By Michael Olenick, a research fellow at INSEAD who writes regularly at Olen on Economics

MAGA bomber and Trump fanatic Cesar Sayoc lost his home to foreclosure where it was purchased, at auction, then flipped by a company controlled by condo and casino developer Bruce M. Goldstein.

Sayoc is the man who allegedly mailed 14 bombs to anti-Trump people and news organizations. Note that my grammar checker says the word “allegedly” isn’t needed, which is probably true since there’s his DNA, fingerprints, and a confession, but I’ll use it because everybody else does. Federal law enforcement says that although none of the bombs exploded, and the one’s we’ve seen look like they were ordered by Wile E. Coyote, they were real bombs.

Sayoc is one strange dude, a 56 year-old testosterone pumped male stripper who lived in his MAGA sticker-covered van after his mom threw him out. Among other jobs, he delivered pizzas and told his lesbian manager, Debra Gureghian, she should be shipped to an island and nuked along with all gay people. Whereas death-threats usually get people fired, or at least written up, she shrugged it off, this being Florida.

Getting to the foreclosed house, Sayoc purchased it on June 6, 2006, from an individual with the initials JRS for $400,000. JRS had purchased the house in November, 1992 for $107,000 and refinanced it a few times, the last being Dec 14, 2000 with an $85,000 mortgage. After selling the house to Sayoc, JRS walked from the table with over $300,000 cash, retiring in a small community in north-central Florida.

To complete the purchase, Sayoc took out a $360,000 mortgage from Countrywide with an interest rate of 9.88% fixed for two years. Ten percent down, plus closing costs, is ten percent more than most people brought to the table back then and the interest rate, given the down payment, seems exorbitant. Sayoc refinanced the house with Indymac for $385,000 on June 1, 2007 at 7.875% fixed for five years. The $15,000 difference is indicative of financed closing costs, not the more typical cash out mortgages popular during that era.

In other words, Sayoc bought a house not as an investment but to live in, refinancing it not to cash out but only to lower his interest rate. The MAGA bomber is naïve, irresponsible, but about the only person whose behavior in this odd story bears some semblance of good faith.

I’ll admit that to having no experience working as a male stripper, my physique as a middle aged Jewish guy not quite being entirely up to the task. But a few keystrokes shows that a) anything can be quickly found on the internet, and b) Simply Hired has done the research and the average wage of a male stripper is $64,521 with the top ten percent earning $127,224 and the bottom 10% earning $32,722.

As the Florida economy started to tank in 2008, and Sayoc aged up, it’s likely his income as a stripper began to slip. He predictably couldn’t afford his $2,791.52 P&I payment, plus homeowners insurance, private mortgage insurance, and real-estate taxes.

Through the economic downturn Sayoc somehow kept the payments coming in, outlasting his bank, Indymac, which filed for bankruptcy July 31, 2008. It’s not clear why but Sayoc did stop paying in Sept. 2008, almost exactly a decade before the bombs went flying.

Indymac hired Florida “Foreclosure King” David J. Stern, who filed a foreclosure after three missed payments plus one month, on Jan 8, 2009.

Florida is a judicial foreclosure state, meaning that each foreclosure is a lawsuit that runs through the court system. Lawsuits start with “process” – a process server physically hands the paperwork to the person being sued or, for companies, to their registered agent. In the event that a person can’t be found, after doing a diligent search, plaintiffs (the person or business suing; the bank, in this case) can fall back to “service by publication” where they put an advertisement into what is supposed to be a well-read newspaper.

Stern, Fannie Mae’s two-time “Lawyer of the Year,” skipped most of that, which wasn’t unusual for him. He claims to have issued four summons (the paperwork the process server is supposed to hand over) on Jan 8, 2009, and charged Indymac $205 for the summons. All four summons were returned “unserved” on Feb. 4, 2009, less than a month later.[1]

Since Stern owned the process serving company, that operated in the same building as his law firm, you’d think he’d tell them to try again. Instead, he apparently did nothing until June 22, 2009, when he filed an affidavit that he’d diligently searched for Sayoc, and sent the notice of the lawsuit to the obscure Daily Business Review, a site behind a paywall that has a number of articles of interest to lawyers and a long list of notices. If you thought publishing a notice that people are being sued behind an internet paywall sounds like the opposite of the spirit of the law – the idea being that defendants can find about the lawsuit in a publicly available place – you’d be thinking right. But this is foreclosure-land where nothing is predictable except a never-ending appetite for fees.

Sayoc somehow figured out he’d been foreclosed on – possibly because he hadn’t paid his mortgage for almost a year by this point – and filed a pro se (self-represented) Motion to Abate on Aug. 4, 2009. That filing isn’t online so I don’t have a copy but, normally, a defendant would file a Motion to Dismiss or an Answer. In any event, it didn’t matter because the Court entirely ignored his pleading, which isn’t unusual for pro se litigants.

Undeterred by Sayoc’s filing Stern ploughed ahead, filing a Motion for Summary Judgment, plus the related paperwork, a week later on Aug. 11, 2009. Like virtually all pro se defendants, Sayoc promptly lost. A judgment of $442,427.52 was entered against him on Sept. 2, 2009.

Among other charges in the final judgment are $16,679.41 for one year of forced placed hazard insurance, a wildly inflated amount Indymac’s stop-loss agreement no-doubt paid out partially from US taxpayer funds.

