Yves here. A Republican SEC commissioner criticizes share buybacks…and where have the Democrats been on this issue? Too busy giving speeches to Goldman to take notice, it seems.

Mind you, one robin does not make a spring. But it is a disgrace that share buybacks have been given a free pass for so long. But it might haves helped if these newfound buyback critics had understood that the tax break for the repatriation of offshore earnings was certain to go mainly to buybacks and executive bonuses, which is what happened the last time companies that used these gimmicks got a tax holiday, in 2004.

By Wolf Richter, a San Francisco based executive, entrepreneur, start up specialist, and author, with extensive international work experience. Originally published at Wolf Street

A study by the SEC of 385 recent share-buyback announcements — this is when companies announcehow much money they will spend in the futureon buying back their own shares, but before they actually begin buying them — found:

- Share-buyback announcements led to “abnormal returns” in the share price over the next 30 days.

- Executives used this share price surge to cash out.

“In fact, twice as many companies have insiders selling in the eight days after a buyback announcement as sell on an ordinary day. So right after the company tells the market that the stock is cheap, executives overwhelmingly decide to sell,” explained SEC Commissioner Robert Jackson Jr. – appointed by President Trump and sworn in earlier this year – in a speechtoday. He went on:

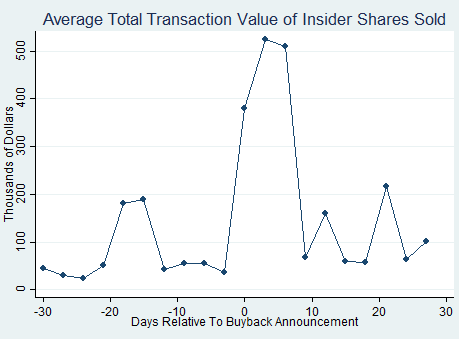

And, in the process, executives take a lot of cash off the table. On average, in the days before a buyback announcement, executives trade in relatively small amounts—less than $100,000 worth. But during the eight days following a buyback announcement, executives on average sell more than $500,000 worth of stock each day—a fivefold increase. Thus, executives personally capture the benefit of the short-term stock-price pop created by the buyback announcement:

“This trading is not necessarily illegal,” he added. “But it is troubling, because it is yet another piece of evidence that executives are spending more time on short-term stock trading than long-term value creation.”

The surge in buybacks is largely due to the new corporate tax law. In the first quarter, companies actually repurchasedan all-time-record $178 billion of their own shares. In terms of announcements of future share buybacks, May set an all-time record of $174 billion – in just one month! So this business is heating up.

SEC Commissioner Jackson pointed at the dark underbelly of these buybacks:

On too many occasions, companies doing buybacks have failed to make the long-term investments in innovation or their workforce that our economy so badly needs.

And, because we at the SEC have not reviewed our rules governing stock buybacks in over a decade, I worry whether these rules can protect investors, workers, and communities from the torrent of corporate trading dominating today’s markets.

He added:

Executives often claim that a buyback is the right long-term strategy for the company, and they’re not always wrong. But if that’s the case, they should want to hold the stock over the long run, not cash it out once a buyback is announced. If corporate managers believe that buybacks are best for the company, its workers, and its community, they should put their money where their mouth is.

He called on his colleagues at the SEC “to update our rules to limit executives from using stock buybacks to cash out from America’s companies.”

In 1982, when corporate share buybacks became legal – until then, they were considered a form of stock manipulation – the SEC adopted some rules, including a safe harbor provision from securities-fraud liability if the pricing and timing of share buybacks meet certain conditions.

“After experience proved that buybacks could be used to take advantage of less-informed investors, the SEC updated its rules in 2003, though researchers noted that several gaps remained,” Jackson added. “In the meantime, the use of stock-based pay at American public companies has exploded.”

[T]he theory behind paying executives in stock is to give them incentives to create long-term, sustainable value. Because executives who receive shares rather than cash demand higher levels of pay, the use of stock-based compensation has led to eye-opening pay packages for top executives.

He reminded us that “in the years leading up to the financial crisis, top executives at Bear Stearns and Lehman Brothers personally cashed out $2.4 billion in stock before the firms collapsed.”

Tying executive pay to the growth of the company, he said, “only works when executives are required to hold the stock over the long term.”

Part of the problem is that the SEC has not yet turned the provisions in the Dodd-Frank Act that were “designed to give investors more information about whether and how managers cash out” into actual rules. Thus investors are still kept “in the dark about executives’ incentives.”

“But it’s not just that the regulations haven’t been finalized. It’s that the problem itself keeps getting worse,” he said. The new tax law “has unleashed an unprecedented wave of buybacks, and I worry that lax SEC rules and corporate oversight are giving executives yet another chance to cash out at investor expense.”

