Yves here. This post includes a very helpful timeline of trade tit for tat so far. There are also four diagrams that show trade flow impacts of various proposed tariff measures. You might want to go to the Bruegel post proper and view them there because they are interactive and I could not pull an interactive version over.

By Francesco Chiacchio, Research Assistant at Bruegel. He was a trainee at the European Central Bank, working on projects related to productivity, Global Value Chains and technology diffusion, export intensity, and credit allocation, as well as on macroeconomic projections. Originally published at Bruegel

The multilateral trading system has been challenged by unilateralist measures and subsequent threats of retaliation. We collect the main events that have shaped the current situation and show which trade flows have been and will potentially be affected by the various measures. We end by discussing possible scenarios moving forward for the EU.

Since the beginning of the year, the multilateral trading system has been challenged with a number of decisions and announcements on tariffs. The trade conflict between the United States and China may be escalating, while the European Union finds itself in a precarious position in responding to the US’ challenges.

So what has and what has not yet happened this year? We focus on the measures taken and announcements made by China, the EU and the US in terms of trade policy. Here is the timeline:

- January 11: US secretary of commerce reports results of an investigation into the effect of imports of steel mill articles on national security.

- January 19: US secretary of commerce reports results of an investigation into the effect of imports of aluminium on national security.

- January 22: President Trump approves recommendations to impose safeguard tariffs on imported large residential washing machines and solar cells and modules.

- February 28: President Trump’s policy agenda and annual report “for free, fair, and reciprocal trade” are released.

- March 6: the European Commission (EC) extends anti-dumping measures on Chinese steel products.

- March 7: the EC outlines EU plan to counter US trade restrictions on steel and aluminium.

- March 8: proclamation of US’ tariffs on imported steel (25%) and aluminium(10%), effective from March 23, without prejudice to (temporarily) exempted countries.

- March 16: the EC launches a public consultation on the US’ tariffs and possible EU retaliatory measures (EU list of products), considering the US tariffs as de facto safeguard measures.

- March 21: Commissioner Malmström met US Secretary of Commerce Ross, “with a view to identifying mutually acceptable outcomes as rapidly as possible”.

- March 22: following the Office of the U.S. Trade Representative (USTR) investigation on “China’s Acts, Policies, and Practices Related to Technology Transfer, Intellectual Property, and Innovation”, President Trump announces his decision to take actions on China.

- March 22: the Chinese Ministry of Commerce (MOFCOM) decides to launch anti-dumping measures for imports of photographic paper from the EU, US, and Japan, from March 23 and for 5 years.

- March 23: USTR launches a WTO challenge to address China’s technology licensing requirements.

- March 23: MOFCOM issues a list of discontinuation concessions against the US’ steel and aluminium tariffs, involving approximately US$3 bln worth of trade, and solicited public comments on tariffs to be imposed on certain products imported from the US.

- March 26: the EC launches a safeguard investigation on imports of steel products to prevent trade diversion into the EU, in response to the US’ steel and aluminium tariffs.

- March 27: MOFCOM launches an anti-dumping investigation against phenol products imported from the US, the EU, the Republic of Korea, Japan, and Thailand.

- April 3: USTR publishes a proposed list of products imported from China that could be subject to 25% tariffs. A public hearing will be held on May 15.

- April 5: MOFCOM publishes a list of US’ products potentially affected by 25% import tariffs of its own, in response to recent US’ announcements. On the same date, it files a request for consultation at the WTO, claiming that US’ steel and aluminium tariffs are actually safeguards.

- April 17: MOFCOM decides to launch provisional anti-dumping measures for grain sorghum originating in the US, starting from April 19.

- April 20: MOFCOM launches provisional anti-dumping measures against the imported halogenated butyl rubber originating in the US, the EU, and Singapore;

- April 24-27: President Macron (April 24) and President Merkel (April 27) meet President Trump, holding talks that included trade relations.

- April 27: USTR releases 2018 Special 301 report on intellectual property rights, identifying 36 countries on the Priority Watch List or Watch List (Greece and Romania are the only EU Member States included, in the Watch List; China is in the Priority Watch List).

- May 1: extension until 1 June of the EU’s exemption from US tariffs on steel and aluminium imports.

- May 3-4: US’ trade delegation meets Chinese officials on the US-China economic relationship, providing a “draft framework” in advance. A second round of trade talks is scheduled to start on May 15th.

- May 8: President Trump and President Xi discuss bilateral trade over phone call.

