By Gail Tverberg, an actuary interested in finite world issues – oil depletion, natural gas depletion, water shortages, and climate change. Originally published at Our Finite World

Most people expect that our signal of an impending reduction in world oil or coal production will be high prices. Looking at historical data (for example, this post and this post), this is precisely the opposite of the correct price signal. Oil and coal supplies decline because prices fall too low for producers. These producers make voluntary cutbacks because the prices they receive fall below their cost of production. There often are supply gluts at the same time.

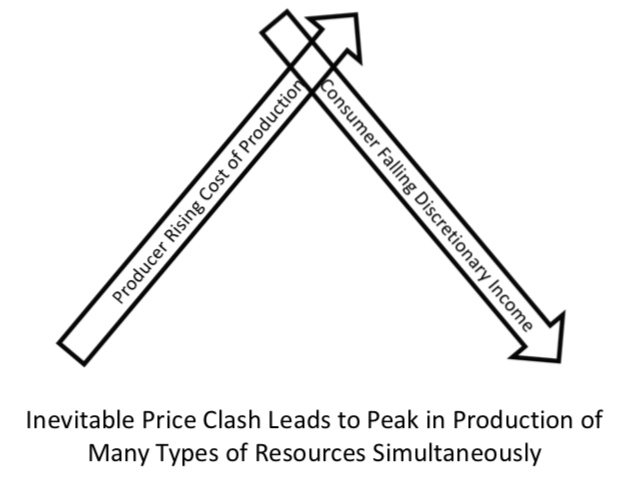

This strange situation arises because prices must be high enough for the producersat the same time that goods and services made by oil (and other energy products) are inexpensive enough for consumers to afford. There is a two way battle taking place:

(1) Prices producers require tend to rise over time, because of depletion. The easiest to extract portion of any resource (such as oil, coal, copper, or lithium) tends to be removed first. What is left tends to be deeper, lower quality, or otherwise more difficult to extract cheaply.

(2) Prices consumers can afford for discretionary goods (such as cell phones and automobiles) tend to fall for a combination of reasons:

- Wages of many workers fall because of competition from lower cost labor in other countries.

- Some jobs are eliminated through the use of computers or robots.

- Young people are increasingly being required to pay for higher education (beyond that which is provided free), leaving many with loans to repay, reducing their discretionary income.

- Changes to US healthcare law (mostly starting January 1, 2014) lead to required health insurance premiums. While some citizens find cost savings in this approach, healthy young people often experience cutbacks in discretionary income as a result.

- Rents and home prices keep rising faster than incomes.

When the discretionary income of the many non-elite workers of the world falls, they buy fewer finished goods and services. Finished goods and services are manufactured using commodities of many kinds, including oil, coal, copper, iron ore, and fresh water. When discretionary demand falls, commodity prices tend to fall. This is the problem we are encountering now. It tends to cause the prices of many commodities to fall below the cost of production. Eventually, producers decide to quit because production is no longer profitable. This is the issue that leads to peak oil, coal or copper.

Figure 1. Illustration showing why falling affordability creates a conflict between supply and demand.

If the Affordability Price Clash Mostly Affects Non-Elite Workers, Does It Matter?

When I talk about non-elite workers, I am talking about workers who are in the bottom 90% of the wage distribution. Elite workers will always have enough income for the necessities of life. There are so many non-elite workers in the world that they, indeed, do make a difference.

Also, the forces that adversely affect non-elite workers tend to have several effects:

- They tend to send a larger share of wages to elite workers, as the economy becomes more complex and more specialized.

- They tend to send more unearned income to elite workers, through capital appreciation, because elite workers can afford to buy shares of stock and expensive homes.

- The wealthy spend their income differently from non-elite workers. Non-elite workers tend to spend the bulk of their discretionary income on devices made using commodities, such as cell phones and automobiles. The wealthy are likely to spend their discretionary income in less energy intensive ways, such as investing in shares of stock and buying services such as private college education for their children.

History shows that economies tend to collapse when wage and wealth disparity becomes too great. Collapse can take various forms, including revolutions by the disgruntled underclass, increased susceptibility to epidemics, or the financial collapse of governments. Wars become more likely, as one country tries to aid its citizens at the expense of citizens of other countries.

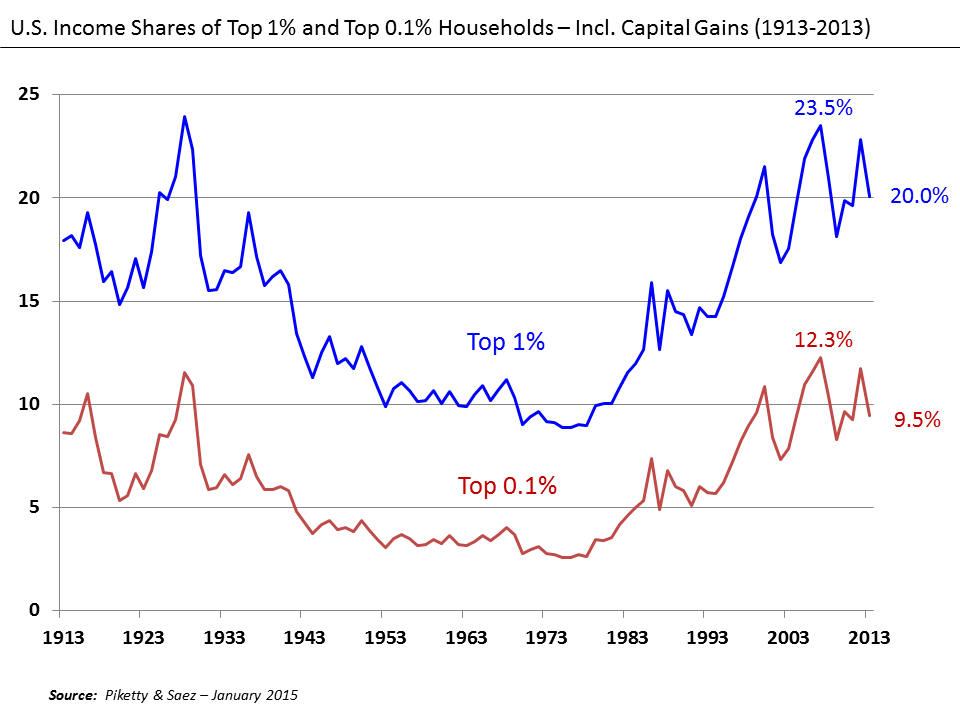

The world today seems to be approaching a crisis point with respect to wage and wealth disparity. Young people in particular are adversely affected. Figure 2 shows a chart indicating that wage disparity seems to be back to the level it was at the time of the Great Depression of the 1930s. This was also a time of low commodity prices and gluts of food and oil.

Figure 2. U. S. Income Shares of Top 1% and Top 0.1%, Wikipedia exhibit by Piketty and Saez.

Gluts tend to occur because commodity prices rise to a level where devices made with these commodities (such as cell phones and automobiles) become too expensive for non-elite workers to afford. Elite workers can still afford the devices, but there are not enough elite workers to make up for the shortfall in non-elite buyers of these devices, so industrial output per capita tends to fall.

