CalPERS’ board and staff look desperate. In response to our documenting that CalPERS’ CEO Marcie Frost told multiple lies during the hiring process and after she joined the giant pension fund, as well as committing perjury on a gubernatorial questionnaire in Washington, Frost is now forcing staff members to lie for her.

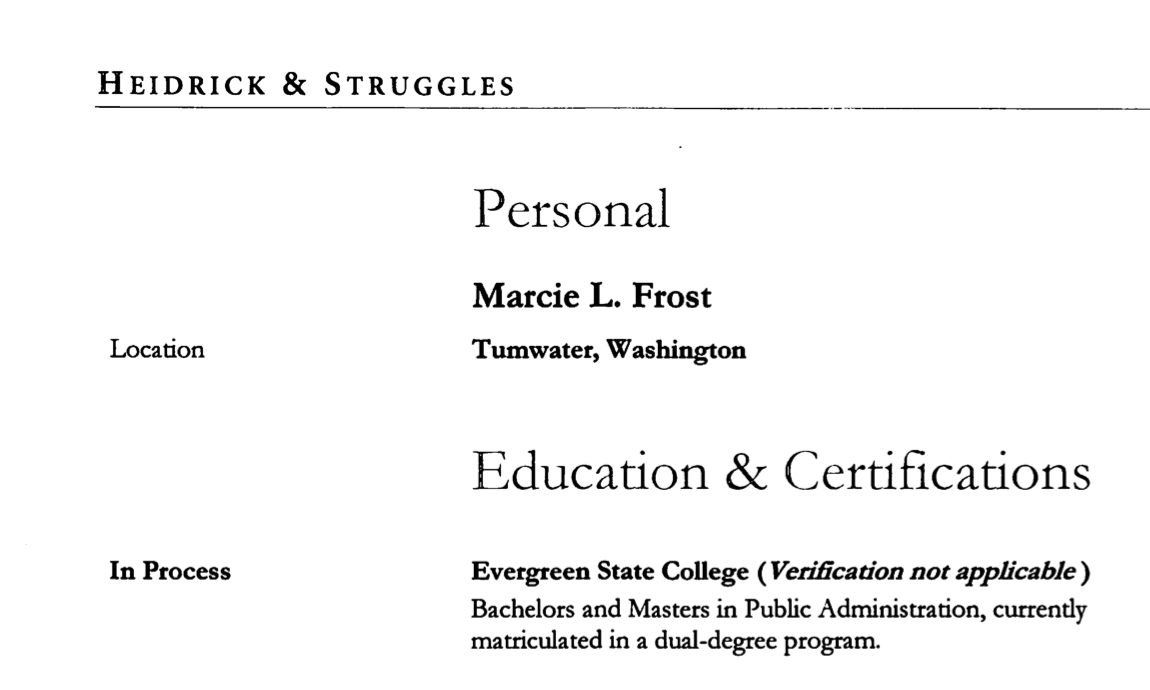

We’ll discuss how an article in the Financial Times’ FundFire publication shows that CalPERS has not denied any of the falsehoods we flagged in Frost’s resume, on the separate resume prepared by search firm Heidrick & Struggles, or in information later provided by CalPERS in news releases and on its website, and on Frost’s LinkedIn page.

Instead, CalPERS’ defense is to have communications officer Wayne Davis throw himself under the bus and try to claim that he was at fault for Frost saying that she was pursuing a dual bachelor’s/master’s degree at The Evergreen State College.1

The FundFire article did give credit to Naked Capitalism but did not address the other misrepresentations we documented, such as Frost omitting that she had worked at the Washington State Employees Credit Union, and her bogus claim that she had implemented Washington State’s first human resources information technology system. Most disturbingly, Frost also made a clear-cut misrepresentation on a Washington filing made under penalty of perjury.

The Financial Times demonstrates that the CalPERS PR officer’s self-blaming does not hold up by walking through CalPERS’ statements about Frost’s education over time. They exactly mirror ones we identified.

The PR fall guy’s excuse is additionally implausible because it is impossible that anyone other than Frost herself could be the source of the misrepresentation on the Heidrick & Struggles resume, which is prominent by virtue of being the very first item presented about her:

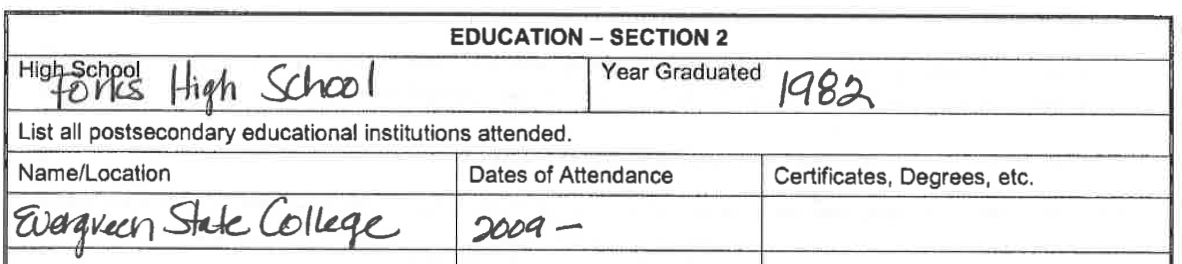

It is also hard to see how CalPERS’ staff could be responsible for the misrepresentation Frost made when she was still working two states away in Washington and filled out a gubernatorial questionnaire under the penalty of perjury as part of her appointment to head Washington’s Department of Retirement Services in 2013:

Recall that Frost attended Evergreen only for two quarters in 2010, a point CalPERS does not dispute. The “2009-” not only states she attended earlier than she actually did, but with the dash, also implies

that she was taking courses on a continuing basis through the date she signed the document.

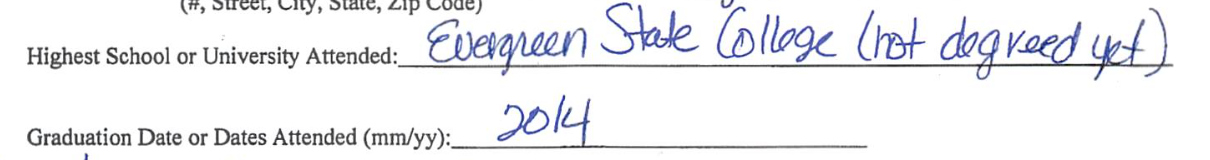

Frost also represented on a SecuriCheck form she provided to CalPERS in 2016 that she had last attended Evergreen in 2014, and was “not degreed yet,” which indictates she was working on a degree:

Recall that Frost had never enrolled in a degree program at Evergreen and thus was never “matriculated” or “pursuing a degree”.

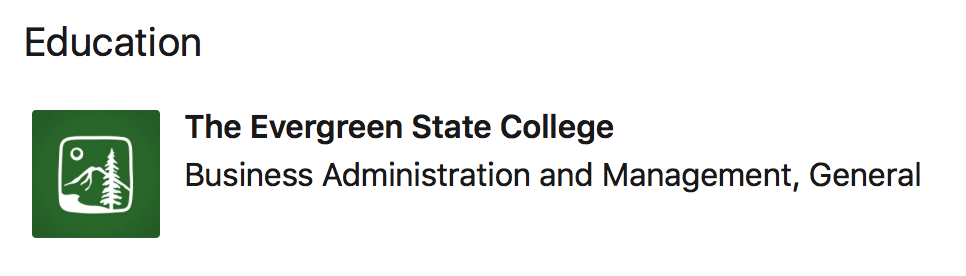

Finally, Frost was making fresh misrepresentations, all on her own, via her current Linked profile, which we believe she put up in early August 2018 (we did not see it before then despite making searches at the start of the month):

Frost never took any business or management courses. She took only an “experiential” writing class.

The Financial Times story also reports that the board is not merely defending Frost, but has also categorically said it will not investigate her. First, this means the board must have engaged in an illegal board meeting to do so.2 Second, and far more troubling, this means the board is actively defending a culture of lying at CalPERS.

We’ve regularly called out CalPERS on its culture of casual lying, which has gotten only worse under Frost. In our 25 years of consulting to financial institutions, the only place we’ve seen this pathology as advanced as it is at CalPERS was at Bankers Trust.3 BT was first caught out when tape recordings of its employees bragging about their success in ripping off derivatives customers became public. The bank was later prosecuted by the State of New York for the failure to escheat abandoned property to the state as required by law. Those scandals led to its acquisition by Deutsche Bank.

It should be obvious that lying badly in public on a regular basis, particularly when done as a matter of course by top executives to the board on YouTube at public meetings, tells staff that lying is not merely acceptable but is important to career advancement. This behavior guarantees adverse selection: honest people will be put off and will leave as soon as an acceptable opportunity opens up. And this is already happening. We are getting e-mails from insiders telling us of defections by frustrated employees, and even remarks in our comments section:

Word around the CalPERS Office of Audit Services is that high-school-educated Marcie Frost serves as a sort of straw (wo)man which allows former US Atty Matt Jacobs to run the show. Hard to say how much truth there is in that, but people are leaving left and right from this dismal environment that was pitched to us as a “destination employer.”

In other words, if the board thinks there is no cost to hanging on to Frost, they are smoking something very strong.

Key sections from the paywalled FundFire story by Fola Akinnib:

The $361.5 billion California Public Employees’ Retirement System (CalPERS) is defending CEO Marcie Frost from questions about her educational background, claiming that misrepresentations about her college experience were made in error.