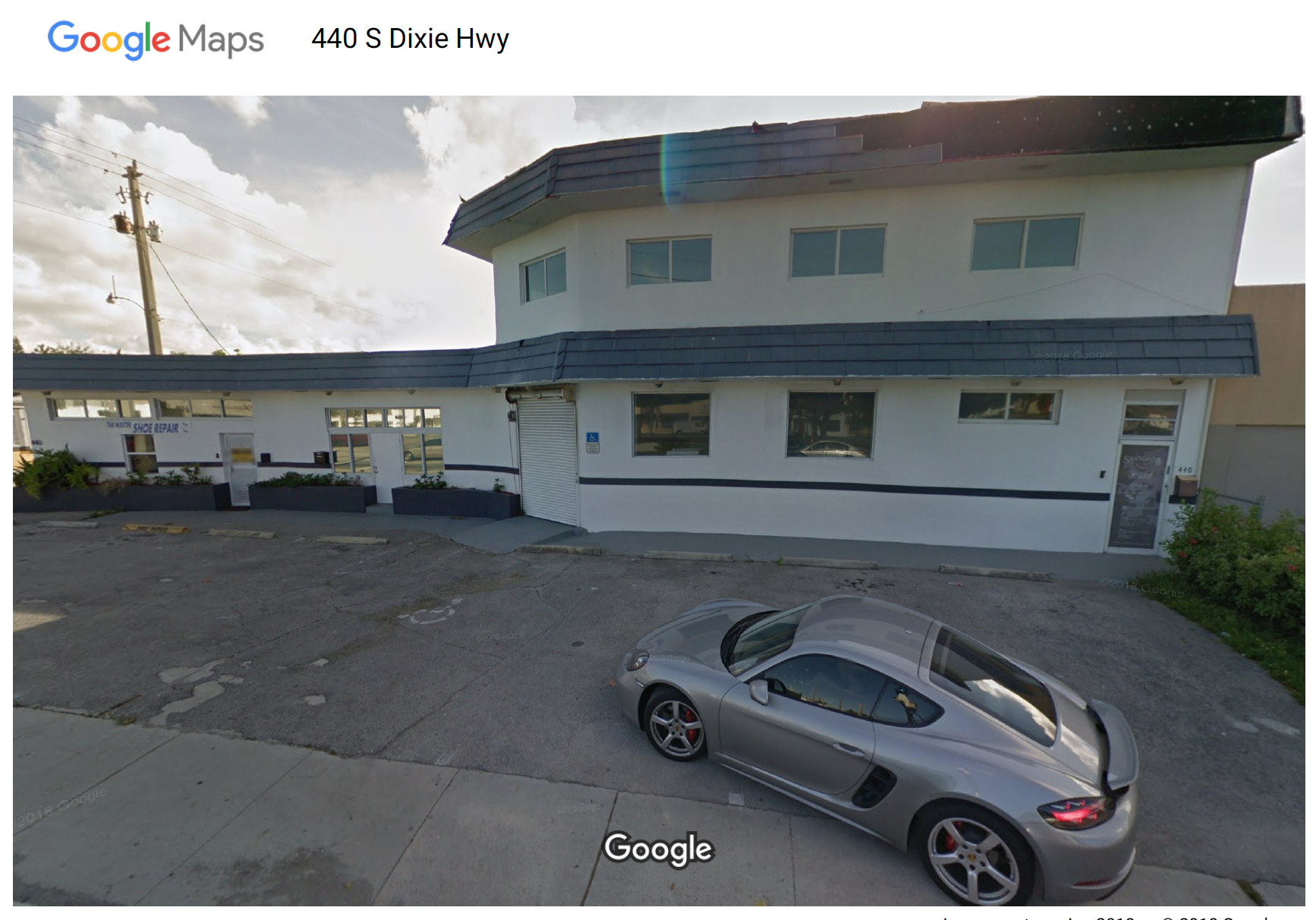

Sayoc’s house was purchased at auction by PMG Mortgage & Lending Co., LLC on Nov. 12, 2009 for $166,500. PMG is a now-dissolved company that was located at 440 South Dixie Highway, Suite 200, Hollywood, FL, with one manager, Bruce M. Goldstein.

PMG Headquarters

At that point, Sayoc did hire a lawyer who tried, unsuccessfully, to overturn the sale. On Dec. 30, 2009, with the courthouse about to close for New Year’s, Sayoc’s motion to set aside the sale was denied. A week later, on Jan. 6, 2010, Stern filed that a Writ of Possession (an eviction) was returned served onto the “unknown spouse of Cesar Sayoc,” which is odd because Sayoc wasn’t married. Details be damned, the court evicted Sayoc Feb. 8, 2010.

PMG’s last filing lists their new address as 1177 Kane Concourse, Bay Harbor Islands, FL 33154. Which is the same address as a condo and casino developer named Bruce M. Goldstein claims his mega-development company is located at.

MAGA bomber Cesar Sayoc had his house purchased in a foreclosure auction, following a rigged court process, prosecuted by a now-disbarred crooked foreclosure lawyer, taken by a condo and casino developer that sounds a lot like his idol, Donald Trump.

