By Dr. Marek Dabrowski, a Non-Resident Scholar at Bruegel, Professor at the Higher School of Economics in Moscow, co-founder and Fellow at CASE – Center for Social and Economic Research in Warsaw and Member of the Scientific Council of the E.T. Gaidar Institute for Economic Policy in Moscow. Originally published at Bruegel

Since the beginning of 2018, currencies of two large emerging-market economies – Argentina and Turkey – suffered from substantial depreciation. Other currencies also recorded losses. Which factors are determining macroeconomic and financial stability in emerging-market economies? And what can be done to prevent a crisis and avoid its economic, social and political costs?

The essence of the this-time-is-different syndrome is simple. It is rooted in the firmly held belief that financial crises are things that happen to other people in other countries at other times; crises do not happen to us, here and now. We are doing things better, we are smarter, we have learned from past mistakes.

Kenneth Reinhart and Carmen Rogoff, 2009

Summary

Symptoms of currency crisis in Argentina and Turkey in August and September 2018 raised again the question over which factors determine macroeconomic and financial stability in emerging-market economies.

As with previous crisis episodes in 1980s and 1990s, prudent domestic policies play the key role. Monetary and fiscal laxity, as well as structural and institutional distortions, are the main crisis causes even if external shock/contagion often serves as a trigger.

Early policy correction can help in preventing a crisis and avoid its economic, social and political costs. If crisis cannot be avoided the comprehensive anti-crisis package, including up-front monetary and fiscal adjustment should be adopted as quickly as possible to arrest market panics and reverse negative expectations.

The Symptoms of New Storm?

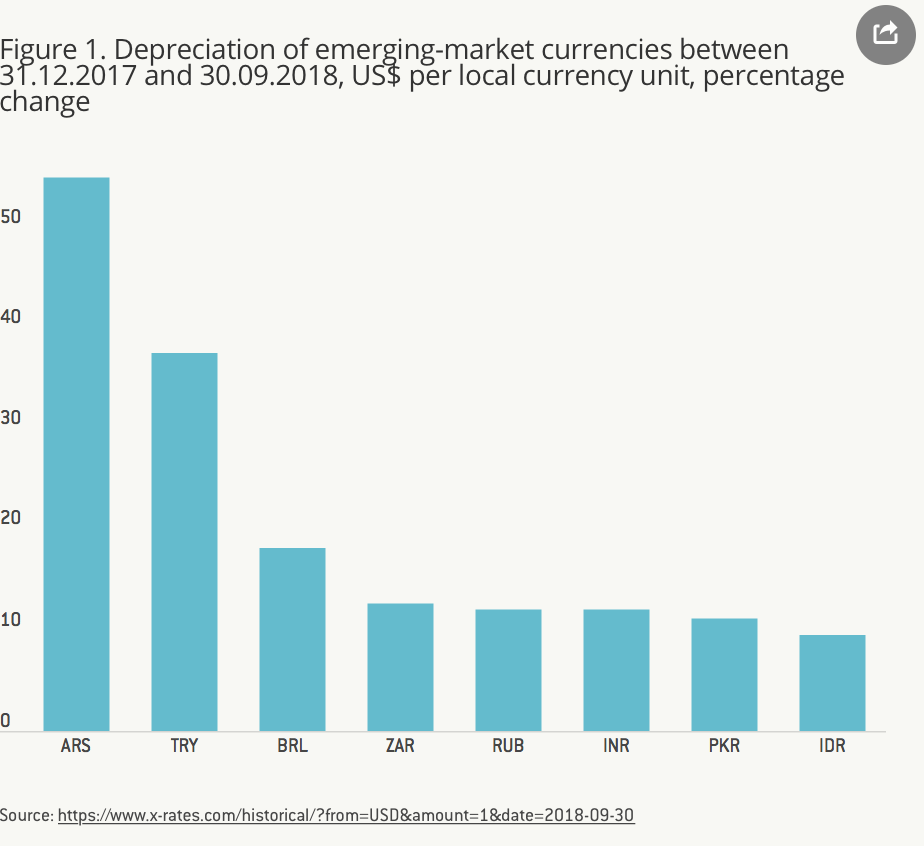

Since the beginning of 2018, currencies of two large emerging-market economies and members of the G20 – Argentina and Turkey – suffered from substantial depreciation. Culmination of speculative attack came in August and September. Other currencies, including the Indian rupee, Indonesian rupiah, Brazilian real, Pakistani rupee, Russian rouble and South African rand also recorded losses, but smaller ones as compared to Argentina and Turkey (Figure 1).