A July 2016 press release naming Frost CEO said that she “is pursuing a dual bachelors and master’s degree in public administration from Evergreen State College.” The college has never offered such a program, a discrepancy first reported by the financial blog Naked Capitalism and confirmed with the college independently by FundFire.

The pension system claims this statement was made in error by the communications team, according to CalPERS public affairs chief Wayne Davis. He failed to address how the pension — or communications staff — came into possession of information with the specifics of the college and degree course in question….

The CalPERS board has no plans to further investigate or take any action regarding the misrepresentations, says board member Richard Costigan. Costigan says Frost’s educational background had no bearing on the board’s decision to hire her.

“I knew at the time we interviewed her she didn’t have a college degree,” says Costigan.

Let’s stop here. First, the issue is that Frost lied, which Costigan astonishingly does not dispute. Lying in the course of being considered for a job is absolutely unacceptable in any functioning organization, and is even more dangerous in a financial institution responsible for the welfare of 1.9 million beneficiaries.

Second, it is not credible that Heidrick & Struggles depicting Frost as “in progress” to getting a master’s degree did not influence how the board regarded her being merely a high school graduate. If the fiction that Frost was working on a master’s degree wasn’t important to Frost and CalPERS, why did they repeatedly flog this false notion?

Back to the story:

The timing of the changes to Frost’s profile on CalPERS’s website also raises questions.

Frost’s 2016 biography used the same language to describe her educational history as the press release announcing her appointment. In 2017, the reference to Evergreen State College was dropped, although the reference to her pursuit of a dual undergraduate and master’s degree remained. The next year, references to the degree were dropped.

The 2018 biography update occurred two days after media reports of the pension system firing Charles Asubonten, who was hired as CalPERS CFO last September. He was dismissed for embellishing his resume and having scant experience in pension finance….

This is as skeptical as you get in a reported story, particularly in the trade press, where journalists are under pressure to take up the talking points of the players they cover so as to preserve access.

And this is the closing, from a written statement by Board President Priya Mathur and Vice President Rob Feckner:

“These continued efforts to tear down CalPERS and discredit Marcie and the broader leadership team at the system are nothing more than a spiteful attempt to attack retirees, beneficiaries, and the promised benefits of public employees,” the statement reads.

As far as CalPERS is concerned, we remain The Blog That Must Not Be Named.

It is noteworthy that Feckner and Mathur both defended former CEO Fred Buenrostro up to the end. Buenrostro is now serving a four and a half year sentence in federal prison for bribery and other charges. Then as now, they seem unable to recognize that defending CalPERS means demanding integrity from all of its executives, most of all, the CEO. We are acting to defend CalPERS beneficiaries and California taxpayers. But CalPERS executives and the board keep doubling down on incompetence, cover-ups, and lies rather than cleaning up the institution. As Fredrick Douglass said in a different context:

I shall feel myself discharging the duty of a true patriot; for he is a lover of his country who rebukes and does not excuse its sins. It is righteousness that exalteth a nation while sin is a reproach to any people.

The board’s sputtering over Frost’s supposedly maligned honor is unlikely to persuade CalPERS’ rank and file employees. Recall that most are college graduates and many had to get degrees and/or certifications to secure employment and advance in their careers. Frost has already lost all credibility with them. As one senior staff member said in an e-mail: “No one expects her to survive this.”

Our bank IT expert Clive had a similar take:

Having seen several board defendings of executives, I wouldn’t be too concerned about CalPERS initial “We’ll defend Marcie to the bitter end” stance. They stick by incumbents 100 percent, never give in to pressure, never let the press run the business, have complete confidence in their appointments etc. etc. etc. – right up until the point when they don’t.

To put it more tersely: How can CalPERS retain a known perjurer as its CEO?

____

1 In another proof of Frost’s minimal relationship to Evergreen, our Richard Kline, who is an Evergreen graduate, pointed out that the name of the school is The Evergreen State College, or TESC, and it is a sore point with graduates and employees when its name is incorrectly truncated.

2 All board meetings are required under the Bagley-Keene Open Meeting Act to have an agenda published in advance, and the body must also cite the legal basis for any private discussions. While there is a procedure CalPERS could have followed to hold an emergency meeting, what the board has effectively said is that they held an illegal serial meeting, as described in a guide to Bagley Keene published by the Attorney General. Specifically, on page 5:

3 We had Bankers Trust’s Chief Scientist as our client for about three months. Ironically, we were brought in to force the bank to honor a promise to spin him and his technology out into an independent venture.

well, yeah; they’re gonna attack NC because you made them look either stupid and/or crooked. Ya hit a nerve somewhere and that means there’s something going on there…… makes me worry bout other states such as Illinois

Very good point. The longer this drags on, the worse the reputation of the entire class of public pension funds becomes. Guilt by association is a ‘thing’ because it does happen, no matter what we think about it.