Goldstein’s PMG flipped the house five months later, on Apr. 26, 2010, for $273,000, yielding a quick $106,500 paid for partly by Indymac’s loss-share agreement (that’d be you, if you’re an American reader who pays tax).

David Dayen wrote an article pointing out the assignment of mortgage Stern filed was likely robosigned and back-dated. That was about the least of the problems in this case. Boris, my Dogue de Bordeaux, could’ve shown up with a note reading “I’m the bank lawyer – he didn’t pay – clip judgment to collar” and walked from court victorious. The notion that law had anything to do with foreclosures at this time in Florida is ludicrous; the entire system was as broken as the economy and the people suffering under it. During this era judges studied the courthouse cafeteria menu more than they did foreclosure paperwork. Back-dated assignments and robosigned paperwork was the norm, and routinely ignored.

Sayoc would go on to declare bankruptcy in 2012 with $21,109 in liabilities. While Indymac appears not to have pursued their deficiency judgment (the difference between the judgment amount and the amount the house sold for), which is not unusual, he should have included it. With the deficiency, Sayoc’s assets of $4,175 were outweighted about 100:1 with his liabilities which, by any standard, is bankrupt.

Today, the Broward county property appraiser estimates Sayoc’s former home is worth $335,940. Zillow estimates the value at a more bubbly $464,105.

Given this history, Sayoc’s rage can be better contextualized. It seems impossible to believe that house was worth $400,000 in 2006, despite that a Countrywide appraiser, paid by Sayoc, confirmed the value. Countrywide’s high-interest loan, despite that Sayoc brought a ten-percent down payment plus closing costs to the table, was designed for an idiot. Indymac’s loan was better, but not too far behind. It must’ve been hard for Sayoc – who doesn’t seem like the sharpest knife in the drawer – to understand why he was scrambling to send off steep payments to a bankrupt bank.

Stern’s involvement was typical for him. In the middle of all this he’d taken his law firm public as the ill-fated David J. Stern Enterprises (DJSP) in Dec. 2009. Stern opted for a reverse-IPO, being acquired by the Chardan 2008 China Acquisition Corp., a Special Purpose Acquisition Company (SPAC), then trading under the ticker CACA. I know DJSP well, having had the privilege of helping to decimate their share price by showing key people it was a fraud factory long before the Florida Attorney General became involved. Goldstein’s PMG saw an opportunity and pounced; almost exactly a year ago Dayen was praisinga similar mortgage vulture.

I can’t vouch for Sayoc’s skills as a stripper but in most other areas of life he seems to be a bumbling idiot, an easy target for Countrywide, Indymac, Stern, Goldstein, and Obama with his ignored promises for hope and change. Then, finally, like so many others who’d been abandoned and forgotten, Donald J. Trump.

___________

[1]Since Indymac was by then a bankrupt bank, eventually sold under an FDIC loss-share arrangement, American taxpayers ended up paying part of these fees.

A strong argument for the return of prohibitions against usury. Conning people into loans they cannot and will not afford is unethical.

I agree with this. It’s unconscionable

“Conning people into loans they cannot and will not afford is unethical.”

Aye. I wholeheartedly agree. And this statement applies not only to home mortgages, but student loans as well. There has been tremendous financial carnage with both types of loans, and I fear that we’ll eventually see ex-students who are drowning in student loan debt lash out as well.

There is the concept of buyer beware. You are nor being forced to sign and you should be extremely diligent when signing legal forms.

Unfortunately, we have corporations and their executive staffs who knowingly try to game individuals and the system for profit and damned be the morals. The rot in the system is permeating everything and the people are noticing. This is how someone like Trump gets elected, by playing on peoples disillusionment with the system…… and some racism for good measure.

I don’t mean to sound condescending, but I bet you are under 45.

Banks used to be stringent about giving loans. I know that sounds incredible given how many credit card offers banks send in the mail and how ridiculous the credit lines are these days, but Sayoc is old enough to have grown up with banks being serious about credit screening. Tons of not sophisticated people assumed if the bank treated them as capable of paying the loan, they must be capable of paying the loan.

exactly right! the history of banking is ugly, but at least after FDR legislated and regulated banking and finance, banks saw themselves as responsible citizens, due diligence purveyors of sound finance: loan applications were scrutinized, banks didn’t hesitate to refuse credit, and people/companies reaching too far were pointed to better choices. sometime in the late 60s/early 70s so-called go-go banking began to change that and, of course, once the regulators acceded, the slide into reckless profiteering accelerated

I was a lowly teller in PA’s then 2nd largest bank and the tide turned noticeably just after I left at the end of the 60s, but I worked the window when platform officers still considered themselves sound finance advisors and thought it irresponsible to let people step off a cliff financially

and, btw, banks didn’t keep mortgages even then: they factored them, sold them to so-called factors, but hardly anyone outside the banks knew that bc payments went to the banks and banks sent the statements. there was never any notice, bar legal proceedings, that the ownerships of the mortgages had changed.

I bought my house at about that time. My wife and I were (and are) gainfully employed in jobs with decent, though not great, wages, and both had excellent credit. So I was not surprised that we had no difficulty getting approved for a mortgage. What shocked me was that we were approved for about double what we should have been. Had we taken the bait, there is no way we would be able to make house payments. Fortunately, my superpower is the ability to do simple arithmetic, and we bought a house within our means. But I can easily see someone in naive good faith assuming that the bank knew its business when it set the cap on the mortgage.

