Mr. Market is not happy with Trump’s latest move in his trade war of wills with China. US stock futures have fallen overnight by more than 1.5% and Asian markets are volatile.

Yesterday, Trump announced that he would have the US Trade Representative identify another $100 billion of goods imported from China on which the US might impose 25% tariffs, with a 60 day comment period. This was in response to China’s reaction to Trump’s threat to impose 25% on $50 billion of Chinese goods. China responded that it would impose tariffs on its own list of $50 billion of US goods, including soybeans and 127 other agricultural goods, cars, chemicals, and aircraft. China also said it would file a case in the WTO contesting the Trump tariffs. Remember that these measures are in addition to the tariffs Trump imposed on steel and aluminum.

The Chinese also made a tart announcement overnight. From Bloomberg:

“The Chinese side will follow suit to the end and at any cost, and will firmly attack, using new comprehensive countermeasures, to firmly defend the interest of the nation and its people,” the Commerce Ministry said in a statement on its website, without further detailing any planned measures.

The Commerce Ministry also made clear it would prefer not to have a trade war.

The earliest the US might impose tariffs is the end of May, on the first $50 billion of Chinese goods targeted. The Trump Administration has been deliberately silent about when it might pull the trigger. However, team Trump may have gone out of the gate sooner than was in its best interest. It was naive to think they could wrest a quick win from China. April is a long time before the November midterms. If the Trump administration keeps the tariff threat in play though then, investors won’t like the volatility, and the trade row could be the trigger for an overdue revaluation. A protracted trade game of chicken would probably weaken the dollar, which would increase import prices and thus the inflation rate. That in turn could stiffen the Fed’s resolve to stick to its guns on interest rate increases, which would be another negative for asset prices.

The $50 billion tit for tat round was expected to have limited macroeconomic impact. We’ll presumably get an update on the latest threats. The effect on the Chinese economy was estimated to be 0.1-0.2% of GDP. Asia Times has a write-up of a Goldman Sachs analysis which shows both sides so far have been targeting goods with limited knock-on effects. Moreover, as some experts noted even before the details were announced, given how many manufactured goods are part of global supply chains, measures nominally targeting Chinese goods would have some of their costs going to other countries, including the US.