The result of those is the looming prospect of continuous trade restrictions and retaliation measures involving a variety of products. Apart from steel and aluminium, the US targeted over 1,300 imported Chinese products worth around $50 billion, possibly aiming at China’s high-tech and industrial sectors.

China announced discontinuation tariff concessions for 128 products and a longer list of its own (also worth approx. $50 billion), focusing more on lower-end products, while the EU has a two-part list of products imported from the US that it could target if the US moves forward with steel and aluminium tariffs (worth approx. $7.5 billion, of which $3.2 billion from Part A, and $4.3 billion from Part B), targeting very “American” goods from specific regions.

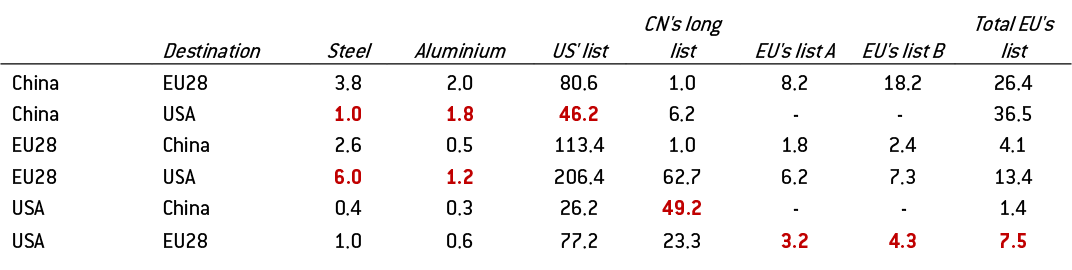

Here is a table on which trade flows are mainly affected. The affected numbers are in red.

Table 1: Trade value of main products possibly affected by announced/implemented tariff schemes (billion USD)

Source: USITC, Eurostat, Comtrade.

Note: Product categories selected up to the 8-digit code where possible, otherwise the 6-digit aggregate is used. Product lists retrieved from the Office of the U.S. Trade Representative (USTR), China’s Ministry of Commerce (MOFCOM), and DG Trade. Data for 2017, except for US exports to China of products affected by China’s proposed retaliation list (2016 data).