I had a similar experience. When I went house-hunting in 2010, I ran through the interest-rate math and decided on my own how much I was willing to borrow. The bank’s cap was over twice that amount. And that was after the crash, when they were being “stingy” with credit.

Looking back, I might have been able to afford the cap, but it would have stretched me to the absolute limit, and my financial life would have been utterly dominated by the mortgage payment. And nowhere in the process was I warned that borrowing the max would have made for an extremely tight financial life. Apparently that’s left for the borrower to figure out. And most people out there can’t run the numbers as precisely as I can.

Yes, and when we went to buy we also found that “our” realtor was invested in helping us to push to more not less expensive places. After all they are paid a cut of the cost not a flat fee so they are hardly inclined to have us pay less.

We also were pre-approved not long before the crash for about double what we could realistically afford and that practice was running rampant at the time. Like you, we did the math but doing the math is also my day job – it’s quite clear a lot of people either didn’t or couldn’t and were taken advantage of.

Thanks NC for this one. Maybe one of these days we can hold white collar criminals accountable so the rest of us don’t have to worry about taking a bullet for the crimes they committed.

Moi aussi, in 2005 when I got a home equity loan for repairs. They wanted to give me an astounding amount, much more than I’d applied for, and it sounded like a very bad idea to take all of it.

Yes. These days being stringent and honest is something they actually advertise, it being so unlikely. While the others, they advertise that they are “Re Investing in You” to use Wells’ phrase.

As Chris Arnade noted elsewhere as well banks used to be funded with Bankers’ money. This left them on the hook for losses and thus more likely to be careful. Now that many of the biggest are public and now that shared among easily-replacable shareholders (or taxpayers) the “Enlightened Self Interest” equation has changed.

In 1992 I worked for Chase Bank in Manhattan. My job was to approve credit cards applications. I had a degree in Secondary Education and American History (granted I also had 3.75 years in an undergraduate economics degree as well). Most of the cards were for college students. I do not recall having to deny a single person based on the guidelines provided to me.

Maybe you approved the $2,000 limit I received as a freshman in college that year (and promptly ran up to the max).

It is OK, I am 53 and I bought my very first house in 1998. A few poor decisions as well as getting married young and having children with no post HS education can make life a little tough.

That being said, maybe that is how I learned people try to screw you all the time and why I say buyer beware.

I am more educated now, but the older I get the less I seem to know…..

I should have also mentioned how our elected “representatives” are part of the process of corruption as well. Crony Capitalism and Regulatory Capture make for a toxic environment in society

Amen! My education was pretty comprehensive in the sciences and humanities but did not include accounting. The connection between the math I had studied and actual real-life stuff was tenuous, to be kind. I went to university not knowing how to balance a chequebook and with *no* clue about interest, let alone compound interest. It was not until I studied to be an account that I gained this basic literacy. This is a catastrophic failing of modern education. Also, the Civics courses that used to be required for high school graduation no longer are — how did this happen? Probably not an accident, but as I don’t have kids I was not in that loop,.paying more attention now.

I know a few high school students these days, and though I applaud the fact that shop is offered to female students and sewing to males, it seems that there is no attempt to teach any student the basics of personal finance, let alone national or global economics, to young people. Where is their education?

Dave, any chance we’ll get a response to Yves’s comment?

This story brings up bitter memories of the years following the financial ‘melt-down,’ when I worked with a group of activists in Denver, fighting to reveal the corruption behind the thousands of foreclosures and attempting to help the people who were losing their homes.

One member of the group committed suicide last year, another committed ‘suicide by police,’ when he was shot by sheriff’s deputies as he refused to leave his home in a mountain community.

The depth of the corruption surrounding the issuing of mortgages and then the foreclosures, was staggering. One of our members, a surveyor, had developed maps of Denver communities, with foreclosed homes marked in red. Entire neighborhoods were a sea of red. Adding insult to injury, were the awful Denver County foreclosure auctions, where jokes were the order of the day, as people watched their former homes being auctioned off to newly formed real estate businesses. Metaphorical vultures and coyotes circled the courthouse.

A handful of people overextending themselves on a house purchase, losing their jobs, going into foreclosure, can be blamed on personal failure. When this happens to thousands of people, and you hear the same story again and again and again …. this is blatant systemic corruption.

Not to mention the fact that house prices rose rapidly, such that you had to pay up to get a house. So even if you were a great credit risk, you way overpaid for your house and were exposed when the crash came.

In short, everybody who bought after a certain date lost, especially if they had an event that cut their income or they needed to move.

I feel these events are sliding into the history books as millions of millennials jump into the pool, not fully understanding the dangers.

Yep, it was the same for me.

And despite all my knowledge, it dawned on me after reading this….that the crooks extracted hundreds of thousands of dollars, but the FL property has rebounded to about the same price paid in the first transaction.

Thereby, begs the question:

Has Wall Street turned residential housing prices into a casino, much like the stock market?

of course

See what Dirt Dealing Churning and Flipping entail. Yes Yes Yes …. The Daisy Chains across America ….. Get Rich Flipping Property ….. See ToxicZombieDevelopments

People doing business in the Sunshine State have joked that there should be warning signs at the airports: Welcome to Florida, the rules are different here.

