Yves here. Murphy is not exaggerating when he discusses how much wealth the rich hide. Gabriel Zucman, in this book The Hidden Wealth of Nations, conservatively estimated that tax evasion by households amounts to about 8% of global wealth.

By Richard Murphy, a chartered accountant and a political economist. He has been described by the Guardian newspaper as an “anti-poverty campaigner and tax expert”. He is Professor of Practice in International Political Economy at City University, London and Director of Tax Research UK. He is a non-executive director of Cambridge Econometrics. He is a member of the Progressive Economy Forum. Originally published at Tax Research UK

The right-wing love to say inequality does not matter. They also love to say that the Gini coefficient that measures inequality is improving. They trumpet as a result that in their opinion all is right in the world because people are now getting no worse off.

But, as many familiar with such data know, it is not revealing of the truth. Inequality is seriously understated because its measurement is based on survey data and the wealthy don’t do surveys any more than they pay taxes. And the wealthy also hide their income and assets more effectively than do the rest of society precisely because they have so much of it that tucking it out of sight is much easier.

So, what really matters is whether or not most people can and do have enough income to have at least an adequate standard of living. The following comes from CommonSpace, the website linked to the Common Weal think tank in Scotland with whom I do some work. I borrow it because I think it summarises a new report from the Joseph rowntree Foundation rather well:

ARE things getting better? The Joseph Rowntree Foundation has published a report on minimum income standards from 2008-2018, and it shows that for those at the bottom and middle of the income pile seeking to have enough to live a decent life, the situation is no better than 10 years ago when the Great Recession began, and in many ways worse.

The report looks at what income is required for a person/family to have an acceptable minimum standard of living. We are talking about the basics here – having enough food, clothing, warmth and being able to access work and partake in cultural activity

CommonSpace has analysed the report and picked out some key points which show just how tough it is for an increasing number of people in the UK to live a decent life and why this is happening.

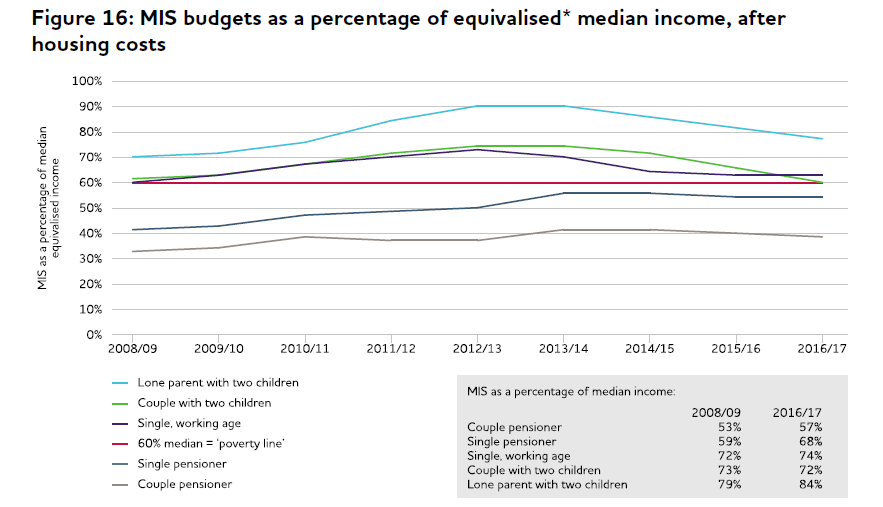

Minimum income standards (MIS) are harder to meet on a median income – the middle point of all incomes in the UK – than 10 years ago, for every group other than couples with two children, who are just marginally in a better position to have a a minimum acceptable standard of living than a decade prior.

For the bottom third of income earners who fall significantly below the median household income – £27,300 – the ability to have a minimum acceptable standard of living quickly becomes unachievable. The majority of households below MIS have someone in work, while the proportion of working households with disposable incomes below MIS has risen since 2008, from 18 per cent to 23 per cent.

