Yves here. Even though the revolving door is widely recognized to be a source of corruption (that is why some agencies have long cooling off periods before a regulator can join a company in the industry they regulated), the phenomenon is more talked about than documented. This post helps fill that gap and discussed possible remedies to regulatory capture.

By Haris Tabakovic, Researcher, Harvard Business School and Thomas Wollmann, Assistant Professor of Economics, University of Chicago Booth School of Business. Originally published at VoxEU

When public sector employees end up working for the private firms which they monitored, regulated, and even disciplined, a clear conflict of interest arises. However, little is known about the the scale and scope of this ‘revolving door’ problem. This column presents evidence from patent examiners employed by the US Patent and Trademark Office, and shows that examiners grant considerably more patents to the firms that ultimately hire them, and that the most likely explanation is that examiners are ‘captured’. This leniency lowers the quality of patents coming out of the agency.

US government employees often find themselves in a peculiar situation which involves monitoring, regulating, and even disciplining the behaviour of firms whom they hope to later work for. In the pharmaceutical industry, for example, the safety of a new drug may be determined by a Food and Drug Administration employee who soon after joins the firm that developed it. In financial services, the penalty for fraud may be determined by a Securities and Exchange Commission (SEC) employee who is subsequently hired by the bank that perpetrated it. These cases pose clear conflicts of interest, but they are hardly unique. Workers move so frequently between agency and industry positions that they are said to pass through ‘revolving doors’ as they move from public- to private-sector roles.

Long before ‘draining the swamp’ became a campaign position of the current US administration, economists raised concerns that lax regulation might be exchanged for lucrative subsequent employment, resulting in agencies that serve the interests of industry over the very public they were designed to protect (Peltzman 1976, Stigler 1971). The scale and scope of the problem, though, was largely unknown, though this is starting to change.

Evidence From Examiners

In recent work (Tabakovic and Wollmann 2018), we study patent examiners employed by the US Patent and Trademark Office (USPTO). Examiners decide how much, if any, protection to grant inventors over their ideas by evaluating the claims made in their applications. The majority of these applications are filed by law firms specialising in intellectual property, many of whom frequently hire former examiners. Transitions from the USPTO to filing firms are hardly surprising – turnover among government employees is high, and law firms house the jobs for which former examiners are best suited. They do, however, create an awkward situation. Many examiners wind up evaluating the applications of firms for whom they hope to work. Patents impact many dimensions of the economy ranging from investment (Budish et al. 2015) and labour income (Kline et al. 2017) to entrepreneurial activity (Farre-Mensa et al. 2017) and the rate of innovation (Moser 2005), so if examiners’ impartiality is compromised, it is a big problem.

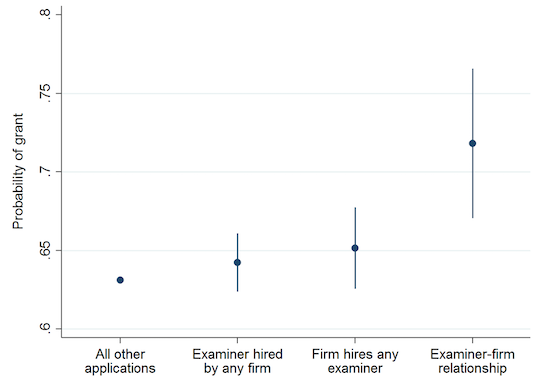

What do the data indicate? First, examiners grant considerably more patents to the firms that ultimately hire them. This fact alone does not imply examiners are ‘captured’, but comparisons among the over one million applications rule some alternative explanations out. For example, the difference is not driven by whether some examiners are more generous overall or whether certain firms are, on average, more successful. Other factors suggest that examiners’ individual preferences for one firm over another, or one type of technology over another, do not drive these results. For example, one might worry that an examiner who is more enthusiastic about engines than semiconductors or cell phones will not only grant more engine-related patents but also tend to work at the firms who specialise in them. Yet, examiners assess only narrowly defined types of technology.

Figure 1 Examiners grant more patents to firms that hire them

Note: This figure plots the coefficients that result from regressing the probability that a patent application is successful on indicators for whether the examiner was hired by any filing firm, whether the filing firm hired any examiner, and whether the filing firm hired the examiner assessing the particular application. The left-most point reflects the constant term, which is added back to the coefficients for comparison’s sake. The specifications include calendar year and patent class fixed effects, though the relative magnitude and significance of the main coefficient of interest – the final one – is robust to including examiner and firm fixed effects as well.

Source: Tabakovic and Wollmann (2018).