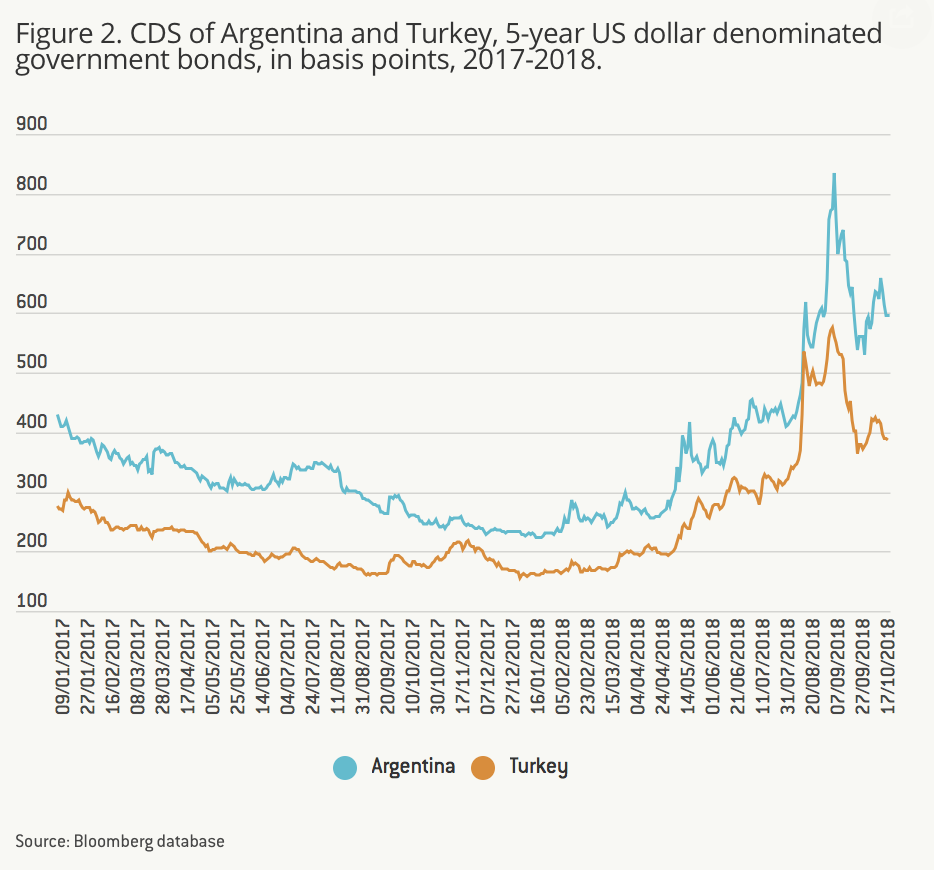

(CDS) for Argentinian and Turkish government bonds denominated in US dollars (Figure 2) started to increase from the beginning of 2018, but picked up dramatically in August and September 2018 – by some 400 basis points for Argentina and 300 basis points for Turkey.

Even though they decreased at the end of September and early October 2018, they continue to stay far above the pre-crisis level.

Are Emerging-Market Financial Crises Back?

In the popular perception, emerging-market economies did not experience serious macroeconomic and financial turbulence since the beginning of this century. This perception was not entirely correct, because several economies – especially in Central and Eastern Europe (CEE) and the former Soviet Union (FSU) – suffered from a spill-over effect of the global financial crisis of 2007-2009 (Dabrowski, 2010). Then the decline in oil and other commodity prices in 2014-2015 triggered substantial currency depreciation and fiscal tensions in Algeria, Azerbaijan, Belarus, Kazakhstan, Malaysia, Nigeria, Russia and a few other countries (Dabrowski, 2015).

Nevertheless, there were not serial emerging-market crises with cross-country contagion, as had occurred in the 1980s or 1990s (except FSU). Besides, victims of the previous crises in Latin America and Asia remained unaffected by turbulences of the late 2000s and early 2010s and continued growing in the period when most advanced economies had to deal with negative consequences of the global financial crisis. Macroeconomic and financial instability did not originate from emerging markets, but from the US and Europe.

While the aim of this note is not to speculate whether, in the coming weeks and months, we will see more crisis episodes and which countries could be affected, the risk of such developments remains relatively high. This is caused, in the first instance, by the continuous tightening of US monetary policy. Historical experience tells us that increasing interest rates in the US have usually led to US dollar strengthening, capital outflow from emerging markets, and pressure on their currencies. Figure 1 confirms that such an effect can be also observed in the current policy cycle.