A common meme connected to state employment is that you defer immediate salary for a superior retirement later on. Destroy the reputation of the state pension system you are sacrificing present salary to be a future beneficiary of and you destroy the very reason for accepting lower salaries now. This will fuel a diminishing of the ‘public sector’ in employment. The available work force will thus shrink, and degrade state performance, and or lower skilled workers will take the positions, being already used to lower returns on their labour, and lower state function efficiency.

If I were an Ultra Cynic, I might see this as one front in the Neoliberal war against State functionality. Sometimes, as we Tinfoil Hatters know from painful experience, a Conspiracy does not need guiding figures. It is organic and self organizing.

No matter one’s point of view, the eventual effect of the CalPERS sordid mismanagement will be the further shrinking and impoverishment of the California Middle Class.

> a Conspiracy does not need guiding figures. It is organic and self organizing.

Our term for this was “emergent conspiracy.” All you need is incentives and opportunists. I think this is a much better and more pervasive model than a shadowy puppet master picking up the phone and issuing orders. The perps gather round at last, all the terms of an enormously complicated equation are canceled out, and everybody says “So that’s what happened!” and then leave with their respective sacks of cash over their shoulders.

“Then, as his planet killed him, it occurred to Kynes that his father and all the other scientists were wrong, that the most persistent principles of the universe were accident and error.” –Frank Herbert

I still haven’t read those books, although I’ve seen you mention that quote occasionally. I’m going to add them to my list. Thanks!

Perhaps the meme for new hires will be,

“Pay me more now and skip the pension…”

This will raise the salaries of public employees.

The public employee’s unions should be happy with that as they get a cut of the vig now.

@ambrit

August 30, 2018 at 10:59 am

——

Good afternoon. Hope you and family are well.

You made some excellent points in your comments, especially about the diminishing of “public sector” jobs. This is consistent with the neo-liberal emphasis that government is the problem and not the solution. It’s also part and parcel of the attack on teacher’s unions by various states.

These attacks need to be challenged constantly.

And, I don’t think you’re an Ultra Cynic in this case. I think you’re realistic.

Hail and… Well, you get the idea.

A warm greeting from us to you.

Sometimes, self-identifying as any sort of Cynic is a ‘guilty pleasure.’

I’m late to the ‘after blog’ party today since I had to do errands. Your point about Teachers Unions is crucial. Teachers are the secondary means of socialization of the young in today’s world. Where the parents are ‘missing in actions’ the Teacher becomes the primary means of socialization. I see Public School Teachers as a communitarian influence on the forming psyches. Private School Teachers have a much more conflicted set of instructions. Indeed, sectarian schools promote the separation of groups, the opposite to the socially optimal paradigm. Charter schools promote ‘Intellectual Elitism’ through the particular segregation of the students, and by inference, the households that they come from. Roughly speaking, except for the purely technical and mechanistic pursuits, Metrics as applied to education are a counter productive force. I realized that the Charter School program was a confidence game when I realized that most of the arguments for the idea were couched in terms of budgeting priorities. The Financialization of Education. All else, like stale p—, rolls downhill from there.

Yoiks and away.

This is how my day went. https://www.youtube.com/watch?v=MxsfGyWjX7g

Hope you’re enjoying our late rainy season.

@ambrit

August 30, 2018 at 10:23 pm

——-

I hope you get back to see this response. Thanks for your good wishes. The rain has been just about right.

Your comment is one of the absolute BEST succinct analyses of the existential problem of charter schools that I have ever read. I couldn’t agree more.

By definition, charter schools cannot provide the necessary socialization that children require as there are no requirements for including ALL of the community.

Public schools, OTOH, provide exposure to a much wider cross-section of a community and research has shown that exposure to “others” makes them much less “other”, and much more seen as just another person with equal value.

The video was great! Hope you have recovered from the beating you took.

The claim that Frost is a proxy holds some water for me. My own mother seved in a similar if lower situation, voting the way she was supposed to, prepping applicants, until she couldn’t take the corruption. And she was at least qualified for the position.

Assumedly Frost doesn’t want to give lie to the charges by telling the truth

CALPERS leaps to defend a dysfunctional culture of blatant lying and casual corruption. Instead of admitting a mistake or fixing the problem, their first instinct is to point the finger at those who do the hard work of reporting the truth. No surprises there.

Their behavior here is not good or acceptable or even tolerable. The laws and regulations which CALPERS appears to be violating exist for a very good reason — because these “little” acts of deception and cronyism feed into “big” acts of beneficiary rip-offs and officials behind bars. Thank goodness for Yves, NC, and the incredible work they’re doing to protect beneficiaries.

Can CalPERS become any more shady? (apologies, I’m still spitting feathers and my grammar may have failed me; that might be more correctly put “Can CalPERS become any shadier?)

