Yves here. One option that used to be popular among the rich but not super rich to evade taxes was to have no residence: spend 1/3 or more of the year on a cruise ship, and spend the rest in at least two other countries. Another classic one is to live in Monaco. But if you’ve ever visited, it is claustrophobic and seems devoid of anything besides sun (its deeming feature), too many tanned middle aged men wearing a bit too much jewelry with much younger blond women, and too many casinos.

By Andres Knobel. Originally published at Tax Justice Network

On February 19th, the OECD launched a consultation entitled “Preventing abuse of residence by investment schemes to circumvent the CRS”. It was about time. Since 2014, we have written several papers and blogs (here, here, here, here and here) explaining how residency and citizenship schemes offered by countries can be abused to avoid automatic exchange of bank account information established by the OECD’s Common Reporting Standard (CRS).

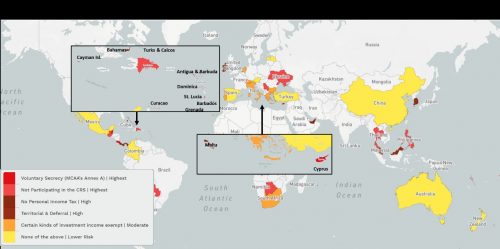

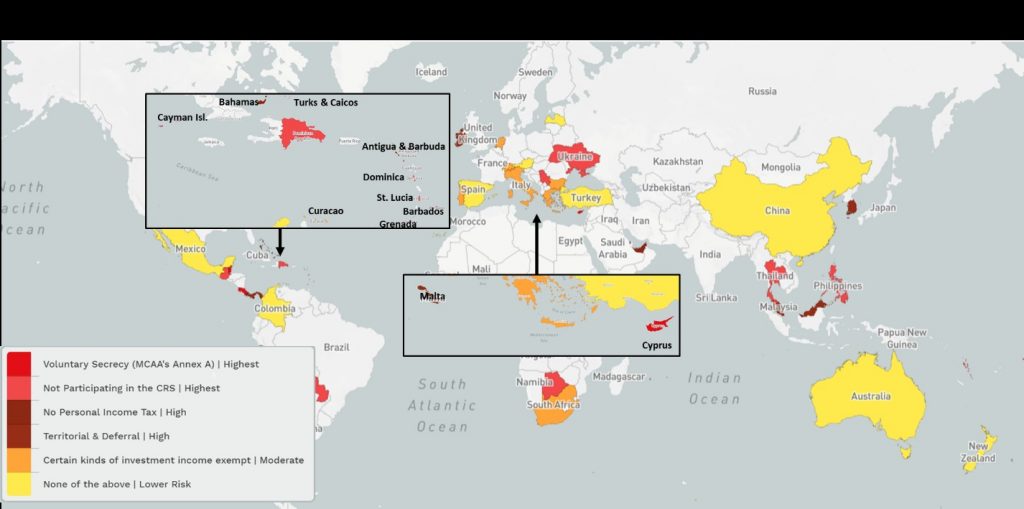

Today, we publish this brief report by myself Andres Knobel and Frederik Heitmüller with the list of countries presenting the highest risk to be abused for avoiding the CRS.

Image based on a map created by 23degrees.io

How does this work? In short, the CRS requires banks and other financial institutions to determine the residence of their account holders, so that their banking information will be sent to the corresponding country (where the account holder actually resides) so that authorities can check if the person has declared the foreign bank account and paid relevant taxes. However, if the account holder manages to trick the bank by pretending to be resident in another country, their banking information will be sent to the wrong country, or it might not be sent at all. Citizenship and residency by investment schemes can be abused for this precise purpose. An account holder may acquire one of these citizenships or residencies in exchange for money, not to migrate to another country, but only to trick their foreign banks about where they actually live.

TJN’s Financial Secrecy Index published last January assessed this under indicator 12. Based on this research, we now present a list with all jurisdictions offering residency or citizenship by investment schemes, considering their level of risk. For example, residencies or citizenships offered by countries who are not participating in the CRS or who have chosen “voluntary secrecy” (to send, but not to receive information under the CRS), present the highest risk because any person who is (determined by the bank to be) resident in one of these countries will become “non-reportable”: their banking information will not even be collected, let alone exchanged with other countries for CRS purposes.

You may be surprised to see that there’s one country missing from the list: the U.S. In principle, the U.S. should be included. After all, it has a residency by investment scheme offering green cards in exchange for USD 500.000, and the U.S. is not participating in the CRS. However, the U.S. is a major risk (probably the greatest) to the CRS, not because of its residency scheme, but because of its lack of participation in the CRS altogether.