The increasing global economic uncertainty associated with protectionist policies, such as the Trump administration is practising in the US, is another factor which can hit many emerging-market economies, in particular those that developed export-oriented manufacturing capacity and participate in global value chains.

The above developments prompt a look, once again, at factors that increase risk of financial crisis and how to prevent them in the least costly way.

The Key Role of Domestic Policies

Whatever is the impact of global factors, the key role is always played by domestic policies. In this respect, the two recent victims, Argentina and Turkey, made several policy mistakes in the past that increased their vulnerability.

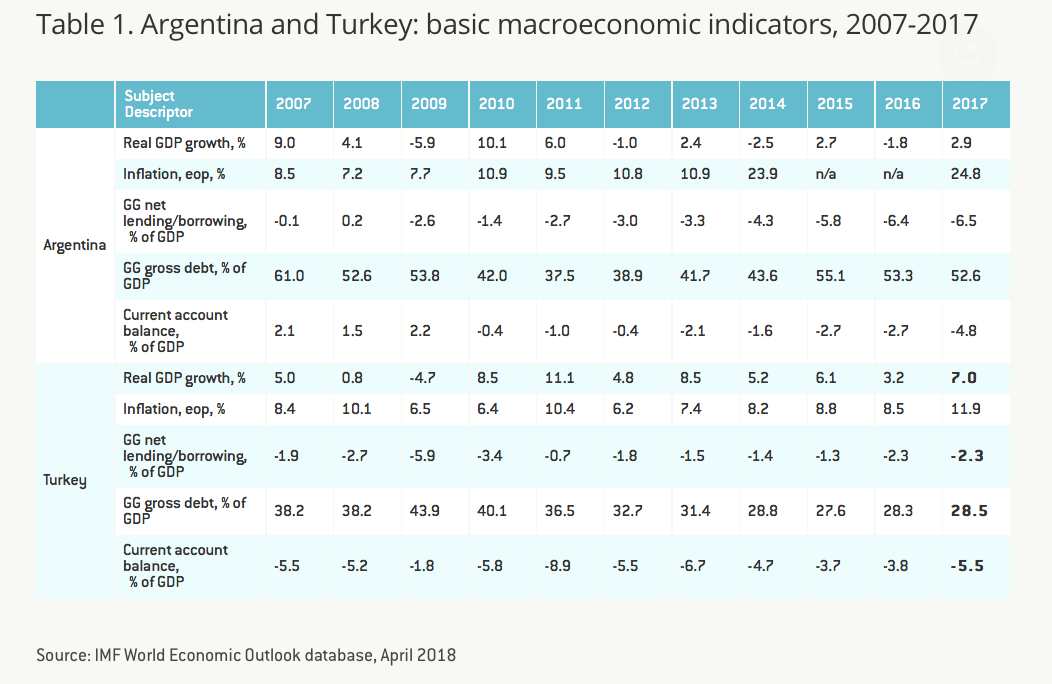

Argentina recorded high and increasing inflation and fiscal deficit, and several episodes of recession in the last decade (Table 1) as a result of the populist policies of President Cristina Fernandez de Kirchner, who ruled the country between 2007 and 2015. These policies included excessive public spending in years of commodity boom; price, foreign exchange and export controls; energy subsidies; a complex and non-transparent tax system; trade protectionism; manipulation of price and GDP statistics; the undermining of central-bank and judicial independence (OECD, 2017).

The case of Turkey is slightly different. The country recorded high growth and ran moderately prudent fiscal policy. However, its monetary policy was too lax – as demonstrated by increasing inflation (much higher than the levels of its main trading partners) and low interest rates (negative in real terms). Furthermore, an authoritarian trend in domestic politics led to deterioration in economic institutions and the reversal of many reforms of the early 2000s (Acemoglu and Ucer, 2015). For example, the Central Bank of the Republic of Turkey (CBRT) was under pressure to avoid an increase in interest rates backed by an ‘unorthodox’ president’s opinion that higher interest rates lead to higher inflation.

The failed military coup d’état in 2016 led to massive personal purges in the judiciary and public administration, which also meant deterioration in economic governance. The new round of ethnic conflict with the Kurdish minority, engagement in the conflict in Syria, tensions with traditional allies (the US and Europe) and practical freezing of the EU accession process forced many investors to reassess geopolitical risks and prospects of deeper integration with the EU economy.