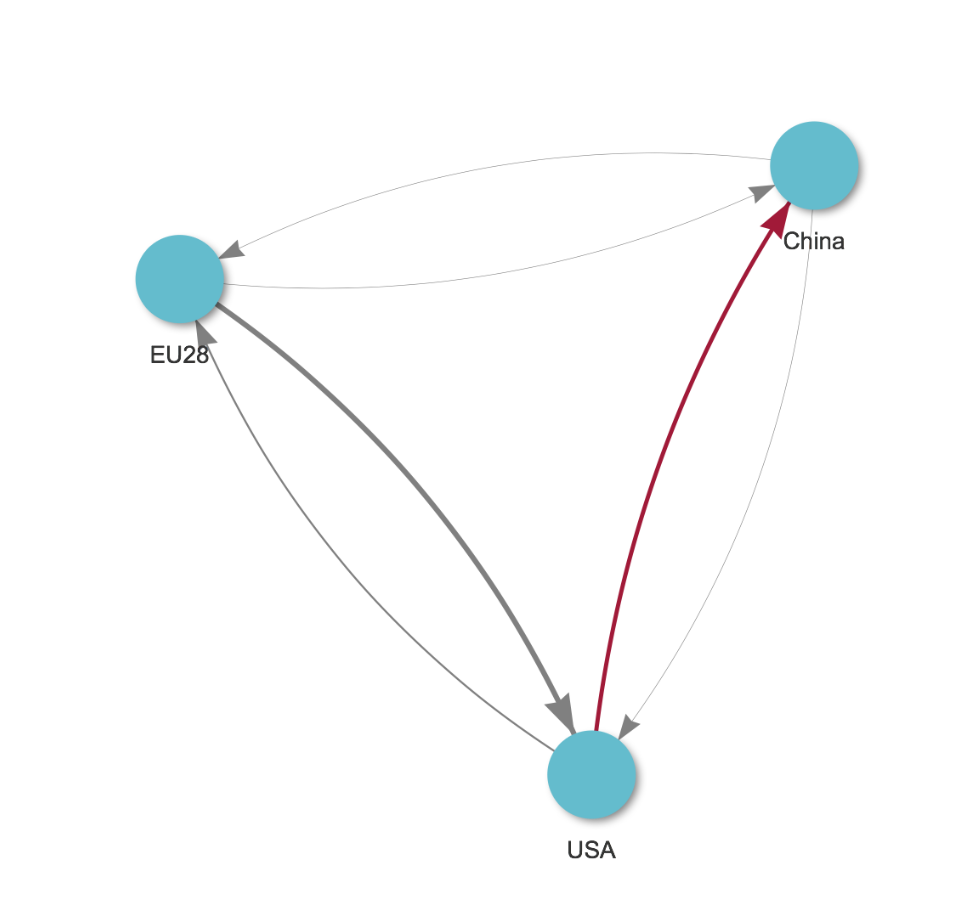

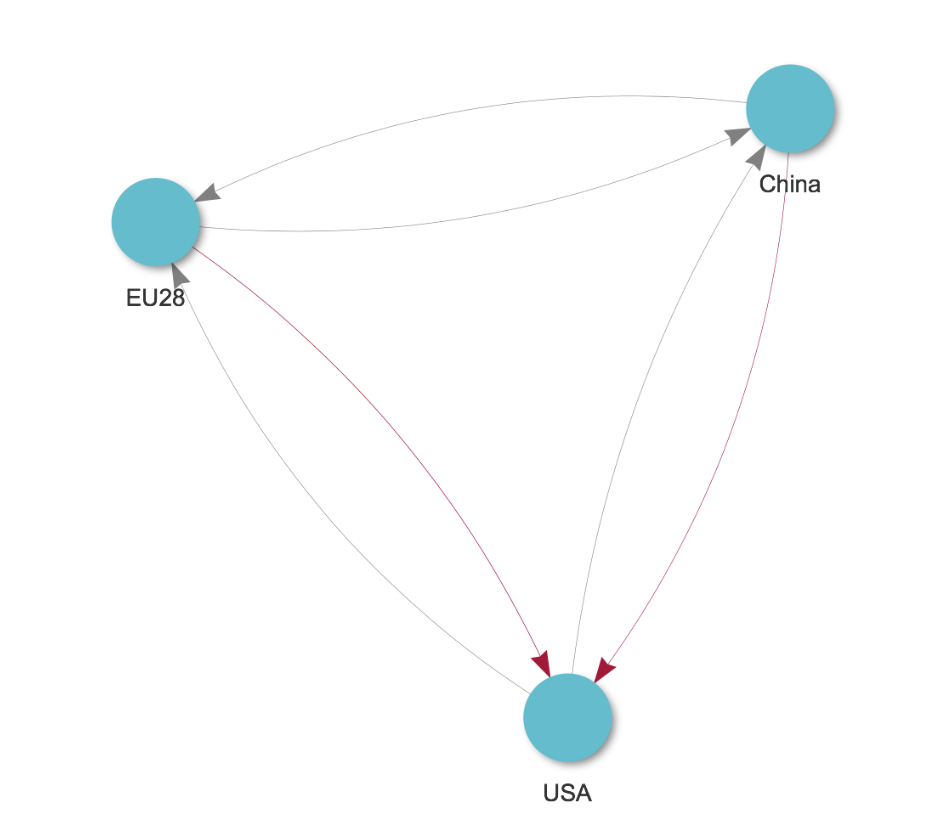

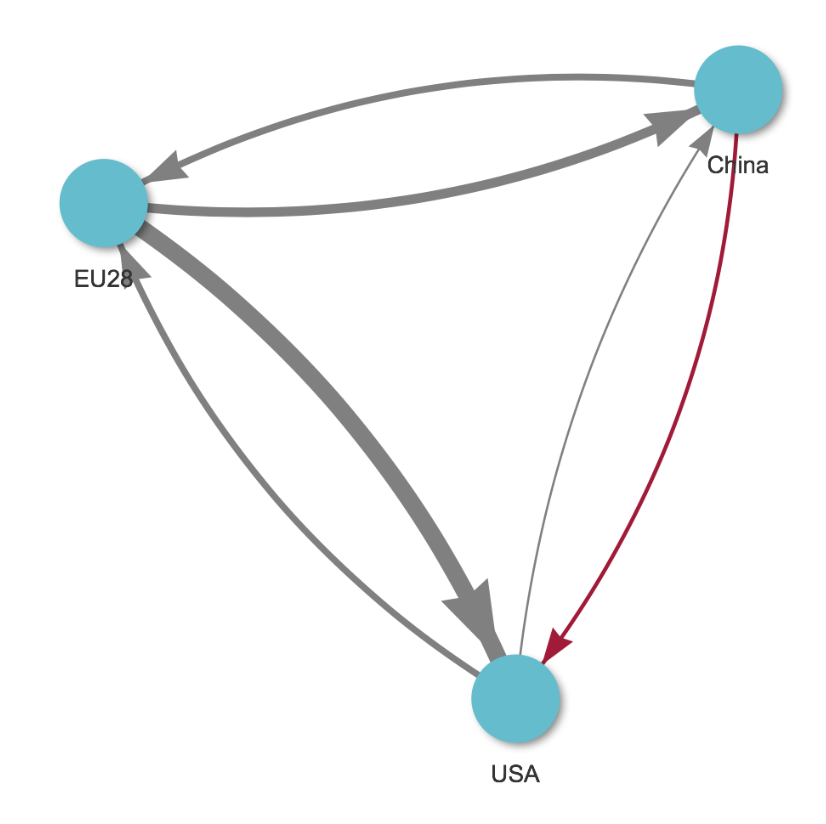

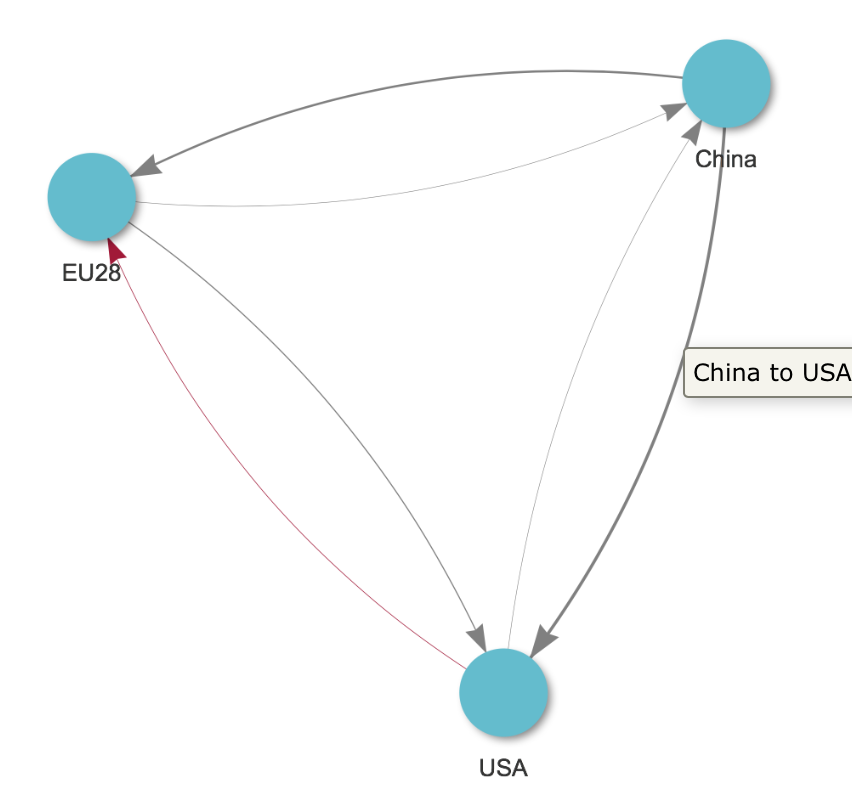

The four charts below depict the network of international trade flows between China, the EU, and the US for different categories of goods (steel and aluminium targeted by US tariffs, the US list of products, China’s long list of products, and the EU’s total list of products). The thickness of the bilateral linkages is proportional to trade value, and highlighted are those (potentially) affected by the announced/implemented tariff schemes.

Figure 1: Network of bilateral trade flows – China’s list

Figure 2: Network of bilateral trade flows – Steel and aluminium

Figure 3: Network of bilateral trade flows – US’ list

Figure 4: Network of bilateral trade flows – EU’s list

The charts show how much is being exported of each of the goods that would be affected by tariffs. Imagine for a moment that a good is perfectly substitutable.

For example, the goods exported from China to the US that would be affected by the US list amount to $46 billion. China exports $81 billion-worth of the same kind of goods to the EU. Chinese producers could compensate for a 10% reduction in Chinese exports to the US, due to the tariff, if they were able to increase their exports to the EU by only some 5%. In turn, the EU could compensate for the newly arriving supply from China by increasing its exports to the US by only 2%.