But whichever, I can’t see how. Tolerating executive-level casual treatment of the truth and facts as some vague, malleable concepts which can be skewed and contorted to fit their chosen interpretation of events is one thing.

Driving a coach and horses (and a whole cavalcade, plus brass band) through democracy is something else again. Why do CalPERS bother with the board and elections to it? A few years ago I might have said because they want to comply — or give the impression of compliance — with State requirements. But they gave up that pretence with their attempts at obfuscation over former Asubonten, former CFO of that parish (can a parish also be a rotten borough simultaneously? CalPERS are certainly trying to see if this is possible) and also Private Equity deliberate falsehoods and misstatements of real rates of returns.

Now, with this latest stunt of board sham approvals (one guesses only the “right” board members got a say in the matter), all attempts at pretence have gone. I guess the stories are so damaging and responses are required in real-time which makes stitch-ups impossible to organise as events move too fast.

CalPERS board members should ask themselves, what, exactly, are they there for? It clearly isn’t to approve things. They don’t, patently, get chance to even “note” matters or have minimal discussions. They don’t have resolutions put before them, other than meaningless nodding dog agenda items. Even the elections are suspect. Staff (executive level, at least) seem to see them as nothing more than a children’s play date, to be pacified with colouring-in books and cake.

Congratulations CalPERS, you’ve reduced yourself to below the level of the Democratic Peoples Republic of Korea. At least they make a better show of going through the motions of representation.

Board member Margaret Brown, one of the few hold-outs against endemic banana-republicanism, must be incandescent.

If you think that’s bad, you should see what goes on in the private sector…

Time for one last quick comment before logging off for the night. Did someone at CalPERS say that CalPERS was described to them as a “destination employer” or a “Final Destination” employer? That employee seemed to suggest the later where career go to die. Might be worth some people sticking around there as you just never know lately what management slots will come popping up. If the Board decided to back her then there must be minutes of this board meeting. Or was it one of those board meetings. And trying a half-a**** attack on NC? Well they can’t say ‘But think of the children!’ here so they are using the next best thing as in ‘But think of the retirees!’. All I can say here is to repeat Julia Roberts’s line-

https://www.youtube.com/watch?v=TE-soqLUK7g

You know, a dual bachelors/masters degree seems like an unusual enough thing to make me suspect that the claim was created out of whole cloth to qualify for a job that required a master’s degree or at least substantial progress towards one. Somebody doing so would NORMALLY already have a bachelors degree. Do we know how the job was posted? Were there other jobs that she applied for that had a similar requirement?

And the big question is “Why did they hire her?” It is inconceivable to me that more qualified people didn’t apply. Why pick somebody who might someday get a master’s degree but currently only had a HS degree? I’m not necessary convinced that credentials are everything, but they are usually the FIRST sort when filling a position. Why did she even get an interview? There is definitely something more to this story.

Couldn’t agree more. Misrepresentation of educational achievement notwithstanding, Ms. Frost appears to have absolutely NO relevant experience, yet mysteriously vaults to the top position t one of the world’s largest pension funds. Note too that Heidrick & Struggles is one of the most exclusive recruiting firms out there. Is this truly representative of the calibre of candidates they present to their clients.

Frost’s only meaningful qualification for the job was that she would do what the person(s) who engineered her hiring wanted done. Beyond that, there is no case that can be made that Frost was remotely qualified to even be considered. None.

Bingo.

Exactly. Find whoever groomed and installed her into this position she could never have otherwise hoped to occupy and you’ll at the same time find out who’s in the shadows impelling the continuing cover-ups. Add in the $362.06 Billion money pot and surprisingly ham-fisted corruption being in play looks increasingly likely.

And how did she establish to the person who got her the job that she was willing to be their cat’s paw? She appears so manifestly unqualified on the face of it for the position that somebody expended some political capital to shepherd her through the process to get hired. The more you look at this the more questions that you have.

> how did she establish to the person who got her the job that she was willing to be their cat’s paw?

Both in California and Washington.

One does wonder whether her work in Washington gave her a reputation.

Particularly interesting is the disappearing WA Credit Union position. Wonder if any names in that organization would ring bells?

Am I being churlish to mention ‘Lewinsky’ in this context?

“…nothing more than a spiteful attempt to attack retirees, beneficiaries, and the promised benefits of public employees”

Is that straw-grasping from a floundering board? I can’t recall any spiteful attacks on CalPERS retirees from Naked Capitalism, so it must be some other unnamed blog they’re referring to.

This tends to confirm that in a time of universal deceit, top positions in corporate government now actually require pathological liars. You cannot run a successful crime syndicate without such sociopaths at the top. Obama is the quintessential, tho more sophisticated example. Sincerity is paramount; if you can fake that you’ve got it made.