Second, when we plot the main effects over time, we find that the differences are much larger in periods when firms are frequently hiring. During the dot com bust or Great Recession, for example, the leniency that examiners extend future employers disappears. Coming out of these hiring troughs, examiner leniency reappears.

Third, we find leniency can be tied to factors determined priorto the examiners joining the USPTO. For example, we show that the geographic location of an examiner’s alma mater predicts where he or she will later work. We then show that examiners who leave the agency grant significantly more patents to this predictedset of firms. One might worry that this merely reflects ‘home bias’ – i.e. favourable treatment for firms close to areas where one grew up or attended school. However, the effect is completely absent among employees who stay at the agency.

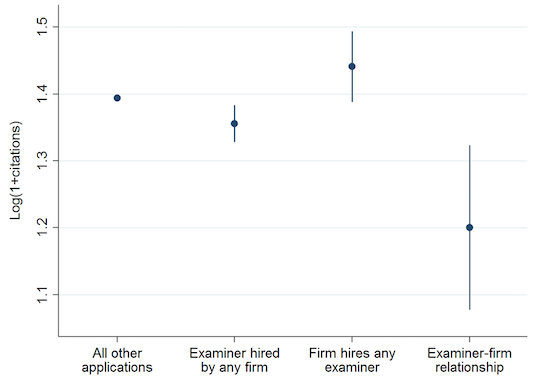

Ultimately, this leniency lowers the quality of patents coming out of the agency, which we measure using citations. For example, patents granted to firms that later hire the examiner who assessed them received about 25% fewer citations, consistent with the idea that these firms’ applications are held to a lower standard.

Figure 2 Patents granted to subsequent employers are of lower quality

Note: This figure plots the coefficients that result from regressing the log of one plus the number of citations a patent receives on indicators for whether the examiner was hired by any filing firm, whether the filing firm hired any examiner, and whether the filing firm hired the examiner assessing the particular application. The left-most point reflects the constant term, which is added back to the coefficients for comparison’s sake. The specifications include calendar year and patent class fixed effects, though the relative magnitude and significance of the main coefficient of interest – the final one – is robust to including examiner and firm fixed effects as well.

Source: Tabakovic and Wollmann (2018).

Policy Considerations

While these results raise doubts about examiner impartiality, they are silent on what policymakers should do about it. Hasty policy changes can have large, unintended consequences in these settings. Several options have been discussed.

Can’t we simply ban examiners from joining law firms for a year or two after leaving, i.e. create a ‘cooling off’ period similar to that which members of Congress or partners at US accounting firms face? This is unclear. Such post-employment restrictions can dissuade talented individuals from joining agencies in the first place, or deprive them of incentives to work hard and ‘show off’.

In fact, recent work by Kempf (2018) substantiates precisely that concern, albeit in a different setting. She studies credit analysts at US rating agencies, tying together data on how they graded various financial products and who later hired them. Prior work showed analysts biased ratings in the direction of their future employers (Cornaggia et al. 2016) – a big problem, since inaccurate ratings may be partly to blame for the financial crisis. Kempf points out, though, that analysts who leave the agencies to join investment banks are much more accurate overall. Even more striking, as the probability that an analyst will be hired by an investment bank rises, their accuracy increases. Perhaps agencies need to permit some corruption to gain some competence. It’s an unsavoury idea, but we live in an imperfect world.

What about monitoring examiner-attorney interactions and punishing the sort of quid pro quo exchanges that made former Illinois governor Rod Blagojevich so famous?1Besides cost and privacy concerns, it is important to remember that regulatory capture requires no explicit agreements at all. Nothing in our data, for example, implies these were ever discussed. In fact, we think very rarely, if ever, does this happen. Industry norms are sufficient – simply following the principle that one should not ‘bite the hand that feeds it’, so to speak, will suffice.

Couldn’t we instead just ‘blind’ the process, withholding the examiners’ identities from the firms? While some agencies might make this work, in most cases this is not practical. Frequent interactions are required. Regulated firms will eventually figure out who their regulator is.

These issues aside, it is also unclear how one agency’s experience applies to another’s. For example, deHaan et al. (2015) find that private law firms defending companies targeted by the SEC hire prosecutors that are harsheroverall. The cause is unclear. Perhaps talent is showcased with toughness in the adversarial process of litigation, and defence firms hire the best litigators, or perhaps defence firms hire the prosecutors they simply do not want to face again. Equally provocative, the authors find that the opposite is true for SEC lawyers based in Washington, DC, at least where criminal investigations are concerned.