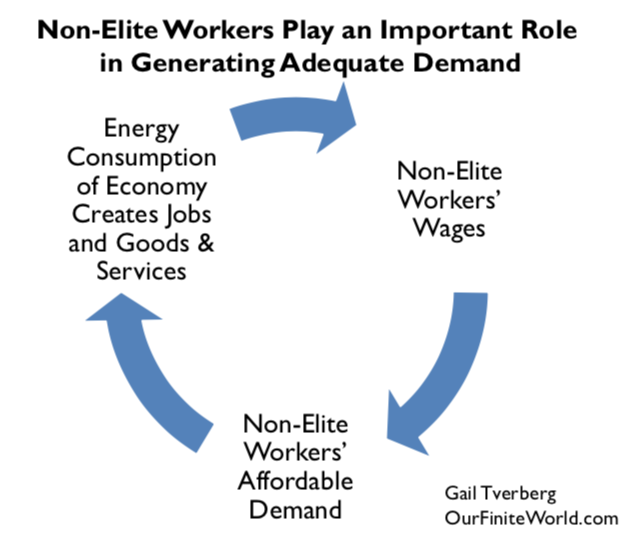

Figure 3 shows the important role that the wages of non-elite workers play in generating adequate demand. If their wages are high enough, they can buy enough goods and services made with commodities to keep commodity prices high. With sufficiently high commodity prices, production can continue.

Figure 3: Chart showing the important role that the wages of non-elite workers play in maintaining energy demand. With adequate demand, prices can remain high enough for production to continue.

Why the Peak in World Oil Production Likely Occurred in 2018

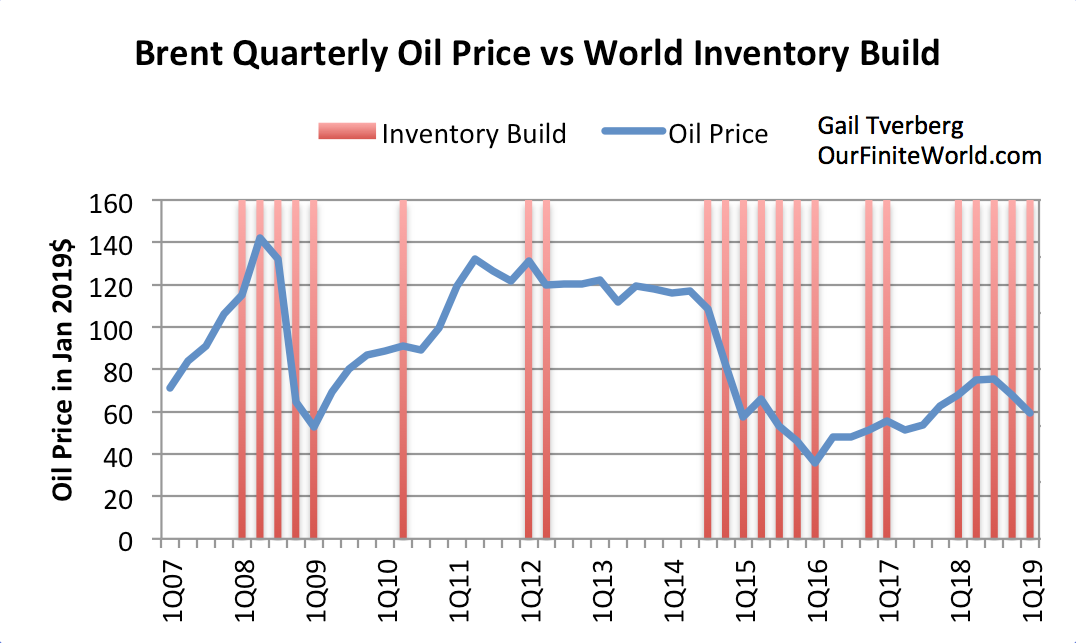

If we look at recent oil data, we see a pattern of growing gluts in supply, as indicated by the red bars in Figure 4. Even in the most recent week, the week ending February 15, 2019, after all of the cuts begun by OPEC and other oil exporters, US crude oil stocks continue to build. This is not the impact a person would expect, if the production cuts are truly effective!

Figure 4. Brent average quarterly oil price (in January 2019$), with an indication of quarters when world crude oil inventories are building. Oil prices are Brent spot oil prices, adjusted using the CPI-Urban to January 2019 prices levels. World inventory build quarters are based on indications shown in US Short Term Energy Outlook reports of various publication dates.

This is precisely the kind of signal we would expect, if products made with oil (and using oil in their operation) are becoming increasingly unaffordable for the non-elite workers of the world. Note that these bars are becoming more frequent and are occurring at lower prices. This is the expected outcome of a clash between the falling discretionary income of non-elite workers and the rising costs of oil producers.

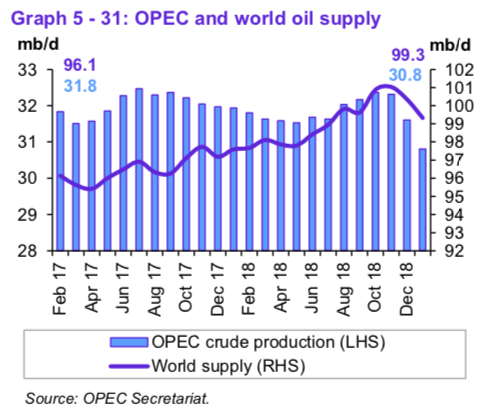

When prices fall too low, producers cut back production. OPEC reports its view of the effect of recent production cutbacks in Figure 5.

Figure 5. OPEC and world oil supply, in chart from OPEC Monthly Oil Market Report for February 2019.

Given the nearly worldwide problem of falling affordability of goods by non-elite workers, we should not be surprised if the peaks in oil production in October and November 2018 ultimately prove to be the maximum production ever recorded. In fact, it seems quite likely that the year 2018 will prove to be the year with the highest-ever oil production.

The cutback in production will appear to be voluntary. Once cutbacks start, they will tend to feed upon themselves. Unless oil prices really spike following the cutbacks (say, to $90 per barrel), exporting countries will find themselves worse off after the cutbacks, for a combination of reasons:

-

- The cutback in production will reduce the number of workers directly and indirectly employed by the oil industry. Their reduced spending will lead to a need for expanded government programs.

- Housing prices will fall in oil exporting countries. This is likely to ultimately lead to debt defaults.

- Tax revenue that governments of oil exporters can collect on the smaller amount of oil will be lower, even though the needs of the economy will be greater.

Ultimately, it seems likely that at least some governments of oil exporting countries will be overthrown, depressing oil production further. If the breakeven price for most OPEC members, including necessary tax revenue, was over $100 per barrel in 2014, it is hard to see how exporters can get along with much less today.

World Coal Production: Following a Similar Pattern to Oil?

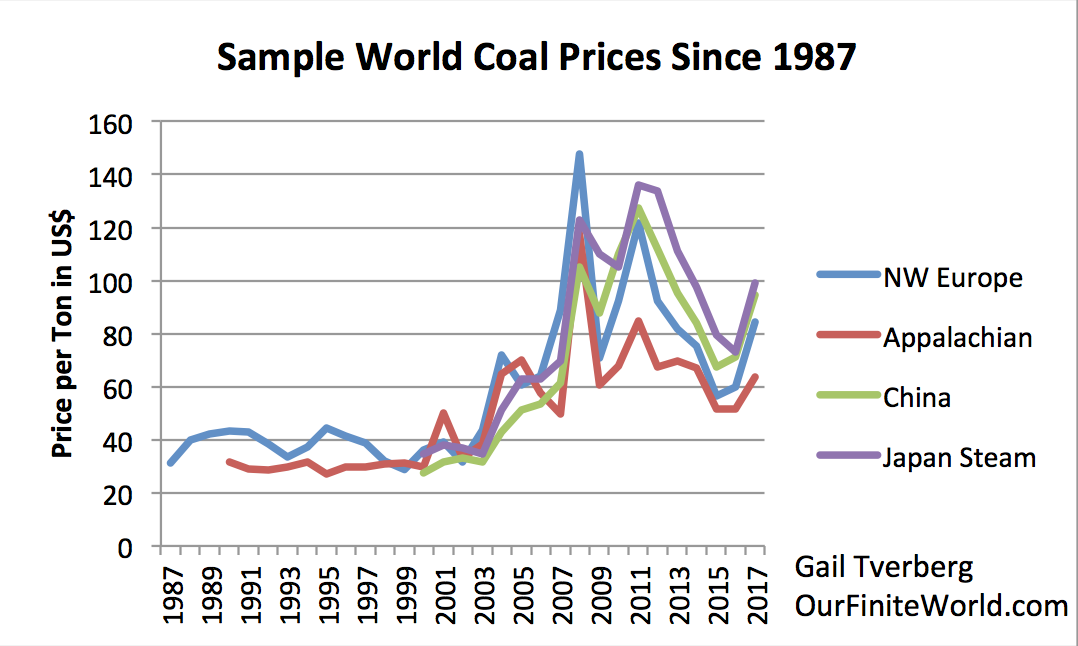

One thing that most people don’t realize is that coal prices follow a very similar pattern to those of oil.

