Earlier this week, American Banker reported that the Office of the Comptroller of the Currency launched a wide-ranging examination of 40 banks in the wake of the Wells Fargo fake accounts scandal. Recall that the reason that Congresscritters and the general public were so incensed was that in some cases the San Francisco bank was stealing, via taking money from customer deposits to pay fees on the fake accounts. In other cases, customers had their credit scores damaged as a result of the process.

The American Banker article makes clear that not only is the OCC refusing to say which banks are up to no good, let alone saying how much “no good” is happening, but it also appears that the OCC isn’t doing anything more serious than having chats with management over tea and cookies telling them they need to tidy these messes up.

I assume Elizabeth Warren has taken note and will subject the Comptroller of the Currency, Joseph Otting, who was formerly head of OneWest (eek!) to some pointed questions.

Let’s be clear: there’s no reason not to name names, save that the OCC has gone back to its bad form of being in the business of bank protection, as opposed to bank regulation. Obama appointee Tom Curry actually did combat some of the agency’s worst behaviors, and his most important action was forcing out its general counsel, Julie Williams, who was the worst sort of bank stooge.

The OCC doesn’t even deign to justify its silence, taking the view that the fact that this misconduct is confidential regulatory information means the agency can keep it hidden. Help me. Since when is it in the public’s interest to keep crooked conduct secret?

Even in the case of a full blown scandal that eventually resulted in the resignation of its CEO, no one ever thought that anything more than Wells Fargo’s stock price was at risk.

Even though these scandals deservedly hurt a bank’s image, lead some customers to quit and new prospects to be correctly wary of a dishonest institution, they are not about to precipitate a bank run. Customers and investors both deserve to know if a bank has been playing fast and loose with retail accounts, and if so, whether it is a relatively small scale problem (say reflecting some weakness in controls that some units gamed) or institution-wide fraud, as was the case with Wells.

The other reasons for exposing banks’ dirty laundry, aside from embarrassing managements that ought to be embarrassed, and maybe even getting their boards to ding their compensation, is that these frauds are seldom isolated. The Wells fake accounts scandal turned out to be the first of many: auto loan insurance, illegally overcharging servicemembers on their mortgages, improperly repossessing servicembers’ cars, and mortgage “rate lock” abuses.

From the American Bankers story:

Federal regulators have quietly ended a review of large and midsize banks’ sales practices that found several systemic issues — and hundreds of problems at individual institutions — and have no plans to make the results public…

The review uncovered specific examples of other banks opening accounts without proof of customers’ consent, an OCC spokesman acknowledged Tuesday. It also spurred the issuance of warnings on five specific industrywide issues that banks needed to address, and more than 250 specific items regulators wanted fixed at individual banks, according to a consultant briefed on the OCC’s findings.

Ahem, this looks like an awful lot of gambling has been uncovered in Casablanca. So could one of the reasons for the OCC’s reticence that they found so much wrong when they did a bit of digging that it would call their former lax light touch oversight into question? Or even worse, that exposure could kick off another Wells Fargo level round of Congressional and media uproar, which would make it very hard for the regulation-hostile Trump administration to do nothing? Recall in the Wells Fargo hearings, even diehard libertarian Jeb Hensarling was calling for Something To Be Done.

The article quotes Dan Ryan, who leads PwC’s banking practice, and claims banks are getting religion in the wake of the OCC’s findings. He would say that, wouldn’t he? An OCC spokesman also claimed that before the Wells scandal, hardly any banks looked at their sales practices across the institution, and the OCC review that started in 2016 prodded them to shape up.

Again from the story:

[OCC spokesman Bryan] Hubbard went on to say that when the OCC review found instances at specific banks of accounts being opened without proof of customer consent, the root causes varied. Among the most common factors were short-term sales promotions without adequate risk controls, deficient account opening and closing procedures, and isolated instances of employee misconduct, he said.

“When unauthorized account opening or other inappropriate sales practices occurred, banks have already taken — or are in process of taking — remedial action,” Hubbard said.

That meant-to-be reassuring picture is at odds with this:

Ryan of PwC offered further specifics about what the OCC found, saying that the agency issued a total of 252 Matters Requiring Attention notices to banks whose sales practices under review.

So-called MRAs focus on practices inside a bank that examiners deem to be deficient and lay out corrective actions that banks are expected to take to remedy the situation….

As part of the sales practice review, the OCC also issued five industrywide MRAs, according to Ryan. He declined to disclose what specific issues those missives involve.