Future Research

In our view, revolving doors can present a serious problem, but policymakers need more guidance. Fortunately, as social networks offer increasingly comprehensive data on worker transitions and governments continue to experiment with post-agency employment restrictions, opportunities will arise frequently for careful academic research to contribute to the debate.

See original post for references

Interesting. I believe there is a very important prerequisite for any regulatory capture , which corruption of lawmakers. Regulatory capture will require either laws to be weak and ambiguous or ,if laws are clear and strong, than laws must provide a good deal of discretion to the administration and government officials. Thus, implementing any remedy for this is going to be very difficult in a time when politicians themselves are corrupt. Further , by threatening defunding of regulator , politicians can have an indirect control over regulator.

As regards to specific instance of regulatory capture of USPTO, I believe author has taken a very narrow approach of focusing only on patent examiners and their relationship with prospective employees .

A documentary named “The Patent Scam” does much better job in explaining working of whole US patent system (including judiciary ) and consequent regulatory capture and corruption. If the author has not seen the documentary than he should definitely watch it. Let me mention some of the important points made in the documentary:-

– the major reason why low quality Patents are financially beneficial for the lawyers/law firms is because of excessively costly and lengthy process of litigation which no small business can afford .

-Thus, all law firm has to do is to obtain a low quality Patents (mostly via shell companies) and threaten legal action against a small business which can not afford going litigation thus will be forced to settle. Documentary mentions a small business owner who is threatened by a lawsuit by a patent owner shell company who owned patent of “scaning a document by scanner and then emailing scanned copy of such document”.

-It is becoming a major problem for small businesses as businesses generating annual profit of 30000 $ are threatened by lawsuits of 300k to 400k for patent infringement.

-A patent examiner have only about 4 hour in which he has to decide whether to grant a patent or not.

-Patent trolling has become an organized industry like Tax heavens.

Well said. The Japanese in the 1980s were well known for the strategy of surrounding existing patents with those with slight variants – a strategy well known by many US patent attorneys. No doubt this technique is being applied by others as I speak.

In my field some of the patents are downright absurd. How they were granted I will never understand – there is nothing novel in many of them – cobbling together techniques that have been well known for decades, if not hundreds of years.

Wasn’t it Harry Truman who, in order to cut the federal budget, wanted to close the Patent office? I laughed when I first heard that, but now …

The method this post uses to assess regulatory capture seems to emphasize the many sins of little fish. What about those who run the regulatory agencies and set policy? What about the politicians who appoint them and those who approve these appointments? What about capture of the Attorney General’s Office? Such laws as remain on the books go unenforced. Crimes go without prosecution and punishment. The laws regulatory agencies are intended to enforce are diluted by agency policy, gutted by new court decisions. and legislative “refinements” of the regulatory laws. Internal funding lines are crimped by captured legislatures and undersecretary designed budgets. I suppose it’s nice to study and characterize the movements of the little fish but is there no study nor method of study for scrutinizing the regulatory capture in the activities of the bigger fish?

So the bottom line, I guess, is “the bottom line,” and because of all the bad things that might happen if anyone were to shake up the system and create enough incentives and penalties to first, draw public-minded people into civil service regulatory work, and then keep them working at “precautionary-principle-driven” tasks, then trying to improve the general welfare outcomes is a feckless task.

My anecdotes are from a different era. Started with the US EPA in fall of 1978, just ahead of the Reagan Revolution. The attorneys I worked with (with one notably corrupt exception) were mostly on the side of Heaven. Many of them were “trust fund babies,” brought into protecting human health and the environment by personal zeal and with limited interest in “going for the big bucks.” They were all about the same age, bred in the hippie/tree-hugger era. This was in one Regional office, one of the largest, and that zeal lasted for about 3 or so years after the Reaganauts took over. Though I must observe that the EPA headquarters and Department of Justice attorneys were generally a lot better plugged into the nascent bubble of Empire, weather-vaning to the whims of “policy” and in daily contact with the growing armies of both lobbyists, and the many operatives in the form of corporate counsel and “hands-on executives” that stalked the halls of “Justice” and EPA’s nasty Waterside Mall offices. The DC EPA and Justice people were not so imbued with the notion of “public service in favor or the general welfare.” And many were happy to collect copies of puny settlement checks (compared to the kinds of civil and then criminal penalties that had been seen up to the early ‘80s) when any enforcement actions were taken at all, along with their reasonably good upper middle class paychecks.

And the quantity and quality of enforcement of laws and regulations and policies was gradually weakened by the Reaganauts and subsequent bosses, actually got pretty much choked off except as against little entities that could be bulk-processed into numbers that gave the impression of an agency still “committed to the (shape-changing) mission.”