Color me utterly unsurprised that dysfunctional, constantly lying CalPers first instinct is, as usual, to shoot the messenger. Typical behavior from this corrupt organization handling MY pension funds.

GAH.

Hopefully the LA Times and SacBee will pick up this story, as that will give it more optics within Cali.

I’m swamped at the moment, but I’m gonna try to fire off some letters and emails today. This is beyond redonkulous at this point. But as you point out:

They’re probably still defending that crook.

As I stated previously, I’ve seen this movie before. The idiots who hire someone clearly unqualified and unfit for the position of CEO don’t want to admit their “mistake” – if, in fact, it even was a mistake – as in: what are they getting out of this CEO that they don’t want to end? There’s so much gross corruption happening at CalPers that it would irresponsible not speculate who’s scratching whose backs and who’re getting what kick backs.

Corrupt, dysfunctional, crooked, messed up – the whole of CalPers from top to bottom.

Thanks, as always, Yves, for being the “Blog who shall not be mentioned.” You’re doing a top notch job, and as a citizen of CA, I thank you very much. Keep it up!

I an continually stunned and amazed at the new levels of stupid people can reach for when they are neck deep in prior stupidity.

Ms. Smith, you are a fierce one for truth.

You are saluted.

My pensions law memory is fuzzy…. Aren’t the board all fiduciaries for the beneficiaries?

Why aren’t there lawsuits flying out left and right?

“Paging Bill Lerach. Mr. William Lerach, white courtesy telephone please!”

as the stomach turns; We know enough to extrapolate there are serial meetings, that they are common. They are admitted to by people that have spoken out against any internal investigation or consequences for serial meetings, punitive actions, and acts that appear to rise to criminality. Some animals are more equal than others.

So what and why? Some of the high level employees and board members are closing ranks to poo poo all the facts. They act as though they have protection, for the deeds appear to be serial violations they describe as business as usual. There appears to be a conspiracy among people able to affect the actions of CalPers.

Someone is paying these people enough that they will do anything to hide mis/mal feasance. The CEO is not qualified to prepare taxes, but controls nearly $2b in funds. Someone has enough clout to keep the governor of California quiet about an ongoing criminal enterprise that has developed. The last leader of the organization is in prison, yet his enablers are still active, perhaps under instruction from the same gravy train that got him jailed.

If an institution this large has to hire someone unqualified to run it, they must be looting it or are being paid well to assist others in looting it. What else could cause this silence from the governor on down? I would certainly appreciate being shown how wrong this assumption is so that I might apologize for such a wild imagination.

> The CEO is not qualified to prepare taxes…

Nice framing.

I think the wildly imaginative ones are the people who still think that maybe all this “incompetence” is merely coincidental. Fred needs some new roommates, badly, but as you point out, everyone who could actually do something about it is strangely quiet. Odd, isn’t it?

“It’s Chinatown, Jake”

This is really scary, and I have some standing as the spouse of a CalPERS pensioner. Someone without a college degree — let alone an MBA from Harvard or Wharton or UChicago and 20 years of experience running major financial institutions — is CEO of the largest public pension fund in the country (do I understand this right?)? Whose credentials, minuscule as they are, are, to put it kindly, embroidered? And the SacBee and LA Times won’t touch it? What? This stinks to high heaven. Has anyone called reporters at Bloomberg or the WSJ about this?

Last time the truth tried to break out, they put Madoff in jail.

The FT picking up this story and independently verifying the details is great.

This bit is particularly rich:

“These continued efforts to tear down CalPERS and discredit Marcie and the broader leadership team at the system are nothing more than a spiteful attempt to attack retirees, beneficiaries, and the promised benefits of public employees,” the [CalPERS] statement reads.

Yep. Demanding competence, honesty, and accountability in the CalPERS’ CEO is an “attack” on the promised benefits of public employees. uh huh…. How is keeping a lying and money losing CEO in place good for beneficiaries? (Nice try, Mathur. Maybe try the “it’s a sexist attack” line next. Anything to avoid addressing the real issue. /s)

Thanks for your continued reporting on CalPERS, PE, and pensions.

It’s clear that someone is getting their vigorish here, either now, or the promise of their vig in the future.

The real question is, “Cui bono,” and I’ve yet to hear an even partial answer to that question.

Someone inside Calpers is doing something dishonest for their own personal benefit, but for the life I cannot figure out who or how.

An interesting bit of history… not that it has anything to do with the current mess…

http://articles.latimes.com/2009/may/07/local/me-pension-probe7

Assuming this anonymous commenter is legit, what’s the story behind this Matt Jacobs guy? Why point the finger at him? Cursory search pulls up not much, other than stuff about prosecuting some fraud cases, and nothing seemingly dirty.