In 2017-2018, both countries recorded increasing current account deficits. In Argentina, this has been the effect of fiscal imbalance and a low rate of private saving; in Turkey, it has been born of private sector over-borrowing and an investment boom. In principle, such deficits can be seen as a normal phenomenon in the world of unrestricted capital movement, in which investors seek the highest rate of return (Dabrowski, 2013). However, if a country has limited access to the world capital market (Argentina), if its domestic investment climate is not rated favourably and if macroeconomic policies are too expansionary (both cases) then the increasing current account deficit should serve as a warning signal and strong argument in favour of policy correction.

History and Reputation Matter

Not surprisingly, both Turkey and Argentina have recorded several macroeconomic and financial crises in their history (Reinhart and Rogoff, 2009). The last episodes happened in both countries in 2000-2002, at the end of the 1990s round of emerging-market crises.

The Argentinian crisis of 2002 was particularly messy and involved abandoning the currency board, a deep devaluation of peso, the default of banks on their liabilities to depositors and a default on public debt. The long conflict with foreign holders of government bonds was resolved only in 2016 (Mander and Moore, 2016). Manipulation of price and GDP statistics in the first half of 2010s additionally undermined the government’s credibility.

Memory of past financial crises influence the behaviour not only of foreign investors but also of domestic money holders. The latter tend to flee domestic currency and (if possible) domestic banks whenever macroeconomic and financial stability is under question. Widespread dollarisation in both countries (and many other emerging-market economies) reflects their continuous macroeconomic fragility even in good times.

Too Little, too Late

As in many similar cases in the past, Argentina and Turkey could have avoided recent crisis if their policies had been corrected in time. Both were warned well in advance by international organisations such as the IMF (2014; 2016) and OECD (2016; 2017). Each country was advised to tighten monetary and fiscal policies in order to curb inflation, and to conduct a series of structural and regulatory reforms to improve the business climate. In addition, Argentina was advised to remove distortions of the Kirchners’ era and Turkey was warned of the risk of overheating[1]. However, either they did not follow these recommendations (Turkey) or they followed them too slowly (Argentina).

There are many reasons why politicians are reluctant to correct unsustainable policies.

First, they are afraid that corrections mean admitting the shortcomings of previous policies – especially if they have engaged themselves in defending them by use of various ‘non-orthodox’ doctrines.

Second, the required policy tightening often remains in conflict with the political timetable; for example, forthcoming elections. In Turkey, this was the constitutional referendum on 16 April 2017 and presidential and parliamentary elections on 24 June 2018.

Third, financial markets rarely react immediately to imprudent policies, especially in tranquil times. Rather, their reaction has a non-linear character, a typical case of multiple equilibria. Politicians often misinterpret such delayed reaction as the tacit approval of their policies. It creates a feeling of impunity and a temptation to continue testing market tolerance.

When market wake-up call finally comes – in the form of higher yields for government bonds, greater spreads on CDS, inflationary pressure, capital outflow, banking panic, or all these phenomena together – it is usually too late for minor adjustment steps. More bold and comprehensive actions are required to stop market panic and reverse negative expectations. They are costlier, economically and politically, than earlier corrective measures.

However, even when crisis is already at the door, governments and central banks often are not ready to act quickly and decisively, choosing instead a strategy of gradual adjustment. This is caused either by an underestimation of the real threat, or a belief that gradual changes will be politically more acceptable and involve smaller output and employment losses, or both. However, a strategy of gradual adjustment works best when policy corrections are done in advance – that is, when the macroeconomic situation is still relatively good. This is also an acceptable approach in the case of more complex structural and institutional changes, under condition that the entire reform plan remains credible and will not be abandoned when the economic situation starts to improve. However, gradual adjustment does not work in an environment of speculative pressure and financial-market panic, because it lacks credibility and is unable to change market expectations. Furthermore, it extends the period of pain and delays the perception of improvement.

Unfortunately, authorities of both analysed countries were not ready to act quickly and decisively enough when the first signs of the forthcoming crisis were already seen. The CBRT took its first decision to increase the one-week repo auction rate from 8.00% to 16.50% on June 1st 2018, followed by another hike to 17.75% one week later[2]. These higher interest rates were not able to stop capital outflow and abrupt depreciation of Turkish lira in August and September, especially because they were not supported by other policy measures – in particular, in the fiscal sphere.

