 1989 and document the formation and evolution of a core and periphery. We unearth an increasingly integrated core next to an entrenched periphery, with a third set of countries in between that is characterised by in-and-out movements (Campos and Macchiarelli 2018).

Searching for Convergence

Our starting point is the seminal paper by Bayoumi and Eichengreen (1993), who identify a core-periphery pattern in the run-up to the formation of EMU. Motivated by optimal currency area theory, they identify demand and supply shocks using long-run restrictions in a structural framework (Blanchard and Quah 1989) and yearly data over 1963-1989. They find a core where supply-side shocks are highly correlated (Germany, France, Belgium, Netherlands, and Denmark) and a periphery where shocks are uncorrelated (Greece, Ireland, Portugal, Spain, Italy, and the UK). They forewarn that if persistent, this divide would be detrimental to EMU.

The vast literature that follows relies on static binary classifications where, for tractability purposes (i.e. exactly identified models), output-related restrictions are seldom imposed (De Haan et al. 2008, Santos and Tenreyro 2010, and Campos et al. 2017).

The novelty of our approach is that we treat these output considerations as over-identifying restrictions on the supply side. Augmenting the original Bayoumi and Eichengreen (1993) framework, we test whether output is quantitatively (magnitude) and qualitatively (sign) affected by supply-side shocks across countries.

This generates an absolute measure of asymmetries that is theory-based, time-variant, and not binary. It reflects the probability of a country being classified as peripheral, and in so doing allow us to ascertain a changing European core and periphery, yearly from 1989 to 2015. Importantly, this does not rely on choosing a particular country, such as Germany, as the anchor.

The more frequently the model under the proposed over-identifying restriction is rejected, the more peripheral a country is said to be. Conversely, the lower this frequency (i.e. the less often the model is rejected for a given country in a given year), the higher the probability of a country being classified as core.

This is implemented by calculating the share of the model’s rejections of the supply-side shock restriction in the total number of bootstrap replications.1 The sample is, with a fixed 25-year window, then shifted one observation up and the structural model is re-estimated so as to obtain a new number of rejections. The procedure is performed iteratively until the end of the sample. We call this index NORD as it reflects the ‘number of rejections dynamics’ in our sample.

In the Beginning, There was Periphery

We use NORD and the Phillips and Sul (2007) framework to study convergence dynamics. One of this procedure’s outcomes is to separate our sample into three groups of countries. All countries in the first set show a commonly sustained decline in the probability of being classified as peripheral. We call it the core.

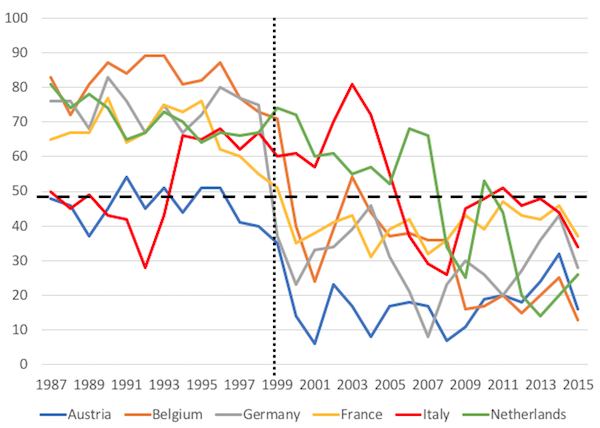

Using the 50% cut-off point for convenience, the first three countries to enter the core are Germany, France, and Austria, all by 1999 – which is the year the euro was introduced. Belgium joins the core in 2000, and Italy and the Netherlands join in 2005 and 2007, respectively.

If one associates the likelihood of being classified as core with that of optimal currency area membership, these results show the formation over time of an endogenous optimal currency area (Frankel and Rose 1998), as countries only start joining the core after the currency union is in place.

Figure 1 When and how did the core form?

Note: NORD for Austria, Germany, France, Belgium, Italy and Netherlands, 1989-2015.

