Yves here. I have more quibbles with Tverberg’s latest post on the future of fossil fuels than I generally do with her work. First, she discussion the correlation between energy use and economic activity, and then is fuzzy regarding causality in not a good way. Second, she provides some very good data on the current levels of renewable energy production, and then argues for a linear projection of present growth rates. You could make much more aggressive assumptions and her conclusion would still hold.

By Gail Tverberg, an actuary interested in finite world issues – oil depletion, natural gas depletion, water shortages, and climate change. Originally published at Our Finite World

One of the great misconceptions of our time is the belief that we can move away from fossil fuels if we make suitable choices on fuels. In one view, we can make the transition to a low-energy economy powered by wind, water, and solar. In other versions, we might include some other energy sources, such as biofuels or nuclear, but the story is not very different.

The problem is the same regardless of what lower bound a person chooses: our economy is way too dependent on consuming an amount of energy that grows with each added human participant in the economy. This added energy is necessary because each person needs food, transportation, housing, and clothing, all of which are dependent upon energy consumption. The economy operates under the laws of physics, and history shows disturbing outcomes if energy consumption per capita declines.

There are a number of issues:

- The impact of alternative energy sources is smaller than commonly believed.

- When countries have reduced their energy consumption per capita by significant amounts, the results have been very unsatisfactory.

- Energy consumption plays a bigger role in our lives than most of us imagine.

- It seems likely that fossil fuels will leave us before we can leave them.

- The timing of when fossil fuels will leave us seems to depend on when central banks lose their ability to stimulate the economy through lower interest rates.

- If fossil fuels leave us, the result could be the collapse of financial systems and governments.

[1] Wind, water and solar provide only a small share of energy consumption today; any transition to the use of renewables alone would have huge repercussions.

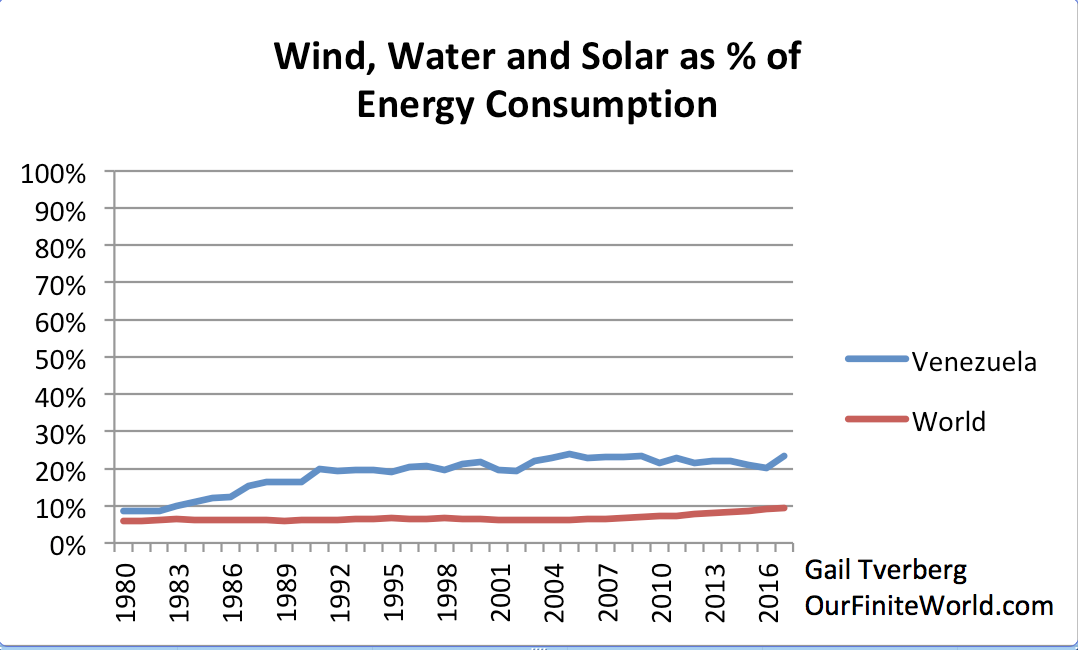

According to BP 2018 Statistical Review of World Energy data, wind, water and solar only accounted for 9.4% 0f total energy consumption in 2017.

Figure 1. Wind, Water and Solar as a percentage of total energy consumption, based on BP 2018 Statistical Review of World Energy.

Even if we make the assumption that these types of energy consumption will continue to achieve the same percentage increases as they have achieved in the last 10 years, it will still take 20 more years for wind, water, and solar to reach 20% of total energy consumption.

Thus, even in 20 years, the world would need to reduce energy consumption by 80% in order to operate the economy on wind, water and solar alone. To get down to today’s level of energy production provided by wind, water and solar, we would need to reduce energy consumption by 90%.

[2] Venezuela’s example (Figure 1, above) illustrates that even if a country has an above average contribution of renewables, plus significant oil reserves, it can still have major problems.

One point people miss is that having a large share of renewables doesn’t necessarily mean that the lights will stay on. A major issue is the need for long distance transmission lines to transport the renewable electricity from where it is generated to where it is to be used. These lines must constantly be maintained. Maintenance of electrical transmission lines has been an issue in both Venezuela’s electrical outages and in California’s recent fires attributed to the utility PG&E.

There is also the issue of variability of wind, water and solar energy. (Note the year-to-year variability indicated in the Venezuela line in Figure 1.) A country cannot really depend on its full amount of wind, water, and solar unless it has a truly huge amount of electrical storage: enough to last from season-to-season and year-to-year. Alternatively, an extraordinarily large quantity of long-distance transmission lines, plus the ability to maintain these lines for the long term, would seem to be required.

[3] When individual countries have experienced cutbacks in their energy consumption per capita, the effects have generally been extremely disruptive, even with cutbacks far more modest than the target level of 80% to 90% that we would need to get off fossil fuels.

Notice that in these analyses, we are looking at “energy consumption per capita.” This calculation takes the total consumption of all kinds of energy (including oil, coal, natural gas, biofuels, nuclear, hydroelectric, and renewables) and divides it by the population.

Energy consumption per capita depends to a significant extent on what citizens within a given economy can afford. It also depends on the extent of industrialization of an economy. If a major portion of industrial jobs are sent to China and India and only service jobs are retained, energy consumption per capita can be expected to fall. This happens partly because local companies no longer need to use as many energy products. Additionally, workers find mostly service jobs available; these jobs pay enough less that workers must cut back on buying goods such as homes and cars, reducing their energy consumption.

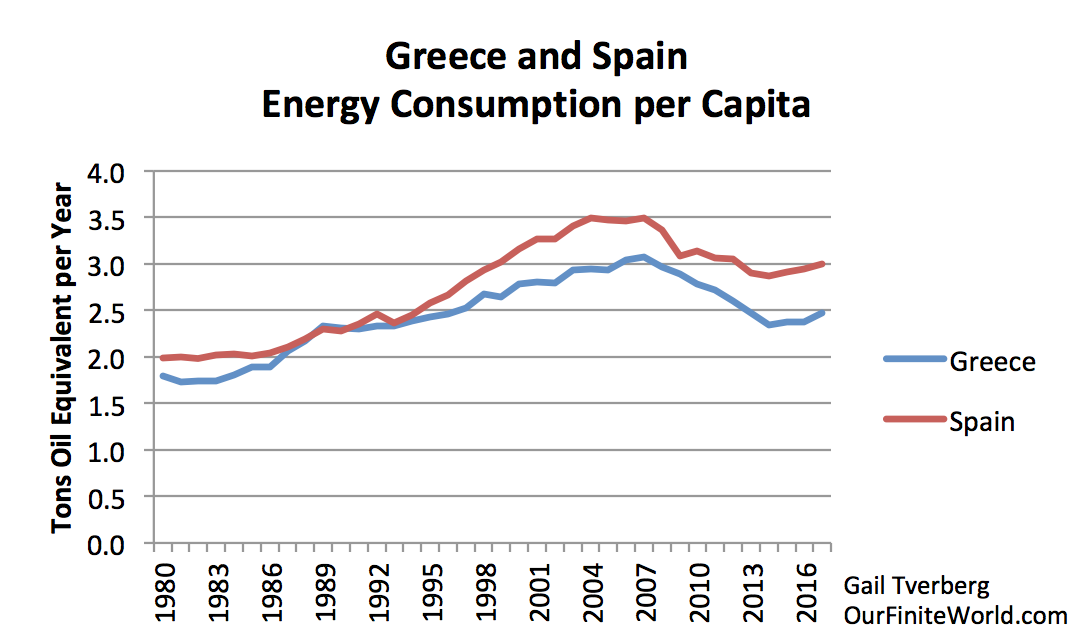

Example 1. Spain and Greece Between 2007-2014

Figure 2. Greece and Spain energy consumption per capita. Energy data is from BP 2018 Statistical Review of World Energy; population estimates are UN 2017 population estimates.

The period between 2007 and 2014 was a period when oil prices tended to be very high. Both Greece and Spain are very dependent on oil because of their sizable tourist industries. Higher oil prices made the tourism services these countries sold more expensive for their consumers. In both countries, energy consumption per capita started falling in 2008 and continued to fall until 2014, when oil prices began falling. Spain’s energy consumption per capita fell by 18% between 2007 and 2014; Greece’s fell by 24% over the same period.