In the event of a full-fledged China-US trade war, trade diversion constitutes a risk to the EU, as the redirection of flows towards the EU may cause an impairment of the position of local industries. Furthermore, greater protectionism may also induce higher production costs and a slowdown of Global Value Chain participation (through the channel of intermediate goods), possibly affecting technology diffusion and productivity growth. However, such a crisis might also bring opportunities for EU industries if there is production and innovation capacity to cover the void left by tariff schemes. Thus, one of the key questions is to what extent the goods affected by bilateral tariffs are substitutable and can somehow be shifted around to other destinations.

In practice, the raising of bilateral tariffs will likely create substantial distortions for the global economy that would also affect the EU, bringing some opportunities but also creating costs for industries. However, a deal between the US and the EU could also have negative consequences for the EU as new trade could be created and the EU would potentially lose access, at least in relative terms. It is time for the EU to reflect on its options in global trade, and to reduce the vulnerability of its industries to the global challenge that Trump and China pose.

A well-documented article.

What has surprised me about this whole affair is how little the WTO has been involved, and how little China, the EU, and other countries have done to retaliate. I would have expected them all to say Trump’s actions violate the WTO agreements, file WTO complaints immediately, and start imposing sanctions immediately — perhaps invoking the same national security exception he did, on the grounds that if he’s right, they’re right.

Instead, all seem willing to at least negotiate some concessions to Trump. The same seems true of NAFTA. So, basically, Trump has shown the United States at least still can play by the pre-WTO rules, in which GATT compliance is voluntary, and the United States can make demands that get bilaterally negotiated.

Perhaps this may change if the WTO ultimately rules against the US, but until then, I’d say Trump has shown the WTO has only psychological significance as far as major trading countries are concerned. It’s just that previous US presidents really believed in it.

My guess is that countries are still trying to get to grips with how to deal with Trump. Since he doesn’t follow the normal rules, they are hesitating to take the ‘usual’ responses. Europe in particular is so unwieldy they will need a long time to develop a consensus to take non-standard measures – the type that could severely damage long term relationships. I think both the Europeans and Chinese think the way to get at Trump is to target industries associated with his core supporters, but that’s easier said than done.

China appears to be figuring it out: https://www.wsj.com/articles/u-s-china-discussing-deal-on-zte-agricultural-tariffs-1526313679

You threaten Trump voters with tariffs on specific products in response to the steel tariffs and then get a concession on something like ZTE to lift some of the retaliatory tariffs.

Kim seems to be figuring it out as well. http://www.bbc.com/news/world-asia-44142046

I don’t think there is a prayer that Kim will denuclearize. Having nuclear bombs on missiles is how he will ensure that China and Russia won’t pull the rug out from underneath him as he can point them at Beijing and Moscow as easily as the US west coast. I think Kim’s primary goal is to get a photo op with him shaking hands with Trump, the US President to bolster his show of power inside North Korea.

I also don’t think that Kim cares much about sanctions being lifted. Improved economic conditions and freedom in North Korea would threaten his hold over North Korea. However, I think he will negotiate a peace deal with South Korea to remove the reason to have US troops on the Korean peninsula. If he is successful in his negotiations with Trump and Seoul, he will figure out how to get the US troops off the peninsula without giving much up.

World leaders are learning the challenging code decryption process between what Trump says and what actually happens. I think this code works to baffle the average voter while having enough deep structure to allow bigger players to figure out some predictive tools. I’m not saying the POTUS understands the workings of this Enigma machine himself, but you can see the big players on the stage become less affected by the incoherent and unpredictable 140 character sentence fragments.

Since January 2017, the US has filed the following disputes against China with the WTO (source),

DS519 – Subsidies to Producers of Primary Aluminium – 12 January 2017 (Obama Admin.)

DS542 – Certain Measures Concerning the Protection of Intellectual Property Rights – 23 March 2018

China has filed the following against the US with the WTO (same source),

DS543 – Tariff Measures on Certain Goods from China – 4 April 2018

DS544 – Certain Measures on Steel and Aluminium Products – 5 April 2018

The dispute resolution process takes years to resolve. It appears as though Trump wants to conduct his dispute resolution in the Public Arena.

As far as previous presidents belief in the WTO dispute resolution (source).

One example of sanctions against the US was the US failure to comply with the “Country of Origin Labeling” (“COOL”) requirements. China has never been sanctioned.

Both EU, China and the US want arbitrarily large consumption for themselves on a finite planet. Not even one of the three are sustainable. Finance with debt/fiat gives the illusion that this is possible. Even if there was only one country, a failed state will result. This way three failed states (if you count EU as a state) will result, with or without violent destruction. There is no way out, other than reduced population and reduced expectations … this can come voluntarily or involuntarily. History is a Darwin test.