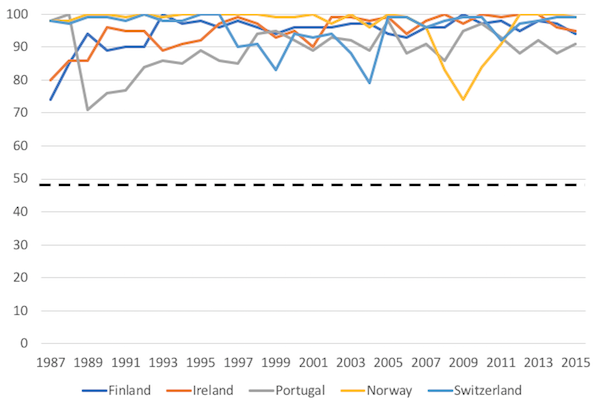

The second set of countries given by the Philips-Sul procedure is shown in Figure 2. Not only do these countries have high levels of NORD, but their series are trend-less. We call this the periphery. This result strongly confirms Bayoumi and Eichengreen’s early warning about EMU, specifically about the possibility of an entrenched periphery. Note that neither Norway nor Switzerland is a member of the euro area, although Portugal, Finland, and Ireland are.

Figure 2 A very entrenched periphery

Note: NORD for Norway, Switzerland, Portugal, Finland, and Ireland, 1989-2015.

The Philips-Sul procedure also identifies a third, intermediary set of countries. Within this group, we distinguish between two main subsets: one for which NORD does not display a sustained movement in or out (‘trendless’), and another one for which it does (‘trending’).

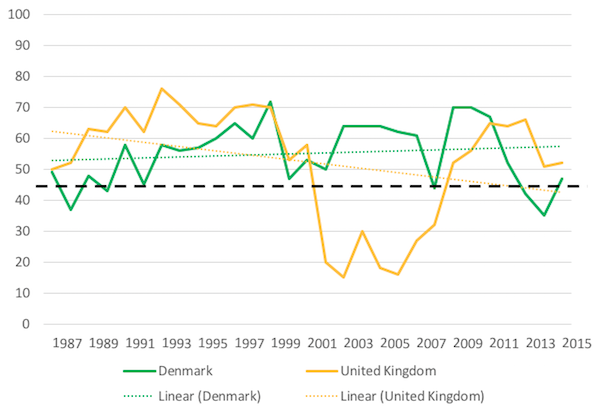

Figure 3 shows the two countries in the middle/trendless sub-set. The figures for Denmark change very little over time, while the opposite happens for the UK where NORD displays one of the highest volatilities in our sample, with the UK moving in and out of the core.

Figure 3 How did the middle trendless group fare?

Note: NORD for Denmark and UK, 1989-2015; OLS trendline added.

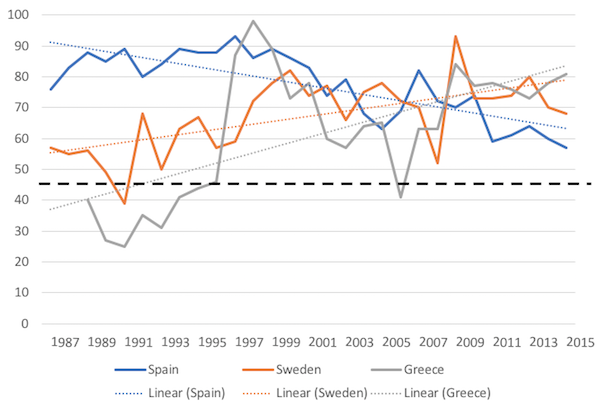

Figure 4 shows the trending/middle sub-set with intermediate levels of NORD. Spain’s NORD is flat until 1999 and starts to decline afterwards, moving towards the core (linear interpolation suggests it may join circa 2020). Inversely, Greece and Sweden move away from the core. In other words, they become more peripheral over time. Note that between the introduction of the euro in 1999 and the onset of the financial crisis in 2007, Greece was moving in the ‘right’ direction – that is, it was core-bound.

Figure 4 How well did the middle trending group perform?

Note: NORD for Spain, Sweden, and Greece, 1989-2015; OLS trendline added.

The Correlates of NORD

What are the factors that help explain the variation in NORD across countries and over time? These correlations are suggestive of whether NORD is doing a good job in capturing core and periphery dynamics.

Using a specification based on endogenous OCA theory, our panel estimates indicate that euro membership and looser product market regulations make countries more likely to be classified as core (Campos and Macchiarelli 2018).

To elaborate on the latter result, we also find that trade openness and, to a lesser extent, foreign direct investment help to ‘import competition’ and in so doing substitute for product market regulations. Imports – but not so much exports – increase the probability of a country being classified as core.2

Conclusions

The results above show that the core and periphery pattern in EMU has changed considerably since 1989, both in terms of relative strengths and distances between main groups of countries, but also in terms of the trajectories of individual countries. For example, it is interesting that different countries join the core in different years.