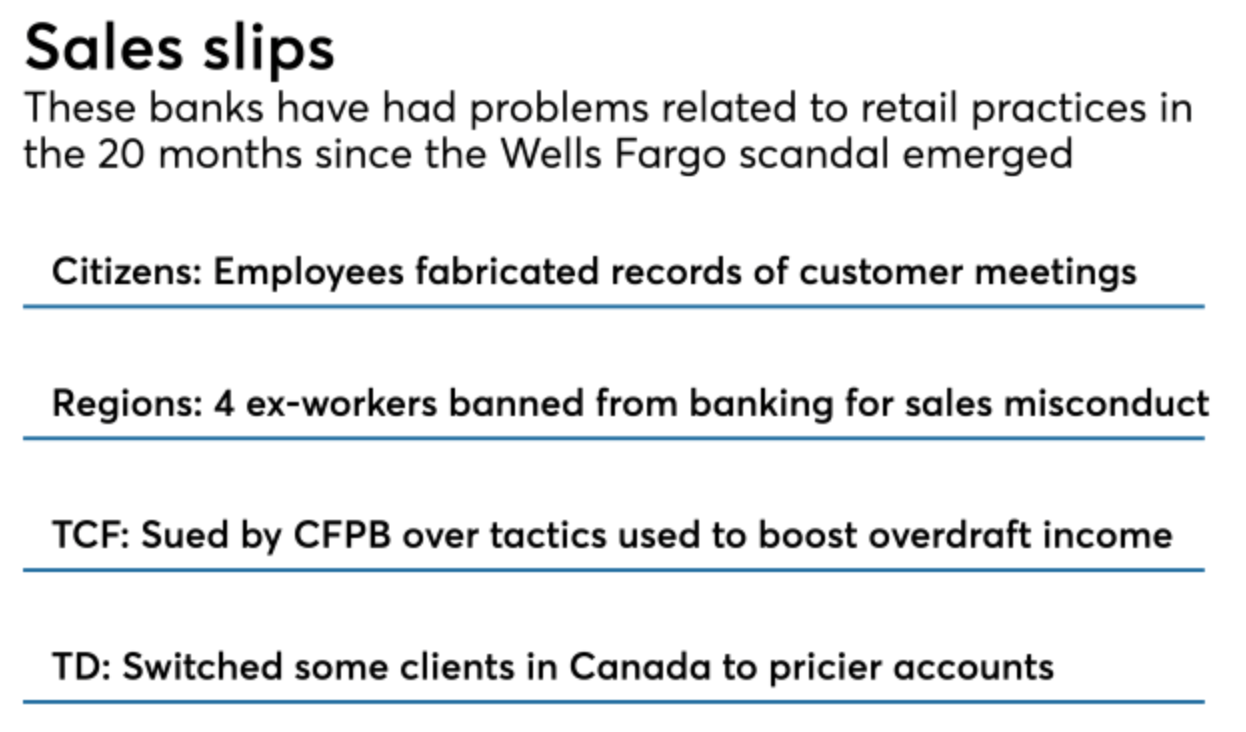

252 matters at 40 banks means an average of over 6 per bank. And then five across the entire banking industry? And Joe Retail Customer is supposed to assume everything is hunky dory at his bank? Admittedly, some cases of bad conduct have come to light:

In its understated manner, American Banker made a pitch for the OCC to come clean:

But absent a report from the OCC, it is hard to assess what is happening in the banking industry as a whole. Though supervisory information about individual banks is confidential, Art Wilmarth, a law professor at George Washington University, argued that the OCC should release its general findings.

“This is a watchdog that’s not barking,” he said.

The problem is that banking customers don’t care enough about abuses like this until they become a victim, and then they find that it is pretty much impossible to prevail when a bank cheats. Even if the press were to give this OCC story some play, how many voters would call or drop an e-mail to their Congresscritter to tell them they were appalled that the OCC would run interference for banks after the Wells scandal? Banking regulators can count on complacency, which makes it even easier than it ought to be to play the revolving door game.

What did we expect from Joseph Otting? After what happened at OneWest, naming him to run the OCC is like appointing Jihadi John commanding general of US forces in the Middle East.

Legal tip of the day: 5 USC § 7211 states that “the right of [federal] employees, individually or collectively, to petition Congress or a Member of Congress, or to furnish information to either House of Congress, or to a committee or Member thereof, may not be interfered with or denied.” Just saying.

Correction: What did we expect from the OCC? During the housing criminal spree, they sat back in their easy chairs with a nice stogey and did nothing but smoke.

Yep. Too bad they didn’t drop a hot ash & go up in smoke–literally.

“Since when is it in the public’s interest to keep crooked conduct secret?”

Perhaps ever since the govt is no longer of the people, by the people, for the people, but instead now only looking out for the best interests of the 1%, claiming that’s in the best interest of the public?

Yes, time to contact congresscritters & let ’em know that we the citizens are watching, aware, & not happy.

Sadly, I find myself using the word ‘disgusted’ far too much in my vocabulary lately when discussing ‘our’ govt.

GRRRRR! I just tried contacting my congresscritter to ask what he plans to do about forcing the OCC to release this information to the public, but it refused to take my question saying my email address was incorrect. It is not!

So instead I had to contact their ‘website problem’ link (which, BTW, accepted my email address) to report that problem.