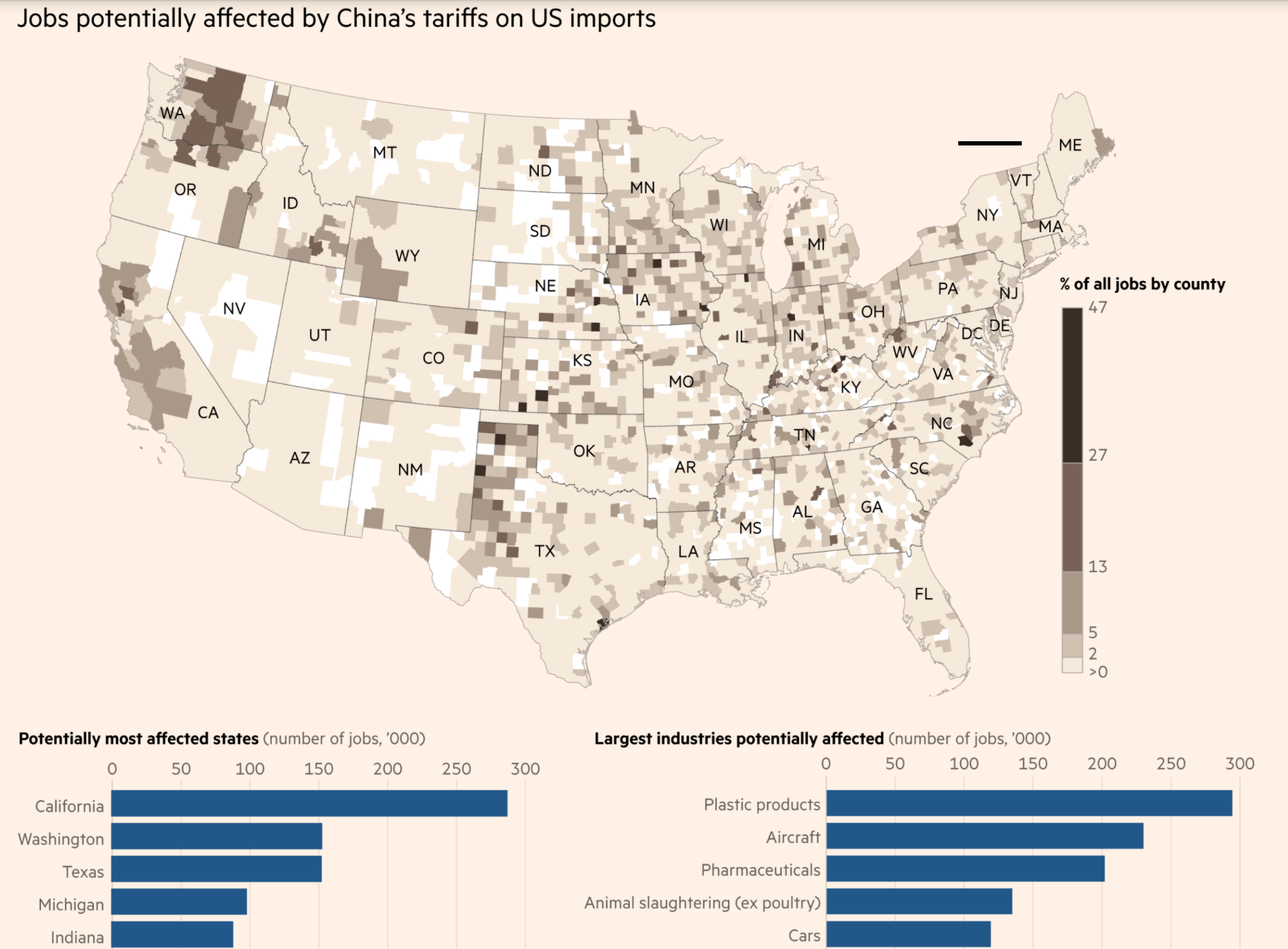

However, Congresscritters representing farm-heavy constituencies are upset about the prospect of Chinese agricultural tariffs, particularly since farm incomes have already been under stress. Agriculture secretary Sonny Perdue tweeted that Trump told him, “Sonny, tell them we’re going to take care of our farmers,” which is pretty thin gruel. This Financial Times chart maps out which parts of the US are most exposed:

From Asia Times:

A report released Thursday found that levies on products targeted in both the Trump administration’s tariff list and China’s retaliatory one would have limited impact on the global tech supply chain. This, despite the US list’s targeting of electronics exports, which accounted for US$130 billion of the total US$600 billion in cross-border trade in 2016.

In fact, the US tariff proposal appears to be applied primarily to component products not often shipped directly to the US, according to the research from Goldman Sachs. The tariffs on consumer electronics categories make up a relatively small amount of sales for most tech companies. Similarly, the analysts point out, the China list also includes items that are either not high-volume tech products, or are often assembled in China directly, such as cars.

In order to limit the pain felt by the US consumer, end-use products, including smartphones, servers, and PCs, were conspicuously absent from the Trump administration’s initial list.

Analysts warned it would be hard to spare US consumer goods in the proposed additional $100 billion of Chinese goods to be tariffed.

Trump has been attempting to use trade threats to force concessions on other fronts. The US has always compartmentalized its negotiations: trade issues are handled separately from national security matters, for instance. Trump has been trying to use trade to force concessions on other fronts, such as telling Mexico that they needed to restrict migrant entry into the US as a condition of preserving Nafta in some form. Team Trump may have interpreted China pressuring Kim Jong-un, in the form of summoning him for less than a state visit, as a geopolitical gesture in response to Trump’s trade ultimatums (China announced that Kim Jong-un said he was willing to denuclearlize in return for security guarantees, which means the US taking its troops out of South Korea. That is actually a long-standing offer, but the US press rarely mentions it. And the US is not prepared to take it up since among other things we like having a military presence close to China. But the optics were presumably helpful to Trump)

The effort to force China to the negotiating table is not working very well. Before Trump’s $100 billion raise in his trade poker game, Administration officials had done a good job of persuading investors that the two sides were talking, with the implication being China would agree to offer some concessions and the tariffs would not be imposed.