Overall, our new theory-based index, NORD, decreases over time for the set of countries that the Philips and Sul (2007) procedure singles out – this set of countries is what we call core. NORD remains high and basically constant for what we define as a peripheral group (worryingly confirming Bayoumi and Eichengreen’s warning about a deep-seated periphery). Finally, NORD varies substantially for an intermediary set of countries since 1989. In the latter, Denmark’s NORD remains constant around the 50% mark while the UK’s moves in and out of the core over time.

The results for Spain are encouraging as they show that although the country should still be classified as periphery, it is clearly moving towards the core. This contrasts with the experiences of Sweden and Greece which, according to their NORD scores, are slowly moving away from the core, or in other words, are gradually becoming more peripheral in the EU.

umm…..

There’s a core? Or there’s a crowd with Brownian Motion?

To be frank, I have no idea what all that jargon means, and what all those definitions entail in terms of the validity of the approach. I only have hunches that a few items would merit some explicit considerations:

(1) The approach assumes that the theory of “optimal currency areas” is verified. Is it really?

(2) It only views “supply shocks” as relevant — I thought that the past decade has shown that demand is a major issue.

(3) The conclusion seem tautological: “euro membership and looser product market regulations make countries more likely to be classified as core” — a-priori membership of a single currency area increases the probability of being a core member of an optimal currency area?

(4) From its economic structure (importance of industry, oversized banks, very high trade surplus, traditionally strong currency), Switzerland could be compared to Germany, 10 times smaller. It is also deeply integrated in economic exchanges with the EU. I would expect an explanation why it is considered as a “peripheral” country whereas Austria belongs to the core.

Articles from VoxEU are regularly posted in NC. So far, they mostly appear to me contrived attempts to fit reality in some overly abstract frameworks with justifications difficult to discern. I suspect they are written by economists for other economists sharing the same conceptual approaches and vocabulary; I usually struggle to find them engaging.

What you said or Lambert is having us on with his new random word robot economist projector.

My (vague) understanding of this article is this:

1) There are some countries in the EU whose industrial sector is strongly integrated with each other;

2) Those countries tend to have coordinated shocks, because they have a common industrial sector; we call these countries the “core”, whereas we call those countries which don’t have such a coordinated shocks and are more unhinged the “periphery”;

IMPORTANT: this is a different definition than the usual where Grmany is “core” cause it’s rich whereas Greece is “periphery” because it’s poor, in theory core and periphery in this sense has nothing to do with being more or less rich, it’s just a matter of how economically integrated one country is with the others.

3) By building a measure of how coordinated are the industrial shocks we can have a measure of “coreness” and say what countries are more core and what more periphery;

4) “optimal currency area” says that only core countries (in this specific sense of being strongly integrated) should adopt a common currency; we see that some countries that adopted the Euro became an optimal currency area because of the euro and looser product market regulations (generally this means lower bariers to entry to foreigners, the use of a generic “regulation” is problematic to say the least);

5) but some other countries are more and more unhinged so this is a problem.

—-

I think there are three problems with this logic:

1) It assumes that “core” and “periphery” is just a matter of integration, but we see that there are more industrialised areas and less industrialised areas, probably because of network effects; in the USA the industrialised area is on the coast, in Europe it’s in the center (the so called Blue banana: https://en.wikipedia.org/wiki/Blue_Banana ). If there is a tendency to polarisation between very industrialised areas and very rural ones then there is a problem, and this has nothing to do (or small to do) with “integration” in the sense it’s used in this article;

2) It skips the problem of an industrial core which needs a market for it’s product, and the corresponding financial effects of german lenders (private capitalists) and greek borrowers (public), with all the problems that come from this;

3) it uses the “deregulation” canard, the problem is not that the market has to be deregulated, just that it has to be part of the common market (which implies few non-trade barriers in the form of DIFFERENT regulations) in order to become fully integrated. The “low regulation” mantra is such a pain, I wonder if they would call “low regulation” also an environment where creditors have no way to get their money back from debtors, or the police didn’t punish strikes with damage to property.

EDITED for grammar

I think that’s about it. Much of the article is beyond my technical skills to critically deconstruct, although I think in principle if economic modelling is any use at all (a debatable point), then looking at issues like the optimum size/structure of currency areas is one of them. Its unfortunate that it is full of assumptions which are hard to assess if you are not an expert on the topic. As one example, I find the use of ‘supply-side shocks’ curious – why not just recessions? I can only assume they are using a wider definition of ‘supply-side shock’ than I’m familiar with.