Having seen that in play numerous times, I can agree. Come for whatever reason, enjoy the orange juice, have a stone crab or two, watch some jai alai, and stay vigilant.

If you are at all ‘quantish,’ do “play the numbers” and bet at the fronton.

Florida has been a mecca for crooks since the early Holocene epoch.

Groucho sells real estate in Florida: https://www.youtube.com/watch?v=nPTqrFas9Bo

Eclair: “… another committed ‘suicide by police,’ when he was shot by sheriff’s deputies as he refused to leave his home in a mountain community.”

I believe I know the incident you are referring to.

It was in the same county, over the pass to the south, that I lost my humble but beloved ranch, as well, as two sheriff’s deputies stood at my door.

He had fought in court for years (as did I), to no avail, as so, so many of us did.

Reading this article brought back memories for me, as well, & of the wounds that have yet to heal.

I’m glad this reporting was published, but would certainly like to see it on MSM to enlighten those who most need it.

I remain stunned by the fact few citizens are even aware so many millions of us lost our homes, & by the many who still blame the homeowner. Insult to injury…

Crittermom, I am sorry for the what you had to go through. You are correct; the wounds will never heal. Scar tissued, maybe, but easily torn.

I am confused by this:

Goldstein’s PMG flipped the house five months later, on Apr. 26, 2010, for $273,000, yielding a quick $106,500 paid for partly by Indymac’s loss-share agreement (that’d be you, if you’re an American reader who pays tax).

How did the loss-share agreement come into play in the “yielding a quick $106,500” to Goldstein’s PMG?

David Stern named his yacht the “Su Casa “…as in “Su Casa Es Mi Casa”.

That’s “Mi casa es su casa.”

Nope. Tom got it right.

So the Vast Great Texas Bank Job BALLOONED into the TOXICZOMBIEDEVOPMENTS that Crashed the World. What is amazing is the Politicians of the 1970s and 1980s have become so vastly wealthy off the RICO REALTY SCAMS. Donald Trump Clintons Bushs and even Elisabeth Warren have all gotten FAT CAT from the SUBPRIME SCAMS.

Yes the Witham Family were suckered at Lake George NY for 600 acres and the Family Marina and Home in 1970. The Author of THE GREAT TEXAS BANK JOB and TOXICZOMBIEDEVOPMENTS knows very very very well HOW DEEPLY the Banksters are in the DAISY CHAINS With Trump’s Bushs Clintons and Obamas BANKSETR GANGSTER PALS.

SEE Trillions Looted Land Frauds on any search engine of Your Choice.

saw this on the the big picture https://theintercept.com/2018/10/26/cesar-sayoc-foreclosure-steven-mnuchin/

cant say we are surprised can we?

Mnuchin bought Indymac in March, 2009, after the foreclosure was filed but before it was finished. Mnuchin went on to file many more foreclosures against others though, with plenty of dodgy paperwork. With the loss-share agreement he was all but paid to kick people to the curb by the US government.

Michael,

I really enjoyed reading about the saga, well researched!

Thank you! :)

Agree with all the comments here; so nice to see some good old fashioned journalism, mining backstory for context.

I wonder Michael if you saw 99 Homes with Michael Shannon as a very convincing Stern-esque opportunist. His tagline: ‘America doesn’t bail out losers; America bails out winners’ The sort of movie that makes your blood boil.

Sayoc’s story does too – his behavior is appalling but it is at the least understandable. It’s damn near foreseeable. Hard not to feel empathy, and hard to believe there’s not more of it.

Seconded! So good to get a sympathetic look at the backstory.

I can’t help but feel sorry for the guy. I’m thinking many, many more people must have terrible psychological scars as a result of those vultures. There are lots of people who are not fortunate enough to be “the sharpest knife in the drawer”, after all…

Yes, old school journalism, digging that little bit deeper for context.

Michael, I wonder if you saw 99 Homes, with Michael Shannon very convincing as a Stern-esque character, gouging wealth out of the less fortunate and savvy via the good offices of Fannie and Freddie. One of those movies that makes your blood boil. Tagline: ‘America doesn’t bail out losers; America only bails out winners’

This piece makes my blood boil on behalf of Sayoc; his subsequent behaviour is appalling of course, but not inexplicable, indeed damn near foreseeable. It’s a bit surprising there isn’t more of it.

Sorry for double post, the first went missing…

Yeah, seriously, great job!

I remember back in 2005ish my LSU rugby buddy dated a weirdly rich MILF in Baton Rouge. One night we went to a friends house, where she drunkenly offered them a fn loan. Me being 21/22 I didn’t really process what i witnessed besides the fact my buddy was dating a MILF who also had a teenage daughter with a serious pill problem.

I feel like my college years 02-08 are a fn scam. From Katrina to the GFC…

Yayyyy Free Market

As I read Dayen’s piece, its thesis is demolished by this here post.

A very telling article. I’m not wild about the last paragraph, unless it was meant very ironically:

“in most other areas of life he seems to be a bumbling idiot, an easy target for Countrywide, Indymac, Stern, Goldstein, and Obama with his ignored promises for hope and change.”

I.e. an easy target for the entire American establishment. A guy who believed that the national system was meant to work. The right words might not be “bumbling idiot.”