This led to one more hike to 24% on September 14th 2018. It is too early to say whether this will be enough to change market expectations and stop a crisis. In October 2018 yields on five-year government bonds denominated in US dollars amounted to more than 7%, and on 10-year bonds stayed around 8% (Pan and Samson, 2018). The anti-crisis actions and policy statements remain contradictory (Smith, 2018).

Argentina’s story is even more illustrative of the ineffectiveness of gradual stabilisation. President Mauricio Macri won the 2015 election on the promise to depart from the populist policies of his predecessor and restore macroeconomic stability. However, undertaken reforms were slow and not always consistent enough, and the macroeconomic policy stance remained loose – as illustrated by Table 1.

After the first signs of market pressures at the end of 2017, macroeconomic policy was tightened but not enough to change expectations. Episodes of market panics were repeated several times, especially in August and September 2018. The Central Bank of the Republic of Argentina increased its key interest rate in several steps – from 27.25% in April to 72.83% on October 4th 2018[3] – but the situation remains very fragile, with uncertain prospects for the coming weeks and months.

Politically, the new administration wasted the window of opportunity to stabilise and reform the economy in the first two years of its term, when the blame could be put on the previous government. Now it must fight a crisis that is largely attributed to its own indecisive actions, and tighten policy a year before the next election and during the country’s presidency of G20.

Lessons To Be Learnt not Only by Emerging Markets

The recent turmoil in emerging markets, still limited by historical standards, should serve as both the warning signal and source of policy lessons for both countries in trouble and others, including advance economies, many of which walk on the edge of fiscal sustainability (examples include Japan or Italy).

First, the era of extremely low interest rates in advanced economies is coming to its end. This will have a strong impact on both them and emerging markets, in terms of direction of capital flows, public and private debt sustainability, financial-sector stability, growth dynamics, and many others.

Second, the current growth recovery in advanced economies could be short-lived, due to tensions in the global trade system, other geopolitical and security risks, supply-side constraints such as shrinking and ageing population and necessary tightening of monetary and fiscal policies. If growth in advanced economies weakens, this will have an additional negative impact on emerging-market economies.

Third, populist policies that ignore fiscal and monetary arithmetic are always of a limited lifespan. The question is only when the country will have to pay for such policies and how much.

Fourth, if economic policy requires corrections, it is always better and less expensive – in economic and political terms – to introduce them sooner rather than later. If the country faces the risk of becoming a victim of market turmoil, the policy adjustment should be fast and strong enough to arrest negative trends immediately and create positive expectations.

Acknowledgement

The author would like to thank Jochen Andritzky, Uri Dadush, Maria Demertzis, Francesco Papadia, Alessio Terzi, Nicolas Veron, and Guntram Wolff for their comments to the earlier draft of this note and Antoine Mathieu Collin for help in collecting statistical data.

See original post for references

________

[1] The first signs of market vulnerability of the Turkish lira were already observed at the end of 2013 (O’Neill, 2018).

[2]http://www.tcmb.gov.tr/wps/wcm/connect/EN/TCMB+EN/Main+Menu/Core+Functions/Monetary+Policy/Central+Bank+Interest+Rates/1+Week+Repo

Oh yeah. The lesson to be learnt is fiscal responsibility. Quite germane German Germanic.

No wonder why he cited R&R

I have the same observation. I’m by far not the sharpest tool in this box, but even I could see the underlying bias in this piece; ie. Internationalism is good, Nationalism is bad.

The authors speak as if National Political Policy is a subset of International Finance.

Hmmm…..

Q: “How many Economists does it take to stop an angry, starving mob?”

A: “It depends on how you prepare them.”

And does the mob have can openers?

Let’s assume can openers.

The quote at the top should say Carmen Rinehart and Kenneth Rogoff. The first names are currently switched.

And maybe one should also link to an article on the Rinehart and Rogoff famous and influential “spreadsheet error”.

https://www.bbc.com/news/magazine-22223190

Thanks to the authors for quoting R+R at the top so I knew what I was getting into…also it’s funny there’s not a peep re paul singer and the vulture capitalists

pretty much every time the authors say politicians, they should be saying economists and politicians

I don’t think I’ve seen a better argument for m4a and a JG, at the very least (but the passage points out that one should never do the very least!)