[B]uybacks give executives an opportunity to take significant cash off the table, breaking the pay-performance link. SEC rules do nothing to discourage executives from using buybacks in this way. It’s time for that to change.

He proposed, among other suggestions, that “SEC rules should encourage executives to keep their skin in the game for the long term. That’s why our rules should be updated, at a minimum, to deny the safe harbor to companies that choose to allow executives to cash out during a buyback.”

And he added:

The increasingly rapid cycling of capital at American public companies has had real costs for American workers and families. We need our corporations to create the kind of long-term, sustainable value that leads to the stable jobs American families count on to build their futures. Corporate boards and executives should be working on those investments, not cashing in on short-term financial engineering.

Investors deserve to know when corporate insiders who are claiming to be creating value with a buyback are, in fact, cashing in.

But this surge in share buybacks, and the corporate dominance in the stock market via those share buybacks, may have a limited life. Read… Huge New Prop under the Stock Market is a One-Time Affair

I suppose that before 1982, when corporate share buybacks became legal, that corporations were forced to spend such money on research and product development – stuff that would ensure corporations long-term competitiveness and even dominance in their field. With buy-backs, the whole thing seems almost ephemeral somehow in that it will have no real long-term benefit to those corporations that go this way. In the long term it will make no real difference as these corporations will go out of business when faced with foreign corporations that don’t indulge in such kick-backs. You could almost describe this as a self-liquidating problem then. The average Fortune 500-size corporation has a lifespan of only 40 to 50 years but with this behaviour I would reckon that that span will decrease in coming years.

Haha, even though this article didn’t focus on buybacks, it did foresee the slow-motion Great American Corporate liquidation in 2005:

Jackson is a Democrat who campaigned for Hillary and was appointed by Trump to fill a Dem seat at the SEC

Rob is a Democrat, not a Republican. It is misleading to say “SEC Frets About Share Buybacks.” The fretting is likely only by the two Democrats…. unfortunately. For a related post, see my GE PX14A6G: Deduct Stock Buyback Impact.

Cue Captain Renault:

The more things change, the more they stay the same.

Captain Renault was an early portrayal of the neo-liberal functionary. Good old Claude Rains got it down pat.

From the film “Casablanca”:

Renault: “This is the end of the chase.”

Rick: “Twenty thousand francs says it isn’t.”

Renault: “Is that a serious offer?”

Rick: “I just paid out twenty. I’d like to get it back.”

Renault: “Make it ten. I’m only a poor corrupt official.”

Imagine him running the enforcement division of any Federal Bureau.

Just another example of the pervasive corruption at the top of American society. Not necessarily illegal, but troubling as the grifter said in his speech. Supported Clinton, appointed by Trump sums it all up.

Hmm… Over nine years into the longest bull market ever engineered and an SEC commish criticizing the asset stripping extravaganza?… Don’t think there could be a clearer signal the party is nearly over and the covenant-lite bondholders will be coming in the back door as the clean-up crew only to be disappointed. I expect we’ll continue to see the negative effects of Reagan legalizing this formerly illegal practice, and the personal greed of a generation of CEOs and their Wall Street sponsors who have created nothing but personal wealth for themselves, for a number of years to come. Might be time for the Supremes to reconsider their Citizens United decision.

Fourth try. Test.

I recall a study of insider trading techniques which suggested an insider might purchase call options near or at-the-money a couple of weeks or more before the event expected to trigger a stock price increase. Is there in peculiar activity in the options markets prior to stock buyback announcements?

We need tariffs to protect US companies against competition from companies overseas that actually re-invest profits to do things like develop products, pursue R&D, and hire people.

Marc’s comment is just peachy!

Capitalism has essentially only two kinds of operators: builders or destroyers.

The only reliable indicator of who is in the ascendent is the prevalence of potholes unrepaired*.

Pip pip!

In England at the moment and it is a bumpy ride.

Is that graph on the square? Share price fluctuates, so even if share volume is constant over time, the graph of dollar volume fluctuates. Announcing a share buy-back usually increases share price, so the graph isn’t describing anything unusual. On the other hand, buy-back price increases are usually around 10-20%, far less than the 500% increase shown in the graph. A Y-axis labeled share volume would make the point (whatever it may be) more clearly.

Previously illegal.

Knowing little about the law on stock buy-back I came to the conclusion that it is shonky all on my Jack Jones when I first became aware of the scam. The interesting thing for me is that the more knowledgeable of my business-focused acquaintances with whom I have discussed it, defend it only on the grounds of its legality.

So what does SEC stand for? … Scrutiny Entirely Comical.

Pip pip!