However, the fact that the US and Chinese were communicating isn’t tantamount to serious horse-trading. From the Financial Times:

The [Thursday] rally was helped by soothing words from senior US officials, who insisted there was still plenty of time to strike a deal with Beijing. Larry Kudlow, the new White House economic chief, noted “it’s nothing around the corner” since the tariffs were currently only “proposals”.

But his attempts to calm market fears came as people briefed on bilateral negotiations said there appeared to be little in the way of grounds for hope. “Clearly the two sides are talking but the discussions do not appear to be meaningful,” said one person familiar with the talks.

But China is going to find it hard to match Trump’s $100 billion raise. From Bloomberg:

Were China to want to match Trump’s latest threat in kind, it wouldn’t have enough American goods imports to target. It could still take other measures — like curbing package tours or student transfers to the U.S., or steps against American companies’ operations in China.

I always thought it was crazy to invest in a country where you could not be sure of your property rights. The Chinese are just about certain not to do anything as aggressive as seizing assets. But they could become relentless in enforcing usually ignored regulations, or restrict dividend payments to parent companies. Since the government has been pursuing overinvoicing as a way to evade capital controls, they should have a bureaucracy in place to assess the validity of purchases of the prices at which foreign materials are purchased. And for US firms, the hassle factor of having the Chinese government all over their foreign purchases would probably be a much bigger cost than a restriction on dividends (most US firms care much more about reported enterprise profits).

The Administration isn’t clear about what it wants. Even though Trump has stated a high-level goal of reducing the US-China trade deficit by $100 billion and curbing China’s misappropriation of US intellectual property, his team does not appear to have an idea of how to get from A to B. From the Financial Times:

The Trump administration has long been divided on how aggressively to embrace protectionist measures, and it appears to be split again over how best to deal with China…

The mixed signals from his administration have also muddied Washington’s negotiating stance and, some analysts argue, played into China’s hands.

Trumps presidency has been a wild ride from its outset. Why should trade be any different?

Well, Each country possesses a set of unique risks and opportunities. Starbucks very recently got whacked over selling “carcinogenic” coffee; this was considered crazy enough on this side of the water to be widely reported, but this kind of “drive-by litigation” is actually a common enough occurrence to lower the stocks of anyone in the EU considering “conquering the US market”. In the case of China, Growth Potential still trump any risks :).

Regarding the trade war, I think the risk is that right now all the talking heads are tracking the daily market actions to determine / frame the discussion in immediate “good or bad” terms. However, the soy bean tariffs, for example, will not “show up” until those tariffed soy beans have been grown, harvested and shipped which is 6-9 months from now.

While China and Donald Trump are tariffing each other with great enthusiasm, the actual effects out in the real, physical, world will not show up for quite a while and – maybe – they will be overdoing it and perhaps there is a sudden surprise waiting later, when the tariffs actually happen?

I wonder how this will influence trade with the rest of the world.

I also wonder about US corporations with manufacturing facilities on China. What are they saying?

For instance, in Latin America they are beign cautious about the consequences

How many US companies have actual manufacturing facilities in China as opposed to JVs with Chinese firms? This is a big source of contention for both many governmental and corporate officials.

Yep. Yves writes about it in a comment below. I even didn’t thougth on outsourced facilities.

What about the EU?:

…

And trade wars as a context for Brexit won’t help the process, I guess.

I count three “only if” statements in a row. If only the EU were an autarky things would be grand.

“A protracted trade game of chicken would probably weaken the dollar, which would increase import prices and thus the inflation rate.”

Isn’t this the whole point of protectionism? That americans can’t buy stuff from outside anymore?

Trump sold protectionism during his election campaign as a way to increase jobs (and presumably wages) in the USA.

But this implies cutting into profits of USA businesses, that Trump doesn’t want to, so his policies are contradictory: even if he persuaded China to protect american IP rights more, this would only make it easier for the likes of Apple to invest in China, thus the opposite effect of what Trump is promising to his electors.