As you say, the use of ‘deregulated’ in the article is curious unless, again, they are using a definition different from the ones I’m familiar with. If anything, I would have thought that more regulation, not less, is important for currency areas as it can be a strong force for convergence.

I assume (I stress assume, I’m not sure of this) that by supply shocks they don’t mean recessions but rather supposed changes in technology, like countries whose productivity varies in the same direction.

Suppose, for example, that France and Germany have a common industrial sector but Italy doesn’t. Then when productivity rises in France, it will also rise in Germany; on the other hand, Italy has a different industrial sector so it’s possible that productivity rises in Italy while it’s falling in Germany or the reverse.

Then they retrofit the reasoning and look for what countries tend to variate together in the same direction, and assume that these countries have a common industrial sector (core), whereas the others don’t (periphery).

Another problem of this logic is that if, for example, Italy is part of the “core” but part of Italian industries shift their factories in Poland because polish wages are lower, this will look as a fall in productivity in Italy and an increase in productivity in Poland, and Italy will look less “core”, even if it is actually integrated.

At the risk of seeming to go off-topic, it appears that the concept of a European `core and periphery’ dichotomy

is not just for economic affairs:

High Court extradition refusal a ‘nuclear bomb’, say Warsaw judges [Irish Times]

I have no idea what this means or how it reaches its conclusions, or even what value there is in being core, peripheral or undetermined.

But the graphs are pretty.

I am from Spain and I would say that we are more likely to converge with Morocco that with the ue-core.

This paper is full of jargon and abstract reasoning and it does not improve our (or at least my) understanding of the issues it talks about.

I would even say that its aim is precisely to obfuscate and obscure this understanding. After all, isn’t it what economics is all about?

If you want to know and understand how the economy works, just go empirical and forget these charlarans.

I agree with you that this paper is full of jargon, and obscure. But saying that Spain is more likely to converge with Morocco than with EU-core puts you in the charlatan group, joining the authors of the paper.

Also from Spain

The periphery: PIIGS and now the defiant UK.

The economics are not divorced from real and perceived cultural and political differences in Europe. They are historical and deep divisions that aren’t overcome by a currency any more than divisions in the Mid East aren’t overcome by arbitrary lines on a map.

I thougth everybody had forgotten the “PIGS” thingy. This suggests that you are under the culturally despreciative, deeply unaware of their own limitations crowd.

Germany hasn’t forgotten.

Don’t tell me you display the opinion of Germany!. And “Germany” has the rigth to call pigs whatever they like. Bull shit.

Carroll Quigley’s giant book Tragedy and Hope has some useful historical material and perspective about how European economies and political systems developed and how those influenced subsequent interactions. Since it is a War and Peace length, you may want to skim and sample prior to diving in.

Edit: Here is some more reference material.reference

After a failed edit :(, here is that reference material link.

Perhaps it was just a silly idea in the first place.

“”historically the German D-Mark had been strengthening since its introduction in 1948 against the currencies of its neighbours, and this reflected – and compensated for – increased German competitiveness. Their weakening currencies allowed German trade partners to keep their export industries in business and their workers employed.

…….

When visiting Europe at the time (I was based in Tokyo in the 1990s), and meeting my peers, the chief economists at other banks, I would of course discuss what in my view was the highly worrying prospect of these plans to abolish the D-Mark. I was astonished by their reaction. About half of them insisted that those plans were so lunatic that, of course, they would not be implemented.

………

“The other half of the chief economists, like me, recognised that a single currency would be introduced, no matter how nonsensical the economics, since it was a political project. (The economics being bad, the politics was even worse: the end of democracy in Europe). They agreed with me that it was going to be a disaster. I asked the chief economist of what was then the fourth largest German bank: „If you think so, why don’t you speak up about this? You are forecasting gloom and doom, but I don’t see any reports by you or your bank about it.“ His answer was shocking: He said that there had been clear instructions from the boards of all the large German banks to their staff that no report on the abolition of the D-Mark and the introduction of a European single currency that was in any way negative was allowed to be published. The economists in the private sector had been muzzled by their bosses. The same I heard from journalists. So the German media only quoted the rigged reports from the banking economists.”

Professor Werner