Bumbling optimist? Believing the system was meant to work for people like him — people with little money, few connections, and no political pull — does make him a bumbling idiot in my opinion but, I’ll admit, I’ve probably dealt with foreclosure-land too long and become jaded and cynical. You have a good point: believing in the system should not make on an idiot. That opens an interesting discussion.

throw in (my 100% fact-less prejudice) possible steroid, alcohol or prescription/illegal drug use and you got a perfect spiral of self-destruction.

given the opioid/suicide crisis hitting middle-aged people, makes you wonder how much came from economic woes. probably a lot.

but most of the media/academia don’t seem to be interested in that story.

Most of it is from economic woes, because it creates immense stress in today’s society, where the media portrays even ‘poor’ people as owning huge, gorgeous homes (turn on any sitcom, netflix show, etc). At a certain point, economic woes become much more real stresses, for example, not being able to pay for a $500 speeding ticket–>not being able to drive to work–>losing your job–>etc.

America has already destroyed itself, and we are starting to really see it all fall apart at the seems, with the largest drug epidemic in the history of the world, the largest indebted generation (indebted at the age of 18), the most insolvencies in a decade than the last 50 years, etc. And the crazy thing is, this story of Sayoc is nothing compared to your average Millenial. Your average Millenial wont even get the chance to buy a home. Let that sink in.

In Korea, they call Millenials the sacrificial generation: too many to have stable jobs, assaulted by predatory adverts, loans, etc, and too poor/indebted to own a home or have kids.

There will be a day of reckoning for the ills my generation has borne, whether economic or civil.

Anecdote: My wife pursued higher ed to get a PhD/JD. She hated every second of it, and this was at a top ten institution. They used her story (poor kid making it to a top ten uni and becoming a doctor lawyer) as a way to entice a new generation of suckers. For suckers they all are. Her professor told her that he had to find $100,000 dollars of funding for every student. Guess what the school paid her? $26,000/year for 7 years. That’s below the minimum livable wage for that state. And guess what? Trump wants students like my wife to pay taxes on the tuition, which is billed at around $80,000 PER YEAR! How is that sustainable? How can these colleges charge 2x the average earnings of the American FAMILY?

And she isnt alone. Ive seen stories of medical students being unable to make ends meat because they were scammed by the schools & loan agencies to take out insane amount of debt, sometimes as high as $250,000 for law or medical school.

This kind of stuff has put a huge wedge between me and my father, he being an oldschool republican Baby Boomer who believes everything is about work and one shouldnt question authority, and that ” knew what they were getting into”. The standard conversation between a Millenial and a Baby Boomer is like this:

Millenial: I need a job.

BB: You dont have experience.

Millenial: I need a job to get experience.

BB: Then work.

Millenial: That’s what im trying to do

BB: You need experience to work here.

Millenial: How am I going to get experience without working?

BB: Work!

I have more in common with my grandfather’s generation, who saw albeitly much harder forms of oppression, like communism & Nazi occupation, but oppression all the same than I do with my dad’s generation, who I honestly can barely take these days. They lie, they scam you and then tell you its your fault, etc. The least moral generation (Clintons, Weinstein, Cosby, Baldwin, etc), that loves talking about the immorality of others. I feel like im living in the Caligula era of Rome, right before the Empire’s collapse.

This Sayoc story is a microcosm of what is to come in the future when Millenials realize they cant form a family, and even if they do, realize that both the wife and husband will need to both work for perpetuity to just keep up with interest payments.

America is falling apart “at the seems.” Absolutely no snark here–this is a homophonic mistake that is truer than the “correct” metaphorical “seams.”

Thats me!

34 years old, Single, no kids, AND 110K in Student Loan Debt.

Credit Score is 500.

Ive totally checked on getting a house unless my ‘future wife’ can get one.

Don’t feel too bad, a lot of us gen x ers are in the same boat (51 yrs old)

Not all baby boomers are like your dad. Some of us understand very well what has happened. One aspect respecting student loan debt hasn’t been talked about much, so I will. When the “new” bankruptcy code went into effect in 1979, student loans were treated like any other loans. On the basis of anecdotal evidence (which was true) very soon thereafter, such loans were made non-dischargeable if the debtor filed her bankruptcy case within 3 years of getting the loan. Then, 3 years became 5 years. Then, 5 years became never, unless you could prove that you would never conceivably be able to repay. This amounted to being able to be hauled to court on a gurney, fresh from an ICU that couldn’t get you sent to a nursing home. And then there were the parents who guaranteed the student loans. For a short time, in the division of the district I am most familiar with, the parents could get out from under these guarantees because they weren’t students. Then, that became impossible when courts higher up scoffed at that distinction. There is no effective statute of limitations on these obligations- don’t know the history of that aspect of it. This legal transformation unsurprisingly skews the entire marketplace for higher education, especially when it takes place simultaneously with the disappearance of decent employment opportunities for non-graduates from post-secondary schools. University tuitions became outrageous. Loans were easy to make- the lenders had the lifetimes of their debtors to collect. And, for good measure, the government gave the holders of these loans the power to do things regarding collections and the addition of fees that dwarfed those of the IRS.

I know it is an outrage. But it is the neoliberals that created this. It isn’t generational. Please don’t look at it that way.