Figure 6. Sample world coal prices, based on information from 2018 BP Statistical Review of World Energy.

In Figure 6, coal prices experience a major peak in 2008, followed by a lower peak in the 2011 period, which peters out by 2013. Prices recently are much lower than in the 2008 period, or in the 2011 to 2013 period. This pattern is very similar to the recent pattern in oil prices.

The similarity in the patterns of coal prices and oil prices makes perfect sense if prices of both oil and coal are based primarily on affordability, and this affordability depends heavily on the wages of non-elite workers. When countries, such as China, ramp up their debt, more non-elite workers can be hired at higher wages. These workers can make more computers, automobiles, steel ingots, and many other goods. They can also afford to buy more output of the world economy. This ramped up demand tends to raise the prices of both coal and oil.

For many commodities, China’s demand represents close to half of the world demand. China has become the world’s number one manufacturer of goods. China needs growing energy consumption to maintain its growth of manufactured goods because it takes energy to operate machines, even computers. It even takes energy to keep the lights on.

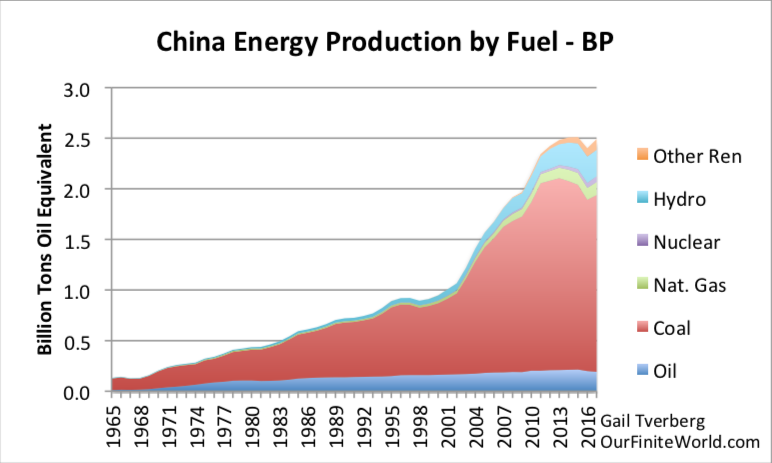

Unfortunately, with the recent lower prices for coal and oil, China is experiencing lower production of both coal and oil (Figure 7). Without growing energy supplies, China cannot meet the world’s growing need for manufactured goods.

Figure 7. China energy production by fuel, based on 2018 BP Statistical Review of World Energy data.

The reason why China has recently reduced production of both coal and oil is the usual one: the rising cost of production conflicts with the low prices available in the marketplace, making production unprofitable for a growing share of producers.

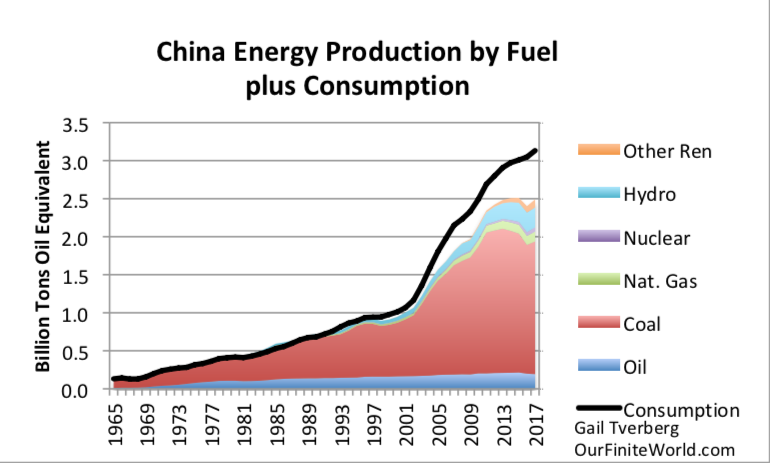

How about China’s total energy consumption? Do imports make up for China’s lack of local production?

Figure 8. China energy production by fuel, with a line added to indicated it total energy consumption, including imports. Based on BP Statistical Review of World Energy 2018 data.

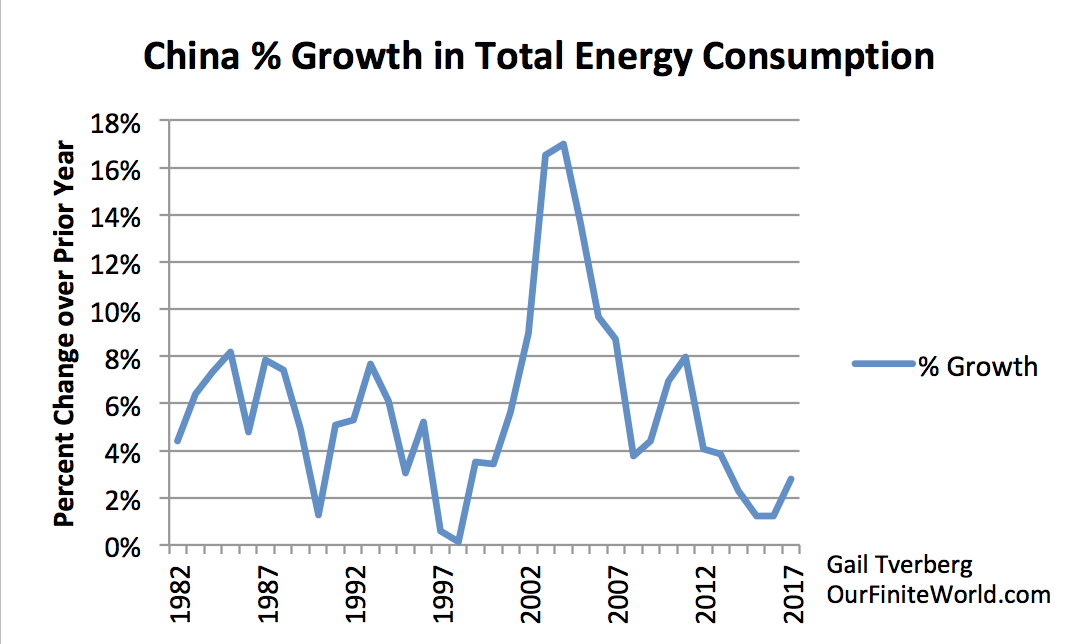

Not really. China is the world’s largest importer of coal, oil and natural gas. It is also the number one user of wind and solar (included in the tiny orange “Other Renewables” portion of the chart). Even with these huge additions to China’s energy production, its annual growth in the quantity of energy it consumes (including imports) has plummeted (Figure 9).

Figure 9. China annual growth in total energy consumption. Based on 2018 BP Statistical Review of World Energydata.

China reports that its real GDP growth rate is still very high (over 6%, net of inflation), but many observers are skeptical of this claim. Certainly, going forward, its coal and oil production cannot continue to decline, or the economy will encounter huge problems. The amount of goods China will be able to manufacture will fall, as will the number of new homes it can build. Without continued growth, China is likely to run into debt default problems. China is such a large country that its problems can be expected to adversely affect the world economy as a whole.