Both Greece and Spain experienced high unemployment rates, and both have needed debt bailouts to keep their financial systems operating. Austerity measures were forced on Greece. The effects on the economies of these countries were severe. Regarding Spain, Wikipedia has a section called, “2008 to 2014 Spanish financial crisis,” suggesting that the loss of energy consumption per capita was highly correlated with the country’s financial crisis.

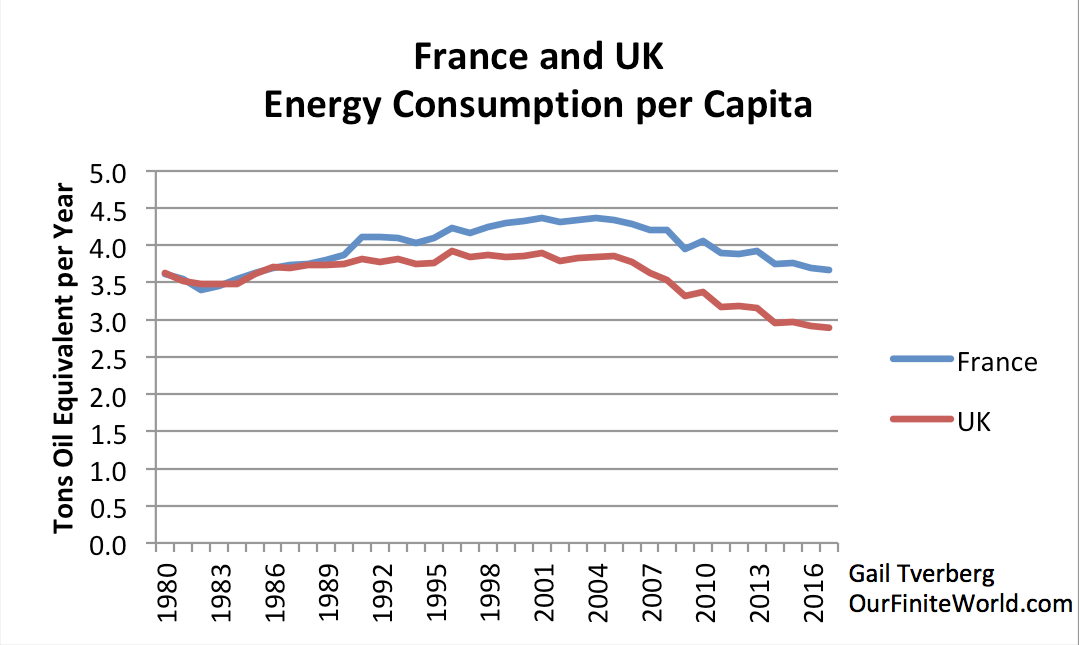

Example 2: France and the UK, 2004 – 2017

Both France and the UK have experienced falling energy consumption per capita since 2004, as oil production dropped (UK) and as industrialization was shifted to countries with a cheaper total cost of labor and fuel. Immigrant labor was added, as well, to better compete with the cost structures of the countries that France and the UK were competing against. With the new mix of workers and jobs, the quantity of goods and services that these workers could afford (per capita) has been falling.

Figure 3. France and UK energy consumption per capita. Energy data is from BP 2018 Statistical Review of World Energy; population estimates are UN 2017 population estimates.

Comparing 2017 to 2004, energy consumption per capita is down 16% for France and 25% in the UK. Many UK citizens have been very unhappy, wanting to leave the European Union.

France recently has been experiencing “Yellow Vest” protests, at least partly related to an increase in carbon taxes. Higher carbon taxes would make energy-based goods and services less affordable. This would likely reduce France’s energy consumption per capita even further. French citizens with their protests are clearly not happy about how they are being affected by these changes.

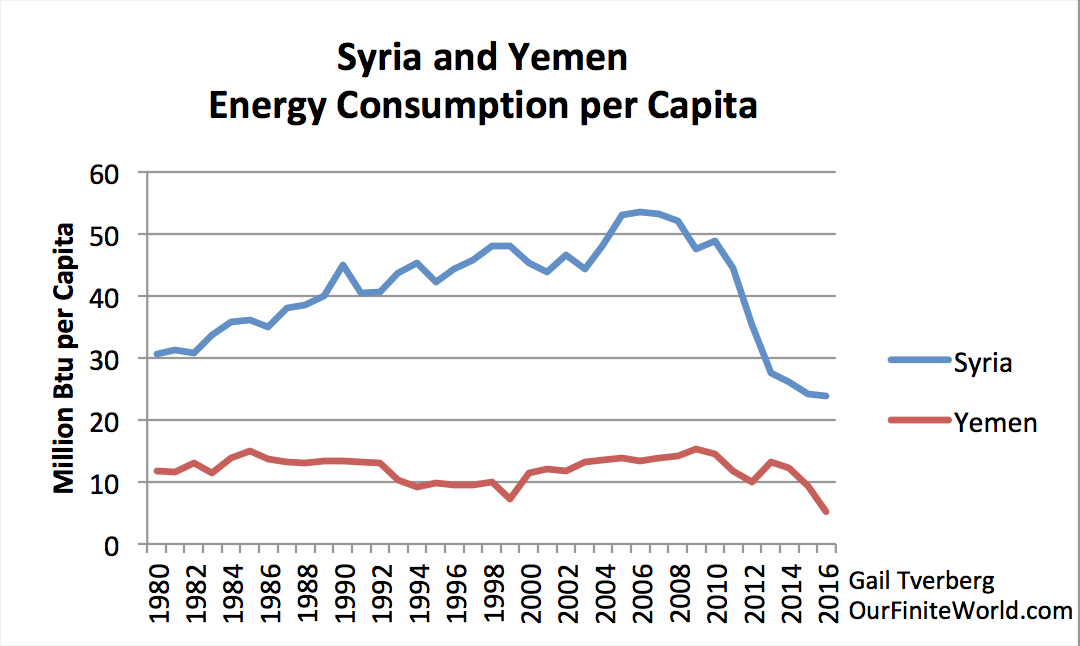

Example 3: Syria (2006-2016) and Yemen (2009-2016)

Both Syria and Yemen are examples of formerly oil-exporting countries that are far past their peak production. Declining energy consumption per capita has been forced on both countries because, with their oil exports falling, the countries can no longer afford to use as much energy as they did in the past for previous uses, such as irrigation. If less irrigation is used, food production and jobs are lost. (Syria and Yemen)

Figure 4. Syria and Yemen energy consumption per capita. Energy consumption data from US Energy Information Administration; population estimates are UN 2017 estimates.

Between Yemen’s peak year in energy consumption per capita (2009) and the last year shown (2016), its energy consumption per capita dropped by 66%. Yemen has been named by the United Nations as the country with the “world’s worst humanitarian crisis.” Yemen cannot provide adequate food and water for its citizens. Yemen is involved in a civil war that others have entered into as well. I would describe the war as being at least partly a resource war.

The situation with Syria similar. Syria’s energy consumption per capita declined 55% between its peak year (2006) and the last year available (2016). Syria is also involved in a civil war that has been entered into by others. Here again, the issue seems to be inadequate resources per capita; war participants are to some extent fighting over the limited resources that are available.

Example 4: Venezuela (2008-2017)

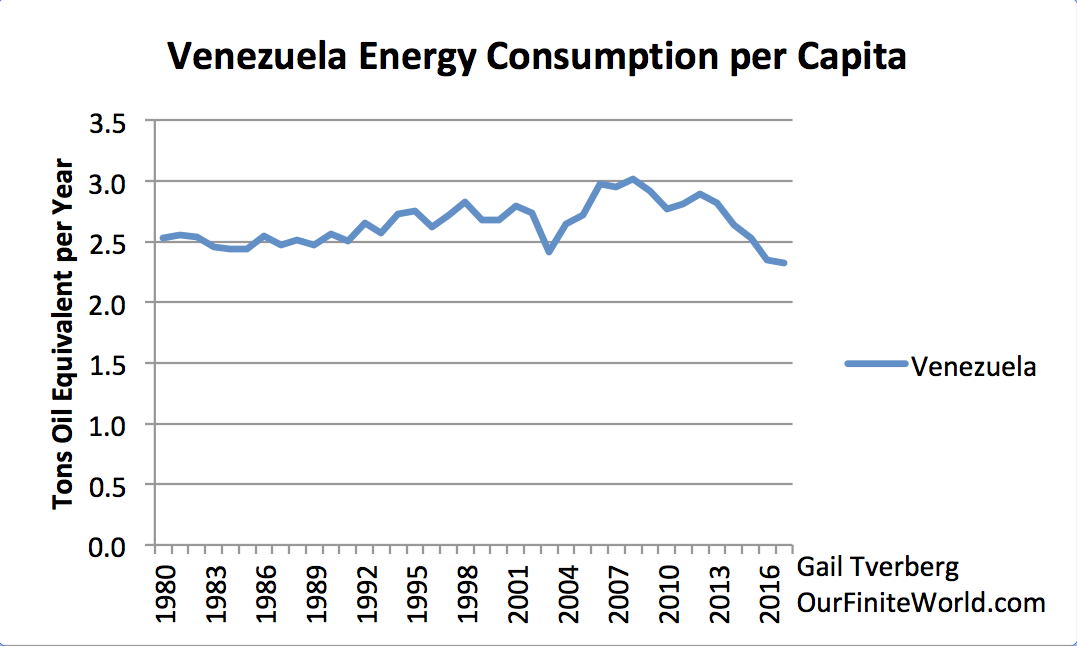

Figure 5. Energy consumption per capita for Venezuela, based on BP 2018 Statistical Review of World Energy data and UN 2017 population estimates.