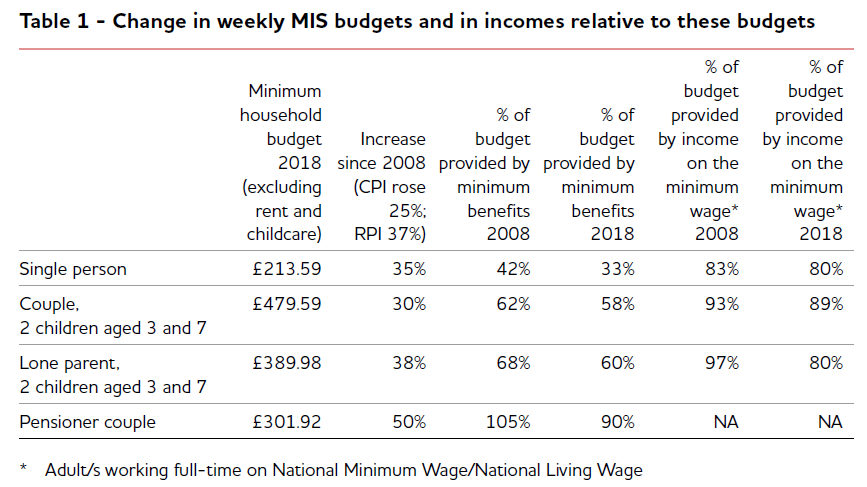

As the table above shows, life has got much harder for those on benefits in the past 10 years, with benefits providing just one-third of what is required for meeting the minimum income standard for a single person, and just 58 per cent for a couple with children and 60 per cent for a lone parent. The state pension previously provided enough to meet the MIS, but are now 10 per cent short of what is required. Austerity combined with rising living costs had its toll.

My point is a simple one: the right wing are wrong.

Markets are not making things better.

Austerity did not work.

People are worse off.

Real inequality is growing.

People are suffering.

And this in the supposed sixth richest nation on earth.

A phenomenom that I think is ocurring in many if not all OECD countries is that home rental has been rising steeply. In Spain the annual rise has been about 15% in the last 12 months. Some have argued that Airbnb and other online renting outlets for tourists are to blame. While this migth be the case for some particular touristic spots, I don’t think it explains a much broader phenomenon.

I have learned recently that some asset managers like Blackstone are investing heavily in RE. In Spain they are specializing in buying houses with low rentals, increasing them, and bullying occupants out of them. Then they close the properties reducing rental offers.

It looks like a new scheme to extract money from the labor class to the rentier. Something that has not yet been captured by national economic indicators, but increases inequality in quite a damaging way. Home rental is now way more expensive than before the Great Recession but incomes did not follow course.

Do you think they are investing in individual homes? My understanding (Yves has written about this in the past) is that the adminstrative cost for an investor in purchasing multiple homes for rent makes it highly unlikely that they are profitable, certainly in the US.

Here in Ireland, there has been very active investment by foreign investment funds in residential properties for rent, but so far as I am aware the investment has been 100% in large scale units – either entire apartment blocks, student blocks, or in some rare cases, estates of smaller homes (usually when they have been put up for sale by banks after foreclosures on developers). They are only interested in investments where economies of scale allows them to minimise administrative and maintanence costs. This investment is generally considered quite positively, as they are building types of housing units that the domestic development industry (which is obsessed with building identikit 4 bedroom houses everywhere) has had little interest in – for example, student accommodation blocks.

Yes they are investing in individual homes. They buy one or more individual apartments in a building and close them (door substituted with brick wall). The more apartments closed, the least is the ownership/rental value in the rest of apartments. I believe the final goal is to buy the whole building at a discount. They start with distressed properties of course.

If you buy them cheaply enough, or if you only manage a few (probably max 4 houses), live nearby, manage them yourself, and have some key maintenance skills, like plumbing, so you aren’t buying those services at retail, it can work. Or if you are renting them just as a way to cover most of your holding costs when you expect city or neighborhood dynamics to enable you to sell them later at a profit despite tenant wear and tear. But that is a lot of ifs.