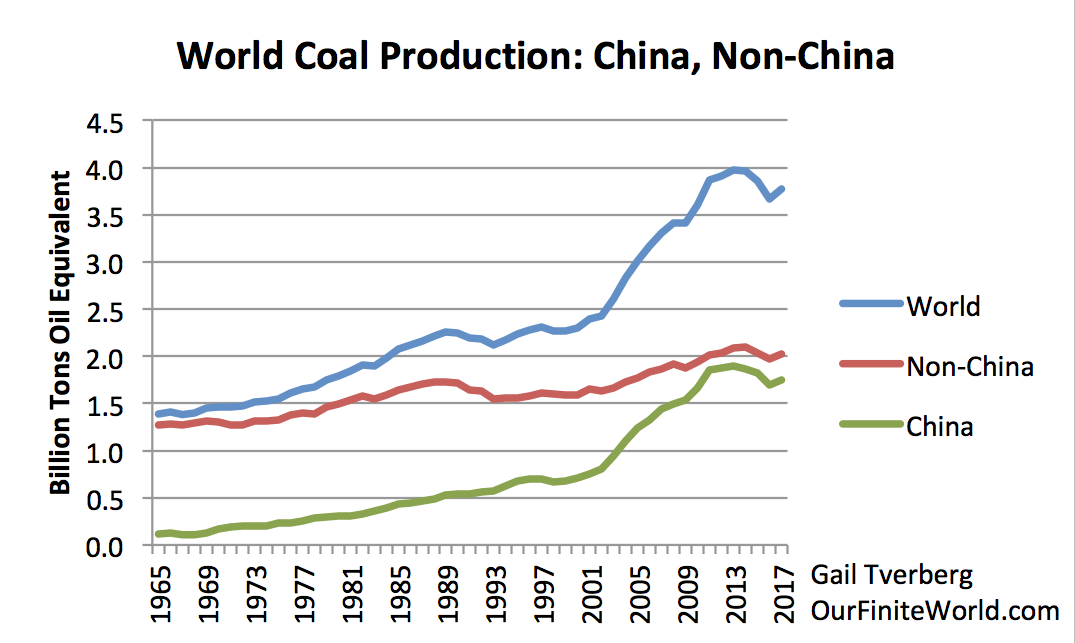

Figure 10 shows that China produces nearly half of the world’s total coal. If China’s coal production declines, world production is also likely to decline.

Figure 10. World coal production, divided into China and Non-China, based on 2018 BP Statistical Review of World Energy data.

The only way to prop up coal production, for either China or the rest of the world, is higher prices, indirectly coming from higher demand from non-elite workers. Businesses can perhaps use rising debt to hire these non-elite workers but, if there is not a sufficient supply of buyers who can afford the additional goods and services made by these workers, the final outcome will be debt defaults.

The Fundamental Problem Is a Physics Problem

The fundamental problem is that the economy grows for the same reason that hurricanes, ecosystems, stars, and plants and animals grow. They are dissipative structures that grow in the presence of energy flows. In the case of hurricanes, the energy comes from the heat in the warm ocean. In the case of the economy, the energy flows are of many different types, including (among others), human energy, energy of draft animals, solar energy, fossil fuels, and wind energy.

One key characteristic of dissipative structures is that they are not permanent. Permanent growth in a finite system is not possible. The laws of physics sets up the system in such a way that dissipative structures grow and eventually collapse. Over time, new dissipative structures form, each varying in a random way from previous dissipative structures. Those best adapted to the ever-changing circumstances tend to last the longest. This is the way that the evolution of economies takes place, just as the evolution of plants and animals takes place.

One characteristic of economies is that physics determines how much energy is needed to manufacture and transport a particular product. It also determines how much the mix of buyers can afford to pay for finished products using this energy. Thus, physics determines the potential profitability of a particular manufacturing process, with lower energy costs tending to make production more profitable. As energy costs rise because of diminishing returns, the system eventually reaches a point where it must collapse. The cost of production rises so high, relative to wages, that many non-elite workers cannot afford the finished goods and services made by the system.

The laws of physics also determine what wage distributions must look like, given the availability of energy and other resources. In general, if there are not enough resources to go around, some members of the economy tend to get “frozen out” by low wages. In addition, in a low-energy per capita situation, the energy that is available tends to rise to the top, to the high-earners of the economy, somewhat like heating water transforms it to its gas phase (steam), which rises to the top. With this structure, even with a severe energy shortfall, some members of the economy can be survivors.

With today’s worldwide economy, the survivors might be some humans and businesses within the world economy. The system would need to start over, building up smaller economies from pieces that managed to stay intact, but the system, as a whole, would not die out, unless the energy shortfall were to be severe.

Modeling the World Economy

One issue with academic research today is that it tends to be divided into many academic “silos.” Researchers tend to know more and more about their own field, but less and less about other fields that might be peripherally related. For example, economists tend not to keep up with the physics of self-organizing networked systems. Geophysicists understand the physics that governs the extraction of fuels, but they have no insight into the fact that the laws of physics might also affect prices and wage distributions.

Without understanding the forces that are causing the results that are being observed, it is very easy to create a model that is more misleading than helpful. For example, a simple model of the earth is the one each of us can see as we look around us.

Figure 11. Source: Edrawsoft.com

The model shown in Figure 11 is a flat map. This is a perfectly good representation of what the earth looks like, if a person is not concerned about what happens at a distance. Of course, to extend the map out, a person really needs to convert the model into a globe. A globe is a very different model.

Economic researchers tend to have some of the same modeling issues as illustrated by the flat map model. Economists favor fitting curves to past data to forecast the future patterns. Curve fitting tends not to be good for determining turning points. When dealing with energy and other resources, we are really interested in when a turning point will happen, forcing production of energy products and resources of many kinds downward.

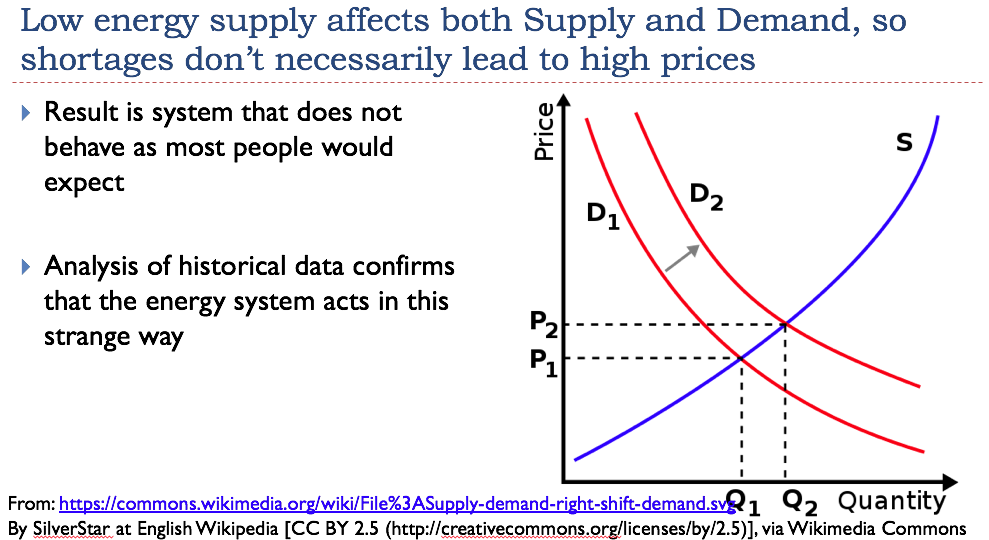

Another model favored by economists is the standard two-dimensional supply and demand model (Figure 12). This model ignores the special role that energy products play because of the operation of the laws of physics. Energy products, as they work through the networked economy, affect both the supply and demand of finished goods and services, making the two dimensional model shown inappropriate.