But he can still sell this to his electors by painting everything in a nationalist color, and implying that everything that annoys the chinese is automatically good to all americans.

The problem is that the US has not just ceded production. It has ceded skills, from the factory floor through supervisors and middle level managers. This isn’t the sort of thing you get back in a year, or even five years. It’s much easier to destroy than build or rebuild, particularly since many of those formerly skilled workers are past retirement age, and what they knew is not current, so even they have catch-up. While that’s still better than starting from scratch, pray tell how do they get back down the curve?

And for some companies, it’s worse than that, since they haven’t just “offshored” but have outsourced to foreign companies. So they have ceded those capabilities entirely.

I either don’t follow you or disagree with you:

1) one of the classic justifications for protectionism is the theory of “infant industry”, initially created by Hamilton and later spoused by German economists: the idea is that the UK was so much more developed industrially that local producers couldn’t compete on high tech products, which pushed the USA or Germany into low tech trades, which in turn kept USA and Germany underdeveloped; USA/Germany thus had to resort to protectionism to catch up with the UK.

The obvious implication is that free international trade is good for the country that has a technological advantage: at the time it didn’t make sense for the UK to impose tariffs, because it didn’t have any catch-up to do.

Today the situation is the same between China and the USA: from the point of view of China, protectionism and export-led expansion makes sense, because it helps the Chinese to reduce the technological gap, but from the point of view of the USA it doesn’t because there is no technological gap to reduce.

Marx’s position was that undeveloped countries needed protectionism to kickstart industrial development (by pumping up industrial capitalist’s profits) while in developed countries protectionism was negative because it increased profits at the expense of wages.

2) but there is another current in modern day neo-protectionism, that is that China et al. are stealing jobs from developed countries, and this is one of the core points of neoliberalism. Trump (and other right-wing populists) are riding this kind of opinion.

In my view this is bunk because we don’t know that the net imports represent lost jobs, they might as well represent consumption in excess of what would happen in a situation of balanced trade.

What really happened IMO is that international trade put pressure on governments to reduce pro-worker legislation, and this is what caused the fall in wages; furthermore, as the wage share is structurally low, even a situation where there isn’t much unemployment is perceived as a situation of crisis, because the jobs that are present are crap jobs and people want a situation of ultra-high employment in the hope of getting better jobs in a super-tight job market.

This leads to stimulus policies like Trump’s tax cuts that in turn tend to increase imports, as some of the stimulus leaks outside.

3) modern neo-protectionists (who are mostly right leaning) blur the two things, and ramp up nationalism by blaming bad jobs on foreigners, implying that without the net imports the job market would be so much better that everyone would have a pony. But this isn’t true: Italy for example is a net exporter and has a lousy job market.

Furthermore, if by “good jobs” we mean an high wage share, this means that the profit share has to fall, but neo-protectionist are able to ignore this problem by blaming the low wages on “foreigners”.

Thus in my opinion the problem of Trump’s policies isn’t that it’s difficult to roll back free trade, but rather that he (like the brexiters) is promising two opposed things contemporaneously: to the workers he is promising that he will put them in a situation where they can snatch much better wages and working conditions (hence a rise in the wage share), and to businesses he is promising that he is going to increase their profits by reducing competition (hence an increase of the profit share). But the profit share and the wage share sum up to 1 in the end.

“The problem is that the US has not just ceded production. It has ceded skills, from the factory floor through supervisors and middle level managers. This isn’t the sort of thing you get back in a year, or even five years. It’s much easier to destroy than build or rebuild, particularly since many of those formerly skilled workers are past retirement age, and what they knew is not current, so even they have catch-up. While that’s still better than starting from scratch, pray tell how do they get back down the curve?”

That’s the whole point of protectionism: you force buyers to buy inferior stuff at higher prices in the hope to stimulate that particular industry; this is likely to be bad for workers unless there is an “infant industry” situation, but it’s the whole point of protectionism not a bad side effect.