And the reduced population will arise from war, diseases and famines, which are the inevitable ecological consequences of overpopulation.

The question is, how much damage will we do in the process before we realise and do something about population control? Damage including the extinction of other species via habitat destruction at unprecedented levels, and ever increasing levels of pollution: atmospheric, water, chemical, plastic, toxins and radioactivity.

Hmm, he who has the money calls the shots. The US dollar lubricates economies and trade, and for net exporters is a comfortable place to be.

The US has the money.

The interesting question: How does Trump’s actions affect the flow of profits?

Maybe it would be more accurate, in light of the apparent real loci of power in the world today, to say that “tensions have risen between nominal US corporate interests, nominal EU corporate interests, and nominal public-private or whatever the equivalent is in Chinese interests…” This ain’t nation-states doing stuff any more, not that since Big World Trade got started back in the days of gold and silver and silk and spices and coal and iron. It;s corporations, acting through their wholly owned “legitimized national false fronts.” It’s all about corporate advantage seeing, and any benefits to the mopery are purely coincidental.

And so many of us wave our little “made in China and Malaysia” “American flags,” trained up as we are to support the mastodon dancing of our betters, even if the view from 1000 feet reminds one of the old ‘60s elephant joke: Q — “What’s the gooey stuff between elephants’ toes?” A — “Slow (and insufficiently agile) natives…”

And Tusk just adds more fuel to the fire, from his tweet thing:

Looking at latest decisions of @realDonaldTrump someone could even think: with friends like that who needs enemies. But frankly, EU should be grateful. Thanks to him we got rid of all illusions. We realise that if you need a helping hand, you will find one at the end of your arm.

2:36 PM – May 16, 2018

Bruegel Org is genuine? I thought it was satirical, as in Pieter Bruegel [Bruegel the Elder] Flemish genre painter of peasantry, ex. “The Blind Leading the Blind” 1568… I guess… Welcome to Brussels, where even the anomie is institutionalized.

Peter Rabbit has a meltdown:

*sigh*

It’s so hard for an academic to get any respect in Washington. Peter wrote a book. Trump read one. ;-)

Wonder if they will serve tea or coffee at the meeting?

>. . . and NEC director Larry Kudlow.

Hahahahahahaahahahaahaha . . .

Meanwhile, a report is circulating that the Kremlin has run out of popcorn and has had to order in a couple more gross cartons. Without hardly any effort on Russia’s part, Trump’s actions are breaking up the Atlantic consensus as well as encouraging more and more countries to trade in currencies other than the US dollar. Just now there is talk of Europe buying Iran’s oil and other trade using euro-denominated export guarantees. The extraterritoriality of US dollar laws is just getting too toxic.

The apparent problem is the big trade deficit with China and the lesser one with the EU.

US could simply impose a tariff on all imports from China based on a formula where the tariff drops to zero when merchandise trade is in balance, and with the message if the tariff proves insufficient to balance trade it will be increased.

I say apparent because in practice there will always be a trade deficit, regardless of tariffs, so long as some foreign savers insist on dollars for their mattress… e.g., many such in Latin America, some countries there even use dollars for local currency, requiring a constant flow of greenbacks as pop grows. And if trade moves into balance the dollar will rise, possibly increasing foreign savers desire for dollars. However, mercantile nations such as China and Germany would presumably stop saving, or accumulating, dollars.

I sell anti-friction bearings. When I started in business I bought exclusively from US manufacturers and developed a good business taking share from mostly Japanese suppliers. I paid my bills and passed on their price increases.

All was good until my biggest supplier, an NYSE listed company, took my customers direct. The customers that I developed and serviced. I had no choice but to go overseas…

My products are among those scheduled for a 25% tariff. I will note that most of the supply of these products from China are already subject to anti dumping tariffs of up to 92%… But because of product line rationalization, many smaller OEMs have no choice but to buy from overseas.. The Majors don’t care about servicing those smaller customers. In fact, my largest customer was won by default because that NYSE listed supplier failed to deliver.. I deliver quality product, on time, at a fair price..

Should the tariffs go into effect… Nothing will change except the cost to my customer,, and by default their customers. There is no readily available alternate supply and testing for engineering approval takes years.

So what is accomplished? IMO It is a stealth tax under the guise of MAGA

Thanks for real information from real life.

This is why the US needs subsidies and federal preferential treatment like Chinese businesses receive. Tariffs can be included in strategic places with a slow incline to give industry a heads up but it’s ultimately state support that makes countries like Germany and China so competitive.