Between 2008 and 2017, energy consumption per capita in Venezuela declined by 23%. This is a little less than the decreases experienced by the UK and Greece during their periods of decline.

Even with this level of decline, Venezuela has been having difficulty providing adequate services to its citizens. There have been reports of empty supermarket shelves. Venezuela has not been able to maintain its electrical system properly, leading to many outages.

[4] Most people are surprised to learn that energy is required for every part of the economy. When adequate energy is not available, an economy is likely to first shrink back in recession; eventually, it may collapse entirely.

Physics tells us that energy consumption in a thermodynamically open system enables all kinds of “complexity.” Energy consumption enables specialization and hierarchical organizations. For example, growing energy consumption enables the organizations and supply lines needed to manufacture computers and other high-tech goods. Of course, energy consumption also enables what we think of as typical energy uses: the transportation of goods, the smelting of metals, the heating and air-conditioning of buildings, and the construction of roads. Energy is even required to allow pixels to appear on a computer screen.

Pre-humans learned to control fire over one million years ago. The burning of biomass was a tool that could be used for many purposes, including keeping warm in colder climates, frightening away predators, and creating better tools. Perhaps its most important use was to permit food to be cooked, because cooking increases food’s nutritional availability. Cooked food seems to have been important in allowing the brains of humans to grow bigger at the same time that teeth, jaws and guts could shrink compared to those of ancestors. Humans today need to be able to continue to cook part of their food to have a reasonable chance of survival.

Any kind of governmental organization requires energy. Having a single leader takes the least energy, especially if the leader can continue to perform his non-leadership duties. Any kind of added governmental service (such as roads or schools) requires energy. Having elected leaders who vote on decisions takes more energy than having a king with a few high-level aides. Having multiple layers of government takes energy. Each new intergovernmental organization requires energy to fly its officials around and implement its programs.

International trade clearly requires energy consumption. In fact, pretty much every activity of businesses requires energy consumption.

Needless to say, the study of science or of medicine requires energy consumption, because without significant energy consumption to leverage human energy, nearly every person must be a subsistence level farmer, with little time to study or to take time off from farming to write (or even read) books. Of course, manufacturing medicines and test tubes requires energy, as does creating sterile environments.

We think of the many parts of the economy as requiring money, but it is really the physical goods and services that money can buy, and the energy that makes these goods and services possible, that are important. These goods and services depend to a very large extent on the supply of energy being consumed at a given point in time–for example, the amount of electricity being delivered to customers and the amount of gasoline and diesel being sold. Supply chains are very dependent on each part of the system being available when needed. If one part is missing, long delays and eventually collapse can occur.

[5] If the supply of energy to an economy is reduced for any reason, the result tends to be very disruptive, as shown in the examples given in Section [3], above.

When an economy doesn’t have enough energy, its self-organizing feature starts eliminating pieces of the economic system that it cannot support. The financial system tends to be very vulnerable because without adequate economic growth, it becomes very difficult for borrowers to repay debt with interest. This was part of the problem that Greece and Spain had in the period when their energy consumption per capita declined. A person wonders what would have happened to these countries without bailouts from the European Union and others.

Another part that is very vulnerable is governmental organizations, especially the higher layers of government that were added last. In 1991, the Soviet Union’s central government was lost, leaving the governments of the 15 republics that were part of the Soviet Union. As energy consumption per capita declines, the European Union would seem to be very vulnerable. Other international organizations, such as the World Trade Organization and the International Monetary Fund, would seem to be vulnerable, as well.

The electrical system is very complex. It seems to be easily disrupted if there is a material decrease in energy consumption per capita because maintenance of the system becomes difficult.

If energy consumption per capita falls dramatically, many changes that don’t seem directly energy-related can be expected. For example, the roles of men and women are likely to change. Without modern medical care, women will likely need to become of the mothers of several children in order that an average of two can survive long enough to raise their own children. Men will be valued for the heavy manual labor that they can perform. Today’s view of the equality of the sexes is likely to disappear because sex differences will become much more important in a low-energy world.

Needless to say, other aspects of a low-energy economy might be very different as well. For example, one very low-energy type of economic system is a “gift economy.” In such an economy, the status of each individual is determined by the amount that that person can give away. Anything a person obtains must automatically be shared with the local group or the individual will be expelled from the group. In an economy with very low complexity, this kind of economy seems to work. A gift economy doesn’t require money or debt!

[6] Most people assume that moving away from fossil fuels is something we can choose to do with whatever timing we would like. I would argue that we are not in charge of the process. Instead, fossil fuels will leave us when we lose the ability to reduce interest rates sufficiently to keep oil and other fossil fuel prices high enough for energy producers.

Something that may seem strange to those who do not follow the issue is the fact that oil (and other energy prices) seem to be very much influenced by interest rates and the level of debt. In general, the lower the interest rate, the more affordable high-priced goods such as factories, homes, and automobiles become, and the higher commodity prices of all kinds can be. “Demand” increases with falling interest rates, causing energy prices of all types to rise.

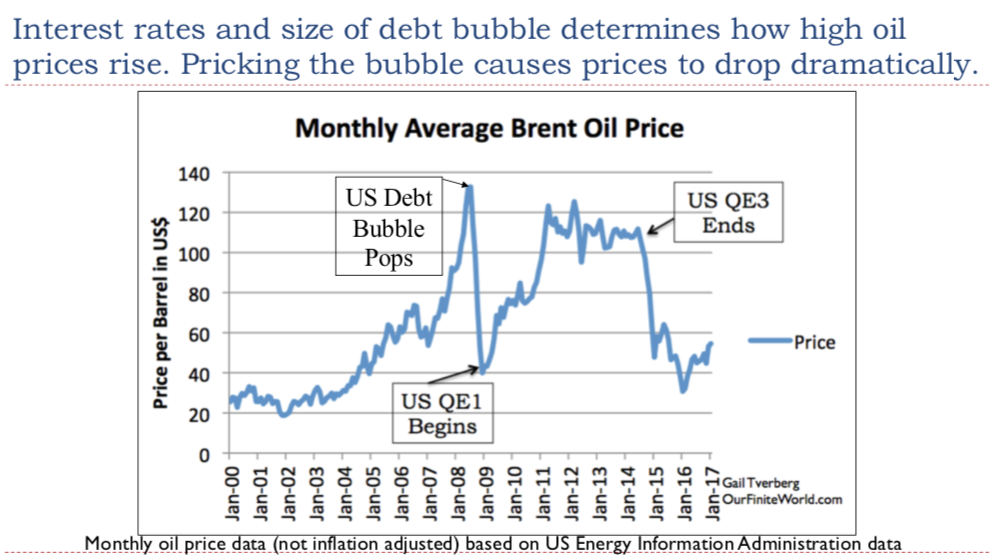

Figure 6.

The cost of extracting oil is less important in determining oil prices than a person might expect. Instead, prices seem to be determined by what end products consumers (in the aggregate) can afford. In general, the more debt that individual citizens, businesses and governments can obtain, the higher that oil and other energy prices can rise. Of course, if interest rates start rising (instead of falling), there is a significant chance of a debt bubble popping, as defaults rise and asset prices decline.

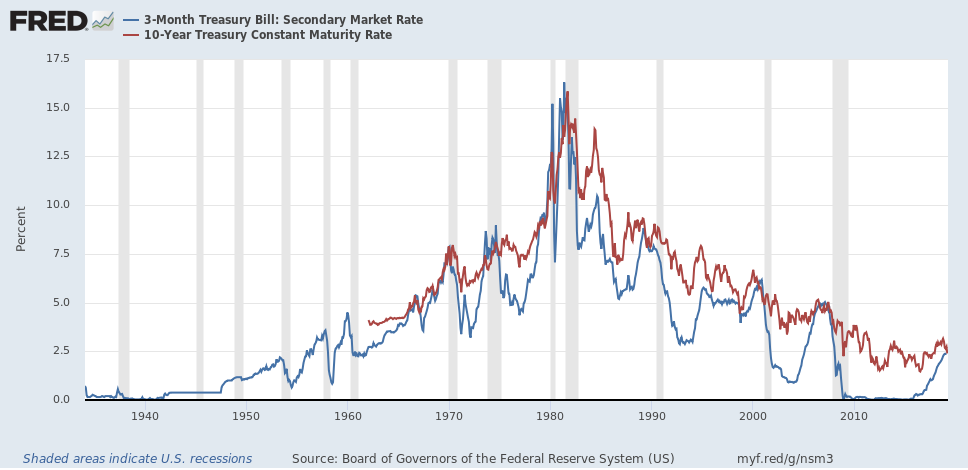

Interest rates have been generally falling since 1981 (Figure 7). This is the direction needed to support ever-higher energy prices.