I suggest you read our site. We’ve written extensively about Jacobs. Board member Margaret Brown said he needed to be fired when she was campaigning last year. I see you missed that among other things, Jacobs failed to stop massive copyright fraud by CalPERS, which cost the system nearly $4 million. Or how about this piece by former general counsel Bill Black:

https://www.nakedcapitalism.com/2017/05/calpers-and-board-come-out-losers-over-kangaroo-court-against-its-most-effective-board-member.html

Here are some of many examples of other posts:

https://www.nakedcapitalism.com/2017/04/corruption-calpers-general-counsel-matt-jacobs-exemplar-culture-casual-lying.html

https://www.nakedcapitalism.com/2017/05/how-calpers-general-counsel-matt-jacobs-violated-california-bar-rules.html

https://www.nakedcapitalism.com/2017/03/calpers-calstrs-other-investors-have-indemnified-private-equity-criminal-conduct-even-though-fiduciary-counsels-say-no.html

Interesting that the NC articles did not show up on a search. Blocked, perhaps?

The Purge in action.

Anyone hear anything from the WSWS lately? (Rhetorical question.)

https://www.youtube.com/watch?v=K8E_zMLCRNg

The biggest Ponzi scheme I ever watched was Bruce McNall.

Nothing made sense from an outsider’s inside perspective, as he ‘owned’ the LA Kings, a Hollywood movie studio, and the finest thoroughbreds.

And this was all on the basis of making money dealing in ancient Greek & Roman coins, in theory.

Only when a Ponzi scheme or some variant which appears to be happening with your inquiry into improprieties herein gets antsy about the truth being leaked out, do they squawk. I mean they have to, they’re cornered rats.

McNall’s bust up was something else. Poof, it all went away like a Cinderella story with the clock striking the twelfth of never.

This is so sickening. Marcie for faking it and the board for letting it slide. And everyone in the chain acting like corruption is their business model. Which it prolly is. The thing that should come of all this self-serving deceit is oversight. Both by the state of California and by the feds – there should be new strict standards set at the very top. Yesterday. The federal government can justify this easily if they set up an insurance fund backing up all pension funds.

The feds don’t do oversight any more. They basically stopped in 2002 when they assigned all the FBI agents to “anti-terrorism” theater. The SEC doesn’t do oversight, either. Evidently the attorney general of California also doesn’t. And it seems the SacBee and LATimes have decided either an investigation here wouldn’t generate enough clicks or the people benefiting from the scam at CALPERS, whatever it is, are good friends of the owners, so the story is not news.

“Toto, I don’t think we’re in 7.5% APR increase anymore.

Also, it looks as if a few employees maybe be earning compound interest, er the Big House.

Having written over 5k resumes for clients, I consider myself a master of slippery wordings. The maximum weasel language limit for Frost’s education would have been:

EVERGREEN STATE COLLEGE, Olympia, WA

Undergraduate Studies, 2010

This is incredibly weak and I would usually advise such a client to quick sign up for another class, allowing them to make the claim of:

Undergraduate Studies, 2010 – Present

Ideally a master’s level class which would permit a misleading (but honest!) bullet point:

– Includes post-graduate level studies.

OK, maybe pluralizing ‘studies’ is a bit over the line.

I would never allow a client to use a resume as misleading as Frost’s. The only good strategy for getting around education requirements is a very well thought out Continuing Professional Education section, in which you can say almost anything IF you can talk the walk in an interview.

If your application is skillfully done, you should assume your resume is the outline for the eventual interview. A resume full of lies is a perjury trap of your own making and is entirely avoidable.

Even without having read any of NC’s excellent articles on CalPERS, I would smell a rat here. No sane org with this much capital would ever hire someone with such a thin resume unless they had an ulterior motive (fall guy?).

At Evergreen, only juniors and seniors are allowed to take graduate level courses, and then only with permission of the instructor. And the credits they get for those courses applies to their undergraduate degree only.

I would need to meet with Ms. Frost to come up with a better resume in that case. That one line was her only hope for credibility, imho.

I’m a generalist and not an expert on anything other than losing elections, but her resume really is remarkably thin for someone overseeing this much money.

When I first started writing resumes, an early client was a gentleman approaching retirement who needed a c.v. for some board he was going to serve on. He managed the South American portfolio for a national bank. First time I ever typed the word “billion” on a resume.

He had two master’s degrees: One in Music and one in Philosophy. This was ten years after Reagan and I could sense he had no regrets about retiring whatsoever. The old ways were better. Liberal Arts majors can learn numbers better than numbers people can learn people.

Thank you, Yves, for yet another bang-up piece on the financial travesty that is CALPERS.

I find it incredible that the world’s largest pension fund is and has been hiring so many unqualified folks to manage so much money.

Keep up the pressure.

I have been sending your pieces on CALPERS to my Rep. in the State Assembly and will continue to do so.