Figure 12. This standard model does not consider the special role energy plays in the economy under the laws of physics, so is not appropriate for energy products.

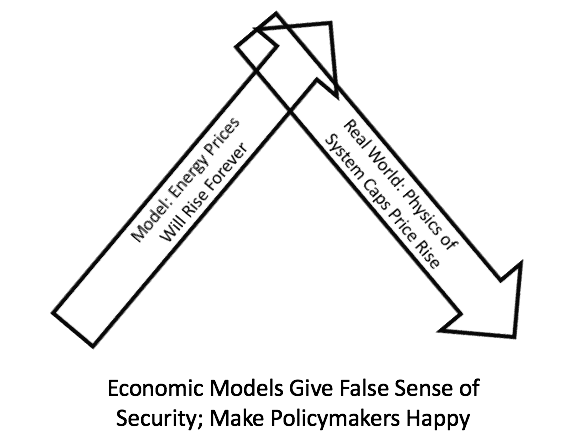

With neither curve fitting nor the standard supply and demand model sounding an alarm with respect to energy prices not being able to rise forever, economists have tended to overlook this issue.

Figure 13. Economic models tend to give a false sense of security because they forecast that the future will be a continuation of the past.

Of course, policymakers are happy to hear happily-ever-after endings. Few policymakers question the reasonableness of the models. They do not consider the possibility that the falling discretionary income of non-elite workers around the world might choke off demand for goods made with energy products.

Even geophysicists who have looked at the problem tend to get the story only half right. They understand underground physics, but they tend not to understand that prices cannot rise indefinitely. This is a different, related issue, also associated with the physics of the situation.

“Climate Change Is Our Biggest Problem” Is a Corollary to Bad Modeling

If a person truly believes that energy prices can and will rise forever, then it is an easy corollary to assume that all fossil fuels that we can identify within the earth’s crust will eventually become extractable. There are no limits except for the limits imposed by climate change.

Of course, if we are really hitting price limits here and now, the situation is likely to be very different. These price limits will cause a very near-term decline in energy supply, which we essentially have no control over. Financial systems are likely to collapse; international trade will be scaled way back; world population is likely to fall. CO2 levels will, in time, adjust to this radically changed world.

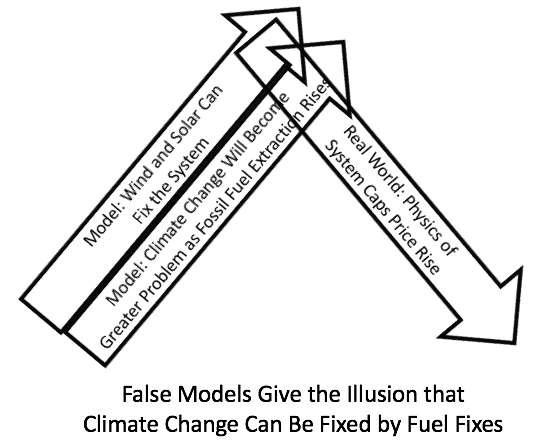

I showed earlier (in How the Peak Oil story could be “close,” but not quite right) that the models used to “prove” that wind and solar can be helpful to the system greatly overstate their benefit to the system. As a result, we don’t really have evidence that wind and solar are even helpful to the system.

Consequently, we really have two false models working together to give an illusion that we have a huge problem which is fixable, if we just exert enough effort. Physics puts a cap on our efforts, however. The physics of the system makes the system collapse before policymakers can hope to even make a small fix.

Figure 14. Two false models work together to give the illusion that climate change is the greatest problem that humans have and that we can fix the problem with fixes to the fuel system.

The unfortunate problem is that policymakers are not really in charge: the laws of physics are in charge. Energy and other resources are no longer inexpensive enough to extract to allow the system to work. The proposed solutions (wind and solar) are not cheap enough to save the system either. We can temporarily hide the problem with more debt (indirect promises of future energy) at lower interest rates, but this does not fix the system.

Conclusion

Many of the problems the world economy is facing today seem to be the result of reaching the limits of energy extraction. Very few researchers understand how a self-organized networked economy really operates. As a result, the symptoms of economic health and economic illness have been confused. It looks quite possible that we have reached both Peak Oil and Peak Coal, approximately simultaneously. This is a frightening situation, because it could be an indication of collapse in the next few years. This would likely be much worse than the Depression of the 1930s.

Of course, even with these observations, we do not know precisely what lies ahead. Somehow, multicellular animals have lived on this earth for a very long time. Amazing coincidences have happened and may continue to happen, allowing economies to flourish. We humans do not have as much control over the current situation as we would like to think that we have. Fortunately, we cannot rule out the possibility of more amazing coincidences, perhaps even caused by a literal Higher Power behind the energy flows. Thus, the result may be different from what our models seem to suggest.

if gail is correct, then it’s time to stop building nuclear plants. they can’t be run without daily deliveries of fossil-fuel-derived paints, solvents, tubing, cabling, casks, fork-lifts, pumps, piping and post-it notes.

Alas, at the Santa Fe Institute we are system theorists and take nearly everything into account and we use game theory as to what is possible and likely and we model it. More than that, the comment section is not the right forum. But a couple of remarks: The above post while interesting is far too simplistic. The use of energy by those other in the top 10% for transportation and heating and cooling is not based on discretion income, the spending on is mandatory. Peak in terms of actual supply including fracking, based on real reserves, not the lies told about reserves hit in 2007 in July. Globally Temps are all over the place but we are at 1.5° C. The Arctic is 6° C. If we stopped everything we’d hit 2° in 2050. Large cities in summer will have temps above 22° F their highest records to the heat island effect so forget about living there. It will take centuries, black swans included, to undo this. If by 2030 we haven’t reduce all further carbon emissions to zero, me must then stop the use of electricity and cars, trucks, buses, & planes. And learn to get on it with. These are absolute facts: updated & more accurate IPCC data.

That is frightening and I suppose your game theory says we will not manage to do anything meaningful by 2030?

I read Gail back in the days of theoildrum.com, and she’s always insightful (even if she merely hones/tweaks her general message).

With the economy being so complex and filled with perverse incentives it’s so hard to predict – and by that I mean how people react to these problems. At least in the USA it seems like it’s the Murphy’s Law of dumb ideas. Whatever is the worst – let’s do that. Currently that seems to be doing close to nothing – status quo.

I’m starting to hope that things like 150+ houses losing gas during the few days of the winter in Minnesota (local-ish to me – they recommended people lower the thermostat to 60 reduce the strain on the system) will finally be the wake-up call to start moving things in a more sustainable direction. Sadly I think it only would have been beneficial if those people had died. Will the deaths from the forest fires in CA have a beneficial affect? Hopefully such things will increase the rate of change from 1-2% to goal per year to 5%.

Will the deaths from forest fires in CA have a beneficial effect?

In my very interested and provincial view, as my house went up in smoke in Oct 2017, I have my doubts.

The local Northern California authorities are encouraging people to rebuild, with higher densities.

They have approved adding additional homes in the the path of the Oct 2017 fire by rezoning some commercial land for residential..

The state authorities are requiring some fire resistant building code upgrades, but a housing area in Ventura, CA built to these new code standards had a 50% burn-down rate in the Southern California wildfires..

But 50% is better than the 100% burned down on my street.

And the local business leaders brought in an Los Angeles economist to push the need for 20K to 30K homes to be added to those being rebuilt.

I suspect “beneficial effects” will arise not from government actions but from insurance companies unwilling to accept the risk to insure homes.

This could change the way homes are built or prevent them being built in some risky areas.