Ad 1)

There is a significant difference between the situation in the 19th century and today. Free trade was used as a means to push surplus goods into foreign markets while the production almost always remained in England. What is today called foreign direct investment took the form of investment in the colonies at the time and this investment was primarily directed towards securing more raw materials like cotton, silk, sugar and so forth. Currently we see a much different picture because not only finished goods but entire industries are exported, including the means of production. One critical factor in producing competitively is knowledge how to do stuff in an industry (nothing to do with patents), which has been partly lost in the US. Therefore higher tariffs will not help bring back domestic production and the likely outcome is higher prices for many years until the outsourced knowledge has been (re)learned or other foreign sources become available.

I agree with your points in 2) and 3) worse jobs are a result of a different power balance between capital and labour within a country and the mobility of capital in excess of labour between countries and not necessarily free trade of goods or services.

USA has an infant industry or is in danger of having one. It has a senior citizen industry. If the skills of production are not passed from seniors to the next generation the US will have an infant industry again. This is why there is protection and support for agriculture in US? So that the ability to produce our own food does not go away?

Regarding loss of technical skills, has the growth of the financial sector as a profit generator in the US economy enabled the US to in a sense live on fumes while it becomes relatively less capable in a “material” technical sense? Isn’t this what has happened to Britain? It seems that in the case of the US this would have led US elites to be, if not indifferent, less concerned about technical depletion.

As Yves said, this isn’t the sort of thing you get back in a year, or even five years.

As someone who used to work in the Machine Tools industry and bailed as jobs disappeared and wages not only stagnated but actually decreased, my guess is that various areas would take at least ten to twenty years to get back.

I understand ‘the whole point of protectionism” but it’s unfortunate that American Industry put itself into this position – that of “not making things” – in the first place. It was obvious to to many workers, too bad it wasn’t obvious to our MBA/Accountant Overlords that could not care less about anything over the quarterly horizon.

Immediate profit and couching everything in terms of profit for Corp C-Suite and “shareholders”, despite neoliberal beliefs, are not the be-all and end-all. If your business doesn’t know how “to make things” but only knows how to manage the Makers and profits, and then you ship all the Making overseas, you are screwed, coming and going, no matter how you attempt to justify the economic situation.

I believe that the plan back then was that America would be the Executive Suite of the world, make the decisions, give the orders, and collect the lion’s share. I believe that it’s vaguely starting to sink in that this might not work.

“That’s the whole point of protectionism: you force buyers to buy inferior stuff at higher prices in the hope to stimulate that particular industry”

I wonder what would happen if you put up just enough tariffs so that locally produced gear would be the the same price as imported gear and let consumers decide by quality? Could prove interesting that.

Tariffs can be useful. Many decades ago the Japanese in their days of greatness gave some Japanese car company several hundred dollars for each car exported – call it $600. That way the Japanese cars would be much cheaper than cars from the US, UK, etc. when they hit the docks. The French simply turned around and whacked a $600 tariff on those Japanese cars as they hit the French docks which brought them back up to levels where French cars would be competitive and gave the French a nice revenue stream.

Thank you MisterMr, that’s quite helpful

I am going to go with the idea that China has realized that there is no benefit in giving way to a bully which Trump is acting like. You give way to a bully and they always come back demanding more. They have seen the way that Russia has been abused the past few weeks through two poisoned dissidents and thought hard on how many Chinese dissidents are also overseas in countries like the UK and the US. There but for the grace of God…..

The Chinese, I think, have decided to go head to head in service of their interests and will refuse to be bullied. I fact, right now there are forty Chinese warships and three American aircraft carrier battle groups all converging on the South China Sea where both fleets will conduct live-fire exercises. Thus this dispute is not only in the arena of trade but also the military sphere. I don’t think that the dispute has also affected the financial sphere such as US Treasury notes but I would guess that both sides have got that at the back of their minds.

Yes, the suspension of Treasury bond purchases by China is the threat that can never be named. Doing so would collapse markets overnight, yet it hangs out there in the balance of this tit-for-tat negotiations. Clearly American is very vulnerable on this issue, but there is a bigger debt hole on the other side that I’m sure Team Trump is well aware of, and that is China’s massive internal debt. Debt to GDP in China is off the charts at 257% at the end of 2017. America is at 152% by comparison. Losing a large portion of American trade would make most of that debt in China unserviceable since a lot of it has already been rewritten several times, requiring the Bank of China to step in to avoid a depression and perhaps a revolution.