Figure 7. Chart of 3-month and 10-year interest rates, prepared by the FRED, using data through March 27, 2019.

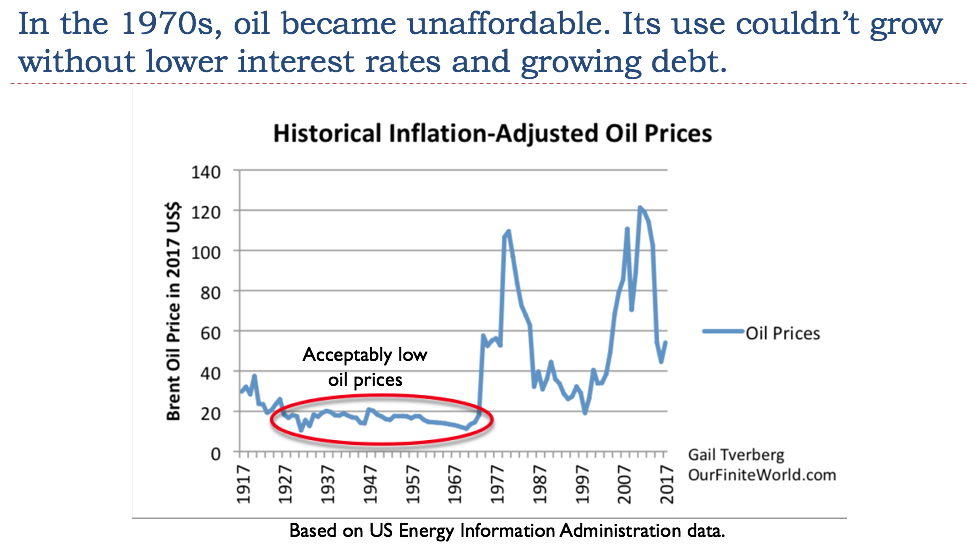

The danger now is that interest rates are approaching the lowest level that they can possibly reach. We need lower interest rates to support the higher prices that oil producers require, as their costs rise because of depletion. In fact, if we compare Figures 7 and 8, the Federal Reserve has been supporting higher oil and other energy prices with falling interest rates practically the whole time since oil prices rose above the inflation adjusted level of $20 per barrel!

Figure 8. Historical inflation adjusted prices oil, based on data from 2018 BP Statistical Review of World Energy, with the low price period for oil highlighted.

Once the Federal Reserve and other central banks lose their ability to cut interest rates further to support the need for ever-rising oil prices, the danger is that oil and other commodity prices will fall too low for producers. The situation is likely to look like the second half of 2008 in Figure 6. The difference, as we reach limits on how low interest rates can fall, is that it will no longer be possible to stimulate the economy to get energy and other commodity prices back up to an acceptable level for producers.

[7] Once we hit the “no more stimulus impasse,” fossil fuels will begin leaving us because prices will fall too low for companies extracting these fuels. They will be forced to leave because they cannot make an adequate profit.

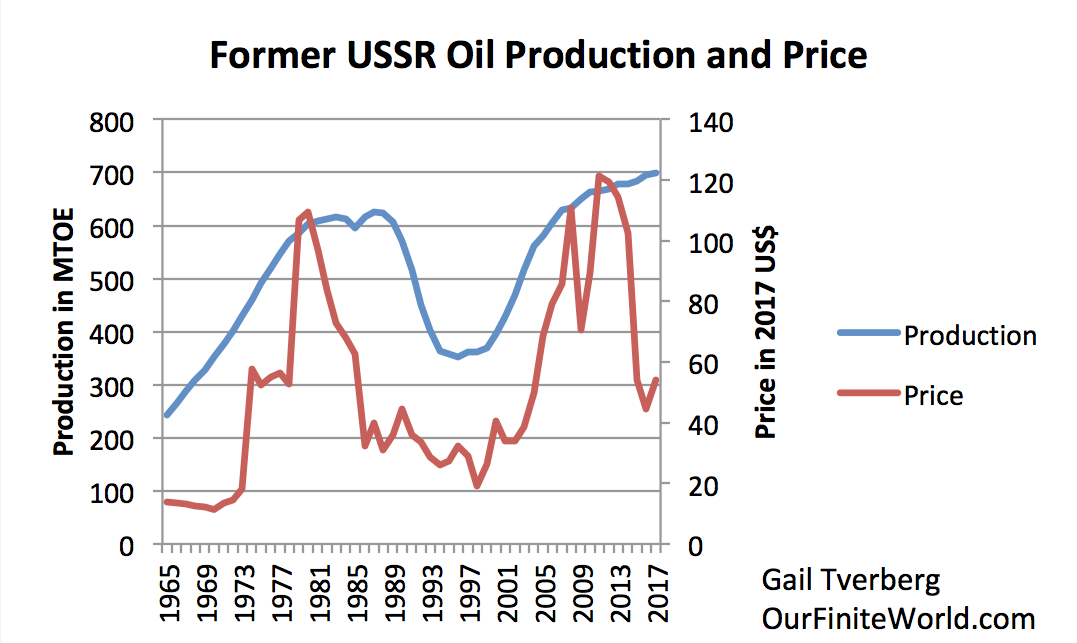

One example of an oil producer whose production was affected by an extended period of low prices is the Soviet Union (or USSR).

Figure 9. Oil production of the former Soviet Union together with oil prices in 2017 US$. All amounts from 2018 BP Statistical Review of World Energy.

The US substantially raised interest rates in 1980-1981 (Figure 7). This led to sharp reduction in oil prices, as the higher interest rates cut back investment of many kinds, around the world. Given the low price of oil, the Soviet Union reduced new investment in new fields. This slowdown in investment first reduced the rate of growth in oil production, and eventually led to a decline in production in 1988 (Figure 9). When oil prices rose again, production did also.

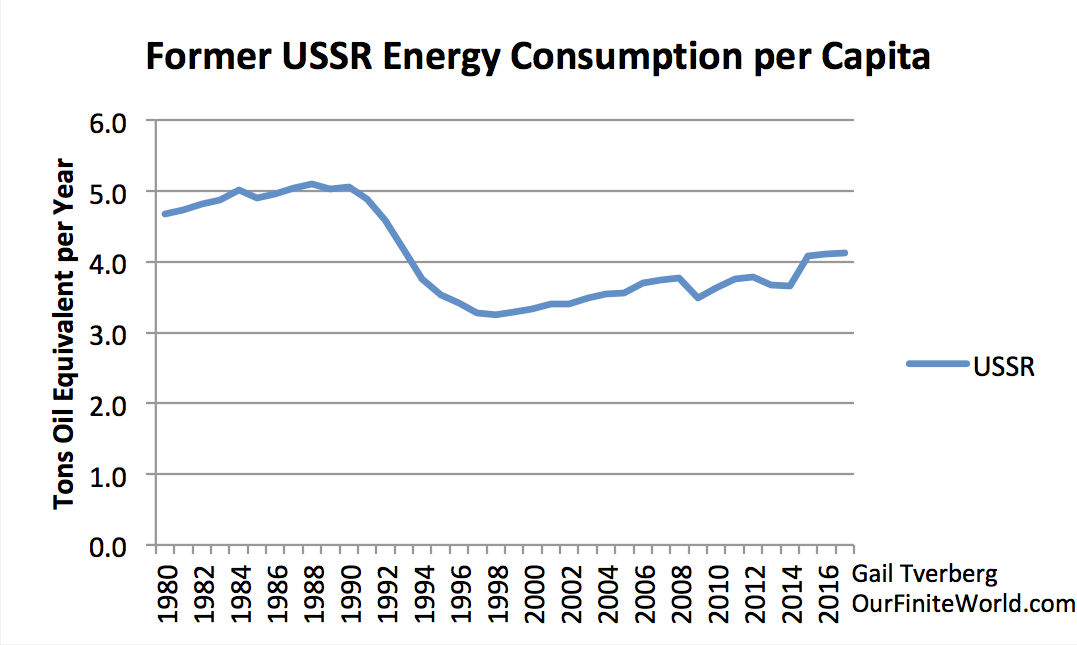

Figure 10. Energy consumption per capita for the former Soviet Union, based on BP 2018 Statistical Review of World Energy data and UN 2017 population estimates.

The Soviet Union’s energy consumption per capita reached its highest level in 1988 and began declining in 1989. The central government of the Soviet Union did not collapse until late 1991, as the economy was increasingly affected by falling oil export revenue.

Some of the changes that occurred as the economy simplified itself were the loss of the central government, the loss of a large share of industry, and a great deal of job loss. Energy consumption per capita dropped by 36% between 1988 and 1998. It has never regained its former level.

Venezuela is another example of an oil exporter that, in theory, could export more oil, if oil prices were higher. It is interesting to note that Venezuela’s highest energy consumption per capita occurred in 2008, when oil prices were high.