Right here, re Jonh Wright’s comment above, illustrates the fossilized thinking that leaders, zoning planners, builders, and insurance cos. in the main, hold. In his area, they all could be switching to earthen berm …. rammed earth, or cob construction as a way to reduce the disasterous effects of perennial wildfires .. but no, it’s back to stick-built, balloon-framed wood construction. Repeat after ea. conflagration !! Now I ask you .. how stupid is That !!

Another plus for the above construction techniques is, if sited correctly, they can take advantage of passive solar, living roof design as strategies to lower considerably, the occupant’s energy footprint while reducing considerably the fire danger. One would think it’d be a win-win-win for municipalities, the home owner .. or renter, and the insurance cos. But no, we collectively, stick to stupid policies because fossilized official mindsets .. propagandized plebians … and unimaginative insurance companies !

And this is but a tinsy twinsy fraction of the kinds of change we as a species need to make.

I agree,

the old cost ratio , in the sense the stick framed house was less expensive to build ;is the immediate cost.

But really the “green” thing to do it is to build in the way that makes the most sense in the long term. Comfort,energy efficiency,sustainability of the materials used, as well as sustainability of the homes maintenance and costs to operate, indefinitely.

And the real threats in our perspective regions should be dealt with in the building;

not after the fact.

Personally, I think it’s going to be a moneymaker…..for the construction industry. “green” isn’t about building disposable things. It will also open the door for new manufacturing. And the trick, I suppose; will be to keep the production of materials “in the plan”, as well.

Gails essays are always fascinating (and somewhat terrifying), but I’m not entirely sure I understand fully her point about renewables. It is certainly true to say that renewables can never replace the utility of coal, oil and gas as concentrated sources of power, but that is not the same thing as saying that they are useless to prevent an economic collapse caused by oil and coal peaking. There is a fundament difference between a thermal power plant or internal combustion engine that requires a constant flow of fossil fuel to keep running and, for example, a hydroelectric plant. Every week I pass a hydro plant built 90 years ago and still substantively the same structure as when it was built – even the turbines have not been replaced. Its been steadily producing 30MW on a more or less consistent basis (apart from during droughts) for that 90 years, and with minimal maintenance should keep going for another century.

My point is that while an economy based on renewables must be substantively smaller than one on fossil fuels, thats not the same as saying that it is a poorer economy. Sweden and Switzerland prosper despite using significantly less fossil fuel derived power than the US or Canada – they produce less than a third of the CO2 emissions. Nobody can seriously argue that those countries are ‘poorer’ by any reasonable measure.

Unless I’m misunderstanding her point (entirely possible), it seems that Gails model is itself a little simplistic as it fails to account for the possibility of adopting an economy into one less energy intensive and more service intensive, while being able to produce the amount of energy needed (not the same as that demanded) to ensure a reasonable quality of life for its population.

there’s a tautological quality to economics. it depends on what you count, and how you count it.

sure…as gail says…there’s fundamental physical limits to what we can do, and we’re fixin to learn all about acute limits to growth(the last 50 years have been preschool, with lots of Bargaining involved(paper growth))…but if 95% of bill gates’ wealth of ones and zeroes vanished overnight, that only really effects me because of the way the measurement is constructed….and because how we all are entangled with it.

I have no idea just how much of the CDO’s and other exotic financial instruments, and more mundane things like stocks, and even cash money…is actually real…nor what it’s worth in—say—bread and water…aside from what appears from down here to be arbitrary valuations, arrived at by the logic of the System, which may not be correlative to the logic of Mother Nature.

I suspise that economists don’t know either, once we look beneath the map for the actual terrain.

Would we even recognise it?

I agree with your view. Gail’s essay is excellent and IMO her best contribution is to help us understand the dynamics of oil and carbon prices embbebed in overall economic issues such as debt dynamics and, above all, worker disposable incomes. Another point I appreciate very much in this post in the integrative approach of different disciplines and I pretty much agree with the author in her section titled “Modelling the world economy” in which she explains how we arrive at bad modelling.

Where I disagree in in the notion of physics determining everything in economy from although I have yet to read her link on the Thermodynamics of Evolution that promises to be interesting. The economy, contrary to physics laws that may ultimately govern everything, is quite an arbitrary human issue and can behave apparently well beyond the laws of physics for significant periods of time. We can use her example on China, where Gail explicitly asserts that “many observers are quite skeptical” on current growth levels. If you ask an expert on debt dynamics like Pettis this is a consequence of debt fuelled growth and now -and for several years in a row- China’s debt fuelled growth is producing “bridges to nowhere”, and that is why such growth is not considered “real”. In Gail’s view this growth is not driven by bridges to nowhere but by energy imports substituting a decline in China where energy and raw material prices are too low to keep ever increasing production. Such growth has been flatening recently and too low commodity prices migth be the reason according to Gail’s view.

IMO, whay she fails to see is the connection between a rapid upsurge in fossil fuel consumption in China between 2000-2010 and a rise in the “bridges to nowhere” -and more- energy waste almost certainly associated with it. The gluts she describes in oil or coal are surely associated with increased energy waste in many forms. I am pretty sure the glut in Natural Gas production in the US is generating a lot of waste, being the most wasteful gas flaring, or even methane release. The moment the crisis arrives a lot of the reduction in energy production will occur in the form of less waste. There is nothing physical but human failure what drives those wastes. (You, PK, explained how the avidity for cash-flow improvements results in shale oil and gas overproduction).

When one looks at those graphics with such gross coal and oil contributions to the total, it is easily to come depressed if you believe that those tiny green, blue or orange contributions by renewables or nuclear should fully replace that of coal, oil or ntl. gas. Absolutely not. First, one should consider overall wastes embbeded in the system which are enormous. My guess is that more than half of coal primary energy consumptiom in China is waste. Even worse, much of renewable primary energy produced in China is also wasted due to poor planning. Somehow when we watch renewable energy we are more stringent on “details” like these but wastes involving fossil fuels must be of orders of magnitude larger. In fact, fossil fuels have allowed humans to waste energy in enormous amounts. This is particularly true if one expands the definition of waste to unnecesary consumptiom or the development of wasteful systems that consume energy.

As another example i will use Spain before and during the crisis. In 2007 Spain consumed 75 million tons of oil products and now consumes about 56 although a low of 54 was reached in the “worst” years.This means that we saw a 28% decline in oil consumptiom from the debt fuelled froth to the austerian lows in 2015. This was not accompanied by a 28% loss of production or GDP because most of it was reduced energy waste. During the peak, Spain was wasting enormous amounts of oil building houses as if all EU retirees were to come and live here (bridges to nowhere). The crisis reduced construction building to more sustainable levels although yet to high IMO.

Thanks, you make the point I was trying to make, but much better!

Your points on China are exactly right – a massive amount of Chinas emissions are simply waste and/or over production. For its own internal reasons China maintains an enormous amount of highly inefficient older plant in operation, even while it has invested in newer more efficient processing. Its just one example where enormous energy savings can be made with no discernible impact on peoples living standards (quite the opposite of course).

I do wish someone would whisper the words ‘Jobs Guarantee’ to Xi – imagine the rapid improvements in China if the government empowered local governments to let all the surplus capacity die, while absorbing the resulting labour surplus in more useful jobs than simply churning out more steel and cement.

Yes. You’d think Xi, of all people, would get that.

Efficiency is not a source of energy, and it certainly is not going to increase the resources of a finite planet.

Actually, thats exactly what efficiency is – its called negawatts in the literature. Increasing output from a given energy input is the very definition of productivity.

I think it is what Gail is talking about – but sounds opposite – that dissipation of energy is efficiency, and conservation. We just use the wrong geometric symbol. A Pyramid is so very pointy… it could launch eternal pyramid schemes. All that hubris. But a circle promotes a much slower dissipation of energy, maybe even a slow spiral. Dissipation in this sense is conservation, energy capture. I got the weird thought that dissipation, or diversity, into smaller units of energy capture isn’t just the power of evolution – it is also the thing we badly, and emotionally, define as “freedom.”

