This is Naked Capitalism fundraising week. 929 donors have already invested in our efforts to combat corruption and predatory conduct, particularly in the financial realm. Please join us and participate via our donation page, which shows how to give via check, credit card, debit card, or PayPal. Read about why we’re doing this fundraiser and what we’ve accomplished in the last year, and our current goal, thanking our guest bloggers.

By Emmanuel Mourlon-Druol, a non resident scholar at Bruegl and a Visiting Professor at the Université Libre de Bruxelles. Originally published at Bruegel

The recent State of the Union speech by Jean-Claude Juncker sparked a discussion about the potential wider use of the euro on the international stage. Historically, it is not the first debate of this kind. Emmanuel Mourlon-Druol analyses four previous cases of debates on international currencies to reveal the different scenarios associated with their greater use, as well as the need to have a clear objective for a currency’s internationalisation.

“The euro must become the face and the instrument of a new, more sovereign Europe” said Jean-Claude Juncker in his ‘State of the Union’ speech before the European Parliament on September 12th 2018. His words have promoted discussion of the potential wider use of the euro on the international stage.

This post reviews, in chronological order, four previous cases when the international role of a currency was debated in the past: the decline of sterling and its progressive and proactive withdrawal from international-currency status; the ‘exorbitant privilege’ of the dollar; the push for giving a voice to Europe on the international monetary stage after the breakdown of Bretton Woods; and the refusal of German authorities to see a greater international use of the D-mark in the 1970s and 1980s.

The past displays a wide array of options for international currencies, but all have one point in common: the necessity of having a clear objective for a currency’s internationalisation, given the risks associated with the process. Having considered these historical scenarios, we can glean implications for the euro’s own possible internationalisation in the present.

Withdrawing From Reserve Currency Status: Sterling After the End of the Second World War

Sterling was the dominant world currency until the end of the second world war, when the dollar overtook it in this role. But as the UK lost influence in world affairs after 1945, its currency remained widely used around the world. Sterling was used as a trading currency, and was also held overseas, by private actors and state institutions. In addition, countries of the Empire and Commonwealth held debts accumulated during wartime, and after the war these debts exceeded the UK’s ability to repay.

The mismatch between the UK’s actual political and military influence in the world and the global role of its currency quickly began to be seen as a source of potential problems. Devastated by the war, the UK could not maintain confidence in the value of the pound. Shortly after the end of the war, British policymakers realised that the costs of having an international currency (currency appreciation, external constraint on domestic economy, policy responsibility) outweighed the benefits (enhanced capacity to borrow, international prestige, support to London as an international financial centre). They attempted to manage the decline of sterling as a reserve currency, which involved exchange controls, international negotiations, and bilateral agreements.

The international role of the pound, for instance, played a significant role in the UK’s relationship with the European Economic Community (EEC) in the 1960s and early 1970s. The role of sterling as a reserve currency was often discussed during the UK’s unsuccessful applications to join the EEC in 1961-1963 and 1967. One of de Gaulle’s vetoes to the UK’s application was explicitly based on the international use of the pound. Being an international currency, the French government argued, sterling could potentially destabilise European economic and monetary stability.

The EEC members feared that they would be committed to support the pound’s exchange rate. Exchange rates were indeed a matter of ‘common concern’ as per article 107 of the Treaty of Rome. It was considered that sterling’s value would be subject to intense downward pressure due to the so-called sterling balances – that is, the sterling assets accumulated as foreign reserves by the UK’s former and existing colonies as well as other foreign countries. During 1970-1971 and the UK’s third attempt to join, it was however understood that sterling balances would no longer be a problem for the UK’s entry to the EEC.

‘Our Currency but Your Problem’: The International Role of the Dollar After the Breakdown of Bretton Woods

Former US treasury secretary John Connally’s [in]famous quip about the dollar remains one of the best ways to describe US policy after 1971. Save for a few sporadic attempts at trying to improve international monetary coordination, US administrations generally did not care about the international consequences of having an international currency.

Connally’s jest dates from a meeting of the G10 held in late 1971, after the US’ unilateral decision to end the Bretton Woods system. The new US policy was aimed at depreciating the dollar in order to help the US economy. Free-floating would prevent the US suffering from what they considered to be misaligned currencies. Regularly however, fluctuations of the dollar after 1971 caused international problems of adjustment. US administrations saw these problems as side issues and were not really concerned about the consequences of their actions. This was, for instance, the case during the US-German dispute of 1977 and 1978 detailed below.

Two attempts at international coordination stand out, however. First, in 1978, the G7 meeting in Bonn agreed on a coordinated macroeconomic plan that was aimed at stabilising currency fluctuations. The goal was, in particular, to mitigate the fall of the dollar. Germany and Japan promised to reflate, while the US promised to fight inflation. The agreement was perceived as a success, but the actual results were limited, and the effort at international coordination did not last long.