Yes, I know a few professional and semi-professional landlords – all of them do all the management and casual repairs themselves wherever possible as agents eat up any profits. I’ve read a few articles on the topic and they all claim that even in high rent areas the only real profit likely is in capital appreciation.

One of my friends fits this description. Matter of fact, I rented the front part of the house she built. While she was my landlady, she seldom hired out for repairs or maintenance. She and her brother, along with her boyfriend, did the work themselves.

As for agents, aka property managers, she avoided them like the plague. PlutoniumKun has it right — they’re profit eaters.

What I’ve been seen reported is that they buy at discount prices and close the house reducing expenses to just municipal contribution (not too high in Spain) and you can even skip for a long while contributions to the building community). I believe they simply count on home appreciation. You just need an agent to look for opportunities and a small expenditure closing the house. As I told they replace the door by a brick wall probably to prevent illegal occupation.

Illegal occupation? That’s a problem here in Tucson. Happened to a recently vacated house in my neighborhood.

The college kids were still moving their stuff out when the squatters moved in. And said squatters stole a good bit of that stuff.

It depends on the level of neighbourhood cohesiveness. When some lowlives tried to open a crack house in the sleepy town we used to live in, mysteriously, that house burned to the ground one bright and sunny afternoon. The local fire department was a quarter mile away and took a half hour to respond. (The fire fighter crew was in the fire house when all this happened.) No suspects ever arrested, and, significantly, no arson investigation.

A phenomenon that is ocurring in centric quarters is what are called “invisible evictions”. Capital equity funds buy distressed rental houses/buildings and inmediately rise (by twice for instance) the rental so that families unable to pay have to go (without judicial eviction). In many cases these become rentals for tourists and these funds own about 85% of units registered for tourism.

Investment in publicly owned houses for rental (protected rental) is quite common in Europe but in Spain has been almost eliminated by the former government. Instead, they proposed a plan with rental subsidies that would warrant benefits for the funds (basically a stealing scheme by which public money goes directly to the landlords). We have had one of the most neoliberal governments in the last decade.

It’s not just Blackstone buying up large numbers of single family homes with the intention of renting them; smaller investment funds do this as well. Many develop proprietary software for analyzing niche real estate markets so they can pick the most cost efficient homes to purchase. They maintain a stable of electricians, plumbers, and general contractors to update and keep up their homes, and then rent the homes at a premium. Once they own enough homes in a given area (and this is absolutely key and by design), the effectively set the floor for rental and resale values. They also generate very stable monthly income for their investors.

Private equity is a real problem. It’s designed to put one more layer of folks picking as many additional dollars as we can stand from our pockets standing between us and the things we need/want. You would be surprised at the sorts of things that are considered attractive investment opportunities because of pricing “inefficiencies” (which are really instances where the target consumer could withstand paying $X more for XXX thing/service without stopping using XXX).

Quite rigth!. Another example are… hospitals! Privately owned hospitals run for public health care services, the latest stupidity brougth by your best neoliberal politician.

I do think Airbnb plays a large part but it isn’t the whole story. Interest rates are kept deliberately low in order to goose asset prices including real estate, causing prices to rise faster than they otherwise might. This has been a great boon to some people like those who invested in rental properties a generation ago.

Imagine the example of someone who bought a 4-unit rental property 25 years ago. The rents would have been based on the original purchase price and if the property was managed well, the mortgage would have been paid off a while ago. As long as the current rents cover maintenance and taxes, everything on top of that is gravy so there’s no huge reason for the owner to jack up rents. However that owner may have bought the property to fund their retirement which is coming right up. But because of low interest rates for nearly a generation, real estate prices have skyrocketed in many areas of the country which is great for the person looking to cash in for their retirement, not so great for everybody else. Now the new owner must raise the rents significantly to cover the mortgage they just took on, in the hopes they can get eventually get the same deal as the previous owner. Meanwhile, other property owners in the community notice the increased rents and decide they ought to be charging more too.