*Sigh* The US can deficit spend without selling Treasuries. That practice is a holdover from gold standard days.

And the Chinese would never sell their Treasures. Short term, it would send the dollar to the moon, the last thing China wants.

See here for more discussion:

https://wolfstreet.com/2018/03/23/chinas-empty-threat-of-dumping-its-us-treasuries/

I have an MMT Badass tattoo on my left ankle. I know the whole Treasury bond scare is a canard.

But for the market and media who report on this trade war, China dumping treasures is the nuclear option. The mere suggestion that China might act in this regard creates a moment of silence while everyone ponders their impending doom. It may be a nothing burger in the end, but the road to that end will be littered with many financial corpses.

Agreed. The Chinese would only have to slow down the purchase of US Treasury notes but the bad optics would cause a lot of rumbling in the stock markets. They have far too much invested in the US to be stupid enough to start a sell-off but I am betting that there may be other ways that they could undercut Trump.

You know, the way that stocks can go up and down and even sideways made me realize something about the stock market a long time ago. When you get down to it, it is just one great, big, “popularity contest” is all. In a popularity contest you do not have to be good to be the most popular and if you want proof that the stock market is just a popularity contest, just think of the valuation of Uber.

I think that may not be quite right RenoDino. I live in Hong Kong where we have invested a large part of our national savings in T bills to underwrite a currency peg. Ten more years ago we asked GS if we could sell or hypothecate some for infrastructural development and the word back eventually was we would have to wait at least two years to start reducing our holdings. The thing is the Fed sells when it chooses.

It’s not like China is not a bully.

They can bully as well as anyone in the world, I believe.

“Poisoned dissidents”?

Mr. Skirpal is an exchanged spy; Ms. Skirpal his daughter. Neither was a dissident.

You’re quite right. I was on the way to bed when I typed that up. I was thinking more of the Chinese dissidents here. Skirpal is actually just a traitor to his country and his daughter was just probably unlucky enough to be the one sharing a dodgy shellfish meal with him at the time. I stand corrected.

Were China to want to match Trump’s latest threat in kind, it wouldn’t have enough American goods imports to target . . .

Couldn’t China just double or triple the tariffs on the minuscule amount it imports from the US for the same effect? You know, make them jets and soybeans scream?

Trump could go after Chinese oligarchs, like he’s doing with the Russian ones, if he’s serious.

Farm state senator Ben Sasse on flake-o-nomics:

D-U-M dumb … that’s how #MAGA spells FREEDUM, son.

China has the freedom to light American agriculture on fire, at any given time.

Not even if we don’t take on their bad behavior do they not have that freedom to light American agriculture on fire.

We live under that Damocle’s sword constantly.

USTR statement:

“Unfair retaliation” would be retaliation that’s disproportionate in size and value to the tariffs imposed by the aggressor nation (that would be “us”). China claims that its retaliatory tariffs announced Wednesday affect $50 billion of US goods, mirroring Trump’s unilateral $50 billion attack on China. Proportionate retaliation is well-accepted practice in trade conflicts. There is nothing “unfair” about it.

As a veteran trade lawyer, Lighthizer knows this perfectly well. Everyone who’s studied the history of GATT and US trade law learnt it as college students. So what is Lighthizer on about with this preposterous claim?

Occam’s Razor says that Lighthizer’s a yes-man, a courtier who accommodates potus’s every demand, to the extent of letting the orange flake draft his press release for him. This will not earn USTR any respect from its international counterparts, who are well versed in trade law and WTO procedure.

The joke goes on … but we aren’t laughing no more.

Unfair in the sense of election meddling.

To me, that’s unfair.

Retaliate with a focus on banskters, for example, would be fair, for socialists.