I would’ve preferred to call but there is no phone contact info for him.

(Our ‘out of touch govt’ at work?)

I find myself once again using that word ‘disgusting’…

I always thought that one of the purposes of financial crises is to teach lots of lessons and inoculate the system against a new financial crisis for at least a generation.

However, it appears that the main lesson that the 2008 financial crisis taught is that a financial crisis can be good for business if you have invested heavily in friendly politicians and regulators.

So it appears we will need another financial crisis for the guillotines to come out.

Guillotines are possible just about any time. I’m a skilled custom wood worker and have been looking at rough guillotine designs for several years. I’ve just been waiting on a client to come forward to complete the design, and construction, of a working model (solely intended for theatrical use, of course).

Wait…252 MRAs? You mean to tell me they didn’t even make these MRIAs (Matters Requiring Immediate Attention)? Sooooooo the activity in some cases is not just an unsafe or unsound banking practice it is actually ILLEGAL, but hey, just get back to us in the next 60-90 days with your plan to fix it and we”ll let you know if we think it’s fair. Niiiice. AND….where is the Federal Reserve in all of this? They have supervisory oversight/participation in a lot of these banks also…..

Orwells Fargo, their necks staged in banking.

Foreseeable development in the wake of the Obama administration’s legacy of failure to criminally prosecute bank and Wall Street executives who engaged in predatory lending, control fraud, securities fraud and foreclosure fraud that led to the GFC during the waning years of the Bush II administration, and who instead were richly rewarded financially. Together with the Trump administration’s very public propaganda regarding deregulation; the recent decision by a majority of legislators of both major political parties to further rollback Dodd-Frank; and the Fed’s QE-ZIRP fueled bubble heist; what’s the lesson for a generation of bank CEOs and their board members?

Don’t really know other than from reading accounts such as this post, but given the past two decades of successive neoliberal de-regulatory regimes, I suspect the OCC and some other federal departments and agencies are presently populated by regulators and prosecutors with conflict-avoidance personalities who have repeatedly seen their colleagues punished professionally by senior levels of their agencies for taking a pro-enforcement stance WRT laws and regulations.

As a former federal regulator, I can bear personal witness to that last statement. There is legal recourse: UCMJ Article 99 specifically prohibits several forms of “cowardly conduct” by federal employees. A decision to start enforcing it again would do a world of good.

The entire banking industry has become an abuse and everyone who has an account is a victim. There is no thought toward providing a needed service for a reasonable price, it’s all about how many fees they can extract from customers.

I worked for WAMU for a couple years in the early aughts. I did so because I thought they were among the better banks based on some articles I’d seen in the local press but after being employed for just a short time I realized that good press they received was just PR and not based on any decent business practices.

One thing they did after I started there, which many other banks had already done, was restructure the way they processed overdraft fees in order to maximize revenue for themselves and take as much as possible from the customer. Basically they’d run through the largest check through an account first and and if there was an overdraft, it would cause any smaller checks to also bounce and generate more fees. We were told to tell the customers that the change in policy was for their own good but it clearly was not.

One of my managers told me that in 2000 when the company generated record profits, the entirety of the company’s operating expenses for the year were offset by fees and so all of the core business of the bank was gravy. I managed to cut into those profits by a few thousand dollars by refunding any fees I could for any customer who asked before I quit.

A corollary to Greshan’s Law, “bad employees and management drive out good”?

Perhaps the fear is of runs on those extra crooked banks as what difference does it make if you lose your money because of a bank collapse or if they just steal it. At least the FDIC protects against the former nowadays, but good luck against mere theft. I think that stealing money from the little people is legal now, or nearly enough to make no difference.

Yves, you asked for help, and a question. “Help me. Since when is it in the public’s interest to keep crooked conduct secret?”

I’ll offer what I can easily.

As it happens I’ve been intending to fold a quote from Supreme Court Justice Louis D. Brandeis into an up coming “other paper” in my own litigation (pursuant to FRCP 7(a) and (b) there seem to be pleadings, motions, and other papers). I’ve had a short biographical website on Brandeis open for the past week or and the below quote was literally just one mouse click away. Though perhaps stretched a little out of context here I think it still adapts well enough.

“Publicity is justly commended as a remedy for social and industrial diseases. Sunlight is said to be the best of disinfectants; electric light the most efficient policeman.”

There are so many quotes about democracy dieing behind closed doors, a veritable crap-ton (a real legal term – look it up in Black’s Law Dictionary), that I won’t trouble you with any of those.

The key issue is whether the examiners refer their MRAs to the OCC’s Enforcement & Compliance Division for potential enforcement actions.

Pursuant to 12 U.S.C. 1818(u), the OCC must disclose to the public all final orders resulting from enforcement actions. There is no equivalent provision for MRAs, perhaps due to the examiners’ historical objective of preventing bank runs.