We are now getting a chance to observe what the collapse in Venezuela looks like on a day- by-day basis. Figure 5, above, shows Venezuela’s energy consumption per capita pattern through 2017. Low oil prices since 2014 have particularly adversely affected the country.

[8] Conclusion: We can’t know exactly what is ahead, but it is clear that moving away from fossil fuels will be far more destructive of our current economy than nearly everyone expects.

It is very easy to make optimistic forecasts about the future if a person doesn’t carefully examine what the data and the science seem to be telling us. Most researchers come from narrow academic backgrounds that do not seek out insights from other fields, so they tend not to understand the background story.

A second issue is the desire for a “happy ever after” ending to our current energy predicament. If a researcher is creating an economic model without understanding the underlying principles, why not offer an outcome that citizens will like? Such a solution can help politicians get re-elected and can help researchers get grants for more research.

We should be examining the situation more closely than most people have considered. The fact that interest rates cannot drop much further is particularly concerning.

Population increases mean more energy needed.

Population decreases don’t mean energy production decreases.

Therefore reducing population means less need for energy production increases and more energy per capita.

Not good enough at math to figure this, but wouldn’t a certain level of population freeze or decrease extend the time before oil runs out and allow more time for renewables?

Why are we importing high fertility thirdworlders who use less energy in their home countries

into our high energy consuming society?

“immigrant labor was added, as well, to better compete with the cost structures of the countries that France and the UK were competing against”

Because competition of course! Also it used to be “who has the gold rules”, now it’s “who controls the price of oil rules”. Then we enter the geopolitical arena, where the PTB decide on the one hand to press venezuela with low prices and arbitrage that against cheap cost to consumers/servers/servants in the “developed” world (quants could probably come up with more convincing examples). I am so cynical about where we are now. Among other salient points in the post, I agree with the premise that we’ll lose fossil fuels in a very likely abrupt fashion and those in charge are hitting the accelerator.

Importing third-worlders? Wow. Just, wow. Is that how you think it works? You know this is 2019, not 1819, right? Any idea why those people from those other countries might be attempting to migrate here, despite all the risks? Could it be that they are facing unlivable situations in their home countries? Could it be the US policies and US corporations have had a lot to do with the living situations in their countries?

How about this: all of the supposed environmentalists who want to drive to the store, fly to their vacation, buy and use every electronic gadget they can get their hands on, actually take the problem of their own energy consumption seriously, rather than blaming others?

It’s not one or the other, it’s both. Regardless of culpability, we are effectively “importing high fertility third worlders.” But point taken about US corporate and MICC policies. If one were so inclined, one could easily conclude conspiratorial overtones are at work there.

If one were so inclined, one could easily conclude conspiratorial overtones are at work there.

With thanks for addressing this topic of utmost importance, this strikes me as just so much economese.

The final line, “The fact that interest rates cannot drop much further is particularly concerning” – is particularly deflating. So, please accommodate the fossil fuel industry because otherwise the world will be hit by a financial and economic crisis? That’s some policy proposal to excite the masses for the future.

I found far more directly digestible substance and a ton of insightful physics-based facts (and none of the economese/monetarese) in Vaclav Smil’s presentation of the issue, for example here – https://www.youtube.com/watch?v=5guXaWwQpe4 (“Energy Revolution? More Like a Crawl”). While Smil (reportedly Bill Gates sought him out as a personal advisor after reading his books on energy) is emphatically advocating for a more sober attitude towards the technical, physical world feasibility of rapid defossilization, he never ties in his talks this feasibility with worry about disrupting the global financial & energy status quo. SMH

I agree, but I found it refreshing that low interest rates of QE were an explicit giveaway to our betters. I remember u of wash tv (yes kids, back in the last century you could just have a tv and watch it …no charge? huh?) and they ran a series with a scientist who explained in stark terms how screwed we are and was/is completely ignored by and large. This is when clinton was “balancing the budget, which at the time we all thought was a good thing in the ’90’s. Sober is just something that those drunk on power have no interest in, unless they are talking about us mopes who really have more than we deserve and there can be a lot fewer of us down here and that wouldn’t bother them at all, unless it became clear they were doing it on purpose like the sackler family (don’t kid yourself, there’s a measurable percentage of the upper crust who think poor people suiciding themselves is a good thing), then it “looks bad” and they might have to “do something”

PS. Sorry, one more knock:

“The electrical system is very complex. It seems to be easily disrupted if there is a material decrease in energy consumption per capita because maintenance of the system becomes difficult.” Uh.. what does that even mean?

Is this an actionable piece of information meant for an influencer or a decision and policy maker? What kind of serious person could use this equivalent of hand waving?

And using the Soviet Union, Syria, Yemen, and Venezuela to extrapolate global scale patterns for today and the near future….??Why not India, China, Africa, ASEAN? I modestly suggest that more than quibbles are in order with this work.

Hahaha! I like you nickname. And the point that you discuss is important. Utilities seem (and I say seem with an objective) worried about that. About system maintenance while consumptiom reduction follows suit. My opinion is that they are somehow rigth but also that they tend to overrepresent this fear on the basis of their bigger fear: a reduction in their consumption mass and revenues. I would like if an expert on electric grids expands on this. As I understand it big inflexible utilities like carbon or nuclear would collapse when their consumption base is reduced from certain level and that would result in energy shortages. So, with short stepwise reductions we migth have at some point high disruptions. To be sure, regarding your second paragraph it works exactly like that. Utility friendly influencers go and convince policy makers that energy efficiency and renewables are so bad because of maintenance and disruption. I have watched this in few energy forums attended by policy makers. These were very sensitive to this claims.

I believe that the problem is not that important if a central planner is given the power to select when and how big utility centres are decomissioned in an orderly fashion.

Pacific Gas and Electric in CA is a poster child for the effects of under investing in Maintenance.

Gotta support that share price and deregulation!

This misses the facts.

Please take a minute to find DOE’s Wind study. And look at Hydro.org.

And of course look at the LED revolution.

Or the refrigeration compressor revolution.

Energy is important however there are a multitude of choices to be made which take advantage of available non fossil fuel resources.

Sorry but this comment is a handwave. You don’t make an argument and you don’t present data. This is logically like saying, “A deficit hurts the economy, look at Bloomberg”.

If you have an argument to make, make it. But if you make another comment this lame, you will be put in moderation.

Yes, I agree in that the big gaping hole at the centre of the argument is around do we use less energy when we get energy efficient. If I may quote freely from the awesome Low Tech Magazine:

“However, energy use in the EU-28 in 2015 was only slightly below the energy use in 2000 (1,627 Mtoe compared to 1.730 Mtoe, or million tonnes of oil equivalents). Furthermore, there are several other factors that may explain the (limited) decrease in energy use, like the 2007 economic crisis. Indeed, after decades of continuous growth, energy use in the EU decreased slightly between 2007 and 2014, only to go up again in 2015 and 2016 when economic growth returned.”

And then the kicker:

“Why is it that advances in energy efficiency do not result in a reduction of energy demand? Most critics focus on so-called “rebound effects”, which have been described since the nineteenth century. [7] According to the rebound argument, improvements in energy efficiency often encourage greater use of the services which energy helps to provide. [8] For example, the advance of solid state lighting (LED), which is six times more energy efficient than old-fashioned incandescent lighting, has not led to a decrease in energy demand for lighting. Instead, it resulted in six times more light.”(My bolding)

So, yeah. Bring on those LEDs, cause that will SOOOOO save us.

And to all NC’ers: please check out Low-Tech Magazine, as they have very solid and interesting articles on this type of subject.

Having worked in IT since the 1980s, heck yeah. All our ‘energy-saving’ gizmos let us use MORE energy than ever before.

Then there’s this conundrum:

https://en.wikipedia.org/wiki/Jevons_paradox

Also kudos to Low-Tech Magazine, though at our current rate of decline, you may want to print out articles you deem useful onto acid-free paper!

I have to think there’s a correlation, not causation, factor going on there. When I moved into my current house I took about replacing the old incandescent lights with LEDs as the old ones died, and it made an appreciable effect on my electric bill. However, my response to that was not “Hey, let me slap in a few more fixtures per room, the house will be lit up like a christmas tree but I’ll be paying as much as I did before.” I would think the mass increasing in lighting would be caused by growth; more buildings, more light fixtures, more lighting.

It seems to me that much of this analysis is confusing cause and effect. Those countries economies shrunk because they were in recession and industry and individuals were using less energy, not the other way around. The rise in oil prices also did not significantly hit Spain and Greeces tourism industries – airlines and other businesses more or less absorbed the costs (aided by hedging). Air prices did not appreciably rise. Tourism dropped because the tourist generating countries were in recession and people cut back on holidays.

It obviously requires ‘deep’ investment, but countries like Sweden and Switzerland maintain high standards of living while generating perhaps one third of the CO2 per capita of north America. That indicates that with coherent planning, there is significant scope for reducing energy use without impacting on standard of living.