Actually, whatever may be said about the rest of Trump’s cabinet, Lighthizer is not a yes-man. Rather, he is a true believer, who’s now getting to do what he’s wanted to do for decades. He represented the U.S. steel industry for many years, and was one of a nationalist faction who believed that the WTO was a horrible error for the United States. He would like a return to the pre-WTO GATT era, in which trade rules were non-binding. The US usually followed GATT, but reserved the right to threaten or impose extraordinary tariffs under Section 301 or other laws. One example was the Plaza Accords which stopped the dollar from appreciating against the yen.

Trump and Lighthizer are now applying laws that the US has not used in a generation and that are likely to run afoul of the WTO. Lighthizer realizes there will be costs, but if these are no worse than a stock market correction, they will be worth it to him to show that the WTO is what the Chinese might call a paper tiger.

As this blog has pointed out, much of the trend toward outsourcing was never driven by profit concerns so much as fads and easy talking points for MBA executives. From now on, any CEO considering outsourcing will have to wonder if the decision will blow up in their face after a trade war. In the long run, this may help revive US manufacturing. Economists may say the benefits will be less than the costs, but I’m sure Lighthizer does not see it that way. From his perspective, Chinese retaliation in the form of persecuting US companies in China may be a feature, not a bug. Of course he’ll complain if it happens, but he may be thinking it will teach those traitors a lesson.

Trump wants to get out or re-do NAFTA.

Does he think the same about WTO?

The whole point of free trade has always been to put the fear of God into labor “You strike and we’ll move the plant overseas. You’ll take this offer and you’ll like it.”

And then first recession, they moved the plant anyway.

That fact that wage, labor conditions, environmental, and tax arbitrage came along with it was just gravy.

China has chosen to respond thus far with threats to impose unjustified tariffs on billions of dollars in U.S. exports, including our agricultural products

That’ll be interesting to see how this all plays out if China imposes agricultural tariffs considering Bank Of China invested/loaned $4 billion And Morgan Stanley $3 billion in funding of Shuanghui’s (now WHGroup) acquisition of Smithfield Foods in 2013. Especially since Smithfield has expanded its US operations into the grain/supply chain- Smithfield Grain. Here’s an interesting article on China’s agri holdings, Corporations replace peasants as the “vanguard” of China’s new food security agenda.

Since Smithfield is now a Chinese owned hog and grain corporation with subsidiaries worldwide, especially in Mexico, will they transport agri-products & pork over the US border into Mexico and then ship to China to avoid their own import tariffs?

Let’s be honest here, a trade-army marches on its stomach.

“No fermented bean curd, no marching.”

Yet more trade theater inspired by the status quo who seem to have forgotten about oil sanctions and Marc Rich.

If banks such as HSBC , who seem to have violated all sorts of money laundering sanctions, only get a wrist slap, why would any of the hundreds of mid-size trade firms care less about this? Pile tariffs high and wide and watch everyone make a bundle – thanks Donald!

It is hard not to see this on an attack on California as well.

A day that lives in infamy…attacking California.

What’s next, Hawaii?

It is hard not to see this on an attack on California farmers that voted for the reign of error, as well.

When attacked, do we back down, surrender or immediately sue for peace?

For Lincoln and Lee, it was ‘Let’s get a victory first. Then we will talk peace.’ And that logic goes for almost everyone, every time, with some exceptions perhaps.

next up: large aircraft? In the $50B round of proposed sanctions, the last item on China’s list was medium sized aircraft (roughly 737 sized). So that’s going right to Boeing next, one of Trump’s key corporate allies. After that, there’s not much left besides natgas, but I don’t see how the energy market can really be tariff’ed.

As an aside, there’s all this talk of hitting Trump states… isn’t this repeating the same electoral strategy mistake again – wouldn’t targeting swing states be better? (not sure how tho, what do they export that hasn’t been covered already?).

All just huffing and puffing so far, fortunately. Regardless of how genuine Trump’s personal intentions are, his administration as a whole is bluffing (as is China) and investors at home and abroad know it. Eventually Mnuchin will come over, maybe with his real bosses, and have a little chat with the Prez. We’ll move on.