Second, in the mid-1980s, the G7 tried to find ways to mitigate the appreciation of the dollar. The Plaza Accord in 1985 aimed at coordinating currency fluctuations directly — not just through economic policy coordination as in Bonn in 1978 — but their positive effect was short-lived. In 1986-1987, G7 discussions focused on the notion of ‘target zones’ for the movement of currencies. But while the international consequences of the dollar’s international status remained a matter of concern for the rest of the world, the US administrations remained unwilling to bear the consequences of this with any alteration to the course of US economic policies.

A European Voice in International Monetary Debates: Calls for Economic and Monetary Union (EMU) After the End of Bretton Woods

The Commission president’s statement on September 12th 2018 echoes similar reflections made by his predecessors in the past 50 years. As soon as the Bretton Woods system collapsed, European commissioners regularly called for a greater international role of Europeans on the world monetary stage.

In his famous October 1977 speech at the European University Institute in Florence, calling for the monetary integration of Europe, former British president of the European Commission Roy Jenkins argued that a single European currency could contribute, alongside the dollar, to a more stable international monetary system:

“The benefits of a European currency, as a joint and alternative pillar of the world monetary system, would be great, and made still more necessary by the current problems of the dollar, with its possible destabilising effects. By such a development the Community would be relieved of many short-run balance-of-payments preoccupations. It could live through patches of unfavourable trading results with a few-points drop in the exchange rate and in relative equanimity. International capital would be more stable because there were fewer exchange risks to play on, and Europe would stand to gain through being the issuer of a world currency.”

The context in 2018 is, of course, not the same as in 1977. Before thinking about the possible international use of a single European currency, the first immediate challenge in 1977 was actually to agree on how to create one. But the point remains that a European monetary unity was perceived as an affirmation of Europe’s role at world level. To use today’s parlance, Jenkins argued that ‘a more sovereign Europe’ went hand-in-hand with the use of a single European monetary unit internationally.

But it was not just Jenkins that put forward this train of thought. Jenkins’ predecessor as president of the European Commission, François-Xavier Ortoli, made a similar point in his ‘Declaration on the State of the Community’[1] (an ancestor of today’s State of the Union speech) that he delivered on January 31st 1974. Ortoli declared that “It is essential that the problems linked to international monetary relations (…) be treated as Community [communautaires] problems and that Europe speaks with one voice in these negotiations.” A few months later, in September, Ortoli further added that “the common dependence of outward-looking economies which rely on the growth of trade for maintaining full employment implies that Europe must effectively participate, that is to say as a unit, in international discussions and must contribute towards defining a new, stable and lasting international monetary and commercial order.”[2] Although again in a different context – Bretton Woods had collapsed shortly before, while the oil shock was just hitting the world economy – Ortoli pushed for the same idea: Europe should assert its ‘monetary sovereignty’ by speaking with one voice on the international stage.

Until the creation of the euro, however, the statements of Ortoli, Jenkins, and others remained at the level of words rather than deeds. The creation in 1972 of an exchange-rate system – called ‘the snake’ – and later the creation of the European Monetary System in 1979, could certainly not have the same impact as did the introduction of a single currency managed by a supranational European Central Bank (ECB) after 1999. But the point stands that Ortoli, Jenkins, and others saw in EMU an instrument that could give Europe more weight internationally. They perceived EMU as a means to strengthen European integration in the unstable international economic system post-Bretton Woods.