However, even when crisis is already at the door, governments and central banks often are not ready to act quickly and decisively, choosing instead a strategy of gradual adjustment. This is caused either by an underestimation of the real threat, or a belief that gradual changes will be politically more acceptable and involve smaller output and employment losses, or both. However, a strategy of gradual adjustment works best when policy corrections are done in advance – that is, when the macroeconomic situation is still relatively good. This is also an acceptable approach in the case of more complex structural and institutional changes, under condition that the entire reform plan remains credible and will not be abandoned when the economic situation starts to improve. However, gradual adjustment does not work in an environment of speculative pressure and financial-market panic, because it lacks credibility and is unable to change market expectations. Furthermore, it extends the period of pain and delays the perception of improvement.

Furthermore, keeping interest rates artificially low was a beggar thy neighbor policy, oh and look! Our neighbors aren’t doing very well! OMG, and don’t you just love the way that incrementalism is how everything supposedly works in regular people land, but in this case don’t wait two seconds, it’s double effort instantaneously OR ELSE! OMG!

Second, the current growth recovery in advanced economies could be short-lived, due to tensions in the global trade system,

OMG we didn’t get ISDS, what about globalization?

Third, populist policies that ignore fiscal and monetary arithmetic are always of a limited lifespan. The question is only when the country will have to pay for such policies and how much.

ACK! Populism!

Fourth, if economic policy requires corrections, it is always better and less expensive – in economic and political terms – to introduce them sooner rather than later. If the country faces the risk of becoming a victim of market turmoil, the policy adjustment should be fast and strong enough to arrest negative trends immediately and create positive expectations.

Yes. $15 min wage, m4a, and jobs guarantee stat or else………

Nations of the world continue to reject the notion that the USD is a defacto reserve currency. Can anyone imagine the RMB as such ……. or even the EURO? Ok, didn’t think so.

Anyhow, proof of the pudding is the concurrence of the Fed’s IRP as increases feed into the global system with collapsing share markets around the globe accompanied by nose bleeds in sovereigns with other varied issues of stability, which is why Turkey and the rest of the peripheral currencies will be hammered in the long game. The EURO is still in a bubble of fantasy land, but has the potential to unwind very quickly post Brexit coupled with the problem of potentials exits of Italy and a couple of PIGS – when, not if! The EU project has been kept afloat with a TINA mentality which will evaporate very quickly if Macron can’t improve the plight of everyday citizens who are rumbling louder every day, and you can bet your last shekel the international money markets are well aware of this fragility. Lay odds on the USD as the last bastion of safety. Gold is such a bitch after all!

The only stable global economy of a size relevant to international money markets and a truly independent central bank (relatively speaking) is the US. Despite the spruiking from China about their Silk Road initiatives and expanding “investment” in developing nations, they still rely on the USD to support their global expansion. It will be so as long as their central bank’s shenanigans with their currency manipulation (don’t even suggest they don’t!) is employed to keep their growth kicking and economy out of the toilet. Can you imagine how quickly the party would lose control if China suffered a national recession? So don’t expect that to change anytime soon.

Publicly Trump hates the Fed IRP. Privately he knows the only way for the US to recover it’s global mojo is to reassert the dominance of the USD without collapsing the pack of cards, so IRP is the only way, assisted by the trade barriers which is more like a bit of bare knuckling in the back bar. The UK are going to be distracted for a while with Brexit goings on, which I see as more of a problem globally than the national risk of the current Brexit pantomime, so the only safe haven for international markets remains the USD. I can’t recall the actual quote but “in the end there is only one game in town” or something like that.

To quibble; the primacy of the USD as the world backstop currency relies on there being a large international trade. This is hostage to the cost of shipping. Even long term I do not see any sail powered freighters being developed. No solar sails to power electric propulsion systems. No giant Savonius Rotors to drive propellers or turbines. Oil is still King. When the oil bust finally gets going, the triage in long distance freight will be savage. As international freight shrinks, the power of the Almighty Dollar will follow suite. Regional trading blocs will rely on local regional currencies. Cheaper and easier to control.

Good point. This was a weird mix of German-Russian Think. I don’t know anything about the Russian budget, but I do see them tightening up, buying lots of gold (from their own mines probably), and almost always agreeing with the Germans. Politically, it makes sense; economically its just nonsense. Unless the money you never cut is money spent on society and the environment. But, as far as the environment is concerned, we know from various reports that Russia became very polluted as it externalized costs during the cold war and maintained its armory of nasty weapons. Nobody looks beyond the drivel of R&R blahblabla to see that this very denialist attitude is created by the contradictions of capitalism/trade/competition and then serves to perpetuate it. But chances are the Russians are shrewdly courting the Germans with this stuff.