I’m tap dancing around this issue with my nephew. He’s 19, skipping community college, and leveraging up to the hilt with student loans to have the full peer 4-5 year college experience. I try to explain to him the reasons for avoiding student loan debt at all costs, forward him many related articles I see on NC, but he stays silent and then asks me to cosign on a loan. It’s a nuanced situation–he didn’t have the best childhood (my brother is a dead-bead Dad), and I understand his longing to get his education, damn the costs–but he doesn’t understand the indentured servitude he’s setting himself up for. I don’t want to be that get-of-my-lawn late baby boomer Uncle, but at the same time, he’s not showing any ability to make sound judgments (I understand he’s young) after I’ve educated him to the pitfalls.

I’m resigning myself to the eventual conversation that will be had. It goes something along the lines of “…after you get your degree, after you’ve gotten a job, after you’ve worked at that job for a few years, and after you’ve made a few years payments on your student loans, after you’ve demonstrated responsible behavior and the ability to follow through, then I may very well come in and make a significant paydown in your student loan debt, but not until you’ve demonstrated those things.” And for my other nephew who appears to be going the firefighter vs. college route, it will be along the same lines but maybe the down payment for a house at the right time in the cycle after he’s been on the job for a demonstrated period of time.

Cant give advice except for you/he risks destroying Thanksgiving dinner for the next 30 years.

Nephew needs to consider the military instead (obviously not for everyone and has its own issues). Sibling is Army reserves after multiple deployments . Post 9/11 GI bill paid 100% of college.

I’ve discussed the military with both as a viable economic alternative. I’ve also specifically advised him that he could work full-time and go to school at night and earn his BA over the long haul. I realize it’s not ideal, but that doesn’t mean it’s not a valid option. What I’m more concerned about is the process (hat tip to Epsilon Theory blog) he chooses, and I fear he’s practicing magical thinking that he will secure some high paying job after college that will enable him to payoff any debt. That is not good process and should not be rewarded. Your sibling appears to be on the right track!

Maybe he could live at home and go to a public university. I don’t think you should co-sign any student loans. But if he’s a good student and you have the money, why not help him with tuition.

I don’t envy your position. This sounds like one of those situations where whatever you decide vis a vis cosigning loans for your nephews, you might well end up regretting it. The thought of you ending up old and destitute should they default on the loans springs immediately to my mind. Maybe you should ask them to be as concerned for your future as you apparently are for theirs. In any event, these are tough choices.

Eclair: “… another committed ‘suicide by police,’ when he was shot by sheriff’s deputies as he refused to leave his home in a mountain community.”

I believe I know the incident you are referring to.

It was in the same county, over the pass to the south, that I lost my humble but beloved ranch, as well, while two sheriff’s deputies stood at my door.

He had fought in court for years (as did I) to no avail, as so, so many of us did.

Reading this article brought back memories for me, as well, & of the wounds that have yet to heal.

I’m glad this reporting was published, but would certainly like to see it on MSM to enlighten those who most need it.

I remain stunned by the fact so few citizens are still unaware that so many MILLIONS of us lost our homes, & by the many who still blame the homeowner. Insult to injury…

The debacle that was HAMP vaporized any and all good feelings I had for Obama et al. And then there was the ACA and a long list with which we here are well acquainted. What a bunch of phking shysters. No wonder HRC couldn’t beat the likes of a Trump. Indeed, he is merely the turd left on our doorstep by the Democrats.

My home we bought into in 1999. In Portland OR. we had the banks looking up our crannies and examining everything to get the loan. Prices started rising in the runup to the meltdown. We both had career jobs at the time. Mid 30s. We had a child, thinking we were in a good spot. Being subscribers to FT( using airline mile points from some credit card), we could clearly see the boom was not going to last. When the Queen famously asked why no one saw it coming, all I could say was ‘pretty much ever-dam-body at the FT said it wasn’t gonna last.”

So I lost my great job in the crash, My wife had taken off a year to bond with the child- as opposed to sticking him in day care in infancy and ‘leaning in’. So neither one of us could find work paying anywhere near what he had had. Despite nifty resumees loaded with corporate logos. Now we face foreclosure at what is probably the top of a market in a boom town that’s been a shelter for refugees from San Fran and Brooklyn. Oh how we loathe Californians here in Oregon. The price of everything has tripled in tend years. I suppose we can bail and scarper, sell the house, get a littl profit on our equity. But where woudl we go? They don’t hire people over 40 anymore. Especially women – Except for the most menial crap at the lowest earnings.

So I am glad I read this article. I figured this guy was some poor MK Ultra Victim. We voted against Hillary out of loathing for what Bill did in office. But thinking Trump is gonna save us is a blind alley also. The MAGA folks can see how the Clintonite Dems lick the ‘intelligence community’s boots, service wall street while mouthing platitudes about ‘pro choice’ and gender/sexuality non-conformance. But do zero for those constituencies, let alone the working classes.

I hate to be that person, but “summons” is a singular noun; the plural is “summonses”. The verb is “to summons”. My late Dad always used to say “I shall get summonsed” if anyone suggested even the slightest infraction of the law ?

I really love the detailed and illustrative explanation for motive here, motive for any one who has been put through similar circumstances (or more broadly related circumstances related to the decadence of society).