I would agree with you about Big Bad Trump and the Middle Kingdom Piggies except for the suspicion that there might be a Black Swan lurking around the pond somewhere. All this bluster and posturing heighten anxiety in the people who are ripe for a panic, or, as said in the Olde Days, Panic.

Europe in 1914 is mentioned as an analogy from history to describe todays’ zeitgeist. Back then, who could have accurately predicted that a Serbian Nationalist assassin, a lone person, even though part of a larger movement, could set off a World War?

So, a cynical scenario:

A die hard Greenpeace clone group makes a bomb boat out of a Zodiac. A dedicated environmentalist pledges herself to die to protect the Lesser Purple Crested Ornithopters nesting sites on a remote atoll in the South China Sea. A Sultanate of Bruneis coast guard cutter spots said Zodiac approaching the Chinese dredging boats off of the atoll and begins to shadow it.

Sultanate captain calls Chinese captain of Chinese frigate ‘protecting’ Chinese land reclamation fleet to warn him of Zodiacs approach. Chinese crews see tiny Zodiac approaching and try not to laugh out loud. Zodiac pulls up alongside Chinese frigate and blows itself up. Frigates magazine goes off. Chinese warships ‘see’ fellow ship destroyed with Sultanate warship in vicinity. Missiles start flying. As part of ‘secret’ treaty, Philippines ships fire in support of Sultanate ship. Ships start sinking. Philippines calls on American fleet for support, as per treaty rights. World goes half way to H—.

Silly? Maybe so, but, ask a similar question of a senior military or political figure in any European capital in the Spring of 1914, and you might have gotten a similarly dismissive response.

China started the trade imbalance wars long before Trump became POTUS (see World Bank tariffs chart). If there’s cause to point the finger at trade imbalance, its at China’s current import tariffs on US goods 3.5 compared to USA’s current weighted import tariffs at 1.6, half of China’s.

China’s disingenuous retaliatory tactics is nothing more than to obscure the real trade war on China’s policies and practices of intellectual property theft. According to a 7 month investigation, a US Trade Rep found that “Chinese theft of American IP currently costs between $225 billion and $600 billion annually.” Senior VP James Andrew Lewis of CSIS in Washington DC states, “China accounts for a majority of economic cyber espionage against the United States (perhaps three-quarters of the losses are from Chinese spying{…] China has sought to acquire U.S. technology by any means, licit or illicit, since Deng Xiaoping opened China to the West. Espionage and theft were part of this, but so were forced technology transfers or mandatory joint ventures as a condition for doing business in China.” Lewis adds, “After 30 years, those chickens have come home to roost.”

Trump’s skills are that of a bull in a China Shop. Nonetheless, for the last 30 years, the onus is on past presidents and congress who acquiesced to IT companies & corporations seeking the lowest common denominator- a country- China, offering up its citizens as cheap labor with no OSHA/labor laws and zero EPA standards. Not to mention US tax loopholes. All in exchange for technology transfers. Companies over-calculated their ability to shield their most valuable technologies. They thought they could control the Dragon. They were wrong. What we’re not seeing behind closed doors are the IT giants and corporations begging Trump to fix their mess.

Forgive me if this sounds naive, but if China targets goods like soy beans and Boeing aircraft can’t we just have the feds buy it in China’s place and set them in some lot somewhere for a while until a third party want’s to buy the at at a discount.

China still has a lot of inefficiencies in it’s manufacturing sectors as a result of it’s state owned enterprise preferencialism that make getting rid of excess capicity and inefficiency a high priority for them. America has, like, the opposite problem; idle production facilities but very accurately priced production costs and efficient production (capital wise)

For the US to compensate a targeted industry it seems like we’d have a lot of leeway given how high our productivity levels are and the fact that we’d we’re backing them a reserve currency.

If we used the the government as a third party to dump our products on the market (which is what China is doing now) it would have the effect of both stopping job/revenue losses in the targeted sectors and keep our products flowing in the global production system (thus preventing our products being replaced in the global supply chain in the mean time).

I guess that other countries could take us to the WTO for dumping but there’d have to produce a near word for word clone of our own indictment against China’s dumping that they say isn’t likely to hold up.