Another issue ignored is the normal plant replacement cycle. Cars are replaced on perhaps an 11 year cycle, bus and train rolling stock on perhaps 2-25 years, large fixed plant such as power stations on around 25 years. If the two power sources are of equivalent capital cost, then there is no ‘cost’ involved in switching from power source A to power source B if it carried out within the normal capital replacement cycle. The UK, for example, switched pretty much from coal dependency to gas electric power generation capacity in little more than a decade back in the 1980’s-90’s, driven entirely by cost dynamics. Much the same process occurred in the US in the past few years, also driven by cost dynamics, although the transition was probably slowed by efforts to prop up the coal industry.

How much difference does energy usage differ in the US because it is much larger than countries like Sweden? Sweden is the 3rd largest country in Europe with a population of 10 million people with 2.3 million living of them in the capital metro area.

The US has about 40 of those sized areas. Does this impose a structural cost in energy usage? Is it significant?

Its the opposite – with electricity generation smaller grids tend to have more energy costs (its tougher to match supply and demand). This is a huge problem with island grids – its why, for example, Ireland spends billions on energy storage and long distance interconnections with other grids. There is however a strong linkage with density – densely populated countries for fairly obvious reasons tend to be more energy efficient.

Hm, I think any comparisons will be very dependent on location, at least in the US.

The climate varies far more over the geographical area than in Sweden – this will affect heating and cooling energy requirements.

The next thing is population density – Sweden has basically two quite dense cities, and the bulk of the population in the south, while the rest of the country has very low density – this will affect energy requirements to transport energy.

Finally, the energy mix, at least when it comes to electricity generation is also quite location dependent in the US, compared to Sweden. Sweden is around 50% nuclear, 40% hydro, and 10% other, with a well integrated national power network. The US is heavily reliant on fossil fuels in many regions and has a less integrated net.

The US is in the difficult position of having a geographically dispersed fossil fuel energy consumers, so that distributing energy requires energy in itself. Sweden is in the easier position of having comparatively concentrated consumers using energy that is lower carbon to produce and distribute.

This basic analysis however excludes external carbon emissions (manufacturing in Asia, aviation), where Sweden probably comes off worse, on a per capita basis.

Yes the point that these countries suffering energy use declines did not plan these declines and go about them in an orderly fashion is worth making. Instead the energy use declines appear to more of a symptom than a cause, and that gives me a little hope that with a good plan in place the transition to a lower energy economy can be less devastating. That is assuming that oil production declines do not pull the rug out from under us while we argue it over which looks likely.

i agree that the article is too simplistic in assuming causality, though i do think that the real phenomenon is a positive feedback loop in that economic growth causes more energy use, and more energy use stimulates economic growth. in other words,

the french and UK charts do not make her point either. both of these economies have been growing since 2004. the civil unrest in each is a result of increasing inequality caused by austerity and socialism for the rich. so indeed, energy use in the UK and France is falling mostly due to greater efficiency, and not economic shrinkage.

exactly my thought that causality is the other way round in the examples!

I wolud be very, very, very reluctant to draw so many conclusions from the BP study. It isn’t that it is bad or flawed, no. It is just that what the energy outlook represents a picture -a complex one- on how development has been achieved in the wings of the fossil fuel dragon and how difficult is for us to even imagine an alternative. The limits are not set by physics but psychics. We need something like a big virtual slap in the face to realise all of our current wrongdoings.

To take an example that I know better than others I will comment on example 1: Spain and Greece with the concluding remark that,

.

My example is Spain. Oil consumptiom peak reached 75 million tons in 2007 when we (the spanish as a group) thougth that we should be building apartments and houses for all european -and a few american- retirees, sun-seeking families, and african & southamerican migrants. To the tune of licenses in 2007 to build 900.000 units in 2007 of which many did not even see the first brick. Previously, it was considered normal or vegetative growth to build about 200.000 units annually. To say that we were spending as much as we could afford is an epic oversimplification. We were just wasting enormous fluxes of cash coming from “austere”, “well meaning”, “wise” — I am out of calificatives– investors living in consumption capped economies. And we are now supposedly trying to pay back those wise guys that thougth it was reasonable such building spree. And here is the point. To illustrate the extreme crazyness reached those years, one municipality in the mediterranean coast passed permits to build what was called ” Manhattan in Cullera”, a row of about 37 building towers for 20.000 inhabitants… but without enough drinking water. Sadly enough plans are being made now to revive this project. This means, if anything that 12 years later we are still in crazy mode. That is why I say that the limits are not physical but psychical.

Bear in mind that accompanying the building crazyness there were plans to build the necessary energy infrastructure in the form of huge natural gas burning plants. Those plants were buildt and in 2018 they were functioning at 18% of their capacity. There were also plans to divert lots of water from spanish most migthy river, Ebro, to feed the thirsty mediterranean agriculture/touristic complex. It was crazyness with method. Those plans were fortunately cancelled.

To say that “we were consuming the energy we could afford” is to say something utterly incrrect. We were just following a path of crazy unsustainable development fuelled by fossil fuels. We have to change our mind on this. In fact we passed from 75MM tons of annual oil consumptiom to a low of 55MM and then resumed growth to 56MM which is still high by european per capita standards but no as crazy as it was. That is a 25% reduction that was not accompanied by an economy shrinking that much. Nothing physical, just psychical or psychological.

During the late crisis years, Spain has enjoyed an utility-friendly fossil fuel friendly conservative inept government that has been late –and wrongly– passing all the EU directives aimed at renewables and energy efficiency to the extent of annoying their correligionary EU authorities. That explains why Spain didn’t follow the path of France or UK with more sustained energy consumption reduction. It is not that we can afford it now, It is that the government stimulated it.

Well that is enough for a rant today.

The only thought this leaves me having after a literal reading is we need to aggressively raise interest rates as soon as possible. Short term financial pain in return for a possibly sustainable environmental future long term.

Dovetails nicely with Michael Hudson’s calls for debt jubilee.

I have my suspicions this is not what the author wants us to conclude, however.

The author cherry-picked stunningly bad examples… Greece, Syria? As if the per-capita energy consumption caused their (obviously external) problems rather than resulting from them. It really makes the whole exercise very suspicious. The consistently bad choices, and willful ignorance or downplaying of external factors seems larger than random error would allow.

The commenters seem to have already identified many issues with this post. It is overly long but does not demonstrate any concrete understanding of what an energy transition implies or can do. The main argument misses the fact that technology transition dynamics are exponential in their early stages – it is equivalent to someone arguing in 1900 that since there are only 1000 motorized cars and millions of horse-drawn wagons by 1920 at most we can expect a 10% substitution. This is not how historical transitions work.

Once the substitute technology achieves scale then the rate of the transition becomes exponential. Renewables are currently the cheapest form of electricity generation in the world! This fact has not yet registered widely but I challenge any nuclear or fossil proponent to provide unsubsidized power purchase agreement (PPA) prices of say 1.79c/kWh of PV (the Masdar KSA bid) or 2c/kWh for wind (average US wind project). These prices are literally cheaper than anything and they are not exceptions.

We demonstrated how these bids were generated without any hidden tricks but just straightforward commercial project development

The fact is that it is technically possible to run a world with 100% renewables and it is likely cheaper to do so. Nevertheless, it does require a consistent policy mobilization. The transition period will indeed see a hump of fossil fuel use that will be used to build out the RE plus storage infrastructure in what we called the Sower’s way.

With regard to the correlation between economic output (measured by GDP) and energy use, this is well established. Clearly, a 100% RE world will need to stabilize at a given rate of energy output. This can be higher than current energy use but not by much – this is why all our Sower scenarios stabilize by 2100.

The problem that countries like Greece and Spain (I leave out Yemen and Syria as we are not talking about war) faced is that the population and the country’s infrastructure was not prepared for the sudden drop of purchasing power due to the crisis. Had they started the transition earlier investing in the low-interest years on alternative energy and energy efficiency the drop in energy use would be the same but the well-being would have been steady (or even increased).

PS: regarding CCS – this is not an advantageous solution for power generation

You have a lot of assertions here that you need to firm up. The problem is none of these renewable technologies are as new as you try to suggest. I was looking at solar panel farm deals in the early 1900s. Ditto thin film solar panel tech, advanced battery technologies, and electric cars. Wind turbines are not new. Hydro is even older. So what is your basis for the claim that there are huge savings to be achieved with technologies that are in reality well established?

And many of these technologies use materials where there are supply issues and other environmental costs to them. Rare earths (which are not rare but environmentally nasty) are a classic example:

https://www.nap.edu/read/12987/chapter/6#91

Further, if you try arguing that the solution is new infrastructure…..building infrastructure has a massive energy cost. The energy cost of building a new home is roughly ten times that of the annual energy cost of running one.

The Tverberg article has problems but at least she makes a go with data. I’ve actually looked at real deals, with forecasts, including their assumptions of increases in manufacturing production efficiency. Guess what? In every case, those assumptions were wildly optimistic. And here we are, nearly 30 years later…..

Yves, you need to firm up some of your own assertions :)

Solar panels in the early 1900s!

I kid, I kid!

Yves, thank you for the thoughtful response.

Still, I think you are underestimating the precipitous drop in the cost and performance in all the relevant scalable renewable energy (sRE) technologies like solar and wind. Solar PV alone has dropped its costs by more more than 97% in the last 25 years but critically more than 80% in the last 10 years (sample link).