Using the U.S. residency scheme to avoid CRS reporting is unlikely because anyone holding a green card would be considered reportable under the U.S. FATCA framework (the U.S. equivalent of the CRS). This doesn’t mean that the U.S. poses no risks for avoiding the CRS. On the contrary. While the U.S. residency scheme is unlikely to be used to avoid the CRS, a much cheaper option is offered: any individual can simply hold their money in U.S. banks and this way avoid the CRS altogether (given that the U.S. is not a participating jurisdiction, U.S. banks will not exchange any information pursuant to the CRS). The U.S. may still exchange information about non-resident account holders if it has a FATCA-based inter-governmental agreement with the country where the account holder is resident. However, since the U.S. will not send information to other countries at the beneficial ownership level, any individual could avoid being reported both under the CRS and under FATCA if he/she holds money in U.S. banks through an entity (not in their own name; see here and here for more details).

In other words, the U.S. represents a major risk to the CRS, not because of its residency by investment scheme, but because of its refusal to join the CRS or to exchange with other countries as much information as it receives from them under FATCA-based agreements.

I’m guessing that the US is a net importer of global tax arbitrageurs? Hence its not joining CRS.

If you’re an American, the federal income tax and investment tax burden is a bargain compared to other countries. Especially if you domicile in Florida or Texas or a Plains state.

Sure an American can find a way to pay less/no taxes, but then you wind up going to extremes like renouncing your US citizenship.

Despite its imperfections, I wouldn’t trade living in the USA for life in any other.

Why? Because I’ve tried to leave this country before.

And you know what? After a few weeks away, I couldn’t escape the fact that I was an American, through and through. The people in that other country were all too willing to remind me of this fact.

So, here I am, America. You’re stuck with me.

Gotta have someone there to help keep the crazies in line.

Given the assimetries of FATCA agreements (a signatary country MUST send to US authorities ALL societary and personal banking information about US citizens, residents or not, while the US would only send some personal banking information about foreign residents from the particular signatary country) and the apparent unwillingness to join CRS agreement, it would seem safe to say that the US government attitude is: give me what I ask for and f#ck you. But it isn’t.

Apparently the problem is that under current US laws, their banks are not required to collect all the information that the CRS agreement requires. I have read that the treasury or the IRS “don’t have the regulatory authority to require US banks collecting all the information” required for simmetric FATCAs or CRS. The problem seems to be that there is nobody in the Congress interested on changing current law not under Obama, much less under Trump.

But you guys surely know much more…

‘The U.S. refusal to … exchange with other countries as much information as it receives from them under FATCA-based agreements.’

FATCA is pure U.S. unilateralism, threatening the rest of world with loss of USD correspondent banking access unless they knuckle under to narking out US expats to the IRS with a blizzard of tedious paperwork.

Seeing this radical escalation of the risk of trading in USD, Russia and China of necessity have proceeded to establish non-dollar remittance and clearance facilities to bypass the politically tainted US dollar entirely.

FATCA is pure hell for an American living aboard. While doing so I had both my EU checking account and brokerage account closed. Not because I wasn’t reporting them but because the reporting requirements are to onerous on the foreign institutions. It’s easier to just reject clients with a US passport, which many banks have done. For this reason and the dual tax reporting many US citizens living aboard have given up the US citizenship. Mostly because of the hardship, not desire.

The dual tax reporting is also a great expense unless you are an expat whose employer is picking up the bill. Many countries have tax treaties and higher rates than US but the US tax system still requires you to file and report while living out of the country. Hiring a qualified CPA that was qualified to mesh US tax reporting requirements and with the country you are living in outside of the US cost me about 5k a year. Totally wasted money done out of concern that the IRS or treasury will run you up a pole.

Hugh,

I had similar experiences. Several of my UK (investment) accounts informed me that they could no longer maintain me as a customer, after I moved to the US on a permanent resident basis. FATCA requirements were just too onerous to deal with. Funny, how a hammer is used to crack a nut. Yes, the fat cats should be paying their fair share, yet middle classes get swept up in the IRS hunt. Corporate taxes and reporting requirements meanwhile….

Fat cats always find a way around. Always have, always will because they are connected to the politicians on both sides of the aisle. Many might not know this but you can get a FATCA reporting waiver. I’m sure the well connected and wealthy have no problem getting the reporting waiver. In my personal experience limited government is better for the average guy.

I am a US citizen that spends time between another country and America. I run a global business and was getting taxed at the US state level and also in the country of business . I decided to move to a non tax state to save on the taxes. FACTA was a problem but with my international CPA it is now routine. I still feel being taxed on a global income is aggressive when one considers all the breaks corporations get. Not fair.

I feel it is pathetic that wealthy individuals (same for corporations) feel it’s important enough to pay no taxes that they go to extremes to avoid them. At some level, we must pay for services that are part of living in society.