Increasing the output/productivity does not increase the amount of energy available. If all you have is a barrel of oil, increasing your energy efficiency from 10% to 100% is not going to magically produce any more oil.

No, but it would make the barrel of oil go ten times further or last ten times longer.

Water and Power, not necessarily in that order, are the keys to survival. Being a supporter of hydroelectric, I’ve always been enamored with NAWAPA, North American Water and Power Alliance, since learning about it in the late 60’s. It was deemed then a stretch too far politically, but it was hoped that in the future it would be seen as a tremendous opportunity. I could go on at length about how it could be retooled in light of today’s more advanced environmental management techniques to realize the immense benefits it promises. However, today’s political and faux environmental reality make me doubt it could ever be realized. So, I’m going to throw in with massive desalination tied to SMR power.

https://www.buzzfeednews.com/article/nijhuis/pipe-dreams-the-forgotten-project-that-could-have-saved-amer

https://ucanr.edu/repository/fileaccess.cfm?article=164087&p=MCJMUU

hydroelectric, destroys habits, which means food. Renewables need to be able to make renewables and not depending on a dead economy to do so.

There is nothing “faux” about the eco-destruction to be wrought through NAWAPA. Also, it involves stealing vast amounts of Canadian water ( and maybe Northwest American water too) and sending it to the Subsidy Sunbelt. Canadians might get nationalistically defensive about their rivers and water and salmon and etc. And so might Oregonians, Washingtonians and Northern Californians.

I believe her point is that the Energy Return on Investment (EROI) of renewable sources is so far not large enough to support a complex economy. I’ve seen elsewhere that the estimated EROI of ancient Rome was about the same as estimates of contemporary solar and wind plants. As I ask the few people with whom I can broach this topic, what’s more likely, that we’re all driving our electric vehicles powered by solar plants (i.e., still living in a complex, technological, economy), or slave-based agriculture?

Interesting post, but as others have commented, not sure what conclusion the author is presenting. I’d also argue that the cost/price for fossil fuels is entirely a human construction, like every other price assigned to physical goods, they are a value judgement. Values can be changed.

In regard to climate change, total emissions have continued to rise, with 2018 estimated to be another record year. Granted, not all emissions are from fossil fuels, but there tend to be correlations across sectors (more “modern” agriculture = more fuel burned).

https://www.theguardian.com/environment/2018/dec/05/brutal-news-global-carbon-emissions-jump-to-all-time-high-in-2018

Is supply and demand the only thing affecting the price of energy or any commodity?

Nope.

And people are more captured by all of those things (nothing natural about them) than globe trotting corps.

Greed a big factor. Choice another.

Interesting. Similar to the MMT argument cutting through layers of abstraction to the fundamental constraints, not dollars or euros but EROI. And the collapse and reformation of dissipative systems should sound familiar to anyone familiar with Michael Greer’s view of catabolic collapse.

I can imagine some of the takeaways from this post being cherry-picked and appropriated for more sinister ends. IOW “low wages are good for the environment because they reduce the demand for fossil fuels” could be the rallying cry for capital as it rebrands exploitative labour practices into virtues and makes them more palatable to the serfs. With much PR tinkering the core messaging will be refined with low wages now being called “responsible wages” and corporate slogans proudly brandishing the “wages that save the planet” meme.

Yes, but this immiseration of the proletariat is exactly what will also bring down the elites. An elite has to be an elite of something, or it’s not much of an elite any more. The 1% need the immediate services of the 9%; the 9% need the services, or at least the existence, of the 90%. That’s why the 1% or the .01% are not going to fly off to some paradise in interplanetary space or remote hideouts in the desert: most of them would wind up as servants or slaves. It won’t matter what propaganda is used.

I have the idea that some people will say, ‘But robots and AI.’ AI which is intelligent enough to actually replace the 9% or the 90% will have to be intelligent enough to pursue its own ends autonomously, which may be incomprehensible, unpredictable, and thus very dangerous to those who set it in motion. Machines embody the purposes of those who make them, so we must expect them to act accordingly. It will take only a minor catastrophe or two to reveal what should have been obvious.

Just as the man said: socialism or barbarism.

Perhaps, but did you see all those dandy pharmaceuticals decorating the suite in yesterday’s:

Guillotine Watch

Look Inside Damien Hirst’s $100,000-per-Night Suite in Las Vegas Bloomberg

tools to suggest… Loving their enslavement -?

Hirst’s $100,000-per-Night Suite in Vegas

Fine … it will be grist for the mill of the future Ruin Men .. And, if water ceases to flow, then that will be the case all the sooner for the relics of Sin and Hedonism !! Eventually, Every metropolis will be ripe for the harvesting.

Once again, the NC commentariat here have helped clarify things to the point that I’m not completely lost. Thank you all for that.

I think that people often mistake the fact that Gail bends over backwards at times to de-hyperbolize her subject matter as indicative of the fact that she reaches no definitive conclusions. Then I stop to imagine how someone like Jim Kunstler, among others for example, might have put the following in somewhat more emphatic terms:

“Consequently, we really have two false models working together to give an illusion that we have a huge problem which is fixable, if we just exert enough effort. Physics puts a cap on our efforts, however. The physics of the system makes the system collapse before policymakers can hope to even make a small fix.

The unfortunate problem is that policymakers are not really in charge: the laws of physics are in charge. Energy and other resources are no longer inexpensive enough to extract to allow the system to work. The proposed solutions (wind and solar) are not cheap enough to save the system either. We can temporarily hide the problem with more debt (indirect promises of future energy) at lower interest rates, but this does not fix the system.

Conclusion

Many of the problems the world economy is facing today seem to be the result of reaching the limits of energy extraction. Very few researchers understand how a self-organized networked economy really operates. As a result, the symptoms of economic health and economic illness have been confused. It looks quite possible that we have reached both Peak Oil and Peak Coal, approximately simultaneously. This is a frightening situation, because it could be an indication of collapse in the next few years. This would likely be much worse than the Depression of the 1930s.”

Sounds pretty darn conclusive to me.

Regarding peak coal specifically.

We have certainly not reached the point of declining availability for thermal coal, in the sense of the remaining reserves being meaningfully more expensive. Coal use has declined because of a combination of intentional policies and reduced rate of economic growth. (thinking especially of China). In the US, natgas happens to be cheaper due to the cost of transporting coal (3-4 cents per ton per mile), which dominates most places.

Something like 10-20% of world coal production is used for metallurgy, and this material has considerable value for its purity, and is arguably a diminishing resource. This is the stuff that they dig deep holes underground to get to.

The rest is thermal coal, increasingly mined from the surface (i.e. dirt cheap extraction process), and costs less at the point of extraction than what will be spent to transport it across continental distances. Unless something changed since 2010 or so when I was last deeply into this, I’m pretty certain that cost of extraction and access to reserves are simply not the rate limiting step for global use.

Without an effort made to bring down the cost of alternative energy sources, thermal coal use could easily continue for a hundred years – obviously a really bad climate scenario. I don’t think the extraction economics is a favorable factor in this case.

This article is totally exasperating. She is using the halo effect[1]. She invokes the word “physics” as an attempt to give her argument more credibility. It’s no better than spiritualists who use the justification “because quantum physics” to explain their mysticism.

Physics is one of the only–perhaps the only–disciplines that can or should be explained with mathematics. Calculus was invented to describe properties observed in the physical world. Once calculus was invented, it allowed scientists to make predictions about the world. The predictions were falsifiable, and many of those predictions ended up being verified.

Economics is nothing like physics, and it’s ridiculous to invoke the comparison.