Comparing deals from 1990s (which I think you meant) and 2019 is like comparing a 1960s jet to a 787 fleet (perhaps not the best comparison but you get the idea).

Speaking of assumptions, I urge you to look at the linked papers. They are open access and published in very prestigious journals – Nature Energy, Nature Communications and Environmental Research Letters. There is a lot of work that has gone into formulating the models and their assumptions to be realistic and let me just say that it is not easy to pass the peer review at that level…

This is not to imply that a 100% renewable energy transition would be painless or would not have implications in the way we structure our society. Material and spatial constraints are definitely there and this is why we are not letting these models to grow forever. Capitalism at this stage needs to come to terms with its limits to growth. Still, as far as we can tell, there is sufficient material resources to get us there and a lot substitutes available.

Our society has been stockpiling a lot of material that remains available for our future use (e.g. aluminum, copper, steel) (link) which will continue to be the case. Earlier forecasts that somehow lithium production will not meet demand (link) are met today with the reality that despite demand increase exceeding the expectations the price of lithium drops!

This is not to say that everything is rosy and we will all get our panels, batteries and EVs with no effort. A very substantial reogranization and reset of global plans and economic goals is needed to make the transition a reality. The key contribution we are trying to make is that technically this is feasible and the data to support it is there. If after reading the papers you still have questions, I am happy to discuss more. It is the realm of policy and human social behavior that is the crucible of our change.

Minor correction on the links, the Nature Energy papers linked are not Open Access at the link.

ResearchGate though has the PDFs for both (currently) under a collaboration with Springer link1 and link2

There are some regions of the world where the sun is powerful enough to bring prices really down : Arabian peninsula, southwestern US, Northern Australia, Tibet…These regions are poised to provide energy for their close neighbours.

This being said, the transportation of power beyond neighbour territories (I.e. most of the developed world population) is an unsolved problem. Using Synthetic hydrocarbon for that is prohibitively expensive, ditto for HVDC. Your paper only talks about electricity generation, but before saying that “technically it is feasible” one has to evaluate the costs of transmission, storage, and necessary conversion into other forms of Energy.

I am not as pessimistic as Gail Tverberg (the EROI of nuclear and solar seem sufficient to me), but I believe her when she says there will be a long transition period during which final consumption will need to be curtailed severely to free the resources necessary for building all these new energy producing/transmitting/transforming infrastructure. Such reduced consumption will affect society’s capacity to service existing debts.

I have some quibbles with this. I suggest that from 1900s to 2000s there were little incentives to improve renewables.

– Improvements have been made in the manufacture of silicon PV panels and those are now much cheaper and more efficient (not much more but closer to theoretical limits of the technology) and with reduced losses by shadowing. That is why solar installations are exploding lately. Also, I believe that concentrating thermal solar panels have improved quite a lot. There is now a growing pipeline of not yet marketable –but probably soon– devices not based on silicon (organic, perovskite, hybrid…). As money is poured on those projects something will come to ligth.

-Regarding batteries the old lead-acid batteries migth have their days counted as a growing number of installers are now prefering Li-ion batteries. Behind the Li-ion technology there is a growing set of alternatives being studied that face the problem of rare earths. These challenges have been treated loosely or theoretically in the past but are now being readily researched in many countries.

I would add that the econosocial and political environment is now more favourable to renewables and the increasing list of promising technologies, suggests that some of these will almost certainly reach maturity in shorter times given the push they are receiving. That would be part of a GND: acceleration in renewables. We are currently witnessing an acceleration on energy efficiency with significant improvements. The case can be made that there were not enough incentives

That link to the Sower’s Way is much appreciated.

Thank you. The paper is written to be accessible.

I just need to note that the methodological meat is all in the supplementary material if anyone is interested to get into the details.

Garbage. I see 2 things…

1) Find data that fits the authors intended story

2) one actual fact that isn’t even really explored but is apparent in the charts shown. Left to its own devices per capita energy consumption is a good indicator of overall economic activity.

The conclusion should be that a holistic plan if going to be needed to replace fossil fuels. Energy consumption per capita will likely need to be curtailed in order to support a swift(er) conversion to other energy sources. Part of this holistic plan is a need to prevent energy conservation from being consumed elsewhere. For example, automobiles are radically more efficient now that 40 years ago, but at least for Americans that efficiency has been consumed by moving further away from work and buying bigger automobiles (and for those of you who will argue American cars are much smaller now than 40 years ago, you need to look at the whole fleet. American cars are smaller, but we buy far fewer of them today. We now buy far more trucks which have gotten way bigger and more foreign cars which too have gotten bigger).

Even at 3am on a temperate night, NY state, by itself, needs 14,000+ MW to keep the hospitals, water pumps, 911, Amazon warehouses, UPS, bread ovens going.

That’s a lot batteries (or flooded valleys for hydro storage) in a 100% renewable world.

The scale of electricity (never mind transport fuel) to keep civilization going is staggering. Renewables aren’t a magic wand—barring global Manhattan Project/Apollo like R&D that started years ago. Just being realistic.

One thing seems clear to me: The longer we delay the transition away from fossil fuels, the higher will be the cost, and the worse will be the result.

Astonishingly no mention of climate change, which will destroy civilization with irreversible methane and albedo feedbacks unless drastic action is taken very soon – Green New Deal. As Stanford’s Mark Jacobson, Sgouris Sgouridis and others have shown, 100% renewable energy by 2050 is feasible, and as the IMF has shown, health cost savings from removing FF pollution and dropping FF subsidies would pay for most of the additional investment needed, plus the job creation and Keynesian multiplier effect of a GND as a bonus. See http://web.stanford.edu/group/efmh/jacobson/Articles/I/CombiningRenew/WorldGridIntegration.pdf

I suppose 100% renewable energy by 2050 is based on the premise that aircraft will either be abandoned or drastically improved to fly on battery power… or have I overlooked another alternative?

Biofuels have been tested successfully. Liquid hydrogen is considered feasible by some. Batteries may eventually improve enough for short hauls. Synthetic fuels is one way surplus energy can be stored.

Good post and good comments. Lots to think about.

I would humbly submit that the residents (and there are quite a few) of the Dancing Rabbit Ecovillage in Missouri have reduced their carbon footprint to about 10% of the average American household, while still maintaining a recognizably “middle class” standard of living. Passive design, renewable, distributed energy generation, agreements around sustainable practices, etc. can (and do) go a long way towards creating actual sustainability.

So no, decreasing your energy usage does not equate to reducing your quality of life. As other commenters have pointed out, correlation is not causation.

Great article, great discussion. Naked Capitalism is such a wonderful resource! I am reading Earth, Inc. by Buckminister Fuller. He re-vamped it with Critical Path. I recommend the latter if you read just one. Early 80’s time-frame, when global population was one-half the present. Much has changed. Much more has NOT.

Not much discussion in here about grid intertie, globally, or tidal energy.

My overall reaction to this article was about paradigm shifts in thinking, expectations, and personal actions. Dancing Rabbit intentional community observation, and what is behind their daily mindful choices…

Not top-down, but at the individual level. Buy a PV array, for your own roof. Do your laundry, dishes, etc during the peak sunshine of the day. Live with the sun. Walk and ride a bike, Stay home.

If we wait for the government to make it happen, we are deluded. Individual actions in concert on a ‘right path’ will make a difference. And fer criminy’s sake, cooperation and sharing!!!

Circling back to Fuller— Leonardo, Elon, Jeff Bezos, Jamie Doiamon and LLoyd Blankfein could never in aeons come up with the marvelous spaceship we ALL miraculously get to ride on and inhabit— hurtling through our galaxy at a million plus miles a hour.

Lets re-tool and say no to hypersonic missles and ‘limited, targeted’ Nukes, and re-tool for Us All. That is a worthy make-work Green New Deal we should get after, globally.

The unrealized potential in 2019… some days I am so heart-sick…

Love and appreciate you all!

No they haven’t reduced to 10%, they are just not counting properly.

Seen from their FAQ, “How do folks support themselves financially?” :

“telecommuting, internet-based jobs, or over-the-phone work (such as coaching, teaching, consulting, or counseling)“

“commuting” on Amtrak, spending part of the time working away from home as consultants or Teachers”

And the best

“Some Rabbits also have income from disability, retirement, trust funds, or savings from before they moved to DR that they use to support themselves”

Every dollar spent out of the commune is tainted with energy use…

Do the Rabbits use metals, glass, cement, … nails, tools … drink coffee, eat bananas …? I can believe Dancing Rabbits might delay things but their lifestyle doesn’t represent a sustainable future. Their ‘adjustments’ are neither wrenching nor without disruption to their previous way of life, nor without substantial costs for rebuilding their housing, investing in their own ‘grid’, and living remotely in a special community. How would Dancing Rabbit scale as a model for the rest of the public?

I looked up the Dancing Rabbit website, and I think is is a great idea–a little reminiscent of the “hippies” in the sixties but with an ecological slant.