Repeat this pattern enough times and we get exactly the situation we’re currently in. I’m seeing it happen all over the town where I live and already starting to hear from some people who bought rental properties that they cannot afford the mortgage unless they do rent them out as illegal hotels (aka Airbnb). The going rate for long term rentals, as high as it is, still won’t cover the mortgage they took out. That’s what happens when you run an economy like a casino and every “investment” is just a chip on the roulette table. The problem for the people investing in rental properties in the midst of a huge real estate bubble is that the house always wins and while you may own a house, you aren’t the house.

I don’t have a lot of sympathy for people who put themselves in this situation, looking to make a quick buck off some Silicon Valley-inspired disruption at the expense of everyone else and coming up short. Because another important rule of thumb about gambling is that if you look around the table and can’t spot the sucker, the sucker is you.

Lambert linked to an article yesterday that highlighted a complaint about the expense of hiring a nanny. Funny how we never hear complaints from the wealthy about the expense of hiring a tax accountant. Paying top dollar to hide some money is just fine but they need to cut corners on having someone else raise their children.

Good thing they have their priorities straight.

Austerity never works and mathematically cannot work. Austerity means the government pumps less money into the economy.

The formula for GDP is: GDP = Federal Spending + Non-federal Spending + Net Exports

Pumping less money into the economy negatively affects Federal Spending and Non-federal Spending.

Therefore austerity always negatively affects GDP.

The numbers do not lie.

“Austerity never works and mathematically cannot work”

What do you mean by work? GDP isn’t the end all be all

Prior to the Crash of 2007-2008 it was much easier to obtain a mortgage. Thus rents were competing with mortgages for people’s money. Today, mortgages are substantially difficult to qualify for and to save for a downpayment to purchase a house or apt. Landlords, regardless of who the landlord is, know this and since for more people than prior to the Crash renting is the only option, they know they have a captive market to abuse.

Looking at the USA and an adequate standard of living: It’s not only not improving, it has been getting worse for 50+ years – ever since LBJ pushed the Great Society and the elimination of poverty. Guns and butter was dead on arrival. All we got was guns. Of course, because inflation is a necessity, things have gotten worse for the lowest income earners. We should start there – at the necessity for inflation and ask why. And then when the answer comes back that we must spend to make the economy grow and maintain a healthy society we will have to admit that the wealth has been taken away by the wealthiest. What else? IIRC in 1965 the poverty rate was 15% and the stats were fairly reliable. Fast fwd to today – the stats are totally tweaked; the economy is so brittle that there is no resilience left and we have institutionalized a true poverty rate of 20% in order to balance out the obscenely wealthy. Else why make up all the fake stats? Just looking at the number/percentage of people on foodstamps tells us everything – there are 49million on food stamps (last I read). That’s around 15% – nothing has changed, except there is a very large percentage of “middle class” people on the edge as well… just think how godawful it would be if LBJ had failed to push Medicare/Medicaid. Right now it’s a rock and a hard place for our dear economists to keep the economy from spiraling out of control either way – inflation or depression – because we’ve outsourced way too much (for one thing). Really looks like extreme inequality is being maintained by the lower 20+% as a counterweight to the fat cats.

I think the problem is even worse than stated. Much of the income hidden in the underground economy by people with below median income is wages that would be subject to FICA taxes. By hiding this money, their Social Security income records are kept lower which reduces their potential Social Security benefits for disability or retirement. Since this is the only disability and retirement income available to many people, any reduction in this is a major hit to their living standards.

The income hidden by the wealthy is pure gain for them since they do not receive directly attributable future benefits from the taxes they would be paying.

Pay for every service and retail item purchased in small businesses with cash.

What’s good for the fat goose is good for the little gander.

The issue here is that the rich are basically an extractive elite on society.

You will not see this money being used to do anything good for society.

I also think that private equity and other institutional investors should be heavily limited in their ability to buy housing in the market. This is nothing more than an upward transfer of money from the middle class and poor to the wealthy.

There needs to be a massive redistribution of wealth and income. Furthermore there needs to be severe penalties for those who hold lots of wealth and his it in tax shelters.

So, let people keep 100% of what they earn, and absolutely nail cheats and frauds to the wall. Further, illegitimate children (includes de facto if not de jure ones created by divorce, esp. as minors) commit crimes at easily 7x usual rates, along with being underachievers in general. So, an end to welfare would doubly help the lower 80% of those who earn the bread they eat.