She also uses the words “because” and “tends to” as though her discussion has some predictive quality. This is the narrative fallacy. She is taking facts that seem to exist and weaving a story around them.

Because of these fallacies, I can’t take anything she says seriously.

[1] Please read The Black Swan and Thinking Fast and Slow.

What interested me in the article was its description of the dependence of the high (the 1%) upon the low (the 90%). As the high damages the low, it damages itself — not in some abstract moral or aesthetic way, but literally and materially. As capitalists and warlords damage the people, they sink down themselves. As the capitalists, warlords, and people damage the global systems they are embedded in, they also sink down. The idea accords with such as the Tao Te Ching and my own observations of daily life, so I tend to believe in it. Can the destroyers turn aside? The Book of Changes says: ‘Waiting in blood. Get out of the pit.’ What an optimist!

The Optimates do tend to win, until total collapse arrives, which can be long – nothing then goes to the Populares.

They don’t mind sinking down as long as they remain at the top relatively speaking. Meaning . . . as long as they can sink everyone else down lower and worse.

I agree with the comments of James and Katy above. I have read some of Gail’s work covering Peak Oil and Peak Coal on energy and climate change blogs. On those same blogs I have read criticism and counter arguments of Gail’s work similar to that other commenters here have stated.

My own view is similar to Katy’s and others in that Gail seems to go around in circles or what Katy defines as the “halo effect”. I try to read Gail’s work and just end up coming away frustrated.

===This is a frightening situation, because it could be an indication of collapse in the next few years. This would likely be much worse than the Depression of the 1930s.====

To me that is just being extremely hyperbolic and statements like that serve no useful purpose. Gail makes statements like that but when you read her argument it is very underwhelming and not convincing at all. It reminds me of Lambert’s post yesterday on “Climate Change Mobilization: To Fear, or Not to Fear?”

I have read much of Jeremy Grantham’s writing on climate change and commodities and his concern is not Peak Oil or Coal but his primary commodity worries are food and water.

The pdf below is a paper by Jeremy Grantham on resources such as oil, water, food, etc.

https://davidruyet.files.wordpress.com/2011/08/jgletter_resourcelimitations2_2q11.pdf

Thanks for the link and mention of Jeremy Grantham. The list of problems on the referenced paper seems comprehensive.

One has to ask – what ‘system’ are we trying to fix? If it is one governed solely by ‘the market’, i.e. by prices and profitability, then Gail’s argument is difficult to dispute. But if the focus is changed to the production of ‘use values’, as opposed to profit for producers, her argument becomes more problematic. Like many authors with a grasp of system theory, Gail seems to assume basic components of ‘the system’, e.g. the production of life’s necessities controlled by prices and profitability, are a given. Western economies are indeed dissipative structures. Their energy requirements have been allowed to grow far beyond those that would be required to supply at least the basic physical necessities and use values required to provide the comforts to which the West’s “non-elite workers” have become accustomed. ‘planned obsolescence, military Keynesianism, etc. sustain finance capitalism and the money games people like Trump play with each other – NOT the real economy.

Which brings us to an analogy that might earn her a place in history right up there with Thomas Malthus:

The use of the phrase “high-earners”, in view of what we have learned about the operations of finance capitalism since 2008, is to say the least highly problematic.

To me, the remarkable 100-year Figure 2 (trends of top earners returning to pre-Depression levels) clearly shows the drop following FDR-era Bankster regulation, and the reversal (around 1973) trending back up to gross inequality very likely strongly linked to the 1973 initiation and later digital development of modern financial derivatives — which inevitably, corruptly contracted in the #BadMath #BlackSwan debacle — but which continues under ill-advised Deregulation of #TBTF, #TBTJ #Banksters.

It took me a couple of hours of reviewing the basics of EROEI and energy reserves to finally understand what the author is saying.

If peak coal has been reached it is not logical to regard it the same as peak oil. Maximum EROEI of oil was reached several decades ago, yet production continuously increased until it has apparently has or will peak about now. Coal, unlike oil, has not even reached it’s maximum EROEI (source https://medium.com/insurge-intelligence/the-new-economic-science-of-capitalisms-slow-burn-energy-collapse-d07344fab6be ). In other words coal is abundant and the cost of extraction has not been increasing. The viability of coal for electrical and industrial use has not declined as far as I understand it.That is fundamentally different than oil.

If peak coal has been reached than it would have to be for a completely different reason than oil’s peak. The author’s explanation of how peak oil would be manifested by economic decline is logical. That is exactly what I was taught in college 15 years ago. That economic decline certainly could cause coal consumption to peak.

In the conclusion it states it is frightening oil and coal have peaked together. That is wildly misleading. Worldwide energy use by TWh/y for oil exceeds that of coal (source https://en.wikipedia.org/wiki/World_energy_consumption#cite_note-BP-Review-2013-1 ). Coal reserves are approximately triple that of oil ( source https://www.ecotricity.co.uk/our-green-energy/energy-independence/the-end-of-fossil-fuels). From one of the above links it shows maximum EROI of oil was around 1950 and now about 70 years later we appear to be at peak oil production. As stated above it is believed maximum EROI of coal has not been reached. Lumping oil’s and coal’s situation together and implying it is at the same place is inappropriate.

The sentence after the author mentions simultaneous peak oil and coal they state it could be an indication of a collapse in the next few years. The argument is reasonable for oil, it is not so for coal. Well established facts contradict it. If coal follows oil’s pattern then the affordability of coal, a trend estimated by EROI, will decrease until a threshold is reached where it will affect the economy and society at large. It will happen someday. It is not happening now.

Have you seen any coal powered haul trucks or jet liners?

Have we already passed Peak Oil and Peak Coal? The concept of a peak for a resource bears no simple relation to the supply of and demand for that resource. The notion that on reaching the peak for a resource there will be a continuous increase in the price for that resource would seem false on its face — if demand for the commodity is discretionary. To further complicate predicting price it seems true on its face that producers costs tend to rise over time as their resource plays out and assuming no new technologies are invented to reduce the producers costs. Add to these assumptions the observation that discretionary spending declines as the consumer’s income declines and expenses increase. Both supply and demand are ‘squishy’. I think Gail Tverberg can rest her case for demonstrating that the peak for a resource alone is not sufficient to infer a price increase for that resource and also that a price increase is not sufficient to infer peak for a resource. Of course these arguments don’t address the title question and I suspect that as demand for oil grows less ‘discretionary’ — such as when trucks, trains, and ships run short of diesel for carrying vital goods like food — prices for oil will rise.

But continuing on … I believe the arguments get a little wobbly. I’m all right with the idea that ordinary consumers make up the largest component of aggregate demand for of everyday goods and services. I can also go along with the idea that the costs for producing a good tend to increase as the prices for the resource used to produce that good increase. But I cannot grasp how the price drops for oil and coal suggest the peak in world oil production likely occurred in 2018. The price changes can just as easily be explained by the decline in aggregate demand that followed the financial collapse of 2008 and the lack of government policy actions to bolster demand. I still think Peak Oil occurred around middle of the last decade as Science Magazine suggests [“Peak Oil Production May Already Be Here”, 25 Mar 2011, Vol. 331, Issue 6024, pp. 1510-1511].

Examining the relationship between economic production and energy use I think the assertion that the economy is a dissipative structure hits at the heart of the energy problem whether we’ve already passed Peak Oil or not. Baring the invention of some wonderful new technology there is only a finite amount of fossil fuel energy. We have built our civilization on the profligate consumption of energy and when that energy is used up there is no new supply. [I believe wind and solar energy might provide an energy floor which might be some help — but that’s all. And please! Physics is not the magic word.]

How will our world end? Will it end with a bang or a whimper? Peak Oil and Climate Chaos are up in the running but there are so many choices for which of many fragilities might initiate the collapse of our civilization and we can choose more than one like dim sum.