Refusing To Be in Charge: The D-mark in the 1970s

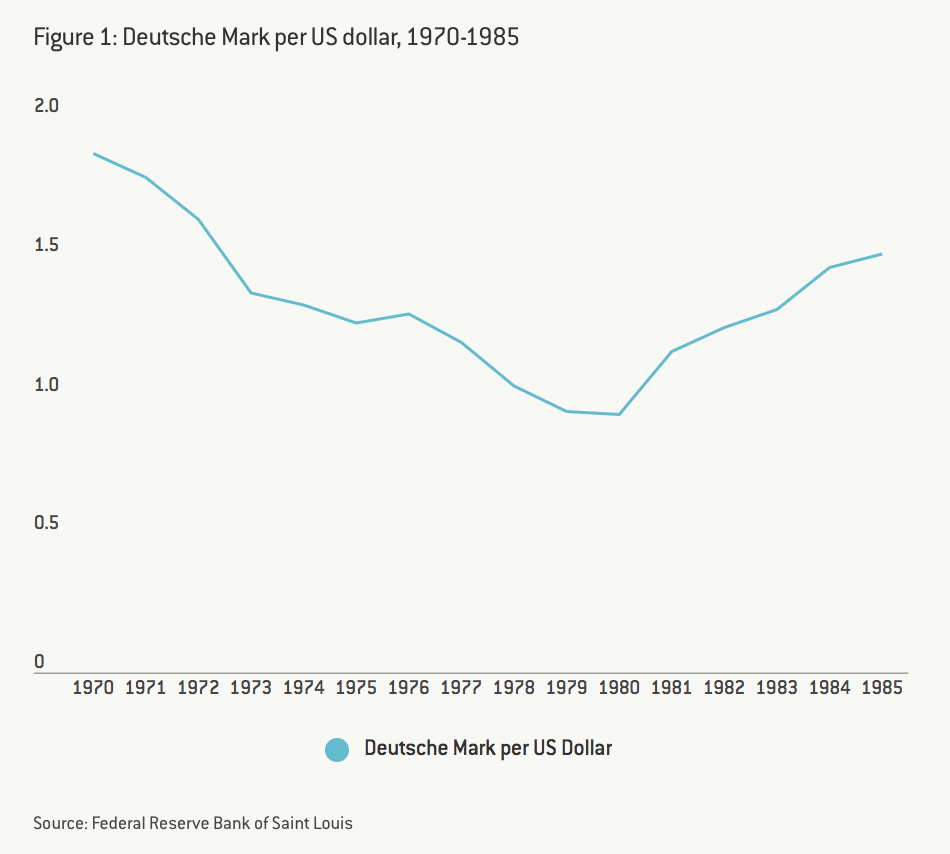

Before the euro was created, one European country was, however, confronted with the prospect of having its currency becoming more widely used internationally: West Germany, the richest and strongest economy and currency in Western Europe. After the breakdown of the Bretton Woods system in the early 1970s, the erratic fluctuations of the dollar quickly became a cause of concern for Europeans, and West Germans in particular.

After floating in 1971, the D-mark was regularly rising in value. But the German government was opposed to the D-mark becoming a reserve currency, for two reasons that highlight well the perennial challenges that come with becoming an international currency. First, the German government feared losing control over its monetary supply, and becoming vulnerable to international dynamics it would/could not control, and that could harm its domestic economic situation. Second, the reserve status of the D-mark would imply an increased international influence. Bonn, for political reasons, refused to take any responsibility of that sort. German influence should be exerted through European integration, as all successive German chancellors made plain.

One episode illustrates well the story of the D-mark’s internationalisation. In 1977 and 1978, the rapid fall of the dollar alarmed West German policymakers. The depreciation of the dollar created inflows into the D-mark, and threatened to transform the D-mark into an international reserve currency. The German government was also irritated at the conduct of US foreign economic policy, which Bonn perceived as ‘malign neglect.’ The view was that the US government was letting the dollar fall on purpose in order to gain a competitive advantage, regardless of the possible international consequences. Further to this, an increased value of the D-mark was also putting strains on intra-European currency relations, as the D-mark appreciated while the other European currencies could not keep pace.

A temporary solution was reached on March 13th 1978 when the Bundesbank and the US Federal Reserve issued a joint communiqué. The two central banks announced their intention to cooperate closely to prevent disorderly and rapid exchange-rate movements, such as the ones that had just occurred. But this solution was only an expedient. A longer-term improvement of the situation relied more on the attitude of the US authorities than on a bilateral declaration such as this. The episode, however, attests to the numerous challenges associated with a greater use of an international currency.

Conclusions

The four cases presented above – sterling, dollar, EMU and D-mark – reveal different scenarios associated with the greater use of an international currency. Four main ideas emerge from them:

- If the goal is well-defined, the internationalisation can be a success: this is the story of the creation of the euro. The euro is today, de facto, already a world currency, second only to the US dollar. The euro can be an instrument to assert Europe’s place in the world. This is exactly the basic situation that Ortoli, Jenkins, and many others were looking for.

- Becoming a widely used international currency bears consequences, and the issuing country is left with two simple options: not caring much about them (US dollar since 1971), or refusing to become an international currency in the first place so as to avoid them (West Germany from 1971 to 1999). Both options are the fruit of a set of very specific circumstances: unparalleled global political and military dominance in the first case, economic caution and historical memory in the second case.

- International attempts at currency coordination are difficult and sporadic. The G7 agreements of the mid-1980s temporarily helped, but in general there was little readiness to make the necessary adjustments.