Start with a corrupted economics, neoclassical economics.

Develop this into an ideology, neoliberalism.

The whole thing is self-reinforcing, and the ideology feeds back into the economics and the economics gives the intellectual grounding for the ideology.

Unfortunately, you can never escape the corruptions that were in the economics at the start and everything just falls apart.

Economics was always far too dangerous to be allowed to reveal the truth about the economy.

The Classical economist, Adam Smith, observed the world of small state, unregulated capitalism around him.

“The labour and time of the poor is in civilised countries sacrificed to the maintaining of the rich in ease and luxury. The Landlord is maintained in idleness and luxury by the labour of his tenants. The moneyed man is supported by his extractions from the industrious merchant and the needy who are obliged to support him in ease by a return for the use of his money. But every savage has the full fruits of his own labours; there are no landlords, no usurers and no tax gatherers.”

How does this tie in with the trickledown view we have today?

Somehow everything has been turned upside down.

The workers that did the work to produce the surplus lived a bare subsistence existence.

Those with land and money used it to live a life of luxury and leisure.

The bankers (usurers) created money out of nothing and charged interest on it. The bankers got rich, and everyone else got into debt and over time lost what they had through defaults on loans, and repossession of assets.

Capitalism had two sides, the productive side where people earned their income and the parasitic side where the rentiers lived off unearned income. The Classical Economists had shown that most at the top of society were just parasites feeding off the productive activity of everyone else.

Economics was always far too dangerous to be allowed to reveal the truth about the economy.

How can we protect those powerful vested interests at the top of society?

The early neoclassical economists hid the problems of rentier activity in the economy by removing the difference between “earned” and “unearned” income and they conflated “land” with “capital”. They took the focus off the cost of living that had been so important to the Classical Economists to hide the effects of rentier activity in the economy.

The landowners, landlords and usurers were now just productive members of society again.

It they left banks and debt out of economics no one would know the bankers created the money supply out of nothing. Otherwise, everyone would see how dangerous it was to let bankers do what they wanted if they knew the bankers created the money supply through their loans.

https://www.bankofengland.co.uk/-/media/boe/files/quarterly-bulletin/2014/money-creation-in-the-modern-economy.pdf

In the developed western nations with diversified economies the capitalistic financial system has a strangle hold on shelter.

The easiest thing and most common thing for bankers sitting in banks to do is loan money to people who need to buy shelter.

Those with the money to buy shelter engage in that activity going into debt and being forced to raise rents post every trade. In general.

If you are poor in Western nations with elastic treasury powers it is because the powers that be want you to be desperate.

Michael Hudson does a fine job in his book “Killing the Host” stating what land and shelter need to be public and what is to be private.

The continual elevation of the costs of shelter have been dealt with in NYC with the rent control system.

When I lived on East Eleventh and my rent was 895 a month there lived in the building people whose rent was 250 a month. From what I hear that apartment is now renting for 3 grand a month.

Wherever people are making good money such as in Silicon Valley or DC or NYC the cost for shelter near enough to allow them to get to work on time take all their money.

All of the things done post the 2008 crash were designed to keep the rentiers solvent and the prices for shelter high and higher.

At least that is what the goals look like to me.

During my lifetime rent has been more than doubled while there was a brief period when I could deal with it.

The population of the earth has about doubled since I reached the age of maturity. The demand for shelter of course increased and as it goes traditional building cannot keep up with the demand.

Only modular factory building can keep up with the demand. Steel is strong and cheap so along comes the steel box to live in.

Where will it go? The first boom town was Rochester NY. As the first will later be last so is last first far as what income in the area and the availability of shelter.

Youth would be wise to buy steel boxes to live in because they have the option of being able to put them on a flatbed truck and move them to the next place they get a job.

“Nomadland” is a book about that trend. Who knows but that man was meant to live in portable shelters and the tent would be the best thing for my grandson to hope for, except that he is in Rochester, NY.

Thanks