In the mid-80s, the lure of pro-corporate and more lucrative positions with the Dark Side began to take a toll. The folks who started having families and seeing how well the other side lived, and variously suffering the debilitation of seeing the “mission” walk away from protecting human health and the environment into the morass of ‘risk assessment-based” and “cost-benefit-based” regulatory policies, “seen their opportunities and took ‘em.” One guy went from pursuing Waste Management for criminal and civil violations of EPA-administered laws to joining up with Waste as in-house counsel, to come back and hack away at EPA enforcement initiatives and actions with his knowledge of the “secret law” of letter opinions and regulatory interpretive memoranda and guidance and policy documents that us mopes who remained were ever more constrained by. He was not alone. The replacements were often straight out of law school, and were clearly there just to get their tickets punched and find a better-paying position on the corporate side.

The same phenomenon was at work in the program offices — field inspectors, people who managed Superfund site cleanups and responses, the permit writers who discovered that Dow and Monsanto could “make a call” and have their carefully developed and documented permitting decisions just waived aside, even clerical staff and HR types and of course senior managers at all levels rode out through that revolving door.

There were other forces at work, too. The Reaganauts cut away at budgets for environmentally important programs and research facilities, and there was always the threat of the “reductions in force,” the dreaded “RIFs,” where large numbers of staff of all types were “declared excess to needs” and shown the door. So you had to try to find some niche work that was within one of the few favored programs (like “LUST,” the leaking underground storage tank program) or the people who were directed to facilitate handing off as much of the permitting and investigatory and enforcement program to the states as they could possibly manage, without respect to whether the state agencies would manage any actual enforcement — they had their own corruptions to look after, their own Dows and Monsantos and USXs and so on to “work with.”

There are still people, as I have noted here before, working at EPA and fighting a kind of desperate rear-guard and insurgent action against the great wasting of the planet, trying interstitially to limit the speed at which the Enemy advances…

For years it cost $60 to apply for a patent. But the Reaganites refashioned the fee into a user-tax they related to the costs of examining the patent. At least that’s what I remember. I think it was in Reagan’s second term that the federal weight limits for long-haul trucks was raised — providing a subsidy for the forces creating cracks and pot-holes in our roads,

Probably due to being on the 2nd floor I missed regulatory capture. From observation, those who left government service in the 1970s for the business world rose into corporate management. In the 1990’s those who left to be government consultants failed. Since the turn of the century, industry consolidation degraded the quality of the regulatory staff. Ultimately, companies ignored the law and only paid fines if caught. It is the politicians who are captured. The fossil fuel industry has the Executive Branch it wants so they can pollute the earth, kill more humans and accumulate excess wealth.

To get to the top, besides drive and luck, inconvenient truths must buried in order to network to the next mentor climbing up the ladder of success.

“Such post-employment restrictions can dissuade talented individuals from joining agencies in the first place, or deprive them of incentives to work hard and ‘show off’.”

If a person takes a job in any regulatory agency solely to find later employment with the very people and enterprises they’re regulating, he or she is motivationally and constitutionally incapable of impartial service to the government and taxpayers. To worry that excluding such people from regulatory agencies weakens them is one of the kinds of distorted thinking that produces regulatory capture. In my opinion.

Exactly right.

Sorry, this is wrong. Post-employment restrictions are intended to avoid regulatory capture. In-depth knowledge gained from one place of employment, such as a regulatory office or agency, cannot be applied in another place of employment in the same or related industry without a conflict of interest. This is an elementary public interest principle.

In Australia the current Royal Commission into the finance sector (banking, insurance and pension funds) has revealed the massive and systemic capture of the regulatory authorities whose very role it is to regulate this sector. This capture, enfeeblement, muzzling or crapification of the regulators means wide-scale fraud perpetuated against customers. This is a direct result of a revolving door network whereby regulators become bankers and bankers become regulators and the conduct of both has gone down the drain.

The US Patent and Trademark Office has been conveniently made into a area where only large corporations and high paid patent lawyers can roam in. Small companies are stupid if they pursue a patent or trademark. If they’re successful in obtaining one, the large sharks will infringe on it with the small company left with no option but to sue. And if they do sue, the defense of the patent will drag on costing thousands of dollars. If they don’t sue they’ll lose. Hobson’s choice!

Well said!

And individuals might as well forget all about seeking patents unless they have come up with some fundamental new art — other than as a source of information. Some of the older patents contain important disclosures — like the early Xerox patents.