I agree she fudged causality but a lot of what she says is right on. I don’t know why she avoids saying the obvious thing – that the entire structure of civilization needs to change in order to manage disruptions from fossil fuels “leaving us” because the producers can’t make a profit. Well, the first such change is obvious to me, we need to nationalize the production and distribution of fossil fuels while we do our best to transition to renewables. That transition needs to do things logically – i.e. don’t create a yellow vest revolution. France should have subsidized electric cars and busses long before it slapped a punitive tax on combustion engines. And it should have guaranteed jobs and incomes sufficient to keep the country employed and fed. So when Tverberg argues both sides of a situation she confuses me. Is it depletion and profiteering or is it loss of demand? Because if it is loss of demand then she is begging the whole question. And we are caught between oil company profits and a cleaner, more temperate world. One point that jumps out is when she says “oil became unaffordable in the 70s” and she blamed high interest rates, which was true enough – it became both to expensive to use and too expensive to drill. But that was primarily due to the fact that our cold war economy had messed up the basics royally, captured the entire world in an economic dysfunctionality, a veritable ponzi world, and did all the wrong things. If our economy is dependent on fossil fuels at every level, we need to begin at the bottom, not the top. Manipulating interest rates is a bad joke. I do like the way she admits that conservation is essential. And conservation is an excellent road map. A living organism does the same thing when it is threatened; it shuts down its energy use at the periphery first. If we concentrated on replacing fossil fuels at the edges of civilization and built up best practices from the bottom to the top we could do it without any social disruption.

I agree with your assertion the fossil fuel industry should be nationalized and the transition away from fossil fuels must be carefully planned. The transition is a problem much too complex for a Market ‘solution’. As you assert “the entire structure of civilization needs to change” including the structure of our economic system and government.

However, my understanding of Tverberg’s argument differs. I believe she is arguing the depletion and profiteering diminishes the capacity of consumers to purchase fossil fuels — and all the goods that use fossil fuels in their production, decreasing aggregate demand for fossil fuels. Focusing on petroleum. the total return from producing petroleum depends on the price and volume of oil sold and the net return depends on the costs for getting the petroleum to market. The costs for producing petroleum increase as the amount of fossil fuels decreases, as do the costs for drilling and purchasing equipment — which includes interest. The Market for petroleum will collapse when the buyers run out of money and credit. Production will collapse when sellers cannot sell enough petroleum — at the price buyers can pay — to earn sufficient profits to cover their costs for producing the petroleum. The Market will collapse either or both ways.

I also disagree with your concluding assertion: “If we concentrated on replacing fossil fuels at the edges of civilization and built up best practices from the bottom to the top we could do it without any social disruption.” I believe no matter how we go about replacing fossil fuels it will require major changes in how we live — major changes in our economic system, in our government, … in our civilization. I think that might entail some social disruption. We can make the changes less painful through planning and without planning the best we can hope for is catastrophic collapse.

When I say the “edges” I’m thinking of how we decline down the energy that starts at some level, say agricultural production, and works its way through society, feeding everyone and their pet. It now starts with fossil fuels. To disrupt the energy at the lowest level is guaranteed to disrupt anything above it, so just like the yellow vests in France, we are vulnerable unless we have safety nets. It is creating those alternative sources of energy, those safety nets, that concerns me. That’s where we should focus. Finance is totally off my radar. I’m not even thinking about how to finance this change-over. Just how to make it function smoothly. With finance sidelined, and compensated for by subsidy of some sort, I assume we can change the system. In the end that subsidy will save us time and money. Decentralizing the grid is one possibility. Localize energy production. We’re so conditioned to think about consolidation we discount local solutions.

Is Gail’s piece on the 9th in response to the one on the 8th by Blair Fix et al?

https://rwer.wordpress.com/2019/04/08/ecological-limits-and-hierarchical-power/

I only say this because Gail’s appears to be composed in a hurry and is getting causality wrong in places by ignoring US foreign policy.

I agree with this post’s conclusion: “We can’t know exactly what is ahead, but it is clear that moving away from fossil fuels will be far more destructive of our current economy than nearly everyone expects,” but I’m not so sure about all the assertions along the way. I would argue for this conclusion differently, making use of some of the post’s warrants, or slight twists on them. I think it’s reasonable to assert that fossil fuel energy consumption, for now, includes a lot of discretionary use which would decrease as the price of fossil fuel energy increases relative to consumer income. At some limit the cost to produce will exceed the amount consumers can afford to pay and the returns to fossil fuel production will drop below the costs of production. The observation that each person added to an economy requires added energy “necessary because each person needs food, transportation, housing, and clothing, all of which are dependent upon energy consumption,” seems sufficient to argue that changes in the population or their per capita energy usage can be related to the size of the total economy. I’m not sure what to conclude from the charts in this post.

Arguments for replacing fossil fuels with solar panels, wind turbines, et al. frequently discuss energy as though it were just a lump of ‘something’ — a lump-of-energy — and one lump can be directly substituted for another. I suppose the malleability of electricity, assuming present technologies, may trick thinking into the lump-of-energy fallacy but the malleability of electricity is not free. Energy comes in many forms — heat, light, electricity to name just a few forms — and each form of energy may be available in different amounts and intensity, or pulsed or variably available. It costs energy to convert energy from one form to another — even electricity — and most applications of energy require energy of a certain intensity relative to the surroundings. Many discussions of power hinge upon the lump-of-energy fallacy, treating energy as though it were some simple commodity which might be stacked in a corner and saved for later uses disregarding the particular characteristics of different forms of energy, the varying energy requirements of different applications, and of course the different capabilities and means for storing energy. Some forms of stored energy — fossil fuels — have special properties with special applications based on those properties. Where energy is located and problems getting it to where it is needed are too often ignored or brushed aside. Arguments for solar or other energy sources based on the price per kW paid to energy producers at the Grid, as provided for in Federal Law, implicitly assume the lump-of-energy fallacy.

I am skeptical and concerned regarding the sustainability solar and wind power as replacements for fossil fuels. An installation of solar panels is supposed to last around twenty-years, and there are some indications the energy they produce may slowly diminish over that twenty-years. How will the replacement panels and associated electrical components be manufactured? LEDs are great, but how will their replacements be made when they burn out? Where will these things be made? Manufacturing materials we take for granted, like steel, concrete, or glass require large amounts of intense heat. Where will that heat come from? How will we make tires and roads? The way global manufacturing industries are structured today, no one location produces all the inputs for manufacturing most items. In the case of the U.S., relatively few manufacturing industries remain located in-country. If only solar power and wind power and other ‘replacements’ for fossil fuel power generation fed the Grid — assuming away the problems of balancing the intermittent availability of some of the sources — the electric Grid In the U.S. is old, extremely complex, and badly maintained. Energy sources could be located adjacent to where the energy is used and they were before the introduction of alternating current. I believe the Green New deal has given little consideration to repair and improve maintenance of the Grid, or question whether feeding alternating current into the Grid obtained by converting electricity from direct current sources near many direct current devices using that power is always the best solution.

As I was reading, a particular paragraph smacked me in the face. I will copy-paste that paragraph here outside it’s context.

“We think of the many parts of the economy as requiring money, but it is really the physical goods and services that money can buy, and the energy that makes these goods and services possible, that are important. These goods and services depend to a very large extent on the supply of energy being consumed at a given point in time–for example, the amount of electricity being delivered to customers and the amount of gasoline and diesel being sold. Supply chains are very dependent on each part of the system being available when needed. If one part is missing, long delays and eventually collapse can occur.”

This is a major insight which Nobel Prize-winning nuclear chemist Frederick Soddy had decades ago. It is what led him to write his book: Wealth, Virtual Wealth and Debt: the Solution of the Economic Paradox.

https://en.wikipedia.org/wiki/Wealth,_Virtual_Wealth_and_Debt

” Money drives the train.” Really? No. Fuel drives the train.

Charles Walters and others carried this further to remind us all that humanly-useable raw materials, as prepared for use through the guided application of energy; are also originational to a functioning bio-physiconomy; right up there with the energy-itself to prepare them with.

https://www.acresusa.com/products/raw-materials-economics

One hopes these and other books like them are read and kept in mind as one reads articles like this . . . which can serve as a jumping-off point to books such as the ones I just mentioned.

( One notes that Tony Wikrent’s economic analysis articles are now being featured every Friday at Ian Welsh. One hopes Tony Wikrent says more here from time to time. One wonders whether Tony Wikrent has heard of Charles Walters, Acres USA, etc. One hopes that he has).

With the right leadership the move to solar and wind can be made far quicker than most people realise. All that is required is the infrastructure that allows solar users to sell their surplus energy into the grid – a few incentives would do wonders. Look at Germany, a country where the sun hardly shines. And Portugal and others. There are also plenty of ways to store energy by pumping water up into natural reservoirs for later use – these have already been identified and wouldn’t require movements of people or destruction of habitat. Of course to do this on a global scale would require governments to govern wisely and not to bow to the pressure of fossil fuel suppliers and to relinquish their control over power production and distribution. The cost of solar and wind energy is now the cheapest source of energy. Period. Even well-established producers are turning to solar to avoid being left with stranded assets. Please watch – The Third Industrial Revolution: A Radical New Sharing Economy on YouTube. We needn’t go the way Gail suggests out of necessity only out of poor leadership.