Uh, I mean. It’s Trump’s fault! Nazis! KKK! White nationalism! (compare those shrieks with this article’s content). Do I think bombs should be mailed to corrupt political figures, well let’s say I would not do it. I can see how it would come to be however. I would say they shouldn’t be, but when the system breaks down to the point where citizens have a complete lack of control, taking it to this level isn’t unthinkable. I think it is more than just that Obama was on his list, given his circumstances–not that his motivation was this clear, or that he was completely conscious of the political reality of the trajectory of his life (but how many average people are?). The worst part about this is that he will be locked away as a “Trump” nut, easy to make fun of (or fingered as a Russian if your are deplorable Chuck Todd–who should be fired for his remarks), while Democrats will use this as fuel to ignore even more the political policies that could have helped this guy keep his life together a decade ago. Of course the entire lesson will be lost on them. They don’t have my sympathy.

But noooope! It’s the Russian’s fault! Now that Olenick’s backstory has broken, I have observed a real push to apply the Russia narrative to the story – somehow. So suddenly, Oleneck’s story was fabricated – or even manufactured by the Russians – all to make the Democrats look bad in the mid-terms and to quash the blue-wave. Any sympathy at all is instantly attacked as some how being a Russian stooge.

This also sets up the narrative should the Dems fail to retake the house.

Oh, good grief. Right at the time when I’m thinking that I’ve really made some progress on Russian verb conjugations.

And adjectives. Do they realize how tricky Russian adjectives can be for a non-native speaker?

Line from one or another movie I recently watched. Or was it a book I read? I forget. In any event it went something like this. “Of all the languages, Russian is the most difficult to learn. That’s why no one speaks it.”

at least they haven’t started house investigations, but that’s probably because they don’t control the house yet. this all seems very familiar. and yes i know the republicans would be doing the same thing if the shoe was on the other foot; after all, they did. at least there was a hostile superpower; the democrats are hyping the threat of buff bernie.

“then trading under the ticker CACA”

Tells you all you need to know.

Now THAT’S journalism of the highest order–exhaustive, incisive, illuminating–the kind of thing so obviously missing these days except on a handful of exceptional sites like Naked Capitalism. Can we nominate Michael Olenick for some sort of public service award?

This is the part I don’t understand. If the banks, the shady lawyer, and others, were responsible for Sayoc losing his home, why is he trying to blow up Trump’s critics? Why didn’t he blow up the people who were actually responsible? Or was he not bright enough, as hinted at, to make the connection (like too many Americans)?

A traitor is more despised than an enemy. At least the latter has the good manners to declare their intentions and do you in face to face instead of claiming to be your ally and knifing you in the back.

I’m a subscriber of the Daily Business Review. It unfortunately does serve as the main publishing paper for service by publication rather than the “major” papers in South Florida like (in order of North to South) the Palm Beach Post, Sun Sentinel, and the Miami Herald.

Since Stern went by publication service, it at least means in this instance there was no gutter service to Sayoc, which was endemic and epidemic during the foreclosure crisis.

I supposed everyone noticed all those judges ignoring the blatant backdating, robosigning, inaccurate summons of the foreclosurers and sometimes the actual fillings by the ones being foreclosed upon especially if the filings were done per se? What happened to the Caser Sayoc would make almost anyone bitter, but I wonder how much attention will be paid to that, or to the tens of millions of Americans at about the same time.

An alternative view: http://market-ticker.org/akcs-www?post=234445

If as seems to be the case, Sayoc was not educated or clever enough to find his way safely through the multiple layers of predation aimed at him, I would rather we felt sorry for him and sorry for us that we live in a country where one must constantly be on guard or angry on his behalf and our own, rather than calling him an idiot. It may just be my ears, but that almost makes it sound like its OK to prey on people if they are naive or that we don’t need to be concerned about it.

I hear what you’re saying and thought it through but, in the end, Sayoc is a white supremacist terrorist. He became that way after being preyed upon; he thought allegiance to strongman Trump would empower him, despite that Trump is so similar to those who’ve preyed on him. Many people lost their homes and everything else without becoming a white supremacist terrorist. That’s why I carefully chose the word “contextualize” rather than explain or justify.

A sizable part of my family was killed in the holocaust but one area that’s rarely spoken about is that those who did it had genuine economic grievances. The Treaty of Versailles was an economic catastrophe. Did Germany deserve it for WWI? Arguably, yes, though that doesn’t make the suffering any less. But when those people transformed from justifiably angry to white christian supremacist murderers they lost any sympathy. While the source of their initial anger might be contextualized their ultimate act of violence — murder factories for civilian Jews, gays, and Roma people (three groups who had nothing to do w/ the Treaty of Versailles) — is beyond the pale; it can be contextualized but never justified. Sayoc didn’t build a murder factory but it sounds like he didn’t because he couldn’t, not because he wouldn’t.

Society as a whole has a moral responsibility to take down the predators before they turn the Sayoc’s of the world into deranged terrorists and we failed (I personally tried but, as a whole, we blew it). But, at least for me, a white supremacist terrorist is, in the end, an idiot.

An extremely cogent response, Mr. Olenick. You understand and well explain the subtle reality, while most see only the broad swipe, the smeared veneer.

My Gen X son linked this article to me, and I thank him for it, and you for writing it.