- If maintaining the international status of a currency is no longer sustainable, a managed retreat is possible. The case of sterling has shown this. But the managed retreat of sterling happened again under a set of very specific circumstances. Whether such a managed retreat is possible to repeat is down to the co-occurrence of multiple factors, some of which are not possible to control. A managed retreat is therefore hardly a baseline scenario. When seeking a greater role for the euro, it would be wise to think about the sustainability of the strategy, in order not to end up in a situation in which retreat becomes necessary.

In light of these past discussions, the key question for the present is what new objective a greater international use of the euro could help Europe to reach? Clarity on this will help the euro avoid the well-known pitfalls associated with becoming an international currency.

The author would like to thank Michael Baltensperger for his contribution to this blog post.

[1] European Commission Historical Archives, Collection of Ortoli Speeches. My translation.

[2] ‘The personality of Europe and Economic and Monetary Union’, 25 September 1974, in European Commission Historical Archives, Collection of Ortoli Speeches.

Nice post, but it misses out on the first international currency movement that worked a-ok from 1865 until WW1 pretty much.

What made it interesting is that all silver & gold coins from a myriad of different countries, were all the exact same weight and fineness, although with different denominations, etc.

https://en.wikipedia.org/wiki/Latin_Monetary_Union

p.s.

In reality, most of the world went off the gold standard post WW1, in that in the heart of Europe, only Austria, Czechoslovakia, Netherlands, Russia* & Switzerland minted gold coins in the inter-war period to follow. England doggedly kept to pre-war Pound values, i.e. a Pound = 1 gold Sovereign until they axequieced in the early 30’s

Previously before the war, Belgium, France, Germany, Italy & Russia all had gold coins in general circulation in their countries, in many different denominations, as paper money was rarely issued in pre 1900 Europe.

And it wasn’t just the gold standard they left, in that in pre-1914 Europe, An Austrian franc, Belgian Franc, French Franc, German Mark & Italian Lira, were all silver coins roughly the size of a USA quarter $ coin.

Post WW1:

All of the above were now minted in base metal instead, consisting of aluminum, bronze or nickel. Everybody was well & truly broke.

And where’d it all go?

Here. It’s reckoned that the USA had 3/4’s of all known above ground supply of all that glitters.

* only one coin minted in 1923

There are a couple of factoids I tend follow to try to determine the trajectory of the Euro’s reserve status.

1. Most non US and non EU banks who maintain correspondent accounts in USD also have EUR accounts. However, all but the biggest US banks don’t have any foreign presence in EUR or any other currency other than USD. Thus the USD clearing world still has greater reach ability than the EUR does simply due to the lack of international presence of most domestic US banks.

2. For all the talk of the US-UK special relationship I find it telling that the US Treasury and US Fed keep all of the US’ foreign exchange reserves in Euro and Yen(and previously DM). Interestingly enough the Euro portion is invested not just in German Bunds but also French and Dutch government bonds(I am trying to find out when this change occured).

3. One advantage of Brexit is it will clarify the somewhat unique and disjointed structure of EUR Target2 clearing. Right now UK banks can become full participants in TARGET2 all the while unlike banks in the rest of the EU they are not subject to any type of ECB supervision or oversight. Their is no other country that I know of that allows this type of situation. Brexit for better or worse by kicking out UK banks from TARGET2 will clarify the lines of authority in EUR bank supervision. Interestingly enough it was Theresa May in her previously life as head of the UK Payments Association before running for parliament who finagled the ECB into giving UK banks direct access to TARGET as a EU non Eurozone country.

Worth remembering: The reserve currency’s nation must run a trade deficit (otherwise, how would other nations have that currency with which to transact their business). Germany would not like this.

I am sorry but to my knowledge neither historical precedent nor theory show this to be the case.

During the era of the gold/silver standard exchanging currency against goods in significant amounts would actually drain the national hoard of precious metal thus leading either to a reduction in foreign trade or a potential internal currency crisis. In fact the British Empire was willing to do absolutely everything to readjust tradeflows if a significant draw down of gold/silver was involved, as an example take a look at the Opium Wars against the Chinese Empire or the recurring crisis during the 19th century when international trade leads to a reduction of the Bank of England’s gold reserves. I would suggest that the Sterling established itself because the British Empire was the dominant economy and traded with everyone, while accepting foreign currencies and using them to buy foreign assets.

In our time central banks are not hindered by gold reserve requirements and can simply sell as much Dolllar/Euro/Francs… as they like in exchange for foreign currencies. The risk here is a loss of external exchange value and delayed inflation if/when the sold Dollars return to the domestic economy. These risks are obviously mitigated as long as the reserve currency status persists. Take a look at the behaviour of the Swiss central bank during the last decade for a practical example. If you take a look at long term data you will see that the US trade deficit grows decades after the reserve status of the USD is established. After all during WW2 most other economies were totally destroyed and preoccupied with rebuilding thereafter.