This financial scuzzbaggery must be ended and the Board at CALPERS must be held accountable.

TESC’s motto “Omnia Extares” (translated into English as “Let it all hang out”) is grammatically incorrect Latin. See:

https://web.archive.org/web/20120827205239/http://archive.cooperpointjournal.com/student-voice/omnia-extares-seriously

> how did she establish to the person who got her the job that she was willing to be their cat’s paw?

Both in California and Washington.

So I actually have master’s degree in public administration. All I had to do was work at a credit union and I could have been running a $360 billion pension fund. Why didn’t my university guidance counselor tell me that?

Your guidance counselor lacked the understanding of the necessary qualifications.

We can only speculate on the actual winning qualifications. Methinks they were demonstrated, not documented.

Don’t worry, Attorney General Becerra is gonna be all over this!

Real soon.

Some may have noticed that I like running jokes.

I never expected this one to run for well over a year…it just goes to show how much of a bad joke the CA Attorney General is.

California is a dumpster fire when it comes to legal issues. Sure, Jerry brown will babble about the environment until his crazy train runs into zoning/environmental concerns.

Sacramento’s primary export is bs and hypocrisy.

It would be wrong not to speculate.

When a ponzu unravels one finds that some of the previously declared assets aren’t there.

Can the audits be trusted? Even the big four have had issues. And what about PE assets?

Might the gov or ag be thinking, I’ll be gone when it blows?

CalPERS affirms confidence in CEO amid questions on educational background Looks like they got together and agreed on a story.

It’s hard not to think this is just the tip of the iceberg.

Looting and pillaging is going on at a fevered pitch nationwide.

They know the end is near.

Their unknowing motto: He who dies with the most toys wins.

Our betters are cashing out. Time to “party on” … somewhere else.

“I knew at the time we interviewed her she didn’t have a college degree,” says Costigan.

For this level of job, isn’t a bachelors degree required, let alone an advanced degree?

Matthew Jacobs is one odd character, Without a doubt hes Marcies puppeteer and his financial ties and disclosures should be investigated as should Ted E’s

Coverage now at Bloomberg, with a mention of NC, too:

https://www.bloomberg.com/news/articles/2018-08-30/calpers-ceo-s-education-to-get-scrutiny-from-some-board-members

I confess this is the first CalPERS post I’ve read in years. Until Yves explained the primacy of CalPERS as the leading retirement fund and a trend setter among retirement funds at a recent NC meet-up I didn’t understand her tenacity in digging into and exposing their seemingly endless scandals and incompetence.

After reading this post and the many comments I remain puzzled about the Marcie Frost resume mis-representations — not about the scandal itself but puzzled about why there is a scandal. Lambert has twice noted “‘how did she establish to the person who got her the job that she was willing to be their cat’s paw?’ Both in California and Washington.” Many other commenters noted her lack of credential ‘merit’ and almost complete lack of experience. The only ‘merit’ or skill she seems to bring to CalPERS is gross lying at what to me appears a skill level markedly below the competence of a moderately capable real-estate agent or car salesman. The recent collapse of the financial system demonstrated an ample supply of extremely well-credentialed, highly capable liars and cheats many of them probably as incompetent as the best of the CalPERS staff and both experienced and connected in California and Washington and ever so pliable to subtle suggestions from the right people — so why did CalPERS consider Marcie Frost let alone hire her? Even her false resume, accepted without question, shouldn’t have made it past the usual personnel computer filters for much lower level jobs at most firms and organizations. Did she give CalPERS a special deal on her salary and benefits package? Does she bring donuts to every board meeting? She’s like someone’s in-your-face insult or the response to a high level game of truth-or-dare challenge to that someone’s power.

I too used to skip over the CALPERS posts, thinking pensions were a boring topic. Little did I realise I was missing out on perhaps the most entertaining serial horror show on the internet.

Take the time one rainy afternoon to read through the posts. Hopefully Yves will work them up into a book one day. It ought to become required reading for governance courses worldwide.

I too used to skip over CALPERS posts, wrongly thinking that anything to do with pensions must be boring. Little did I realise that I was missing out on the most entertaining serial horror story on the internet.

You really should read the archived posts, it’s a blast.

I am retired. I appreciate your suggestion but while CALPERS posts do have high entertainment value the serial horrors seem too real — they give me nightmares.

Fair enough. While I’m in a different country, I’m pretty sure the same stuff happens here too. It’s just we lack an intrepid reporter to uncover and chronicle what lies beneath our own systems.

And apologies for the double post.

Sorry you are not allowed to apologize for the double post. You may not steal credit from SkyNet, or at any rate it can unwise. SkyNet may eat your comments if you piss it off.

I used to do background checks for new hires and this is blatant lying that would and should have disqualified the candidate from the get go.